Celyad Oncology SA (Euronext & Nasdaq: CYAD) (the “Company”), a

clinical-stage biotechnology company focused on the discovery and

development of chimeric antigen receptor T cell (CAR T) therapies

for cancer, today announced an update on its financial results and

recent business developments for the first half ended June 30,

2022.

"As the Company continues to evolve, we are

excited about a renewed focus on additional value drivers for

Celyad Oncology. Importantly, with our world-class intellectual

property focused on allogeneic CAR T technology, we have multiple

opportunities for partnerships with peers in the industry,”

commented Michel Lussier, interim Chief Executive Officer of Celyad

Oncology. “We also were proud to recently announce that the FDA

lifted the clinical hold on our CYAD-101 program. In addition, we

look forward to the upcoming data read out for CYAD-211 in the

second half of 2022. We are truly ushering in a new chapter for

Celyad Oncology by unlocking the potential of not only our product

candidates, but also our portfolio of IP, technology, and overall

expertise in cell therapy.”

Second Quarter 2022 and Recent Business

Highlights

- The Board of Directors named Hilde

Windels as Chair of the Board of Directors

- Michel Lussier named Interim Chief

Executive Officer of the Company

Pipeline and Business Updates

CYAD-211 – Allogeneic shRNA-based, anti-BCMA CAR

T for r/r MM

CYAD-211 is an investigational, short hairpin

RNA (shRNA)-based allogeneic CAR T candidate for the treatment of

r/r MM. CYAD-211 is engineered to co-express a B cell maturation

antigen (BCMA) targeting CAR and a single shRNA, which interferes

with the expression of the CD3ζ component of the T-cell receptor

(TCR) complex.

- Preliminary data reported in

December 2021 from the dose-escalation segment of the IMMUNICY-1

Phase 1 trial evaluating CYAD-211 following

cyclophosphamide/fludarabine (CyFlu) preconditioning chemotherapy

in patients with r/r MM showed evidence of clinical activity with a

good tolerability profile including no evidence of Graft versus

Host Disease. In addition, all patients in the trial had detectable

CYAD-211 cells in the peripheral blood.

- Enrollment is currently ongoing in

the IMMUNICY-1 Phase 1 trial to evaluate enhanced lymphodepletion

(eLD) and increased CYAD-211 doses with the aim to improve cell

persistence and potentially maximize the clinical benefit of

CYAD-211. The IMMUNICY-1 protocol also allows for CYAD-211 redosing

in certain patients.

- Additional data updates from the

eLD cohorts of the Phase 1 IMMUNICY-1 trial of CYAD-211 for r/r MM

are expected during second half of 2022.

CYAD-101 – Allogeneic TIM-based NKG2D CAR T for

mCRC

CYAD-101 is an investigational, non-gene edited, allogeneic CAR

T candidate engineered to co-expresses the TIM peptide alongside a

CAR based on NKG2D, a receptor expressed on natural killer (NK) and

T cells, that binds to eight stress-induced ligands.

- In June 2022 we submitted our

complete response to the clinical hold of the CYAD-101-002 phase 1b

trial to the FDA stating our intent to amend the eligibility

criteria to exclude patients who have bilateral lung metastases and

patients who have received treatment with epidermal growth factor

receptor (EGFR) targeting monoclonal antibodies within the previous

9 months prior to trial recruitment. In July 2022, based on that

complete response, we received notification that the FDA lifted the

clinical hold on the CYAD-101-002 phase 1b trial

shARC Platform

Discovery research continues on programs focused

on the co-expression of Interleukin-18 in conjunction with our

short hairpin RNA shRNA technology platform, also known as our

shARC (shRNA Armored CAR) franchise, with a focus on the

development of next-generation, allogeneic CAR T candidates.

CYAD-02 – Autologous NKG2D CAR-T for r/r AML and

MDS

CYAD-02 is an investigational, autologous CAR T therapy that

co-expresses both the NKG2D CAR and a single shRNA targeting the

NKG2D ligands MICA/MICB on the CAR T cells.

