Hermès International: 2023 Full-Year Results

Outstanding sales and results in

2023

Revenue amounted to €13.4 billion (+21% at

constant exchange rates and +16% at current exchange rates)

Recurring operating income reached €5.7 billion (+20%)Net profit

amounted to €4.3 billion (+28%)

Paris, 9 February 2024

The group’s consolidated revenue amounted to

€13,427 million in 2023, up 21% at constant exchange rates and 16%

at current exchange rates compared to 2022. Recurring operating

income amounted to €5,650 million, i.e. 42.1% of sales. Net profit

group share reached €4,311 million, an increase of 28%.

In the fourth quarter 2023, sales reached €3,364

million, up 18% at constant exchange rates and 13% at current

exchange rates, despite the particularly high comparison base in

America and in Asia. The group pursued the trend seen over the

third quarter, thanks to sustained sales.

Axel Dumas, Executive Chairman of Hermès, said:

“In 2023, Hermès has once again cultivated its singularity and

achieved an outstanding performance in all métiers and across all

regions against a high base. These solid results reflect the strong

desirability of our collections and the commitment and talent of

the house’s women and men. I thank them all warmly.”

Sales by geographical area at the end of

December(at constant exchange rates unless otherwise

indicated)

At the end of December, all the geographical

areas posted a solid performance with homogeneous growth of around

20%. Sales increased both in the group’s stores (+20%), which

benefitted from a strong demand and the reinforcement of the

exclusive distribution network, and in wholesale activities (+24%),

driven by the travel retail business.

Asia excluding Japan (+19%) pursued its strong

growth, with significant increases in sales in all the countries of

the region. A second store opened in October in Chengdu, the

capital city of the province of Sichuan, becoming the house’s

thirty-third address in Mainland China, following the opening of a

store in Tianjin in July. In Korea, the store at the Shilla Hotel

in Seoul reopened in December after renovation and extension

work.

Japan (+26%) recorded a steady and sustained

increase in sales. The Daimaru Sapporo store on Hokkaido island and

the Takashimaya store in the centre of Kyoto were inaugurated in

October and November, after renovation and expansion. America

(+21%) confirmed an outstanding performance, in particular in the

second half of the year. After being renovated and expanded, the

Chicago store was inaugurated at the end of October, and the

Bellagio store reopened in Las Vegas in December, following the

store openings of Naples on the Gulf of Mexico in February, Aspen

in June and Los Angeles Topanga in July. The Hermès in the Making

travelling exhibition which showcases the know-how of the House,

met with great success in Chicago in October.

Europe excluding France (+20%) and France (+20%)

recorded robust growth, thanks to the loyalty of local clients and

to the dynamic of tourists flows. Following renovation, the

Crans-Montana store in Switzerland reopened in December, after the

store located in the historic centre of Bordeaux in November and

the Vienna store in Austria in September. The Silk event Par un

beau soir de carrés, staged in Brussels in November, attracted

great attention.

Sales by sector at the end of

December(at constant exchange rates unless otherwise

indicated)

At the end of December 2023, all the métiers

confirmed their solid momentum, with Ready-to-wear and Accessories,

Watches and Other Hermès Sectors achieving a remarkable

increase.

The Leather Goods and Saddlery métier (+17%),

which demand is very sustained, saw a strong increase. The Maximors

bag, with its sterling work, and Della Cavalleria Élan and Arçon

bags have been unveiled. Finally, the models displaying exceptional

savoir-faire in an Arts & Craft’s spirit around the Haut à

Courroies notably have met with great success.In 2023, Hermès

inaugurated the leather goods workshops in Louviers and la

Sormonne, the first two industrial buildings in France to carry the

E4C2 label that assesses environmental performance based on energy

consumption and carbon emissions. Production capacities continue to

grow with four leather goods workshop projects over the next four

years: Riom (Puy-de-Dôme) in 2024, L’Isle-d’Espagnac (Charente) in

2025, Loupes (Gironde) in 2026 and Charleville-Mézières (Ardennes)

scheduled for 2027, which will reinforce the nine centres of

expertise located all over France. Hermès continues to reinforce

its local anchoring in France in regions with strong manufacturing

know-how, while also developing employment and training.

