Nextensa NV/SA: Publication of a transparency notification

27 July 2023 - 1:40AM

Nextensa NV/SA: Publication of a transparency notification

PRESS RELEASEBrussels, 26 July 2023, 5.40 PM CESTRegulated

information

NEXTENSA NV/SA: PUBLICATION OF A TRANSPARENCY

NOTIFICATION

From a transparency notification dated 24 July

2023 made by AXA Belgium NV/SA, it appears that the total number of

voting rights of AXA Belgium NV/SA in Nextensa NV/SA has decreased

to 9.99% of the voting

rights.

This threshold underrun is due to the new

denominator following the granting of double voting rights to

certain of the shares in Nextensa NV/SA (in accordance with article

28 of the articles of association).

Based on this transparency notification,

Nextensa understands that AXA Belgium NV/SA holds

15.86%

of the total number of shares (= financial participation) in

Nextensa NV/SA on 24 July 2023.

_________________

Content of the notification:

REASON FOR THE

NOTIFICATION: passive threshold

overrun

NOTIFICATION BY: the parent

company or controlling person

PERSON(S) SUBJECT TO THE NOTIFICATION

REQUIREMENT:

|

Name and legal form |

Address |

|

AXA S.A. |

25 Avenue Matignon, 75008, Paris, France |

|

AXA Holdings Belgium S.A./N.V. |

Place du Trône 1, 1000 Brussels |

|

AXA Belgium S.A./N.V. |

Place du Trône 1, 1000 Brussels |

TRANSACTION DATE: 19 July 2023

THRESHOLD THAT HAS BEEN EXCEEDED: 10%

DENOMINATOR: 15 875 379

DETAILS OF THE NOTIFICATION:

|

A) Voting rights |

Previous notification |

After the transaction |

|

|

# voting rights |

# voting rights |

% voting rights |

|

Holders of voting rights |

|

Related to securities |

Unrelated to securities |

Related to securities |

Unrelated to securities |

|

AXA S.A. |

0 |

0 |

0 |

0.00% |

0.00% |

|

AXA Holdings Belgium S.A./N.V. |

0 |

0 |

0 |

0.00% |

0.00% |

|

AXA Belgium S.A./N.V. |

1 586 646 |

1 586 646 |

0 |

9.99% |

0.00% |

| Sub-total |

1 586 646 |

1 586 646 |

0 |

9.99% |

0.00% |

| TOTAL |

|

1 586 646 |

0 |

9.99% |

0.00% |

|

B) Equivalent financial instruments |

After the transaction |

|

Holders of equivalent financial instruments |

Type of financial instrument |

Maturity |

Exercise period or date |

# voting rights that can be acquired if the financial instrument is

exercised |

% voting rights |

Settlement |

| |

|

|

|

0 |

0.00% |

|

|

TOTAL (A & B) |

# voting rights |

% voting rights |

| |

1 586 646 |

9.99% |

ADDITIONAL INFORMATION:

Transparency notification of a passive threshold crossing,

following the press release published by the company Nextensa NV/SA

on 19 July 2023 in application of article 15 of the law of 2 May

2007 on the disclosure of major shareholdings since double voting

rights have been granted to certain of the shares in the company

(in accordance with article 28 of the articles of association).

This operation brings the number of voting rights in the company

Nextensa NV/SA to 15 875 379.

FULL CHAIN OF CONTROL OF THE COMPANIES VIA WHICH THE

PARTICIPATION IS EFFECTIVELY HELD:

AXA Belgium NV/SA is 94.93% owned by AXA Holdings Belgium NV/SA

and 5.07% by AXA S.A.

AXA Holdings Belgium NV/SA is 100% owned by AXA S.A.

AXA S.A. is not a controlled entity.

The AXA Group's operating entities, including AXA S.A.'s

insurance subsidiaries, act and exercise their voting rights

independently of Group entities that have the status of portfolio

management companies or investment firms.

_________________

The notice can be consulted on the company's website

https://nextensa.eu/en/investor-relations/shareholders-transparency/.

FOR MORE INFORMATION

Michel Van Geyte | Chief Executive Officer Gare Maritime, Rue

Picard 11, B505, 1000 Brussels +32 2 882 10 08 |

investor.relations@nextensa.eu www.nextensa.eu

ABOUT NEXTENSA

Nextensa is a mixed-use real estate investor and developer. The

company's investment portfolio is divided between the Grand Duchy

of Luxembourg (41%), Belgium (44%) and Austria (15%); its total

value as of 31/03/2023 was approximately € 1.28 billion.

As a developer, Nextensa is primarily active in shaping large

urban developments. At Tour & Taxis (development of over

350,000 sqm) in Brussels, Nextensa is building a mixed real estate

portfolio consisting of a revaluation of iconic buildings and new

constructions. In Luxembourg (Cloche d’Or), it is working in

partnership on a major urban extension of more than 400,000 sqm

consisting of offices, retail and residential buildings.

The company is listed on Euronext Brussels and has a market

capitalization of €442.1 million (value 30/06/2023).

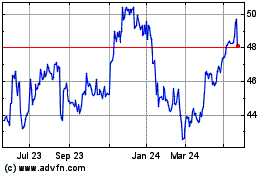

Nextensa (EU:NEXTA)

Historical Stock Chart

From Dec 2024 to Jan 2025

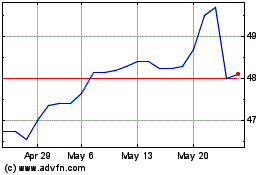

Nextensa (EU:NEXTA)

Historical Stock Chart

From Jan 2024 to Jan 2025