Dollar Mostly Higher Ahead Of Friday's Data Deluge

15 January 2016 - 1:09AM

RTTF2

The dollar is trading higher against the Euro and the Japanese

Yen Thursday morning, but is down slightly against the British

pound. Investors finally got some U.S. economic data to react to

this morning and are preparing themselves for a barrage of data on

Friday.

First-time claims for U.S. unemployment benefits unexpectedly

increased in the week ended January 9th, according to a report

released by the Labor Department on Thursday. The report said

initial jobless claims climbed to 284,000, an increase of 7,000

from the previous week's unrevised level of 277,000. Economists had

expected jobless claims to edge down to 275,000.

While the Labor Department released a report on Thursday showing

a significant drop in U.S. import prices in the month of December,

the decrease was not quite as steep as economists had

anticipated.

The Labor Department said import prices tumbled by 1.2 percent

in December after falling by a revised 0.5 percent in November.

Economists had expected import prices to slump by 1.4 percent

compared to the 0.4 percent drop originally reported for the

previous month.

The report also said export prices slid by 1.1 percent in

December following a revised 0.7 percent decrease in November.

Export prices had been expected to dip by 0.5 percent compared to

the 0.6 percent decrease originally reported for the previous

month.

Investors can look forward to the release of the producer price

index, retail sales, industrial production and consumer sentiment

among others on Friday.

Rate-setters were divided on the size of the interest rate

reduction during the December policy session and they explored the

possibility of further easing in future, the minutes of the

meeting, released Thursday by the European Central Bank,

showed.

"Some members expressed a preference for a 20 basis point cut in

the deposit facility rate at the current meeting, mainly with a

view to strengthening the easing impact of this measure and

reflecting the view that, to date, no material negative side

effects on bank margins and financial stability had emerged," the

minutes of the December 3 meeting, said.

On December 3, the bank cut its deposit facility rate by 10

basis points to a record low -0.30 percent. The size of the

reduction was at the lower end of the 10-20 basis points cut

economists had forecast.

The minutes said some members were cautious regarding a deeper

rate cut as they felt it will increase the side effects over

time.

"A cut in the deposit facility rate of 10 basis points was seen

as unlikely to trigger material negative side effects and was also

seen as having the advantage of leaving some room for further

downward adjustments, should the need arise," the report said.

The dollar dropped to an early low of $1.0942 against the Euro

Thursday, but has since bounced back to around $1.0860.

The German economy grew the most in four years in 2015 as feeble

inflation, record low unemployment and wage growth boosted

household spending. Gross domestic product advanced 1.7 percent

after expanding 1.6 percent in the previous year, Destatis said

Thursday. This was the fastest growth since 2011, when GDP climbed

3.7 percent.

Germany's wholesale prices continued to fall in December but the

pace of decline slowed further, Destatis reported Thursday.

Wholesale prices decreased 1 percent year-on-year in December,

slower than the 1.1 percent drop seen in November. Nonetheless, the

index has been falling since July 2013.

The Bank of England maintained its record low interest rate and

quantitative easing unchanged as expected, on Thursday.

Policymakers observed that downside risks to global growth and

the recent decline in oil prices could depress the near-term

inflation outlook.

The Monetary Policy Committee, governed by Mark Carney, voted

8-1 to keep the interest rate unchanged at 0.50 percent. The rate

has been at the current record low level since early 2009.

The MPC voted unanimously to retain the asset purchase plan at

GBP 375 billion.

Ian McCafferty has been the sole dissenter since August, seeking

a 25 basis points rate hike, suggesting that the majority of

policymakers are in no hurry to tighten monetary policy.

The buck reached a high of $1.4359 against the pound sterling

Thursday, but has since eased back to around $1.4410.

The greenback has climbed to around Y118.175 against the

Japanese Yen this afternoon, from around Y117.400 this morning.

Core machine orders in Japan plummeted 14.4 percent on month in

November, the Cabinet Office said on Thursday, worth 773.8 billion

yen. The headline figure missed forecasts for a decline of 7.3

percent following the 10.7 percent increase in October.

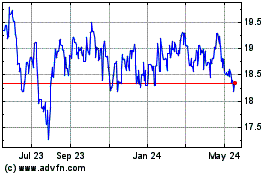

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Oct 2024 to Nov 2024

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Nov 2023 to Nov 2024