The Ready-to-wear and Accessories sector (+28%)

pursued its strong growth, thanks to the success of the

ready-to-wear and footwear collections. The men’s and women’s

spring-summer 2024 collections were very well received when they

were presented at fashion shows in June and September

respectively.

The Silk and Textiles sector (+16%) recorded a

solid performance, supported by the success of the collections

which feature exceptional materials and unique craftsmanship.

Production capacities continue to expand, notably with the set-up

of a new printing line at the Pierre-Bénite site in Lyon.

The Perfume and Beauty sector (+12%) benefitted

from the success of both the latest creations and the House’s

classics such as Terre d'Hermès, the Jardins collection and Twilly

d’Hermès. The Hermès Beauty range was enhanced with a fifth chapter

at the end of September, Regard Hermès, inspired by the House’s

emblematic shades, as well as with limited editions of Rouge

Hermès.

The Watches métier (+23%) confirmed its splendid

performance, displaying singular creativity and remarkable

watchmaking know-how, in both the complication models and the

House’s iconic models. The Hermès H08 line is a great success and

welcomed several new models this year.

The Other Hermès sectors (+26%), which include

Jewellery and Homeware, recorded strong growth. Jewellery showcased

the Chaîne d’ancre design, reinterpreted in a multitude of shapes

and materials unveiled at an exhibition at the Faubourg store in

Paris in July. Outstanding results

Recurring operating income increased by 20% to

€5,650 million compared to €4,697 million in 2022. Thanks to the

strong sales growth and the favourable impact of currency hedging,

annual recurring operating profitability reached its highest level

ever at 42.1%, up from 40.5% in 2022.

Consolidated net profit group share amounted to

€4,311 million (32.1% of sales) compared to €3,367 million in 2022,

an increase of 28% resulting from the outstanding operating

performance as well as an improved return on cash management.

Operating cash flow was €5,123 million, up 25%.

This enabled us to finance €859 million of operating investments

and a €794 million increase in working capital requirements,

consistent with the strong rise in activity. Adjusted free cash

flow reached €3,192 million.

After distribution of the ordinary dividend

(€1,359 million) and inclusion of financial investments (€316

million) and treasury share buybacks (€132 million for 74,954

shares outside the liquidity contract), the restated net cash

position increased by €1,422 million to €11,164 million compared to

€9,742 million as at 31 December 2022.

A sustainable and responsible

model

The Hermès group continued to recruit and

increased its workforce by around 2,400 people. At the end of 2023,

the group had 22,040 employees, including 13,700 in France. Over

the past three years, Hermès has created more than 5,400 jobs,

including 3,300 in France.

True to its commitment as a responsible

employer, and its policy of sharing the fruits of growth with all

those who contribute to it on a daily basis, Hermès will pay at the

beginning of the year a bonus of €4,000 to all its employees

worldwide in respect of 2023, after announcing last July a new plan

for the allocation of free shares to all the employees. Hermès is

strengthening its commitments in the fields of education and

knowledge transmission particularly through the deployment of the

École Hermès des savoir-faire, which has extended its leatherwork,

cutting and stitching diploma courses in 8 regional training

schools in France this year.

In line with the House’s commitments to the

fight against climate change, Hermès pursued its actions in line

with its emissions reduction targets validated by the Science Based

Target initiative (SBTi). Hermès aims to reduce emissions by 50.4%

on scope 1 and 2 in absolute value and by 58.1% in intensity on

scope 3, over the 2018-2030 period. Pursuing its commitment to

quality and the development of sustainable materials for its 16

business lines, the House is continuing its drive to achieve

certification for its 44 supply chains by 2024. Thus, at the end of

December, more than 80% of the leather goods division’s suppliers

were LWG (Leather Working Group) certified.

