ECB Minutes Signal Scope For Further Easing

14 January 2016 - 8:39PM

RTTF2

Rate-setters were divided on the size of the interest rate

reduction during the December policy session and they explored the

possibility of further easing in future, the minutes of the

meeting, released Thursday by the European Central Bank,

showed.

"Some members expressed a preference for a 20 basis point cut in

the deposit facility rate at the current meeting, mainly with a

view to strengthening the easing impact of this measure and

reflecting the view that, to date, no material negative side

effects on bank margins and financial stability had emerged," the

minutes of the December 3 meeting, which the ECB calls "account"

said.

On December 3, the bank cut its deposit facility rate by 10

basis points to a record low -0.30 percent. The size of the

reduction was at the lower end of the 10-20 basis points cut

economists had forecast.

The minutes said some members were cautious regarding a deeper

rate cut as they felt it will increase the side effects over

time.

"A cut in the deposit facility rate of 10 basis points was seen

as unlikely to trigger material negative side effects and was also

seen as having the advantage of leaving some room for further

downward adjustments, should the need arise," the report said.

The 25-member Governing Council, which met in Frankfurt, left

the main refinancing rate, or the refi, unchanged at record low

0.05 percent and the marginal lending facility rate at 0.30

percent.

During the December meeting, the ECB also decided to extend its

EUR 1.1 trillion asset purchase programme until March 2017, or

beyond, if necessary.

"There was broad support for shifting the intended end date of

the purchases from September 2016 to March 2017," the minutes

said.

Suggestions to extend asset purchases beyond March 2017 and

expanding the monthly volume of purchases from EUR 60 billion, or

of frontloading them, were also made, the minutes said.

"There was broad agreement that such measures would not be

warranted at this juncture, while a reassessment could be made in

future," the report added.

Members also sought "to remind governments forcefully about

their responsibility to contribute decisively to rebalancing the

euro area economy and to supporting the euro area recovery with

appropriate measures", the ECB said.

Regarding the economic outlook, policymakers agreed that

moderate recovery in the euro area economy was likely to continue,

though the risks to the growth outlook were seen as remaining on

the downside, in particular stemming from the external environment,

mainly from the emerging markets, and broader geopolitical

risks.

While the euro area inflation was expected to pick up, members

also agreed that there had been a further deterioration in the

outlook for inflation, so that the return to inflation rates below,

but close to, 2 percent would likely take longer than previously

expected, the minutes said.

"The longer inflation remained below the ECB's inflation aim,

the greater the challenge for monetary policy," the report

added.

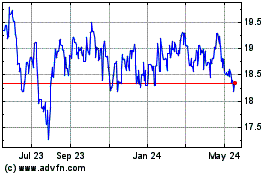

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Jul 2023 to Jul 2024