Annual results 2023: Organic sales growth of +4.5% driven by record

turnover in the Sports segment. Increase in adjusted EBITDA value

and margin thanks to a very solid performance in Sports and

significant recovery in North America

Tarkett Annual results 2023:

Organic sales growth of +4.5% driven by record turnover

in the Sports segment

Increase in adjusted EBITDA value and margin thanks to a

very solid performance in Sports and significant recovery in North

America

Strong improvement in free cash flow generation and

reduction in debt leverage

Results for 2023

-

Revenue for 2023 is stable compared to 2022, i.e., +0.1%,

but organic growth reached +4.5% taking into account rising volumes

in Sports and the positive effect of the selling price increases

implemented in 2022.

-

Revenue in Q4 2023 down -2.4% compared to 2022 due to

unfavourable currency effects,

but organic growth of +4.1% driven mainly by strong

activity in the Sports segment.

-

Adjusted EBITDA is up significantly: €288 million (8.6% of

sales), an increase of €+53 million (+1.6 margin points) compared

to 2022.

-

Record adjusted EBITDA in Sports and strong improvement in

profitability of flooring in North America.

-

EBIT: €125 million (€+81 million compared to

2022).

-

Net profit (Group share) of €+20 million in 2023, compared

to a loss of €-27 million in 2022

-

Positive free cash flow of €+147 million thanks to good

management of working capital requirements.

-

Net financial debt at €552 million, down by €103 million

compared to 2022, i.e., a financial leverage of 1.9x adjusted

EBITDA at the end of 2023 December.

-

In 2023, Tarkett maintained its A- rating with CDP (Carbon

Disclosure Project), confirming its leadership in climate action

among flooring and sports surfaces manufacturers.

Paris, 15

February 2024: The Supervisory Board of Tarkett (Euronext

Paris: FR0004188670 TKTT), met today and reviewed the Group’s

consolidated results for the 2023 financial year. The Group uses

alternative performance indicators (not defined under IFRS),

described in detail in Appendix 1 on page 6 of this document:

|

In millions of euros |

2023 |

2022 |

Change in % |

|

Revenue |

3,363.1 |

3,358.9 |

+0.1% |

|

Of which organic change |

+4.5% |

+8.9% |

|

Adjusted EBITDA |

287.8 |

234.9 |

+22.5% |

|

% of revenue |

8.6% |

7.0% |

|

Adjusted EBIT |

154.1 |

85.8 |

+79.6% |

|

% of revenue |

4.6% |

2.6% |

|

EBIT |

125.1 |

44.4 |

+181.8% |

|

% of revenue |

3.7% |

1.3% |

|

Net profit attributable to shareholders of the

company |

20.4 |

-26.8 |

- |

|

Fully diluted earnings per share (€) |

+0.31 |

-0.41 |

|

Free cash flow |

-147.1 |

-148.3 |

- |

|

Net debt |

551.7 |

654.8 |

- |

|

Leverage (Net debt/adjusted EBITDA over 12 months) |

1.9x |

2.8x |

|

|

- Fourth quarter revenue and

adjusted EBITDA by segment

Net revenue of the Group

amounted to €770.5 million, down -2.4% compared to the fourth

quarter of 2022. Organic growth stood at +4.1% excluding selling

price increases in the CIS region. Over this period, volumes rose

by +3.2%, supported by the dynamism of the Sports segment and the

good performance of activity in CIS, offsetting a decline in

activity in EMEA where demand remains low. The Commercial segments

in North America grew, but this performance did not offset the weak

activity in Residential and, to a lesser extent, Hospitality.

Selling prices (+0.9%) were stable compared to the previous

year.

|

Revenue in millions of euros |

Q4 2023 |

Q4 2022 |

Change |

Of which organic growth |

|

EMEA |

197.7 |

204.9 |

-3.5% |

-3.2% |

|

North America |

202.7 |

221.5 |

-8.5% |

-3.6% |

|

CIS, APAC & Latin America |

155.0 |

170.7 |

-9.2% |

+9.2% |

|

Sports |

215.1 |

192.5 |

+11.8% |

+16.4% |

|

TOTAL |

770.5 |

789.5 |

-2.4% |

+4.1% |

Group adjusted EBITDA rose

sharply to €50.7 million, i.e., 6.6% of sales, compared to €25.1

million in the fourth quarter of 2022, i.e., 3.2% of sales.The

positive impact of volumes and lower material costs were the main

contributors to the improvement in adjusted EBITDA over the

quarter, offsetting inflation in other purchasing costs and

salaries.

|

Adjusted EBITDA in millions of

euros |

Q4 2023 |

Q4 2022 |

Margin 2023 |

Margin 2022 |

|

TOTAL |

50.7 |

25.1 |

6.6% |

3.2% |

1. Group results in 2023

Net revenue of the Group

amounted to €3,363 million, up slightly by +0.1% compared to 2022.

