UNITED

STATES

SECURITIES AND EXCANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO § 240.13d-2(a)

(Amendment No. 2)*

Adagene, Inc.

(Name of Issuer)

Ordinary

shares, par value USD $0.0001 per share

(Title of Class of Securities)

005329

107**

(CUSIP Number)

Peter Luo

Adagene, Inc.

4F, Building C14, No. 218

Xinghu Street, Suzhou Industrial Park

Suzhou, Jiangsu Province, 215123

People’s Republic of China

+86-512-8777-3632

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

January 19,

2024

(Date of Event Which Requires the Filing of

this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box: ¨

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

Rule 13d-7(b) for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial

filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

| CUSIP: 005329 107** | Page 2 of 8 Pages |

| 1

|

Names of reporting persons

Peter Luo |

| 2 |

Check the appropriate box if a member of a group

(a)

x (b)

¨ |

| 3 |

SEC

use only |

| 4 |

Source of funds

PF; OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Item 2(d) or 2(e) x |

| 6 |

Citizenship or place of organization

United States |

Number

of

shares

beneficially

owned by

each

reporting

person

with |

7 |

Sole Voting Power

12,008,498(1) |

| 8 |

Shared Voting Power

0 |

| 9 |

Sole Dispositive Power

3,245,439(2) |

| 10 |

Shared Dispositive Power

6,334,595(3) |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,008,498 (1) |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

Percent of Class Represented by Amount in Row (11)

21.28%(4) |

| 14 |

Type of Reporting Person

IN |

(1) Represents

(i) 1,799,691 ordinary shares (including ordinary shares represented by the ADSs) held by Peter Luo; (ii) 337,415 ordinary

shares underlying share options granted to Peter Luo that are vested or will be vested within 60 days of February 27, 2024, (iii) 1,075,000

ordinary shares held by Great Han Fortune LP for the benefit of Peter Luo and (iv) 33,333 ordinary shares held by Great Han Fortune

LP for the benefit of Peter Luo that are vested or will be vested within 60 days of February 27, 2024, (v) 6,000,000 ordinary

shares held by HAN 2020 Irrevocable Trust, for which Xiaohong She is the Trustee and may be deemed the beneficial owner, (vi) 52,198

ordinary shares held by Xiaohong She; (vii) 48,230 ordinary shares underlying share options granted to Xiaohong She that are vested

or will be vested within 60 days of February 27, 2024, (viii) 230,000 ordinary shares held by Great Han Fortune LP for the

benefit of Xiaohong She, (ix) 4,167 ordinary shares held by Great Han Fortune LP for the benefit of Xiaohong She that are vested

or will be vested within 60 days of February 27, 2024; (x) total of 1,561,717 ordinary shares (including ordinary shares represented

by the ADSs) held by Raymond Tam, JC Xu, Qinghai Zhao and several key employees of the Company, and (xi) total of 866,747 share

options granted to Raymond Tam, JC Xu, Qinghai Zhao and several key employees that are vested or will be vested within 60 days of February 27,

2024.

(2) Represents

(i) 1,799,691 ordinary shares (including ordinary shares represented by the ADSs) held by Peter Luo; (ii) 337,415 ordinary

shares underlying share options granted to Peter Luo that are vested or will be vested within 60 days of February 27, 2024, (iii) 1,075,000

ordinary shares held by Great Han Fortune LP for the benefit of Peter Luo, and (iv) 33,333 ordinary shares held by Great Han Fortune

LP for the benefit of Peter Luo that are vested or will be vested within 60 days of February 27, 2024.

| CUSIP: 005329 107** | Page 3 of 8 Pages |

(3) Represents

(i) 52,198 ordinary shares held by Xiaohong She; (ii) 48,230 ordinary shares underlying share options granted to Xiaohong She

that are vested or will be vested within 60 days of February 27, 2024, (iii) 230,000 ordinary shares held by Great Han Fortune

LP for the benefit of Xiaohong She, (iv) 4,167 ordinary shares held by Great Han Fortune LP for the benefit of Xiaohong She that

are vested or will be vested within 60 days of February 27, 2024, and (v) 6,000,000 ordinary shares held by HAN 2020 Irrevocable

Trust, for which Xiaohong She is the Trustee and may be deemed the beneficial owner.

