Euro Strengthens Amid Debt-resolution Hopes

02 December 2011 - 10:29PM

RTTF2

The euro rallied in early deals on Friday as European stocks

traded notably higher, braced by German Chancellor Angela Merkel's

comments that European nations are working toward setting up a

fiscal union with rigorous budgetary oversight to resolve the

Eurozone's debt crisis.

Merkel said before the parliament that the eurozone nations must

urgently come together to restore confidence in the market. While

raising her continuous objection about the common eurobonds, the

German leader stressed the "need to change the treaties or create

new treaties," bringing in budget discipline and effective crisis

management mechanism.

In a major speech in the Southern French port city of Toulon,

French President Nicolas Sarkozy said Thursday that France and

Germany must come together to ensure stability at the heart of

Europe. The meeting would come just ahead of a summit of European

leaders in Brussels on December 9, where possible changes to the EU

treaties will be on the agenda.

While admitting that the sovereign debt crisis is the biggest

challenge that Europe has ever experienced, Sarkozy said he will

meet German Chancellor Angela Merkel next Monday in Paris and make

proposals to guarantee Europe's future.

Meanwhile, Sarkozy meets Britain's Prime Minister David Cameron

today to discuss measures that will help contain Europe's mounting

debt crisis.

Thus far, the U.K. FTSE 100 index advanced 1.47 percent,

Germany's DAX jumped 1.4 percent and France's CAC-40 index rose to

1.70 percent.

Data released in the region was not so encouraging, with the

producer price inflation in the euro area easing more than

economists expected in October.

According to the report released by statistical office Eurostat

showed that the producer price inflation, excluding construction,

eased to 5.5 percent in October from 5.8 percent in September.

Economists expected a growth rate of 5.6 percent for October.

On a monthly basis, producer prices edged up 0.1 percent in

October, slower than the previous month's 0.3 percent rise.

Economists were looking for a 0.2 percent growth.

Extending its 2-day winning streak, the euro advanced to a

1-week high of 1.2376 against the Swiss franc around 6:00 am ET.

The 1-hour RSI is trading above the overbought territory and the

pair is expected to ease its recent strength in the near-term.

Retail sales in Switzerland remained unchanged on an annual

basis in October in line with economists' expectations, the Federal

Statistical Office said today. In nominal terms, retail sales

dropped 3.3 percent year-on-year. On a seasonally adjusted

month-on-month basis, sales rose 2.5 percent in real terms and 1.6

percent nominally.

The euro advanced to more than a 2-week high of 105.15 against

the yen around 6:20 am ET. The immediate resistance for the pair

could be at its 30-day SMA of 105.45 and a move above that level

could help testing the 23.6 percent of the retracement level around

106.20.

The monetary base in Japan surged 19.5 percent on year in

November, the Bank of Japan said early in the day, standing at

118.497 trillion yen. That follows the 17.0 percent annual

expansion in October. Seasonally adjusted, the monetary base spiked

an annualized 41.2 percent to 121.191 trillion yen.

Against the pound, the single currency strengthened to a 4-day

high of 0.8607 around 4:15 am ET and the pair was hovering around

the 0.86 level thereafter. On the upside, the euro-pound pair may

test the neck line of a double bottom formed in the daily chart,

around the 0.8650 level.

The seasonally adjusted UK Markit/ Chartered Institute of

Purchasing & Supply (CIPS) purchasing managers' index for the

construction sector posted 52.3 in November, down from 53.9 in

October. A reading above 50 indicates expansion of the sector.

After having tested a peak around the 1.34 level against the

dollar, the European currency moved sideways after 4:15 am ET. The

euro-greenback pair is presently worth 1.3484 with 1.3530 seen as

the next likely resistance level.

Traders are reluctant to take positions ahead of the U.S. Labor

Department's crucial jobs report, which is scheduled for release at

8:30 am ET. The report is expected to show that employment

increased by about 130,000 jobs in November, although the

unemployment rate is expected to remain at 9.0 percent.

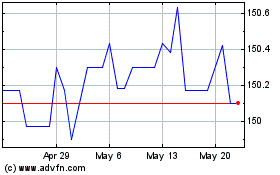

Euro vs ISK (FX:EURISK)

Forex Chart

From May 2024 to Jun 2024

Euro vs ISK (FX:EURISK)

Forex Chart

From Jun 2023 to Jun 2024