Abcam plc (Nasdaq: ABCM) (‘Abcam’, the ‘Group’ or the

‘Company’), a global leader in the supply of life science research

tools, today announces its interim results for the six-month period

ended 30 June 2023 (the ‘period’).

FINANCIAL PERFORMANCE

Six months ended

£m, unless stated otherwise

30 June 2023

30 June 2022

Revenue

203.2

185.2

Reported gross profit margin, %

76.2%

74.1%

Adjusted gross profit margin*, %

76.2%

75.6%

Reported operating profit

27.9

9.3

Adjusted operating profit**

54.8

42.6

Adjusted operating profit, %

27.0%

23.0%

Reported diluted earnings per share

7.2p

2.5p

Adjusted diluted earnings per share

16.8p

14.0p

* Excludes the amortisation of the fair value of assets relating

to the inventory acquired in connection with the acquisition of

BioVision at June 30, 2022. ** Adjusted figures exclude system and

process improvement costs, amortisation of fair value adjustments,

strategic review costs, EGM costs, integration and reorganisation

costs, amortisation of acquisition intangible assets and

share-based payments. Such excluded items are described as

“adjusting items”. Further information on these items is shown

below.

Commenting on the performance, Alan Hirzel, Abcam’s Chief

Executive Officer, said: “In the first half of 2023, we

remained focused on supporting our global customers and meeting our

business and corporate objectives. Our strategy has transformed

Abcam to become a scale innovator and important catalyst in the

global life science community.

The proposed acquisition by Danaher demonstrates external

validation of our brand, business model, product quality, and

market platform, while providing certain and significant value for

our shareholders. Danaher’s operating company model allows us to

continue to pursue our strategy, while harnessing the power of the

Danaher Business System to ensure we remain the partner of choice

for our customers.”

FY20231 & FY2024 OUTLOOK Due to the pending

acquisition, financial guidance has been suspended.

Analyst and investor meeting and webcast: Due to the

pending acquisition, the conference call and webcast have been

cancelled.

About Abcam plc As an innovator in reagents and tools,

Abcam's purpose is to serve life science researchers globally to

achieve their mission faster. Providing the research and clinical

communities with tools and scientific support, the Company offers

highly validated antibodies, assays, and other research tools to

address important targets in critical biological pathways.

Already a pioneer in data sharing and ecommerce in the life

sciences, Abcam's ambition is to be the most influential company in

life sciences by helping advance global understanding of biology

and causes of disease, which, in turn, will drive new treatments

and improved health.

Abcam's worldwide customer base of approximately 750,000 life

science researchers’ uses Abcam's antibodies, reagents, biomarkers,

and assays. By actively listening to and collaborating with these

researchers, the Company continuously advances its portfolio to

address their needs. A transparent program of customer reviews and

datasheets, combined with industry-leading validation initiatives,

gives researchers increased confidence in their results.

Founded in 1998 and headquartered in Cambridge, UK, the Company

has served customers in more than 130 countries. Abcam's American

Depositary Shares (ADSs) trade on the Nasdaq Global Select Market

(Nasdaq: ABCM).

____________________ 1 FY23 USD budgeted rate GBP:USD 1.20; H1

2023 average USD reported rates GBP:USD 1.23 (H1 2022, GBP:USD

1.31); July-August 2023 average USD reported rates GBP:USD 1.28 (H2

2022 GBP: USD 1.17).

Forward-Looking Statements This announcement contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by the following words: “may,”

“might,” “will,” “could,” “would,” “should,” “expect,” “plan,”

“anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,”

“potential,” “continue,” “contemplate,” “possible” or the negative

of these terms or other comparable terminology, although not all

forward-looking statements contain these words. They are not

historical facts, nor are they guarantees of future performance.

Any express or implied statements contained in this press release

that are not statements of historical fact may be deemed to be

forward-looking statements, including, without limitation,

statements regarding: Abcam's portfolio, ambitions, market

opportunities, and Danaher’s and Abcam’s ability to complete the

transaction on the proposed terms or on the anticipated timeline,

or at all are neither promises nor guarantees, but involve known

and unknown risks and uncertainties that could cause actual results

to differ materially from those projected, including, without

limitation: risks and uncertainties related to securing the

necessary regulatory approvals and Abcam shareholder approval, the

sanction of the High Court of Justice of England and Wales and

satisfaction of other closing conditions to consummate the

transaction; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

definitive transaction agreement relating to the transaction; risks

related to diverting the attention of Danaher’s and Abcam’s

management from ongoing business operations; failure to realize the

expected benefits of the transaction; significant transaction costs

and/or unknown or inestimable liabilities; the risk of shareholder

litigation in connection with the transaction, including resulting

expense or delay; the risk that Abcam’s business will not be

integrated successfully if applicable or that such integration if

applicable may be more difficult, time-consuming or costly than

expected; Danaher’s ability to fund the cash consideration for the

transaction; risks related to future opportunities and plans for

the combined company, including the uncertainty of expected future

regulatory filings, financial performance and results of the

combined company following completion of the acquisition;

disruption from the transaction, making it more difficult to

conduct business as usual or maintain relationships with customers,

employees or suppliers; effects relating to the announcement of the

transaction or any further announcements or the consummation of the

acquisition on the market price of Abcam’s American depositary

shares; regulatory initiatives and changes in tax laws; market

volatility; other risks and uncertainties affecting Danaher and

Abcam; and as a foreign private issuer, we are exempt from a number

of rules under the U.S. securities laws and Nasdaq corporate

governance rules and are permitted to file less information with

the SEC than U.S. companies, which may limit the information

available to holders of our American Depositary Shares (“ADS”); and

the other important factors discussed from time to time under the

caption "Risk Factors" in Abcam's Annual Report on Form 20-F for

the year ended December 31, 2022 (“Annual Report”) and in any

subsequent reports on Form 6-K, each of which is on file with or

furnished to the U.S. Securities and Exchange Commission ("SEC")

and which are available on the SEC website at www.sec.gov, as such

factors may be updated from time to time in Abcam's subsequent

filings or furnishings with the SEC. Any forward-looking statements

contained in this announcement speak only as of the date hereof and

accordingly undue reliance should not be placed on such statements.

