UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024

Commission File Number: 001-37891

AC IMMUNE SA

(Exact name of registrant as specified in its

charter)

EPFL Innovation Park

Building B

1015 Lausanne, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

AC IMMUNE SA |

| |

|

|

| |

|

|

| |

|

|

By: |

/s/ Andrea Pfeifer |

| |

|

|

|

Name: |

Andrea Pfeifer |

| |

|

|

|

Title: |

Chief Executive Officer |

| |

|

|

By: |

/s/ Christopher Roberts |

| |

|

|

|

Name: |

Christopher Roberts |

| |

|

|

|

Title: |

Chief Financial Officer |

Date: May 21, 2024

EXHIBIT INDEX

* Filed herewith.

Exhibit 99.1

INVITATION TO THE ANNUAL GENERAL MEETING 2024 to the Shareholders of AC Immune SA Thursday, 20 June 2024 2:30pm CEST 8:30am EDT

Our goal is global leadership in Precision Medicine for the diagnosis and treatment of neurodegenerative diseases We are executing a clear business strategy built on three pillars: Accelerate development of novel therapeutics in Alzheimer’s disease (AD) Expand our strategic focus in Parkinson’s disease (PD) and NeuroOrphan indications Continued focus on Precision Medicine alzheime r ’ s par k in s o n ’ s disease and neuro orphans diagnostics

Contents 2 4 6 6 7 7 8 9 12 14 Letter to shareholders Overview Agenda & proposals 1. 2023 IFRS Consolidated Financial Statements, 2023 Statutory Financial Statements, 2023 Compensation Report 2. Appropriation of Losses 3. Discharge of the Members of the Board of Directors and the Executive Committee 4. Compensation for the Members of the Board of Directors and the Executive Committee 5. Re - elections 6. Changes in the Articles of Association Organizational notes Organizational notes Legal notes Say on Pay Shareholder information on compensation proposals 16 Annex 1 Proposals for revisions of AC Immune SA’s Articles of Association 19 1 | AC Immune Invitation to the Annual General Meeting 2024

Letter to shareholders We are delighted to invite you to AC Immune’s 8th Annual General Meeting (AGM) as a public company. For those who cannot attend in person, we kindly invite you to vote through the elected Independent Proxy. We are pleased to present to you our 2023 IFRS Consolidated Financial Statements and 2023 Statutory Financial Statements to be approved by shareholders. This year’s Annual Report again contains our Environmental, Social and Governance Report. In review, 2023 brought welcome developments in terms of pipeline progression with the focused financing concluded in December positioning the Company for further success. The recent landmark agreement announced with Takeda, potentially worth over USD 2 billion, provided us with an extraordinary opportunity to derisk ACI - 24.060 and further accelerate its development towards commercialization. This deal again highlights our leadership in active immuno - therapy for neurodegenerative disease, and underscores our commitment to deliver as soon as possible on the promise of Precision Prevention. You can find a full description of our activities and financials at ir.acimmune.com . Our focus on active immunotherapies to treat NDDs... With tremendous progress on our three active immuno - therapies ACI - 24.060, ACI - 35.030, and ACI - 7104.056, targeting the hallmark pathologies of Amyloid beta (Abeta), Tau, and alpha - synuclein (a - syn), respectively, we are leading the way towards delivering innovative new approaches to Alzheimer’s Disease (AD), Parkinson’s Disease (PD) and potentially other neurodegenerative diseases (NDDs). Our first - in - class vaccine candidate targeting phospho - Tau, ACI - 35.030, has now entered a large Phase 2b clinical trial program in preclinical AD with our partner, Janssen Pharmaceuticals Inc. (a Johnson & Johnson Company). This development, announced last December, came with an initial CHF 15 million milestone payment and is expected to deliver another CHF 25 million with the achievement of a predefined patient enrollment target. We are driving forward with our a - syn targeted active immunotherapy, ACI - 7104.056, for PD. We completed the enrolment of the first cohort in the VacSYn Phase 2 clinical trial and we anticipate reporting initial safety and immunogenicity findings in the second half of 2024. ...spurs us towards the goal of prevention of neurodegeneration Our goal is to shift the treatment paradigm to earlier intervention and ultimately, prevention. With Takeda now alongside, the innovative ABATE Phase 2 clinical trial of our anti - Abeta active immunotherapy, ACI - 24.060, in patients with prodromal AD and individuals with Down syndrome, continues to progress well, with its impact on amyloid plaque levels in AD patients after 6 and 12 months of therapy being reported in 2024. Following the Fast Track designation received from the US FDA in June 2023, we are opening new clinical trial sites in the US to enroll individuals with Down syndrome. The disease - modifying potential of immunotherapeutic approaches for AD has been clinically validated and accepted by the FDA. We believe however, that the best modality with the right features for long - term prevention is active immuno - therapy which is why both ACI - 24.060 and ACI - 35.030 are being tested in individuals with earlier - stage or even Douglas Williams, Chair Dear Shareholders, Andrea Pfeifer, Chief Executive Officer 2 AC Immune Invitation to the Annual General Meeting 2024 | Letter to shareholders

preclinical AD. The same is true for our other programs in diseases such as PD. We firmly believe that AC Immune’s programs will have a profound social and economic impact with potential to be employed worldwide. Leading in Precision Medicine: advancing development of novel diagnostic agents As a leader in the emerging field of Precision Medicine for neurodegenerative diseases (NDDs), AC Immune has a selection of product candidates in development as imaging agents or for testing biofluids. These candidates offer more detailed information to enhance the characterization of specific disease pathologies in patients, and 2023 saw multiple development milestones achieved. Many of these developments are based on the strength of our Morphomer technology platform. A Phase 3 clinical trial of PI - 2620, our positron emission tomography (PET) tracer for Tau, is ongoing by our partner, Life Molecular Imaging, to generate gold - standard evidence for the tracer and enable regulatory approval for use as an imaging agent in AD. Our other PET tracer programs targeting a - syn and TDP - 43 continue to progress apace, building on earlier breakthroughs such as that seen with ACI - 12589, the first - ever a - syn PET tracer to distinguish multiple system atrophy (MSA) from other a - syn pathologies. The a - syn - PET program has produced more candidates with profiles better suited to detection of PD. TDP - 43 is an important target in multiple NDDs such as amyotrophic lateral sclerosis (ALS) and frontotemporal lobar degeneration (FTLD) and as a prominent co - pathology in AD and PD. To enable the characterization of pathologies related to TDP - 43 proteinopathy, our programs developing a biofluid assay (in cerebrospinal fluid, CSF) and PET tracer specific for this target have been advancing. We anticipate the PET tracer to be cleared for clinical development later in 2024. Management strength and continuity As part of our plans to ensure the Company remains positioned appropriately for the enormous opportunities and challenges of successfully bringing innovative new therapies and diagnostics to bear against neurodegenerative diseases, the management team moves from strength to strength. We recently announced changes to our Executive Leadership, including the appointments of Christopher Roberts (Chief Financial Officer) and Dr Madiha Derouazi (Chief Scientific Officer). To ensure continuity, Dr Marie Kosco - Vilbois remains with the company as an expert Scientific Advisor and we thank her for her outstanding commitment and service to the Company as CSO over the past 5 years. In December, despite the ever - challenging environment in the financial markets, we executed a focused financing transaction raising USD 50 million before expenses, alongside the news of ACI - 35.030 progressing into the Phase 2 b trial and the associated CHF 15 million milestone payment, allowing us to extend our cash runway into 2026 and providing us with important Balance Sheet strength . Looking into the future There is no doubt that 2024 promises to deliver significant milestones for the Company on multiple fronts, which we are eagerly looking forward to sharing with you. We want to sincerely thank all our stakeholders for their continuing support. We continue to push to bring much needed innovation to the clinical management and prevention of neurodegenerative diseases and remain committed in 2024 to consolidating AC Immune’s position at the forefront of delivering on the promise of precision prevention! We look forward to meeting with you in person at our AGM this year and thank you again for your ongoing support. If you cannot attend, we encourage you to exercise your voting rights through the Independent Proxy. Yours sincerely, Douglas Williams Chair Andrea Pfeifer Chief Executive Officer

