Excellent 2022 performance in a challenging environment 21% growth to €130.8m, of which 10% organic Confirmed pricing power: strong ability to pass on the increase in agricultural raw materials prices

10 February 2023 - 4:00AM

Excellent 2022 performance in a challenging environment 21% growth

to €130.8m, of which 10% organic Confirmed pricing power: strong

ability to pass on the increase in agricultural raw materials

prices

PRESS RELEASE Loudéac, 09 February

2023

Excellent 2022 performance in a

challenging environment

21% growth to €130.8m, of which 10%

organic

Confirmed pricing power: strong ability

to pass on the increase in agricultural raw materials

prices

WINFARM (ISIN: FR0014000P11 - ticker:

ALWF), the number-one French distance seller for the farming

industry, today reported its revenue for financial year

2022, up 21% from 2021. WINFARM posted robust growth of 28% in

fourth-quarter 2022, reflecting continued strong growth

momentum.

|

|

Q4 |

|

Full year |

|

in €m, unaudited |

2021 |

2022 |

Chg. |

Chg. organic 1 |

|

2021 |

2022 |

Chg. |

Chg. organic1 |

|

Farming supplies |

25.1 |

31.7 |

+26% |

+10% |

|

96.7 |

116.8 |

+21% |

+9% |

|

Farming nutrition |

2.3 |

3.2 |

+42% |

+42% |

|

9.8 |

12.2 |

+25% |

+25% |

|

Other2 |

0.4 |

0.5 |

+39% |

+31% |

|

1.5 |

1.8 |

+21% |

+14% |

|

TOTAL |

27.8 |

35.4 |

+28% |

+21% |

|

108.1 |

130.8 |

+21% |

+10% |

Patrice Etienne, Chairman-Chief

Executive Officer and founder of

WINFARM, said: “We are very proud of the work accomplished

in 2022. The increase in agricultural raw materials prices and

widespread inflation weighed on the overall environment but without

affecting our growth. Thanks to the depth of our ranges and the

quality of our services, we have remained a benchmark for our

customers, to whom we have offered competitiveness and secure

supply. We were able to pass on the price increase by effectively

managing our inventories. In terms of external growth, after BTN in

Haas in 2021, we acquired Kabelis in 2022 to become a leader in the

landscaping market in France and Europe. Despite all the challenges

posed in 2022, we maintained our sales momentum, driven by the

constant desire to safeguard our profitability. We are ready to

take on new challenges in 2023 and continue to grow.”

Continued acceleration in Q4 2022: +28%

(+21% organic) to €35.4m

Q4 2022 sales totalled €35.4m, up a substantial

28% year on year. The Group achieved double-digit organic growth

(+21%).

For full-year 2022, consolidated revenue

amounted to €130.8m, up 21%, including the Kabelis Group companies

acquired in July 2022. The Group’s consolidated revenue increased

10% on a like-for-like basis.

The Farming Supplies business

(89% of annual revenue), whose products are marketed under the

Vital Concept brand, generated revenue of €116.8m in 2022, up 21%

compared with 2021 (+10% organic). In 2022, WINFARM proactively

succeeded in passing on the substantial price fluctuations of its

products while responding to customer demand against a backdrop of

shortages. Underpinned by keen anticipation and agility, this

robust management enabled the Group to continue winning new

business throughout 2022.

Revenue from the Agronutrition

business (10% of annual revenue), marketed under the Alphatech

brand, came out at €12.2m, up sharply (+25% like-for-like and

organic). The performance was driven by the Group’s aggressive

sales policy, particularly in exports.

2023: initial easing in

prices

WINFARM expects prices to gradually return to a

more normal level in 2023. By building up inventories consistent

with its reasonable purchasing policy, the Group will be able to

maintain its competitive edge with customers and reinforce its

standing as a key player in the upstream agricultural sector in

Europe.

In the longer term, the Group is confirming its

revenue target for 2025 of around €200m and an EBITDA margin of

around 6.5%. It expects to achieve half of this acceleration in

growth through organic growth and half through external growth.

About WINFARM

Founded in Loudéac, in the heart of Brittany, in

the early 1990s, WINFARM is now the French leader in distance

selling for the agricultural world. WINFARM offers farmers and

breeders comprehensive, unique and integrated solutions to help

them meet the new technological, economic, environmental and social

challenges of the next generation of agriculture. With a vast

catalogue of 15,000 product references (seeds, phytosanitary and

harvesting products, etc.), two-thirds of which are own brands,

WINFARM has nearly 50,000 customers in France and Belgium.

WINFARM generated revenue of €131m in 2022. By

2025, WINFARM aims to achieve revenue of around €200m and an EBITDA

margin of about 6.5%.

The company is listed on Euronext Growth Paris

(ISIN: FR0014000P11 - ticker: ALWF) - Eligible for PEA PME equity

savings plans - Certified as an "Innovative Company" by

bpifrance.

For more information about the company:

www.winfarm-group.com

Contacts:

|

WINFARMinvestisseurs@winfarm-group.com |

|

|

ACTIFIN, Financial CommunicationsBenjamin

Lehari+33 (0)1 56 88 11 11winfarm@actifin.fr |

ACTIFIN, Financial Press RelationsLoris Daougabel

+33 (0)1 56 88 11 16ldaougabel@actifin.fr |

1 Like-for-like basis: excluding the

consolidation of Kabelis group companies in 2022 revenue2 Revenue

from farming advisory services (under the Agritech brand) and

experimental farm activities (under the Bel Orient brand)

- WINFARM_CP_CA_T4_2022_EN_vDEF

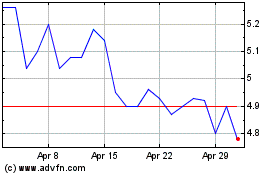

Winfarm (EU:ALWF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Winfarm (EU:ALWF)

Historical Stock Chart

From Jul 2023 to Jul 2024