Filed Pursuant to Rule 424(b)(5)

Registration No. 333-271389

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 2, 2023)

ADVENT TECHNOLOGIES HOLDINGS, INC.

10,000,000 shares of Common Stock

This prospectus supplement and the accompanying prospectus relate to the offer and sale of 10,000,000 shares of our Common Stock, par value $0.0001 per share (the “Common Stock”). Shares of our Common Stock to which this prospectus supplement relates will be issued in a privately negotiated transaction pursuant to the terms of a Securities Purchase Agreement we have entered into with John Nash, Scott Dols, Timothy Beckett, the Kantor Family Trust, BJI Financial, and the Cavalry Fund (collectively, the “Purchasers”). We are offering the Common Stock at a combined purchase price of $2,000,000.

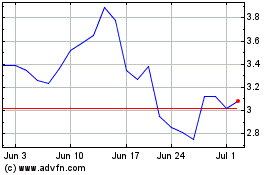

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “ADN.” On December 26, 2023, the last reported sale price of our Common Stock on the Nasdaq Capital Market was $0.2033 per share.

We have engaged Joseph Gunnar & Co., LLC (the “placement agent”) to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered in this offering. The placement agent is not purchasing or selling any of the securities we are offering, and the placement agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. There is no required minimum number of securities that must be sold as a condition to completion of this offering, and there are no arrangements to place the funds in an escrow, trust, or similar account. See “Plan of Distribution” beginning on page S-18 of this prospectus supplement for more information regarding these arrangements.

Investing in our Common Stock involves a high degree of risk. Before deciding whether to invest in the Common Stock, you should review carefully the risks and uncertainties that are described in the “Risk Factors” section beginning on page S-8 of this prospectus supplement, and in the documents incorporated by reference herein, including our most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2022 as well as the risks and uncertainties described in the other documents incorporated herein by reference.

| |

|

Per Share |

|

|

Total |

|

| Offering Price |

|

$ |

0.200 |

|

|

$ |

2,000,000.00 |

|

| Placement Agent Fees (1) |

|

$ |

0.18 |

|

|

$ |

180,000.00 |

|

| Proceeds, Before Expenses, to Us |

|

$ |

0.812 |

|

|

$ |

1,820,000.00 |

|

|

(1) |

Includes a cash fee of 9.0% of the gross proceeds of this offering. The Company is also reimbursing the Placement Agent for up to $25,000 of its expenses related to the offering. See “Plan of Distribution” for additional information about the compensation payable to the placement agent. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the Common Stock to the investors is expected to be made on or about December 27, 2023, subject to satisfaction of certain closing conditions.

Joseph Gunnar & Co., LLC

The date of this prospectus supplement is December 27, 2023

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

On April 21, 2023, we filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-3 (File No. 333-271389) using a shelf registration process relating to the securities described in this prospectus supplement, which registration statement was declared effective by the SEC on May 2, 2023. Under this shelf registration process, we may offer and sell, either individually or in combination, Common Stock, warrants and units, for total gross proceeds of up to $200 million.

This document consists of two parts. The first part is the prospectus supplement, which describes the specific terms of this transaction. The second part is the accompanying prospectus, which provides more general information, some of which may not apply to the securities offered by this prospectus supplement.

We urge you to read carefully this prospectus supplement, the accompanying prospectus and any free writing prospectuses we have authorized for use in connection with this transaction, together with information incorporated by reference in this prospectus supplement and the accompanying prospectus, before investing in any of the securities being offered under this prospectus supplement. You should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus, along with the information contained in any free writing prospectuses we have authorized for use in connection with this transaction. We have not and the placement agent has not authorized anyone to provide you with different or additional information. This prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

The information appearing in this prospectus supplement, the accompanying prospectus or any related free writing prospectus is accurate only as of the date on the front of the document and any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus supplement and any free writing prospectus that we have authorized for use in connection with this transaction may add, update or change the information contained in the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. To the extent that any statement that we make in this prospectus supplement or any related free writing prospectus is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference into this prospectus supplement or the related free writing prospectus, as the case may be, you should rely on the information in this prospectus supplement or the related free writing prospectus. If any statement in one of these documents is inconsistent with a statement in another document having a later date - for example, a document incorporated by reference in the accompanying prospectus - the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement and in the accompanying prospectus were accurate only as of the date when made. Moreover, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

In this prospectus supplement, unless otherwise expressly stated or the context otherwise requires, the terms “we,” “us,” “our” and the “Company” refer to Advent Technologies Holdings, Inc. and our subsidiaries on a combined basis, except that in the description of the securities offered, these terms refer solely to Advent Technologies Holdings, Inc. and not to any of our subsidiaries.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy, at prescribed rates, any documents we have filed with the SEC at its Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We also file these documents with the SEC electronically. You can access the electronic versions of these filings on the SEC’s internet website found at http://www.sec.gov.

This prospectus supplement and the accompanying prospectus omit some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits included in the registration statement for further information about us and the securities offered by us. Statements in this prospectus supplement and the accompanying prospectus concerning any document filed as an exhibit to the registration statement or otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus supplement and the accompanying prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement and the accompanying prospectus, and later information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference shall be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement modifies or replaces that statement.

In addition to those documents incorporated by reference in the section of the prospectus titled “Information We Incorporate By Reference,” we incorporate by reference, as of their respective dates of filing, the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) between the date of this prospectus supplement and the termination of this transaction of the securities described in this prospectus supplement. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC.

| ● | Our

Current Reports on Form 8-K, filed with the SEC on May 5,

2023, May 15,

2023, May 26, 2023,

June 2, 2023, June 20,

2023, August 11,

2023 and November 22,

2023 (in each case, excluding Items 2.02 and 7.01 on Form 8-K and Item 9.01 related thereto); |

| ● | Our

Quarterly Report on Form 10-Q

for the quarter ended March 31, 2023, filed with the SEC on May 15, 2023; |

| ● | Our

Quarterly Report on Form 10-Q

for the quarter ended June 30, 2023, filed with the SEC on August 14, 2023; and |

| ● | Our

Quarterly Report on Form 10-Q

for the quarter ended September 30, 2023, filed with the SEC on November 14, 2023. |

You may request a free copy of any of the documents incorporated by reference in this prospectus supplement by writing or telephoning us at the following address:

Advent Technologies Holdings, Inc.

Corporate Secretary

500 Rutherford Avenue, Suite 102

Boston, MA 02129

(617) 655-6000

These filings and reports can also be found on our website, located at https://www.advent.energy/, by following the links to “Investors” and “SEC Filings.”

