Filed Pursuant to Rule 424(b)(5)

Registration No. 333-255576

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 28, 2021)

14,300,000 Common Shares

We are offering 14,300,000 of our common shares

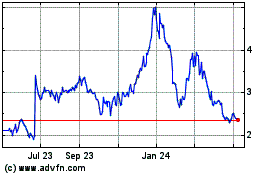

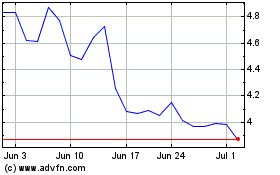

as part of this offering (the “Public Offering”). Our common shares trade on The Nasdaq Global Market under the trading symbol

“ACIU”. On December 14, 2023, the last sale price of our common shares as reported on The Nasdaq Global Market was $3.71 per

share.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| |

Per

Share |

Total |

| Public offering price |

$3.50 |

$50,050,000 |

| Underwriting discounts and commissions (1) |

$0.21 |

$ 3,003,000 |

| Proceeds before expenses, to us |

$3.29 |

$47,047,000 |

| (1) | See “Underwriting” for details regarding other items of underwriting compensation. |

Delivery of the common shares is expected to be

made on or about December 19, 2023.

Joint Book-Running Managers

| Jefferies |

Leerink Partners |

Lead Manager

H.C. Wainwright & Co.

The date of this prospectus

supplement is December 15, 2023.

table

of contents

Page

Prospectus Supplement

Prospectus

Presentation of

Financial Information

Our consolidated financial statements

incorporated by reference herein are presented in Swiss Francs and in accordance with International Financial Reporting Standards

(IFRS), as issued by the International Accounting Standards Board (IASB). None of the consolidated financial statements incorporated

by reference herein were prepared in accordance with generally accepted accounting principles in the United States. The terms

“dollar,” “USD” or “$” refer to U.S. dollars and the term “Swiss Franc” and

“CHF” refer to the legal currency of Switzerland, unless otherwise indicated. Unless otherwise indicated, certain Swiss

Franc amounts and certain U.S. dollar amounts have been translated into U.S. dollars and Swiss Francs, respectively, at a rate of

USD 1.00 to CHF 0.914, the official exchange rate quoted as of September 30, 2023 by the U.S. Federal Reserve Bank. Such

Swiss Franc and U.S. dollar amounts are not necessarily indicative of the amounts of U.S. dollars and Swiss Francs, respectively,

that could actually have been purchased upon exchange of the other currency at the dates indicated or any other date, and such

translated amounts have been provided solely for the convenience of the reader. We have made rounding adjustments to some of the

figures included in this prospectus. Accordingly, any numerical discrepancies in any table between totals and sums of the amounts

listed are due to rounding. Unless explicitly mentioned otherwise herein, all references to our financial statements in this

prospectus supplement are references to our IFRS financial statements exclusively.

Trademarks

The Company owns various

registered and unregistered trademarks, for some of which protection has been obtained or is being sought, including Morphomer™,

SupraAntigen® and its corporate name, logo and Nasdaq Global Market symbol. All other trademarks, trade names and service

marks of other companies appearing in this prospectus supplement are the property of their respective owners. Solely for convenience,

the trademarks and trade names in this prospectus supplement may be referred to without the respective ® and ™ symbols,

but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under

applicable law, their rights thereto. The Company does not intend to use or display other companies’ trademarks and/or trade names

to imply a relationship with, or endorsement or sponsorship of the Company by, any other companies.

About This Prospectus

Supplement

This document consists of two parts. The first

part is this prospectus supplement, which describes the specific terms of this offering. The second part is the accompanying prospectus,

which is part of a registration statement that we filed with the SEC using a “shelf” registration process. The accompanying

prospectus describes more general information, some of which may not apply to this offering.

Before buying any of our securities that we are

offering, we urge you to carefully read both this prospectus supplement and the accompanying prospectus together with all of the information

incorporated by reference herein, as well as the additional information described under the headings “Where You Can Find More Information”

and “Incorporation by Reference.” These documents contain important information that you should consider when making your

investment decision.

To the extent there is a conflict between the

information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or

in any document incorporated by reference in this prospectus supplement, on the other hand, you should rely on the information in this

prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having

a later date—for example, a document incorporated by reference in this prospectus supplement—the statement in the document

having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained

in or incorporated by reference in this prospectus and any related free writing prospectus filed by us with the SEC. We have not, and

the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus supplement does not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the securities described in this prospectus

supplement or an offer to sell or the solicitation

of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information

appearing in this prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only

as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since

those dates.

You should also read and consider the information

in the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation

by Reference” in this prospectus supplement.

Unless otherwise indicated or the context otherwise

requires, all references in this prospectus supplement to “AC Immune,” “ACIU,” “Company,” “we,”

“our,” “ours,” “us” or similar terms refer to AC Immune SA, a Swiss stock corporation, together with

its subsidiary.

Special Note Regarding

Forward-Looking Statements

This prospectus supplement contains statements

that constitute forward-looking statements. All statements other than statements of historical facts contained in this prospectus supplement,

including statements regarding our future results of operations and financial position, business strategy, product candidates, product

pipeline, ongoing and planned clinical studies, including those of our collaboration partners, regulatory approvals, research and development

costs, timing and likelihood of success, as well as plans and objectives of management for future operations are forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act

of 1934, as amended, or the Exchange Act. Many of the forward-looking statements contained in this prospectus supplement can be identified

by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,”

“should,” “plan,” “intend,” “estimate,” “will” and “potential,”

among others.

Forward-looking statements appear in a number

of places in this prospectus supplement and include, but are not limited to, statements regarding our intent, belief or current expectations.

Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management.

Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the

forward-looking statements due to various factors, including, but not limited to, those identified under the section entitled “Risk

Factors” in this prospectus supplement. These risks and uncertainties include factors relating to:

| · | the success of our and our collaboration partners’ clinical studies, and our and their ability to obtain and maintain regulatory

approval and to commercialize our active immunotherapies (ACI-35.030, ACI-24.060 and ACI-7104.056), monoclonal antibodies (semorinemab

and crenezumab) and diagnostics (Tau-PET tracer PI-2620 and a-syn PET tracer ACI-12589) and to a lesser extent our preclinical candidates; |

| · | the preclinical and clinical safety, efficacy and utility of our product candidates; |

| · | the ability of our competitors to discover, develop or commercialize competing products before or more successfully than we do; |

| · | our plans to research, develop and commercialize our product candidates; |

| · | the identification of serious adverse, undesirable or unacceptable side effects related to our product candidates; |

| · | our ability to maintain our current strategic relationships with our collaboration partners; |

| · | our ability to protect and maintain our, and not infringe on third parties’, intellectual property rights throughout the world; |

| · | our ability to raise capital when needed in order to continue our product development programs or commercialization efforts; |

| · | our ability to attract and retain qualified employees and key personnel; |

| · | the acceptance by the Food and Drug Administration and applicable foreign regulatory authorities of data from studies that we and

our collaboration partners conduct within and outside the United States now and in the future; |

| · | our foreign private issuer status, the loss of which would require us to comply with the Exchange Act’s domestic reporting regime,

and cause us to incur significant legal, accounting and other expenses; |

| · | our incorporation in Switzerland, the laws of which govern our corporate affairs and may differ from those applicable to companies

incorporated in the United States; and |

| · | the other risk factors discussed under “Risk Factors.” |

These forward-looking statements speak only as

of the date of this prospectus supplement and are subject to a number of risks, uncertainties and assumptions described under the section

in this prospectus supplement entitled “Risk Factors” and elsewhere in this prospectus supplement. Because forward-looking

statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond

our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected

in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the

forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to

time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do

not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future

events, changed circumstances or otherwise.

