Rezolve, a leader in mobile commerce and engagement, and Grupo

Carso, today announced a strategic partnership that will see

Rezolve’s technology integrated into Claro Shop and T1 Comercios,

one of Mexico’s largest online marketplaces, and is expected to

transform the mobile shopping experience for millions of consumers.

Claro Shop is a leader in Mexico’s fast-growing ecommerce sector

featuring more than 2,000,000 products in thousands of official

stores. The company works with more than 10,000 well-known brands,

including global leaders like Levi’s, Puma, Apple, Samsung, and

Nike. Claro Shop reported over 10 million mobile users in 2019. T1

Comercios, owned by Claro Shop, is part of Grupo Carso, which

consists of 268 companies.

Rezolve, an enterprise SaaS platform designed from the ground up

specifically for mobile commerce and engagement, is positioned to

become an engine of mobile engagement that enables the

transformation of interactions between consumers and merchants on

mobile devices. Using the Rezolve platform, merchants can lead

consumers directly to special offers by using mobile technology

like geofencing, notifications on smartphones, Bluetooth beacons,

or watermarked advertisements.

With ‘Rezolve Inside’ powering the Claro Shop App, users will

benefit from a truly omnichannel experience, interacting with

stores based on location, image, audio, social media and more,

allowing users to make an instant purchase with a single click. In

addition, merchants will be able to engage with consumers wherever

they are bringing Claro Shop into the physical world with online to

offline and offline to online engagement.

“We are delighted to announce this agreement with Claro Shop and

Grupo Carso,” said Dan Wagner, Rezolve’s Chairman and CEO. “Claro

Shop will be the first to offer Rezolve’s leading mobile commerce

and engagement platform in Mexico. Rezolve has enjoyed a strong

growth in Asia, and now with this strategic partnership we will be

able to grow our presence in Mexico as well.”

Rezolve currently has go-to-market partner agreements with

leading global players that have a combined global reach of over 20

million merchants and over 1 billion consumers across China, Asia,

Europe, North America, and now Central America as well. Rezolve’s

platform already serves over 230,000 of those merchants today.

About RezolveRezolve is taking retailing into a

new era of customer engagement with a proprietary mobile engagement

platform. The Rezolve Platform is a powerful set of mobile commerce

and engagement capabilities that provide mobile application vendors

with a range of valuable commercial opportunities that can be

realized without having to develop code, host operations or manage

security. The Rezolve Inside SDK allows mobile application vendors

to quickly deliver innovation for their consumers into existing or

new mobile apps. Rezolve was founded in 2016, is headquartered in

London, UK and has offices including: Shanghai, New Delhi, Taipei,

Frankfurt, Madrid and New Mexico. (www.rezolve.com).

About Grupo Carso Grupo Carso is one of

the largest and most important diversified conglomerates in Latin

America and is controlled by the family of Carlos Slim. The Group

has an important presence in the Mexican economy, where it remains

one of the market leaders thanks to an exceptional portfolio of

formats, products and services.Since its foundation 41 years ago,

Grupo Carso has been characterized by its dynamism, its innovation

in processes and technologies, and the sustainable management of

resources. Within the sectors that constitute it, operating

synergies have been achieved, profitability and constant cash flows

have been generated, which has meant a history of creating

long-term value for shareholders.

About Armada Acquisition Corp. IArmada

Acquisition Corp. I is a blank check company whose business purpose

is to effect a merger, capital stock exchange, asset acquisition,

stock purchase, reorganization or similar business combination with

one or more businesses. Armada was founded on November 5, 2020 and

is headquartered in Philadelphia, PA.

Important Information About the Proposed Transaction

with Armada Acquisition Corp. I and Where to Find

It On December 17, 2021, Rezolve Limited, a private

limited liability company registered under the laws of England and

Wales (“Rezolve”), entered into a business combination agreement,

dated as of December 17, 2021, with Armada Acquisition Corp. I, a

Delaware corporation (“Armada”), Rezolve Group Limited, a Cayman

Islands exempted company (“Cayman NewCo”), and Rezolve Merger Sub,

Inc., a Delaware corporation (“Rezolve Merger Sub”), which was

amended on November 10, 2022 by that certain First Amendment to the

Business Combination Agreement whereby Cayman Newco is no longer a

party to the business combination agreement or the business

combination.