(4) Calculated

based on (i) 55,145,839 ordinary shares issued and outstanding as of December 31, 2023, as provided by the Issuer and (ii) 1,289,892

ordinary shares underlying share options granted to Peter Luo-Acting-in-Concert-Group that are vested or will be vested within 60 days

of February 27, 2024.

| CUSIP: 005329 107** | Page 4 of 8 Pages |

| 1

|

Names of reporting persons

HAN 2020 Irrevocable Trust |

| 2 |

Check the appropriate box if a member of a group

(a)

x (b)

¨ |

| 3 |

SEC

use only |

| 4 |

Source of funds

PF; OO |

| 5 |

Check

if disclosure of legal proceedings is required pursuant to Item 2(d) or 2(e) x |

| 6 |

Citizenship or place of organization

California |

Number

of

shares

beneficially

owned by

each

reporting

person

with |

7 |

Sole Voting Power

6,000,000(1) |

| 8 |

Shared Voting Power

0 |

| 9 |

Sole Dispositive Power

6,000,000(1) |

| 10 |

Shared Dispositive Power

0 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

6,000,000 (1) |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

Percent of Class Represented by Amount in Row (11)

10.88%(2) |

| 14 |

Type of Reporting Person

OO |

(1) Represents

6,000,000 ordinary shares held by HAN 2020 Irrevocable Trust, for which Xiaohong She is the Trustee and may be deemed the beneficial

owner.

(2) Calculated

based on 55,145,839 ordinary shares issued and outstanding as of December 31, 2023, as provided by the Issuer.

| CUSIP: 005329 107** | Page 5 of 8 Pages |

The

Amendment No.1 to Schedule 13D filed with the Commission on February 17, 2023 (the “Existing Schedule 13D/A”) by a

Reporting Person relating to the Ordinary Shares, is hereby amended in this Amendment No.2 (the “Amendment” and, together

with the Existing Schedule 13D/A, the “Schedule 13D/A”). This Amendment is being filed to reflect the change of information

set forth in the Existing Schedule 13D/A. Capitalized terms not defined herein have the meanings

ascribed to them in the Existing Schedule 13D/A.

| Item 1. | Security

and Issuer. |

This

statement on the Amendment relates to the ordinary shares, par value USD $0.0001 per share of Adagene Inc. (“Ordinary Shares”,

a Cayman Islands exempted company (the “Issuer”). The address of the principal executive offices of the Issuer is

4F, Building C14, No. 218, Xinghu Street, Suzhou Industrial Park, Suzhou, Jiangsu Province, 215123, People’s Republic of China

| Item 2. | Identity and Background. |

(a)(b)(c)(f) This

statement is being filed by Peter Luo, a United States citizen, and HAN 2020 Irrevocable Trust, a trust established under the

laws of California (collectively, the “Reporting Persons”). Mr. Luo is the Chief Executive Officer, Chairman and Director

of the Issuer. The principal business address of the Reporting Persons is 6042 Cornerstone Ct W, Suite E, San Diego, CA 92121.

(d)(e) Other than as

described below, in the last five years, the Reporting Persons have not been convicted in a criminal proceeding (excluding traffic violations

and similar misdemeanors) nor has he been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with respect to such laws.

| Item 3. | Source and Amount of Funds or Other Consideration. |

The source of funds used

in purchasing the securities beneficially owned by the Reporting Persons are personal funds, except with respect to ordinary shares underlying

or acquired in connection with the exercise of options granted by the Reporting Persons to the Issuer.

| Item 4. | Purpose of Transaction. |

On August 31, 2023,

a member of the Peter Luo-Acting-in-Concert-Group (as defined below) gifted 80,000 ordinary shares to a family member for nil consideration.

On September 28, 2023,

Fangyong (Felix) Du’s resignation became effective; therefore, Fangyong (Felix) Du is no longer subject to the concert party agreement

due to his departure from the Issuer. Accordingly, on the same day, the Reporting Persons ceased to beneficially own the voting power

with respect to Fangyong (Felix) Du’s 1,292,688 ordinary shares.