In 2023, the group has initiated the Science

Based Targets for Nature (SBTN) process to set scientific targets

for nature, in particular in biodiversity, fresh water, forests and

soils. Hermès is one of 120 companies worldwide to have launched

this process. Regarding the protection of natural resources, the

House also implemented its particularly demanding responsible real

estate standard that integrates sustainability issues across the

life cycle of real estate projects.

Proposed dividend

At the General meeting to be held on 30 April

2024, a dividend proposal of €15.00 per share will be made. The

€3.50 interim dividend that will be paid on 15 February 2024, will

be deducted from the dividend approved by the General Meeting. In

addition, an exceptional dividend of €10.00 per share will be

proposed to the General meeting.

Post-closing event

No significant event has occurred since the

closing on 31 December 2023. In line with its distribution network

vertical integration strategy, the house has reinforced its

relationship with its historical partner in the Middle East. Thus,

Hermès became in early 2024 a majority shareholder alongside its

partner in the retail activities located in the United Arab

Emirates. The latter remains the majority shareholder in the other

countries of the region (Qatar, Kuwait, Bahrain). The impact of the

change in consolidation method resulting from this acquisition of a

majority stake and the amount paid will not be significant on the

2024 consolidated financial statements.

Outlook

In the medium-term, despite the economic,

geopolitical, and monetary uncertainties around the world, the

group confirms an ambitious goal for revenue growth at constant

exchange rates.

The group has moved into 2024 with confidence,

thanks to the highly integrated artisanal model, the balanced

distribution network, the creativity of collections and the loyalty

of clients.

Thanks to its unique business model, Hermès is

pursuing its long-term development strategy based on creativity,

maintaining control over know-how and singular communication.

For 2024, the theme will be In the Spirit of the

Faubourg. This place, the fruit of Émile Hermès’ dream, is the

beating heart of the house. It accompanies Hermès everywhere and

inspires the effervescence and joyful spirit so dear to the

house.

The press release and the presentation of the

2023 results are available on the group’s website:

https://finance.hermes.com

At the Supervisory Board meeting on 8 February

2024, Executive Management presented the audited financial

statements for 2023. The audit procedures have been completed and

the audit report is under preparation. The complete consolidated

financial statements will be available by 31 March 2024 at the

following address https://finance.hermes.com and on the AMF

website: www.amf-france.org

Upcoming events:

- 25 April 2024: Q1 2024 revenue

publication

- 30 April 2024: General meeting of

shareholders

- 25 July 2024: publication of H1

2024 results (after market)

2023 KEY FIGURES

|

In millions of euros |

2023 |

2022 |

| |

|

|

|

Revenue |

13,427 |

11,602 |

|

Growth at current exchange rates vs. n-1 |

15.7 % |

29.2% |

|

Growth at constant exchange rates vs. n-1 (1) |

20.6 % |

23.4% |

|

|

|

|

|

Recurring operating income (2) |

5,650 |

4,697 |

|

As a % of revenue |

42.1% |

40.5% |

|

|

|

|

|

Operating income |

5,650 |

4,697 |

|

As a % of revenue |

42.1% |

40.5% |

|

|

|

|

|

Net profit – Group share |

4,311 |

3,367 |

|

As a % of revenue |

32.1% |

29.0% |

|

|

|

|

|

Operating cash flows |

5,123 |

4,111 |

|

|

|

|

|

Operating investments |

859 |

518 |

|

|

|

|

|

Adjusted free cash flow (3) |

3,192 |

3,405 |

|

|

|

|

|

Equity – Group share |

15,201 |

12,440 |

|

|

|

|

|

Net cash position (4) |

10,625 |

9,223 |

|

|

|

|

|

Restated net cash position (5) |

11,164 |

9,742 |

|

|

|

|

|

Workforce (number of employees) (6) |

22,037 |

19,686 |

(1) Growth at constant exchange

rates is calculated by applying the average exchange rates of the

previous period to the current period’s revenue, for each

currency.