The information contained on (or accessible through) our website does not constitute a part of this prospectus supplement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, any free writing prospectus and the documents incorporated herein and therein by reference may contain forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this prospectus supplement, the accompanying prospectus, any free writing prospectus or the documents incorporated herein or therein by reference, are forward looking statements. The words “believe,” “may,” “might,” “could,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “plan” and similar words are intended to identify estimates and forward-looking statements.

Our forward-looking statements are based on our current assumptions and expectations about future events and trends, which affect or may affect our business, strategy, operations, financial performance or prospects. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light of information currently available to us. Many important factors may materially and adversely affect the assumptions and expectations described in the forward-looking statements. You should read this prospectus supplement, the accompanying prospectus, any free writing prospectus, and the documents we incorporate by reference herein and therein, completely and with the understanding that our actual future results may be materially different and worse than what we expect.

Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for us to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

The following factors, among others, could cause our financial performance to differ materially from that expressed in such forward-looking statements:

|

● |

our ability to maintain the listing of our shares of Common Stock and warrants on Nasdaq; |

|

● |

our ability to raise financing in the future; |

|

● |

our success in retaining or recruiting officers, key employees or directors; |

|

● |

factors relating to our business, operations and financial performance, including: |

|

○ |

our ability to control the costs associated with our operations; |

|

○ |

our ability to grow and manage growth profitably; |

|

○ |

our reliance on complex machinery for our operations and production; |

|

○ |

the market’s willingness to adopt our technology; |

|

○ |

our ability to maintain relationships with customers; |

|

○ |

the potential impact of product recalls; |

|

○ |

our ability to compete within our industry; |

|

○ |

increases in costs, disruption of supply or shortage of raw materials; |

|

○ |

risks associated with strategic alliances or acquisitions; |

|

○ |

the impact of unfavorable changes in U.S. and international regulations; |

|

○ |

the availability of and our ability to meet the terms and conditions for government grants and economic incentives; and |

|

○ |

our ability to protect our intellectual property rights. |

|

● |

market conditions and global and economic factors beyond our control, including general economic conditions, unemployment and our liquidity, operations and personnel; |

|

● |

volatility of our stock price and potential share dilution; |

|

● |

future exchange and interest rates; and |

|

● |

other factors contained in, or incorporated into, this prospectus supplement, including our Annual Report on Form 10-K for the year ended December 31, 2022, and any related free writing prospectus, under the section entitled “Risk Factors.” |

Estimates and forward-looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of the risks and uncertainties described herein and in our other SEC filings, the results and outcomes set forth in the forward-looking statements discussed in this prospectus supplement, the accompanying prospectus, any free writing prospectus, and the documents incorporated by reference herein and therein, might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to, but not limited to, the factors mentioned above. Because of these uncertainties, you should not place undue reliance on these forward-looking statements when making an investment decision.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus and may not contain all the information that you need to consider in making your investment decision. To understand this transaction fully, you should carefully read this prospectus supplement, the accompanying prospectus, any free writing prospectuses we have authorized for use in connection with this transaction and the documents incorporated by reference herein and therein carefully. In particular, you should carefully read the sections titled “Risk Factors” in this prospectus supplement and in the accompanying prospectus and the documents identified in the section “Incorporation of Certain Documents by Reference.”

Overview

Company Overview

Advent is an advanced materials and technology development company operating in the fuel cell and hydrogen technology space. Advent develops, manufactures, and assembles complete fuel cell systems and the critical components that determine the performance of hydrogen fuel cells and other energy systems, as well as high-temperature proton exchange membranes (“HT-PEM” or “HT-PEMs”) and fuel cell systems for the off-grid and portable power markets and plans to expand into the mobility market. Advent’s mission is to become a leading provider of fuel cell systems, HT-PEMs, fuel cells, and HT-PEM based membrane electrode assemblies (“MEA” or “MEAs”), which are critical components used in fuel cells, and other electrochemical applications such as electrolyzers and flow batteries. Advent develops the core chemistry components, the MEAs, that enable fuel cells to operate at high temperatures and also provide these MEAs to third-party fuel cell manufacturers.

To date, Advent’s principal operations have been to develop and manufacture MEAs, and to design fuel cell stacks and complete fuel cell systems for a range of customers in the stationary power, portable power, automotive, aviation, energy storage and sensor markets. Advent has its headquarters, research and development, and manufacturing facility in Boston, Massachusetts, a product development facility in Livermore, California, and facilities in Greece, Denmark, and Germany and sales and warehousing facilities in the Philippines.

The majority of Advent’s current revenue derives from the sale and servicing of fuel cell systems and MEAs, as well as the sale of membranes and electrodes for specific applications in the iron flow battery and cellphone markets, respectively. While fuel cell systems and MEA sales and associated revenues are expected to provide the majority of Advent’s future income, both of these markets remain commercially viable and have the potential to generate material future revenues based on Advent’s existing customers. Advent has also secured grant funding for a range of projects from research agencies and other organizations. Advent expects to continue to be eligible for grant funding based on its product development activities over the foreseeable future.

Advent plans to scale-up U.S. and European production and its global sales operations to handle future demand. Advent’s investment priorities are increasing MEA production volumes, executing on new product development initiatives (next-generation fuel cell systems and MEAs), and optimizing production operations to improve unit costs. Advent’s principal focus is on the total fuel cell market, from components to complete systems, and we plan to use our products and technology to address pressing global climate needs.

Recent Developments

Nasdaq Delisting Notice

On May 24, 2023, Advent received a letter from the Listing Qualifications Staff (the “Staff”) of Nasdaq Stock Market LLC (“Nasdaq”) indicating that the bid price of Advent’s common stock had closed below $1.00 per share for 30 consecutive business days and, as a result, Advent was not in compliance with Nasdaq Listing Rule 5550(a)(2), which sets forth the minimum bid price requirement for continued listing on the Nasdaq Capital Market (the “Minimum Bid Requirement”). This initial letter provided that Advent had until November 20, 2023, to regain compliance with the Minimum Bid Requirement (the “Initial Period”) by maintaining a closing bid price of $1.00 per share for a minimum of ten consecutive business days.

Advent requested in writing an additional 180-calendar day compliance period after the expiration of the Initial Period to regain compliance with the Nasdaq requirements and informed Nasdaq of its intention to cure the deficiency during any second compliance period extension by effecting a reverse stock split, if necessary. During the Initial Period, Advent continued to satisfy the criteria for initial listing on the Nasdaq Capital Market, except the Minimum Bid Requirement, and the continued listing requirement for market value of publicly held shares.