1. 2023 IFRS Consolidated Financial Statements, 2023 Statutory Financial Statements, 2023 Compensation Report 1. Approval of 2023 IFRS Consolidated Financial Statements and 2023 Statutory Financial Statements 2. Advisory vote on the 2023 Compensation Report 2. Appropriation of Losses 3. Discharge of the Members of the Board of Directors and the Executive Committee 4. Compensation for the Members of the Board of Directors and the Executive Committee 1. Binding vote on Maximum Aggregate Compensation for Members of the Board of Directors from the AGM 2024 to the AGM 2025 2. Binding vote on Maximum Aggregate Compensation for Members of the Executive Committee for the financial year 2025 5. Re - elections 1. Re - elections of Members of the Board of Directors 2. Re - elections of Members of the Compensation, Nomination & Corporate Governance Committee 3. Re - election of the Statutory Auditors 4. Re - election of the Independent Proxy 6. Changes in the Articles of Association 1. Capital band (Article 3a) 2. Increase of conditional share capital for employee benefit plans (Article 3c paras. 1 and 3) 3. Changes related to the share register (Article 4 paras. 2, 3, 4, 5 and 6) 4. Other changes O v e r vie w 4 AC Immune Invitation to the Annual General Meeting 2024 | Overview

AGENDA & PRO P O S A LS

1. 2023 IFRS Consolidated Financial Statements, 2023 Statutory Financial Statements, 2023 Compensation Report 1. Approval of 2023 IFRS Consolidated Financial Statements and 2023 Statutory Financial Statements The Board of Directors proposes that the 2023 IFRS Consolidated Financial Statements and the 2023 Statutory Financial Statements be approved. d explanation In their reports to the General Meeting, PricewaterhouseCoopers SA, the independent auditors, recommend approval of the 2023 IFRS Consolidated Financial Statements and 2023 Statutory Financial Statements without reservations. Accordingly, the Board of Directors proposes the approval of the 2023 IFRS Consolidated Financial Statements and 2023 Statutory Financial Statements. The 2023 IFRS Consolidated Financial Statements as well as the 2023 Statutory Financial Statements are available to the shareholders online at ir.acimmune.com/events/agm . 1.2 Advisory vote on the 2023 Compensation Report The Board of Directors proposes that the 2023 Compensation Report be endorsed (non - binding advisory vote). d explanation The 2023 Compensation Report as filed with the US SEC as Exhibit 99.2 to the Company’s Form 6 - K on 14 March 2024 can be downloaded from the Company’s website: ir.acimmune.com/sec - filings . It explains the governance framework and the principles underlying the compensation structure at AC Immune. In addition, the 2023 Compensation Report sets out the remuneration of the Board of Directors and the Executive Committee for 2023 as required under the Swiss Code of Obligations as in force since 1 January 2023. 2. Appropriation of Losses The Board of Directors proposes the following appropriation of losses: C HF ’ 000 Accumulated profit (loss) at Jan 1, 2023 Net profit (loss) for the year 2023 (262’115) ( 4 8 ’ 88 3 ) Accumulated losses brought forward (310’998) Under IFRS accounting standards, the consolidated net loss for the business year 2023 amounted to CHF 54’233K. d explanation The net loss for the year 2023 is carried forward. Agenda & proposals 6 AC Immune Invitation to the Annual General Meeting 2024 | Agenda & proposals

3. Discharge of the Members of the Board of Directors and the Executive Committee The Board of Directors proposes that all Members of the Board of Directors and the Executive Committee be granted discharge for the financial year 2023. d explanation The Board of Directors proposes to proceed in one single vote for the discharge of all Members of the Board of Directors and the Executive Committee. The discharge only applies with respect to disclosed facts. 4. Compensation for the Members of the Board of Directors and the Executive Committee 1. Binding vote on Maximum Aggregate Compensation for Members of the Board of Directors from the AGM 2024 to the AGM 2025 The Board of Directors proposes the approval of the total maximum amount of compensation for the Members of the Board of Directors of CHF 883K (excluding employer social security contributions) covering the period from the AGM 2024 to the AGM 2025. d explanation The Board of Directors (Board) submits to the AGM for approval the total maximum aggregate amount of compensation for the Members of the Board for their upcoming term of office and for the Members of the Executive Committee (EC) for the financial year 2025 as per agenda items 4.1 and 4.2. The Board, upon recommendation of the Compensation, Nomination and Corporate Governance Committee, will decide upon the allocation of compensation. More detailed information on the proposals can be found in the section entitled “Say on Pay: Shareholder information on compensation proposals”. 4.2 Binding vote on Maximum Aggregate Compensation for Members of the Executive Committee for the financial year 2025 The Board of Directors proposes the approval of the total maximum amount of compensation for the Members of the Executive Committee of CHF 7’605K (excluding employer social security contributions) from 1 January 2025 to 31 December 2025. d explanation The explanation above for agenda item 4.1 also extends to this item 4.2. 7 Agenda & proposals | AC Immune Invitation to the Annual General Meeting 2024

5. Re - elections 1. Re - elections of Members of the Board of Directors The Board of Directors proposes that each of the following persons be re - elected for a term of office until the end of the Annual General Meeting 2025: • Douglas Williams as Member and Chair of the Board of Directors and as Members of the Board of Directors: • Monika Bütler • Carl June • Werner Lanthaler • Andrea Pfeifer • Monica Shaw • Roy Twyman d explanation The AGM elects individually the Members of the Board of Directors and its Chair for a term of one year until completion of the next AGM. Only re - elections of current Members of the Board of Directors are being proposed. The proposed composition of the Board of Directors is of seven directors, of which three are women (43%). Of the seven members of the Board of Directors, six are considered independent within the meaning of the Swiss Code of Best Practice for Corporate Governance of Economiesuisse. Following evaluation by the Compensation, Nomination & Corporate Governance Committee and after careful consideration, the Board of Directors has determined that the Board and its committees have an appropriate balance of skills, experience, diversity and knowledge of AC Immune’s business to effectively fulfill its duties and responsibilities. For further information on the proposed candidates, please refer to the section of the Company’s website: acimmune.com/en/board - of - directors/ . 2. Re - election of Members of the Compensation, Nomination & Corporate Governance Committee The Board of Directors proposes that: • Monika Bütler • Roy Twyman • Douglas Williams be re - elected as Members of the Compensation, Nomination & Corporate Governance Committee for a term of office until the end of the Annual General Meeting 2025. d explanation The AGM elects individually each Member of the Compensation, Nomination & Corporate Governance Committee for a term of one year until completion of the next AGM. After careful consideration, the Board of Directors has determined that with the proposed Members, the Compensation, Nomination & Corporate Governance Committee has an appropriate balance of skills, experience and knowledge of AC Immune’s business to effectively fulfill its duties and responsibilities. Subject to her election, the Board intends to re - appoint Monika Bütler as Chair of the Compensation, Nomination & Corporate Governance Committee. Agenda & proposals continued 8 AC Immune Invitation to the Annual General Meeting 2024 | Agenda & proposals

