false

0000318306

0000318306

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): November 14, 2024

ABEONA

THERAPEUTICS INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-15771 |

|

83-0221517 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

6555

Carnegie Ave, 4th Floor

Cleveland,

OH 44103

(Address

of principal executive offices) (Zip Code)

(646)

813-4701

(Registrant’s telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value |

|

ABEO |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On

November 14, 2024, Abeona Therapeutics Inc. (the “Company”) issued a press release entitled “Abeona Therapeutics Reports

Third Quarter 2024 Financial Results and Recent Corporate Updates” regarding its financial results for the quarter ended September

30, 2024. The full text of the press release is filed as. Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein.

The

information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Abeona Therapeutics Inc. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Joseph

Vazzano |

| |

Name: |

Joseph Vazzano |

| |

Title: |

Chief Financial Officer |

| |

|

|

| Date:

November 14, 2024 |

|

|

Exhibit 99.1

Abeona

Therapeutics® Reports Third Quarter 2024 Financial Results and Recent Corporate Updates

FDA

accepts BLA resubmission of pz-cel in recessive dystrophic epidermolysis bullosa and sets PDUFA target action date of April 29, 2025

Company

makes significant progress toward potential commercialization of pz-cel in 2025; Builds momentum with payor discussions and target treatment

centers

CLEVELAND,

November 14, 2024 – Abeona Therapeutics Inc. (Nasdaq: ABEO) today reported financial results for the third quarter ended September

30, 2024, and recent corporate updates.

“With

the acceptance of our Biologics License Application (BLA) resubmission for pz-cel, we are ramping up our commercial readiness efforts,

especially with respect to onboarding potential pz-cel treatment sites and continuing discussions with payors,” said Vish Seshadri,

Chief Executive Officer of Abeona.

Third

Quarter and Recent Progress

Pz-cel

for RDEB

| ● | Abeona

completed a Type A meeting in August 2024 where it aligned with the FDA on the content for

the resubmission of the Company’s BLA for pz-cel, its investigational first-in-class,

autologous cell-based gene therapy currently in development for RDEB, including additional

information to satisfy all Chemistry Manufacturing and Controls (CMC) requirements noted

in the Complete Response Letter (CRL) issued in April 2024. The CRL required that certain

CMC issues be addressed in the BLA resubmission, and did not identify any deficiencies related

to the clinical efficacy or clinical safety data in the BLA. The FDA did not request any

new clinical trials or clinical data to support the approval of pz-cel. |

| ● | Also

in August 2024, the Centers for Medicare and Medicaid Services (CMS) granted a product-specific

procedure code ICD-10-PCS (International Classification of Diseases, 10th Revision, Procedure

Coding System) for pz-cel. Also, as part of the Inpatient Prospective Payment System (IPPS)

Final Rule for fiscal year 2025, CMS assigned Medicare reimbursement of pz-cel to Pre-Major

Diagnostic Category, Medicare Severity Diagnosis Related Group 018 (Pre-MDC MS-DRG 018),

which is among the highest available inpatient hospital reimbursement levels for cell and

gene therapies. The favorable Medicare decisions support efficient hospital billing, reimbursement

and patient access. |

| ● | In

October 2024, Abeona

resubmitted its BLA for pz-cel to the FDA, seeking approval

of pz-cel as a potential new treatment for patients with RDEB. |

| ● | Also

in October 2024, Abeona entered into a lease agreement for additional facility space in Cleveland,

Ohio to enable manufacturing capacity expansion beyond the current planned manufacturing

footprint. |

| ● | Also

in October 2024, the United States Patent and Trademark Office issued a new patent (U.S.

Patent No. 12,110,504) (“the ‘504 Patent”) and allowed the claims of a

second patent (based on U.S. Patent Application No. 16/066,253) that is expected to issue

in the coming weeks. Both patents are entitled “Gene Therapy for Recessive Dystrophic

Epidermolysis Bullosa Using Genetically Corrected Autologous Keratinocytes,” and include

claims that cover the use of pz-cel for the treatment of RDEB. The ‘504 Patent has

an expiration date of January 3, 2037, subject to any applicable patent term extension. |

| ● | In

November 2024, the FDA accepted for review the resubmission of Abeona’s pz-cel BLA

and set a PDUFA target action date of April 29, 2025. |

| ● | In

preparation for potential commercialization, Abeona continues to make progress on several

key initiatives, including onboarding high-volume epidermolysis bullosa treatment centers

in the U.S. for pz-cel treatment, engaging payers to ensure patient access, and educating

key stakeholders. |

| ● | In

preparation for potential pz-cel launch, Abeona has hired and trained personnel to support

commercialization, manufacturing, supply chain and quality. |

Pipeline

and partnered programs

| ● | In

July 2024, Abeona announced a non-exclusive agreement with Beacon Therapeutics, under which

Beacon Therapeutics will evaluate Abeona’s patented AAV204 capsid for its potential

use in AAV gene therapies for select ophthalmology indications. |

| ● | In

October 2024, Ultragenyx participated in a successful pre-BLA meeting with the FDA during

which Ultragenyx aligned on the details of its BLA for partnered program UX111 AAV gene therapy

for Sanfilippo syndrome type A (MPS IIIA) that is expected to be filed around the end of

2024. |

Third

Quarter Financial Results and Cash Runway Guidance

Cash,

cash equivalents, short-term investments and restricted cash totaled $110.0 million as of September 30, 2024. As of June 30, 2024, cash,

cash equivalents, short-term investments and restricted cash totaled $123.0 million.