Abcam disclaims any obligation or undertaking to update or revise

any forward-looking statements contained in this announcement,

whether as a result of new information, future events or otherwise,

other than to the extent required by applicable law.

Use of Non-IFRS Financial Measures To supplement our

audited financial results prepared in accordance with International

Financial Reporting Standards (“IFRS”) we present Adjusted

Operating Profit, Adjusted Operating Profit Margin, Adjusted EBITDA

Margin, Total Constant Exchange Rate Revenue (“CER revenue”), which

are financial measures not prepared in accordance with IFRS

(“non-IFRS financial measures”). We believe that the presentation

of these non-IFRS financial measures provide useful information

about our operating results and enhances the overall understanding

of our past financial performance and future prospects, allowing

for greater transparency with respect to key measures used by

management in its financial and operational decision making. These

non-IFRS financial measures are supplemental in nature as they

include and/or exclude certain items not included and/or excluded

in the most directly comparable IFRS financial measures and should

not be considered in isolation, or as a substitute for, financial

measures prepared in accordance with IFRS. Further, other companies

may calculate these non-IFRS financial measures differently than we

do, which may limit the usefulness of those measures for

comparative purposes.

Management believes that the presentation of (a) Adjusted

Operating Profit, Adjusted Operating Profit Margin, Adjusted EBITDA

Margin, and Adjusted Diluted Earnings Per Share provide useful

information to investors and others as management regularly reviews

these measures as important indicators of our operating performance

and makes decisions based on them, and (b) CER revenue provides

useful information to investors and others as management regularly

reviews this measure to identify period-on-period or year-on-year

performance of the business and makes decisions based on it.

Please see the following “Non-IFRS Financial Measures” for a

qualitative reconciliation of non-IFRS financial measures presented

in this Trading Update to their most directly comparable IFRS

financial measures. We define:

- Adjusted Gross Profit as gross

profit before taking account exceptional items.

- Adjusted Operating Profit as

profit for the period / year before taking account of finance

income, finance costs, tax, exceptional items, share-based

payments, and amortization of acquisition intangibles. Exceptional

items consist of certain cash and non-cash items that we believe

are not reflective of the normal course of our business; and we

identify and determine items to be exceptional based on their

nature and incidence or by or by their significance (“exceptional

items”). As a result, the composition of exceptional items may vary

from period to period / year to year.

- Adjusted Operating Profit Margin

as adjusted operating profit calculated as a percentage of

revenue.

- Adjusted EBITDA Margin as adjusted

operating profit before depreciation as a percentage of

revenue.

- Adjusted Diluted Earnings Per

Share as adjusted operating profit less net financing

expenses and effective tax payments divided by fully diluted shares

outstanding.

- CER as our total revenue growth

from one fiscal period / year to the next on a constant exchange

rate basis.

Quantitative reconciliations of Adjusted Gross Profit, Adjusted

Operating Profit, Adjusted Operating Profit Margin, Adjusted EBITDA

Margin, Adjusted Diluted Earnings Per Share and CER revenue to

their respective most directly comparable IFRS financial measures

of Operating Profit, Operating Profit Margin, Net Income, Reported

Revenue and Diluted Earnings Per Share, can be found under the

heading “Adjusted Performance Measures”.

Interim management report

Introduction In the

half-year period ended 30 June 2023, revenues of £203.2 million

grew 5.5% CER and 9.7% on a reported basis. Adjusted operating

profits increased 29% to £54.8 million (H1 2022: £42.6 million) and

adjusted diluted earnings per share grew 20% to 16.8p (H1 2022:

14.0p).

The Company has cash of £79.0 million and net debt of £38.7

million (£300 million RCF less £120.0 million borrowed).

Financial review

Six months ended 30

June

Reported revenues

Change in

reported

revenues

%

CER growth

%

2023

£m

2022

£m

Catalogue revenue – regional

split

Americas

85.8

74.6

15%

8%

EMEA

52.4

46.0

14%

10%

China

31.7

30.3

5%

5%

Japan

8.3

10.0

(17%)

(14%)

Rest of Asia Pacific

14.6

13.7

7%

1%

Catalogue revenue

192.8

174.6

10%

6%

CP&L revenue1

10.4

10.6

(2%)

(8%)

Total reported revenue

203.2

185.2

10%

6%

Total revenue – product type

In-house

138.5

123.6

12%

8%

Third party

64.7

61.6

5%

1%

Total reported revenue

203.2

185.2

10%

6%

- Custom Products & Licensing (CP&L) revenue comprises

custom service revenue, revenue from the supply of IVD products and

royalty and licence income.

REVENUE Revenue of £203.2 million (H1 2022: £185.2m)

represents 5.5% CER growth.