- In December 2021, the Company presented clinical results from

the dose-escalation CYCLE-1 Phase 1 trial evaluating CYAD-02 for

the treatment of r/r acute myeloid leukemia (AML) and

myelodysplastic syndromes (MDS). Data from the trial showed that a

single shRNA can target two independent genes (MICA/MICB) to

enhance the phenotype of the CAR T cells. In addition, the dual

knockdown showed a positive contribution to the initial clinical

activity of CYAD-02 as well as a trend towards increased

engraftment and persistence compared to the first-generation,

autologous NKG2D receptor CAR T.

- The Company continues to explore potential partnership

opportunities for the future development of CYAD-02.

Strategic Focus on Intellectual

Property

The Company maintains a robust intellectual

property portfolio within the landscape of CAR T, including twelve

foundational U.S. patents associated with allogeneic CAR T for the

treatment of cancer as well as patents for NKG2D receptor-based

cell therapies. We believe these patents provide an avenue for the

Company to develop its own programs as well as to seek potential

partnership opportunities.

First Half 2022 Financial Results

Key financial figures for the first half of

2022, compared with the first half of 2021 and full year 2021, are

summarized below:

|

Selected key financial figures (€ millions) |

Half Year 30 June 2022 |

Half Year 30 June 2021 |

Full Year 31 December 2021 |

|

Revenue |

- |

- |

- |

|

Research and development expenses |

(10.5) |

(10.0) |

(20.8) |

|

General and administrative expenses |

(6.2) |

(4.8) |

(9.9) |

|

Change in fair value of contingent

consideration |

1.1 |

(2.0) |

0.8 |

|

Other income/(expenses) |

1.6 |

1.8 |

3.4 |

|

Operating loss |

(14.1) |

(14.9) |

(26.4) |

|

Loss for the period/year |

(14.1) |

(14.9) |

(26.5) |

|

Net cash used in operations |

(16.3) |

(12.2) |

(26.6) |

|

Cash and cash equivalents |

14.4 |

12.0 |

30.0 |

Research and Development expenses were €10.5

million for the first half of 2022, compared to €10.0 million for

the first half of 2021. The €0.5 million increase was mainly driven

by intellectual property filing and maintenance fees to strengthen

intellectual property prosecution and the increase of employee

expenses mainly related to the full expense impact of the employees

recruited during 2021 to support the Group’s preclinical and

clinical programs, employee turnover and management changes, both

of which were partially offset by the decrease in clinical

activities resulting from the Phase 1b CYAD-101-002 (KEYNOTE-B79)

trial which was on clinical hold during the second quarter of

2022.

General and Administrative expenses were €6.2

million for the first half of 2022, compared to €4.8 million for

the first half of 2021. This increase is primarily attributable to

an increase in insurance costs for the period, combined with an

increase in employee expenses mainly related to management changes

through the six-month period ended June 30, 2022.

A fair value adjustment of €1.1 million

(non-cash income) related to the reassessment of the contingent

consideration and other financial liabilities associated with the

advancement of the Company’s NKG2D-based CAR T candidates as of

June 30, 2022, required by International Financial Reporting

Standards (IFRS), was mainly driven by the updated assumptions on

projected revenue associated with the Company’s CYAD-101 program,

for which the timing of the potential commercialization has been

delayed by one year. Additionally, the addressable patient

population for CYAD-101 has been reduced based on recent safety

findings from the CYAD-101-002 Phase 1b trial. The fair value

adjustment was also driven by updated assumptions to discount rate

and revaluation of the U.S. dollar foreign exchange rate.

The Company also posted €1.6 million in net

other income for the first half of 2022, compared to a net other

income of €1.8 million for the first half of 2021. Other income for

the first half of 2022 is primarily due to grant income from the

Walloon Region of €1.4 million.

Net loss for the first half of 2022 was €14.1

million, or € (0.62) per share, compared to a net loss of €14.9

million, or € (1.02) per share, for the first half of 2021.

Net cash used in operations was €16.3 million

for the first half of 2022, compared to €12.2 million for the first

half of 2021.

As of June 30, 2022, the Company had cash and

cash equivalents of €14.4 million ($15.0 million).

As of June 30, 2022, the total number of basic

shares outstanding were 22.6 million similar to December 31,

2021.