Prospectus Supplement

Summary

This summary highlights selected information

contained elsewhere in this prospectus supplement and the accompanying prospectus and in the documents we incorporate by reference. This

summary does not contain all of the information you should consider before making an investment decision. You should read this entire

prospectus supplement carefully, especially the risks of investing in our common shares discussed under “Risk Factors” beginning

on page S-8 of this prospectus supplement, along with our consolidated financial statements and notes to those consolidated financial

statements and the other information incorporated by reference in this prospectus supplement.

AC Immune SA

AC Immune is a leading, clinical stage biopharmaceutical

company advancing one of the broadest portfolios focused on pioneering Precision Medicine for neurodegenerative diseases. Our highly differentiated

approach integrates novel therapeutics and diagnostics to overcome the fundamental challenge in this therapeutic area – the high

number of co-pathologies driving disease development and progression and the urgent need for more tailored therapeutic regimens.

Leveraging our dual proprietary technology platforms,

SupraAntigen and Morphomer, we have built a comprehensive pipeline with the goal of being first-in-class or best-in-class candidates spanning

multiple treatment modalities and targeting both established and emerging neurodegenerative pathologies. We are currently advancing 16

therapeutic and diagnostic programs, with one program in Phase 3 and five in Phase 2 clinical trials, targeting five different types of misfolded pathological

proteins related to Alzheimer’s disease (AD), Parkinson’s disease (PD) and other neurodegenerative disorders. Our pipeline

assets are further validated by the multiple partnerships we have established with leading global pharmaceutical companies. We believe

our clinically validated technology platforms and multi-target, multimodal approach position AC Immune to revolutionize the treatment

paradigm for neurodegenerative disease by shifting it towards Precision Medicine and disease prevention.

We are a Swiss stock corporation (société

anonyme) organized under the laws of Switzerland. We were formed as a Swiss limited liability company (société à

responsabilité limitée) on February 13, 2003 with our registered office and domicile in Basel, Switzerland. We converted

to a Swiss stock corporation (société anonyme) under the laws of Switzerland on August 25, 2003. Our Swiss enterprise

identification number is CHE-109.878.825. Our domicile and registered office is in Ecublens, at the École Polytechnique Fédérale

Lausanne (EPFL) Innovation Park Building B, 1015 Lausanne, Vaud, Switzerland. Our common shares were admitted to trading on Nasdaq Global

Market on September 23, 2016, and trade under the symbol ACIU.

Our general

telephone number is +41 21 345 91 21 and our internet address is www.acimmune.com. References to our website address do not constitute

incorporation by reference of the information contained on the website, and the information contained on the website is not part of this

document or any other document that we file with or furnish to the SEC.

Recent Developments

On December 15, 2023, we announced that our development

partner has programmed the launch of a Phase 2b clinical study to evaluate ACI-35.030 (JNJ-64042056) in patients with preclinical AD,

those individuals not yet showing symptoms. Under the terms of the licensing agreement with Janssen Pharmaceuticals, Inc. (Janssen), a

Johnson & Johnson company, we will now receive a milestone payment of CHF 15 million and are eligible to receive another milestone

payment of CHF 25 million related to achieving a non-disclosed enrollment target.

Implications of Being a Foreign Private Issuer

We are also considered a “foreign

private issuer.” Accordingly, we report under the Exchange Act as a non-U.S. company with foreign private issuer status. This

means that

as long as we qualify

as a foreign private issuer under the Exchange Act we will be exempt from certain provisions of the Exchange Act that are applicable to

U.S. domestic public companies, including:

| · | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered

under the Exchange Act; |

| · | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability

for insiders who profit from trades made in a short period of time; and |

| · | the rules under the Exchange Act requiring the filing with the SEC, of quarterly reports on Form 10-Q containing unaudited financial

and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Although as a foreign private issuer we will not

be required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities

are registered under the Exchange Act, we report our results of operations voluntarily on a quarterly basis.

We may take advantage of these exemptions until

such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of

our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of

our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States

or (iii) our business is administered principally in the United States.

The Offering

This summary highlights information presented

in greater detail elsewhere in this prospectus supplement. This summary is not complete and does not contain all the information you should

consider before investing in our securities. You should carefully read this entire prospectus supplement before investing in our securities

including “Risk Factors” and our financial statements included in this prospectus supplement or incorporated by reference

herein.

| Common shares offered by us |

At the ordinary shareholders’ meeting held on June

24, 2022, our shareholders approved the creation of an authorized share capital which allows the Board of Directors to increase the share

capital of the Company and issue new common shares, without further shareholder approval, at any time until June 24, 2024, in an amount

not exceeding CHF 400,000 through the issuance of up to 20,000,000 common shares (the “Authorized Share Capital”).

The Board of Directors will determine the time of issuance,

the issue price, the manner in which the new shares will be paid for, the date from which the new shares carry the right to dividends

and, subject to the provisions of the Articles of Association, the limitation or exclusion of the preferential subscription rights of

existing shares.

At the Board of Directors’ meeting held on December

11, 2023, the Board of Directors approved an authorized capital increase of up to 16.5 million common shares (the “Capital Increase”).

The Public Offering consists of the sale by us of our common shares (the “Offered Shares”), which consist of 14,300,000 shares

newly issued through the Capital Increase. |

| |

|

| Offered Shares |

The Offered Shares will have a nominal value of CHF 0.02

each. All 14,300,000 Offered Shares will be issued in an authorized share capital increase against cash contributions. The Offered Shares

will be fully fungible and rank pari passu in all respects with each other and with all of our existing shares.