On November 21, 2023, Nasdaq notified Advent that, after an analysis of the requirements under Nasdaq Listing Rule 5810 (c)(3)(A), the Staff determined that Advent is eligible for an additional 180 calendar day extension period (the “Additional Period”), or until May 20, 2024, to regain compliance with the Minimum Bid Requirement. This Additional Period relates exclusively to the bid price deficiency and Advent may be delisted during this Additional Period for failure to maintain compliance with any other listing requirements which occur during the Additional Period. If at any time during the Additional Period the closing bid price of the common stock is at least $1.00 per share for a minimum of 10 consecutive business days, Nasdaq will provide written confirmation of compliance and this matter will be closed.

In the event that Advent is not able to cure the bid price deficiency during the Additional Period, the Staff will provide written notice that the common stock will be delisted; however, Advent may request a hearing before the Nasdaq Hearings Panel (the “Panel”), which request, if timely made, would stay any further suspension or delisting action by the Staff pending the conclusion of the hearing process and expiration of any extension that may be granted by the Panel. There can be no assurance that Advent will be able to regain compliance with the Minimum Bid Requirement or maintain compliance with the other Nasdaq listing requirements during the Additional Period or that, if Advent is unable to cure the deficiency in the Additional Period and appeals the delisting determination by the Staff to the Panel, such appeal would be successful.

Corporate Information

We are incorporated under the laws of the State of Delaware. Our principal executive offices are located at 500 Rutherford Avenue, Suite 102, Boston, MA 02129, and our telephone number is (617) 655-6000. We maintain an Internet website at https://www.advent.energy/. The information contained on (or accessible through) our website is not incorporated into this prospectus supplement or the accompanying prospectus.

THE OFFERING

| Securities offered |

|

10,000,000 shares of Common Stock, par value $0.0001 per share (“Common Stock”), having an aggregate gross sales price of up to $2,000,000. |

|

|

Prior to this offering, the Company’s issued and outstanding shares of Common Stock totaled 62,108,317 as of September 30, 2023. Upon issuance of the shares of Common Stock in this offering, the issued and outstanding shares of Common Stock will total 72,108,317. |

| Manner of offering |

|

The securities will be issued pursuant to a privately negotiated transaction. |

| Use of proceeds |

|

We estimate that the net proceeds to us from this offering will be approximately $1,820,000.00, after deducting placement agent fees and estimated offering expenses payable by us. We intend to use the proceeds from this offering to fund our operations, which includes, which includes, but is not limited to, developing and manufacturing complete fuel cell systems and the Membrane Electrode Assembly (MEA) at the center of the fuel cell, designing fuel cell stacks and completing fuel cell systems for a range of customers in the stationary power, portable power, automotive, aviation, energy storage and sensor markets, and for working capital and general corporate purposes. See “Use of Proceeds” on page S-11 of this prospectus supplement. |

| Nasdaq Capital Market symbol |

|

“ADN” |

| Dividend policy |

|

We have not previously paid cash dividends on our Common Stock. It is our current intention to invest our cash flow and earnings in the growth of our business and, therefore, we do not plan to pay cash dividends for the foreseeable future. Investors should not purchase our Common Stock with the expectation of receiving cash dividends. |

| Risk factors |

|

This investment involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement and other information included or incorporated by reference herein, as well as the risks and uncertainties described in the other documents we file with the SEC, for a discussion of factors you should carefully consider before deciding to invest in our Common Stock. |

Unless otherwise indicated, the number of shares of our Common Stock to be outstanding immediately after this transaction as shown above is based on 62,108,317 shares of Common Stock outstanding as of September 30, 2023 but excluding the following as of such date:

|

● |

3,147,687 shares of Common Stock issuable upon the exercise of share options outstanding as of September 30, 2023 at a weighted average exercise price of $8.22 per share; |

|

● |

26,369,557 shares of Common Stock issuable upon the exercise of warrants outstanding as of September 30, 2023 at a weighted average exercise price of $11.50 per share; |

|

● |

2,038,036 shares of Common Stock issuable upon the vesting of restricted stock units outstanding as of September 30, 2023; and |

|

● |

242,925 shares of Common Stock reserved for future issuance under our equity incentive plans as of September 30, 2023. |

Unless otherwise indicated, all information in this prospectus supplement assumes no exercise of outstanding options or warrants described above.

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. Before you invest in our Common Stock, you should carefully consider the risk factors set forth below, those risk factors related to us and our business described in “Item 1A. Risk Factors” in Part I of our most recent Annual Report on Form 10-K, which is incorporated herein by reference, and those risk factors that may be included in any applicable prospectus supplement, together with all of the other information included in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference, in evaluating an investment in our Common Stock. If any of the risks discussed in the foregoing documents were to occur, our business, financial condition, results of operations and cash flows could be materially adversely affected. Please read “Special Note Regarding Forward-Looking Statements.”

Risks Relating to this transaction and an investment in our Common Stock

A return on the Common Stock purchased in this offering is not guaranteed.

There is no guarantee that the shares of Common Stock purchased in this offering will earn any positive return in the short term or long term. Investing in our Common Stock is speculative and involves a high degree of risk and should be undertaken only by holders whose financial resources are sufficient to enable them to assume such risks and who have no need for immediate liquidity in their investment. Investing in our securities is appropriate only for holders who have the capacity to absorb a loss of some or all of their holdings.

We have broad discretion in the use of proceeds from the offering.

Our management will have broad discretion with respect to the application of net proceeds received by us from the sale of the shares under this prospectus supplement and may spend such proceeds in ways that do not improve our results of operations or enhance the value of the securities. Any failure by management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business or cause the price of our common shares to decline.

You may experience immediate and substantial dilution in the net tangible book value per share of the Common Stock you purchase.

The price per share of our Common Stock being offered may be higher than the net tangible book value per share of our Common Stock outstanding prior to your purchase and in such case, you will suffer immediate dilution based on the difference between the price you pay per share of our Common Stock and our net tangible book value per share at the time of your purchase.

Future issuances of securities may result in substantial dilution to our existing stockholders and investors.

We may issue or sell additional shares of Common Stock or other securities that are convertible or exchangeable into shares of Common Stock in subsequent offerings or may issue additional shares of Common Stock or other securities to finance future acquisitions. We cannot predict the size or nature of future sales or issuances of securities or the effect, if any, that such future sales and issuances will have on the market price of the shares. Sales or issuances of substantial numbers of shares of Common Stock or other securities that are convertible or exchangeable into Common Stock, or the perception that such sales or issuances could occur, may adversely affect prevailing market prices of the Common Stock. With any additional sale or issuance of shares of Common Stock or other securities that are convertible or exchangeable into Common Stock, our stockholders will suffer dilution to their voting power and economic interest in the Company. Furthermore, to the extent holders of our stock options, warrants or other convertible securities convert or exercise their securities and sell the shares of Common Stock they receive, the trading price of the Common Stock on Nasdaq may decrease due to the additional amount of shares available in the market.

