Celyad Oncology (Euronext & Nasdaq: CYAD) (the “Company”), a

biotechnology company focused on innovative technologies for

chimeric antigen receptor (CAR) T-cell therapies, today announces

its financial results for the fiscal year 2022 ended December 31,

2022 and provides a business update.

Michel Lussier, Interim Chief Executive Officer

of Celyad Oncology, said: “2022 was a crossroad year for Celyad

Oncology, with important changes and turning points. We strongly

believe all those changes, together with our prior accomplishments,

significantly strengthened our position. Having dealt with the 2022

challenges, Celyad has now positively reinvented itself as a

leaner, more agile organization. We believe that Celyad is well

prepared and has the relevant unique assets and know how to create

significant shareholder value in the next few years.”

Operational highlights

- Since late 2022,

the Company has implemented a differentiated and innovative

strategy, increasing its R&D efforts in areas of expertise

where it believes it can leverage the differentiated nature of its

platform technology and continue to bolster its intellectual

property (IP) estate; and

- The Company will

continue to explore options to tackle the major current limitations

of CAR T-cell therapies through development of its dual targeting

CARs with NKG2D capabilities, B7-H6 targeting immunotherapies and

multiplexing approach of short hairpin RNAs (shRNAs).

Upcoming Anticipated

Milestones

- The Company will

provide an update on its shRNA multiplexing and dual CAR platforms

and business development in the first half of 2023;

- The Company will

take part in the World Oncology Cell Therapy Congress in Boston, US

(25-26 April 2023), as well as in the Immuno-Oncology summit in

London (20-22 June 2023);

- The Company

anticipates the arrival of a new CEO in the first half of 2023;

and

- We anticipate

fundraising in the first half of 2023.

Full Year 2022 Financial

Review

As of December 31, 2022, the Company had cash

and cash equivalents of €12.4 million ($13.3 million).

The Company projects that its existing cash and

cash equivalents should be sufficient to fund operating expenses

and capital expenditure requirements into the fourth quarter of

2023.

After due consideration of detailed budgets and

estimated cash flow forecasts for the years 2023 and 2024, the

Company projects that its existing cash and cash equivalents will

not be sufficient to fund its estimated operating and capital

expenditures over at least the next 12 months from the date that

the financial statements are issued.

The Company is currently evaluating different

financing options to obtain the required funding to extend the

Company’s cash runway beyond 12 months from the date the financial

statements are issued.

Key financial figures for full-year 2022,

compared with full-year 2021, are summarized below:

|

Selected key financial figures (€ millions) |

Full year 2022 |

Full year 2021 |

|

Revenue |

- |

- |

|

Research and development expenses |

(18.9) |

(20.8) |

|

General and administrative expenses |

(10.5) |

(9.9) |

|

Change in fair value of contingent consideration |

14.7 |

0.8 |

|

Impairment of Oncology intangible assets |

(35.1) |

- |

|

Other income/(expenses) |

9.0 |

3.4 |

|

Operating loss |

(40.9) |

(26.4) |

|

Loss for the period/year |

(40.9) |

(26.5) |

|

Net cash used in operations |

(28.0) |

(26.6) |

|

Treasury position(1) |

12.4 |

30.0 |

(1) “Treasury position” is an alternative

performance measure determined by adding Short-term investments and

Cash and cash equivalents from the statement of financial position

prepared in accordance with IFRS. The purpose of this measure by

Management is to identify the level of cash available internally

(excluding external sources of financing) within 12 months.

The Company’s license and collaboration

agreements generated no revenue in 2022 and in 2021.

Research and Development (R&D) expenses were

€18.9 million in 2022 as compared to €20.8 million in 2021, a

year-over-year decrease of €1.8 million. The decrease in the

Company’s R&D expenses is primarily driven by the Company’s

decision to discontinue some of preclinical and in process

development costs after the Company’s decision to adopt and

implement a new business strategy over the last few months of 2022,

as well as a decrease of the expenses associated with share-based

payments (non-cash expenses) related to the warrant plan offered to

our employees and directors.

General and Administrative (G&A) expenses

were €10.5 million in 2022 as compared to €9.9 million in 2021, an

increase of €0.6 million. This increase is primarily related to

higher insurances costs and consulting fees partially compensated

by the decrease of the expenses associated with the share-based

payments (non-cash expenses) related to the warrants plan offered

to our employees and directors.