5.3 Re - election of the Statutory Auditors The Board of Directors proposes that PricewaterhouseCoopers SA, in Pully, Switzerland, be re - elected as Statutory Auditors for the financial year 2024. d explanation PricewaterhouseCoopers SA has been the external auditor of the Company since 2018. They have reconfirmed to the Board that they have the independence required to perform this function. 5.4 Re - election of the Independent Proxy The Board of Directors proposes that Reymond & Associés, Lausanne, be re - elected as Independent Proxy for a term of office until the end of the Annual General Meeting 2025. d explanation The AGM elects the Independent Proxy for a one - year term until completion of the next AGM. Reymond & Associés, Lausanne, have functioned as Independent Proxy since the 2020 AGM and meet the independence criteria. The Independent Proxy may receive instructions from shareholders who do not wish to attend the AGM. See Organizational Notes on pages 12 - 13 of this Invitation. 6. Changes in the Articles of Association The Board of Directors submits to the approval by the shareholders proposals 6.1 to 6.4 regarding the amendments of the Articles of Association which are set out and explained in Annex 1 to this AGM 2024 Invitation “Proposals for revisions of AC Immune SA’s Articles of Association” and the text of the Articles of Association available on the Company’s website at: ir.acimmune.com/events/agm . The Board of Directors submits the proposals regarding the introduction of a capital band (proposal 6.1), regarding a conditional share capital increase for employee share benefit plans (proposal 6.2) and regarding the share register (proposal 6.3), which are each subject to a qualified majority of the votes, to individual votes, and all other proposed changes, which are subject to simple majority, to one single vote. d explanation These amendments are proposed to reflect amendments brought by the Swiss corporate law reform which entered into force in January 2023 for implementation by Swiss companies within a period of two years thereafter. Some of these proposals address mandatory adjustments while other changes are proposed to adjust the Articles of Association to new commonly accepted standards. Finally, cosmetic changes and translation adjustments are also proposed by the Board of Directors. The detailed amendments are described in Annex 1 to this AGM 2024 Invitation. 6.1 Capital band (Article 3a) The Board of Directors proposes to replace the existing authorized share capital with a capital band with an upper limit of CHF 2 ’ 882 ’ 858 . 10 and a lower limit of CHF 2 ’ 082 ’ 858 . 10 , authorizing the Board of Directors to increase and/or decrease the Company’s share capital one or several times within these limits until 20 June 2029 , and accordingly to amend Article 3 a of the Articles of Association as reflected in Annex 1 to this AGM 2024 Invitation . d explanation See the explanation in Annex 1 to this AGM 2024 Invitation. 9 Agenda & proposals | AC Immune Invitation to the Annual General Meeting 2024

6.2 Increase of conditional share capital for employee benefit plans (Article 3c paras. 1 and 3) The Board of Directors proposes to increase the conditional share capital for employee benefit plans from CHF 91’844.20 to CHF 129’844.20 as reflected in Annex 1 to this AGM 2024 Invitation. d explanation See the explanation in Annex 1 to this AGM 2024 Invitation. 6.3 Changes related to the share register (Article 4 paras. 2, 3, 4, 5 and 6) The Board of Directors proposes to change Article 4 paras. 2, 3, 4, 5 and 6 of the Articles of Association as reflected in Annex 1 to this AGM 2024 Invitation. d explanation See the explanation in Annex 1 to this AGM 2024 Invitation. 6.4 Other changes The Board of Directors proposes to change the following Articles as reflected in Annex 1 to this AGM 2024 Invitation and the text of the Articles of Association available on the Company’s website at: ir.acimmune.com/events/agm : Article 6 para. 2; Article 7; Article 8; Article 9; Article 10; Article 11; Article 12; Article 15 para. 2; Article 17 paras. 2 and 3; Article 18 paras. 2 - 4; Article 20 para. 2; Article 21; Article 23 para. 1; Article 26; Article 28; Article 29 paras. 1, 3 and 5; Article 30; Article 32 para. 2; Article 33; Article 37; Article 38; Article 39; Article 40 para. 1; Article 41; Article 46 para. 2 and Article 47. d explanation See the explanation in Annex 1 to this AGM 2024 Invitation. Agenda & proposals continued 10 AC Immune Invitation to the Annual General Meeting 2024 | Agenda & proposals

ORG A NIZ A T IO N A L NOTES

Availability of the 2023 IFRS Consolidated Financial Statements, the 2023 Statutory Financial Statements, and the 2023 Compensation Report The 2023 IFRS Consolidated Financial Statements, 2023 Statutory Financial Statements and 2023 Compensation Report, as well as the Reports of the Auditors for 2023 are included in the Annual Report 2023 which may be downloaded from the Company’s website at ir.acimmune. com/events/agm or you may order a printed copy at no cost via email at agm@acimmune.com indicating your mailing address. Please note that the Annual Report 2023 is only available in English. Exercise of voting rights Only shareholders holding shares as of 13 May 2024 at 4:00 PM US Eastern Time, and who have not sold their shares prior to the Annual General Meeting 2024 (“AGM”), are eligible to vote their shares. Shareholders who newly acquired shares after 13 May 2024 at 4:00 PM US Eastern Time are not entitled to vote. Proxy appointment Shareholders may attend the AGM in person or be represented at the AGM by their legal or duly authorized representative or by the Independent Proxy, Reymond & Associés Attorneys, Lausanne, Switzerland. Invitation Shareholders who are registered with Computershare Trust Company N.A. (“Computershare”) on 13 May 2024 (“Registered Shareholders”) will receive their AGM invitation and a personalized Proxy Card from Computershare. Shareholders who hold their shares through their broker or bank (“Beneficial Owners”), should receive or request these materials through their broker or bank and should be able to vote on the broker/bank portal . Voting Shareholders may vote electronically, attend the AGM in person, be represented by an eligible proxy in person, or use a Proxy Card for the Independent Proxy . Electronic voting Registered Shareholders can give voting instructions electronically through the Computershare portal with their individual shareholder number. Beneficial Owners should give instructions electronically through their nominee, custodian, broker or bank, following their instructions. Electronic voting instructions must be received not later than 18 June 2024 at 11:59 PM, US Eastern Time. Electronic voting instructions will be represented at the AGM by the Independent Proxy, Reymond & Associés Attorneys, Lausanne, Switzerland. Attendance at the AGM Shareholders who do not wish to give voting instructions to the Independent Proxy electronically may attend the AGM in person and should send to the Company by email ( agm@acimmune.com ) their attendance card which is incorporated in the Proxy Card, and present themselves at the admission desk at least 20 minutes prior to the AGM with the documents listed in the section “Necessary Documents” below. Alternatively, they may also be represented by an eligible proxy (see instructions in the next section). The venue for the AGM, at 2:30 PM Central European Summer Time, is : EPFL Innovation Park Building E Luna Conference Room 1015 Lausanne Switzerland Shareholders who have appointed and instructed the Independent Proxy can attend the AGM in person, but may not vote their shares at the AGM, as their votes are already tabulated with the Independent Proxy. Therefore, shareholders who wish to vote in person must leave the proxy voting sections in the proxy card blank and select the personal attendance option, when returning the attendance card to the Company. Organizational notes 12 AC Immune Invitation to the Annual General Meeting 2024 | Organizational notes

Representation at the AGM Shareholders may be represented at the AGM by their legal representative or by another duly authorized representative. Such representatives should present themselves 20 minutes prior to the AGM with the documents listed in the section “Necessary Documents” below. Representation at the AGM by the Independent Proxy Alternatively, shareholders may also give their voting instructions with the Proxy Card to the Independent Proxy, either by email at the address: cherpillod@jmrlegal.ch . or at the postal address: Reymond & Associés Attorneys, Avenue de la Gare 1, PO 7255, 1002 Lausanne, Switzerland, for delivery together with the documents listed in the section “Necessary Documents” below. Such instructions have to arrive at the Independent Proxy not later than 20 June 2024 at 10 AM, Central European Summer Time. Once received by the Independent Proxy, voting instructions may not be changed by shareholders . Should the Independent Proxy receive voting instructions from shareholders both electronically and in writing, only the electronic instructions will be taken into account . Necessary documents in case of Attendance Documents to be presented by shareholders attending the AGM in person or being represented by an eligible representative are: • for representatives (if applicable), a document proving the representation to the satisfaction of the Company, • a photocopy of a valid passport or identity card of the shareholder, • a most recent bank statement establishing the number of shares in their nominal ownership, and • a signed declaration of honor confirming that the shareholder was the owner of the represented shares on 13 May 2024 and that they have not issued electronic voting instructions to the Independent Proxy nor sold the shares prior to the AGM. If for any reason shareholders have not received an Invitation or their Proxy Card, a model Proxy Card and a model declaration of honor may be downloaded from the Company’s website at: ir.acimmune.com/events/agm . 13 Organizational notes | AC Immune Invitation to the Annual General Meeting 2024