We may issue additional equity securities, or engage in other transactions which could dilute our book value or affect the priority of our Common Stock, which may adversely affect the market price of our Common Stock.

Our board of directors may determine from time to time to raise additional capital by issuing additional shares of our Common Stock or other securities. In addition, we may issue additional securities in connection with future acquisitions we may make. We are not restricted from issuing additional shares of Common Stock, including securities that are convertible into or exchangeable for, or that represent the right to receive, Common Stock. We cannot predict or estimate the amount, timing, or nature of any future offerings or issuances of additional stock in connection with acquisitions, or the prices at which such offerings may be affected. Such offerings could be dilutive to Common Stockholders. New investors also may have rights, preferences and privileges that are senior to, and that adversely affect, our then-current Common Stockholders. Additionally, if we raise additional capital by making additional offerings of debt or securities, upon liquidation of the Company, holders of our debt securities, and lenders with respect to other borrowings, will receive distributions of our available assets prior to the holders of our Common Stock. Additional equity offerings may dilute the holdings of our existing stockholders or reduce the market price of our Common Stock, or both. Holders of our Common Stock are not entitled to preemptive rights or other protections against dilution.

The market price of our Common Stock may be volatile.

The market price of our Common Stock may be volatile and subject to wide fluctuations in response to numerous factors, many of which are beyond our control. This volatility may affect the ability of holders of Common Stock to sell their securities at an advantageous price. Market price fluctuations in our Common Stock may be due to our operating results failing to meet expectations of securities analysts or investors in any period, downward revision in securities analysts’ estimates, adverse changes in general market conditions or economic trends, acquisitions, dispositions or other material public announcements by us or our competitors, along with a variety of additional factors. These broad market fluctuations may adversely affect the market price of the Common Stock.

Financial markets have periodically at times experienced significant price and volume fluctuations that have particularly affected the market prices of equity securities of companies and that have often been unrelated to the operating performance, underlying asset values or prospects of such companies. Accordingly, the market price of our Common Stock may decline even if our operating results, underlying asset values or prospects have not changed. Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be other than temporary, which may result in impairment losses. There can be no assurance that continuing fluctuations in price and volume will not occur. If such increased levels of volatility and market turmoil continue, our operations could be adversely impacted, and the trading price of our Common Stock may be materially adversely affected.

Sales of a significant number of shares of our Common Stock in the public markets, or the perception that such sales could occur, could depress the market price of our Common Stock.

Sales of a significant number of shares of our Common Stock in the public markets, or the perception that such sales could occur as a result of our utilization of a universal shelf registration statement, could depress the market price of our Common Stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our Common Stock or the market perception that we are permitted to sell a significant number of our securities would have on the market price of our Common Stock.

Resales of our Common Stock in the public market during this offering by our stockholders may cause the market price of our Common Stock to fall.

We may issue shares of Common Stock from time to time in connection with this offering. The issuance from time to time of these new shares of Common Stock, or our ability to issue new shares of Common Stock in this offering, could result in resales of shares our Common Stock by our current stockholders concerned about the potential dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our Common Stock.

A liquid market in our Common Stock on Nasdaq may not be maintained.

Our stockholders may be unable to sell significant quantities of Common Stock into the public trading markets without a significant reduction in the price of their shares, or at all. There can be no assurance that there will be sufficient liquidity of the Common Stock on the trading market, and that we will continue to meet the listing requirements of Nasdaq or achieve listing on any other national securities exchange. There can be no assurance that an active and liquid market for our Common Stock will be maintained, and our stockholders may find it difficult to resell shares of Common Stock.

We do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. As a result, you will need to sell your shares of Common Stock to receive any income or realize a return on your investment.

To date, we have not paid any cash dividends on our Common Stock. We do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. We cannot assure you that we would, at any time, generate sufficient surplus cash that would be available for distribution to the holders of our Common Stock as a dividend.

Risks Relating to the Business

Our audited financial statements included a statement that there is a substantial doubt about our ability to continue as a going concern and a continuation of negative financial trends could result in our inability to continue as a going concern.

Our audited financial statements as of and for the year ended December 31, 2022 were prepared on the assumption that we would continue as a going concern. Our audited financial statements as of and for the year ended December 31, 2022 did not include any adjustments that might result from the outcome of this uncertainty. Our management has determined that there is a substantial doubt about our ability to continue as a going concern over the next twelve months based on the insufficient amount of cash and cash equivalents as of the financial statement filing date and our independent auditors have included a “going concern” explanatory paragraph in their report on our financial statements as of and for the year ended December 31, 2022. In July 2022, we received official ratification from the European Commission of the European Union for one of the Important Projects of Common European Interest (“IPCEI”), Green HiPo. This project provides for the availability of funding of €782.1 million over the next six years. As of the issuance date of the consolidated financial statements, we have not received an agreement which provides the terms of the funding. In addition to Green HiPo, management may pursue additional capital raises in the future. We cannot provide assurance that we will be able to obtain additional funding on acceptable terms, if at all. If we are unable to obtain sufficient funding, we could be required to delay our development efforts, limit activities and reduce research and development costs, which could adversely affect its business prospects. The reaction of investors to the inclusion of a going concern statement by our independent auditors, and our potential inability to continue as a going concern, could materially adversely affect the price of our Common Stock.

We have incurred losses since inception and we expect that we will continue to incur losses for the foreseeable future.

We have not been profitable since operations commenced, and we may never achieve or sustain profitability. We expect to continue to incur net losses and generate negative cash flows until we can produce sufficient revenues and gross profit to cover our costs. We may never become profitable. Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future. We will require significant additional capital to continue operations and to implement our business strategy. We cannot estimate with reasonable certainty the actual amounts necessary to successfully complete the development, manufacture and commercialization of our products and there is no certainty that we will be able to raise the necessary capital on reasonable terms or at all.

We continue to generate a low level of revenue from our core products.

Based on conversations with existing customers and incoming inquiries from prospective customers, we anticipate substantial increased demand for our MEAs and fuel cell systems from a wide range of customers as we scale up our production facilities and testing capabilities, and as the awareness of our MEA capabilities becomes widely known in the industry. We expect both existing customers to increase order volume, and to generate substantial new orders from new customers, with some of whom we are already in discussions regarding prospective commercial partnerships and joint development agreements. As of September 30, 2023, we were still generating a low level of revenues compared to our future projections and have not made any commercial sales to new customers.

We may not be able to maintain compliance with the continued listing requirements of the Nasdaq Capital Market.

Our common stock is listed on the Nasdaq Capital Market. To maintain that listing, we must satisfy minimum financial and other requirements including, without limitation, a requirement that our closing bid price be at least $1.00 per share.

