UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May 2024

Commission

File Number: 001-38064

Aeterna

Zentaris Inc.

(Translation

of registrant’s name into English)

c/o

Norton Rose Fulbright Canada, LLP, 222 Bay Street, Suite 3000, PO Box 53, Toronto ON M5K 1E7

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Explanatory

Note

As

previously announced, on December 14, 2023, Aeterna Zentaris Inc. (“Aeterna”, “we”, “our” or the

“Company”) and Ceapro Inc. (“Ceapro”) entered into an Arrangement Agreement (as amended by the Amendment Agreement,

dated January 16, 2024, and as may be further amended, supplemented or otherwise modified from time to time, the “Arrangement Agreement”),

pursuant to which Aeterna and Ceapro undertook a business combination transaction (the “Arrangement”). Pursuant to the Arrangement

Agreement, and subject to the terms and conditions therein, Aeterna will acquire all of the issued and outstanding common shares in the

capital of Ceapro in a company-approved Plan of Arrangement (the “Plan of Arrangement”) under the Canada Business Corporations

Act such that Ceapro will become a wholly-owned subsidiary of Aeterna and Aeterna will continue the operations of Aeterna and Ceapro

on a combined basis (the “Arrangement”).

On

May 17, 2024, Aeterna issued a news release announcing the record date for the distribution of warrants to purchase common shares of

Aeterna to its shareholders and warrantholders in connection with the Arrangement. A copy of the news release is attached hereto as Exhibit

99.1 and incorporated herein by reference.

On

the same date, Aeterna filed with the Canadian Securities Regulatory Authorities on SEDAR+ a Statement of Executive Compensation for

the Year Ended December 31, 2023, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

This

Report on Form 6-K and Exhibits 99.1 and 99.2 included with this Report on Form 6-K are hereby incorporated by reference into Aeterna’s

Registration Statements on Forms S-8 (No. 333-224737, No. 333-210561 and No. 333-200834) and Form F-3 (No. 333-254680) (collectively,

the “Registration Statements”) and shall be deemed to be a part thereof from the date on which this Report on Form 6-K is

furnished, to the extent not superseded by documents or reports subsequently filed or furnished. The information contained on any websites

referenced in Exhibit 99.1 included with this Report on Form 6-K is not incorporated by reference or deemed to be a part of this Report

on Form 6-K or any of the Registration Statements.

Aeterna

has filed a Registration Statement on Form F-1 (including a prospectus) (File No. 333-277115) (the “Form F-1 Registration Statement”)

with the U.S. Securities and Exchange Commission (the “SEC”) for the issuance of common share purchase warrants and Common

Shares issuable upon exercise thereof in connection with the Plan of Arrangement. Before you invest in any Common Shares, you should

read the prospectus in the Form F-1 Registration Statement and the other documents incorporated by reference therein for more complete

information about Aeterna, Ceapro, the Arrangement and the common share purchase warrant offering.

You

may get copies of the Form F-1 Registration Statement for free by visiting EDGAR on the SEC website at www.sec.gov or at SEDAR+ at www.sedarplus.ca.

Alternatively, you may obtain copies of them by contacting the following:

Media

Contact

Joel

Shaffer

FGS

Longview

joel.shaffer@fgslongview.com

416-670-6468

No

Offer or Solicitation

This

Report on Form 6-K and the exhibit attached hereto and incorporated by reference herein, and the information contained herein and therein

are not, and do not, constitute an offer to sell any securities or a solicitation of an offer to buy any securities in the United States

or any other state or jurisdiction, nor shall any securities of Aeterna be offered or sold in any jurisdiction in which such an offer,

solicitation or sale would be unlawful. Neither the SEC nor any state securities commission has approved or disapproved of the transactions

described herein or determined if this communication is truthful or complete. Any representation to the contrary is a criminal offense.

You

should not construe the contents of this Report on Form 6-K or the exhibit attached hereto and incorporated herein by reference as legal,

tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal

and related matters concerning the matters described herein.

