Antipodean Currencies Rise On China Stimulus

30 September 2024 - 1:16PM

RTTF2

Antipodean currencies such as the Australia and the New Zealand

dollars strengthened against their major currencies in the Asian

session on Monday, as Chinese stimulus boosted risk assets and

commodities.

Traders reacted positively to the additional stimulus measures

from the Chinese government to spur growth in the world's second

largest economy.

The Chinese government announced further steps to revive the

nation's economy, with the central bank cutting interest rates and

adding to stimulus measures already announced recently.

Metal stocks traded higher after three of China's largest cities

relaxed rules for homebuyers and China's central bank revised the

mortgage rate pricing mechanism to ease financial pressure on

homeowners.

Crude oil prices traded higher as additional stimulus measures

from the Chinese government eased concerns about the outlook for

demand. West Texas Intermediate Crude oil futures for November

added $0.51 or at $68.18 a barrel.

In economic news, total private sector credit in Australia was

up 0.5 percent on month in August, the Reserve Bank of Australia

said on Monday - matching expectations and unchanged from the

previous month. Credit was up 5.7 percent on year in August.

Housing credit rose 0.4 percent on month and 5.0 percent on year,

while personal credit added 0.1 percent on month and 2.5 percent on

year and business credit climbed 0.7 percent on month and 7.7

percent on year. Broad money gained 0.4 percent on month and 5.5

percent on year.

Data from Caixin showed that the manufacturing sector in China

fell into contraction territory in September, with a manufacturing

PMI score of 49.3. That's down from 50.4 in August.

The survey also showed that the services PMI came in at 50.3,

down from 51.6 in August.

The Australia and the New Zealand dollars started trading higher

against their major rivals since last Thursday.

In the Asian trading today, the Australian dollar rose to a

2-1/2-month high of 1.6093 against the euro, from Friday's closing

value of 1.6171. The aussie may test resistance around the 1.59

region.

Against the U.S. and the Canadian dollars, the aussie advanced

to more than 1-1/2-year highs of 0.6940 and 0.9369 from Friday's

closing quotes of 0.6902 and 0.9326, respectively. If the aussie

extends its uptrend, it is likely to find resistance around 0.70

against the greenback and 0.94 against the loonie.

Against the yen, the aussie edged up to 98.91 from last week's

closing value of 98.14. The next possible upside target for the

aussie is seen around the 107.00 region.

The NZ dollar rose to a 2-1/2-month high of 0.6375 against the

U.S. dollar, more than a 3-month high of 1.7510 against the euro

and a 4-day high of 1.0869 against the Australian dollar, from last

week's closing quotes of 0.6340, 1.7604and 1.0885, respectively. If

the kiwi extends its uptrend, it is likely to find resistance

around 0.65 against the greenback, 1.74 against the euro and 1.07

against the aussie.

Against the yen, the kiwi edged up to 90.95 from Friday's

closing value of 90.15. The kiwi may test resistance around the

94.00 region.

Looking ahead, the Bank of England is set to issue U.K. mortgage

approvals for August. The number of mortgage approvals is expected

to rise to 64,000 after an increase of 61,999 in the prior

month.

In the New York session, U.S. Chicago PMI for September and U.S.

Dallas fed manufacturing index for September are slated for

release.

At 8:00 am ET, Destatis releases Germany's flash inflation data

for September. Economists expect inflation to slow to 1.5 percent

from 1.9 percent in August.

At 1:55 pm ET, U.S. Fed Chair Jerome Powell is scheduled to

speak at the National Association for Business Economics event

later in the day for clues to additional rate cuts.

The Federal Reserve reduced its benchmark interest rate by 50

basis points on September 12, marking the first decrease since

2020. Traders are now positioning themselves for the U.S. central

bank to cut rates by another 75-100 bps this year.

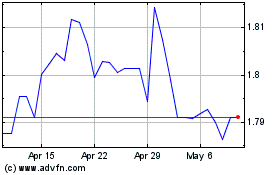

Euro vs NZD (FX:EURNZD)

Forex Chart

From Oct 2024 to Nov 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

From Nov 2023 to Nov 2024