Christian Dior : Organic revenue growth of 14% in the first nine

months of 2023

Organic revenue growth of 14%

in the first nine months of

2023

Paris, October 10, 2023

The Christian Dior group

recorded organic revenue growth of 14% in the first nine months of

2023 compared with the same period in 2022. All business groups

reported sustained organic revenue growth over the period, with the

exception of Wines & Spirits, faced with a high basis of

comparison. After taking into account the negative 4% exchange rate

impact, revenue for the Group was up 10%. Europe, Japan and the

rest of Asia achieved double-digit organic growth. In the third

quarter, organic revenue growth came to 9%.

Change in revenue by business

group

|

In millions of euros |

9 months 2022 |

9 months 2023 |

Change First 9

months2023/2022 Reported Organic* |

|

Wines & Spirits |

5 226 |

4 689 |

-10% |

-7% |

|

Fashion & Leather Goods |

27 823 |

30 912 |

+11% |

+16% |

|

Perfumes & Cosmetics |

5 577 |

6 021 |

+8% |

+12% |

|

Watches & Jewelry |

7 575 |

7 951 |

+5% |

+9% |

|

Selective Retailing |

10 095 |

12 431 |

+23% |

+26% |

|

Other activities and eliminations |

189 |

201 |

- |

- |

|

Total |

56 485 |

62 205 |

+10% |

+14% |

* On a constant consolidation scope and currency

basis. For the Group, the impact of changes in scope with respect

to the first 9 months of 2022 was nil; the impact of exchange rate

fluctuations was -4%.

The Wines & Spirits

business group saw a revenue decline (-7% organic) in the first

nine months of 2023, faced with a high basis of comparison with the

same period in 2022. Driven by its value-based strategy, the

Champagne business grew over the period, despite more moderate

demand in the third quarter. Hennessy cognac was affected in the

United States by the economic environment, the post-Covid

normalization of demand and the continued high inventory levels of

its retailers. Among Provence rosé wines, the Group acquired the

prestigious, world-leading Minuty estate.

The Fashion & Leather Goods

business group achieved organic revenue growth of 16% in the first

nine months of 2023. Louis Vuitton delivered an excellent

performance, once again buoyed by the creativity and quality of its

products, and by its strong ties to art and culture. Many new

designs were unveiled in leather goods and watches, in particular

the new Tambour, a fusion of Swiss watchmaking expertise and Louis

Vuitton’s Parisian elegance. Following the immense enthusiasm

generated in July by the first show of new Men’s Creative Director

Pharrell Williams, held on the Pont-Neuf bridge in Paris, Nicolas

Ghesquière’s boundless creativity continued to captivate audiences,

with the Women’s Spring/Summer 2024 ready-to-wear show held at the

Maison’s future location at 103 avenue des Champs-Élysées.

Christian Dior Couture continued to deliver remarkable growth in

all its product categories. Fashion shows curated by Maria Grazia

Chiuri and Kim Jones gave center stage to excellent craftsmanship

in freshly elegant collections. The Dioriviera collection was

unveiled throughout the summer in a series of spectacular pop-up

stores around the world. Victoire de Castellane’s new high jewelry

collection, Les Jardins de la Couture, was inspired by two worlds

very dear to Christian Dior’s heart: couture and gardens. Celine

continued to enhance its desirability, driven by the success of

Hedi Slimane’s designs and fashion shows. Loewe’s growth continued

to be driven by J.W. Anderson’s bold, creative leadership and by

the success of the latest new leather goods designs. Loro Piana saw

strong growth and launched the first capsule collection made with

recycled cashmere. Fendi expanded its retail network. Rimowa, Marc

Jacobs and Berluti all turned in an excellent performance.

The Perfumes & Cosmetics

business group achieved organic revenue growth of 12% in the first

nine months of 2023, driven by its powerful innovative momentum,

and maintained its highly selective distribution strategy. Parfums

Christian Dior achieved a remarkable performance, extending its

lead in its key markets. Fragrances saw major growth, carried by

the success of women’s scents Miss Dior and J’adore, which was

enriched with Francis Kurkdjian’s latest creation, L’Or de J’adore,

and the continued worldwide success of Sauvage. Dior Addict in

makeup and Prestige in skincare also contributed to the Maison’s

rapid growth. Guerlain continued to grow, driven in particular by

its popular Aqua Allegoria scents and premium fragrance collection

l’Art et la Matière, as well as the excellent response to its

Terracotta Le Teint makeup. Parfums Givenchy was buoyed by its

fragrances’ ongoing success. Benefit’s growth was driven by the

successful launch of its new Fan Fest mascara and the popularity of

Pore Care.

The Watches & Jewelry

business group achieved organic revenue growth of 9% in the first

nine months of 2023. Following the successful reopening of “The

Landmark”, its iconic New York store, Tiffany continued its store

network renovation program, in Tokyo in particular, where two new

exceptional stores were opened, in the Ginza and Omotesando

districts. The new Lock collection continued to be rolled out

worldwide and expanded to new jewelry categories, and the second

part of the Blue Book: Out of the Blue high jewelry collection was

launched. Bulgari, which experienced strong growth, celebrated the

75th anniversary of its iconic cross-category Serpenti collection.

To mark the occasion, a new exhibition was held in Dubai after the

Shanghai, New York and Seoul shows that took place in the first

half of the year. High jewelry, which saw the launch of the

Mediterranea collection, turned in an outstanding performance.