Legal notes Shareholder proposals on Agenda Items Proposals from shareholders on agenda items are only permissible if they are submitted to the AGM by the shareholders themselves or by an eligible representative acting on their behalf. The Independent Proxy will not act as a representative for this purpose. Publication of the Invitation Per AC Immune’s Articles of Association, the official Invitation to the Annual General Meeting 2024 will be published in the Swiss Official Gazette of Commerce (“SOGC”) on or before 31 May 2024. Concurrently with the publication in the SOGC, AC Immune’s website “Investors/Annual General Meeting 2024” on ir.acimmune.com/events/agm will display a copy of the publication and provide a link to the publication as soon as it is released in the SOGC. Ecublens, 21 May 2024 AC Immune SA On behalf of the Board of Directors Douglas Williams Chair of the Board of Directors 14 AC Immune Invitation to the Annual General Meeting 2024 | Legal notes

SAY ON PAY SHAREHOLDER INFORMATION ON COMPENSATION PROPOSALS

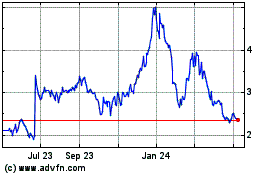

Additional information for the vote on Board and Executive Committee compensation In accordance with Article 734 para. 1 of the Swiss Code of Obligations (CO) and our Articles of Association, the aggregate future compensation of the Board of Directors and the Executive Committee (EC) is submitted to a binding shareholder vote during the AGM. The shareholders’ approval for the compensation of the Board of Directors relates to the one - year period from 1 July 2024 to 30 June 2025 and consists of one vote for the total maximum aggregate amount of compensation . [agenda item 4 . 1 ] The shareholders’ approval for the compensation of the Executive Committee relates to the 2025 financial year and consists of one vote for the total maximum aggregate amount of compensation. [agenda item 4.2] Important information regarding these votes can be found on the following pages. Explanation of the calculations of Board compensation for the 2024 AGM – 2025 AGM term of office The proposed Board compensation structure for the period from the 2024 AGM to the 2025 AGM is similar compared to the previous term of office, while amounts have been adjusted. These include annual fees and equity grant values for the Chair, Vice Chair, and other Board members, as well as the fees for participating in or chairing the Audit and Finance Committee (AFC) and Compensation, Nomination and Corporate Governance Committee (CNC). The planned compensation structure is set out in the following table: Board member fees (non - executive directors) Equity grant Chair of the Board Vice Chair of the Board CHF 87’000 CHF 70’000 CHF 85’000 CHF 75’000 Member of the Board CHF 54’000 CHF 70’000 Committee fees Chair Member Audit and Finance Committee (AFC) CHF 15’000 CHF 10’000 Compensation, Nomination and Corporate Governance Committee (CNC) CHF 15’000 CHF 10’000 The compensation of non - executive Board Members is comprised of a fixed fee for Board membership and additional fees for any Board committee roles. The fees are paid on a per - term basis in two six - month instalments. In addition, each member of the Board receives an annual equity grant with a one - year vesting at the end of their term of appointment. Since 2017, newly appointed Board Members receive a one - time initial equity grant that vests annually over a three - year period. For the 2024 AGM to the 2025 AGM, AC Immune’s Board of Directors will be comprised of our CEO and 6 non - executive Members . Our CEO, Prof . Andrea Pfeifer, is unremunerated for her Board membership . 1’242 883 862 0 500 1’000 1’500 2024 AGM (7 Board members) 2023 AGM (7 Board members) 2022 AGM (9 Board members) The total maximum aggregate amount of compensation is CHF 883K, excluding employer social security contributions, which is an increase of 2.4% (CHF 21K) compared to the previous (2023 – 2024) term, and a 29% reduction compared with the preceding (2022 – 2023) term. This reflects changes to the board size and composition, as well as modest planned adjustments to remuneration of the Chair and Vice Chair. Requested compensation amounts for the Board of Directors Total remuneration: Fees and Equity excluding social security contributions Shareholder information on compensation proposals 16 AC Immune Invitation to the Annual General Meeting 2024 | Shareholder information on compensation proposals

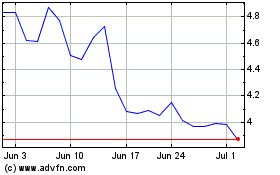

Overview of standard compensation elements for the Executive Committee AC Immune aims to provide competitive compensation to attract, motivate and retain outstanding talent across the Company. Our reward approach is intended to align our people’s core values and business goals with our strategic mission, investor value as well as to enable a healthy company culture. Compensation principles • We design our total compensation to align employee contribution and behaviours with the interests of AC Immune’s shareholders, our business objectives and to recognize the achievement of key goals and milestones • We maximize our Executive Committee’s (EC) accountability, to ensure they take a long - term owner’s perspective and can match the impact of their contribution on our success with meaningful reward through our long - term incentive plan • Compensation and incentive programs are fair and equitable and based on an annual assessment of market data from appropriate, and robust data sources. The peer group comparators selected for the external market assessment, are a representative combination of European and US bio - technology companies and provide an equitable balance of size and market capitalization from which executive talent could be sourced Based on our principles, the Executive Committee’s total compensation is comprised of an annual base salary, benefits, a short - term variable incentive (bonus) and a long - term share - based incentive (equity). • The annual salary, including any other cash payments (e.g. car allowance) reflects the value of individual Executive Committee roles, as well as the level of responsibility, performance, expertise, and potential of each jobholder • Benefits: Employment benefits are provided that are aligned with local market practice and legal requirements and include retirement savings, accident, illness, and pension related insurances (as well as social security contributions). Retirement savings are included in the aggregate amount proposed in the vote; other employment benefits, as well as social security contributions are in addition to the aggregate amount • Short - term incentive (bonus) rewards the achievement of AC Immune’s Company Objectives for the financial year, as well as individual contribution. Bonuses are a fixed target amount, and any bonus is paid during the first quarter of the year following the performance year • Long - Term incentive (equity) awards are designed to drive sustainable long - term contribution to align compensation with shareholder value. For the Executive Committee, the equity grant amount is determined based on performance and is a mixture of Stock Options and Restricted Stock Units. LTI awards are set annually Explanation of the calculations of Executive Committee compensation for the financial year 2025 The total maximum aggregate EC remuneration to be approved by the shareholders for the financial year 2025 totals CHF 7’605K. The modest (0.3%) increase in aggregate remuneration compared with the prior year can be attributed to changes to the resourcing and composition of the Executive Management team. The following chart shows the maximum amounts of EC compensation requested this year and for the prior 2 AGMs. 0 2’000 4’000 6’000 8’000 7’895 7’581 7’605 Requested compensation amounts for Executive Management Jan - Dec 2023 Jan - Dec 2024 Jan - Dec 2025 Total remuneration: cash compensation, benefts and equity 17 Shareholder information on compensation proposals | AC Immune Invitation to the Annual General Meeting 2024

