2024 Half-Year Earnings Report

Adjusted EBITDA up +37%

Strong improvement in profitability and

cash generation indicators, with broadly stable revenue in the

first half of the year

- 2024 half-year revenue of €517.4

million (-0.3%)

- Significant improvement in adjusted EBITDA margin, to 7.3%

(+200 basis points)

- Adjusted EBITDA of +€37.7 million, up +37.4%, with growth in

all three geographical segments

- Free cash flow up sharply by €26.1 million compared with the

first half of 2023, to -€6.3 million

Confirmation of 2024 full-year targets

- Revenue down slightly

- Continued improvement in the Group’s adjusted EBITDA margin,

with an increase in adjusted EBITDA by value

Capital Markets Day: September 26, 2024

- Presentation of Solutions30’s roadmap for 2026

The consolidated financial statements of the

Solutions30 Group for the period from January 1 to June 30, 2024

were reviewed by the Supervisory Board on September 18, 2024. The

review of the half-yearly financial information by the authorized

auditor has been completed and their report has been published on

the website. The half-yearly financial report, including the

consolidated financial statements (condensed interim financial

statements and notes) reviewed by the auditor, is available on the

Solutions30 website, www.solutions30.com, in the “Investors

Relations” section.

Gianbeppi Fortis, Chief Executive Officer of

Solutions30, stated: “Solutions30’s results for the first half of

2024 demonstrate our ability to keep improving the Group’s

profitability, largely due to being more selective with the

contracts we take on. With revenue stable compared with the first

half of last year, our adjusted EBITDA rose by 37.4%, with

increases in all three of our geographical segments. All our

profitability and cash generation indicators have shown significant

improvement, highlighting the effectiveness of our tailored

management approach in each of our markets. In this regard, the

margin in Germany is already enhancing the Group’s overall

performance, while still offering potential for further growth. We

confirm our outlook for 2024 and look forward to presenting our

roadmap for the coming years at our Capital Markets Day on

September 26th.”

| Key

figures – Consolidated data |

|

In millions of euro |

H1 2024 |

H1 2023 |

Change |

|

Revenue |

517.4 |

519.1 |

(0.3)% |

|

Adjusted EBITDA |

37.7 |

27.5 |

37.4% |

|

As a % of revenue (EBITDA margin) |

7.3% |

5.3% |

|

|

Adjusted EBIT |

11.1 |

5.0 |

124.4% |

|

As a % of revenue |

2.1% |

1.0% |

|

|

Operating income |

1.4 |

(6.4) |

n/a |

|

As a % of revenue |

0.3% |

(1.2)% |

|

|

Net income, Group share* |

(5.9) |

(14.4) |

n/a |

|

Free cash flow |

(6.3) |

(32.4) |

n/a |

|

|

|

|

|

Financial structure figures

In millions of euros |

06.30.2024 |

06.30.2023 |

Change |

|

Equity |

117.1 |

131.8 |

(14.7) |

|

Net debt |

110.6 |

95.3 |

15.2 |

|

Net bank debt |

26.7 |

10.3 |

16.4 |

* The Group share of net income includes non-cash

amortization of customer relationships of -€7.2 million in the

first half of 2024. Restated for this charge net of its tax impact,

Group net income, strictly reflecting its operating performance,

would break even in the first half of 2024.

Solutions30’s consolidated revenue for the first

half of 2024 amounted to €517.4 million, stable overall compared

with the first half of 2023 (-0.3%). Organic growth was -0.7%, with

the impact of acquisitions at +0.3%. After a 3.8% increase in

revenue in the first quarter of 2024, revenue decreased by -4.3% in

the second quarter. This decline was due to the Group’s decision to

reduce its exposure to certain contracts whose margins no longer

met its standards, notably in the telecom segments in France and

Spain, as well as delays in the ramp-up of fiber activities in

Belgium caused by negotiations among service providers aimed at

streamlining their deployment investments (see press release from

July 24, 2024).