The fair value adjustment (€14.7 million)

relating to the contingent consideration and other financial

liabilities as of December 31, 2022, is mainly driven by the full

reversal of the liability. This liability is a result of business

combination accounting (IFRS3) which requires the liability to be

recorded unless the possibility of any outflow is remote.

This impairment comes as a result of the

Company’s strategic shift in focus away from clinical development

and the early stage nature of the implementation of the Celyad 2.0

strategy, which involves shifting from an organization focused on

clinical development to one prioritizing R&D discovery and the

monetization of its intellectual property (IP) portfolio through

partnerships, collaborations and license agreements. To date, no

effective sublicence contract nor collaboration contract has been

entered into, and as a result there is uncertainty as to the timing

and amount of associated short, medium and long term revenues.

Given this uncertainty, and per accounting

standards, the Company recognizes a full impairment loss on the

remaining value of goodwill, In Process Research and Development,

and Horizon Discovery’s shRNA platform, resulting in a non-cash

impairment of €35.1 million on a consolidated basis for the

financial year ended December 31, 2022.

This accounting conclusion, which reflects the

Company’s financial situation as of December 31, 2022, does not

affect Management’s commitment to continue in its efforts to pursue

the potential monetization of the Company’s IP. If and when such a

firm sublicense or collaboration contract occurs and hence

increases the probability of revenue, the Management will estimate

the reversal of the impairment which will be limited so that the

carrying amount of the asset does not exceed its recoverable amount

along with the remeasurement of the related contingent

liability.

The Company’s other income is principally

associated with grants received from the Walloon Region mainly in

the form of recoverable cash advances (RCAs) and R&D tax credit

income as well as the gain on sale of the CTMU activities:

- Grant income

(RCAs): additional grant income has been recognized in 2022 on

grants in the form of RCAs. According to IFRS standards, the

Company has earned grants for the period amounting to €1.6 million,

out of which €0.5 million is accounted for as a financial liability

and the remaining €1.1 million as a grant income;

- Grant income

(Others): additional grant income has been recognized in 2022 on

grants received and from the regional government (for €0.9

million), not referring to RCAs and not subject to

reimbursement;

- With respect to

R&D tax credit, the current year income is €0.5 million;

and

- Gain on sale of

CTMU activities (for €5.2 million) results from the terms of the

asset purchase agreement between Celyad Oncology and Cellistic

under which Cellistic agreed to acquire Celyad Oncology’s

Manufacturing Business Unit for a total consideration of €6.0

million.

Net loss for the year ended December 31, 2022

was €40.9 million, or €1.81 per share, compared to a net loss of

€26.5 million, or €1.70 per share, for the same period in 2021. As

noted above, the increase in net loss between periods was primarily

due to the non-cash impairment adjustment on the Oncology

intangible assets.

Net cash used in operations for the year ended

December 31, 2022, which excludes non-cash effects, amounted to

€28.0 million, which is in line with net cash used in operations of

€26.6 million for the year ended December 31, 2021.

The net assets of the Company as of December 31,

2022, on a BE-GAAP non-consolidated basis, have fallen below half

of the Company’s capital. As a result, in accordance with Article

7:228 of the Belgian Code for Companies and Associations, the Board

of Directors plans to submit for a vote, at its May 5, 2023

shareholders’ meeting, its business plan including a proposal to

continue the Company’s activities. The Board of Directors will

publish a detailed report regarding this proposal on or around

April 3, 2023, together with the convocation with proposed

resolutions for the shareholders’ meeting.

Annual Report 2022

The Annual Report for the year ended December

31, 2022 will be published on March 23, 2023, and will be available

on the Company’s website, www.celyad.com. The Company’s statutory

auditor, EY Bedrijfsrevisoren/Réviseurs d’Entreprises BV/SRL (EY),

has confirmed that the completed audit has not revealed any

material misstatement in the consolidated financial statements. EY

also confirmed that the accounting data reported in the press

release are consistent, in all material respects, with the

consolidated financial statements from which it has been

derived.

Conference Call and Webcast

Details

A conference call will be held on Friday, March

24th at 1:00 p.m. CET / 8:00 a.m. EDT to review the financial and

operating results for full year 2022. Please dial into the call

five to ten minutes prior to start time using the appropriate

number below and ask to join the “Celyad Oncology SA call”:

- United States /

International: +1-877-407-9716 or +1-201-493-6779

- Belgium: +32 (0)

800-73-904 (Fixed) or +32 (0) 800-73-566 (Mobile)

Participants may also access to the live webcast

link for instant telephone access to the event. Archived recording

will be available in the "Events" section of the Celyad website

after the event.

