Press release: Orange issues 700 million euros of hybrid notes

28 March 2024 - 6:00PM

Press release: Orange issues 700 million euros of hybrid notes

Press releaseParis, 28 March 2024

NOT FOR DISTRIBUTION IN THE UNITED STATES OF AMERICA

Orange issues 700 million euros of hybrid

notes

Orange S.A. (the Company) successfully priced

the issuance of €700 million undated deeply subordinated fixed to

reset rate notes with a first call date as of 15 December 2030 and

with a fixed coupon of 4.50% until the first reset date (the

New Notes).

The New Notes are intended to be admitted to trading on Euronext

Paris. It is also expected that the rating agencies will assign the

New Notes a rating of BBB-/Baa3/BBB- (S&P / Moody's / Fitch)

and an equity content of 50%.

The Company also launched today a tender offer (the

Tender Offer) to repurchase:

- its €1 billion Undated 6 Year Non-Call Deeply Subordinated

Fixed to Reset Rate Notes with first reset date on 15 April 2025

and admitted to trading on Euronext Paris (ISIN FR0013413887) (of

which €1 billion is currently outstanding) (the NC 2025

Existing Notes); and

- its €1.25 billion Undated 12 Year Non-Call Deeply Subordinated

Fixed to Reset Rate Notes with first reset date on 1st October 2026

and admitted to trading on Euronext Paris (ISIN XS1115498260) (of

which €1.25 billion is currently outstanding) (the NC 2026

Existing Notes and, together with the NC 2025 Existing

Notes, the Existing Notes),

up to a maximum acceptance amount which will not exceed

€700,000,000. Besides the Company has decided to set the Series

Maximum Acceptance Amount with respect to NC 2025 Existing Notes at

€550,000,000 and with respect to NC 2026 Existing Notes, at

€150,000,000.

The purpose of the Tender Offer and the planned issuance of New

Notes is, amongst other things, to proactively manage the Company's

hybrid portfolio. The Tender Offer also provides qualifying holders

with the opportunity to sell their Existing Notes ahead of their

respective upcoming first reset date and allows them to apply for

priority in the allocation of the New Notes.

DisclaimerThis announcement does not constitute an

invitation to participate in the Tender Offer or the issuance of

New Notes in or from any jurisdiction in or from which, or to or

from any person to or from whom, it is unlawful to make such

invitation under applicable securities laws. The distribution of

this announcement in certain jurisdictions may be restricted by

law. Persons into whose possession this announcement comes are

required to inform themselves about, and to observe, any such

restrictions.Tenders of Notes for purchase pursuant to the Tender

Offer will not be accepted from qualifying holders in any

circumstances in which such offer or solicitation is unlawful. The

Company does not make any recommendation as to whether or not

qualifying holders should participate in the Tender

Offer.Securities may not be offered or sold in the United States

absent registration under, or an exemption from the registration

requirements of, the Securities Act. The New Notes have not been,

and will not be, registered under the Securities Act or the

securities laws of any state or other jurisdiction of the United

States, and may not be offered, sold or delivered, directly or

indirectly, in the United States or to, or for the account or

benefit of, any U.S. Person.United States This

Tender Offer is not being made and will not be made directly or

indirectly in or into, or by use of the mails of, or by any means

or instrumentality (including, without limitation, facsimile

transmission, telex, telephone, email and other forms of electronic

transmission) of interstate or foreign commerce of, or any facility

of a national securities exchange of, the United States or to U.S.

Persons as defined in Regulation S of the U.S. Securities Act of

1933, as amended (the Securities Act) (each a

U.S. Person) and the Notes may not be tendered in

the Tender Offer by any such use, means, instrumentality or

facility from or within the United States, by persons located or

resident in the United States of America (“U.S. holders” within the

meaning of Rule 800(h) under the Securities Act). Accordingly, any

documents or materials related to this Tender Offer are not being,

and must not be, directly or indirectly, mailed or otherwise

transmitted, distributed or forwarded (including, without

limitation, by custodians, nominees or trustees) in or into the

United States or to any such person. Any purported tender

instruction in response to this Tender Offer resulting directly or

indirectly from a violation of these restrictions will be invalid,

and tender instructions made by a person located or resident in the

United States of America or any agent, fiduciary or other

intermediary acting on a non-discretionary basis for a principal

giving instructions from within the United States will not be

accepted.For the purposes of the above paragraphs, United

States means the United States of America, its territories

and possessions (including Puerto Rico, the U.S. Virgin Islands,

Guam, American Samoa, Wake Island and the Northern Mariana

Islands), any state of the United States of America and the

District of Columbia.

About OrangeOrange is one of the world’s leading

telecommunications operators with revenues of 44.1 billion euros in

2023 and 137,000 employees worldwide at 31 December 2023, including

73,000 employees in France. The Group has a total customer base of

298 million customers worldwide at 31 December 2023, including 254

million mobile customers and 25 million fixed broadband customers.

The Group is present in 26 countries. Orange is also a leading

provider of global IT and telecommunication services to

multinational companies under the brand Orange Business. In

February 2023, the Group presented its strategic plan "Lead the

Future", built on a new business model and guided by responsibility

and efficiency. "Lead the Future" capitalizes on network excellence

to reinforce Orange's leadership in service quality.Orange is

listed on Euronext Paris (symbol ORA) and on the New York Stock

Exchange (symbol ORAN).For more information on the internet and on

your mobile: www.orange.com, www.orange-business.com and the Orange

News app or to follow us on Twitter: @orangegrouppr.Orange and any

other Orange product or service names included in this material are

trademarks of Orange or Orange Brand Services Limited.

Press contacts: Tom Wright;

tom.wright@orange.comCaroline Cellier;

caroline.cellier@orange.com

CAUTION: NOT FOR DISTRIBUTION IN THE UNITED

STATESThis press release, of a purely informative nature, is not

and cannot in any way be construed as an offering to sell any

securities, or as a solicitation of any offer to buy securities, in

any jurisdiction, including the United States, Japan, Australia,

Canada and the United Kingdom. The securities mentioned in this

press release have not been and will not be registered pursuant to

the US Securities Act of 1933, as modified. They cannot be offered

or sold in the United States absent registration or an exemption

from registration. No public offer of these securities has been or

will be made in the United States or elsewhere.

- PR_Orange_Hybrids_bond_issue_Pricing_EN_2024

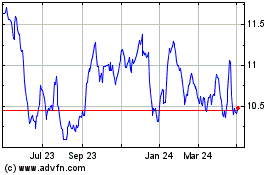

Orange (EU:ORA)

Historical Stock Chart

From Dec 2024 to Jan 2025

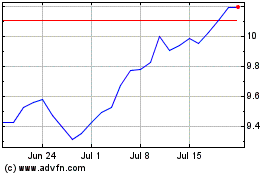

Orange (EU:ORA)

Historical Stock Chart

From Jan 2024 to Jan 2025