NetworkNewsWire

Editorial Coverage: Bitcoin was a major topic of conversation

among investors in 2017, but it wasn’t the only cryptocurrency

related investment that garnered investors’ attention in the

blockchain space. In 2017 alone, there were 235 Initial Coin

Offerings (ICOs) completed, which raised a total of $3.7 billion

dollars, and 2018 is shaping up to be the year of ICOs. ICOs are a

way for blockchain start-up companies to gain funding for projects.

Instead of offering shares of a company to its investors, they

offer a certain amount of cryptocurrency. Some companies that stand

to benefit from the influx of funding to ICOs include

Victory Square Technologies, Inc. (CSE:VST) (OTC:VSQTF)

(FWB:6F6) (VSQTF

Profile), Eastman Kodak Company (NYSE: KODK), Helios,

Matheson Analytics (NASDAQ: HMNY), Glance

Technologies (CSE: GET:CC), and Social Reality,

Inc. (NASDAQ: SRAX).

In 2017, there were a number of ICO success stories. The most

notable is Filecoin, a blockchain data storage network project,

which raised $200 million in just 60 minutes in mid-August. The ICO

named Status raised $100 million in just 24 hours, and in six

months brought its investors a +1,521% return. Cobinhood (COB), a

zero-trading fee cryptocurrency exchange platform, just recently

closed its ICO which raised over $13 million.

There’s good reason to believe that 2018 could be a strong year

for ICOs. In 2017, ICOs were unregulated, but this looks set to

change in 2018. The Gibraltar Blockchain Exchange (GBX) announced

plans to launch its own ICO called “rock token” (RKT) in February

2018, and has already sold $21 million in its pre-sale. GBX plans

to use those funds to develop the world’s first licensed and

regulated token sale platform. This development will add a level of

legitimacy that the ICO industry badly needs to attract mainstream

investors who remain skeptical of ICOs.

In an unregulated ICO market, selecting an ICO to invest in has

proven to be extremely difficult. There’s estimated to be 30

different ICOs that close each month, each with their own

intricacies. Unfortunately, there have been a few companies who

have taken advantage of the lack of regulation, simply taking the

funds raised and running without starting the project. Investors,

up until now, have faced the challenge of figuring out which

fundraising projects are real, and will provide positive

returns.

To avoid the uncertainty of choosing specific ICOs, investors

are beginning to look to companies that have established portfolios

of strong ICO investments. One such company, Victory Square

Technologies Inc. (CSE:VST) (OTC:VSQTF) (FWB:6F6), invests in

cryptocurrency related assets, including ICOs, cryptocurrencies,

and blockchain startups. Located in Vancouver, B.C., Canada,

Victory Square invests, incubates, and mentors developing

blockchain companies and has a strong track record of finding and

investing in high-return ICOs. Victory Square was recently invited

to participate in an exclusive early contributors round for

Bluzelle, a decentralized database service where users have the

ability to rent out computer storage space in exchange for a

token.

In total, Victory Square has researched and invested in 12

mainstream cryptocurrencies and ICOs, and holds a portfolio of

smaller coins. To date, Victory Square has invested nearly $2

million towards ICOs and cryptocurrencies, with its biggest focus

on four specific ICOs. Neuromation sold out of its 60 million

Neurotoken (NTK) after just 8 hours of a public sale a few days

ago, bringing in $50 million. As mentioned above, Bluzelle is set

to be potentially the most promising ICO in 2018 and Victory Square

has announced that they will be purchasing a $500,000 allocation of

Bluzelle tokens (BLZ) with an additional 25% bonus tokens given to

early contributors. Victory Square also contributed $150,000 to the

Gibraltar Blockchain Exchange’s rock token. Victory Square has

generated a positive return on investment (ROI) on all of the coins

it has invested in, with a total token portfolio ROI of over

1000%.

Victory Square’s strategy of identifying attractive ICO and

cryptocurrency investments relies heavily on building partnerships

within the cryptocurrency industry. A big step toward including

ICOs in the Victory Square portfolio was its acceptance into the

Blockchain Investors Consortium, or BIC. The BIC currently has 120

members working together to share due diligence and investment

opportunities in the most promising blockchain ventures.

The BIC was started after founder Mike Costache researched over

200 ICOs and chose 25 of the most promising opportunities to invest

in and advise on. To become a member of the BIC, companies and

individuals must hold at least $3 million worth of digital assets,

and have at least $1 million invested in either ICOs or actively

traded cryptocurrencies.

Victory Square has also agreed to sponsor an investment prize of

$100,000 at the d10e conference, a decentralization conference with

a focus on emerging blockchain and other disruptive technologies,

such as ICOs. As many as 20 companies will compete in a series of

pitch presentations, with ICO companies among the competitors

looking to gain attention from the d10e judges. Of the 20 companies

participating, three will be selected as the winners. The prize

pool will be split equally among the winners as either an equity

investment or as a token allocation. The judges of the conference

include a range of investors and other leaders in the blockchain

and crypto spaces.