Forward-Looking

Statements

The

information in this Report on Form 6-K and the exhibit attached hereto and incorporated herein by reference include forward-looking statements

within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, specifically Section 27A of the U.S. Securities Act

of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements involve

a number of known and unknown risks, uncertainties and other factors that could actual results and outcomes to be materially different

from historical results or from any future results expressed or implied by such forward-looking statements.

Forward-looking

statements include, but are not limited to, the ability of Aeterna and Ceapro to successfully consummate the Plan of Arrangement pursuant

to the Arrangement Agreement, dated as of December 14, 2023, between Aeterna and Ceapro with respect thereto within the time expected

or at all and, if completed, the anticipated benefits and synergies as well as the assets, cost structure, financial position, cash flows

and growth prospects of the combined company.

Risks

and factors that could cause actual results or outcomes to differ materially from expectations include, among others, the following:

| ● |

the

failure of Aeterna or Ceapro to obtain regulatory approvals and securities exchange approvals, including from the Nasdaq Capital

Market (“NASDAQ”) and the Toronto Stock Exchange (“TSX”); |

| ● |

Aeterna’s

ability to raise capital and obtain financing to continue its currently planned operations; |

| ● |

Aeterna’s

ability to maintain compliance with the continued listing requirements of the NASDAQ and to maintain the listing of its common shares

on the NASDAQ; |

| ● |

Aeterna’s

ability to continue as a going concern, which is dependent, in part, on its ability to transfer cash from Aeterna Zentaris GmbH to

Aeterna and its U.S. subsidiary and to secure additional financing; |

| ● |

Aeterna’s

now heavy dependence on the success of Macrilen™ (macimorelin) and related out-licensing arrangements and the continued availability

of funds and resources to successfully commercialize the product, including its heavy reliance on the success of the license and

assignment agreement with Novo Nordisk A/S; |

| ● |

Aeterna’s

ability to enter into out-licensing, development, manufacturing, marketing and distribution agreements with other pharmaceutical

companies and keep such agreements in effect; |

| ● |

Aeterna’s

reliance on third parties for the manufacturing and commercialization of Macrilen™ (macimorelin); |

| ● |

potential

disputes with third parties, leading to delays in or termination of the manufacturing, development, out-licensing or commercialization

of Aeterna’s product candidates, or resulting in significant litigation or arbitration; |

| ● |

uncertainties

related to the regulatory process; |

| ● |

unforeseen

global instability, including the instability due to the global pandemic of the novel coronavirus; |

| ● |

Aeterna’s

ability to efficiently commercialize or out-license Macrilen™ (macimorelin); |

| ● |

Aeterna’s

reliance on the success of the pediatric clinical trial in the European Union (“E.U.”) and U.S. for Macrilen™ (macimorelin); |

| ● |

the

degree of market acceptance of Macrilen™ (macimorelin); |

| ● |

Aeterna’s

ability to obtain necessary approvals from the relevant regulatory authorities to enable it to use the desired brand names for its

product; |

| ● |

Aeterna’s

ability to successfully negotiate pricing and reimbursement in key markets in the E.U. for Macrilen™ (macimorelin); |

| ● |

any

evaluation of potential strategic alternatives to maximize potential future growth and shareholder value may not result in any such

alternative being pursued, and even if pursued, may not result in the anticipated benefits; |

| ● |

Aeterna’s

ability to protect its intellectual property; and |

| ● |

the

potential of liability arising from shareholder lawsuits and general changes in economic conditions. |

Additional

risk factors that could cause actual results to differ materially include those risks identified in Item 3. “Key Information –

Risk Factors” contained in Aeterna’s most recent Annual Report on Form 20-F filed with the SEC and its other filings and

submissions from time to time, including those containing its quarterly and annual results, with the SEC, which are available on Aeterna’s

website located at www.aeterna.com.

Many

of these risks and factors are beyond Aeterna’s control. Aeterna cautions you not to place undue reliance on these forward-looking

statements. All written and oral forward-looking statements attributable to Aeterna and/or Ceapro, or persons acting on their behalf,

are qualified in their entirety by these cautionary statements. Moreover, unless required by law to update these statements, Aeterna

will not necessarily update any of these statements after the date hereof, either to conform them to actual results or to changes in

their expectation.