Organic growth reached 4.5% and remains unchanged including selling

price increases in the CIS region (selling price adjustments in the

CIS countries are historically intended to offset currency

movements and are therefore excluded from the organic growth

calculation).

The effect of selling price increases mainly

implemented during the second half of 2022 is on average +3.9% over

2023 and contributed mainly to the first half of the financial

year. Volumes were generally stable over the entire year with

contrasting situations depending on activities and geographies.

Sports experienced strong growth again (+20.2%), volumes in CIS

improved after the sharp fall in 2022 and North American Commercial

activity held on track over the financial year in a market that

remains complicated. On the other hand, Residential activities in

North America and Europe fell sharply as a result of the drop in

real estate transactions. The currency effect was unfavourable over

the year (-4.5%), mainly due to the depreciation of the rouble and

the dollar.

|

Revenue in millions of euros |

2023 |

2022 |

Change |

Of which organic growth |

Organic change incl. CIS price changes

(1) |

|

EMEA |

850.2 |

912.3 |

-6.8% |

-5.5% |

-5.5% |

|

North America |

889.2 |

923.7 |

-3.7% |

-1.3% |

-1.3% |

|

CIS, APAC & Latin America |

598.5 |

652.8 |

-8.3% |

+5.9% |

+5.4% |

|

Sports |

1,025.2 |

870.2 |

+17.8% |

+20.2% |

+20.2% |

|

Group Total |

3,363.1 |

3,358.9 |

+0.1% |

+4.5% |

+4.4% |

Adjusted EBITDA amounted to

€287.8 million, i.e., 8.6% of revenue, compared to €234.9 million

in 2022, i.e., 7.0% of revenue.

The combined effect of the decrease in volumes

and the product mix on EBITDA is €-48 million. This unfavourable

mix effect between the divisions reflects the lower variable cost

margins in the Sports segment, particularly on installation and

civil engineering services for turnkey projects.

Raw material, energy and transport prices began

to decline in the second half of the year in particular, with a net

positive effect over the year of €+76 million compared to 2022.

However, wage inflation remained very significant.

The selling price increases deployed during the

2022 financial year led to a positive effect of +131 million euros

in 2023. SG&A is rising (€-29 million) to support the growth of

Sports and the launch of new collections in flooring.

Currency effects, excluding CIS, had a negative

€-11 million impact compared to 2022, mainly due to the

depreciation of the dollar. The net effect of prices and currencies

in the CIS countries (“lag effect”) amounts to €-25 million due to

the significant devaluation of the rouble.

Adjusted EBITDA margin increased over the year

(8.6% of sales compared to 7.0% in 2022).

|

Adjusted EBITDA in millions of

euros |

2023 |

2022 |

Margin 2023 |

Margin 2022 |

|

EMEA |

74.5 |

76.6 |

8.8% |

8.4% |

|

North America |

77.6 |

44.0 |

8.7% |

4.8% |

|

CIS, APAC & Latin America |

86.7 |

84.8 |

14.5% |

13.0% |

|

Sports |

114.5 |

86.5 |

11.2% |

9.9% |

|

Central |

-65.6 |

-57.0 |

- |

- |

|

TOTAL |

287.8 |

234.9 |

8.6% |

7.0% |

EBIT amounted to €125.1 million

in 2023: a significant increase compared to 2022 (€44.4 million).

EBIT adjustments (detailed in Appendix 1) amounted

to €29.0 million in 2023 compared to €41.4 million in 2022. They

mainly consist of restructuring costs linked to the implementation

of savings plans and the discontinuing of underperforming

activities.