Abeona

estimates that its current cash and cash equivalents, short-term investments and restricted cash, as well as its credit facility, are

sufficient resources to fund operations into 2026, before accounting for any potential revenue from commercial sales of pz-cel, if approved,

or proceeds from the sale of a Priority Review Voucher (PRV), if awarded by the FDA.

Research

and development expenses for the three months ended September 30, 2024 were $8.9 million, compared to $7.1 million for the same period

of 2023. General and administrative expenses were $6.4 million for the three months ended September 30, 2024, compared to $4.2 million

for the same period of 2023. The increase in general and administrative expenses is primarily due to commercial and launch preparation

costs. Net loss for the third quarter of 2024 was $30.3 million, including a $15.2 million loss resulting from the quarterly remeasurement

of the fair value of warrant and derivative liabilities. In the third quarter of 2023, net loss was $11.8 million, including a $1.1 million

loss resulting from the quarterly remeasurement of the fair value of warrant liabilities.

Conference

Call Details

The

Company will host a conference call and webcast on Thursday, November 14, 2024, at 8:30 a.m. ET, to discuss the quarter results. To access

the call, dial 877-545-0320 (U.S. toll-free) or 973-528-0002 (international) and Entry Code: 500590 five minutes prior to the start of

the call. A live, listen-only webcast and archived replay of the call can be accessed on the Investors & Media section of Abeona’s

website at https://investors.abeonatherapeutics.com/events. The archived webcast replay will be available for 30 days following

the call.

About

Abeona Therapeutics

Abeona Therapeutics Inc. is a clinical-stage biopharmaceutical company developing cell and gene therapies for serious diseases. Prademagene

zamikeracel (pz-cel) is Abeona’s investigational autologous, COL7A1 gene-corrected epidermal sheets currently in development for

recessive dystrophic epidermolysis bullosa. The Company’s fully integrated cell and gene therapy cGMP manufacturing facility served

as the manufacturing site for pz-cel used in its Phase 3 VIITAL™ trial, and is capable of supporting commercial production of pz-cel

upon FDA approval. The Company’s development portfolio also features AAV-based gene therapies for ophthalmic diseases with high

unmet medical need. Abeona’s novel, next-generation AAV capsids are being evaluated to improve tropism profiles for a variety of

devastating diseases. For more information, visit www.abeonatherapeutics.com.

Forward-Looking

Statements

This press release contains

certain statements that are forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, and that involve risks and uncertainties. We have attempted to identify forward-looking

statements by such terminology as “may,” “will,” “believe,”

“anticipate,” “expect,” “intend,” “potential,” and similar words and expressions (as

well as other words or expressions referencing future events, conditions or circumstances), which constitute and are intended to identify

forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result

of various important factors, numerous risks and uncertainties, including but not limited to, the timing and outcome of the FDA’s

review of our BLA resubmission for pz-cel; the FDA’s grant of a Priority Review Voucher upon pz-cel approval; continued interest

in our rare disease portfolio; our ability to enroll patients in clinical trials; the outcome of future meetings with the FDA or other

regulatory agencies, including those relating to preclinical programs; the ability to achieve or obtain necessary regulatory approvals;

the impact of any changes in the financial markets and global economic conditions; risks associated with data analysis and reporting;

and other risks disclosed in the Company’s most recent Annual Report on Form 10-K and subsequent periodic reports filed with the

Securities and Exchange Commission. The Company undertakes no obligation to revise the forward-looking statements or to update them to

reflect events or circumstances occurring after the date of this press release, whether as a result of new information, future developments

or otherwise, except as required by the federal securities laws.

