Suez Gets $13.66 Billion Approach from Ardian, GIP; Veolia to Continue Bid

18 January 2021 - 6:30PM

Dow Jones News

By Mauro Orru

Private-equity investors Ardian and Global Infrastructure

Partners have approached Suez SA with an 11.31 billion-euro ($13.66

billion) takeover offer as an alternative to a bid from Veolia

Environnement SA.

French waste and water management company Suez said late Sunday

that its board of directors unanimously backed a proposal from

Ardian and Global Infrastructure Partners to buy Suez shares at

EUR18 a share.

"The board of directors gives its unanimous support to the

solution envisaged with the participation of responsible,

long-term, top quality investors. It has mandated the group's CEO

to continue to work to deliver it, including opening discussions

with Veolia to reach a solution in line with Suez's corporate

interest," Suez's Board of Directors Chairman Philippe Varin

said.

Veolia previously acquired a 29.9% stake in Suez from energy

company Engie SA, although the process has become mired in legal

disputes, with Suez opposed to what it considers a hostile takeover

by Veolia.

Private-equity firm Ardian had previously expressed interest in

buying the stake from Engie.

Veolia said it stake in Suez isn't for sale and it considers

hostile any proposal involving a sale or transfer that would thwart

its efforts to take over Suez.

"I remain open to discussion with the board of directors of Suez

within the framework of the project that I sent them last week,"

Veolia Chief Executive Antoine Frerot said.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

January 18, 2021 02:15 ET (07:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

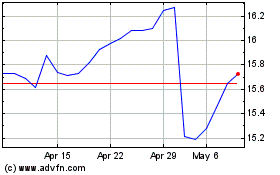

Engie (EU:ENGI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Engie (EU:ENGI)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Engie (Euronext): 0 recent articles

More Engie News Articles