ANNEX 1 TO THE AGM 2024 INVITATION

Proposals for revisions of AC Immune SA’s Articles of Association The Board of Directors proposes to the shareholders to revise the Articles of Association of AC Immune SA according to this Annex 1. The proposed revisions are highlighted in bold text in the right column. The current texts and the revised texts are in English language only. The full Articles of Association with the proposed changes in English and French languages include also the deleted texts in marked - up format and can be accessed on the Company’s website ir.acimmune.com/events/agm as well as in the Swiss Official Gazette of Commerce. The full Articles of Association also contain formal corrections, such as typos, clarifications, paragraph numbering and purely linguistic changes to improve the translation of the prevailing French version. The official invitation to the 2024 Annual General Meeting published in the Swiss Official Gazette of Commerce, which is also accessible on the Company’s website, features the proposals in both English and French languages . Please refer to the Organizational Notes on pages 12 - 13 of the Invitation . Proposal 6.1: Introduction of a capital band d explanation The capital band is a new tool introduced by the 2023 revision of Swiss corporate law giving companies flexibility to raise capital on the financial markets without having to convene a General Meeting of the Shareholders. In particular, the capital band would allow the Company to raise capital on financial markets in order to support the Company’s research and clinical development programs and its execution strategy. It replaces the previous provision on “Authorized Capital”. The Board recommends creating a capital band of approx. 40% of the outstanding capital for a duration of 5 years (until 20 June 2029) in accordance with the new Swiss corporate law, as the previous authorized capital amounting to 5’700’000 shares will expire on 24 June 2024. This 40% ratio is in line with the practice of peer companies in Switzerland listed on US stock exchanges. This proposed amendment is subject to a qualified majority of two thirds of the represented share votes at the Annual General Meeting. Proposed amendments: Current Text Amended Text (additions in Bold characters) Art. 3a Authorized Capital Increase of Share Capital The Board of Directors is authorized to increase the share capital, in one or several steps, until 24 June 2024, by a maximum amount of CHF 114’000 by issuing a maximum of 5’700’000 registered shares with a par value of CHF 0.02 each, to be fully paid up. An increase of the share capital (i) by means of an offering underwritten by a financial institution, a syndicate or another third party or third parties, followed by an offer to the then - existing shareholders of the Company and (ii) in partial amounts, shall also be permissible. Art. 3a Capital Band 1 The Company has a capital band ranging from CHF 2’082’858.10, corresponding to 104’142’905 registered shares with a par value of CHF 0.02 each, to be fully paid up (lower limit) to CHF 2’882’858.10, corresponding to 144’142’905 registered shares with a par value of CHF 0.02 each to be fully paid up (upper limit). The Board of Directors is authorized to conduct, one or several , increases and/or reductions of the share capital within the capital band at any time until 20 June 2029. An increase of the share capital (i) by means of an offering underwritten by a financial institution, a syndicate or another third party or third parties, followed by an offer to the then - existing shareholders of the Company and (ii) in partial amounts, shall also be permissible. 19 Proposals for revisions of AC Immune SA’s Articles of Association | AC Immune Invitation to the Annual General Meeting 2024

Current Text Amended Text (additions in Bold characters) The Board of Directors shall determine the time of the issuance, the issue price, the manner in which the new registered shares have to be paid up, the date from which the registered shares carry the right to dividends, the conditions for the exercise of the preemptive rights and the allotment of preemptive rights that have not been exercised. The Board of Directors may allow the preemptive rights that have not been exercised to expire, or it may place with third parties such rights or registered shares, the preemptive rights of which have not been exercised, at market conditions or use them otherwise in the interest of the Company. 2 In case of a capital increase, the following applies: The Board of Directors shall determine the amount of share capital to be issued, the date of the issuance, the issue price, the manner in which the new registered shares have to be paid up (including cash contributions, contributions in kind, set - off and conversion of freely usable reserves, including retained earnings, into share capital) , the date from which the registered shares carry the right to dividends, the conditions for the exercise of the preemptive rights and the allotment of preemptive rights that have not been exercised. The Board of Directors is authorized to restrict or to prohibit trading in the preemptive rights to the new shares. The Board of Directors may allow the preemptive rights that have not been exercised to expire, or it may place with third parties such rights or registered shares, the preemptive rights of which have not been exercised, at market conditions or use them otherwise in the interest of the Company. The Board of Directors is authorized to withdraw or limit the preemptive rights of the shareholders and to allot them to third parties: a) if the issue price of the new registered shares is determined by reference to the market price (with a customary discount); or b) for the acquisition of an enterprise, part of an enterprise or participations, or for the financing or refinancing of any of such acquisition, or in the event of share placement for the financing or refinancing of such placement; or c) for raising of capital (including private placements) in a fast and flexible manner which probably could not be reached without the exclusion of the statutory pre - emptive right of the existing shareholders. The Board of Directors is authorized to withdraw or limit the preemptive rights of the shareholders wholly or in part and to allot them to individual shareholders or third parties: a) if the issue price of the new registered shares is determined by reference to the market price (with a customary discount); or b) if the new registered shares are used for the acquisition of an enterprise, part of an enterprise or participations, or for the financing or refinancing of any of such acquisition , for the conversion of loans or claims into shares, for the financing of new investment projects undertaken by the Company, the acquisition or financing of products, intellectual property or licenses, or the financing of strategic initiatives undertaken , or in the event of share placement for the financing or refinancing of such placement ; or c) if the new registered shares are issued for raising of equity capital (including private placements) in a fast and flexible manner where such raising of capital would be difficult or would only be possible at less favorable conditions without the exclusion or restriction of the statutory pre - emptive right of the existing shareholders; or d) if the new registered shares are used either to extend the shareholder base, to increase the free float or for investment by strategic partners; or e) for the participation of members of the Board of Directors, members of the Executive Committee, employees, contractors, consultants or other persons performing services for the benefit of the Company or any of its group companies, whereby increases of the share capital are only admissible up to 5% of the share capital entered in the commercial register at the time of the respective resolution; or f) for other important reasons in the sense of art. 652b para. 2 CO. Proposals for revisions of AC Immune SA’s Articles of Association continued 20 AC Immune Invitation to the Annual General Meeting 2024 | Proposals for revisions of AC Immune SA’s Articles of Association

Current Text Amended Text (additions in Bold characters) The acquisition of registered shares out of authorized capital increase of share capital for general purposes and any transfers of registered shares shall be subject to the restrictions specified in Article 4 of the Articles of Association . 3 The subscription to and acquisition of new registered shares and any subsequent transfer of their ownership shall be subject to the restrictions specified in Article 4 of the Articles of Association . 4 Capital reductions may be performed both by reducing the par value of the shares and by cancelling shares. In case of a reduction of the par value, the Board of Directors shall adapt all provisions of the Articles of Association relating to the par value of the shares as well as the number of shares with a new nominal value corresponding to the fixed upper and lower limits of the capital band as per art. 3a para. 1 accordingly. 5 In case of a capital reduction within the capital band, the Board of Directors shall, to the extent necessary, determine the number of cancelled shares and the use of the amount of the reduction . 6 The acquisition and holding of shares repurchased for purposes of cancellation under the capital band are, to the extent permitted by law, not subject to the 10% limit for own shares within the meaning of art. 659 para. 2 CO. 7 The Board of Directors is authorized to carry out simultaneous reductions and re - increases of the share capital . Proposal 6.2: Amendment of the amount of the Conditional Share Capital for Employee Benefit Plans (Article 3c paras. 1 and 3 of the Articles of Association) d explanation An increase of the conditional share capital of up to 1,900,000 shares will be needed for employee benefit plans to allow for future short - and medium - term grants of equity to employees to cover the projected needs. The new balance of the conditional capital will amount to 6,492,210 shares compared to the previous balance of 4,592,210 which is fully committed. In addition, in line with new Swiss corporate law, the exercise modalities are described in a new paragraph 3. This proposed amendment is subject to a qualified majority of two thirds of the represented share votes at the Annual General Meeting. Proposed amendments: Current Text Amended Text (additions in Bold characters) Art. 3c Conditional Share Capital Increase for Employee Benefit Plans The share capital of the Company shall be increased by an amount not exceeding CHF 91’844.20 through the issue of a maximum of 4’592’210 registered shares, payable in full, each with a nominal value of CHF 0.02, in connection with the exercise of option rights granted to any employee of the Company or a subsidiary, and any consultant, members of the Board of Directors, or other person providing services to the Company or a subsidiary. Art. 3c Conditional Share Capital Increase for Employee Benefit Plans 1 The share capital of the Company shall be increased by an amount not exceeding CHF 129,844.20 through the issue of a maximum of 6,492,210 registered shares, payable in full, each with a nominal value of CHF 0.02, in connection with the exercise of option rights and/or shares granted to any employee of the Company or a subsidiary, and any consultant, members of the Board of Directors, or other person providing services to the Company or a subsidiary. […] 2 […] 3 The exercise of conversion or option rights, as well as the waiver of such rights, may be exercised by written declaration or by electronic means. […] 4 […] All other paragraphs of Article 3c shall be maintained without amendment. 21 Proposals for revisions of AC Immune SA’s Articles of Association | AC Immune Invitation to the Annual General Meeting 2024