(2) Recurring operating income

is one of the main performance indicators monitored by the group’s

General Management. It corresponds to the operating income

excluding non-recurring items having a significant impact likely to

affect the understanding of the group’s economic performance.

(3) Adjusted free cash flow

corresponds to the sum of operating cash flows and change in

working capital requirement, less operating investments and

repayment of lease liabilities, as per IFRS cash flow

statement.

(4) The

net cash position includes cash and cash equivalents on the asset

side of the balance sheet, less bank overdrafts presented within

the short-term borrowings and financial liabilities on the

liability side of the balance sheet. It does not include lease

liabilities recognised in accordance with IFRS 16.

(5) The

restated net cash position corresponds to the net cash position,

plus cash investments that do not meet IFRS criteria for cash

equivalents as a result of their original maturity of more than

three months, minus borrowings and financial liabilities.

(6) The headcount relates to

employees on permanent contracts and those on fixed-term contracts

lasting more than 9 months.

INFORMATION BY GEOGRAPHICAL ZONE

(a)

|

|

|

As of Dec. 31st |

Evolution /2022 |

| In millions of

Euros |

|

2023 |

2022 |

Published |

At constant exchange rates |

| France |

|

1,274 |

1,064 |

19.8% |

19.8% |

| Europe (excl.

France) |

|

1,818 |

1,536 |

18.4% |

20.2% |

| Total

Europe |

|

3,093 |

2,600 |

19.0% |

20.0% |

| Japan |

|

1,260 |

1,101 |

14.5% |

25.7% |

| Asia-Pacific

(excl. Japan) |

|

6,273 |

5,556 |

12.9% |

19.1% |

| Total

Asia |

|

7,533 |

6,657 |

13.2% |

20.2% |

| Americas |

|

2,502 |

2,138 |

17.1% |

20.5% |

| Other |

|

299 |

207 |

44.4% |

44.0% |

|

TOTAL |

|

13,427 |

11,602 |

15.7% |

20.6% |

|

|

|

4th quarter |

Evolution /2022 |

| In millions of

Euros |

|

2023 |

2022 |

Published |

At constant exchange rates |

| France |

|

359 |

311 |

15.5% |

15.5% |

| Europe (excl.

France) |

|

491 |

413 |

18.9% |

21.0% |

| Total

Europe |

|

850 |

724 |

17.4% |

18.6% |

| Japan |

|

321 |

279 |

15.0% |

26.2% |

| Asia-Pacific

(excl. Japan) |

|

1,401 |

1,314 |

6.6% |

12.3% |

| Total

Asia |

|

1,722 |

1,593 |

8.1% |

14.8% |

| Americas |

|

717 |

620 |

15.7% |

21.6% |

| Other |

|

76 |

54 |

39.4% |

39.2% |

|

TOTAL |

|

3,364 |

2,991 |

12.5% |

17.5% |

(a) Sales by destination.