GROSS MARGIN Reported and adjusted gross profit of £154.9

million (H1 2022: £137.3m) equates to a reported gross margin of

76.2% (H1 2022: 74.1%). Adjusted gross profit in the prior

comparable period differs from reported gross profit by £2.7

million impacted by the amortisation of the fair value of assets

relating to the inventory acquired in the acquisition of

BioVision.

OPERATING COSTS

Six months ended 30

June

Reported

Adjusted

2023

£m

2022

£m

2023

£m

2022

£m

Selling, general & administrative

expenses (‘SG&A’)

107.4

108.9

90.3

87.3

Research & development expenses

(‘R&D’)

19.6

19.1

9.8

10.1

Total operating costs and

expenses

127.0

128.0

100.1

97.4

Adjusted operating costs of £100.1 million (H1 2022: £97.4m)

represents approximately 2% growth excluding depreciation.

On a reported basis, total reported costs were £127.0 million

(H1 2022: £128.0m), a decrease of £1.0 million.

ADJUSTING ITEMS Total reported expenses include the

following adjusting items:

- £11.3 million from acquisition, integration, and reorganisation

charges (H1 2022: £6.0m)

- £7.9 million relating to the amortisation of acquired

intangibles (H1 2022: £8.9m)

- £7.7 million in charges for share-based payments (H1 2022:

£13.0m)

Costs relating to the Oracle Cloud ERP project of £2.6 million

were incurred in the prior period adjusting items.

Further details on adjusting items and a reconciliation between

reported and adjusted profit measures are provided below.

NET PROFIT Adjusted net profit was £39.1 million (H1

2022: £32.2m). Reported net profit was £16.8 million (H1 2022:

£5.8m).

CASH Cash of £79.0 million (period ended 31 December

2022: £89.0m).

On 7 March 2023, the Group replaced its existing Revolving

Credit Facility (‘RCF’) with a new four-year RCF for an amount of

£300 million. Outstanding borrowings net of fees was £117.7

million. We ended the period with net debt of £38.7 million.

ADJUSTED PERFORMANCE MEASURES Adjusted performance

measures are used by the Directors and management to monitor

business performance internally and exclude certain cash and

non-cash items which they believe are not reflective of the normal

day-to-day operating activities of the Group. The Directors believe

that disclosing such non-IFRS measures enables a reader to isolate

and evaluate the impact of such items on results and allows for a

fuller understanding of performance from period to period. Adjusted

performance measures may not be directly comparable with other

similarly titled measures used by other companies. A detailed

reconciliation between reported and adjusted measures is presented

below.

The following table presents reconciliation of profit for the

period, the most directly comparable IFRS measure, to adjusted

operating profit and includes the calculation of the adjusted

operating profit margin for the periods indicated:

Six months ended

30 June 2023

(unaudited)

£m

Six months ended

30 June 2022

(unaudited)

£m

Profit for the period

16.8

5.8

Tax charge

6.6

1.6

Finance income

(0.7)

(0.1)

Finance costs

5.2

2.0

Amortisation of fair value adjustments

(i)

—

2.7

System and process improvement costs

(ii)

—

2.6

Integration and reorganisation costs

(iii)

9.1

6.0

EGM costs

(iv)

2.0

—

Strategic review costs

(v)

0.2

—

Amortisation of acquisition

intangibles

(vi)

7.9

9.0

Share-base payment charges

(vii)

7.7

13.0

Adjusted operating profit

54.8

42.6

Revenue

203.2

185.2

Adjusted operating profit margin

27.0%

23.0%

The following table represents a reconciliation of profit for

the period, the most directly comparable IFRS financial measure, to

adjusted profit for the periods indicated, which is used in the

calculation of adjusted diluted earnings per share:

Six months ended

30 June 2023

(unaudited)

£m

Six months ended

30 June 2022

(unaudited)

£m

Profit for the period

16.8

5.8

Weighted average ordinary shares for the

purpose of diluted earnings per share

232.7

230.6

Diluted earnings per share

7.2p

2.5p

Profit for the period

16.8

5.8

Amortisation of fair value adjustments

(i)

—

2.7

System and process improvement costs

(ii)

—

2.6

Integration and reorganisation costs

(iii)

9.1

6.0

EGM costs

(iv)

2.0

—

Strategic review costs

(v)

0.2

—

Amortisation of acquisition

intangibles

(vi)

7.9

9.0

Share-base payment charges

(vii)

7.7

13.0

Tax effects of items (i) to (vii)

(4.6)

(6.9)

Adjusted profit for the period

39.1

32.2

Weighted average ordinary shares for the

purpose of diluted earnings per share

232.7

230.6

Adjusted diluted earnings per share

16.8p

14.0p

(i)

Six months ended 30 June 2023: no

such costs incurred. Six months ended 30 June 2022: comprises

amortisation of fair value adjustments relating to the acquisition

of BioVision. Following the acquisition, the Group recognised a

fair value uplift of £6.0m to inventory carried on the Group's

balance sheet. This adjustment was amortised over 4 months from

November 2021 and is now fully amortised. Such costs are included

within cost of sales.

(ii)

Six months ended 30 June 2023: no

such costs incurred. Six months ended 30 June 2022: comprises costs

of the strategic ERP implementation which do not qualify for

capitalisation. Such costs are included within selling, general and

administrative expenses.

