There’s a golden thread that weaves its way through all that’s

happened to us and will happen to us.

It boils down to one word: bubbles. Yet one economist and

analyst after the next are announcing that there is NO bubble… or

at least not yet. And they give their reasons (none of which make

any sense).

Even Janet Yellen, the Fed chairman, is of the opinion that

we’re not in any kind of bubble.

Here’s the thing…

That is exactly what happens when bubbles

form.

People from all backgrounds — the smart and dumb, the educated

and the educators — deny the existence of that bubble.

I can understand why they do it. Most of them benefit from the

free ride they’re enjoying as a result of the bubble, they don’t

want it to end.

What they fail to realize, in their delusional states, is that

bubbles don’t correct. They burst. And the aftermath is brutally

painful.

The fact that so many people are defending the Fed’s policies and arguing

why we’re not in a bubble is the best sign that it is in

fact a bubble.

By just stepping back and being objective, this fact is

obvious.

The trajectory of the market,

especially in the last year, has been classically bubble-like in

its pattern.

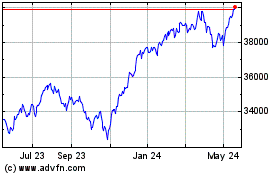

The Dow Jones has seen a larger point gain than in the

dramatic late-1994 to early-2000 bubble. It is up over 140% in a

little less than five years, and there has only been one bull

market since the early 1950s that has lasted longer than that

without at least a 20% bear market pull back.

The last bubble that burst saw the Dow rise 100% in five

years, then crash by 50%!

The Fed is creating one bubble after the next by its policy of

pushing down short-term and long-term interest rates, which leads

to massive speculation and returns chasing.

The consequence of unprecedented quantitative

easing and money printing has not been inflation in

consumer prices (as I’ve said for years it wouldn’t be), but

inflation in financial assets.

Here’s the thing, from decades of studying all the bubbles in

modern history, I’ve identified 10 rules that such phenomena

follow.

Knowing them helps you to identify bubbles when no one else can,

and it helps you know what the aftermath will most likely look like

when the manure hits the fan.

The 10 rules that bubbles follow are:

Rule #1: All growth, progress and

evolution is exponential, not linear.

Rule #2: All growth is cyclical, not

incremental.

Rule #3: Bubbles always burst; there are

no exceptions.

Rule #4: The greater the bubble, the

greater the burst.

Rule #5: Bubbles tend to go back to where

they started or a bit lower.

Rule #6: Financial bubbles tend to get

more extreme over time as credit availability expands along with

our incomes and wealth.

Rule #7: Bubbles become so attractive that

they eventually suck in even the skeptics, like a succubus

ensnaring unwary men.

Rule #8: No one wants the “high” and easy

gains of the bubble to end, so everyone goes into denial,

especially in the latter stages.

Rule #9: Major bubbles occur only

about once in a human lifetime, so it

is easy to forget the lessons from the last one. The last bubble of

this magnitude that burst was from 1922 to 1929: the Great

Depression.

Rule #10: Bubbles may seem fruitless and

destructive when they burst, but they actually serve a very

essential function in the process of innovation and human progress

(more on that another day.)

Learn why

the Dow will plunge to 6,000!

Harry Dent

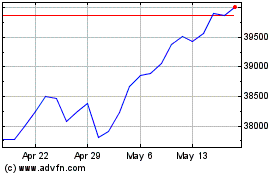

Dow Jones

Index Chart

From Feb 2025 to Mar 2025

Dow Jones

Index Chart

From Mar 2024 to Mar 2025