Adjusted EBITDA amounted to €37.7 million, up

+37.4% compared to the first half of 2023, and up in each of the

Group’s three geographical segments. The adjusted EBITDA margin

improved sharply to 7.3% from 5.3% in the first half of 2023 (+200

basis points), with a very marked increase in France and other

countries, and a slight improvement in the Benelux.

Free cash flow, traditionally negative in the

first half of the year, improved significantly, by €26.1 million,

to -€6.3 million, compared with -€32.4 million in the first half of

2023. This trend was fueled by an increase in adjusted EBITDA,

strong conversion of adjusted EBITDA into cash flow, and an

improved working capital trend. All of this occurred as the Group

increasingly prioritizes profitability and cash generation on an

ongoing basis.

Analysis by geographical

segment

|

|

H1 2024 |

H1 2023 |

Change |

|

Benelux |

|

|

|

| Revenue |

196.8 |

180.0 |

+9.3% |

| Adjusted EBITDA |

19.6 |

17.5 |

+12.0% |

|

Adjusted EBITDA margin % |

10.0% |

9.7% |

+30 bps |

|

France |

|

|

|

| Revenue |

188.4 |

199.4 |

(5.5)% |

| Adjusted EBITDA |

17.4 |

15.8 |

+10.1% |

|

Adjusted EBITDA margin % |

9.2% |

7.9% |

+130 bps |

|

Other countries |

|

|

|

| Revenue |

132.2 |

139.7 |

(5.4)% |

| Adjusted EBITDA |

6.5 |

(0.8) |

n/a |

|

Adjusted EBITDA margin % |

4.9% |

(0.6)% |

n/a |

|

HQ* |

(5.7) |

(5.0) |

14% |

|

Revenue |

517.4 |

519.1 |

(0.3)% |

| Adjusted

EBITDA |

37.7 |

27.5 |

+37.4% |

|

Adjusted EBITDA margin % |

7.3% |

5.3% |

+200 bps |

* Costs related to the Group’s

centralized functions

In the Benelux, revenue

amounted to €196.8 million, a purely organic increase of +9.3%.

Following strong growth of +21.6% in the first quarter, revenue

growth turned slightly negative at -1.1% in the second quarter,

primarily due to delays in the ramp-up of certain fiber deployment

activities. This slowdown was due to a wait-and-see attitude on the

part of Belgian telecom service providers, who recently began

negotiations aimed at streamlining deployments across the country.

Over the first six months, Connectivity Solutions posted growth of

+8.7%. Energy Solutions continue to expand, at +11.9%, with

promising diversification into photovoltaics and low-voltage grid

services following the model applied in France. Lastly, revenue

from Technology Solutions increased by +10.6%.

Adjusted EBITDA for the Benelux stood at €19.6

million, up +12%. The corresponding margin remains in the double

digits, at 10.0% for the first half of 2024, a slight improvement

on the first half of 2023 (9.7%) but still down compared to the

second half of 2023 (+12.9%). This decrease is due to the delays

mentioned above.

In France, revenue totaled

€188.4 million in the first half of 2024, a decrease of -5.5%. This

included an organic decline of -6.4%, which was partially offset by

a +0.9% impact from the acquisition of Elec-ENR, consolidated since

July 2023. Amid a slowdown in the fiber connection market,

Solutions30 has implemented a highly selective approach to its

Connectivity Solutions, resulting in a -15.6% decline. The company

is prioritizing margins and cash generation over volumes. During

the second quarter, the Group reduced its exposure to certain

suboptimal contracts, so as to concentrate on a portfolio of

contracts whose current or potential profitability levels are fully

in line with Group standards. At the same time, Energy Solutions

continue to post strong growth, up +57.6% in the first half of

2024, and offer excellent prospects. Technology Solutions

contracted by -3.8%.

Adjusted EBITDA for France reached €17.4 million

in the first half of 2024, up +10.1%, with a margin of 9.2%,

compared to 7.9% in the first half of 2023 and 9.6% in the second

half of 2023. The transformation plan for Solutions30’s French

businesses, launched in 2022, continues to deliver positive

results. Margins have also benefited from the completion of the

integration of Scopelec, that started in the first quarter of 2023,

the growth of its Energy Solutions, and the selective approach

taken with its Connectivity Solutions.