DOCUMENTS

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

AETERNA

ZENTARIS INC. |

| |

|

|

| Date:

May 17, 2023 |

By: |

/s/

Giuliano La Fratta |

| |

|

Giuliano

La Fratta |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Aeterna

Zentaris Announces Details Regarding Transaction with Ceapro

TORONTO,

ON, May 17, 2024 – Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS) (“Aeterna” or the “Company”)

announces that it has finalized certain details regarding the previously announced merger of equals transaction (the “Transaction”)

with Ceapro Inc. (“Ceapro”).

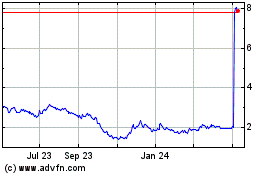

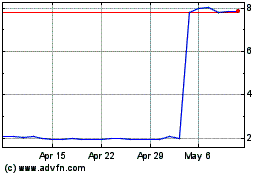

On

May 3, 2024, the Company completed a share consolidation (or reverse stock split) (the “Consolidation”) of its common

shares (the “Common Shares”) on the basis of one post-Consolidation Common Share for every four pre-Consolidation

Common Shares. As a result of the Consolidation, the exchange ratio to be used in connection with the issuance of Common Shares to Ceapro

shareholders under the Transaction has been adjusted. On closing of the Transaction, Ceapro shareholders will now receive 0.02360 of

a Common Share for each Ceapro share held.

As

part of the Transaction, holders of Common Shares as of the close of business on May 29, 2024 (the “Record Date”)

will receive 0.47698 of a Common Share purchase warrant (a “Transaction Warrant”) on May 31, 2024 (the “Payment

Date”) for each post-Consolidation Common Share.

The

Toronto Stock Exchange and Nasdaq have determined that the Common Shares will trade on a due bill basis from the opening of markets on

May 29, 2024 to the Payment Date (i.e., May 31, 2024), inclusive. A due bill is an entitlement attached to listed securities undergoing

a material corporate action, such as the issuance of the Transaction Warrants. Any trades that are executed during the due bill period

will be flagged to ensure purchasers receive the entitlement to the Transaction Warrants. Ex-distribution trading in the Common Shares

will commence as of the opening of markets on June 3, 2024, as of which date purchases of Common Shares will no longer have the attaching

entitlement to Transaction Warrants. The due bill redemption date will be June 4, 2024.

Shareholders

will not need to take any action in connection with the issuance of Transaction Warrants. Aeterna will use direct registration system

(“DRS”) advice statements representing Transaction Warrants and will send out DRS advice statements to registered

shareholders indicating the number of Transaction Warrants that they are receiving. In addition, Computershare Trust Company of Canada

will electronically issue the appropriate number of Transaction Warrants to CDS and DTC for further distribution by CDS and DTC to their

respective participants. Non-registered (beneficial) shareholders who hold their Common Shares in an account with their investment dealer

or other intermediary will have their accounts automatically updated by such investment dealer or intermediary to reflect the Transaction

Warrants in accordance with the applicable brokerage account providers’ usual procedures.

Subject

to obtaining all required approvals and satisfying all required conditions, the Transaction is expected to close on or about June 3,

2024.

About

Aeterna Zentaris Inc.

Aeterna

is a specialty biopharmaceutical company developing and commercializing a diversified portfolio of pharmaceutical and diagnostic products

focused on areas of significant unmet medical need. Aeterna’s lead product, macimorelin (Macrilen; Ghryvelin), is the first and

only U.S. FDA and European Commission approved oral test indicated for the diagnosis of adult growth hormone deficiency (AGHD). Aeterna

is leveraging the clinical success and compelling safety profile of macimorelin to develop it for the diagnosis of childhood-onset growth

hormone deficiency (CGHD), an area of significant unmet need.

Aeterna

is also dedicated to the development of its therapeutic assets and has established a pre-clinical development pipeline to potentially

address unmet medical needs across a number of indications, including neuromyelitis optica spectrum disorder (NMOSD), Parkinson’s

disease (PD), hypoparathyroidism and amyotrophic lateral sclerosis (ALS; Lou Gehrig’s disease). For more information, please visit

www.zentaris.com and connect with Aeterna on LinkedIn and Facebook.