Celyad Oncology First Half 2022

Conference Call Details

Date: Friday, August 5, 2022Time: 2 p.m. CEST /

8 a.m. EDTDial-in: +1 201 493 6779 (International), + 1 877 407

9716 (United States) or +32 (0) 800 73 904 (Belgium). Please ask to

be joined into the Celyad Oncology SA call.

The conference call will be webcast

live and archived within the “Events”

section of the Celyad Oncology website.

About Celyad Oncology

Celyad Oncology is a clinical-stage

biotechnology company focused on the discovery and development of

chimeric antigen receptor T cell (CAR T) therapies for cancer. The

Company is developing a pipeline of allogeneic (off-the-shelf) and

autologous (personalized) CAR T cell therapy candidates for the

treatment of both hematological malignancies and solid tumors.

Celyad Oncology was founded in 2007 and is based in

Mont-Saint-Guibert, Belgium and New York, NY. The Company has

received funding from the Walloon Region (Belgium) to support the

advancement of its CAR T cell therapy programs. For more

information, please visit

www.celyad.com.

Forward-Looking Statement

This release may contain forward-looking

statements, within the meaning of applicable securities laws,

including the Private Securities Litigation Reform Act of 1995, as

amended. Forward-looking statements include, without limitation,

statements regarding: Celyad Oncology’s ability to leverage its

intellectual property to develop programs and seek potential

partnership opportunities, the continued development of Celyad

Oncology’s TIM technology, the lifting of the clinical hold on

CYAD-101-002 trial, the timing and outcomes of additional data from

Phase 1 IMMUNICY-1 trial of CYAD-211, safety and clinical activity

of the product candidates in Celyad Oncology’s pipeline, Celyad

Oncology’s ability to effectively leverage its intellectual

property portfolio, Celyad Oncology’s financial condition and cash

runway, and expected results of operations and business outlook.

The words “may,” “might,” “will,” “could,” “would,” “should,”

“plan,” “anticipate,” “intend,” “believe,” “expect,” “estimate,”

“future,” “potential,” “continue,” “target” and similar words or

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Forward-looking statements may involve known and

unknown risks and uncertainties which might cause actual results,

financial condition, performance or achievements of Celyad Oncology

to differ materially from those expressed or implied by such

forward-looking statements. Such risk and uncertainty include,

without limitation: Celyad Oncology’s ability to continue to access

to the equity purchase agreement with Lincoln Park Capital Fund,

LLC, our financial and operating results, the duration and severity

of the COVID-19 pandemic, and global economic uncertainty,

including with respect to geopolitical conditions and attendant

sanctions resulting from the conflict in Ukraine. A further list

and description of these risks, uncertainties and other risks can

be found in Celyad Oncology’s U.S. Securities and Exchange

Commission (SEC) filings and reports, including in its Annual

Report on Form 20-F filed with the SEC on March 24, 2022 and

subsequent filings and reports by Celyad Oncology. These

forward-looking statements speak only as of the date of publication

of this document and Celyad Oncology’s actual results may differ

materially from those expressed or implied by these forward-looking

statements. Celyad Oncology expressly disclaims any obligation to

update any such forward-looking statements in this document to

reflect any change in its expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based, unless required by law or regulation.

Investor and Media Contacts:Sara

ZelkovicCommunications & Investor Relations DirectorCelyad

Oncology investors@celyad.com

Source: Celyad Oncology SA

Celyad Oncology

SAInterim Consolidated Statement of Comprehensive

Income (Unaudited)

