Pound Rises As U.K. Exits Recession

10 May 2024 - 1:41PM

RTTF2

The British pound strengthened against other major currencies in

the pre-European session on Friday, after the U.K. economy exited a

technical recession in the first quarter with the economic output

growing better than expected led by a rebound in the services

output and household spending.

Data from the Office for National Statistics showed that the

U.K. gross domestic product grew 0.6 percent from the fourth

quarter, when the economy shrunk 0.3 percent. Output had declined

0.1 percent in the third quarter last year.

Economists had expected the first quarter growth to come in at

0.4 percent.

GDP rose 0.2 percent year-on-year in the first quarter, beating

expectations for stagnation.

The monthly GDP indicator grew 0.4 percent sequentially in March

after 0.2 percent gain in February, which was revised up from 0.1

percent. In January, GDP rose 0.3 percent. Economists had forecast

a 0.1 percent increase for March.

European stock markets traded higher, after data showing a much

bigger than expected increase in U.S. jobless claims for last week

added to recently renewed optimism that the U.S Fed will lower

interest rates by September and optimism over China's economic

recovery likely to underpin investor sentiment.

The dollar fell and bond yields dipped as fresh signs of an

easing U.S. labor market helped keep hopes of Fed interest rate

cuts alive.

There is also optimism around Chinese economic recovery after

April trade data beat estimates and two key cities of Hangzhou and

Xian scrapped all restrictions on home purchases to lure

buyers.

Traders also remain cautious ahead of a report on U.S. consumer

sentiment in the month of May, which includes readings on inflation

expectations.

Thursday, the pound weakened against other major currencies

after the Bank of England maintained its key policy rate for the

sixth consecutive meeting.

The Monetary Policy Committee decided to hold the Bank Rate at

5.25 percent again in a split vote. The current bank rate is the

highest since early 2008.

Meanwhile, the Bank of England (BoE) Governor Andrew Bailey

hinted at potential future rate cuts. The British sterling held

steady against its major rivals in the Asian trading today.

In the European trading now, the pound rose to an 8-day high of

195.17 against the yen, from yesterday's closing value of 194.63.

The next possible upside target for the pound is seen around the

200.00 region.

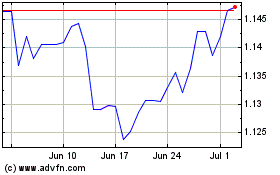

Against the Swiss franc and the U.S. dollar, the pound advanced

to 3-day highs of 1.1368 and 1.2542 from Thursday's closing quotes

of 1.1347 and 1.2525, respectively. If the pound extends its

uptrend, it is likely to find resistance around 1.15 against the

franc and 1.27 against the greenback.

The pound edged up to 0.8595 against the euro, from yesterday's

closing value of 0.8609. On the upside, 0.84 is seen as the next

resistance level for the pound.

Looking ahead, European Central Bank will publish account of its

latest monetary policy meeting at 7:30 am ET.

In the New York session, Canada jobs data for April, U.S.

University of Michigan's consumer sentiment for May, U.S. Baker

Hughes oil rig count data and U.S. Federal budget balance report

for April are slated for release.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2024 to May 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From May 2023 to May 2024