Victory Square’s acceptance into the BIC, and the subsequent

sponsorship involvement in d10e, are examples of its strategy of

networking within the ICO community to build connections that help

it identify and invest in up-and-coming ICO success stories.

ICO Chatter with Some Notable Companies

Eastman Kodak Company (KODK) is an American

technology company historically known for its foundation in

pre-digital photography, but this month (January 2018) it saw a

two-day run in its common stock price after announcing plans to

launch a cutting edge “major blockchain initiative” in partnership

with Wenn Digital. The initiative will use the Ethereum blockchain

to ensure the image rights of photographers by registering their

work and then pursuing the use of their images to secure payment.

The announcement was paired with a statement that Kodak and Wenn

will issue an Ethereum-based cryptocurrency called Kodak Coins, or

KodakCoin, which will be used to help photographers receive payment

for their work. KodakCoin will be launched through an ICO, starting

on January 31, 2018. During its pre-sale, KodakCoin raised $2

million. Kodak also said it will install rows of bitcoin mining

rigs at its headquarters in New York that will be branded Kodak

KashMiner.

Helios and Matheson Analytics (NASDAQ: HMNY) is

an information technology services and solutions provider that made

news last year when it acquired the license to a crime-stopper

facial recognition technology and then acquired a majority stake in

movie subscription company MoviePass, Inc. Investors took note when

MoviePass announced this month (January 2018) that it has spent

months exploring the possibility of a blockchain-powered initial

coin offering (ICO). Helios and Matheson Analytics CEO Ted

Farnsworth said the company has its own blockchain analysis effort

under way. The company, which recently reached the 1.5 million

customers milestone, focuses on big data, artificial intelligence,

business intelligence, social listening, and consumer-centric

technology.

Glance Technologies (CSE: GET:CC) is another

company hoping to profit by adapting blockchain technology to its

existing operations. The firm operates Glance Pay, a payment system

designed to allow smartphone users to choose where they want to

eat, order goods and services, send payments, access receipts, earn

rewards and interact with merchants. In November 2017, Glance

appointed Dinis Guarda to its advisory board. Guarda, ranked as the

5th most influential influencer in blockchain in the world by Right

Relevance, will be working to secure teams for Glance that will

develop the technology for a possible ICO for a rewards-based

cryptocurrency to be integrated into Glance Pay. Glance also

recently announced that its partially owned subsidiary Cannapay

Financial, Inc. has signed an agreement with Cannabis Big Data

Holdings, Inc. that will help provide data collection insight and

cryptocurrency transaction functionality for cannabis retailers and

producers using blockchain technology. Glance also announced in

December 2017 that it had completed its purchase of the Block

impact cryptocurrency and blockchain solution from Ztudium Inc,

which it intends to integrate into the Glance Pay mobile payment

platform.

Social Reality (NASDAQ: SRAX) is using its

existing business model as a digital marketing and data management

platform to position itself as the first public company to offer

delivery of a transparent data management and distribution system

via a secure blockchain platform. The company’s BIG Platform will

use an open source governance structure and token rewards, enabling

consumers to claim their data and receive compensation when that

data is purchased, rewarding them with a digital token. BIGtoken

will be launched as an ICO, with both pre-sales and sale of the

tokens set to commence in January 2018. On the news of beginning

its own ICO, Social Reality saw a spike of over 70 percent in its

stock, closing at $4.90 on the day the ICO was announced in

October. The stock has been doing well ever since and is currently

trading at $5.90 on January 12, 2018.

With over $3.7 billion dollars invested in ICOs in 2017, and the

recent developments in Gibraltar towards creating a regulated

environment for ICOs to thrive in, there is strong reason to

believe that 2018 will be the year that ICOs attract interest from

mainstream investors. The companies mentioned above are in a strong

position to benefit from this increased investor interest.

For more information on Victory Square, visit Victory Square

Technologies, Inc. (CSE:VST) (OTC:VSQTF) (FWB:6F6).

For more information about Victory Square Technologies Inc.

(CSE:VST) (OTC:VSQTF) (FWB:6F6), view the full report on Microsmallcap.com.

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

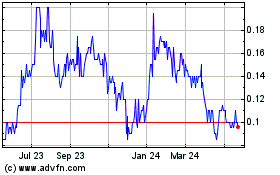

GameOn Entertainment Tec... (CSE:GET)

Historical Stock Chart

From Jan 2025 to Feb 2025

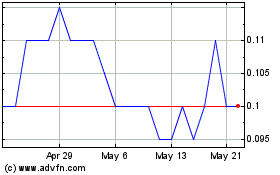

GameOn Entertainment Tec... (CSE:GET)

Historical Stock Chart

From Feb 2024 to Feb 2025