On December 11, 2023,

Mr. Luo gifted 250,000 ordinary shares to a family member for nil consideration.

On January 19, 2024,

Mr. Luo transferred 4,000,000 ordinary shares to HAN 2020 Irrevocable Trust, which Xiaohong She is the Trustee and may be deemed

the beneficial owner, for estate planning purpose.

On January 31, 2024,

Mr. Luo transferred 2,000,000 ordinary shares to HAN 2020 Irrevocable Trust, which Xiaohong She is the Trustee and may be deemed

the beneficial owner, for estate planning purpose.

On January 31, 2024,

a member of the Peter Luo-Acting-in-Concert-Group received 80,000 ordinary shares from such person’s family member for nil consideration.

| CUSIP: 005329 107** | Page 6 of 8 Pages |

The Reporting Persons acquired

the ordinary shares reported herein for investment and estate planning purposes, in the ordinary course of business. Other than as disclosed

in this Amendment, the Reporting Persons currently do not have any plans or proposals that would result in or relate to any of the transactions

or changes listed in Items 4(a) through 4(j) of the Schedule 13D. Mr. Luo is the Chief Executive Officer and the Chairman

of the Board of Directors of the Issuer. The Reporting Persons, including members of the Peter Luo-Acting-in-Concert-Group, may acquire

additional ordinary shares in the ordinary course of business, including in connection with outstanding options or additional options

to be granted by the Issuer to Mr. Luo and/or share repurchase plan established by Mr. Luo in his personal capacity.

| Item 5. | Interest in Securities of the Issuer. |

(a) and (b) The

information set forth in the cover page for the Reporting Persons is hereby incorporated by reference.

(c) Other

than as discussed in this Amendment, including with respect to ordinary shares underlying options, during the past sixty days prior to

the date of this statement, the Reporting Persons have not acquired any shares of the Issuer’s Ordinary Shares.

(d) No

other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from

the sale of ordinary shares of the Issuer owned by the Reporting Persons.

(e) Not

applicable.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With

Respect to Securities of the Issuer. |

On December 14, 2020,

Peter Luo, Fangyong (Felix) Du, Ping Ren, Dr. Hua Gong, JC Xu, Qinghai Zhao, Man Kin (Raymond) Tam, Xiaohong (Kristine) She, Yan

Li, Guizhong Liu, Alexander Goergen, and, on February 18, 2021, Yu (Albert) Ren) (together, the “Peter Luo-Acting-in-Concert-Group”)

entered into a concert party agreement (the “Agreement”), pursuant to which the parties agree to (i) always be acting

in concert in respect of their respective direct or indirect voting rights at our shareholders’ general meetings, (ii) recognize

the controlling position of Peter Luo; and (iii) act in concert in accordance with Peter Luo’s opinions in respect of the

daily operations and management and the major decision-making of the Issuer.

Dr. Hua

Gong, Yu (Albert) Ren and Fangyong (Felix) Du are no longer subject to the concert party agreement due to their departure from

the Issuer.

| CUSIP: 005329 107** | Page 7 of 8 Pages |

| Item 7. | Materials to be Filed as Exhibits. |

| CUSIP: 005329 107** | Page 8 of 8 Pages |

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: March 1,

2024

| PETER LUO |

| | |

| | /s/ Peter Luo |

| | Name: |

Peter Luo |

| | HAN

2020 IRREVOCABLE Trust |

| | |

| | /s/ Xiaohong She |

| | Name: |

Xiaohong She |

| | Title: |

Trustee |

Exhibit A

Concert Party Agreement

This Concert Party Agreement (hereinafter this “Agreement”)

is executed by and among the following parties on December 14, 2020:

| (1) | Mr. Peter (Peizhi) Luo (the “Founder”); |

| (2) | Mr. Fangyong (Felix) Du (“Mr. Du”); |

| (3) | Ms. Ping Ren (“Ms. Ren”) |

| (4) | Ms. Hua Gong (“Ms. Gong”); |

| (6) | Mr. Qinghai Zhao (“Mr. Zhao”); |

| (7) | Mr. Raymond Tam (“Mr. Tam”) |

| (8) | Ms. Xiaohong (Kristine) She (“Ms. She”); |

| (9) | Ms. Yan Li (“Ms. Li”); |

| (10) | Mr. Guizhong Liu (“Mr. Liu”); |

| (11) | and Mr. Alexander Goergen (“Mr. Goergen”). |

The Founder, Mr. Du, Ms. Ren, Ms. Gong, Ms. Xu,

Mr. Zhao, Mr. Tam, Ms. She, Ms. Li, Mr. Liu and Mr. Goergen are collectively referred to as the “Parties”

and individually referred to as a “Party”.

Whereas:

| (A) | Adagene Inc. (“Adagene”, which, together with the subsidiaries directly or indirectly

controlled by it and its consolidated affiliated entities, are collectively referred to as the “Designated Companies”)

is a limited liability company established under the laws of the Cayman Islands; |

| (B) | Parties all beneficially own, directly or indirectly, either equity interests or equity awards in Adagene. |

| (C) | The Parties propose to reach the following relevant agreements on the control over the Designated Companies and acting in concert. |

| 1.1 | The Parties hereby represent and confirm as follows: |

Since the date on which the Parties

started holding, directly or indirectly, their respective equity interests or equity awards in the Designated Companies: Mr. Du,

Ms. Ren, Ms. Gong, Ms. Xu, Mr. Zhao, Mr. Tam, Ms. She, Ms. Li, Mr. Liu and Mr. Goergen have

all agreed to the operational and management philosophy of Founder; in respect of the respective shareholders and directors’ voting

rights held, directly or indirectly, by the Parties in the Designated Companies, Founder has always been in the controlling position;

and in respect of the daily operations and management and the major decision-making of the Designated Companies during the period, Mr. Du,

Ms. Ren, Ms. Gong, Ms. Xu, Mr. Zhao, Mr. Tam, Ms. She, Ms. Li, Mr. Liu and Mr. Goergen have

all acted in concert in accordance with Founder's opinions. At the shareholders' general meetings and the board meetings of the Designated

Companies, when directly or indirectly exercising their voting rights, Mr. Du, Ms. Ren, Ms. Gong, Ms. Xu, Mr. Zhao,

Mr. Tam, Ms. She, Ms. Li, Mr. Liu and Mr. Goergen have been all in line with Founder's votes, have never opposed

Founder's proposals. Notwithstanding of the foregoing, nothing contained in this Agreement shall prevent any Party in his or her capacity

as an officer or a director of the Designated Companies from taking or failing to take any action that such person reasonably determines

it is obligated to take or not to take in the performance of its fiduciary duties or as otherwise required by the applicable law.

| 1.2 | The Parties hereby undertake as follows: |

The Parties shall (i) always be

acting in concert in respect of their respective direct or indirect voting rights at the shareholders’ general meetings and the

board meetings in the Designated Companies, (ii) recognize the controlling position of Founder; and (iii) act in concert in

accordance with Founder's opinions in respect of the daily operations and management and the major decision-making of the Designated Companies.

At the shareholders' meetings and the board meetings of the Designated Companies, when exercising their voting rights, Mr. Du, Ms. Ren,

Ms. Gong, Ms. Xu, Mr. Zhao, Mr. Tam, Ms. She, Ms. Li, Mr. Liu and Mr. Goergen shall exercise their

voting rights in accordance with Founder's opinions. According to the decisions made in accordance with Founder's opinions at the shareholders’

general meetings and the board meetings of the Designated Companies, Mr. Du, Ms. Ren, Ms. Gong, Ms. Xu, Mr. Zhao,

Mr. Tam, Ms. She, Ms. Li, Mr. Liu and Mr. Goergen shall not challenge or object to such decisions for any reason

whatsoever. Where a Party is unable to attend any shareholders’ general meeting or board meeting of the Designated Companies, its

proxy, if applicable, shall exercise its voting rights in accordance with the aforesaid undertaking.