This communication relates to the proposed business combination

transaction among Armada, Rezolve, and Rezolve Merger Sub, Inc. A

full description of the terms of the transaction will be provided

in a registration statement on Form F-4 that Rezolve intends to

file with the SEC that will include a prospectus of Rezolve with

respect to the securities to be issued in connection with the

proposed business combination and a proxy statement of Armada with

respect to the solicitation proxies for the special meeting of

stockholders of Armada to vote on the proposed business

combination. Armada urges its investors, stockholders and other

interested persons to read, when available, the preliminary proxy

statement/ prospectus as well as other documents filed with the SEC

because these documents will contain important information about

Armada, Rezolve, Rezolve Merger Sub and the transaction. After the

registration statement is declared effective, the definitive proxy

statement/prospectus to be included in the registration statement

will be mailed to shareholders of Armada as of a record date to be

established for voting on the proposed business combination. Once

available, shareholders will also be able to obtain a copy of the

Registration Statement on Form F-4, including the proxy

statement/prospectus included therein, and other documents filed

with the SEC without charge, by directing a request to: Armada

Acquisition Corp. I, 1760 Market Street, Suite 612, Philadelphia,

PA 19103 USA; (215) 543-6886. The preliminary and definitive proxy

statement/prospectus to be included in the registration statement,

once available, can also be obtained, without charge, at the SEC’s

website (www.sec.gov). This communication does not contain all the

information that should be considered concerning the proposed

business combination and is not intended to form the basis of any

investment decision or any other decision in respect of the

business combination. Before making any voting or investment

decision, investors and security holders are urged to read the

registration statement, the proxy statement/prospectus and all

other relevant documents filed or that will be filed with the SEC

in connection with the proposed business combination as they become

available because they will contain important information about the

proposed transaction.

Forward-Looking Statements

This communication contains forward-looking statements that are

based on beliefs and assumptions and on information currently

available. In some cases, you can identify forward-looking

statements by the following words: “may,” “will,” “could,” “would,”

“should,” “expect,” “intend,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “project,” “potential,” “continue,”

“ongoing” or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain

these words. These statements involve risks, uncertainties and

other factors that may cause actual results, levels of activity,

performance or achievements to be materially different from the

information expressed or implied by these forward-looking

statements. We caution you that these statements are based on a

combination of facts and factors currently known by us and our

projections of the future, which are subject to a number of risks.

Forward-looking statements in this communication include, but are

not limited to, statements regarding the proposed Business

Combination, including the structure of the transaction, statements

regarding the expectations of the strategic partnership between

Rezolve and Grupo Caruso transforming the mobile shopping

experience, as well as statements regarding Rezolve’s platform

transforming interactions between consumers and merchants on mobile

devices, leading consumers directly to special offers and the

benefits of the Rezolve technology to consumers and merchants.

These forward looking statements are subject to a number of risks

and uncertainties, including, among others, those risks to be

included under the header “Risk Factors” in the registration

statement on Form F-4 to be filed by Rezolve with the SEC and those

risks included under the header “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in the final prospectus of

Armada related to its initial public offering filed with the U.S.

Securities and Exchange Commission on August 16, 2021. Furthermore,

if the forward-looking statements prove to be inaccurate, the

inaccuracy may be material. In addition, you are cautioned that

past performance may not be indicative of future results. In light

of the significant uncertainties in these forward-looking

statements, you should not rely on these statements in making an

investment decision or regard these statements as a representation

or warranty by us or any other person that we will achieve our

objectives and plans in any specified time frame, or at all. The

forward-looking statements in this communication represent our

views as of the date of this communication. We anticipate that

subsequent events and developments will cause our views to change.

We have no intention to update the forward-looking statements

herein, except to the extent required by applicable law. You

should, therefore, not rely on these forward-looking statements as

representing our views as of any date subsequent to the date of

this communication.

No Offer or Solicitation

This communication is for informational purposes only and does

not constitute an offer or for a solicitation of an offer to buy or

sell securities, assets or the business described herein or a

commitment to Armada or Rezolve, nor is it a solicitation of any

vote, consent or approval in any jurisdiction pursuant to or in

connection with the proposed business combination or otherwise, nor

shall there be any offer, sale, issuance or transfer of securities

in any jurisdiction in contravention of applicable law.

Participants in SolicitationArmada, Rezolve,

and Rezolve Merger Sub and their respective directors and executive

officers, may be deemed participants in the solicitation of proxies

of Armada’s stockholders in respect of the proposed business

combination. Information about the directors and executive officers

of Armada is set forth in Armada’s proxy statement on Schedule 14A

for its 2023 Annual Meeting of Stockholders, which was filed with

the SEC on January 5, 2023 and is available free of charge at the

SEC’s web site at www.sec.gov. Information about the directors and

executive officers of Rezolve Rezolve Merger Sub and more detailed

information regarding the identity of all potential participants,

and their direct and indirect interests by security holdings or

otherwise, will be set forth in the definitive proxy

statement/prospectus for the proposed business combination when

available. Additional information regarding the identity of all

potential participants in the solicitation of proxies to Armada’s

stockholders in connection with the proposed business combination

and other matters to be voted upon at the special meeting, and

their direct and indirect interests, by security holdings or

otherwise, will be included in the definitive proxy

statement/prospectus, when it becomes available.

ContactsFor Rezolve:Investor Contact:Kevin

HuntRezolveIR@icrinc.com

Media Contact:Urmee Khanurmeekhan@rezolve.com44-7576-094-040

Media Contact:Edmond LococoICR Inc.RezolvePR@icrinc.com

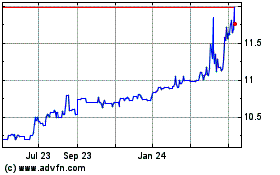

Armada Acquisition Corpo... (NASDAQ:AACI)

Historical Stock Chart

From Feb 2025 to Mar 2025

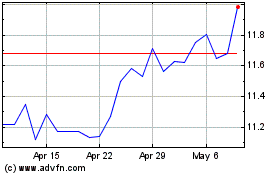

Armada Acquisition Corpo... (NASDAQ:AACI)

Historical Stock Chart

From Mar 2024 to Mar 2025