On May 24, 2023, we were notified by Nasdaq Listing Qualifications Staff about bid price deficiency. The Company is reviewing plans to regain compliance with the $1.00 closing bid price requirement. The Company had not regained compliance with the bid price requirement by November 21, 2023, and was notified by Nasdaq that it qualified for an additional 180-calendar day compliance period. In order to regain compliance within the additional 180-calendar day compliance period, the Company must cure the bid price deficiency and continue to satisfy the criteria for initial listing on the Nasdaq Capital Market and the continued listing requirement for market value of publicly held shares. If we fail to continue to meet all applicable continued listing requirements for The Nasdaq Capital Market in the future and Nasdaq determines to delist our common stock, the delisting could adversely affect the market liquidity of our common stock, our ability to obtain financing to repay debt and fund our operations.

A failure to maintain effective internal control over financial reporting could have a material adverse effect on our business and stock prices.

Although we are not required to obtain or include in our annual reports on Form 10-K an attestation report from our independent registered accountants with respect to the effectiveness of our internal control over financial reporting, like all other public companies, our Chief Executive Officer and our Chief Financial Officer are required, annually, to assess, and disclose their findings in our annual reports on Form 10-K with respect to, the effectiveness of our internal control over financial reporting in a manner that meets the requirements of Section 404(a) of the Sarbanes-Oxley Act. The rules governing the standards that must be met for our Chief Executive and Chief Financial Officers to assess and report on the effectiveness of our internal control over financial reporting are complex and require significant documentation, testing and possible remediation, which could significantly increase our operating expenses.

Additionally, if we are unable to maintain the effectiveness of our internal control over financial reporting in the future, we may be unable to report our financial results accurately and on a timely basis. In such an event, investors and clients may lose confidence in the accuracy and completeness of our financial statements, as a result of which our liquidity, access to capital markets, and perceptions of our creditworthiness could be adversely affected and the market prices of our Common Stock could decline. In addition, we could become subject to investigations by the Nasdaq Capital Market, the SEC or other regulatory authorities, which could require us to expend additional financial and management resources. As a result, an inability to maintain the effectiveness of our internal control over financial reporting in the future could have a material adverse effect on our business, financial condition, results of operations and prospects.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our Common Stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. If one or more of the analysts who cover us downgrade our stock or publish inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, demand for our stock could decrease, which might cause our stock price and trading volume to decline.

USE OF PROCEEDS

The Company will receive $1,820,000.00 of gross proceeds from this offering after deducting the placement agent fees and estimated offering expenses payable by us.

We intend to use the net proceeds to fund the operating expenses and capital expenses for product development and plan to make substantial investments over the next several years, among others, in new production equipment and warehousing, systems assembly line, MEA assembly automation, aeronautical stacks, facility expansion, new hirings and for working capital and general corporate purposes. Accordingly, we will have broad discretion in the application of the proceeds of this offering. We incurred operating losses and negative operating cash flow for the year ended December 31, 2022 and for the nine months ended September 30, 2023. The Company expects to use the net proceeds from the offering in pursuit of its ongoing general business objectives. To that end, a substantial portion of the net proceeds from the offering are expected to be allocated to working capital requirements. To the extent that we have negative operating cash flows in future periods, we may need to deploy a portion of the net proceeds from the offering and/or our existing working capital to fund such negative cash flow.

The amounts and timing of our use of the net proceeds from this offering will depend on a number of factors, such as the timing and progress of any collaborative or strategic partnering efforts, and the competitive environment for our products. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. Accordingly, our management will have broad discretion in the timing and application of these proceeds.

All expenses relating to the offering under this prospectus supplement will be paid out of the gross proceeds of the offering.

As of the date of this prospectus supplement, we cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion of this transaction or the amounts that we will actually spend on the uses set forth above.

The amounts and timing of our actual use of proceeds will vary depending on numerous factors, including the factors described under the heading “Risk Factors” beginning on page S-8 and under the heading “Risk Factors” in the prospectus accompanying this prospectus supplement and our other SEC filings. As a result, management will retain broad discretion over the allocation of the net proceeds from this transaction, and investors will be relying on the judgment of our management regarding the application of the net proceeds.

DILUTION

We calculate net tangible book value per share by dividing the net tangible book value, which is tangible assets less total liabilities, by the number of outstanding shares of our Common Stock. Dilution represents the difference between the amount per share paid by purchasers of shares in this transaction and the net tangible book value per share of our Common Stock immediately after giving effect to this transaction. Our net tangible book value as of September 30, 2023 was approximately $30.8 million or $0.50 per share.

After giving effect to the sale of our Common Stock pursuant to this prospectus supplement and accompanying prospectus in the aggregate amount of $2.0 million at a price of $0.20 per share, our net tangible book value as of September 30, 2023 would have been $32.8 million, or $0.45 per share of Common Stock. This represents an immediate dilution in the net tangible book value of $0.05 per share to our existing stockholders and an immediate increase in net tangible book value of $0.25 per share to investors participating in this transaction. The following table illustrates this per share dilution:

| Assumed offering price per share of Common Stock |

|

|

|

|

|

$ |

0.20 |

|

| Net tangible book value per share as of September 30, 2023 |

|

$ |

0.50 |

|

|

|

|

|

| Dilution per

share attributable to this transaction |

|

$ |

(0.05 |

) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| As-adjusted net tangible book value per share as of September 30, 2023 after giving effect to this offering |

|

|

|

|

|

$ |

0.45 |

|

| Increase per

share to new investors purchasing shares in this transaction |

|

|

|

|

|

$ |

0.25 |

|

The table above assumes for illustrative purposes that an aggregate of 10,000,000 shares of our Common Stock are sold pursuant to this prospectus supplement and the accompanying prospectus at a price of $0.20 per share, for aggregate gross proceeds of $2 million. This information is supplied for illustrative purposes only.

The above discussion and table are based on 62,108,317 shares of Common Stock outstanding as of September 30, 2023 and excludes the following:

|

● |

3,147,687 shares of Common Stock issuable upon the exercise of share options outstanding as of September 30, 2023 at a weighted average exercise price of $8.22 per share; |

|

● |

26,369,557 shares of Common Stock issuable upon the exercise of warrants outstanding as of September 30, 2023 at a weighted average exercise price of $11.50 per share; |

|

● |

2,038,036 shares of Common Stock issuable upon the vesting of restricted stock units outstanding as of September 30, 2023; and |

|

● |

242,925 shares of Common Stock reserved for future issuance under our equity incentive plans as of September 30, 2023.

|

DIVIDEND POLICY

We have not declared or paid any cash dividends on our capital stock since our inception. We currently intend to retain future earnings, if any, to finance the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. Payment of future dividends, if any, will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, restrictions contained in current or future financing instruments, provisions of applicable law and other factors the board deems relevant.