| 2 | Extension of Acting in Concert |

| 2.1 | The Parties undertake that if any Party sells, transfers, assigns or otherwise disposes of (collectively,

“Transfer”) all or part of the equity interests in any of the Designated Companies held, directly or indirectly, by

it (“Equity Interests”) through means other than (i) disposing via a “national securities exchange”

as defined under Section 6 of the Securities Exchange Act of 1934, as amended or (ii) granting and maintaining a bona fide

lien or security interest in, pledging, hypothecating or encumbering to any person such Equity Interests, then one of the conditions to

the effectiveness of such Transfer of Equity Interests is that the transferee shall agree to be subject to the obligations under this

Agreement and be added as a party to this Agreement. Each Party undertakes to consult with the Founder prior to Transfer of any of its

Equity Interests to ensure orderly sales or transfer of the Equity Interests by the Parties. If any Party Transfers the Equity Interests

without breaching any obligations hereunder, this Agreement shall be terminated with respect to such Party. |

| 2.2 | In the event that any Party breaches any of the foregoing undertakings made by it, it shall, at the request

of the non-defaulting Parties, Transfer all of its Equity Interests to the non-defaulting Parties in the appropriate manner and at an

appropriate price as permitted by law. |

Except as otherwise agreed in this Agreement,

each Party to this Agreement shall use its best endeavors to keep any form of the technical and commercial information, undisclosed information

and materials (including written, verbal, tangible or intangible) of all other Parties acquired by it due to negotiation, execution or

performance of this Agreement strictly confidential, including any content of this Agreement and other potential cooperation matters and

transactions among the Parties. The period of confidentiality shall be until such information and materials have been made public as unanimously

agreed among the Parties. Each Party shall restrict the obtaining of such information by its agents, advisors, etc. only on a need-to-

know basis so as to properly perform the obligations under this Agreement, and to procure such persons to comply with the confidentiality

obligations under this clause.

The Parties agree and confirm that,

the violation of any provision in this Agreement or the failure to exercise any obligations under this Agreement shall constitute a breach

of this Agreement. The non-breaching Party has the right to request the breaching Party to rectify or take remedial measures within ten

(10) days after the non-breaching Party sends notice in writing by mail or electronic mail.

This Agreement and all agreements and/or

documents referred to or expressly contained herein constitute the entire agreement among the Parties with respect to the subject matter

of this Agreement and supersede all prior oral and written agreements, contracts, understanding and communications among the Parties with

respect to the subject matter of this Agreement.

The illegality or invalidity of any

provision of this Agreement shall not affect the validity of any other provisions of this Agreement.

Any amendments to this Agreement shall

be effective and binding upon the Parties only if they are made in writing and signed by the Parties or their respective representatives.

| 8 | Governing Law and Dispute Resolution |

| 8.1 | The Parties agree to negotiate in good faith to resolve any dispute arising out of or in connection with

the interpretation and performance of this Agreement. In the event that the Parties fail to resolve a dispute through negotiation, any

Party may submit any dispute, controversy, disagreement or claim arising out of or relating to this Agreement, including the existence,

validity, interpretation, performance, breach or termination of this Agreement or any non-contractual disputes arising out of or relating

to this Agreement to the arbitration administered by the Hong Kong International Arbitration Centre for final resolution in accordance

with the Arbitration Rules of the Hong Kong International Arbitration Centre in effect at the time of submission of the notice of

arbitration. |

| 8.2 | This Agreement shall be governed by and construed in accordance with the laws of the State of New York without regard to the conflict

of laws thereunder. |

| 8.3 | The number of arbitrator shall be one (1). The arbitration procedure shall be conducted in English. |

The Parties confirm that the undertakings

made by them under this Agreement shall not be changed due to a change in Designated Companies, an increase in capital and share, merger,

division, restructurings or any other matter involving the Designated Companies.