The Offered Shares are / will be issued as uncertificated

securities (droits-valeurs, within the meaning of Article 973c of the Swiss Code of Obligations) and, when administered by a financial

intermediary (dépositaire, within the meaning of the Federal Act on Intermediated Securities, “FISA”), qualify

as intermediated securities (titres intermédiés, within the meaning of the FISA). The Offered Shares are / will

be registered in the Company’s non-public register of uncertificated securities (registre des droits-valeurs). |

| Common shares to be outstanding immediately after this offering |

98,749,352 common shares. |

| |

|

| Determination of Offering Price |

The Offering Price was determined by us and the underwriters on the basis of investor demand resulting from an accelerated book building procedure and prevailing market conditions, as further as described in the “Underwriting” section of this prospectus supplement. |

| |

|

| Use of Proceeds |

We estimate that the net proceeds to us from this offering will be approximately $46.3 million (CHF 42.3

million), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net

proceeds from this offering, together with existing liquidity, primarily to strategically invest in research and clinical

development of our current pipeline, our technology platforms, working capital, capital expenditures and general corporate purposes.

See “Use of Proceeds.” |

| |

|

| Risk Factors |

You should read the “Risk Factors” section of this prospectus supplement for a discussion of factors to consider carefully before deciding to purchase our securities. |

| |

|

| Nasdaq Global Market Symbol |

“ACIU” |

As of the date of this prospectus supplement,

our issued share capital registered in the commercial register of the Canton of Vaud is CHF 1,794,907.30 consisting of 89,745,365 common

shares, of which 5,243,958 are held as treasury shares, leaving 84,501,407 common shares outstanding with a nominal value of CHF 0.02

each. The number of our common shares to be outstanding immediately after this offering is based on 84,449,352 common shares outstanding

as of September 30, 2023, but excludes 92,540 of our common shares which were issued upon the exercise of options and restricted share

units between January 1, 2023 and September 30, 2023 and have not been registered and an additional 6,342,329 common shares which will

be issuable upon the exercise of options and restricted share units outstanding under our existing equity incentive plans at a weighted-average

exercise price of CHF 3.51 per common share.

Risk Factors

You should carefully consider the risks and

uncertainties described below and the other information in this prospectus supplement before making an investment in our securities. Our

business, financial condition or results of operations could be materially and adversely affected if any of these risks occurs, and as

a result, the market price of our common shares could decline and you could lose all or part of your investment. This prospectus supplement

also contains forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.”

Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain

factors.

For a discussion of additional risks related

to our business, our relationship with third parties, our intellectual property, our financial condition and capital requirements, or

our regulatory environment, see the section titled “Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended

December 31, 2022, and our other filings with the SEC that are also incorporated by reference into this prospectus supplement.

Risks Related to Our Common Shares and the Public Offering

Because our Board of Directors’ resolutions

regarding an authorized capital increase may be challenged, it is not certain that the share capital increase in connection with the offering

will occur when anticipated.

The issuance of the 14,300,000 shares requires

registration of the share capital increase with the commercial register of the Canton of Vaud. The Public Offering is based upon the resolution

regarding an authorized ordinary capital increase that was approved by the Board of Directors on December 11, 2023. Such registration

may, for reasons beyond our control, not take place in time to enable all Offered Shares to be traded on a timely basis, or to be issued

and delivered at all. Consequently, investors may suffer losses, in particular, if they entered into short selling transactions and are

unable to meet their obligations to deliver Offered Shares.

The price of our common shares is volatile and

may fluctuate due to factors beyond our control.

The share prices of publicly traded pharmaceutical,

biopharmaceutical and drug discovery and development companies have been highly volatile and are likely to remain highly volatile in the

future. The market price of our common shares may fluctuate significantly due to a variety of factors, including:

| · | positive or negative results of testing and clinical studies by us, strategic partners, or competitors; |

| · | delays in entering into strategic relationships with respect to development and/or commercialization of our product candidates or

entry into strategic relationships on terms that are not deemed to be favorable to us; |

| · | the sentiment of retail investors, including the perception of our clinical trial results by such retail investors, which investors

may be subject to the influence of information provided by social media, third party investor websites and independent authors distributing

information on the internet; |

| · | technological innovations or commercial product introductions by us or our collaboration partners or competitors; |

| · | changes in government regulations; |

| · | developments concerning proprietary rights, including patents and litigation matters; |

| · | public concern relating to the commercial value or safety of any of our product candidates; |

| · | financing or other corporate transactions; |

| · | publication of research reports or comments by securities or industry analysts or key opinion leaders; |

| · | general market conditions in the pharmaceutical or biopharmaceutical industry or in the economy as a whole; or |

| · | other events and factors beyond our control. |

Broad market and industry factors may materially

affect the market price of companies’ stock, including ours, regardless of actual operating performance. Furthermore, issuers such

as ourselves, whose securities have historically had limited trading volumes and/or have been susceptible to relatively high volatility

levels, can be particularly vulnerable to short-seller attacks and trading in our common shares by non-fundamental investors such as hedge

funds and others who may enter and exit positions in our common shares frequently and suddenly, causing increased volatility of our share

price. Short selling is the practice of selling securities that the seller does not own but rather has borrowed or intends to borrow from

a third party with the intention of buying identical securities at a later date to return to the lender, and profit from a decline in

the value of the securities in the process. The publication of any commentary by short sellers with the intent of creating negative market

momentum may bring about a temporary, or possibly long-term, decline in the market price of our common shares.

There is only a limited free float of our common

shares; this may have a negative impact on the liquidity of and the market price for our common shares.

As of December 15, 2023, certain principal shareholders

controlling 5% or more of our common shares as well as our executive officers and directors together beneficially owned approximately

59.9% of our common shares. The limited free float may have a negative impact on the liquidity of our common shares and result in a low

trading volume of our common shares, which could adversely affect the price of our common shares.

Certain of our existing shareholders exercise

significant control over us, and your interests may conflict with the interests of such shareholders.

As of December 15, 2023, certain principal shareholders

as well as our executive officers and directors together beneficially owned approximately 59.9% of our common shares. Depending on the

level of attendance at our general meetings of shareholders, these shareholders may be in a position to determine the outcome of decisions

taken at any such general meeting. To the extent that the interests of these shareholders may differ from the interests of the Company’s

other shareholders, the latter may be disadvantaged by any action that these shareholders may seek to pursue. Among other consequences,

this concentration of ownership may have the effect of delaying or preventing a change in control and might therefore negatively affect

the market price of our common shares.

Future sales, or the possibility of future sales,

of a substantial number of our common shares could adversely affect the price of our common shares.

Future sales of a substantial number of our common

shares, or the perception that such sales will occur, could cause a decline in the market price of our common shares. If certain of our

shareholders sell substantial amounts of common shares in the public market, or the market perceives that such sales may occur, the market

price of our common shares and our ability to raise capital through an issue of equity securities in the future could be adversely affected.

We also entered into a registration rights agreement in connection with the Series E Private Placement with certain investors in the Series

E Private Placement, pursuant to which we agreed under certain circumstances to file a registration statement to register the resale of

the common shares held by certain of our existing shareholders, as well as to cooperate in certain public offerings of such common shares.