(iii)

Six months ended 30 June 2023:

integration and reorganisation costs relate primarily to

incremental costs associated with the cost refinement actions

announced in May 2023, which includes the consolidation of our

global footprint, streamlining organisational structures and

eliminating redundant processes. Further costs included here are

those associated with the finalisation of the integration of

BioVision. These costs are included in selling, general and

administrative expenses (£8.0m) and research and development

expenses (£1.1m). Six months ended 30 June 2022: integration and

reorganisation costs relate primarily to the integration of

BioVision (comprising mainly retention and severance costs,

employee backfill costs for those involved in the integration,

settlement costs and professional fees) and footprint costs. Such

costs are included within selling, general and administrative

expenses.

(iv)

Six months ended 30 June 2023:

professional fees associated with the calling of an extraordinary

general meeting ('EGM') for July 2023. These costs are included in

selling, general and administrative expenses. Six months ended 30

June 2022: no such costs incurred.

(v)

Six months ended 30 June 2023:

professional fees associated with the ongoing strategic review

initiated in June 2023. These costs are included in selling,

general and administrative expenses. Six months ended 30 June 2022:

no such costs incurred.

(vi)

For the six-month period ended 30

June 2023, £7.2m (30 June 2022: £7.6m) of amortisation of

acquisition intangibles is included in research and development

expenses, with the remaining £0.7m (30 June 2022: £1.4m) included

in selling, general and administrative expenses.

(vii)

Comprises share-based payment

charges and employer’s tax contributions thereon for all the

Group’s equity- and cash-settled schemes. Charges of £1.5m (30 June

2022: £1.4m) are included in research and development expenses,

with the remaining £6.2m (30 June 2022: £11.6m) included within

selling, general and administrative expenses.

Looking forward On 28 August 2023, Abcam announced that

it has entered into a definitive agreement pursuant to which

Danaher Corporation to acquire all of the outstanding shares for

$24.00 per share in cash.

Alan Hirzel Chief Executive Officer

Michael S Baldock Chief Financial Officer

31 August 2023

Forward-Looking Statements This announcement contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by the following words: “may,”

“might,” “will,” “could,” “would,” “should,” “expect,” “plan,”

“anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,”

“potential,” “continue,” “contemplate,” “possible” or the negative

of these terms or other comparable terminology, although not all

forward-looking statements contain these words. They are not

historical facts, nor are they guarantees of future performance.

Any express or implied statements contained in this press release

that are not statements of historical fact may be deemed to be

forward-looking statements, including, without limitation,

statements regarding: Abcam's portfolio, ambitions, market

opportunities, and Danaher’s and Abcam’s ability to complete the

transaction on the proposed terms or on the anticipated timeline,

or at all are neither promises nor guarantees, but involve known

and unknown risks and uncertainties that could cause actual results

to differ materially from those projected, including, without

limitation: risks and uncertainties related to securing the

necessary regulatory approvals and Abcam shareholder approval, the

sanction of the High Court of Justice of England and Wales and

satisfaction of other closing conditions to consummate the

transaction; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

definitive transaction agreement relating to the transaction; risks

related to diverting the attention of Danaher’s and Abcam’s

management from ongoing business operations; failure to realize the

expected benefits of the transaction; significant transaction costs

and/or unknown or inestimable liabilities; the risk of shareholder

litigation in connection with the transaction, including resulting

expense or delay; the risk that Abcam’s business will not be

integrated successfully if applicable or that such integration if

applicable may be more difficult, time-consuming or costly than

expected; Danaher’s ability to fund the cash consideration for the

transaction; risks related to future opportunities and plans for

the combined company, including the uncertainty of expected future

regulatory filings, financial performance and results of the

combined company following completion of the acquisition;

disruption from the transaction, making it more difficult to

conduct business as usual or maintain relationships with customers,

employees or suppliers; effects relating to the announcement of the

transaction or any further announcements or the consummation of the

acquisition on the market price of Abcam’s American depositary

shares; regulatory initiatives and changes in tax laws; market

volatility; other risks and uncertainties affecting Danaher and

Abcam; and as a foreign private issuer, we are exempt from a number

of rules under the U.S. securities laws and Nasdaq corporate

governance rules and are permitted to file less information with

the SEC than U.S. companies, which may limit the information

available to holders of our American Depositary Shares (“ADS”); and

the other important factors discussed from time to time under the

caption "Risk Factors" in Abcam's Annual Report on Form 20-F for

the year ended December 31, 2022 (“Annual Report”) and in any

subsequent reports on Form 6-K, each of which is on file with or

furnished to the U.S. Securities and Exchange Commission ("SEC")

and which are available on the SEC website at www.sec.gov, as such

factors may be updated from time to time in Abcam's subsequent

filings or furnishings with the SEC. Any forward-looking statements

contained in this announcement speak only as of the date hereof and

accordingly undue reliance should not be placed on such statements.

Abcam disclaims any obligation or undertaking to update or revise

any forward-looking statements contained in this announcement,

whether as a result of new information, future events or otherwise,

other than to the extent required by applicable law.

Responsibility statement

We confirm to the best of our knowledge:

- the interim financial statements have been prepared in

accordance with IAS 34

At the date of this statement, the Directors are those listed in

the Annual Report and Accounts 2022 and there were no further

changes.