Financial Calendar 2023

| • May 5th, 2023 |

First

Quarter 2023 Business Update |

| • May 5th, 2023 |

Annual

shareholders meeting |

| • August 3rd, 2023 |

First

Half 2023 Interim Results |

| • November 9th, 2023 |

Third

Quarter 2023 Business Update |

The financial calendar is communicated on an

indicative basis and may be subject to change.

About Celyad Oncology

Celyad Oncology is a biotechnology company

focused on the discovery and development of innovative technologies

chimeric antigen receptor (CAR) T-cell therapies. The Company is

focusing on opportunities to fully harness the true potential of

its proprietary technology platforms and intellectual property and

support the development of next-generation CAR T candidates in

solid tumors and hematological malignancies. Celyad Oncology is

based in Mont-Saint-Guibert, Belgium and New York, NY. For more

information, please visit www.celyad.com.

Celyad Oncology Forward-Looking

Statement

This release may contain forward-looking

statements, within the meaning of applicable securities laws,

including the Private Securities Litigation Reform Act of 1995, as

amended, including, without limitation, statements regarding

beliefs about and expectations for the Company’s updated strategic

business model, including associated potential benefits,

transactions and partnerships, statements regarding the potential

value of the Company’s IP, statements regarding the Company’s

financial statements and cash runway, statements regarding the

Company’s future hiring plans, statements regarding the Company’s

future fundraising plans, and statements regarding the continuation

of the Company’s existence. The words “will,” “believe,”

“potential,” “continue,” “target,” “project,” “should” and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Any forward-looking statements in this release

are based on management’s current expectations and beliefs and are

subject to a number of known and unknown risks, uncertainties and

important factors which might cause actual events, results,

financial condition, performance or achievements of Celyad Oncology

to differ materially from those expressed or implied by such

forward-looking statements. Such risks and uncertainties include,

without limitation, risks related to the material uncertainty about

the Company’s ability to continue as a going concern; the Company’s

ability to realize the expected benefits of its updated strategic

business model; the Company’s ability to develop its IP assets and

enter into partnerships with outside parties; the Company’s ability

to enforce its patents and other IP rights; the possibility that

the Company may infringe on the patents or IP rights of others and

be required to defend against patent or other IP rights suits; the

possibility that the Company may not successfully defend itself

against claims of patent infringement or other IP rights suits,

which could result in substantial claims for damages against the

Company; the possibility that the Company may become involved in

lawsuits to protect or enforce its patents, which could be

expensive, time-consuming, and unsuccessful; the Company’s ability

to protect its IP rights throughout the world; the potential for

patents held by the Company to be found invalid or unenforceable;

and other risks identified in Celyad Oncology’s U.S. Securities and

Exchange Commission (SEC) filings and reports, including in the

latest Annual Report on Form 20-F filed with the SEC and subsequent

filings and reports by Celyad Oncology. These forward-looking

statements speak only as of the date of publication of this

document and Celyad Oncology’s actual results may differ materially

from those expressed or implied by these forward-looking

statements. Celyad Oncology expressly disclaims any obligation to

update any such forward-looking statements in this document to

reflect any change in its expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based, unless required by law or regulation.

Celyad Oncology Contacts:

|

Investor Contact: |

Media Contact: |

|

David Georges |

Caroline Lonez |

|

VP Finance and Administration |

R&D Communications and Business Development |

|

investors@celyad.com |

communications@celyad.com |

Source: Celyad Oncology SA

Celyad Oncology SA

Consolidated Statement of Comprehensive

Loss

|

(€'000) |

For the year ended December 31, |

|

|

2022 |

|

2021 |

|

|

Revenue |

- |

|

- |

|

|

Cost of sales |

- |

|

- |

|

|

Gross profit |

- |

|

- |

|

|

Research and Development expenses |

(18 928) |

|

(20 773) |

|

|

General & Administrative expenses |

(10 546) |

|

(9 908) |

|

|

Change in fair value of contingent consideration |

14 679 |

|

847 |

|

|

Impairment of Oncology intangible assets |

(35 084) |

|

- |

|

|

Other income |

9 360 |

|

4 909 |

|

|

Other expenses |

(338) |

|

(1 466) |

|

|

Operating Loss1 |

(40 857) |

|

(26 391) |

|

|

Financial income |

185 |

|

144 |

|

|

Financial expenses |

(198) |

|

(255) |

|

|

Loss before taxes |

(40 870) |

|

(26 502) |

|

|

Income taxes |

(65) |

|

(10) |

|

|

Loss for the period |

(40 935) |

|

(26 512) |

|

|

Basic and diluted loss per share (in €) |

(1.81) |

|

(1.70) |

|

[1] For 2022 and 2021, the Group does not have

any non-controlling interests and the losses for the year are fully

attributable to owners of the parent.