In October 2020 and August 2018, we filed registration statements on Form F-3 to register the resale of two of our shareholder’s

common shares pursuant to the requirements of their registration rights agreements. In addition, in 2019, we adopted a new omnibus equity

incentive plan under which we have the discretion to grant a broad range of equity-based awards to eligible participants. These shares

were registered pursuant to the registration statement on Form S-8 that we filed with the SEC and, therefore, can be freely sold in the

public market upon issuance, subject to volume limitations applicable to affiliates. If a large number of our common shares are sold in

the public market after they become eligible for sale, the sales could reduce the trading price of our common shares and impede our ability

to raise future capital.

If you purchase common shares in this offering,

you will suffer immediate dilution of your investment.

The Offering Price will be substantially higher

than the as adjusted net tangible book value per common share. Therefore, if you purchase common shares in this offering, you will pay

a price per common share that substantially exceeds our as adjusted net tangible book value per common share after this offering. Based

on the public offering price of $3.50 per common share, you will experience immediate dilution of $2.20 (CHF 2.01) per common share, representing

the difference between our as adjusted net tangible book value per common share after giving effect to this offering and the Offering

Price. To the extent outstanding options or warrants are exercised, you will incur further dilution. See “Dilution.”

We have broad discretion in the use of our cash

and cash equivalents and short-term financial assets (liquidity) and may not use them effectively.

Our management has broad discretion in the application

of our cash and cash equivalents and short-term financial assets. Our or our collaboration partners’ decisions concerning the allocation

of research, development, collaboration, management and financial resources toward particular product candidates or therapeutic areas

may not lead to the development of any viable commercial product and may divert resources away from better opportunities. If we make incorrect

determinations regarding the viability or market potential of any of our programs or product candidates or misread trends in the pharmaceutical

or biopharmaceutical industry, in particular for neurodegenerative diseases, our business, financial condition and results of operations

could be materially adversely affected. As a result, we may fail to capitalize on viable commercial products or profitable market opportunities,

be required to forego or delay pursuit of opportunities with other product candidates or other diseases and disease pathways that may

later prove to have greater commercial potential than those we choose to pursue, or relinquish valuable rights to such product candidates

through collaboration, licensing or other royalty arrangements in cases in which it would have been advantageous for us to invest additional

resources to retain sole development and commercialization rights.

We do not expect to pay dividends in the foreseeable

future.

We have not paid any dividends since our incorporation.

Even if future operations lead to significant levels of distributable profits, we currently intend that any earnings will be reinvested

in our business and that dividends will not be paid until we have an established revenue stream to support continuing dividends. Based

on Swiss law and our articles of association, the declaration of dividends requires a resolution passed by a simple majority of the votes

cast at a shareholders’ meeting regardless of abstentions and empty or invalid votes. The proposal to pay future dividends to shareholders

will in addition effectively be at the discretion of our board of directors after considering various factors including our business prospects,

liquidity requirements, financial performance and new product development. In addition, payment of future dividends is subject to certain

limitations pursuant to Swiss law or by our articles of association compliance with which must be confirmed by our auditors. Accordingly,

investors cannot rely on dividend income from our common shares and any returns on an investment in our common shares will likely depend

entirely upon any future appreciation in the price of our common shares.

We are a Swiss corporation. The rights of our

shareholders may be different from the rights of shareholders in companies governed by the laws of U.S. jurisdictions.

We are a Swiss corporation. Our corporate affairs

are governed by our articles of association and by the laws governing companies, including listed companies, incorporated in Switzerland.

The rights of our shareholders and the responsibilities of members of our board of directors may be different from the rights and obligations

of shareholders and directors of companies governed by the laws of U.S. jurisdictions. In the performance of its duties, our board of

directors is required by Swiss law to consider the interests of our Company first, then of our shareholders, our employees and other stakeholders,

in all cases, with due observation of their fiduciary duties of care and loyalty. It is possible that some of these parties will have

interests that are different from, or in addition to, your interests as a shareholder. Swiss corporate law limits the ability of our shareholders

to challenge resolutions made or other actions taken by our board of directors in court. Our shareholders generally are not permitted

to file a suit to reverse a decision or an action taken by our board of directors but are instead only permitted to seek damages for breaches

of their fiduciary duties by the directors. As a matter of Swiss law, shareholder claims against a member of our board of directors for

breach of fiduciary duty would have to be brought in Lausanne, Switzerland, or the country in which the relevant

member of our board of directors is domiciled.

In addition, under Swiss law, any claims by our shareholders against us must be in principle brought exclusively in Lausanne, Switzerland

(except for certain U.S. securities and other claims that may be brought in U.S. federal court).

Our common shares are issued under the laws

of Switzerland, which may not protect investors in a similar fashion afforded by incorporation in a U.S. state.

We are organized under the laws of Switzerland.

There can be no assurance that Swiss law will not change in the future in a way detrimental to shareholders or that it will serve to protect

investors in a similar fashion afforded under corporate law principles in the U.S., which could adversely affect the rights of investors.

Our status as a Swiss corporation may limit

our flexibility with respect to certain aspects of capital management and may cause us to be unable to make distributions without subjecting

our shareholders to Swiss withholding tax.

The Swiss law effective at the time according

to which our current Authorized Share Capital were installed (i.e., on June 24, 2022) allowed our shareholders to authorize share capital

that can be issued by the board of directors without additional shareholder approval. This authorization is limited to 50% of the existing

registered share capital and must be renewed by the shareholders once expired. As of January 1, 2023, the new Swiss corporate law introducing

the capital band mechanism has come into force. It will no longer be possible to renew the Company's current Authorized Share Capital

beyond June 24, 2024. Instead, the Company can only introduce the capital band pursuant to Article 653s et seq. of the revised Swiss Code

of Obligations which requires an amendment of the Articles of Association by way of a resolution of a duly convened general meeting of

shareholders of the Company. Under the capital band mechanism, the general meeting of shareholders can authorize the board of directors

at any time within a maximum of five years to increase or decrease the share capital by a maximum amount of 50% of the current share capital.

Additionally, as a principle, Swiss law grants

pre-emptive subscription rights to existing shareholders to subscribe to any new issuance of shares. Any common share capital increase

resolution preserving pre-emptive subscription rights expires after 3 months and requires a simple majority of the votes cast at the shareholder’s

meeting regardless of abstentions and empty or invalid votes. Swiss law also does not provide as much flexibility in the various terms

that can attach to different classes of shares as do the laws of some other jurisdictions. Swiss law also reserves for approval by shareholders

certain corporate actions over which a board of directors would have authority in some other jurisdictions. For example, dividends must

be approved by shareholders. These Swiss law requirements relating to our capital management may limit our flexibility, and situations

may arise in which greater flexibility would have provided substantial benefits to our shareholders.