In other countries, revenue

amounted to €132.2 million in the first half of 2024, down -5.4%.

Germany stood out with growth of +24.8%, driven by the ramp-up of

fiber activities, and is gradually establishing itself as a

powerful growth driver for the Group. Poland also continued to

grow, at +20.7%. In Spain, where Solutions30 has deliberately

reduced its exposure to a mature fiber market, revenue was down

-26.3%. In Italy, after an anticipated -25.9% fall in the first

half of 2024, business is currently recovering under more favorable

economic conditions. Finally, in the United Kingdom, revenue fell

by -13.9%, reflecting increased selectivity.

Adjusted EBITDA for other countries came to €6.5

million in the first half of 2024, compared with -€0.8 million in

the first half of 2023. The corresponding margin stood at 4.9%, a

significant improvement from the first half of 2023 (-0.6%) and

consistent with the 4.8% in the second half of 2023. Germany is

already enhancing the margins of both the region and the Group

overall, due to strong market fundamentals and Solutions30’s solid

positioning within it. In Italy, margins improved significantly in

the first six months of the year. In Spain and the United Kingdom,

where margins remain below the Group’s normative levels,

selectivity measures have been implemented. In Poland,

profitability remains satisfactory.

Consolidated earnings

On the basis of adjusted EBITDA of €37.7 million

in H1 2024, after recognition of operating depreciation and

provisions of €10.6 million (vs. €8.9 million in H1 2023), and

after amortization of the right of use of leased assets (IFRS16)

amounting to €16.0 million (vs. €13.6 million in H1 2023), the

Group’s adjusted EBIT stands at €11.1 million, up 124% compared to

€5.0 million in H1 2023.

Operating income was positive, at €1.4 million for the first

half of 2024, also marking a clear improvement on the first half of

2023, when it stood at -€6.4 million. It includes:

- €2.5 million in net non-current

operating expenses. The expenses mainly concern France and the

United Kingdom.

- €7.2 million in amortization of

customer relationships, stable compared with the first half of

2023. This charge, relating to past acquisitions, is purely

accounting in nature, with no cash impact, and is not related to

tangible assets.

Net financial result was a loss of -€6.1

million, compared with -€2.9 million for the first half of 2023.

This change mainly reflects the rise in interest rates between the

two periods. Net financial income also includes an income of €1.8

million (with no cash impact) linked to the downward adjustment in

the value of earnouts on past acquisitions (€1.2 million in the

first half of 2023). Nevertheless, net financial income for the

first six months showed a clear improvement compared to the second

half of 2023 (-€10.2 million, which included a total of -€2.8

million from an upward adjustment in earnout valuations, a currency

conversion loss, and a negative impact from changes in the value of

hedging instruments).

After accounting for a net tax charge of -€2.1

million, the Group’s share of the net income of So-Tec (€0.3

million) which is accounted for using the equity method, and

deducting minority interests of -€0.6 million, Group net income

amounted to -€5.9 million. Although negative, it improved

significantly compared with the first half of 2023 (-€14.4

million).

Cash flow

The Group’s operating cash generation, which is

usually lower in the first half than in the second due to the

seasonal nature of working capital requirements, improved

significantly compared with the first half of 2023.

Group operating cash flow amounted to €32.8

million, compared with €22.9 million in the first half of 2023.

This improvement is a direct result of the rise in adjusted EBITDA,

of which operating cash flow represents 87%, reflecting a good

level of conversion of margin into cash.

Adjusted for non-cash items, the change in

working capital represented a negative flow of -€30.6 million,

compared with -€44.8 million in the first half of 2023. This

improvement reflects a markedly favorable customer advance payments

balance, particularly in Germany. The change in working capital for

the first half of 2024 includes a sharp drop in factoring of -€38.7

million, due to a lower volume of receivables in France as a result

of the aforementioned decrease in activity, as well as a high level

of customer collections in Germany. As a result, net cash flow from

operating activities in the first half of 2024 was positive at €2.2

million, compared with -€22.0 million in the first half of

2023.

