Antipodean Currencies Slide Amid Risk Aversion

21 May 2024 - 1:57PM

RTTF2

The antipodean currencies such as the Australia and the New

Zealand dollars weakened against their major counterparts in the

Asian session on Tuesday, as Asian stock markets traded lower amid

lingering uncertainty about the outlook for interest rates, with

some U.S. Fed officials warning the central bank may still need to

raise rates if inflation persists. Traders also seemed reluctant to

make more significant bets ahead of the release of the minutes of

the latest Fed meeting.

While the likelihood interest rates will be lower by September

remains high, the chances have fallen to 76.3 percent from close to

90 percent last week, according to CME Group's FedWatch Tool.

Crude oil prices settled lower, weighed down by concerns the

Federal Reserve will likely keep interest rates higher for a longer

time. West Texas Intermediate Crude oil futures dropped to around

$79.80, down $0.26 from the previous close.

In economic news, members of the Reserve Bank of Australia's

Monetary Policy Board said that the country's economy was slowing,

and that inflation was declining less than expected, minutes from

the central bank's May 7 meeting revealed on Tuesday. A higher cash

rate may be necessary to slow the pace of disinflation, the bank

said.

At the meeting, the RBA policy board left its benchmark interest

rates unchanged, leaving the cash rate target at 4:35 percent. The

board also retained the interest rate paid on Exchange Settlement

balances at 4.25 percent.

In the Asian trading today, the Australian dollar fell to a

4-day low of 103.92 against the yen, from yesterday's closing value

of 103.34. The aussie may test support around the 102.0 region.

Against the U.S. dollar, the euro and the Canadian dollar, the

aussie dropped to 6-day lows of 0.6646, 1.6327 and 0.9067 from

yesterday's closing quotes of 0.6667, 1.6279 and 0.9089,

respectively. If the aussie extends its downtrend, it is likely to

find support around 0.65 against the greenback, 1.65 against the

euro and 0.89 against the loonie.

The aussie edged down to 1.0909 against the NZ dollar, from

Monday's closing value of 0.9089. On the downside, 1.08 is seen as

the next support level for the aussie.

The NZ dollar fell to 6-day lows of 0.6089 against the U.S.

dollar and 1.7821 against the euro, from yesterday's closing quotes

of 0.6107 and 1.7784, respectively. If the kiwi extends its

downtrend, it is likely to find support around 0.59 against the

greenback and 1.81 against the euro.

Against the yen, the kiwi edged down to 95.22 from Monday's

closing value of 95.51. The next possible downside target for the

kiwi is seen around the 91.00 region.

Looking ahead, Eurozone current account figures and foreign

trade data, both for March and U.K. industrial trends survey data

are due to be released in the European session.

In the New York session, Canada CPI data for April and U.S.

Redbook report are slated for release.

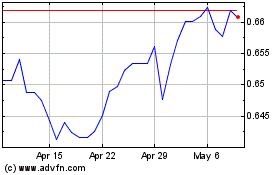

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From May 2024 to Jun 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Jun 2023 to Jun 2024