Under Swiss law, a Swiss corporation may pay dividends

only if the corporation has sufficient distributable profits from previous fiscal years, or if the corporation has distributable reserves,

each as evidenced by its audited statutory balance sheet. Freely distributable reserves are generally booked either as “free reserves”

or as “capital contributions” (apports de capital, contributions received from shareholders) in the “reserve

from capital contributions.” Distributions may be made out of issued share capital—the aggregate nominal value of a company’s

issued shares—only by way of a capital reduction. To the extent we introduce the capital band, only net proceeds from capital increase

using the capital band (less certain expenses and net of repayments from us) will be recognized as reserves from capital contributions.

As of December 31, 2022, we had CHF 432.6 million of reserves from capital contributions confirmed by the Swiss Federal Tax Administration

and CHF 1,794,907 of issued share capital (consisting of 89,745,365 common shares each with a nominal value of CHF 0.02 and no preferred

shares) on our audited statutory balance sheet. Of the total issued shares and issued share capital, we held 6,214,021 fully paid-in treasury

shares representing CHF 124,280 of issued share capital. In addition, we expect that part of the proceeds from this Public Offering will

be recognized as reserves from capital contributions.

Generally, Swiss withholding tax of 35% is due

on dividends and similar distributions to our shareholders, regardless of the place of residency of the shareholder, unless the distribution

is made to shareholders out of (i) a reduction of nominal value or (ii) assuming certain conditions are met, reserves from capital contributions

accumulated on or after January 1, 1997. We expect the aggregate of the reserves from capital contributions confirmed by the Swiss Federal

Tax Administration and share capital, less the total losses brought forward (to the extent set off against reserves from capital contributions

or share capital), less the treasury shares (to the

extent booked against reserves from capital contributions),

less the lowest legally possible issued share capital and legal reserve to represent the maximum amount potentially available for future

dividends or capital reductions on a Swiss withholding tax-free basis. We would be able to pay dividends out of distributable profits

or freely distributable reserves but such dividends would be subject to Swiss withholding taxes. There can be no assurance that we will

have sufficient distributable profits, free reserves, reserves from capital contributions or registered share capital to pay a dividend

or effect a capital reduction, that our shareholders will approve dividends or capital reductions proposed by us, or that we will be able

to meet the other legal requirements for dividend payments or distributions as a result of capital reductions.

A U.S. investor who qualifies for benefits under

the Convention Between the United States of America and the Swiss Confederation for the Avoidance of Double Taxation with Respect to Taxes

on Income, which we refer to as the “U.S.-Swiss Treaty,” may apply for a refund of the tax withheld in excess of the 15% treaty

rate (or in excess of the 5% reduced treaty rate for qualifying corporate shareholders with at least 10% participation in our voting stock,

or for a full refund in the case of qualified pension funds). There can be no assurance that we will have sufficient reserves from capital

contributions to pay dividends free from Swiss withholding tax, or that Swiss withholding tax rules will not be changed in the future.

In addition, we cannot provide assurance that the current Swiss law with respect to distributions out of reserves from capital contributions

will not be changed or that a change in Swiss law will not adversely affect us or our shareholders, in particular as a result of distributions

out of reserves from capital contributions becoming subject to additional corporate law or other restrictions. If we are unable to make

a distribution through a reduction in nominal value or out of confirmed reserves from capital contributions, we will not be able to make

distributions without subjecting our shareholders to Swiss withholding taxes.

See “Tax Considerations—Swiss Tax

Considerations” for a summary of certain Swiss tax consequences regarding dividends distributed to holders of our common shares.

U.S. shareholders may not be able to obtain

judgments or enforce civil liabilities against us or our executive officers or members of our board of directors.

We are organized under the laws of Switzerland

and our registered office and domicile is located in Ecublens, near Lausanne, Canton of Vaud, Switzerland. Moreover, a number of our directors

and executive officers are not residents of the U.S., and all or a substantial portion of the assets of such persons are located outside

the U.S. As a result, it may not be possible for investors to effect service of process within the U.S. upon us or upon such persons or

to enforce against them judgments obtained in U.S. courts, including judgments in actions predicated upon the civil liability provisions

of the federal securities laws of the U.S. We have been advised by our Swiss counsel that there is doubt as to the enforceability in Switzerland

of original actions, or of actions for enforcement of judgments of U.S. courts, for civil liabilities to the extent solely predicated

upon the federal and state securities laws of the U.S. Original actions against persons in Switzerland based solely upon the U.S. federal

or state securities laws are governed, among other things, by the principles set forth in the Swiss Federal Act on Private International

Law. This statute provides that the application of provisions of non-Swiss law by the courts in Switzerland shall be precluded if the

result is incompatible with Swiss public policy. Additionally, certain mandatory provisions of Swiss law may be applicable regardless

of any other law that would otherwise apply.

Switzerland and the U.S. do not have a treaty

providing for reciprocal recognition and enforcement of judgments in civil and commercial matters. The recognition and enforcement of

a judgment of the courts of the U.S. in Switzerland is governed by the principles set forth in the Swiss Federal Act on Private International

Law. This statute provides in principle that a judgment rendered by a non-Swiss court may be enforced in Switzerland only if:

| · | the non-Swiss court had jurisdiction pursuant to the Swiss Federal Act on Private International Law; |

| · | the judgment of such non-Swiss court has become final and non-appealable; |

| · | the judgment does not contravene Swiss public policy; |

| · | the court procedures and the service of documents leading to the judgment were in accordance with the due process of law; and |

| · | no proceeding involving the same parties and the same subject matter was first brought in Switzerland, or adjudicated in Switzerland,

or was earlier adjudicated in a third state for which the decision is recognizable in Switzerland. |

Our status as a Swiss corporation means that

our shareholders enjoy certain rights that may limit our flexibility to raise capital, issue dividends and otherwise manage ongoing capital

needs.

Swiss law reserves for approval by shareholders

certain corporate actions over which a board of directors would have authority in some other jurisdictions. For example, the payment of

dividends and cancellation of treasury shares must be approved by shareholders. Swiss law also requires that our shareholders themselves

resolve, or authorize our board of directors, to increase our share capital. Although under the current Swiss law our shareholders may

resolve a capital band which authorizes the board of directors to increase or decrease the share capital without additional shareholder

approval, Swiss law limits this authorization to 50% of the issued share capital at the time of the authorization. The authorization,

furthermore, has a limited duration of up to five years and must be renewed by the shareholders from time to time thereafter.

Since January 1, 2023, the new Swiss corporate

law introducing the capital band mechanism has come into force. It will no longer be possible to renew the Company's current Authorized

Share Capital beyond June 24, 2024. Instead, the Company can only introduce the capital band pursuant to Article 653s et seq. of the revised

Swiss Code of Obligations which requires an amendment of the Articles by way of a resolution of a duly convened general meeting of shareholders

of the Company.

