Investors With $2 Trillion in Assets Urge Cement Makers to Cut Emissions

22 July 2019 - 9:32PM

Dow Jones News

By Maitane Sardon

A group of investors with over $2 trillion in assets under

management is calling on the world's largest construction-material

firms to cut their emissions, warning that those that fail to do so

may face divestments going forward.

In a letter sent on Monday to chairs of the boards of CRH PLC

(CRG.DB), LafargeHolcim (HCMLY), HeidelbergCement AG (HEI.XE) and

Compagnie de Saint-Gobain SA (SGO.FR), the investors outlined the

steps companies should take to manage climate-related risks and

reduce their carbon emissions in line with the Paris Agreement.

Some of the investor signatories include Hermes Asset

Management, BNP Paribas Asset Management, Aberdeen Standard

Investments, the Local Authority Pension Fund Forum, Ethos

Foundation and Sarasin & Partners

"The cement sector needs to dramatically reduce the contribution

it makes to climate change. Delaying or avoiding this challenge is

not an option. This is ultimately a business-critical issue for the

sector," said Stephanie Pfeifer, chief executive of the

Institutional Investors Group on Climate Change.

The investor group is asking companies to commit to being carbon

neutral by 2050 and to provide greater climate-related financial

disclosures. They are also urging companies to engage with policy

makers to support measures to mitigate climate change.

The cement sector, which produces 7% of the world's emissions,

is the second-highest emitter of carbon dioxide according to the

International Energy Agency. With global cement production expected

to grow up to 23% by 2050, the IEA expects emissions to rise by

4%.

Write to Maitane Sardon at maitane.sardon@dowjones.com

(END) Dow Jones Newswires

July 22, 2019 07:17 ET (11:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

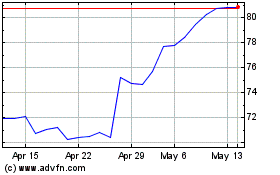

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

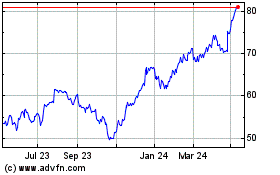

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Dec 2023 to Dec 2024