Chaumet held its A Golden Age: 1965-1985 retrospective

exhibition in the historic salons of its 12 Vendôme location, while

Fred unveiled Audacious Blue, the Maison’s first lab-grown blue

diamonds, with both Maisons posting strong growth. In watchmaking,

highlights of the quarter included the opening of TAG Heuer’s

flagship store in New York and Hublot’s appointment as the Official

Timekeeper for the FIFA Women’s World Cup in Australia.

In Selective Retailing, organic

revenue growth was 26% in the first nine months of 2023. Sephora

performed exceptionally well and continued to gain market share,

with particularly strong momentum in North America, Europe and the

Middle East. Its distribution network continued to expand,

particularly in the United Kingdom, where a second store is due to

open soon, following the huge success of its first store opening at

the beginning of the year. DFS benefited from the gradual recovery

in international travel and, in particular, from the return of

tourists to the flagship destinations of Hong Kong and Macao. Le

Bon Marché, which is growing steadily, continued to develop

innovative concepts and benefit from a loyal French customer base

as well as a return of international travelers.

Outlook

In an uncertain economic and geopolitical

environment, the Christian Dior Group is confident in the

continuation of its growth and will maintain a strategy focused on

continuously enhancing the desirability of its brands, drawing on

the authenticity and quality of its products, excellence in

distribution and agile organization.

The Group will draw on its powerful brands and

the talent of its teams to further strengthen its global leadership

in the luxury goods market in 2023.

Apart from the information mentioned in this

press release, during the quarter and to date, no events or changes

have occurred that could significantly modify the Group’s financial

structure

This financial release is available on our

website www.dior-finance.com.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in Christian

Dior’s Annual Report which is available on the website

(www.dior-finance.com). These forward looking statements should not

be considered as a guarantee of future performance, the actual

results could differ materially from those expressed or implied by

them. The forward looking statements only reflect Christian Dior’s

views as of the date of this document, and Christian Dior does not

undertake to revise or update these forward looking statements. The

forward looking statements should be used with caution and

circumspection and in no event can Christian Dior and its

management be held responsible for any investment or other decision

based upon such statements. The information in this document does

not constitute an offer to sell or an invitation to buy shares in

Christian Dior or an invitation or inducement to engage in any

other investment activities.”

This document is a free translation into English

of the original French financial release dated October 10, 2023.It

is not a binding document. In the event of a conflict in

interpretation, reference should be made to the French version,

which is the authentic text.

ANNEX

Christian Dior – Revenue by

business group and by quarter

|

Revenue for 2023 (in millions of

euros) |

|

2023 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activitiesand eliminations |

Total |

|

First quarter |

1 694 |

10 728 |

2 115 |

2 589 |

3 961 |

(52) |

21 035 |

|

Second quarter |

1 486 |

10 434 |

1 913 |

2 839 |

4 394 |

140 |

21 206 |

|

First half |

3 181 |

21 162 |

4 028 |

5 427 |

8 355 |

87 |

42 240 |

|

Third quarter |

1 509 |

9 750 |

1 993 |

2 524 |

4 076 |

113 |

19 964 |

|

First nine months |

4 689 |

30 912 |

6 021 |

7 951 |

12 431 |

201 |

62 205 |

|

Revenue for 2023 (organic growth versus same period in

2022) |

|

2023 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activitiesand eliminations |

Total |

|

First quarter |

+3% |

+18% |

+10% |

+11% |

+28% |

- |

+17% |

|

Second quarter |

-8% |

+21% |

+16% |

+14% |

+25% |

- |

+17% |

|

First half |

-3% |

+20% |

+13% |

+13% |

+26% |

- |

+17% |

|

Third quarter |

-14% |

+9% |

+9% |

+3% |

+26% |

- |

+9% |

|

First nine months |

-7% |

+16% |

+12% |

+9% |

+26% |

- |

+14% |

|

Revenue for 2022 (in millions of euros) |

|

2022 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activitiesand eliminations |

Total |

|

First quarter |

1 638 |

9 123 |

1 905 |

2 338 |

3 040 |

(41) |

18 003 |

|

Second quarter |

1 689 |

9 013 |

1 714 |

2 570 |

3 591 |

149 |

18 726 |

|

First half |

3 327 |

18 136 |

3 618 |

4 909 |

6 630 |

109 |

36 729 |

|

Third quarter |

1 899 |

9 687 |

1 959 |

2 666 |

3 465 |

79 |

19 755 |

|

First nine months |

5 226 |

27 823 |

5 577 |

7 575 |

10 095 |

189 |

56 485 |

As table totals are calculated based on unrounded

figures, there may be discrepancies between these totals and the

sum of their component figures.

- Christian Dior - Ventes T3 2023 VA

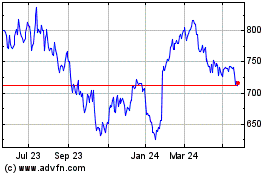

Christian Dior (EU:CDI)

Historical Stock Chart

From Jan 2025 to Feb 2025

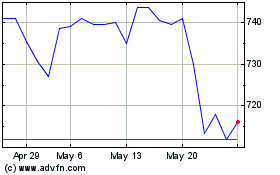

Christian Dior (EU:CDI)

Historical Stock Chart

From Feb 2024 to Feb 2025