MATERIAL TAX CONSIDERATIONS

The following discussion describes certain material U.S. federal income tax consequences relating to the acquisition, ownership and disposition of our common stock by a U.S. Holder or Non-U.S. Holder (as each term is defined below). This discussion is based on the current provisions of the Internal Revenue Code of 1986, as amended (referred to as the “Code”), existing and proposed U.S. Treasury regulations promulgated thereunder, and administrative rulings and court decisions in effect as of the date hereof, all of which are subject to change at any time, possibly with retroactive effect. No ruling has been or will be sought from the Internal Revenue Service, or IRS, with respect to the matters discussed below, and there can be no assurance the IRS will not take a contrary position regarding the tax consequences of the acquisition, ownership or disposition of our common stock, or that any such contrary position would not be sustained by a court.

We assume in this discussion that the shares of our common stock will be held as capital assets (generally, property held for investment). This discussion does not address all aspects of U.S. federal income taxes and does not deal with state or local taxes or U.S. federal gift and estate tax laws, or any non-U.S. tax consequences that may be relevant to holders in light of their particular circumstances. This discussion also does not address the special tax rules applicable to particular holders, such as:

|

● |

a bank, insurance company, or other financial institution; |

|

● |

a tax-exempt entity, organization, or arrangement; |

|

● |

a government or any agency, instrumentality, or controlled entity thereof; |

|

● |

a real estate investment trust; |

|

● |

an S corporation or other pass-through entity (or an investor in an S corporation or other pass-through entity); |

|

● |

a regulated investment company; |

|

● |

a “controlled foreign corporation” or a “passive foreign investment company”; |

|

● |

a dealer or broker in stocks and securities, or currencies; |

|

● |

a trader in securities that elects mark-to-market treatment or any other holder subject to mark-to-market treatment; |

|

● |

a holder of our common stock that is liable for the alternative minimum tax; |

|

● |

a holder of our common stock that received such security through the exercise of options, warrants, or similar derivative securities or otherwise as compensation; |

|

● |

a holder of our common stock that holds such security in a tax-deferred account (such as an individual retirement account or a plan qualifying under Section 401(k) of the Code); |

|

● |

a holder of our common stock that has a functional currency other than the U.S. dollar; |

|

● |

a holder of our common stock that holds such security as part of a hedge, straddle, constructive sale, conversion or other integrated transaction; |

|

● |

a holder of our common stock required to accelerate the recognition of any item of gross income with respect to such security, as a result of such income being recognized on an applicable financial statement; |

|

● |

a holder of our common stock that is a U.S. expatriate or former citizen or long-term resident of the United States; |

|

● |

a holder of our common stock that does not hold such security as a capital asset within the meaning of Section 1221 of the Code (generally, for investment purposes); |

|

● |

a holder of our common stock whose security may constitute “qualified small business stock” under Section 1202 of the Code or “Section 1244 stock” for purposes of Section 1244 of the Code; or |

|

● |

a holder of our common stock that acquired such security in a transaction subject to the gain rollover provisions of Section 1045 of the Code. |

In addition, this discussion does not address the tax treatment of partnerships or other pass-through entities or of persons who hold our common stock through partnerships or other entities that are pass-through entities for U.S. federal income tax purposes. A partner in a partnership or other pass-through entity that will hold our common stock should consult his, her or its own tax advisor regarding the tax consequences of the ownership and disposition of our common stock through a partnership or other pass-through entity, as applicable.

For the purposes of this discussion, a “U.S. Holder” means a beneficial owner of our common stock that is for U.S. federal income tax purposes (a) an individual citizen or resident of the United States, (b) a corporation (or other entity treated as a corporation for U.S. federal income tax purposes), organized in or under the laws of the United States, any state thereof or the District of Columbia, (c) an estate the income of which is includable in gross income for U.S. federal income tax purposes regardless of its source, or (d) a trust if it (1) is subject to the primary supervision of a court within the United States and one or more U.S. persons (within the meaning of Section 7701(a)(30) of the Code) has the authority to control all substantial decisions of the trust or (2) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. A “Non-U.S. Holder” is, for U.S. federal income tax purposes, a beneficial owner of common stock (other than a partnership or other entity or arrangement classified as a partnership for U.S. federal income tax purposes) that is not a U.S. Holder.

The discussion of U.S. federal income tax considerations is for information purposes only and is not tax advice. Investors should consult their own tax advisors regarding the U.S. federal, state, local and non-U.S. income and other tax considerations of acquiring, holding and disposing of our common stock.

Tax Considerations Applicable to U.S. Holders

Distributions

We currently anticipate that we will retain all available funds and any future earnings for use in the operation of our business and do not anticipate declaring or paying any cash dividends on our common stock for the foreseeable future. In the event that we do make distributions to a U.S. Holder, those distributions generally will constitute dividends for U.S. tax purposes to the extent paid out of our current or accumulated earnings and profits (as determined under U.S. federal income tax principles). Distributions to a U.S. Holder that are not derived from our current or accumulated earnings and profits will constitute a return of capital that is applied against and reduces, but not below zero, the U.S. Holder’s adjusted tax basis in our common stock, and to the extent in excess of such basis, will be treated as gain realized on the sale or exchange of our common stock, as described below.

Disposition of Our Common Stock

Upon a sale or other taxable disposition of our common stock, a U.S. Holder generally will recognize capital gain or loss in an amount equal to the difference between the amount realized and the U.S. Holder’s adjusted tax basis in the applicable common stock. Capital gain or loss will constitute long-term capital gain or loss if the U.S. Holder’s holding period for the applicable common stock exceeds one year. The deductibility of capital losses is subject to certain limitations. U.S. Holders who recognize losses with respect to a disposition of our common stock should consult their own tax advisors regarding the tax treatment of such losses.

Medicare Tax

Certain U.S. Holders that are individuals, estates or trusts are subject to a 3.8% tax on all or a portion of their “net investment income,” which may include all or a portion of their dividend income and net gains from the disposition of securities. U.S. Holders that are individuals, estates or trusts are urged to consult their tax advisors regarding the applicability of the Medicare tax to their income and gains in respect of its investment in our securities.

Information Reporting and Backup Withholding

Information reporting requirements generally will apply to payments of dividends (including constructive dividends) on our common stock and to the proceeds of a sale or other disposition of common stock by a U.S. Holder unless such U.S. Holder is an exempt recipient, such as a corporation. Backup withholding will apply to those payments if the U.S. Holder fails to provide the holder’s taxpayer identification number, or certification of exempt status, or if the Holder otherwise fails to comply with applicable requirements to establish an exemption. Backup withholding is not an additional tax. Rather, amounts withheld as backup withholding may be credited against a person’s U.S. federal income tax liability, and a Holder generally may obtain a refund of any excess amounts withheld under the backup withholding rules by timely filing the appropriate claim for refund with the IRS and furnishing any required information.