Net investments amounted to €8.5 million, or 1.6% of revenue, in

line with their normal levels of around 2%, and were mainly related

to information systems and technical equipment. The Group relies

mainly on a proprietary IT platform, a strategic resource for

managing operations that accounts for most of these

investments.

Overall, free cash flow, usually negative during

the first half of the year, improved significantly to -€6.3 million

compared to -€32.4 million in the first half of 2023. This reflects

an increased focus on selectivity and discipline, as well as the

positive impact of the German expansion on the Group’s cash

generation.

After including -€17.7 million in rent paid,

-€3.5 million in earnouts paid on past acquisitions, -€0.2 million

in acquisitions for the first six months, -€4.1 million in interest

paid, and -€0.6 million in currency exchange losses, the change in

cash net of bank debt was -€32.4 million, compared to -€64.3

million in the first half of 2023.

Financial structure

As of June 30, 2024, the Group’s equity amounted

to €117.1 million, compared with €124.6 million on December 31,

2023. The Group’s gross cash position stood at €68.8 million,

compared with €118.2 million at the end of December 2023 and €73.4

million at June 30, 2023, reflecting the usual seasonality of the

Group’s working capital. Gross bank debt amounted to €95.5 million,

compared with €112.5 million at December 31, 2023, due to the

repayment of loans during the first half of the year. The Group had

€26.7 million in net bank debt at the end of June 2024 compared to

€5.7 million in cash net of debt at the end of December 2023 and

net debt of €10.3 million at the end of June 2023.

After taking into account €81.4 million in lease

liabilities (IFRS 16) and €2.4 million in potential financial debt

related to earnouts and future put options, the Group’s total net

debt amounted to €110.6 million at June 30, 2024. The increase on

the €78.4 million recorded at December 31, 2023 largely reflects

the seasonal nature of the Group’s cash generation.

Outstanding assigned receivables under the

Group’s non-recourse factoring program amounted to €71 million at

June 30, 2024, compared to €109 million at December 31, 2023 and

€86 million at June 30, 2023. Generally speaking, factoring can be

used to finance working capital arising from recurring activities

that are fully developed, at a moderate cost. This program,

combined with a solid financial structure, provides Solutions30

with the resources it needs to finance its growth strategy.

2024 full-year outlook confirmed

In a market environment that remains mixed

across regions in the second half of the year, Solutions30

continues to prioritize margins over volumes in its more mature

markets. At the same time, it is reallocating resources to markets

with strong potential for profitable growth, particularly Germany,

which has met all expectations and is on track to become the

Group’s third pillar, alongside France and the Benelux.

Thus, the selective measures implemented in the

second quarter regarding certain telecom contracts in France and

Spain will continue to translate into lower revenue from those

businesses but will have a positive effect on Group margins.

At the same time, the strong growth seen in the

Energy Solutions business, especially in France, and the ramp-up of

fiber deployments in Germany are expected to continue. In Italy,

business is currently returning to normal, under improved economic

conditions.

After a year of significant growth in 2023,

business in the Benelux is expected to remain strong, though it may

slow down temporarily due to ongoing discussions among telecom

service providers about pooling their investments and, to a lesser

extent, the electoral context. These two factors are likely to

weigh on Benelux margins in the second half of the year and for the

year as a whole, without in any way calling into question the

fundamentals of this geographical segment.

For the full year 2024, Solutions30 confirms the outlook shared on

July 26, 2024, expecting slightly lower revenue compared to 2023,

along with an improvement in the Group’s adjusted EBITDA margin,

translating into an increase in adjusted EBITDA.