Financial result stood at

€-69.2 million in 2023, compared to €-51.3 million in 2022.The

increase in the cost of debt is due to the rise in financial

interest net of hedging effects. This increase is mainly due to the

rise in average gross debt over the first half of the year and

higher financing costs.The tax burden amounted to

€35.4 million in 2023, up on the previous year (€18.1 million) due

to the increase in taxable income in North America (USA and Canada)

with the good performance of Sports and flooring

activities.The net profit (Group share) for the

2023 financial year is a profit of €20.4 million, i.e., a diluted

earnings per share of €0.31 up on 2022.

Comments by segment

The EMEA segment achieved a

turnover of €850 million, down -6.8% compared to 2022, including an

unfavourable exchange effect of -1.3% and negative organic growth

of -5.5%. The economic context of high inflation and interest rates

is hindering renovation and new construction projects throughout

the area. Activity in the Residential segment was significantly

lower than in 2022 and the decline in sales is marked by an

unfavourable product mix, with vinyl rolls performing better than

more expensive categories such as parquet. In a difficult market

environment, activity in the Commercial segments is showing only a

slight decline compared to 2022 due to steady volumes in the two

main activities, vinyl products for the Healthcare and Education

sectors and carpets for Workplace.

The segment’s adjusted EBITDA amounts to €75

million, i.e. 8.8% of sales, compared to €77 million (8.4% of

sales) in 2022. The drop in volumes was offset by a positive

inflation balance driven by the positive effect of selling price

increases implemented in 2022 over the first half of 2023 and the

drop in material prices over the second half.

The North American segment

generated a turnover of €889 million, down -3.7% compared to 2022,

with a negative exchange effect linked to the depreciation of the

dollar against the euro (-2.4%) and a negative organic growth of

-1.3%. Commercial segment (Workplace, Healthcare, Education) demand

has been slow but the Group has delivered volume growth driven by

Accessories and Carpet Tiles. Conversely, volumes in the

Residential and Hospitality segments are down in a market where

demand is still suffering from inflation and the level of interest

rates.

The segment’s adjusted EBITDA rose sharply to

€78 million, i.e., 8.7% of sales, compared to €44 million (4.8% of

sales) in 2022. The improvement is due to the favourable effects of

volumes, the product mix, but also a positive inflation balance

driven by on-board price increases in the previous year and the

inflexion of material costs compared to last year. The segment also

benefits from initiatives to turn around certain activities both in

terms of sales and industrial

efficiency.

Revenue in the CIS, APAC and Latin

America segment amounted to €599 million, down -8.3% with

a very unfavourable exchange effect mainly resulting from the

depreciation of the rouble (-27% compared to 2022). Activity was

well positioned with organic growth of +5.9% (excluding selling

price effects in CIS countries). It benefits from the improvement

in volumes in Russia and Ukraine compared to 2022, which had been

marked by a significant decline compared to 2021. These countries

represent 8% and 0.7% respectively of the Group’s sales over the

year. Vinyl rolls and LVT tiles for the Residential market were the

drivers of the business, accompanied by reactive price management

to secure volumes. In Asia, activity was down, mainly due to a

marked drop in sales in China. In order to optimise its cost base,

the Group closed the commercial carpet production site located in

Suzhou (China). Latin America is stable compared to 2022 with a

slight drop in volumes offset by price increases.

Adjusted EBITDA for the CIS, APAC, Latin America

segment is slightly improving: €87 million, i.e., 14.5% of sales,

compared to €85 million (13.0% of sales) in 2022. The increase in

margin comes from lower material purchase prices and improved plant

productivity.

Revenue in the Sports

segment stood at a record level of €1,025 million,

a very strong increase of +17.8% compared to 2022, including +20.2%

organic growth. The market continues to be very dynamic,

particularly for synthetic turf sports fields and athletics tracks

in North America. The segment also benefited from price increases

which more than offset inflation in raw material costs.

As a result of this very sustained activity, the

Sports segment posts a clear increase in adjusted EBITDA: €114.5

million, i.e., 11.2% of sales compared to €86.5 million (9.9% of

sales) in 2022.

2. Balance Sheet and Cash Flow

2023

Working capital requirements

stood at €118 million at the end of December 2023 compared to €233

million at the end of December 2022, an improvement of €115 million

over the financial year. The Group has implemented significant

actions to reduce the volume of inventories, which represent 80

days at the end of December 2023, compared to 86 days at the end of

December 2022. These actions, in addition to the fall in the

purchase price of raw materials, reduced the value of inventories

by -€85 million to €453 million at the end of December 2023.

