NZ Dollar Falls Amid RBNZ Rate Cut Speculation

03 October 2024 - 2:18PM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Thursday, as traders speculate the Reserve

Bank of New Zealand is likely to slash its interest rate at the

next monetary policy meeting.

Markets speculate the Reserve Bank of New Zealand (RBNZ) to cut

its Official Cash Rate (OCR) by 50 basis points to 4.75 percent at

its next monetary policy meeting to be held on October 9, 2024.

Investors remain concerned about the prospects of a wider Middle

East war, with Israel's war cabinet reportedly weighing its

response after Iran launched its largest-ever attack on the country

in an escalation of hostilities.

Multiple airstrikes were reported in Beirut earlier today with

explosions heard in the Lebanese capital. Authorities said at least

six people were killed.

Amid West Asia conflict escalation, several countries have

issued advisories and some have evacuated their citizens.

In economic releases, trading later in the day may be impacted

by reaction to the latest U.S. economic data, including reports on

weekly jobless claims, service sector activity and factory

orders.

In the Asian trading today, the NZ dollar fell to a 6-day low of

1.7704 against the euro, from yesterday's closing value of 1.7633.

The kiwi is likely to find support around the 1.81 region.

Against the U.S. and the Australian dollars, the kiwi dropped to

nearly a 2-week low or 0.6227 and a 1-1/2-month low of 1.1025 from

Wednesday's closing quotes of 0.6262 and 1.0990, respectively. If

the kiwi extends its downtrend, it is likely to find support around

0.60 against the greenback and 1.11 against the aussie.

The kiwi edged down to 91.22 against the yen, from an early near

2-week high of 91.93. On the downside, 87.00 is seen as the net

support level for the kiwi.

In economic news, the services sector in Japan continued to

expand in September, albeit at a slower pace, the latest survey

from Jibun Bank revealed on Thursday with a services PMI score of

53.1. That's down from 53.7 in August, although it remains above

the boom-or-bust line of 50 that separates expansion from

contraction. The data also said the composite PMI slipped to 52.0

in September from 52.9 in August.

Japan's newly appointed Prime Minister Shigeru Ishiba said that

the nation is not prepared for additional rate hikes, following a

meeting with the central bank governor.

Looking ahead, PMI reports from various European economies and

U.K. for September and Eurozone PPI data for August are slated for

release in the European session.

In the New York session, U.S. weekly jobless claims, Canada and

U.S. PMI reports for September and U.S. factory orders for August

are set to be released.

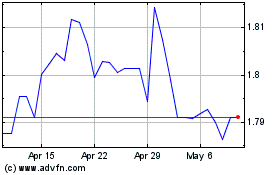

Euro vs NZD (FX:EURNZD)

Forex Chart

From Oct 2024 to Nov 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

From Nov 2023 to Nov 2024