By order of the Board

Alan Hirzel Chief Executive Officer

Michael S Baldock Chief Financial Officer

31 August 2023

Condensed consolidated income

statement

For the six month period ended 30 June

2023

Note

Six months

ended

30 June 2023

(unaudited)

£m

Six months

ended

30 June 2022

(unaudited)

£m

Revenue

203.2

185.2

Cost of Sales

(48.3)

(47.9)

Gross profit

154.9

137.3

Selling, general and administrative

expenses

(107.4)

(108.9)

Research and development expenses

(19.6)

(19.1)

Operating profit

27.9

9.3

Finance income

0.7

0.1

Finance costs

(5.2)

(2.0)

Profit before tax

23.4

7.4

Tax

4

(6.6)

(1.6)

Profit for the period attributable to

equity shareholders of the parent

16.8

5.8

Earnings per share

Basic earnings per share

5

7.3p

2.5p

Diluted earnings per share

5

7.2p

2.5p

Condensed consolidated statement of

comprehensive income

For the six month period ended 30 June

2023

Six months

ended

30 June 2023

(unaudited)

£m

Six months

ended

30 June 2022

(unaudited)

£m

Profit for the period attributable to

equity shareholders of the parent

16.8

5.8

Items that may be reclassified to the

income statement in subsequent periods

Movement on cash flow hedges

1.2

(0.7)

Exchange differences on translation of

foreign operations

(34.5)

56.5

Tax relating to these items

(0.3)

0.1

Items that will not be reclassified to

the income statement in subsequent periods

Movement in fair value of investments

0.3

(0.3)

Tax relating to these items

—

0.1

Other comprehensive (expense) / income

for the period

(33.3)

55.7

Total comprehensive (expense) / income

for the period

(16.5)

61.5

Condensed consolidated balance sheet

As at 30 June 2023

Note

As at

30 June

2023

(unaudited)

£m

As at

31 December

2022

(audited)

£m

Non-current assets

Goodwill

379.6

398.3

Intangible assets

219.4

227.9

Property, plant and equipment

81.5

80.5

Right-of-use assets

76.0

79.2

Investments

7

3.5

3.2

Deferred tax asset

11.3

12.1

771.3

801.2

Current assets

Inventories

66.3

68.0

Trade and other receivables

92.3

84.0

Current tax receivable

16.3

13.9

Derivative financial instruments

7

1.9

0.5

Cash and cash equivalents

79.0

89.0

255.8

255.4

Total assets

1,027.1

1,056.6

Current liabilities

Trade and other payables

(61.4)

(67.8)

Derivative financial instruments

7

—

(0.8)

Lease liabilities

(9.8)

(8.5)

Borrowings

(117.7)

(119.6)

Current tax liabilities

—

(5.1)

(188.9)

(201.8)

Net current assets

66.9

53.6

Non-current liabilities

Deferred tax liability

(29.5)

(32.1)

Lease liabilities

(89.5)

(95.8)

(119.0)

(127.9)

Total liabilities

(307.9)

(329.7)

Net assets

719.2

726.9

Equity

Share capital

0.5

0.5

Share premium account

269.4

269.4

Merger reserve

68.6

68.6

Own shares

(1.7)

(1.9)

Translation reserve

55.2

89.7

Hedging reserve

0.8

(0.1)

Retained earnings

326.4

300.7

Total equity attributable to the equity

shareholders of the parent

719.2

726.9

Approved by the Board of directors and authorised for issue on

31 August 2023.

Condensed consolidated statement of

changes in equity

For the six month period ended 30 June

2023 (unaudited)

Share

capital

£m

Share

premium

account

£m

Merger

reserve

£m

Own

shares

£m

Translation

Reserve

£m

Hedging

reserve

£m

Retained

earnings

£m

Total equity

£m

Balance as at 1 January 2023

0.5

269.4

68.6

(1.9)

89.7

(0.1)

300.7

726.9

Profit for the period

—

—

—

—

—

—

16.8

16.8

Other comprehensive (loss) / income

—

—

—

—

(34.5)

0.9

0.3

(33.3)

Total comprehensive (loss) / income for

the period

—

—

—

—

(34.5)

0.9

17.1

(16.5)

Own shares disposed of on exercise of

share options

—

—

—

0.2

—

—

0.2

0.4

Share-based payments inclusive of deferred

tax

—

—

—

—

—

—

8.4

8.4

Balance as at 30 June 2023

0.5

269.4

68.6

(1.7)

55.2

0.8

326.4

719.2

For the six month period ended 30 June

2022 (unaudited)

Share

capital

£m

Share

premium

account

£m

Merger

reserve

£m

Own

shares

£m

Translation

reserve

£m

Hedging

reserve

£m

Retained

earnings

£m

Total

£m

Balance as at 1 January 2022

0.5

268.3

68.6

(2.2)

31.1

0.2

289.6

656.1

Profit for the period

—

—

—

—

—

—

5.8

5.8

Other comprehensive income / (loss)

—

—

—

—

56.5

(0.6)

(0.2)

55.7

Total comprehensive income / (loss) for

the period

—

—

—

—

56.5

(0.6)

5.6

61.5

Issue of ordinary shares, net of share

issue costs

—

0.6

—

—

—

—

—

0.6

Own shares disposed of on exercise of

share options

—

—

—

0.2

—

—

(0.2)

—

Share-based payments inclusive of deferred

tax

—

—

—

—

—

—

9.6

9.6

Purchase of own shares

—

—

—

—

—

—

(0.2)

(0.2)

Balance as at 30 June 2022

0.5

268.9

68.6

(2.0)

87.6

(0.4)

304.4

727.6

Condensed consolidated cash flow

statement

For the six month period ended 30 June

2023

Note

Six months

ended

30 June 2023

(unaudited)

£m

Six months

ended

30 June 2022

(unaudited)

£m

Cash generated from operations

6

37.4

33.3

Net income taxes paid

(10.1)

(3.5)

Net cash inflow from operating

activities

27.3

29.8

Investing activities

Interest income

0.7

0.1

Purchase of property, plant and

equipment

(9.7)