Increased payment terms granted by major suppliers have also

contributed to lower working capital requirements. Factoring

programmes represented a net financing of €161 million at the end

of December 2023, a slight decrease compared to the end of December

2022 (€166 million).

Capital expenditure amounted to

€92.9 million in 2023 compared to €96.7 million in 2022.

The Group generated a positive free cash

flow of €147.1 million for the year, a very strong

increase compared to 2022 (-148.3 million euros) thanks to the

improvement in EBITDA and the significant reduction in working

capital requirements.

Net financial debt amounted to

€552 million at the end of December 2023, compared to €655 million

at the end of December 2022, i.e., a decrease of -103 million

euros. The leverage stood at 1.9x the adjusted

EBITDA at the end of December 2023, i.e., a sharp decrease of

-0.9x.

At the end of the 2023 financial year, the Group

had a good level of liquidity amounting to €656

million comprising the undrawn RCF in an amount of €350 million at

the end of December 2023, other confirmed and unconfirmed credit

lines in an amount of €82 million and €224 million in cash.

3. Dividends

As the macroeconomic and market environment

remain uncertain, and with a view to preserving cash flow in 2024

and consolidating the recovery initiated in 2023, the management

board will not propose paying a dividend for the 2023 financial

year.

4. 2024 Outlook

In a complex and uncertain geopolitical and

macroeconomic environment, Tarkett does not expect market

conditions to improve in the short term.

Demand in EMEA is expected to remain low in the

coming months given the persistence of high interest rates, the

continued low number of real estate transactions and the

difficulties in the construction sector. In this area, the Group

will continue to adapt its production and cost structure to market

conditions.

In North America, the indicators for the

Residential market remain dormant, but the Group’s limited exposure

to this segment and its differentiating positioning on certain

distribution channels should allow favourable development in this

activity. The Commercial segments have been better oriented in

recent months without any clear signs of recovery being identified,

particularly given the weakness of office property. Nevertheless,

the Group’s objective is to continue the momentum initiated in 2023

in order to gain market share and continue to strengthen its

profitability.

The Sports segment has experienced exceptional

growth over the past two years, which is expected to continue in

2024 but at a less sustained pace. These prospects should enable

the further improvement of the results in this segment.

In this complex market environment, Tarkett is

maintaining its operational and financial recovery roadmap launched

in 2023. After the very strong cash generation in 2023, the Group

continues to aim for positive cash generation and deleveraging

through rigorous control of working capital requirements and costs,

as well as control of investments allocated as a priority to

innovative, growth and productivity projects.

This press release may contain forward-looking statements. These

statements do not constitute forecasts regarding results or any

other performance indicator, but rather trends or targets. These

statements are by their nature subject to risks and uncertainties

as described in the Company’s Registration Document available on

its website (https://www.tarkett-group.com/en/category/urd/). They

do not reflect the future performance of the Company, which may

differ significantly. The Company does not undertake to provide

updates to these statements.

Auditing procedures on the consolidated

financial statements have been performed. The statutory auditor's

report is currently being issued, and consolidated financial

statements for 2023 are available on Tarkett’s website

https://www.tarkett-group.com/en/document/?_categories=financial-documents

Financial calendar

- 25 April 2024:

Q1 2024 Revenue - Press release after close of trading

- 26 April 2024:

Annual General Meeting

- 25 July 2024:

Financial results for H1 2024 - Press release after close of

trading

- 24 October 2024:

Q3 2024 Revenue - Press release after close of trading

Investor Relations and Individual Shareholders

Contact

investors@tarkett.com

Media ContactsBrunswick –

tarkett@brunswickgroup.com – Tel.: +33 (0) 1 53 96 83 83Hugues

Boëton – Tel.: +33 (0) 6 79 99 27 15 – Benoit Grange – Tel.: +33

(0) 6 14 45 09 26

About TarkettWith a 140-year

history, Tarkett is a worldwide leader in innovative and durable

flooring and sports surface solutions, generating a turnover of 3.4

billion euros in 2023. The Group has around 12,000

employees and 23 R&D centres, 8 recycling centres and 34

production sites. Tarkett designs and manufactures solutions for

hospitals, schools, housing, hotels, offices, shops and sports

fields, serving customers in more than 100 countries. To

build “The Way to Better Floors”, the Group is committed to the

circular economy and sustainable development, in line with its

Tarkett Human-Conscious Design® approach. Tarkett is listed on the

Euronext regulated market (compartment B, ISIN: FR0004188670,

ticker: TKTT). www.tarkett-group.com

Appendices

1/ Definition of alternative performance indicators (not

defined under IFRS)