Tax Considerations Applicable to Non-U.S. Holders

Distributions

We currently anticipate that we will retain all available funds and any future earnings for use in the operation of our business and do not anticipate declaring or paying any cash dividends on our common stock for the foreseeable future. In the event that we do make distributions on our common stock to a Non-U.S. Holder, those distributions generally will be treated as dividends, as return of capital or as gain on the sale or exchange of common stock for U.S. federal income tax purposes as described in “U.S. Holders — Distributions.”

Subject to the discussions below under the sections titled “Information Reporting and Backup Withholding” and “Foreign Accounts,” any distribution (including constructive distributions) on our common stock that is treated as a dividend paid to a Non-U.S. Holder that is not effectively connected with the holder’s conduct of a trade or business in the United States will generally be subject to withholding tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty between the United States and the Non-U.S. Holder’s country of residence. To obtain a reduced rate of withholding under a treaty, a Non-U.S. Holder generally will be required to provide the applicable withholding agent with a properly executed IRS Form W-8BEN, IRS Form W-8BEN-E or other appropriate form, certifying the Non-U.S. Holder’s entitlement to benefits under that treaty. Such form must be provided prior to the payment of dividends and must be updated periodically and when otherwise required by law.

We generally are not required to withhold tax on dividends paid (or constructive dividends deemed paid) to a Non-U.S. Holder that are effectively connected with such Holder’s conduct of a trade or business within the United States (and, if required by an applicable income tax treaty, are attributable to a permanent establishment or fixed base that the Holder maintains in the United States) if a properly executed IRS Form W-8ECI, stating that the dividends are so connected, is furnished to us. In general, such effectively connected dividends will be subject to U.S. federal income tax on a net income basis at the regular rates applicable to U.S. persons. A corporate Non-U.S. Holder receiving effectively connected dividends may also be subject to an additional “branch profits tax,” which is imposed, under certain circumstances, at a rate of 30% (or such lower rate as may be specified by an applicable treaty) on the corporate Non-U.S. Holder’s effectively connected earnings and profits, subject to certain adjustments.

Distributions to a Non-U.S. Holder that are not derived from our current or accumulated earnings and profits generally will be treated as a return of capital that will be applied against and reduce (but not below zero) the Non-U.S. Holder’s basis in its common stock and to the extent in excess of such basis, will be treated as gain from the sale or exchange of such common stock as described under “Disposition of Our Common Stock” below.

If a Non-U.S. Holder holds stock through a financial institution or other agent acting on the Holder’s behalf, the Holder will be required to provide appropriate documentation to such agent. The Holder’s agent may then be required to provide certification to the applicable withholding agent, either directly or through other intermediaries.

Disposition of Our Common Stock

Subject to the discussions below under the sections titled “Information Reporting and Backup Withholding” and “Foreign Accounts,” a Non-U.S. Holder generally will not be subject to U.S. federal income or withholding tax with respect to gain realized on a sale or other disposition of our common stock unless:

|

● |

the gain is effectively connected with the Non-U.S. Holder’s conduct of a trade or business in the United States (and, if required by an applicable income tax treaty between the United States and such Non-U.S. Holder’s country of residence, the gain is attributable to a permanent establishment or fixed base maintained by the Non-U.S. Holder in the U.S.), in which case the Non-U.S. Holder will be taxed on a net income basis at the regular rates and in the manner applicable to U.S. persons, and if the Non-U.S. Holder is a corporation, an additional branch profits tax at a rate of 30%, or a lower rate as may be specified by an applicable income tax treaty, may also apply; |

|

● |

the Non-U.S. Holder is a nonresident alien present in the United States for 183 days or more in the taxable year of the disposition and certain other requirements are met, in which case the Non-U.S. Holder will be subject to a 30% tax (or such lower rate as may be specified by an applicable income tax treaty between the United States and such Holder’s country of residence) on the net gain derived from the disposition, which may be offset by certain U.S.-source capital losses of the Non-U.S. Holder, if any, provided that the Non-U.S. Holder has timely filed U.S. federal income tax returns reporting those losses; or |

|

● |

we are, or have been, a “United States real property holding corporation,” or USRPHC, for U.S. federal income tax purposes during the five-year period preceding such disposition (or the Non-U.S. Holder’s holding period, if shorter). We do not believe that we are or have been a USRPHC and, even if we are or were a USRPHC, as long as our common stock is regularly traded on an established securities market, dispositions will not be subject to tax for a Non-U.S. Holder that has not held more than 5% of our common stock, actually or constructively, during the five-year period preceding such Non-U.S. Holder’s disposition (or the Non-U.S. Holder’s holding period, if shorter). |

See the sections titled “Information Reporting and Backup Withholding” and “Foreign Accounts” below for additional information regarding withholding rules that may apply to proceeds of a disposition of our common stock paid to foreign financial institutions or non-financial foreign entities.

Information Reporting and Backup Withholding

We must report annually to the IRS and to each Non-U.S. Holder the gross amount of the distributions (including constructive distributions) on our common stock paid to such Holder and the tax withheld, if any, with respect to such distributions. Non-U.S. Holders may have to comply with specific certification procedures to establish that the Holder is not a U.S. person (as defined in the Code) in order to avoid backup withholding at the applicable rate, currently 24%. Generally, a Non-U.S. Holder will comply with such procedures if it provides a properly executed applicable IRS Form W-8 or by otherwise establishing an exemption. Dividends paid to Non-U.S. Holders subject to withholding of U.S. federal income tax, as described above under the heading “Distributions,” will generally be exempt from U.S. backup withholding.

Information reporting and backup withholding generally will apply to the proceeds of a disposition of our common stock by a Non-U.S. Holder effected by or through the U.S. office of any broker, U.S. or foreign, unless the Non-U.S. Holder certifies its status as a Non-U.S. Holder and satisfies certain other requirements, or otherwise establishes an exemption. Generally, information reporting and backup withholding will not apply to a payment of disposition proceeds to a Non-U.S. Holder where the transaction is effected outside the United States through a non-U.S. office of a non-U.S. broker. However, for information reporting purposes, dispositions effected through a non-U.S. office of a broker with substantial U.S. ownership or operations generally will be treated in a manner similar to dispositions effected through a U.S. office of a broker. Non-U.S. Holders should consult their own tax advisors regarding the application of the information reporting and backup withholding rules to them.