d explanation The following changes are proposed for clarification purposes. This proposed amendment is subject to a qualified majority of two thirds of the represented share votes at the Annual General Meeting. Current Text Amended Text (additions in Bold characters) Art. 4 Share Register […] Art. 4 Share Register 1 […] Upon request, acquirers of shares will be registered in the share register without limitation as shareholders if they expressly certify that they acquired the shares in their own name and for their own account. 2 Upon request, acquirers of shares will be registered in the share register without limitation as shareholders if they expressly certify that they acquired the shares in their own name and for their own account , that there is no agreement on the redemption or return of the respective shares, and that they bear the economic risk associated with the shares. Shareholders may apply for their registration electronically. Persons who do not expressly declare in the registration application that they are holding the shares on their own account (thereafter: nominees) shall forthwith be entered on the share register as shareholders with voting rights up to a maximum of 3 percent of the share capital. Beyond that limit, registered shares of nominees shall only be entered as voting if the nominees in question confirm in writing that they are willing to disclose the names, addresses and shareholdings of the persons on whose account they hold 0.5 percent or more of the share capital. The Board of Directors concludes agreements with nominees that among other things govern the representation of shareholders and the voting rights. 3 Persons who do not expressly make the declarations referred to in art. 4 para. 2 (thereafter: N ominees) shall forthwith be entered in the share register as shareholders with voting rights up to a maximum of 3 percent of the share capital. Beyond that limit, registered shares of N ominees shall only be entered as voting if the N ominees in question disclose the names, addresses and shareholdings of the persons on whose account they hold 0.5 percent or more of the share capital. In particular, shares are not deemed to have been acquired on the shareholder’s own account if the shareholder has entered (or enters) into an agreement on the redemption or return of the relevant shares or if the shareholder does not (or no longer) bear the economic risk associated with the shares. The Board of Directors has the right to conclude agreements with N ominees that , among other things , govern the representation of shareholders and the voting rights. After hearing the registered shareholder or nominee, the Board of Directors may remove entries in the share register with retroactive effect as per the date of entry, if such entry was based on false information. The party affected must be informed of such removal immediately. 4 After hearing the registered shareholder or N ominee, the Board of Directors may remove entries in the share register with retroactive effect as per the date of entry, if such entry was based on false information. The party affected must be informed of such removal immediately. No individual or legal entity may, directly or indirectly, formally, constructively or beneficially own (as defined in the next paragraph below) or otherwise control voting rights (“Controlled Shares”) with respect to 33 1⁄3 % or more of the registered share capital recorded in the Commercial Register except if such individual or legal entity has submitted prior to the acquisition of such Controlled Shares an orderly tender offer to all shareholders with a minimum price of the higher of (i) the volume weighted average price of the last 60 trading days prior to the publication of the tender offer or (ii) the highest price paid by such individual or legal entity in the 12 months preceding to the publication of the tender offer. Those associated through capital, voting power, joint management or in any other way, or joining for the acquisition of shares, shall be regarded as one person. The registered shares exceeding the limit of 33 1⁄3 % and not benefiting from the exemption regarding a tender offer shall be entered in the share register as shares without voting rights. 5 No individual or legal entity may, directly or indirectly, formally, constructively or beneficially own (as defined in the next paragraph below) or otherwise control , alone or acting in concert with others, voting rights (“Controlled Shares”) with respect to 33 1⁄3 % or more of the registered share capital recorded in the Commercial Register except if such individual or legal entity has submitted prior to the acquisition of such Controlled Shares an orderly tender offer to all shareholders with a minimum price of the higher of (i) the volume weighted average price of the last 60 trading days prior to the publication of the tender offer or (ii) the highest price paid by such individual or legal entity in the 12 months preceding to the publication of the tender offer. Those associated through capital, voting power, joint management or in any other way, or joining for the acquisition of shares, shall be regarded as one person. The registered shares exceeding the limit of 33 1⁄3 % and not benefiting from the exemption regarding a tender offer shall be entered in the share register as shares without voting rights. Proposals for revisions of AC Immune SA’s Articles of Association continued Proposal 6.3 : Clarifications of the provision regarding the share register and transferability of the shares (article 4 para. 2, 3, 4, 5 and 6 of the Articles of Association) 22 AC Immune Invitation to the Annual General Meeting 2024 | Proposals for revisions of AC Immune SA’s Articles of Association

Current Text Amended Text (additions in Bold characters) For the purposes of this Article 4, “Controlled Shares” in reference to any individual or entity means: a) all shares of the Company directly, indirectly or constructively owned by such individual or entity; provided that (i) shares owned, directly or indirectly, by or for a partnership, or trust or estate will be considered as being owned proportionately by its partners, or beneficiaries; and (ii) shares owned, directly or indirectly, by or for a corporation will be considered as being owned proportionately by any shareholder owning 50% or more of the outstanding voting shares of such corporation; and (iii) shares subject to options, warrants or other similar rights shall be deemed to be owned; and b) all shares of the Company directly, indirectly beneficially owned by such individual or entity; provided that (ii) (iii) (i) a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise alone or together with other such persons has or shares: (1) voting power which includes the power to vote, or to direct the voting of, such security; and/or (2) investment power which includes the power to dispose, or to direct the disposition of, such security. Any person who, directly or indirectly, creates or uses a trust, proxy, power of attorney, pooling arrangement or any other contract, arrangement, or device with the purpose or effect of divesting such person of beneficial ownership of shares of the Company or preventing the vesting of such beneficial ownership as part of a plan or scheme to evade the provisions of these A rticles of A ssociation shall be deemed to be the beneficial owner of such shares. A person shall be deemed to be the beneficial owner of shares if that person has the right to acquire beneficial ownership of such shares within 60 days, including but not limited to any right acquired: (A) through the exercise of any option, warrant or right; (B) through the conversion of a security; (C) pursuant to the power to revoke a trust, discretionary account, or similar arrangement ; or (D) pursuant to the automatic termination of a trust, discretionary account or similar arrangement . 6 For the purposes of this Article 4, “Controlled Shares” in reference to any individual or entity means: a) all shares of the Company directly, indirectly or constructively owned by such individual or entity; provided that (i) shares owned, directly or indirectly, by or for a partnership, or trust or estate will be considered as being owned proportionately by its partners, or beneficiaries; and (ii) shares owned, directly or indirectly, by or for a corporation will be considered as being owned proportionately by any shareholder owning 50% or more of the outstanding voting shares of such corporation; and (iii) shares subject to options, warrants or other similar rights shall be deemed to be owned; and b) all shares of the Company directly, indirectly beneficially owned by such individual or entity; provided that (ii) (iii) (i) a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise alone or together with other such persons has or shares: (1) voting power which includes the power to vote, or to direct the voting of, such security; and/or (2) investment power which includes the power to dispose, or to direct the disposition of, such security. Any person who, directly or indirectly, creates or uses a trust, proxy, power of attorney, pooling arrangement or any other contract, arrangement, or device with the purpose or effect of divesting such person of beneficial ownership of shares of the Company or preventing the vesting of such beneficial ownership as part of a plan or scheme to evade the provisions of these A rticles of A ssociation shall be deemed to be the beneficial owner of such shares. A person shall be deemed to be the beneficial owner of shares if that person has the right to acquire beneficial ownership of such shares within 60 days, including but not limited to any right acquired: (A) through the exercise of any option, warrant or right; (B) through the conversion of a security; (C) pursuant to the power to revoke a trust, discretionary account, or similar arrangement ; or (D) pursuant to the automatic termination of a trust, discretionary account or similar arrangement . […] 7 […] […] 8 […] Article 4 para. 1, 7 and 8 shall be maintained without amendment. 23 Proposals for revisions of AC Immune SA’s Articles of Association | AC Immune Invitation to the Annual General Meeting 2024

