LINEDATA: Half year results 2020: Net margin rate stable at 9.7%

10 September 2020 - 1:45AM

LINEDATA: Half year results 2020: Net margin rate stable at 9.7%

Half year results 2020:Net margin rate

stable at 9.7%

| |

H1 2019 |

H1 2020 |

Change |

|

REVENUE |

84.8 |

78.5 |

-7.4% |

|

EBITDA% of revenue |

21.525.4% |

18.4 23.4% |

-14.6% |

|

OPERATING PROFIT% of revenue |

13.315.7% |

9.8 12.5% |

-26.4% |

|

NET INCOME% of revenue |

8.29.7% |

7.6 9.7% |

-7.4% |

Rounded, audited figures (€M)

Neuilly-sur-Seine, September 9,

2020 – Linedata (LIN:FP), a global

solutions and outsourcing services provider for asset management,

insurance, and credit professionals, showed a moderate decline in

its profitability indicators for the first half of 2020 in a global

economic environment impacted by the Covid-19 health crisis.

The Group achieved half-year revenues of €78.5

million, down 7.4% compared to the first half of 2019. This erosion

of revenue is more pronounced in client segments that rely more

heavily on consulting and customization resources, due in

particular to difficulties for employees to access client sites.

Conversely, SaaS (Software-as-a-Service), recurring license rental

fees and maintenance are trending well with an overall growth of

€1.4 million in recurring income to €64.5 million, representing 84%

of total turnover.

EBITDA stood at €18.4 million, down 14.6%

compared to the first half 2019. The €3.1 million decrease is

explained, on the one hand, by the contraction in half-yearly

revenue and, on the other, by Linedata’s desire to retain its

talents and accelerate the major transformation projects of the

Group’s offerings. As a result, many consulting and research

resources were reallocated to strategic R&D projects focused on

the future. This figure also includes €1.0 million in restructuring

costs. The EBITDA margin remains robust at 23.4%, down only 2

points compared to the first half of 2019.

EBITDA margin analysis

|

EBITDA Margin Rate |

H1 2019 |

H1 2020 |

|

Asset Management (*) |

25.2% |

24.9% |

|

Lending & Leasing |

25.6% |

19.7% |

|

Total |

25.4% |

23.4% |

(*) The “Other” segment consisting of insurance

and retirement savings has been integrated into Asset

Management

For the first half of 2020, the Asset Management

segment posted a more-or-less stable margin rate, close to 25%,

despite the decrease in revenue. This good performance is explained

by the proportion of recurring income in the business model, which

contributes more strongly to profitability.

Conversely, the EBITDA margin for the Lending

& Leasing business line, with revenue declining 17.7%, was down

around 6 points.

Result analysis

Operating Income reached €9.8 million, down

26.4%, due to exceptional provision reversals in 2019.

Financial income amounted to -€1.0 million

compared with -€1.9 million last year. The improvement is mainly

due to exchange rate effects. The €1.2 million tax on profits was

down €2.0 million compared to the same period in the previous

fiscal year, due in particular to the implementation in France of

the IP Box system, which allows income from software protected by

copyright to benefit from taxation at a reduced rate of 10%.

Net result for the first half of 2020 amounted

to €7.6 million, i.e. a net margin rate of 9.7%, stable compared

with first half of 2019.

Balance sheet analysis

As of June 30, 2020, shareholders’ equity

represented €116.5 million, down €2.1 million compared with the

situation at December 31, 2019. This decrease reflects the dividend

to be paid in the amount of €6.3 million and the acquisition of the

company’s own shares for the amount of €1.2 million.

The Group continued its deleveraging efforts in

early 2020. Net debt, excluding the impact of IFRS 16 rental

liabilities, totaled €65.2 million, down €11.6 million from the end

of the previous fiscal year. This represents 1.7 times the EBITDA

(on sliding 12-month basis).

Outlook

The Group anticipates a better trend for

revenues in the second half of the year and an improvement in its

operating margin.

Next announcement: 3rd quarter

2020 revenue, on October 21, 2020

ABOUT LINEDATA

With 20 years’ experience and 700+ clients in 50

countries, Linedata’s 1300 employees in 20 offices provide global

humanized technology solutions and services for the asset

management and credit industries. Linedata supports corporate

development and boosts its clients’ growth. Linedata's 2019 revenue

was €169.7 million. Linedata is listed on Euronext Paris

compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg

LIN:FPlinedata.com

|

LinedataFinance Department+33 (0)1 73 43 70

27infofinances@linedata.com |

Cap Value+33 (0)1 80 81 50 00info@capvalue.frwww.capvalue.fr |

- PR_LINEDATA_CA_Resultats semestriels_2020

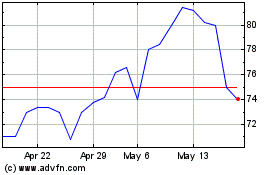

Linedata Services (EU:LIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Linedata Services (EU:LIN)

Historical Stock Chart

From Jan 2024 to Jan 2025