Additionally, subject to specified exceptions,

including exceptions explicitly described in our articles of association, Swiss law grants pre-emptive subscription rights to existing

shareholders to subscribe for new issuances of shares. Swiss law also does not provide as much flexibility in the various rights and regulations

that can attach to different categories of shares as do the laws of some other jurisdictions. These Swiss law requirements relating to

our capital management may limit our flexibility, and situations may arise where greater flexibility would have provided benefits to our

shareholders.

Shareholders in countries with a currency other

than Swiss Francs face additional investment risks from currency exchange rate fluctuations in connection with their holding of our common

shares.

Any future payments of dividends, if any, will

likely be denominated in Swiss Francs. The foreign currency equivalent of any dividend, if any, paid on our common shares or received

in connection with any sale of our common shares could be adversely affected by the depreciation of the Swiss Franc against such other

currency.

We are a foreign private issuer and, as a result,

we are not subject to U.S. proxy rules and are subject to Exchange Act reporting obligations that, to some extent, are more lenient and

less frequent than those of a U.S. domestic public company.

We are reporting under the Exchange Act as a non-U.S.

company with foreign private issuer status. Because we qualify as a foreign private issuer under the Exchange Act and although we are

subject to Swiss laws and regulations with regard to such matters and intend to furnish quarterly financial information to the SEC, we

are exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including (i) the sections

of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange

Act; (ii) the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and

their liability for insiders who profit from trades made in a short period of time; and (iii) the rules under the Exchange Act requiring

the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or of current

reports on Form 8-K, upon the occurrence of specified significant events. In addition, foreign private issuers are not required to file

their annual report on Form 20-F until four months after the end of each financial year, whereas U.S. domestic issuers that are accelerated

filers are required to file their annual report on Form 10-K within 75 days after the end of each fiscal year. Foreign private issuers

are also exempt from the Regulation Fair Disclosure, aimed at preventing issuers from making selective disclosures of material information.

As a result of the above, you may not have the same protections afforded to shareholders of companies that are not foreign private issuers.

As a foreign private issuer and as permitted

by the listing requirements of Nasdaq, we rely on certain home country governance practices rather than the corporate governance requirements

of Nasdaq.

We are a foreign private issuer. As a result,

in accordance with Nasdaq Listing Rule 5615(a)(3), we comply with home country (in this case, Swiss) governance requirements and certain

exemptions thereunder rather than complying with certain of the corporate governance requirements of Nasdaq. Swiss law does not require

that a majority of our board of directors consist of independent directors. Our board of directors therefore may include fewer independent

directors than would be required if we were subject to Nasdaq Listing Rule 5605(b)(1). In addition, we are not subject to Nasdaq Listing

Rule 5605(b)(2), which requires that independent directors regularly have scheduled meetings at which only independent directors are present.

While Swiss law also requires that our board of

directors elects an audit and finance committee from among its members, as a foreign private issuer, the independence of the members of

such committee is determined by home country regulations and the conditions of Section 10B of the Securities Exchange Act, excluding any

Nasdaq Listing Rules. Section 10B of the Securities Exchange Act also prescribes qualification requirements for the audit and finance

committee. Swiss law also requires that we elect a compensation committee, we follow home country requirements with respect to such committee

and our compensation, nomination and corporate governance committee is tasked with certain director nomination and governance responsibilities.

As a result, our practice varies from the requirements of Nasdaq Listing Rule 5605(d), which sets forth certain requirements as to the

responsibilities, composition and independence of compensation committees, and from the independent director oversight of director nominations

requirements of Nasdaq Listing Rule 5605(e).

Furthermore, in accordance with Swiss law and

generally accepted business practices, our articles of association do not provide quorum requirements generally applicable to general

meetings of shareholders. Our practice thus varies from the requirement of Nasdaq Listing Rule 5620(c), which requires an issuer to provide

in its bylaws for a generally applicable quorum, and that such quorum may not be less than one-third of the outstanding voting stock.

Our articles of association provide for an independent proxy holder elected by our shareholders, who may represent our shareholders at

a general meeting of shareholders, and we must provide shareholders with an agenda and other relevant documents for the general meeting

of shareholders. Our practice varies from the requirement of Nasdaq Listing Rule 5620(b), which sets forth certain requirements regarding

the solicitation of proxies. In addition, we have opted out of shareholder approval requirements for the issuance of securities in connection

with certain events such as the acquisition of stock or assets of another company, the establishment of or amendments to equity-based

compensation plans for employees, a change of control of us, and certain private placements. To this extent, our practice varies from

the requirements of Nasdaq Listing Rule 5635, which generally requires an issuer to obtain shareholder approval for the issuance of securities

in connection with such events.

As a result of the above, you may not have the

same protections afforded to shareholders of companies that are not foreign private issuers.

We may lose our foreign private issuer status,

which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur significant legal,

accounting and other expenses.

We are a foreign private issuer and therefore

we are not required to comply with all of the periodic disclosure and current reporting requirements of the Exchange Act applicable to

U.S. domestic issuers. We may no longer be a foreign private issuer as of June 30, 2024 (or the end of our second fiscal quarter in any

subsequent fiscal year), which would require us to comply with all of the periodic disclosure and current reporting requirements of the

Exchange Act applicable to U.S. domestic issuers as of January 1, 2025 (or the first day of the fiscal year immediately succeeding the

end of such second quarter). In order to maintain our current status as a foreign private issuer, either (a) a majority of our common

shares must be either directly or indirectly owned of record by non-residents of the U.S. or (b) (i) a majority of our executive officers

or directors may not be U.S. citizens or residents, (ii) more than 50 percent of our assets cannot be located in the U.S. and (iii) our

business must be administered principally outside the U.S. If we lost this status, we would be required to comply with the Exchange Act

reporting and other requirements applicable to U.S. domestic issuers, which are more detailed and extensive than the requirements for

foreign private issuers. We may also be required to make changes in our corporate governance practices in accordance with various SEC

and stock exchange rules. The regulatory and compliance costs to us under U.S. securities laws if we are required to comply with the reporting

requirements applicable to a U.S.

domestic issuer may be significantly higher than

the cost we would incur as a foreign private issuer. As a result, we expect that a loss of foreign private issuer status would increase

our legal and financial compliance costs and would make some activities highly time-consuming and costly. We also expect that if we were

required to comply with the rules and regulations applicable to U.S. domestic issuers, it would make it more difficult and expensive for

us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher

costs to obtain coverage. These rules and regulations could also make it more difficult for us to attract and retain qualified members

of our board of directors.

If we fail to maintain an effective system of

internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result,

shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of

our common shares.