- Organic growth

measures the change in revenue compared with the same period in the

previous year, excluding the exchange rate effect and changes in

scope. The foreign exchange effect is obtained by applying the

previous year’s exchange rate to sales for the current year and

calculating the difference with sales for the current year. It also

includes the effect of price adjustments in the CIS countries

intended to offset the change in local currencies against the euro.

In 2023, a €-3.1 million negative impact of selling price

adjustments is excluded from organic growth and included in the

foreign exchange effect.

- The scope effect

is composed of:

- current year sales by entities not

included in the scope of consolidation in the same period of the

previous year, until the anniversary of their consolidation, the

reduction in sales due to discontinued operations that are not

included in the current year's scope of consolidation but were

included in sales for the same period of the previous year, until

the anniversary of their disposal.

|

In millions of euros |

2023 Turnover |

2022 Turnover |

Change |

Of which volume |

Of which selling prices |

Of which CIS selling prices |

Of which exchange rate effect |

Of which scope effect |

|

Group Total Q1 |

698.5 |

684.7 |

+2.0% |

-7.8% |

+6.9% |

+0.4% |

+2.3% |

+0.2% |

|

Of which organic growth |

-0.9% |

|

|

|

|

Of which selling price increases |

|

+7.3% |

|

|

|

Group Total Q2 |

909.8 |

879.3 |

+3.5% |

+2.4% |

+5.2% |

-1.2% |

-2.9% |

+0.0% |

|

Of which organic growth |

+7.5% |

|

|

|

|

Of which selling price increases |

|

+4.0% |

|

|

|

Group Total H1 |

1,608.3 |

1,564.0 |

+2.8% |

-2.1% |

+5.9% |

-0.4% |

-0.7% |

+0.1% |

|

Of which organic growth |

+3.9% |

|

|

|

|

Of which selling price increases |

|

+5.5% |

|

|

|

Group Total Q3 |

984.3 |

1,005.4 |

-2.1% |

+2.8% |

+3.1% |

-0.2% |

-7.8% |

+0.0% |

|

Of which organic growth |

+6.0% |

|

|

|

|

Of which selling price increases |

|

+2.9% |

|

|

|

Group Total Q4 |

770.5 |

789.5 |

-2.4% |

+3.2% |

+0.9% |

+0.8% |

-7.6% |

+0.2% |

|

Of which organic growth |

+4.1% |

|

|

|

|

Of which selling price increases |

|

+1.7% |

|

|

Group Total H2 |

1,754.8 |

1,794.9 |

-2.2% |

+3.0% |

+2.1% |

+0.2% |

-7.7% |

+0.1% |

|

Of which organic growth |

+5.1% |

|

|

|

|

Of which selling price increases |

|

+2.4% |

|

|

Group Total |

3,363.1 |

3,359.9 |

+0.1% |

+0.6% |

+3.9% |

+0.0% |

-4.4% |

+0.1% |

|

Of which organic growth |

+4.5% |

|

|

|

|

Of which selling price increases |

|

+3.9% |

|

|

- Adjusted

EBITDA is the operating result before depreciation and

amortisation restated for the following income and expenses:

restructuring costs with the aim of increasing the Group’s future

profitability, gains and losses on significant asset disposals,

provisions and reversals of provisions for impairment, costs

related to business combinations and legal reorganizations,

expenses related to share-based payments and other one-off expenses

considered non-recurring by their nature.