Investor

and Media Contact:

Greg

Gin

VP, Investor Relations and Corporate Communications

Abeona Therapeutics

ir@abeonatherapeutics.com

ABEONA

THERAPEUTICS INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Loss

($

in thousands, except share and per share amounts)

(Unaudited)

| | |

For the three months

ended September 30, | | |

For the nine months

ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| License and other revenues | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 3,500 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Royalties | |

| — | | |

| 30 | | |

| — | | |

| 1,605 | |

| Research and development | |

| 8,941 | | |

| 7,148 | | |

| 25,366 | | |

| 23,712 | |

| General and administrative | |

| 6,404 | | |

| 4,156 | | |

| 22,173 | | |

| 13,174 | |

| Gain on operating lease right-of-use assets | |

| — | | |

| — | | |

| — | | |

| (1,065 | ) |

| Total expenses | |

| 15,345 | | |

| 11,334 | | |

| 47,539 | | |

| 37,426 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (15,345 | ) | |

| (11,334 | ) | |

| (47,539 | ) | |

| (33,926 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 1,189 | | |

| 593 | | |

| 3,223 | | |

| 1,374 | |

| Interest expense | |

| (1,102 | ) | |

| (105 | ) | |

| (3,126 | ) | |

| (309 | ) |

| Change in fair value of warrant and derivative liabilities | |

| (15,156 | ) | |

| (1,101 | ) | |

| (7,530 | ) | |

| (7,465 | ) |

| Other income | |

| 145 | | |

| 111 | | |

| 531 | | |

| 2,729 | |

| Net Loss | |

$ | (30,269 | ) | |

$ | (11,836 | ) | |

$ | (54,441 | ) | |

$ | (37,597 | ) |

| Basic and diluted loss per common share | |

$ | (0.63 | ) | |

$ | (0.48 | ) | |

$ | (1.41 | ) | |

$ | (1.89 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding - basic and diluted | |

| 48,081,758 | | |

| 24,797,564 | | |

| 38,504,273 | | |

| 19,942,613 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Change in unrealized gains (losses) related to available-for-sale debt securities | |

| 50 | | |

| (33 | ) | |

| (18 | ) | |

| 1 | |

| Foreign currency translation adjustments | |

| — | | |

| 29 | | |

| — | | |

| 29 | |

| Comprehensive loss | |

$ | (30,219 | ) | |

$ | (11,840 | ) | |

$ | (54,459 | ) | |

$ | (37,567 | ) |

ABEONA

THERAPEUTICS INC. AND SUBSIDIARIES

Condensed

Consolidated Balance Sheets

($

in thousands, except share and per share amounts)

(Unaudited)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 15,726 | | |

$ | 14,473 | |

| Short-term investments | |

| 93,975 | | |

| 37,753 | |

| Restricted cash | |

| 338 | | |

| 338 | |

| Other receivables | |

| 1,613 | | |

| 2,444 | |

| Prepaid expenses and other current assets | |

| 1,005 | | |

| 729 | |

| Total current assets | |

| 112,657 | | |

| 55,737 | |

| Property and equipment, net | |

| 4,058 | | |

| 3,533 | |

| Operating lease right-of-use assets | |

| 3,789 | | |

| 4,455 | |

| Other assets | |

| 88 | | |

| 277 | |

| Total assets | |

$ | 120,592 | | |

$ | 64,002 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,789 | | |

$ | 1,858 | |

| Accrued expenses | |

| 5,210 | | |

| 5,985 | |

| Current portion of long-term debt | |

| 4,444 | | |

| — | |

| Current portion of operating lease liability | |

| 1,057 | | |

| 998 | |

| Current portion payable to licensor | |

| 4,921 | | |

| 4,580 | |

| Other current liabilities | |

| 1 | | |

| 1 | |

| Total current liabilities | |

| 18,422 | | |

| 13,422 | |

| Long-term operating lease liabilities | |

| 3,402 | | |

| 4,402 | |

| Long-term debt | |

| 14,206 | | |

| — | |

| Warrant liabilities | |

| 38,789 | | |

| 31,352 | |

| Total liabilities | |

| 74,819 | | |

| 49,176 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock - $0.01 par value; authorized 2,000,000 shares; No shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | |

| — | | |

| — | |

| Common stock - $0.01 par value; authorized 200,000,000 shares; 43,404,706 and 26,523,878 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | |

| 434 | | |

| 265 | |

| Additional paid-in capital | |

| 849,388 | | |

| 764,151 | |

| Accumulated deficit | |

| (803,965 | ) | |

| (749,524 | ) |

| Accumulated other comprehensive loss | |

| (84 | ) | |

| (66 | ) |

| Total stockholders’ equity | |

| 45,773 | | |

| 14,826 | |

| Total liabilities and stockholders’ equity | |

$ | 120,592 | | |

$ | 64,002 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

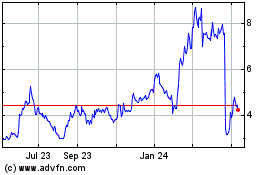

Abeona Therapeutics (NASDAQ:ABEO)

Historical Stock Chart

From Jan 2025 to Feb 2025

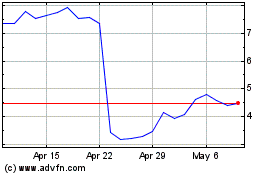

Abeona Therapeutics (NASDAQ:ABEO)

Historical Stock Chart

From Feb 2024 to Feb 2025