INFORMATION BY SECTOR

|

|

|

As of Dec. 31st |

Evolution /2022 |

| In millions of

Euros |

|

2023 |

2022 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

5,547 |

4,963 |

11.8% |

16.7% |

| Ready-to-wear

and Accessories (2) |

|

3,879 |

3,152 |

23.1% |

28.2% |

| Silk and

Textiles |

|

932 |

842 |

10.7% |

15.6% |

| Other Hermès

sectors (3) |

|

1,653 |

1,371 |

20.5% |

25.8% |

| Perfume and

Beauty |

|

492 |

448 |

9.8% |

11.7% |

| Watches |

|

611 |

519 |

17.7% |

23.2% |

| Other products

(4) |

|

313 |

306 |

2.2% |

5.2% |

|

TOTAL |

|

13,427 |

11,602 |

15.7% |

20.6% |

|

|

|

4th quarter |

Evolution /2022 |

| In millions of

Euros |

|

2023 |

2022 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

1,371 |

1,300 |

5.4% |

10.4% |

| Ready-to-wear

and Accessories (2) |

|

945 |

775 |

21.9% |

27.5% |

| Silk and

Textiles |

|

285 |

263 |

8.3% |

13.3% |

| Other Hermès

sectors (3) |

|

413 |

348 |

18.9% |

24.4% |

| Perfume and

Beauty |

|

126 |

105 |

19.9% |

22.2% |

| Watches |

|

138 |

118 |

16.7% |

22.0% |

| Other products

(4) |

|

87 |

82 |

5.6% |

8.8% |

|

TOTAL |

|

3,364 |

2,991 |

12.5% |

17.5% |

(1) The “Leather Goods and Saddlery” business

line includes bags, riding, memory holders and small leather

goods.(2) The “Ready-to-wear and Accessories” business line

includes Hermès Ready-to-wear for men and women, belts, costume

jewellery, gloves, hats and shoes.(3) The “Other Hermès business

lines” include Jewellery and Hermès home products (Art of Living

and Hermès Tableware).(4) The “Other products” include the

production activities carried out on behalf of non-group brands

(textile printing, tanning…), as well as John Lobb, Saint-Louis and

Puiforcat.

2023 quarterly revenue

| |

|

Q1 |

Q2 |

Q3 |

Q4 |

2023 |

| Revenue (in

€m) |

|

3,380 |

3,317 |

3,365 |

3,364 |

13,427 |

| Growth at

current exchange rates |

|

22.3% |

22.4% |

7.3 % |

12.5 % |

15.7 % |

| Growth at

constant exchange rates |

|

23.0% |

27.5% |

15.6 % |

17.5 % |

20.6% |

--------------------------------------------------------------------------------

Extra-financial performances

|

RESPONSIBLE EMPLOYER2,400 Jobs

created |

DIVERSITY AND

INCLUSION6.85%Direct disability

employment rate |

GENDER EQUALITY60%Women managers

in the group |

|

VERTICAL

INTEGRATION55%Manufactured in its

in-house and exclusive workshops |

LONG-TERM RELATIONSHIPS19

yearsAverage age of supplier relationships (Top

50) |

LOCAL

ANCHORING74%Objects made in

France |

|

CLIMATE Scopes 1 & 2

(SBTi)-30%Emissions reduction in absolute

value between in 2023 vs 2022 |

BIODIVERSITYSBTNScientific

approach for nature initiated |

WATER CONSUMPTION

-62%Industrial water intensity over 10 years |

|

TRANSPARENCY

AWARDS#1CAC LARGE 60 |

COMMITTED TO

COMMUNITIES400Local actions and

partnerships in 2023 |

DURABILITY>

200,000Repairs in workshops |

APPENDIX – EXTRACT FROM CONSOLIDATED ACCOUNTS

Financial statements of the year, including

notes to the consolidated accounts, will be available at the end of

March 2024 on the website https://finance.hermes.com, together with

the other chapters of the Annual Financial Report.

