Engie Upgrades Outlook on Positive Performance, Reduced Risks

07 November 2023 - 7:00PM

Dow Jones News

By Andrea Figueras

Engie raised its full-year guidance after what it called a

continued good performance with reduced risks as it approaches the

end of the year.

The French power utility on Tuesday said that it now expects

recurring net income in a range of 5.1 billion euros to 5.7 billion

euros ($5.47 billion-$6.11 billion), up from a prior forecast

between EUR4.7 billion and EUR5.3 billion.

It now sees non-nuclear earnings before interest and taxes of

EUR9 billion to EUR10 billion, while it previously anticipated EBIT

excluding nuclear between EUR8.5 billion and EUR9.5 billion.

The company posted earnings before interest, taxes, depreciation

and amortization of EUR11.9 billion, compared with EUR10.67 billion

for the same period last year, while revenue fell to EUR61.8

billion in the period, down 10.2% organically on-year.

Non-nuclear EBIT was EUR8 billion, up from EUR6.3 billion,

mainly driven by the units global energy management and sales as

well as renewables.

Engie backed its dividend policy with a 65% to 75% payout ratio

based on net recurring income and a floor of EUR0.65 a share for

the 2023 to 2025 period.

Write to Andrea Figueras at andrea.figueras@wsj.com

(END) Dow Jones Newswires

November 07, 2023 02:45 ET (07:45 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

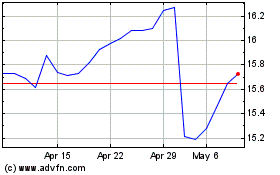

Engie (EU:ENGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Engie (EU:ENGI)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Engie (Euronext): 0 recent articles

More Engie News Articles