Webcast for investors and analysts

Date: Wednesday, September 18, 2024

6:30 PM (CET) – 5:30 PM (GMT)

Speakers:

Gianbeppi Fortis, Chief Executive Officer

Jonathan Crauwels, Chief Financial Officer

Amaury Boilot, Group General Secretary

Connection details:

Webcast in french:

https://channel.royalcast.com/landingpage/solutions30-en/20240918_1/

Webcast in English:

https://channel.royalcast.com/landingpage/solutions30-en/20240918_1/

Upcoming events

Capital Markets Day September 26, 2024

Q3 2024 Revenue Report November 4, 2024 (after market close)

About Solutions30 SE

Solutions30 provides consumers and businesses

with access to the key technological advancements that are shaping

our everyday lives, especially those driving the digital

transformation and energy transition. With its network of more than

16 000 technicians, Solutions30 has completed over 65 million

call-outs since its inception and led over 500 renewable energy

projects with a combined maximum output surpassing 1600 MWp. Every

day, Solutions30 is doing its part to build a more connected and

sustainable world. Solutions30 has become an industry leader in

Europe with operations in 10 countries: France, Italy, Germany, the

Netherlands, Belgium, Luxembourg, Spain, Portugal, the United

Kingdom, and Poland.

The capital of Solutions30 SE consists of 107,127,984 shares, equal

to the number of theoretical votes that can be exercised.

Solutions30 SE is listed on the Euronext Paris exchange (ISIN

FR0013379484- code S30). Stock indexes: CAC Mid & Small | CAC

Small | CAC Technology | Euro Stoxx Total Market Technology |

Euronext Tech Croissance.

Visit our website for more information: www.solutions30.com

Contact

Individual Shareholders:

shareholders@solutions30.com - Tel: +33 (0)1 86 86 00 63

Analysts/investors:

investor.relations@solutions30.com

Press - Image 7:

Charlotte Le Barbier - Tel: +33 6 78 37 27 60 -

clebarbier@image7.fr

__________________________________________________________________

The Group uses financial indicators not defined

by IFRS:

- Profitability indicators and their components

are key operational performance indicators used by the Group to

monitor and evaluate its overall operating results and results by

country.

- Cash flow indicators are used by the Group to

implement its investment and resource allocation strategy.

The non-IFRS financial indicators used are

calculated as follows:

Organic growth includes the

organic growth of acquired companies after they are acquired, which

Solutions30 assumes they would not have experienced had they

remained independent. In 2024, the Group’s organic growth includes

only the internal growth of its long-standing subsidiaries.

Adjusted EBITDA is the

“operating margin” as reported in the Group’s financial

statements.

Free cash flow corresponds to

the net cash flow from operating activities minus the acquisitions

of intangible assets and property, plant, and equipment net of

disposals.

Calculation of free cash flow

|

In millions of euro |

H1 2024 |

H2 2023 |

H1 2023 |

|

Net cash flows from operating activities |

2.2 |

56.1 |

(22.0) |

| Acquisition of

non-current assets |

(9.2) |

(10.5) |

(10.9) |

| Disposal of

non-current assets after tax |

0.7 |

0.3 |

0.4 |

|

Free cash-flow |

(6.3) |

45.8 |

(32.4) |

Cash net of debt corresponds to

“Cash and cash equivalents” as it appears in the Group’s financial

statements from which is deducted “Loans from credit institutions,

long-term” and “Short-term loans from credit institutions, lines of

credit, and bank overdrafts” as they appear in note 10.2 of the

Group’s annual financial statements.

Adjusted EBIT corresponds to

operating income as shown in the Group’s financial statements, to

which “Customer relationship amortization” and “Other non-current

operating expenses” are added and from which “Other non-current

operating income” is deducted.

Reconciliation between operating income and

adjusted EBIT

|

In millions of euros |

H1 2024 |

H2 2023 |

H1 2023 |

|

Operating

income |

1.4 |

3.7 |

(6.4) |

|

Customer relationship amortization |

7.2 |

7.3 |

7.1 |

| Other non-current

operating income |

(2.1) |

(0.4) |

— |

| Other non-current

operating

expenses |

4.6 |

7.1 |

4.3 |

|

Adjusted EBIT |

11.1 |

17.7 |

5.0 |

|

As a % of revenue |

2.1 % |

3.3 % |

1.0 % |

Non-current transactions

include other income and expenses that are significant in their

amount, unusual, and infrequent.

Net debt corresponds to “Debt,

long-term,” “Debt, short-term,” and long- and short-term “Lease

liabilities” as they appear in the Group’s financial statements

from which “Cash and cash equivalents” as they appear in the

Group’s financial statements are deducted.