CONSOLIDATED INCOME STATEMENT

|

In millions of euros |

2023 |

2022 |

|

Revenue |

13,427 |

11,602 |

|

Cost of sales |

(3,720) |

(3,389) |

|

Gross margin |

9,708 |

8,213 |

|

Sales and administrative expenses |

(3,169) |

(2,680) |

|

Other income and expenses |

(889) |

(836) |

|

Recurring operating income |

5,650 |

4,697 |

|

Other non-recurring income and expenses |

- |

- |

|

Operating income |

5,650 |

4,697 |

|

Net financial income |

190 |

(62) |

|

Net income before tax |

5,840 |

4,635 |

|

Income tax |

(1,623) |

(1,305) |

|

Net income from associates |

105 |

50 |

|

CONSOLIDATED NET INCOME |

4,322 |

3,380 |

|

Non-controlling interests |

(12) |

(13) |

|

NET INCOME ATTRIBUTABLE TO OWNERS OF THE

PARENT |

4,311 |

3,367 |

|

Basic earnings per share (in euros) |

41.19 |

32.20 |

|

Diluted earnings per share (in euros) |

41.12 |

32.09 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

|

In millions of euros |

2023 |

2022 |

|

|

Consolidated net income |

4,322 |

3,380 |

|

|

Changes in foreign currency adjustments 1 |

(114) |

126 |

|

|

Hedges of future cash flows in foreign currencies 1 2 |

7 |

129 |

|

|

|

69 |

23 |

|

- recycling through profit or loss

|

(63) |

106 |

|

|

Assets at fair value 2 |

- |

333 |

|

|

Employee benefit obligations: change in value linked to actuarial

gains and losses 2 |

10 |

41 |

|

|

Net comprehensive income |

4,225 |

4,009 |

|

- attributable to owners of the

parent

|

4,213 |

3,996 |

|

- attributable to non-controlling

interests

|

13 |

14 |

|

|

(1) Transferable through profit or loss.(2) Net of tax. |

CONSOLIDATED BALANCE SHEET

ASSETS

|

In millions of euros |

31/12/2023 |

31/12/2022 |

|

Goodwill |

72 |

- |

|

Intangible assets |

225 |

213 |

|

Right-of-use assets |

1,716 |

1,582 |

|

Property, plant and equipment |

2,340 |

2,007 |

|

Investment property |

7 |

8 |

|

Financial assets |

1,141 |

1,109 |

|

Investments in associates |

200 |

54 |

|

Loans and deposits |

70 |

65 |

|

Deferred tax assets |

631 |

555 |

|

Other non-current assets |

37 |

39 |

|

Non-current assets |

6,438 |

5,630 |

|

Inventories and work-in-progress |

2,414 |

1,779 |

|

Trade and other receivables |

431 |

383 |

|

Current tax receivables |

51 |

19 |

|

Other current assets |

300 |

263 |

|

Financial derivatives |

188 |

160 |

|

Cash and cash equivalents |

10,625 |

9,225 |

|

Current assets |

14,008 |

11,828 |

|

TOTAL ASSETS |

20,447 |

17,459 |

LIABILITIES

|

In millions of euros |

31/12/2023 |

31/12/2022 |

|

Share capital |

54 |

54 |

|

Share premium |

50 |

50 |

|

Treasury shares |

(698) |

(674) |

|

Reserves |

10,744 |

8,795 |

|

Foreign currency adjustments |

189 |

303 |

|

Revaluation adjustments |

553 |

546 |

|

Net income attributable to owners of the parent |

4,311 |

3,367 |

|

Equity attributable to owners of the parent |

15,201 |

12,440 |

|