Copies of information returns may be made available to the tax authorities of the country in which the Non-U.S. Holder resides or is incorporated under the provisions of a specific treaty or agreement.

Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules from a payment to a Non-U.S. Holder can be refunded or credited against the Non-U.S. Holder’s U.S. federal income tax liability, if any, provided that an appropriate claim is timely filed with the IRS.

Foreign Accounts

Legislation commonly referred to as the “Foreign Account Tax Compliance Act,” or “FATCA,” generally imposes a 30% withholding tax on dividends on common stock if paid to a non-U.S. entity unless (i) if the non-U.S. entity is a “foreign financial institution,” the non-U.S. entity undertakes certain due diligence, reporting, withholding, and certification obligations, (ii) if the non-U.S. entity is not a “foreign financial institution,” the non-U.S. entity identifies certain of its U.S. investors, if any, or (iii) the non-U.S. entity is otherwise exempt under FATCA.

Intergovernmental agreements between the United States and foreign countries with respect to FATCA may significantly modify the requirements described in this section for Non-U.S. Holders. Holders should consult their own tax advisors regarding the possible implications of FATCA on their investment in our common stock.

The preceding discussion of material U.S. federal tax considerations is for information only. It is not tax advice. Prospective investors should consult their own tax advisors regarding the particular U.S. federal, state, local and non-U.S. tax consequences of purchasing, holding and disposing of our common stock, including the consequences of any proposed changes in applicable laws.

The preceding discussion of material U.S. federal tax considerations is for information only. It is not tax advice. Prospective investors should consult their own tax advisors regarding the particular U.S. federal, state, local and non-U.S. tax consequences of purchasing, holding and disposing of our common stock, including the consequences of any proposed changes in applicable laws.

PLAN OF DISTRIBUTION

We have engaged Joseph Gunnar & Co., LLC to act as our exclusive placement agent, on a reasonable best-efforts basis, in connection with this offering pursuant to this prospectus supplement and accompanying prospectus. The terms of this offering were subject to market conditions and negotiations between us, the placement agent, and prospective investors. The engagement agreement does not give rise to any commitment by the placement agent to purchase any of the securities, and the placement agent will have no authority to bind us by virtue of the engagement agreement. The placement agent is not purchasing the securities offered by us in this offering and is not required to sell any specific number or dollar amount of securities. Further, the placement agent does not guarantee that it will be able to raise new capital in any prospective offering. The placement agent has no commitment to buy any of the securities offered pursuant to this prospectus supplement and accompanying prospectus. We have entered into a securities purchase agreement directly with the investors in connection with this offering, and we will only sell to investors who have entered into the securities purchase agreement. We may not sell the entire amount of shares of our Common Stock offered pursuant to this prospectus supplement.

We expect to deliver the shares of our Common Stock being offered pursuant to this prospectus supplement on or about December 27, 2023, subject to satisfaction of customary closing conditions.

We have agreed to indemnify the placement agent against specified liabilities relating to or arising out of the agent’s activities as placement agent.

Fees and Expenses

We have agreed to pay the placement agent in connection with this offering a cash fee equal to 9.0% of the aggregate gross proceeds of this offering. We have also agreed to reimburse the placement agent up to a total of $25,000 for actual fees and expenses of legal counsel and other out-of-pocket expenses.

We estimate that the total expenses payable by us in connection with this offering, excluding the placement agent fees and expenses referred to above, will be approximately $15,000.

Tail Financing Payments

We have also agreed to pay the placement agent, subject to certain exceptions, a tail fee equal to the cash compensation in this offering, if any investor, who was contacted or introduced to us by placement agent during the term of the engagement, provides us, directly or indirectly, with any capital or funds in any public or private offering or other financing or capital raising transaction during the 12-month period following the termination or expiration of our engagement agreement with the placement agent.

Regulation M

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of common shares by the placement agent acting as principal. Under these rules and regulations, the placement agent:

|

● |

may not engage in any stabilization activity in connection with our securities; and |

|

● |

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

Other Relationships

From time to time, the placement agent may provide in the future various advisory, investment and commercial banking and other services to us in the ordinary course of business, for which it may receive customary fees and commissions. Except as disclosed in this prospectus supplement, we have no present arrangements with the placement agent for any services.

Listing of Common Stock

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “ADN.”

EXPERTS

The financial statements of the Company as included in our Annual Report on Form 10-K for the year ended December 31, 2022, are incorporated herein by reference in reliance on the report of Ernst & Young (Hellas) Certified Auditors Accountants S.A., an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

LEGAL MATTERS

The validity of the securities being issued hereby will be passed upon by our legal counsel, Nutter, McClennen & Fish, LLP, Boston, Massachusetts. Pryor Cashman LLP, New York, New York is acting as counsel to the placement agent in connection with this offering.

PROSPECTUS

ADVENT

TECHNOLOGIES HOLDINGS, INC.

Up

to 50,000,000 Shares of Common Stock

and

635,593 Shares of Common Stock

This

prospectus relates to the offer and resale of an aggregate of up to 50,635,593 shares of our common stock, $0.0001 par value per share,

by Lincoln Park Capital Fund, LLC (“Lincoln Park” or the “Selling Stockholder”). The shares included in this

prospectus consist of shares of common stock that we have issued or that we may, in our discretion, elect to issue and sell to Lincoln

Park, from time to time after the date of this prospectus and the date of the satisfaction of the conditions to the Selling Stockholder’s

purchase obligations (the “Commencement Date”) as set forth in the common stock purchase agreement we entered into with Lincoln

Park on April 10, 2023 (the “Purchase Agreement”). Pursuant to the Purchase Agreement, Lincoln Park has committed to

purchase from us, at our direction, up to $50,000,000 of our common stock, subject to the terms and conditions specified in the Purchase

Agreement. The shares included in this prospectus also include the 635,593 shares of common stock (the “Commitment Shares”)

that we issued to Lincoln Park concurrently with our execution of the Purchase Agreement as consideration for

its irrevocable commitment to purchase shares of our common stock at our election in our sole discretion, from time to time after the

date of this prospectus, upon the terms and subject to the satisfaction of the conditions set forth in the Purchase Agreement. See the

section titled “Lincoln Park Transaction” for a description of the Purchase Agreement and the section titled “Selling

Stockholder” for additional information regarding Lincoln Park.

We

are not selling any shares of common stock being offered by this prospectus and will not receive any of the proceeds from the sale of

such shares by Lincoln Park. However, we may receive up to $50,000,000 in aggregate gross proceeds from sales of our common stock to

Lincoln Park that we may, in our discretion, elect to make, from time to time after the date of this prospectus, pursuant to the Purchase

Agreement.

Lincoln