|

In millions of euros |

Adjusted EBITDA 2023 |

Adjusted EBITDA 2022 |

Margin 2023 |

Margin 2022 |

|

Group Total – Q1 |

31.8 |

37.3 |

4.6% |

5.5% |

|

Group Total – Q2 |

94.2 |

88.9 |

10.4% |

10.1% |

|

Group Total – H1 |

126.1 |

126.2 |

+7.8% |

8.1% |

|

Group Total – Q3 |

110.9 |

83.6 |

11.3% |

8.3% |

|

Group Total – Q4 |

50.7 |

25.1 |

6.6% |

3.2% |

|

Group Total – H2 |

161.7 |

108.7 |

9.2% |

6.1% |

|

Group Total |

287.8 |

234.9 |

8.6% |

7.0% |

|

In millions of euros |

of which adjustments |

|

2023 |

Restructuring |

Gains/losses on asset disposals/impairment |

Business combinations |

Share-based payments |

Other |

2023 adjusted |

|

EBIT |

125.1 |

8.4 |

3.2 |

- |

9.6 |

7.8 |

154.1 |

|

Impairment, amortisation and depreciation |

133.2 |

- |

-1.2 |

- |

- |

- |

132.0 |

|

Other |

1.7 |

- |

- |

- |

- |

- |

1.7 |

|

EBITDA |

260.0 |

8.4 |

2.0 |

- |

9.6 |

7.8 |

287.8 |

|

In millions of euros |

of which adjustments |

|

2022 |

Restructuring |

Gains/losses on asset disposals/impairment |

Business combinations |

Share-based payments |

Other |

2022 adjusted |

|

EBIT |

44.4 |

18.7 |

7.3 |

0.5 |

6.3 |

8.6 |

85.8 |

|

Impairment, amortisation and depreciation |

152.0 |

-2.2 |

0.3 |

- |

- |

- |

150.1 |

|

Other |

-1.0 |

- |

- |

- |

- |

- |

-1.0 |

|

EBITDA |

195.4 |

16.5 |

7.7 |

0.5 |

6.3 |

8.6 |

234.9 |

- Free

cash flow is defined as cash generated from operations

before change in working capital, plus or minus the following

inflows and outflows: change in working capital, repayment of lease

liabilities, net interest received (paid), net tax collected

(paid), various operating items collected (disbursed), acquisition

of intangible assets and property, plant and equipment, and income

(loss) from fixed asset disposals.

|

Free cash flow (in millions of euros) |

2023 |

2022 |

|

Cash flow from operations before change in working capital

and repayment of lease liabilities |

259.5 |

182.6 |

|

Repayment of lease liabilities |

-39.8 |

-35.1 |

|

Cash flow from operations before change in working capital;

including repayment of lease liabilities |

219.7 |

147.5 |

|

Change in working capital |

117.9 |

-134.7 |

|

of which change in factoring programmes |

-4.9 |

4.2 |

|

Net interest paid |

-46.2 |

-31.2 |

|

Net tax paid |

-45.0 |

-24.0 |

|

Miscellaneous operating items paid |

-7.8 |

-11.8 |

|

Acquisition of intangible assets and property, plant and

equipment |

-92.9 |

-96.7 |

|

Proceeds from disposal of property, plant and equipment |

1.2 |

2.5 |

|

Free cash flow |

147.1 |

-148.3 |

- Net financial debt

is defined as the sum of interest bearing loans and borrowings

minus cash and cash equivalents. Borrowings correspond to any

obligation to repay funds received or raised that are subject to

repayment terms and interest. They also include liabilities on

leases.

- Financial leverage

is the ratio of net financial debt, including leases accounted for

as per IFRS 16, to adjusted EBITDA over the last 12 months.