(4.5)

Purchase of intangible assets

(12.0)

(11.0)

Transfer of cash from escrow in respect of

future capital expenditure

—

0.3

Net cash inflow arising from

acquisitions

—

1.2

Net cash outflow from investing

activities

(21.0)

(13.9)

Financing activities

Principal element of lease obligations

(5.4)

(5.7)

Interest element of lease obligations

(1.2)

(0.9)

Interest paid

(2.9)

(1.1)

Proceeds on issue of shares, net of issue

costs

0.4

0.6

Facility arrangement fees

9

(2.6)

—

Utilisation of revolving credit

facility

9

120.0

—

Repayment of revolving credit facility

9

(120.0)

—

Purchase of own shares

(0.1)

(0.2)

Net cash outflow from financing

activities

(11.8)

(7.3)

Net (decrease) / increase cash and cash

equivalents

(5.5)

8.6

Cash and cash equivalents at beginning of

period

89.0

95.1

Effect of foreign exchange rates

(4.5)

5.9

Cash and cash equivalents at end of

period

79.0

109.6

Free cash flow

(i)

(1.0)

8.0

(i)

Free cash flow comprises net cash

generated from operating activities less net capital expenditure,

and the principal and interest elements of lease obligations.

Notes to the condensed consolidated interim financial

statements

For the six month period ended 30 June 2023

1. General information The condensed consolidated interim

financial statements for the six month period ended 30 June 2023

are unaudited and do not comprise statutory accounts within the

meaning of section 434 of the Companies Act 2006. They do not

include all of the information required in annual financial

statements in accordance with IFRS, and should be read in

conjunction with the consolidated financial statements for the year

ended 31 December 2022. The financial information for the year

ended 31 December 2022 does not constitute the Company’s statutory

accounts for that period, but has been extracted from those

accounts, which were approved by the Board of Directors on 20 March

2023 and have been delivered to the Registrar of Companies. The

auditor has reported on those accounts, their opinion was

unqualified, did not draw attention to any matters by way of

emphasis and did not contain any statement under section 498(2) or

(3) of the Companies Act 2006.

2. Basis of preparation The interim financial statements

for the six month period ended 30 June 2023 included in this

interim financial report have been prepared in accordance with UK

adopted International Accounting Standard 34, ‘Interim Financial

Reporting’, and have been prepared on a going concern basis as

described further below.

a. Accounting policies The accounting policies adopted in

the preparation of the condensed consolidated interim financial

statements are those as set out in the Group’s financial statements

for the year ended 31 December 2022, except for the following:

Tax Taxes on income in the interim periods are accrued using the

tax rate that would be applicable to the expected total annual

profit. This is described in note 4.

New accounting standards and interpretations There have not been

any new standards or interpretations adopted in the period which

would have a material financial impact on, or disclosure

requirement for, the Group’s interim report.

b. Critical accounting judgements and sources of estimation

uncertainty Judgements and estimates are the same as those as

set out in the Group’s financial statements for the year ended 31

December 2022, except for the key estimation uncertainty for the

impairment of assets held for sale. These assets were fully

impaired in the year ended 31 December 2022 and there have not been

any further assets held for sale in the six months ended 30 June

2023.

c. Going concern On 28 August 2023, the Group announced

that it had entered into a definitive agreement pursuant to which

Danaher Corporation ‘Danaher’ will acquire all of the outstanding

shares of Abcam for $24.00 per share in cash, subject to

shareholder approval. The Directors unanimously recommend the offer

to shareholders and believe the Group is well positioned for future

continued success under Danaher ownership. On 28 August 2023,

Danaher also publicly announced its intent to continue to operate

Abcam as a standalone operating company and brand within Danaher’s

Life Sciences segment. The Directors recognise that

unavoidable uncertainties exist regarding the future plans and

funding requirements for the business under the new ownership.

Notwithstanding any uncertainty regarding post consummation

operations (assuming the acquisition is consummated) and Danaher’s

plans with respect thereto, the directors have considered the

Group’s forecasts and projections without taking account of whether

the contemplated acquisition will or will not ultimately be

consummated, taking account of reasonably possible changes in the

Group’s trading performance. These show that the Group is expected

to operate within the limits of its available resources and would

continue as a going concern.

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operation for the foreseeable

future and a period of not less than twelve months from the date of

this report and are therefore satisfied that the going concern

basis remains appropriate for the preparation of the financial

statements. Accordingly, the going concern basis has been applied

in preparing the interim financial report and the interim financial

statements do not include the adjustments that would result if the

Group was no longer considered a going concern.

Notes to the condensed consolidated interim financial statements

(continued)

For the six month period ended 30 June 2023

3. Operating segments The Directors consider that there

is only one core business activity and there are no separately

identifiable business segments which are engaged in providing

individual products or services or a group of related products and

services which are subject to separate risks and returns. The

information reported to the Group’s Chief Executive Officer, who is

considered the chief operating decision maker, for the purposes of

resource allocation and assessment of performance, is based wholly

on the overall activities of the Group. The Group has therefore

determined that it has only one reportable segment under IFRS 8

Operating Segments, which is ‘sales of antibodies and related

products’. The Group’s revenue and assets for this one reportable

segment can be determined by reference to the Group’s income

statement and balance sheet.