These proposed amendments are subject to a simple majority of the votes of the shares represented at the Annual General Meeting. Article 8 of the Articles of Association is proposed to be amended as follows: Current Text Amended Text (additions in Bold characters) Art. 8 Powers The General Meeting is the supreme body of the Company. It has the following non delegable powers: a) to adopt and amend the Articles of Association; b) to elect and remove the members of the Board of Directors, the Chairman of the Board of Directors, the members of the Compensation Committee, the Auditors and the Independent Proxy; c) to approve the management report and the annual accounts and to determine the allocation of profits, in particular with regard to dividends and bonus payments; d) to discharge the members of the Board of Directors and of the Executive Committee; e) to approve the aggregate amounts of compensation of the Board of Directors and the Executive Committee in accordance with Article 18 of the Articles of Association; f) to pass resolutions concerning all matters which are reserved to the authority of the General Meeting by law or by the Articles of Association. Art. 8 Powers The General Meeting is the supreme body of the Company. It has the following non delegable powers: a) to adopt and amend the Articles of Association; b) to elect and remove the members of the Board of Directors, the Chairman of the Board of Directors, the members of the Compensation, Nomination and Corporate Governance Committee, the Auditors and the Independent Proxy; c) to approve the management report, the annual consolidated and stand - alone accounts and other reports legally required, and to determine the allocation of profits, in particular with regard to dividends; d) to determine the interim dividend and approve the interim account required therefor; e) to pass resolutions on repaying the statutory capital reserve; f) to discharge the members of the Board of Directors and of the Executive Committee; g) to delist the securities of the Company; h) to approve the aggregate amounts of compensation of the Board of Directors and the Executive Committee in accordance with Article 18 of the Articles of Association; and i) to pass resolutions concerning all matters which are reserved to the authority of the General Meeting by law or by the Articles of Association. Article 9 of the Articles of Association is proposed to be amended as follows: Current Text Amended Text (additions in Bold characters) Art. 9 Ordinary General Meeting The Ordinary General Meeting shall be held annually within six months after the close of the business year at such time and at such location, which may be within or outside Switzerland, as determined by the Board of Directors. Art. 9 Ordinary General Meeting The Ordinary General Meeting shall be held annually within six months after the close of the business year . General Meetings are held at such time and at such physical location, which may be within or outside Switzerland, as determined by the Board of Directors . The Board of Directors may provide that shareholders who are not present at the place of the General Meeting may exercise their rights by electronic means and may also order that the General Meeting be held by electronic means without a venue. Proposals for revisions of AC Immune SA’s Articles of Association continued Proposal 6.4 : Other changes to the Articles of Association as outlined below. 24 AC Immune Invitation to the Annual General Meeting 2024 | Proposals for revisions of AC Immune SA’s Articles of Association

Article 10 of the Articles of Association is proposed to be amended as follows: Current Text Amended Text (additions in Bold characters) Art. 10 Extraordinary General Meeting Extraordinary General Meetings may be called by resolution of the General Meeting, the Auditors or the Board of Directors, or by shareholders with voting powers, provided they represent at least 10% of the share capital and who submit (a)(1) a request signed by such shareholder(s) that specifies the item(s) to be included on the agenda, (2) the respective proposals of the shareholders and (3) evidence of the required shareholdings recorded in the share register and (b) such other information as would be required to be included in a proxy statement pursuant to the rules of the country where the Company’s shares are primarily listed. Art. 10 Extraordinary General Meeting Extraordinary General Meetings may be called by resolution of the General Meeting, the Auditors or the Board of Directors, or by shareholders with voting powers, provided they represent at least 5 % of the share capital or of the votes and who submit (a)(1) a request signed by such shareholder(s) that specifies the item(s) to be included on the agenda, (2) the respective proposals of the shareholder ( s ) and (3) evidence of the required shareholdings recorded in the share register and (b) if applicable such other information as would be required to be included in the invitation pursuant to the rules of the country where the Company’s shares are primarily listed. Article 1 1 para. 3 and 6 of the Articles of Association are proposed to be deleted. Article 11 para. 1, 2, 4, 5, 7 and 8 of the Articles of Association are proposed to be amended as follows with a new numbering from para. 2 to 6: Current Text Amended Text (additions in Bold characters) Art. 11 Notice and Agenda of Shareholders’ Meeting Notice of a General Meeting of Shareholders shall be given by the Board of Directors or, if necessary, by the Auditor, not later than twenty calendar days prior to the date of the General Meeting of Shareholders. Notice of the General Meeting of Shareholders shall be given by way of a one - time announcement in the official means of publication of the Company pursuant to Article 46 of these Articles of Association. The notice period shall be deemed to have been observed if notice of the General Meeting of Shareholders is published in such official means of publication, it being understood that the date of publication shall not be computed in the notice period. Shareholders of record may in addition be informed of the General Meeting of Shareholders by ordinary mail or e - mail. Art. 11 Notice and Agenda of Shareholders’ Meeting 1 Notice of a G eneral M eeting shall be given by the Board of Directors or, if necessary, by the Auditor s , not later than twenty calendar days prior to the date of the G eneral M eeting. Notice of the G eneral M eeting shall be given by way of a one - time announcement in the official means of publication of the Company pursuant to Article 46 of these Articles of Association. The notice period shall be deemed to have been observed if notice of the G eneral M eeting is published in such official means of publication, it being understood that the date of publication shall not be computed in the notice period. Shareholders of record may in addition be informed of the G enera l M eeting by ordinary mail or e - mail. The notice of a General Meeting of Shareholders shall specify the items on the agenda and the proposals of the Board of Directors and the shareholder(s) who requested that a General Meeting of Shareholders be held or an item be included on the agenda, and, in the event of elections, the name(s) of the candidate(s) that has or have been put on the ballot for election. 2 The notice of a G eneral M eeting shall specify (i) the date, the starting time, the form and the location of the General Meeting, (ii) the items on the agenda, (iii) the proposals of the Board of Directors with a short explanation for these proposals, (iv) if applicable, any shareholders’ proposals with a short explanation of each, (v) the name and the address of the independent proxy, and (vi), in the event of elections, the name(s) of the candidate(s) that has or have been put on the ballot for election. The Board of Directors shall state the matters on the agenda. [del e t e d] 25 Proposals for revisions of AC Immune SA’s Articles of Association | AC Immune Invitation to the Annual General Meeting 2024