|

In millions of euros |

|

31 December 2023 |

31 December 2022 |

|

Financial debts - long term |

|

592.6 |

711.0 |

|

Financial debts and bank overdrafts - short term |

|

40.0 |

45.2 |

|

Financial debts excluding IFRS 16 (A) |

|

632.6 |

756.2 |

|

Lease liabilities - long term |

|

111.8 |

91.7 |

|

Lease liabilities - short term |

|

31.6 |

27.7 |

|

Lease liabilities - IFRS 16 (B) |

|

143.4 |

119.4 |

|

Gross debt - long term |

|

704.4 |

802.7 |

|

Gross debt - short term |

|

71.6 |

72.9 |

|

Gross debt (C) = (A) + (B) |

|

776.0 |

875.6 |

|

|

|

|

|

|

Cash and cash equivalents (D) |

|

224.3 |

220.8 |

|

|

|

|

|

|

Net debt (E) = (C) - (D) |

|

551.7 |

654.8 |

|

|

|

|

|

|

Adjusted EBITDA 12 months (F) |

|

287.8 |

234.9 |

|

|

|

|

|

|

Ratio (E) / (F) |

|

1.9x |

2.8x |

2/ Bridges in millions of euros 2023, H2 and Q4

2023

Net revenue by segment

Adjusted EBITDA by nature

|

Q4 2022 |

789.5 |

|

+/- EMEA |

-6.6 |

|

+/- North America |

-8.1 |

|

+/-CIS, APAC & Latin America |

15.7 |

|

+/- Sports |

31.6 |

|

Q4 2023 Like-for-Like |

822.1 |

|

+/- Currencies |

-23.2 |

|

+/- “Lag effect” in CIS (1) |

-30.1 |

|

+/- Scope |

-1.8 |

|

Q4 2023 |

770.5 |

(1) Including selling price increases

|

Q4 2022 |

25.1 |

|

+/- Volume / Mix |

5.9 |

|

+/- Selling prices |

6.9 |

|

+/- Raw materials and Transport |

37.0 |

|

+/- Salary increases |

-7.8 |

|

+/- Productivity |

7.6 |

|

+/- SG&A |

-8.9 |

|

+/- Non-recurring and other |

-13.5 |

|

+/- “Lag effect” in CIS (1) |

-1.4 |

|

+/- Currencies |

-0.4 |

|

+/- Scope |

0.2 |

|

Q4 2023 |

50.7 |

(1) Including selling price

increases

|

H2 2022 |

1,794.9 |

|

+/- EMEA |

-14.9 |

|

+/- North America |

-14.7 |

|

+/-CIS, APAC & Latin America |

36.3 |

|

+/- Sports |

85.7 |

|

H2 2023 Like-for-Like |

1,887.3 |

|

+/- Currencies |

-60.3 |

|

+/- “Lag effect” in CIS(1) |

-74.1 |

|

+/- Scope |

1.8 |

|

H2 2023 |

1,754.8 |

(1) Including selling price increases

|

H2 2022 |

108.7 |

|

+/- Volume / Mix |

-2.7 |

|

+/- Selling prices |

38.5 |

|

+/- Raw materials and Transport |

68.5 |

|

+/- Salary increases |

-16.1 |

|

+/- Productivity |

15.4 |

|

+/- SG&A |

-19.1 |

|

+/- Non-recurring and other |

-17.1 |

|

+/- “Lag effect” in CIS(1) |

-9.3 |

|

+/- Currencies |

-4.5 |

|

+/- Scope |

-0.8 |

|

H2 2023 |

161.7 |

|

2022 |

3,358.9 |

|

+/- EMEA |

-49.9 |

|

+/- North America |

-11.6 |

|

+/-CIS, APAC & Latin America |

38.3 |

|

+/- Sports |

175.9 |

|

FY 2023 Like-for-Like |

3,511.6 |

|

+/- Currencies |

-63.5 |

|

+/- “Lag effect” in CIS(1) |

-88.5 |

|

+/- Scope |

3.5 |

|

2023 |

3,363.1 |

(1) Including selling price

increases

|

2022 |

234.9 |

|

+/- Volume / Mix |

-47.7 |

|

+/- Selling prices |

131.4 |

|

+/- Raw Materials and Transport |

76.2 |

|

+/- Salary increases |

-32.1 |

|

+/- Productivity |

19.4 |

|

+/- SG&A |

-29.3 |

|

+/- Non-recurring and other |

-26.3 |

|

+/- “Lag effect” in CIS |

-24.9 |

|

+/- Currencies |

-11.3 |

|

+/- Scope |

-2.5 |

|

2023 |

287.8 |

- Press Release - Tarkett -2023_Results_ENG

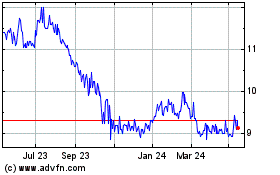

Tarkett (EU:TKTT)

Historical Stock Chart

From Jan 2025 to Feb 2025

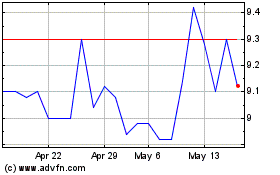

Tarkett (EU:TKTT)

Historical Stock Chart

From Feb 2024 to Feb 2025