Geographical information

Revenues are attributed to regions based

primarily on customers’ location. The Group’s revenue from external

customers is set out below:

Six months ended

30 June 2023

(unaudited)

£m

Six months ended

30 June 2022

(unaudited)

£m

The Americas

91.7

82.2

EMEA

55.4

47.2

China

33.0

31.6

Japan

8.4

10.3

Rest of Asia

14.7

13.9

203.2

185.2

Revenue by type is shown below:

Six months ended

30 June 2023

(unaudited)

£m

Six months ended

30 June 2022

(unaudited)

£m

Catalogue revenue

192.8

174.6

Custom products and services

2.7

2.8

IVD

3.3

3.4

Royalties and licenses

4.4

4.4

Custom products and licensing

10.4

10.6

Total reported revenue

203.2

185.2

Notes to the condensed consolidated interim financial statements

(continued)

For the six month period ended 30 June 2023

4. Income tax The major components of the income tax

charge in the income statement are as follows:

Six months

ended

30 June 2023

(unaudited)

£m

Six months

ended

30 June 2022

(unaudited)

£m

Current tax

Current income tax charge

4.5

9.3

Adjustment in respect of prior years

—

—

4.5

9.3

Deferred tax

Origination and reversal of temporary

differences

1.5

(7.7)

Adjustment in respect of prior years

0.6

—

2.1

(7.7)

Total income tax charge

6.6

1.6

Reclassifications: certain amounts in the prior year financial

statements have been reclassified to conform to the current year

presentation.

The Group reported a net tax charge of £6.6m (30 June 2022:

£1.6m).

With effect from 1 April 2023, the UK Corporation Tax rate

increased to 25% (30 June 2022: 19%). Taxation for other

jurisdictions is calculated at the rate prevailing in the relevant

jurisdictions.

Effective tax rates represent management’s best estimate of the

average annual effective tax rate on reported or adjusted profits

with these rates being applied to the six months results.

The estimated effective rate of tax on the reported profit for

the six months ended 30 June 2023 is approximately 28.2% (30 June

2022: 21.6%), which represents management’s best estimate of the

average annual effective tax rate on profits expected for the six

month period.

Notes to the condensed consolidated interim financial statements

(continued)

For the six month period ended 30 June 2023

5. Earnings per share The calculation of earnings per

ordinary share (EPS) is based on profit after tax attributable to

owners of the parent and the weighted number of shares in issue

during the period.

Six months

ended

30 June 2023

(unaudited)

£m

Six months

ended

30 June 2022

(unaudited)

£m

Profit attributable to equity

shareholders of the parent

16.8

5.8

Million

Million

Weighted average number of ordinary shares

in issue

229.4

228.9

Less ordinary shares held by Equiniti

Share Plan Trustees Limited

(0.2)

(0.3)

Weighted average number of ordinary

shares for the purposes of basic EPS

229.2

228.6

Effect of potentially dilutive ordinary

shares – share options and awards

3.5

2.0

Weighted average number of ordinary

shares for the purposes of diluted EPS

232.7

230.6

Basic EPS is calculated by dividing the earnings attributable to

the equity shareholders of the parent by the weighted average

number of shares outstanding during the period. Diluted EPS is

calculated by adjusting the weighted average number of ordinary

shares outstanding to assume conversion of all potentially dilutive

ordinary shares. Such potentially dilutive ordinary shares comprise

share options and awards granted to employees where the exercise

price is less than the average market price of the Company’s

ordinary shares during the period and any unvested shares which

have met, or are expected to meet, the performance conditions at

the end of the reporting period.

Six months

ended

30 June 2023

(unaudited)

Six months

ended

30 June 2022

(unaudited)

Basic EPS

7.3p

2.5p

Diluted EPS

7.2p

2.5p

6. Notes to the cash flow statement

Six months

ended

30 June 2023

(unaudited)

£m

Six months

ended

30 June 2022

(unaudited)

£m

Operating profit for the period

27.9

9.3

Adjustments for:

Depreciation of property, plant and

equipment

7.9

6.9

Depreciation of right-of-use assets

4.4

4.8

Amortisation of intangible assets

13.4

13.7

(Gain) / loss on disposal of right of use

assets

(0.2)

0.6

Impairment of non-current assets

2.1

—

Derivative financial instruments at fair

value through profit or loss

(0.9)

0.2

Research and development expenditure

credit

(1.2)

(0.9)

Share-based payments charge

6.0

12.0

Unrealised currency translation losses /

(gains)

1.1

(0.8)

Operating cash flows before movements

in working capital

60.5

45.8

(Increase) / decrease in inventories

(2.1)

2.9

Increase in receivables

(12.5)

(12.5)

Decrease in payables

(8.5)

(2.9)

Cash generated from operations

37.4

33.3

Notes to the condensed consolidated interim financial statements

(continued)

For the six month period ended 30 June 2023

7. Financial instruments and risk management The Group’s

activities expose it to a variety of financial risks that include

currency risk, interest rate risk, credit risk and liquidity

risk.

The condensed interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; accordingly, they should be read

in conjunction with the Group’s financial statements for the year

ended 31 December 2022. There have been no changes to the risk

management policies since the year ended 31 December 2022.

The table below analyses financial instruments carried at fair

value by valuation method. The different levels have been defined

as follows:

- Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities;

- Level 2 fair value measurements are those derived from inputs

other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived from prices); and

- Level 3 fair value measurements are those derived from

valuation techniques that include inputs for the asset or liability

that are not based on observable market data (unobservable market

inputs).

The following table presents the Group’s assets and liabilities

carried at fair value by valuation method.

