Press Release: Q4 sales growth of 10.3%, 2024 business EPS guidance exceeded, and strong business EPS rebound expected in 2025

30 January 2025 - 5:30PM

Sanofi: Q4 sales growth of 10.3%, 2024 business EPS guidance

exceeded, and strong business EPS rebound expected in 2025

Paris, January 30, 2025

Q4: sales growth of 10.3% at

CER1 and business

EPS2 of €1.31

- Pharma launches

up 56.5%, reaching sales of €0.8 billion, 8% of total sales, led by

ALTUVIIIO

- Dupixent sales

up 16.0% to €3.5 billion

- Vaccines sales

up 10.8% to €2.2 billion, driven by Beyfortus sales in Europe

- Business EPS of

€1.31, -11.0% at CER and -14.9% reported; IFRS EPS of €0.54

FY: double-digit sales growth and business EPS guidance

exceeded

- Sales totaled

€41.1 billion, an increase of 11.3% at CER

- Sales targets

exceeded: Dupixent >€13 billion and Beyfortus blockbuster status

(€1.7 billion) in its first full year

- Research and

Development expenses reached €7.4 billion, up 14.6%, in line with

commitments

- Business EPS of

€7.12, +4.1% at CER, above guidance, and -1.8% reported; IFRS EPS

of €4.59

- The Board of

Directors met on January 29, 2025; proposes a dividend of €3.92 for

2024, 30th year of consecutive increases

Pipeline: increased investment and progress

- Q4: four

regulatory approvals: Dupixent EoE (children) (EU), Kevzara PMR

(EU), Cerdelga GD1 (children) (EU), Efluelda flu (JP)3

- FY: 14

regulatory approvals of medicines and vaccines, 21 regulatory

submission acceptances, and eight positive phase 3 readouts

emphasize a positive and improving pipeline momentum

Further progress towards a focused biopharma

business

- Intention to

sell a controlling stake in Opella consumer health at an attractive

valuation; closing in Q2 2025 at the earliest4

Guidance

- In 2025, sales

are anticipated to grow by a mid-to-high single-digit percentage at

CER5. Sanofi confirms the expectation of a strong rebound in

business EPS with growth at a low double-digit percentage at CER

(before share buyback).6

- Sanofi intends

to execute a share buyback program in 2025 of €5 billion. Shares

will be purchased preferably through block trades and in the open

market with the purpose of cancellation.

Paul Hudson, Chief Executive Officer: “We

achieved double-digit sales growth in 2024 while pursuing the

transformation of the company. Innovation was a key driver of our

growth as launches already contributed 11 percent of sales, with

Beyfortus becoming a blockbuster in its first full year of sales.

We exceeded our business EPS guidance. In 2024, we announced an

intention to sell a controlling stake in Opella consumer health,

which will make Sanofi a focused, science-driven biopharma company.

We increased R&D investments and achieved significant progress

with our pipeline in 2024, including positive phase 3 study results

for new medicines such as rilzabrutinib in rare diseases and

tolebrutinib in multiple sclerosis. As we enter 2025, we expect

continued, solid growth in sales and a strong rebound in earnings.

We are also confident in the mid to long-term growth prospects of

Sanofi, supported by ongoing launches, Dupixent (currently expected

to reach sales of around €22 billion in 20307, in line with the

current ambition), and expected future launches from our

pipeline.”

|

|

Q4 2024 |

Change |

Change at CER |

FY 2024 |

Change |

Change at CER |

|

IFRS net sales reported |

€10,564m |

+9.1% |

+10.3% |

€41,081m |

+8.6% |

+11.3% |

| IFRS net income

reported |

€683m |

— |

— |

€5,744m |

+6.4% |

— |

| IFRS EPS

reported |

€0.54 |

— |

— |

€4.59 |

+6.5% |

— |

| Free cash

flow8 |

€2,340m |

-25.5% |

— |

€5,955m |

-19.6% |

— |

| Business

operating income |

€2,078m |

-11.8% |

-7.7 % |

€11,343m |

+1.5% |

+7.6% |

| Business net

income |

€1,642m |

-15.1% |

-11.2 % |

€8,912m |

-1.8% |

+4.1% |

|

Business EPS |

€1.31 |

-14.9% |

-11.0% |

€7.12 |

-1.8% |

+4.1% |

1 Changes in net sales are at constant exchange

rates (CER) unless stated otherwise (definition in Appendix 9).2 To

facilitate an understanding of operational performance, Sanofi

comments on the business net income statement which is a non-IFRS

financial measure (definition in Appendix 9). The income statement

is in Appendix 3 and a reconciliation of reported IFRS to business

net income is in Appendix 4.3 For the definition of medical and

scientific terms, please see the first use of the word in the

Pipeline update section.4 Subject to finalization of definitive

agreements and subject to obtaining regulatory approvals from the

competent authorities.5 In 2025, sales growth will exclude any

impact from hyperinflation. In 2024, it is estimated that sales

growth benefited by 1.8 percentage points.6 Applying average

January 2025 exchange rates, the currency impacts are estimated

between +2% and +3% on sales and +2% and +3% on business EPS.7 At

CER.8 Free cash flow is a non-IFRS financial measure (definition in

Appendix 9).

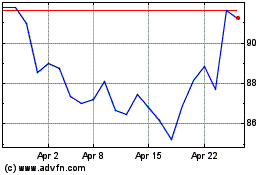

Sanofi (EU:SAN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sanofi (EU:SAN)

Historical Stock Chart

From Mar 2024 to Mar 2025