Our management is responsible for establishing

and maintaining adequate internal controls over financial reporting. Effective internal controls over financial reporting are necessary

for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud,

among other objectives. Any failure to implement any required new or improved controls, or difficulties encountered in their implementation

could cause us to fail to meet our reporting obligations. In addition, any testing by us conducted in connection with Section 404 of the

Sarbanes-Oxley Act of 2002, or any testing by our independent registered public accounting firm, may reveal deficiencies in our internal

controls over financial reporting, which are deemed to be material weaknesses or that may require prospective or retroactive changes to

our consolidated financial statements or identify other areas for further attention or improvement.

Moreover, if we are not able to comply with the

requirements of Section 404 applicable to us in a timely manner, or if we or our independent registered public accounting firm identifies

deficiencies in our internal control over financial reporting that are deemed to be material weaknesses, the market price of our common

shares could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require

additional financial and management resources. Furthermore, investor perceptions of our company may suffer if deficiencies are found,

and this could cause a decline in the market price of our common shares. Irrespective of compliance with Section 404, any failure of our

internal control over financial reporting could have a material adverse effect on our stated operating results and harm our reputation.

If we are unable to implement these requirements effectively or efficiently, it could harm our operations, financial reporting, or financial

results and could result in an adverse opinion on our internal control over financial reporting from our independent registered public

accounting firm.

If securities or industry analysts do not publish

research, or publish inaccurate or unfavorable research, about our business, the price of our common shares and our trading volume could

decline.

The trading market for our common shares will

depend in part on the research and reports that securities or industry analysts publish about us or our business. If no or too few securities

or industry analysts cover our company, the trading price for our common shares would likely be negatively affected. In addition, if one

or more of the analysts who cover us downgrade our common shares or publish inaccurate or unfavorable research about our business, the

price of our common shares would likely decline. If one or more of these analysts cease coverage of our company or fail to publish reports

on us regularly, demand for our common shares could decrease, which might cause the price of our common shares and trading volume to decline.

There is a substantial likelihood that we will

be a passive foreign investment company (a “PFIC”) for 2023 or future taxable years. If we are a PFIC for any taxable year

during which a U.S. investor owns our common shares, the investor generally will be subject to adverse U.S. federal income tax consequences.

As discussed in our Annual Reports on Form 20-F

for 2019, 2020 and 2022, we were likely a PFIC for our taxable years of 2019, 2020 and 2022. For the reasons described below, there is

a substantial likelihood that we will be a PFIC for our taxable year of 2023. We may also be a PFIC for future taxable years.

Under the Internal Revenue Code of 1986, as amended,

we will be a PFIC for any taxable year in which, after the application of certain look-through rules with respect to subsidiaries, either

(i) 75% or more of our gross income consists of passive income (the “income test”), or (ii) 50% or more of the average value

of our

assets (generally determined on a quarterly basis)

consists of assets that produce, or are held for the production of, passive income (the “asset test”). Passive income generally

includes dividends, interest, certain non-active rents and royalties, and gains from financial investments. Cash is generally a passive

asset. Goodwill (the value of which may be determined by reference to the excess of the sum of a corporation’s market capitalization

and liabilities over the value of its other assets) is generally an active asset to the extent attributable to business activities that

produce active income. For purposes of the above calculations, we will be treated as if we hold our proportionate share of the assets

of, and directly receive our proportionate share of the income of, any other corporation in which we directly or indirectly own at least

25% of the shares of such corporation by value.

We have not obtained valuations of our assets

(including goodwill or going concern value) and thus are not in a position to make a definitive determination regarding their value. However,

the average value of our assets (including goodwill and going concern value) may be implied by reference to our market capitalization,

which has been volatile. As a result, the average value of our goodwill, going concern value and other active assets may not be sufficiently

large in relation to the average value of our passive assets for 2023 (or any other taxable year) for purposes of the PFIC asset test. Because

our PFIC status is a factual annual determination that can be determined only after the end of the relevant taxable year, we cannot express

any definitive view regarding our PFIC status for the current or any future taxable year. However, if the value of our assets is determined

by reference to our market capitalization and our market capitalization does not increase substantially by the end of 2023, we will most

likely be a PFIC for 2023.

In addition, the application of the income test

to a company like us (whose overall losses from research and development activities significantly exceed its gross income) is not entirely

clear. We will be a PFIC for any taxable year under the income test if 75% or more of our gross income (as determined for U.S. federal

income tax purposes) for such year consists of interest and other passive income. Prior to the commercialization and sales of any of our

product candidates, our gross income may consist primarily of upfront or milestone payments and grants (which we believe are likely to

be treated as active income) and interest (which is passive income). The receipt of upfront payments is non-recurring in nature, and the

receipt of grants or milestone payments is subject to various conditions. Therefore, there can be no assurance as to the amount of grants,

milestone payments or upfront payments (if any) that we will receive for any taxable year. Moreover, we may earn income from sublicensing,

which may be passive unless certain conditions are satisfied. There is no assurance that the Internal Revenue Service (“IRS”)

will not challenge the classification of any of our income items for PFIC purposes for any taxable year. Accordingly, there is no assurance

that we will not be a PFIC for any taxable year under the income test.

If we are a PFIC for any taxable year and a U.S.

investor owns our common shares during any portion of that year, we will continue to be treated as a PFIC with respect to the U.S. investor,

even if we are not a PFIC for any subsequent taxable year, unless the U.S. investor makes a “deemed sale” election with respect

to our common shares.

U.S. investors that own our common shares during

any taxable year in which we are (or were) a PFIC generally will be subject to adverse U.S. federal income tax consequences, including

(i) the treatment of all or a portion of any gain on disposition of our common shares as ordinary income, (ii) the application of a deferred

interest charge on such gain and the receipt of certain dividends and (iii) the requirement to file certain reports to the IRS. We do

not intend to provide the information that would enable investors to make a “qualified electing fund” election which, if available,

could materially affect the U.S. federal income tax consequences to investors if we are a PFIC for any taxable year.

For further discussion, see the section in this

prospectus supplement entitled “Tax Considerations—Material U.S. Federal Income Tax Considerations—Passive Foreign Investment

Company.”

Use of Proceeds

We estimate that the net proceeds to us from

the Public Offering will be approximately $46.3 million (CHF 42.3 million), after deducting underwriting discounts and commissions and

estimated offering expenses payable by us.

As of September 30, 2023, we had cash and cash

equivalents of CHF 31.9 million and short-term financial assets of CHF 48.0 million for a total liquidity balance of CHF 79.9 million.

We intend to use the net proceeds from this offering, together with existing liquidity, primarily to strategically invest in research

and clinical development of our current pipeline, our technology platforms, working capital, capital expenditures and general corporate

purposes.