1 The operating loss arises from the Company’s

loss for the period before deduction of financial income, financial

expenses and income taxes. The purpose of this measure by

Management is to identify the Company’s results in connection with

its operating activities.

Celyad Oncology SA

Consolidated Statement of Financial

Position

|

(€’000) |

December 31, |

December 31, |

|

|

2022 |

|

2021 |

|

|

NON-CURRENT ASSETS |

4 891 |

|

45 651 |

|

|

Goodwill and Intangible assets |

864 |

|

36 168 |

|

|

Property, Plant and Equipment |

309 |

|

3 248 |

|

|

Non-current Trade and Other receivables |

- |

|

2 209 |

|

|

Non-current Grant receivables |

3 454 |

|

3 764 |

|

|

Other non-current assets |

264 |

|

262 |

|

|

CURRENT ASSETS |

14 825 |

|

34 292 |

|

|

Trade and Other Receivables |

1 118 |

|

668 |

|

|

Current Grant receivables |

- |

|

1 395 |

|

|

Other current assets |

1 017 |

|

2 211 |

|

|

Short-term investments |

- |

|

- |

|

|

Cash and cash equivalents |

12 445 |

|

30 018 |

|

|

Assets held for sale |

245 |

|

- |

|

|

TOTAL ASSETS |

19 716 |

|

79 943 |

|

|

EQUITY |

4 317 |

|

43 639 |

|

|

Share Capital |

78 585 |

|

78 585 |

|

|

Share premium |

6 317 |

|

6 317 |

|

|

Other reserves |

34 800 |

|

33 172 |

|

|

Capital reduction reserve |

234 562 |

|

234 562 |

|

|

Accumulated deficit |

(349 947) |

|

(308 997) |

|

|

NON-CURRENT LIABILITIES |

4 973 |

|

22 477 |

|

|

Bank loans |

- |

|

- |

|

|

Lease liabilities |

118 |

|

1 730 |

|

|

Recoverable Cash advances (RCAs) |

4 584 |

|

5 851 |

|

|

Contingent consideration payable and other financial

liabilities |

- |

|

14 679 |

|

|

Post-employment benefits |

13 |

|

53 |

|

|

Other non-current liabilities |

258 |

|

164 |

|

|

CURRENT LIABILITIES |

10 426 |

|

13 827 |

|

|

Bank loans |

- |

|

- |

|

|

Lease liabilities |

137 |

|

902 |

|

|

Recoverable Cash advances (RCAs) |

437 |

|

362 |

|

|

Trade payables |

4 752 |

|

6 611 |

|

|

Other current liabilities |

5 100 |

|

5 952 |

|

|

TOTAL EQUITY AND LIABILITIES |

19 716 |

|

79 943 |

|

Celyad Oncology SA

Consolidated Net Cash Burn

Rate2

|

(€’000) |

For the year ended 31 December, |

|

|

2022 |

|

2021 |

|

|

Net cash used in operations |

(28 010) |

|

(26 643) |

|

|

Net cash (used in)/from investing activities |

7 202 |

|

(126) |

|

|

Net cash (used in)/from financing activities |

3 241 |

|

39 521 |

|

|

Effects of exchange rate changes |

(6) |

|

32 |

|

|

Change in Cash and cash equivalents |

(17 573) |

|

12 784 |

|

|

Change in Short-term investments |

- |

|

- |

|

|

Net cash burned over the period |

(17 573) |

|

12 784 |

|

2 ‘Net cash burn rate’ is an alternative

performance measure determined by the year-on-year net variance in

the Group’s treasury position as above defined. The purpose of this

measure for the Management is to determine the change of the

treasury position.

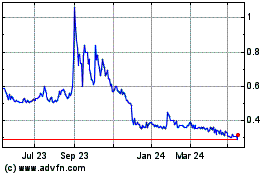

Celyad Oncology (EU:CYAD)

Historical Stock Chart

From Feb 2025 to Mar 2025

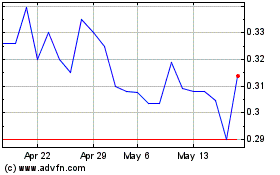

Celyad Oncology (EU:CYAD)

Historical Stock Chart

From Mar 2024 to Mar 2025