Net debt/EBITDA ratio

corresponds to “net debt” divided by annualized EBITDA.

Net debt-to-equity ratio

corresponds to “net debt” divided by equity.

Net debt

|

In millions of euros |

06.30.2024 |

12.31.2023 |

|

Bank debt |

95.5 |

112.5 |

| Lease

liabilities |

81.4 |

76.4 |

| Liabilities from

earnouts and put options |

2.4 |

7.7 |

| Cash and cash

equivalents |

(68.8) |

(118.2) |

|

Net debt |

110.6 |

78.4 |

|

|

|

|

|

Equity |

117.1 |

124.6 |

|

% of net debt |

94.4 % |

62.9 % |

Net bank debt corresponds to

“Long-term loans from credit institutions” and “Short-term loans

from credit institutions, lines of credit, and bank overdrafts” as

they appear in note 10.2 of the Group’s annual financial statements

from which are deducted “Cash and cash equivalents” as they appear

in the Group’s financial statements.

Net bank debt

|

In millions of euros |

06.30.2024 |

12.31.2023 |

|

Loans from credit institutions, long-term |

66.5 |

75.6 |

|

Short-term loans from credit institutions and lines of credit |

29.0 |

37.0 |

|

Gross bank debt |

95.5 |

112.6 |

|

Cash and cash equivalents |

(68.8) |

(118.2) |

|

Net bank debt |

26.7 |

(5.7) |

|

Cash net of bank debt |

(26.7) |

5.7 |

Gross bank debt corresponds to

“Loans from credit institutions, long-term” and “Short-term loans

from credit institutions, lines of credit, and bank overdrafts” as

they appear in note 10.2 of the Group’s annual financial

statements.

Working capital corresponds to

“current assets” as reported in the Group’s financial statements

(excluding “Cash and cash equivalents” and “Derivative financial

instruments”) less “current liabilities” (excluding “Debt,

short-term,” “Current provisions,” and “Lease liabilities”).

Working capital:

|

In millions of euros |

06.30.2024 |

12.31.2023 |

|

Inventory and work in progress |

26.9 |

25.7 |

| Trade receivables

and related accounts |

233.8 |

211.6 |

| Current contract

assets |

1.0 |

1.0 |

| Other

receivables |

74.5 |

66.5 |

| Prepaid

expenses |

5.6 |

3.1 |

| |

|

|

| Trade

payables |

(173.2) |

(200.1) |

| Tax and social

security liabilities |

(124.6) |

(120.8) |

| Other current

liabilities |

(16.1) |

(15.0) |

| Deferred

income |

(48.2) |

(18.9) |

|

Working capital |

(20.3) |

(46.9) |

|

|

|

|

| Change in working

capital |

26.5 |

17.7 |

| Non-monetary

items |

4.1 |

8.5 |

|

Change in working capital adjusted for non-monetary

items |

30.6 |

26.2 |

Net investments correspond to

the sum of the lines “Acquisition of current assets”, “Acquisition

of non-current financial assets,” and “Disposal of non-current

assets after tax” as they appear in the consolidated statement of

cash flows.

Net investments:

|

In millions of euros |

06.30.2024 |

06.30.2023 |

|

Acquisition of non-current assets |

(9.0) |

(10.8) |

| Acquisition of

non-current financial assets |

(0.2) |

(0.1) |

| Disposal of

non-current assets after tax |

0.7 |

0.4 |

|

Net investments |

(8.5) |

(10.5) |

- PRESS RELEASE English 06.24 (2)

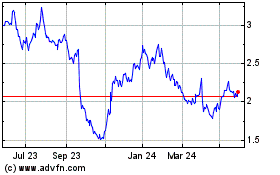

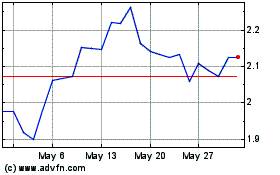

Solutions 30 (EU:S30)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solutions 30 (EU:S30)

Historical Stock Chart

From Nov 2023 to Nov 2024