30 June 2023

Level 1

£m

Level 2

£m

Level 3

£m

Total

£m

Assets

Derivative financial instruments

—

1.9

—

1.9

Investments

0.9

—

2.6

3.5

Total assets

0.9

1.9

2.6

5.4

30 June 2022

Level 1

£m

Level 2

£m

Level 3

£m

Total

£m

Assets

Derivative financial instruments

—

0.3

—

0.3

Investments

0.8

—

2.5

3.3

Total assets

0.8

0.3

2.5

3.6

Liabilities

Derivative financial instruments

—

(0.9)

—

(0.9)

Total liabilities

—

(0.9)

—

(0.9)

There were no transfers between levels during the period.

The Group’s Level 2 financial instruments consist of forward

foreign exchange contracts fair valued using forward exchange rates

that are quoted in an active market.

The Group continues to generate significant amounts of US

Dollars, Euros, Japanese Yen and Chinese Renminbi in excess of

payments in these currencies and has hedging arrangements in place

to reduce its exposure to currency fluctuations.

The Group’s Level 3 financial instruments consist of unlisted

equity shares.

The fair value of the unquoted equity shares can be determined

as management monitors the ongoing performance of the

investment.

Notes to the condensed consolidated interim financial statements

(continued)

For the six month period ended 30 June 2023

7. Financial instruments and risk management (continued)

The following table details the forward contracts outstanding as at

the period end:

Maturing in

US Dollars

Euros

Japanese Yen

Chinese Renminbi

Sell $m

Average

rate

Sell €m

Average

rate

Sell ¥m

Average

rate

Sell ¥m

Average

rate

Year ending 31 December 2023

15.0

1.22

18.3

1.13

773

160.1

34.8

8.33

Year ending 31 December 2024

0.9

1.26

2.1

1.13

116

165.8

7.9

8.79

8. Capital commitments As at 30 June 2023, the Group had

capital commitments of £10.5m (30 June 2022: £7.9m) relating to the

acquisition of property, plant and equipment and intangible

assets.

9. Borrowings On 7 March 2023, the Group replaced its

existing Revolving Credit Facility (‘RCF’) which was due to expire

on January 31 2024 with a new RCF for an amount of £300m. The

amount of £120m drawn down on the previous RCF was rolled forward

into the new facility.

The new RCF has a term of 4 years, with the option to extend for

one further year, for an amount of £300m and with no accordion

option. Borrowings under the new facility are unsecured but are

guaranteed by certain of our material subsidiary companies.

Arrangement fees incurred in securing the new facility, which were

£2.6m, have been capitalised and the associated borrowings have

been presented net of these. Arrangement fees are amortised through

finance costs over the term of the facility.

10. Subsequent events On 28 August 2023, Abcam announced

that it has entered into a definitive agreement pursuant to which

Danaher Corporation will acquire all of the outstanding shares of

Abcam for $24.00 per share in cash, subject to shareholder

approval.

Risks and uncertainties

The principal risks and uncertainties which the Group faces in

the undertaking of its day-to-day operations and in pursuit of its

longer-term objectives are set out in the Annual Report and

Accounts 2022 on page 30 and in note 4 to the consolidated

financial statements. Information on financial risk management is

set out in note 26 to the consolidated financial statements. A copy

of the Annual Report and Accounts is available on the Group's

website www.abcamplc.com/investors/reports-presentations/.

The principal risks and risk profile of the Group have not

changed over the interim period and are not expected to change over

the next six months.

The principal risks and uncertainties remain as:

- Challenges in implementing our strategies for revenue growth in

light of competitive challenges;

- The development of new products or the enhancement of existing

products, and the need to adapt to significant technological

changes or respond to the introduction of new products by

competitors to remain competitive;

- Our customers discontinuing or spending less on research,

development, production or other scientific endeavours;

- Failing to successfully identify or integrate acquired

businesses or assets into our operations or fully recognize the

anticipated benefits of businesses or assets that we acquire;

- The ongoing COVID 19 pandemic, including variants, continues to

affect our business, including impacts on our operations and supply

chains;

- Failing to successfully use, access and maintain information

systems and implement new systems to handle our changing

needs;

- Cyber security risks and any failure to maintain the

confidentiality, integrity and availability of our computer

hardware, software and internet applications and related tools and

functions;

- Failing to successfully manage our current and potential future

growth;

- Any significant interruptions in our operations;

- Our products fail to satisfy applicable quality criteria,

specifications and performance standards;

- Failing to maintain and enhance our brand and reputation;

- Ability to react to unfavourable geopolitical or economic

changes that affect life science funding;

- Failing to deliver on transformational growth projects;

- Our dependence upon management and highly skilled employees and

our ability to attract and retain these highly skilled employees;

and

- As a foreign private issuer, we are exempt from a number of

rules under the U.S. securities laws and Nasdaq corporate

governance rules and are permitted to file less information with

the SEC than U.S. companies, which may limit the information

available to holders of our American Depositary Shares

(“ADS”).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230831501793/en/

For further information please contact: Abcam Alan

Hirzel, Chief Executive Officer Michael Baldock, Chief Financial

Officer Tommy Thomas, Vice President, Investor Relations + 44 (0)

1223 696 000

FTI Consulting (media enquiries) Ben Atwell / Pat Tucker

Abcam@fticonsulting.com

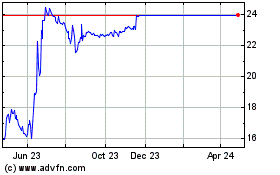

Abcam (NASDAQ:ABCM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Abcam (NASDAQ:ABCM)

Historical Stock Chart

From Jan 2024 to Jan 2025