Non-controlling interests |

2 |

16 |

|

Equity |

15,203 |

12,457 |

|

Borrowings and financial liabilities due in more than one year |

50 |

35 |

|

Lease liabilities due in more than one year |

1,720 |

1,629 |

|

Non-current provisions |

31 |

30 |

|

Post-employment and other employee benefit obligations due in more

than one year |

151 |

181 |

|

Deferred tax liabilities |

2 |

20 |

|

Other non-current liabilities |

106 |

103 |

|

Non-current liabilities |

2,060 |

1,998 |

|

Borrowings and financial liabilities due in less than one year |

1 |

2 |

|

Lease liabilities due in less than one year |

289 |

268 |

|

Current provisions |

134 |

133 |

|

Post-employment and other employee benefit obligations due in less

than one year |

16 |

15 |

|

Trade and other payables |

880 |

777 |

|

Financial derivatives |

45 |

74 |

|

Current tax liabilities |

586 |

496 |

|

Other current liabilities |

1,233 |

1,239 |

|

Current liabilities |

3,183 |

3,004 |

|

TOTAL EQUITY AND LIABILITIES |

20,447 |

17,459 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

|

In millions of euros |

Number of shares |

Share capital |

Share premium |

Treasury shares |

Consolidated reserves and net income attributable to owners

of the parent |

Actuarial gains and losses |

Foreign currency adjustments |

Revaluation adjustments |

|

|

|

|

Financial investments |

Hedges of future cash flows in foreign

currencies |

Equity attributable to owners of the parent |

Non-controlling interests |

Equity |

|

As at 1 January 2022 |

105,569,412 |

54 |

50 |

(551) |

9,712 |

(125) |

178 |

188 |

(105) |

9,400 |

12 |

9,412 |

|

Net income |

|

- |

- |

- |

3,367 |

- |

- |

- |

- |

3,367 |

13 |

3,380 |

|

Other comprehensive income |

|

- |

- |

- |

- |

41 |

125 |

333 |

129 |

628 |

1 |

630 |

|

Comprehensive income |

|

- |

- |

- |

3,367 |

41 |

125 |

333 |

129 |

3,996 |

14 |

4,009 |

|

Change in share capital and share premiums |

|

- |

- |

|

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase or sale of treasury shares |

|

- |

- |

(123) |

2 |

- |

- |

- |

- |

(121) |

- |

(121) |

|

Share-based payments |

|

- |

- |

- |

55 |

- |

- |

- |

- |

55 |

- |

55 |

|

Dividends paid |

|

- |

- |

- |

(845) |

- |

- |

- |

- |

(845) |

(8) |

(852) |

|

Other |

|

- |

- |

- |

(44) |

- |

- |

- |

- |

(44) |

(2) |

(46) |

|

As at 31 December 2022 |

105,569,412 |

54 |

50 |

(674) |

12,247 |

(85) |

303 |

521 |

25 |

12,440 |

16 |

12,457 |

|

Net income |

|

- |

- |

- |

4,311 |

- |

- |

- |

- |

4,311 |

12 |

4,322 |

|

Other comprehensive income |

|

- |

- |

- |

- |

10 |

(115) |

- |

7 |

(98) |

1 |

(97) |

|

Comprehensive income |

|

- |

- |

- |

4,311 |

10 |

(115) |

- |

7 |

4,213 |

13 |

4,225 |

|

Change in share capital and share premiums |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase or sale of treasury shares |