However, due to the uncertainties inherent in

the product development process, it is difficult to estimate with certainty the exact amounts of the net proceeds from the Public Offering

that may be used for the above purposes. The amount and timing of our actual expenditures will depend upon numerous factors, including

the results of our research and development efforts, the timing and success of our ongoing preclinical and clinical studies or preclinical

and clinical studies we may commence in the future and the timing of regulatory submissions. As a result, our management will have broad

discretion over the use of the net proceeds from the Public Offering, and investors will be relying on our judgment regarding the application

of the net proceeds. In addition, we might decide to postpone or not pursue certain preclinical activities or clinical studies if the

net proceeds from the Public Offering and our other sources of cash are less than expected.

Pending the use of the proceeds from the Public

Offering, we intend to invest the net proceeds in short-term, interest-bearing deposits. We are likely to convert a substantial amount

of the proceeds into CHF shortly after the closing of the Public Offering.

Dividend Policy

We have never declared

or distributed dividends on our capital stock. We intend to retain all available funds and any future earnings, if any, to fund the development

and expansion of our business and we do not anticipate distributing any dividends in the foreseeable future. Any future determination

related to dividend policy will be made at the discretion of our board of directors.

Under Swiss law, any

dividend must be approved by our shareholders. In addition, our auditors must confirm that the dividend proposal of our board of directors

conforms to Swiss statutory law and our articles of incorporation. A Swiss corporation may pay dividends only if it has sufficient distributable

profits brought forward from the previous business years (report des bénéfices) or if it has distributable reserves

(réserves à libre disposition), each as evidenced by its audited standalone statutory balance sheet prepared pursuant

to Swiss law and after allocations to reserves required by Swiss law and its articles of association have been deducted. Distributable

reserves are generally booked either as “free reserves” (réserves libres) or as “reserve from capital

contributions” (apports de capital). Distributions out of nominal share capital, which is the aggregate nominal value of

a corporation’s issued shares, may be made only by way of a share capital reduction.

Capitalization

The table below sets forth our cash and cash equivalents

and our total capitalization (defined as total debt and equity) as of September 30, 2023:

| · | on an as adjusted basis to give effect to our sale of 14,300,000 shares in the Public Offering, at the public offering price of $3.50

per common share, after deducting underwriting discounts and estimated offering expenses payable by us. |

Investors should read this table in conjunction

with our consolidated financial statements and related notes included in this prospectus supplement and incorporated by reference herein.

For more details on how you can obtain the documents incorporated by reference in this prospectus supplement and the accompanying prospectus,

see “Where You Can Find More Information” and “Incorporation by Reference.”

| | |

As of September 30, 2023 |

| | |

Actual | |

As Adjusted |

| | |

(in thousands of CHF) |

| Cash and cash equivalents | |

| 31,927 | | |

| 74,231 | |

| Short-term financial assets | |

| 48,000 | | |

| 48,000 | |

| Total liquidity | |

| 79,927 | | |

| 122,231 | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Common shares, nominal value CHF 0.02 per share 84,449,352 shares issued and outstanding on an actual basis and 98,749,352 issued and outstanding on an as adjusted basis | |

| 1,802 | | |

| 2,088 | |

| Share premium | |

| 434,451 | | |

| 476,469 | |

| Treasury shares | |

| (106 | ) | |

| (106 | ) |

| Currency translation differences | |

| 5 | | |

| 5 | |

| Accumulated losses | |

| (310,488 | ) | |

| (310,488 | ) |

| Total equity | |

| 125,664 | | |

| 167,968 | |

| Total capitalization | |

| 125,664 | | |

| 167,968 | |

The number of common shares in the table above

excludes 92,540 of our common shares which were issued upon the exercise of options and restricted share units between January 1, 2023

and September 30, 2023 and have not been registered and an additional 6,342,329 common shares which will be issuable upon the exercise

of options and restricted share units outstanding under our existing equity incentive plans at a weighted-average exercise price of CHF

3.51 per common share.

Dilution

If you invest in our common shares in this offering,

your ownership interest will be diluted immediately to the extent of the difference between the price you pay in this offering and the

net tangible book value per common share after this offering.

Our net tangible book value as of September 30,

2023 was $82.3 million (CHF 75.2 million), or $0.97 per common share (CHF 0.89 per common share), based on 84,449,352 common shares then

outstanding. Net tangible book value per share represents the amount of our total assets less our total liabilities, excluding intangible

assets, divided by 84,449,352, the total number of our common shares issued and outstanding at September 30, 2023.

After giving effect to the sale by us of 14,300,000

shares in this offering at a public offering price of $3.50 per share, less the underwriting discounts and estimated offering expenses

payable by us, our net tangible book value at September 30, 2023 would have been $128.6 million, or $1.30 per common share. This represents

an immediate increase in net tangible book value of $0.33 per share to existing shareholders and an immediate dilution of $2.20 per share

to investors in this offering. The following table illustrates this per share dilution:

| |

|

(in USD) |

|

(in CHF) |

| Public offering price per share |

|

|

3.50 |

|

|

|

|

3.20 |

|

|

| Historical net tangible book value per share as of September 30, 2023 |

|

|

|

|

0.97 |

|

|

|

|

0.89 |

| Increase per share attributable to new investors purchasing shares in this offering |

|

|

|

|

0.33 |

|

|

|

|

0.30 |

| As adjusted net tangible book value per share after giving effect to this offering |

|

|

1.30 |

|

|

|

|

1.19 |

|

|

| Dilution per share to new investors |

|

|

2.20 |

|

|

|

|

2.01 |

|

|

Swiss Franc amounts have been translated into

U.S. dollars at a rate of CHF 0.914 to USD 1.00, the official exchange rate quoted as of September 30, 2023 by the U.S. Federal Reserve

Bank. Such U.S. dollar amounts are not necessarily indicative of the amounts of U.S. dollars that could actually have been purchased upon

exchange of Swiss Francs on September 30, 2023 and have been provided solely for the convenience of the reader.

The calculations above are based on 84,449,352

common shares outstanding as of September 30, 2023, but excludes 92,540 of our common shares which were issued upon the exercise of options

and restricted share units between January 1, 2023 and September 30, 2023 and have not been registered and an additional 6,342,329 common

shares which will be issuable upon the exercise of options and restricted share units outstanding under our existing equity incentive

plans at a weighted-average exercise price of CHF 3.51 per common share.

In addition, we may choose to raise additional

capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating

plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of such

securities may result in further dilution to our shareholders.

Tax Considerations

Swiss Tax Considerations

The following summary contains a description

of material Swiss tax consequences of the acquisition, ownership and disposition of Offered Shares, but it does not purport to be a comprehensive

description of all of the Swiss tax considerations that may be relevant to a decision to purchase, own or dispose. In particular, the

summary does not take into account the specific circumstances of any particular investor.

This summary is based on the tax laws, regulations

and regulatory practices of Switzerland as in effect on the date hereof, all of which are subject to change (or subject to changes in