|

|

For the Six-month period |

For the Six-month period |

| (€'000) |

ended June 30, |

ended June 30, |

|

|

2022 |

2021 |

|

Revenue |

- |

|

- |

|

| Cost of sales |

- |

|

- |

|

| Gross

profit |

- |

|

- |

|

| Research and Development

expenses |

(10 527 |

) |

(9 956 |

) |

| General & Administrative

expenses |

(6 245 |

) |

(4 785 |

) |

| Change in fair value of

contingent consideration |

1 128 |

|

(1 961 |

) |

| Other income |

1 781 |

|

1 987 |

|

| Other expenses |

(214 |

) |

(162 |

) |

| Operating

Loss |

(14 077 |

) |

(14 877 |

) |

| Financial income |

148 |

|

166 |

|

| Financial expenses |

(127 |

) |

(143 |

) |

| Loss before

taxes |

(14 056 |

) |

(14 854 |

) |

| Income taxes |

- |

|

- |

|

| Loss for the

period |

(14 056 |

) |

(14 854 |

) |

| Basic

and diluted loss per share (in €) |

(0.62 |

) |

(1.02 |

) |

| Other comprehensive

income/(loss) |

|

|

| Items that will not be

reclassified to profit and loss |

- |

|

- |

|

| Remeasurement of

post-employment benefit obligations, net of tax |

- |

|

- |

|

| Items that may be

subsequently reclassified to profit or loss |

(9 |

) |

14 |

|

| Currency translation

differences |

(9 |

) |

14 |

|

|

Other comprehensive income / (loss) for the period, net of

tax |

(9 |

) |

14 |

|

|

Total comprehensive loss for the period |

(14 065 |

) |

(14 840 |

) |

|

Total comprehensive loss for the period attributable to

Equity Holders |

(14 065 |

) |

(14 840 |

) |

Celyad Oncology

SAInterim Consolidated Statement of Financial

Position (Unaudited)

|

(€’000) |

June 30, |

December 31, |

|

|

2022 |

2021 |

|

NON-CURRENT ASSETS |

43 760 |

|

45 651 |

|

| Goodwill and Intangible

assets |

36 589 |

|

36 168 |

|

| Property, Plant and

Equipment |

2 855 |

|

3 248 |

|

| Non-current Trade and Other

receivables |

- |

|

2 209 |

|

| Non-current Grant

receivables |

4 094 |

|

3 764 |

|

| Other non-current assets |

222 |

|

262 |

|

| CURRENT

ASSETS |

19 380 |

|

34 292 |

|

| Trade and Other

Receivables |

757 |

|

668 |

|

| Current Grant receivables |

2 814 |

|

1 395 |

|

| Other current assets |

1 424 |

|

2 211 |

|

| Short-term investments |

- |

|

- |

|

| Cash

and cash equivalents |

14 385 |

|

30 018 |

|

|

TOTAL ASSETS |

63 140 |

|

79 943 |

|

| EQUITY |

30 650 |

|

43 639 |

|

| Share Capital |

78 585 |

|

78 585 |

|

| Share premium |

6 317 |

|

6 317 |

|

| Other reserves |

34 239 |

|

33 172 |

|

| Capital reduction reserve |

234 562 |

|

234 562 |

|

| Accumulated deficit |

(323 053 |

) |

(308 997 |

) |

| NON-CURRENT

LIABILITIES |

21 134 |

|

22 477 |

|

| Bank loans |

- |

|

- |

|

| Lease liabilities |

1 381 |

|

1 730 |

|

| Recoverable Cash advances

(RCAs) |

5 971 |

|

5 851 |

|

| Contingent consideration

payable and other financial liabilities |

13 551 |

|

14 679 |

|

| Post-employment benefits |

53 |

|

53 |

|

| Other non-current

liabilities |

178 |

|

164 |

|

| CURRENT

LIABILITIES |

11 356 |

|

13 827 |

|

| Bank loans |

- |

|

- |

|

| Lease liabilities |

783 |

|

902 |

|

| Recoverable Cash advances

(RCAs) |

669 |

|

362 |

|

| Trade payables |

6 008 |

|

6 611 |

|

| Other

current liabilities |

3 896 |

|

5 952 |

|

|

TOTAL EQUITY AND LIABILITIES |

63 140 |

|

79 943 |

|

| |

|

|

|

|

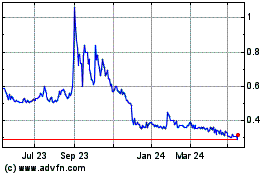

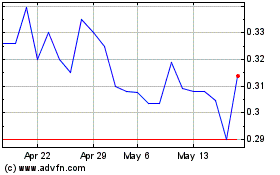

Celyad Oncology (EU:CYAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Celyad Oncology (EU:CYAD)

Historical Stock Chart

From Feb 2024 to Feb 2025