|

- |

- |

(24) |

(105) |

- |

- |

- |

- |

(129) |

- |

(129) |

|

Share-based payments |

|

- |

- |

- |

104 |

- |

- |

- |

- |

104 |

- |

104 |

|

Dividends paid |

|

- |

- |

- |

(1,376) |

- |

- |

- |

- |

(1,376) |

(10) |

(1,386) |

|

Other |

|

- |

- |

- |

(51) |

- |

- |

- |

- |

(51) |

(17) |

(68) |

|

AS AT 31 DECEMBER 2023 |

105,569,412 |

54 |

50 |

(698) |

15,130 |

(75) |

189 |

521 |

32 |

15,201 |

2 |

15,203 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

In millions of euros |

2023 |

2022 |

|

Net income attributable to owners of the parent |

4,311 |

3,367 |

|

Depreciation and amortisation of fixed assets, rights of use and

impairment losses |

772 |

730 |

|

Foreign exchange gains/(losses) on fair value adjustments |

56 |

12 |

|

Change in provisions |

15 |

12 |

|

Net income from associates |

(105) |

(50) |

|

Net income attributable to non-controlling interests |

12 |

13 |

|

Capital gains or losses on disposals and impact of changes in scope

of consolidation |

(14) |

(1) |

|

Deferred tax expense |

(14) |

(16) |

|

Accrued expenses and income related to share-based payments |

104 |

55 |

|

Dividend income |

(12) |

(11) |

|

Other |

(0) |

(0) |

|

Operating cash flows |

5,123 |

4,111 |

|

Change in working capital requirements |

(794) |

73 |

|

CASH FLOWS RELATED TO OPERATING ACTIVITIES

(A) |

4,328 |

4,184 |

|

Operating investments |

(859) |

(518) |

|

Acquisitions of consolidated shares |

(288) |

(1) |

|

Acquisitions of other financial assets |

(52) |

(165) |

|

Disposals of operating assets |

0 |

1 |

|

Disposals of consolidated shares and impact of losses of

control |

- |

0 |

|

Disposals of other financial assets |

- |

5 |

|

Change in payables and receivables related to investing

activities |

93 |

32 |

|

Dividends received |

112 |

67 |

|

CASH FLOWS RELATED TO INVESTING ACTIVITIES

(B) |

(995) |

(579) |

|

Dividends paid |

(1,386) |

(852) |

|

Repayment of lease liabilities |

(277) |

(261) |

|

Treasury share buybacks net of disposals |

(130) |

(123) |

|

Borrowing subscriptions |

0 |

0 |

|

Repayment of borrowings |

(1) |

(0) |

|

CASH FLOWS RELATED TO FINANCING ACTIVITIES

(C) |

(1,794) |

(1,237) |

|

Foreign currency translation adjustment (D) |

(138) |

159 |

|

CHANGE IN NET CASH POSITION (A) + (B) + (C) +

(D) |

1,402 |

2,528 |

|

Net cash position at the beginning of the period |

9,223 |

6,695 |

|

Net cash position at the end of the period |

10,625 |

9,223 |

REMINDER

2023 HALF YEAR KEY FIGURES

|

In millions of euros |

H1 2023 |

H1 2022 |

| |

|

|

|

Revenue |

6,698 |

5,475 |

|

Growth at current exchange rates vs. n-1 |

22.3% |

29.3% |

|

Growth at constant exchange rates vs. n-1 (1) |

25.2% |

23.2% |

|

|

|

|

|

Recurring operating income (2) |

2,947 |

2,304 |

|

As a % of revenue |

44.0% |

42.1% |

|

|

|

|

|

Operating income |

2,947 |

2,304 |

|

As a % of revenue |

44.0% |

42.1% |

|

|

|

|

|

Net profit – Group share |

2,226 |

1,641 |

|

As a % of revenue |

33.2% |

30.0% |

|

|

|

|

|

Operating cash flows |

2,615 |

2,001 |

|

|

|

|

|

Investments (excluding financial investments) |

249 |

190 |

|

|

|

|

|

Adjusted free cash flow (3) |

1,720 |

1,421 |

|

|

|

|

|

Equity – Group share |

13,249 |

10,259 |

|

|

|

|

|

Net cash position (4) |

9,326 |

7,280 |

|

|

|

|

|

Restated net cash position (5) |

9,848 |

7,685 |

|

|

|

|

|

Workforce (number of employees) (6) |

20,607 |

18,428 |

(1) Growth at constant exchange

rates is calculated by applying the average exchange rates of the

previous period to the current period’s revenue, for each

currency.

(2) Recurring operating income

is one of the main performance indicators monitored by the group’s

General Management. It corresponds to the operating income

excluding non-recurring items having a significant impact likely to

affect the understanding of the group’s economic performance.

(3) Adjusted free cash flow

corresponds to the sum of operating cash flows and change in

working capital requirement, less operating investments and

repayment of lease liabilities, as per IFRS cash flow

statement.

(4) The

net cash position includes cash and cash equivalents on the asset

side of the balance sheet, less bank overdrafts presented within

the short-term borrowings and financial liabilities on the

liability side of the balance sheet. It does not include lease

liabilities recognised in accordance with IFRS 16.

(5) The

restated net cash position corresponds to the net cash position,

plus cash investments that do not meet IFRS criteria for cash

equivalents as a result of their original maturity of more than

three months, minus borrowings and financial liabilities.

(6) The headcount relates to

employees on permanent contracts and those on fixed-term contracts

lasting more than 9 months.

- hermes_20240209_pr_2023fullyearresults_va

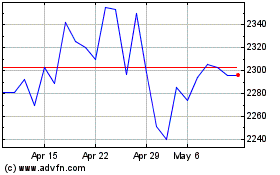

Hermes (EU:RMS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hermes (EU:RMS)

Historical Stock Chart

From Feb 2024 to Feb 2025