Current Text Amended Text (additions in Bold characters) Shareholders who represent an aggregate of at least 10 percent of the share capital or together representing shares with a nominal value of 1 million Swiss francs may demand that an item be placed on the agenda of a General Meeting of Shareholders. A request for inclusion of an item on the agenda must be requested in writing delivered to or mailed and received at the registered office of the Company at least 120 calendar days before the first anniversary of the date that the Company’s proxy statement was released to shareholders in connection with the previous year’s ordinary General Meeting of Shareholders. However, if no ordinary General Meeting of Shareholders was held in the previous year or if the date of the ordinary General Meeting of Shareholders has been changed by more than 30 calendar days from the date contemplated at the time of the previous year’s proxy statement, request for inclusion of an item on the agenda must be requested not fewer than the later of (i) 150 calendar days prior to the date of the contemplated annual General Meeting or (ii) the date which is ten calendar days after the date of the first public announcement or other notification to the shareholders of the date of the contemplated annual General Meeting. To be timely for an extraordinary General Meeting, a shareholder’s notice to the Secretary must be delivered to or mailed and received at the registered office of the Company not fewer than the later of (i) 120 calendar days before the date of the extraordinary General Meeting of Shareholders or (ii) the date which is ten calendar days after the date of the first public announcement or other notification to the shareholders of the date of the contemplated extraordinary General Meeting of Shareholders. 3 Shareholders who represent an aggregate of at least 0.5 percent of the share capital or of the votes may demand that (i) an item be placed on the agenda of a G eneral M eeting , and (ii) proposals relating to items on the agenda be included in the invitation to the General Meeting . Such requests must be made in writing , delivered to or mailed and received at the registered office of the Company at least 60 calendar days before the first anniversary of the date that the Company’s invitation notice was issued to shareholders in connection with the previous year’s Ordinary General Meeting . Shareholders may submit a brief explanation when requesting an item to be placed on the agenda or making a proposal to be included in the invitation to the General Meeting. Such statement shall be short, clear and concise. Each request for inclusion of an item on the agenda must include (i) a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting; (ii) the name and address, as they appear on the Company’s register of shareholders, of the shareholder proposing such business; (iii) the number of shares of the Company which are beneficially owned by such shareholder; (iv) the dates upon which the shareholder acquired such shares; (v) documentary support for any claim of beneficial ownership; (vi) any material interest of such shareholder in such business; and (vii) a statement in support of the matter and, for proposals sought to be included in the Company’s proxy statement, any other information required by Securities and Exchange Commission Rule “14a - 8”. 4 Each request for inclusion of an item on the agenda or proposal concerning agenda items must include (i) the name and address, as they appear on the Company’s register of shareholders, of the shareholder; (ii) the number of shares of the Company which are beneficially owned by such shareholder; (iii) the dates upon which the shareholder acquired such shares; and (iv) documentary support for any claim of beneficial ownership. In addition, if the shareholder intends to solicit proxies from the shareholders of the Company, such shareholder shall notify the Company of this intent in accordance with the Securities and Exchange Commission Rule “14a - 4” and/or “14a - 8”. [del e t e d] No resolution may be passed at a General Meeting of Shareholders concerning an item in relation to which due notice was not given. Proposals made during a General Meeting of Shareholders to (i) convene a extraordinary General Meeting or (ii) initiate a special investigation in accordance with article 697a of the Swiss Code of Obligations are not subject to the due notice requirement set forth herein. 5 No resolution may be passed at a G eneral M eeting concerning an item in relation to which due notice was not given with the exception of requests for the conven ing of a n E xtraordinary General Meeting, for the initiat ion of a special investigation and for the election of Auditors . No advance notice is required to propose motions on duly notified agenda items and to debate items without passing resolutions. 6 No advance notice is required to propose motions on duly notified agenda items or to debate items without passing resolutions. Proposals for revisions of AC Immune SA’s Articles of Association continued 26 AC Immune Invitation to the Annual General Meeting 2024 | Proposals for revisions of AC Immune SA’s Articles of Association

Article 12 of the Articles of Association is proposed to be amended as follows: Current Text Amended Text (additions in Bold characters) Art. 12 Documentation The annual business report, the compensation report and the Auditor’s report must be submitted for examination by the shareholders at the registered office of the Company at least 20 days prior to the date of the Ordinary General Meeting. Each shareholder may request that a copy of this documentation be sent to him promptly by e - mail. Such right shall be included in the invitation to the General Meeting. Art. 12 Documentation The annual business report, the compensation report, the Auditor s’ report and any other reports that require shareholder approval shall be published on the Company’s website at least 20 days prior to the date of the Ordinary General Meeting. Article 15 of the Articles of Association is proposed to be amended as follows: Current Text Amended Text (additions in Bold characters) Art. 15 Minutes The Board of Directors is responsible for the keeping of the minutes of the Meeting, which shall state the number, kind, nominal value of shares represented by the shareholders, by the corporate bodies and by the independent proxy and gives information on resolutions passed, elections, requests for information and information as well as declarations given by the shareholders. The minutes shall be signed by the Chairman and the Secretary. Art. 15 Minutes 1 The Board of Directors is responsible for the keeping of the minutes of the Meeting, which shall state the number, kind, nominal value of shares represented by the shareholders, by the corporate bodies and by the I ndependent P roxy and gives information on resolutions passed, elections, requests for information and information as well as declarations given by the shareholders. The minutes shall be signed by the Chairman and the Secretary. The shareholders are entitled to inspect the minutes. 2 The shareholders may request access to the minutes within 30 days from the General Meeting . 27 Proposals for revisions of AC Immune SA’s Articles of Association | AC Immune Invitation to the Annual General Meeting 2024

Current Text Amended Text (additions in Bold characters) Art. 17 Resolutions and Elections […] Art. 17 Resolutions and Elections 1 […] The General Meeting shall pass its resolutions and carry out its elections with the simple majority of the votes cast regardless of abstentions and empty or invalid votes, unless statutory law or articles of association state otherwise. In the event of tie votes, the request shall be refused. The Chairman shall not have a casting vote. 2 The General Meeting shall pass its resolutions and carry out its elections with the simple majority of the votes cast regardless of abstentions and empty or invalid votes, unless statutory law or the A rticles of A ssociation state otherwise. In the event of tie votes, the proposal shall be refused. The Chairman shall not have a casting vote. A resolution of the General Meeting passed by at least two thirds of the represented share votes and the absolute majority of the represented shares par value is required for: a) The cases listed in art. 704 para. 1 CO, i.e.: (i) the change of the company purpose; (ii) the creation of shares with privileged voting rights; (iii) the restriction of the transferability of registered shares; (iv) an increase of capital, authorized or subject to a condition; (v) an increase of capital out of equity, against contribution in kind, or for the purpose of acquisition of assets and the granting of special benefits; (vi) the limitation or withdrawal of subscription rights; (vii) the change of the domicile of the Company; and (viii) the liquidation of the Company; b) the merger, de - merger or conversion of the Company (subject to mandatory law); c) the alleviating or withdrawal of restrictions upon the transfer of registered shares; d) the conversion of registered shares into bearer shares and vice versa; and e) the amendment or elimination of the provisions of Article 4 and 29 of the Articles of Association as well as those contained in this Article 17. 3 A resolution of the General Meeting passed by at least two thirds of the represented share votes and the absolute majority of the represented shares par value is required for: a) The cases listed in art. 704 para. 1 CO, i.e.: (i) the change of the C ompany purpose; (ii) the consolidation of shares, unless the consent of all the shareholders concerned is required; (iii) a capital increase from equity capital, in return for contributions in kind or by offset with a claim, and the granting of special privileges; (iv) the restriction or cancellation of the preemptive rights; (v) the introduction of conditional capital, or the introduction of a capital band; (vi) the conversion of participation certificates into shares; (vii) the alleviation or restriction of the transferability of registered shares; (viii) the introduction of shares with preferential right to vote; (ix) change in the currency of the equity capital; (x) the introduction of a casting vote for the chair of the General Meeting; (xi) a provision of the Articles of Association on holding the General Meeting abroad; (xii) the delisting of the equity securities of the Company; (xiii) the change of the domicile of the Company; (xiv) the introduction of an arbitration clause in the Articles of Association; (xv) the dissolution of the Company; b) the merger, de - merger or conversion of the Company (subject to mandatory law); c) the conversion of registered shares into bearer shares and vice versa; and d) the amendment or elimination of the provisions of Article 4 and 29 of the Articles of Association as well as those contained in this Article 17. Article 17 para. 1 shall be maintained without amendment. Proposals for revisions of AC Immune SA’s Articles of Association continued Article 17 para. 2 and 3 of the Articles of Association is proposed to be amended with the new numbering in para. 3 as follows: 28 AC Immune Invitation to the Annual General Meeting 2024 | Proposals for revisions of AC Immune SA’s Articles of Association