| 10 | Variation or Termination of this Agreement |

| 10.1 | This Agreement shall become effective on the date of signing by the Parties and shall not be varied or

terminated without the unanimous written consent of the Parties. This Agreement shall executed in any number of counterparts, each of

which shall be deemed an original with the same effect. |

| 10.2 | Except for the confidential obligations provided in Article 3, all rights, obligations and undertakings

hereunder will be terminated upon the termination of this Agreement. |

(intentionally left blank below, followed by signature pages)

IN WITNESS WHEREOF, the

Parties have caused this Agreement to be duly executed as of the day first written above.

| |

Peter (Peizhi) Luo |

| |

|

| |

By: |

/s/ Peter Luo |

| |

|

Name: |

Peter Luo |

| |

|

Title: |

Chief Executive Officer |

| |

Fangyong (Felix) Du |

| |

|

| |

By: |

/s/ Fangyong (Felix) Du |

| |

|

Name: |

|

| |

|

Title: |

|

| |

Ping Ren |

| |

|

| |

By: |

/s/ Ping Ren |

| |

|

Name: |

Ping Ren |

| |

|

Title: |

|

| |

Hua Gong |

| |

|

| |

By: |

/s/ Hua Gong |

| |

|

Name: |

Hua Gong |

| |

|

Title: |

|

| |

JC Xu |

| |

|

| |

By: |

/s/ JC Xu |

| |

|

Name: |

JC Xu |

| |

|

Title: |

|

| |

Qinghai Zhao |

| |

|

| |

By: |

/s/ Qinghai Zhao |

| |

|

Name: |

Qinghai Zhao |

| |

|

Title: |

|

| |

Raymond Tam |

| |

|

| |

By: |

/s/ Raymond Tam |

| |

|

Name: |

Raymond Tam |

| |

|

Title: |

|

| |

Xiaohong (Kristine) She |

| |

|

| |

By: |

/s/ Xiaohong She |

| |

|

Name: |

Xiaohong She |

| |

|

Title: |

|

| |

Yan Li |

| |

|

| |

By: |

/s/ Yan Li |

| |

|

Name: |

Yan Li |

| |

|

Title: |

|

| |

Guizhong Liu |

| |

|

| |

By: |

/s/ Guizhong Liu |

| |

|

Name: |

Guizhong Liu |

| |

|

Title: |

|

| |

Alexander Goergen |

| |

|

| |

By: |

/s/ Alexander Goergen |

| |

|

Name: |

Alexander Goergen |

| |

|

Title: |

|

Exhibit B

AGREEMENT AS TO JOINT FILING

OF SCHEDULE 13D

The undersigned hereby agree

that they are filing jointly pursuant to Rule 13-d-1(k)(1) of the Securities Exchange Act of 1934, as amended, with respect

to ordinary shares of Adagene Inc., and that all subsequent amendments to this statement on Schedule 13D may be filed on behalf of each

of the undersigned without the necessity of filing additional joint filing agreements.

The undersigned further agree

and acknowledge that such shall be responsible for the timely filing of such amendments, and for the completeness and accuracy of the

information concerning it contained herein, but shall not be responsible for completeness and accuracy of the information concerning

the other, except to the extent that it knows or has reason to believe that such information is inaccurate.

This Agreement may be executed in any number of

counterparts, all of which taken together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the undersigned have set

their hands as of this 1st day

of March, 2024.

| | PETER LUO |

| | By: |

/s/

Peter Luo |

| | Name: |

Peter Luo |

| | |

| | HAN 2020

Irrevocable Trust |

| | By: |

/s/

Xiaohong She |

| | Name: |

Xiaohong She |

| | Title: |

Trustee |

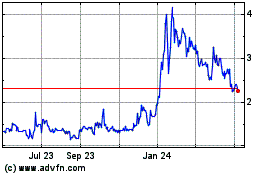

Adagene (NASDAQ:ADAG)

Historical Stock Chart

From Jan 2025 to Feb 2025

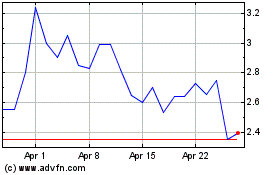

Adagene (NASDAQ:ADAG)

Historical Stock Chart

From Feb 2024 to Feb 2025