Forward-Looking

Statements

The

information in this news release has been prepared as of May 17, 2024. Certain statements in this news release, referred to herein as

“forward-looking statements”, constitute “forward-looking statements” within the meaning of the United States

Private Securities Litigation Reform Act of 1995 and “forward-looking information” under the provisions of Canadian securities

laws. All statements, other than statements of historical fact, that address circumstances, events, activities, or developments that

could or may or will occur are forward-looking statements. When used in this press release, words such as “anticipate”, “assume”,

“believe”, “continue”, “could”, “expect”, “forecast”, “future”,

“goal”, “guidance”, “indicate”, “intend”, “likely”, “maintain”,

“may”, “objective”, “outlook”, “plan”, “potential”, “project”,

“seek”, “strategy”, “synergies”, “view”, “will”, “would” or the

negative or comparable terminology as well as terms usually used in the future and the conditional are generally intended to identify

forward-looking statements, although not all forward-looking statements include such words.

Forward-looking

statements in this news release include, but are not limited to statements and comments relating to: the Transaction Warrants, including

the record date and distribution date thereof, the expected outcomes and benefits of the Transaction; the ability of Aeterna and Ceapro

to complete the Transaction on the terms described herein, or at all; the anticipated timeline for the completion of the Transaction;

and receipt of final regulatory and stock exchange approvals with respect to the Transaction (including approval of the continued listing

of the Common Shares on the Nasdaq and the TSX, the issuance of the Transaction Warrants and the completion of the Consolidation).

Forward-looking

statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by Aeterna and Ceapro as

of the date of such statements, are inherently subject to significant business, economic, operational and other risks, uncertainties,

contingencies and other factors, including those described below, which could cause actual results, performance or achievements of Aeterna

and Ceapro to be materially different from results, performance or achievements expressed or implied by such forward-looking statements

and, as such, undue reliance must not be placed on them. Forward-looking statements are also based on numerous material factors and assumptions,

including as described in this news release, with respect to, among other matters: Aeterna’s and Ceapro’s present and the

combined company’s future business strategies; operations performance within expected ranges; anticipated future cash flows; local

and global economic conditions and the environment in which the combined operations will operate in the future; anticipated capital and

operating costs; and the availability and timing of required stock exchange, regulatory and other approvals for the completion of the

Transaction.

Many

factors, known and unknown, could cause actual results to be materially different from those expressed or implied by such forward-looking

statements. Such risks include, but are not limited to: the ability to consummate the Transaction; the satisfaction of other conditions

to the consummation of the Transaction on the proposed terms in the time assumed; the ability to obtain necessary stock exchange, regulatory

or other approvals in the time assumed; the ability to realize the anticipated benefits of the Transaction or to implement the business

plan for the combined company, including as a result of a delay in completing the Transaction or difficulty in integrating the businesses

of the companies involved; significant Transaction costs or unknown liabilities; directors and officers of Aeterna and Ceapro may have

interests in the Transaction that may be different from those of Aeterna and Ceapro shareholders generally; the focus of both management’s

time and attention on the Transaction may detract from other aspects of their respective businesses; the tax treatment of the Transaction

may be subject to uncertainties; risks relating to the retention of key personnel during the interim period; the ability to realize synergies

and cost savings at the times, and to the extent anticipated; the potential impact on research and development activities; the potential

impact of the announcement or consummation of the Transaction on relationships, including with regulatory bodies, employees, suppliers,

customers, competitors and other key stakeholders; Aeterna’s and Ceapro’s economic model and liquidity risks; technology

risks; changes in or enforcement of national and local government legislation, taxation, controls or regulations and/or changes in the

administration of laws, policies and practices; legal or regulatory developments and changes; the impact of foreign exchange rates; pricing

pressures; and local and global political and economic conditions.

Information

contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making

a forecast or projection, including Aeterna’s and Ceapro’s respective management perceptions of historical trends, current

conditions and expected future developments, as well as other considerations that are believed to be appropriate in the circumstances.

Aeterna and Ceapro consider these assumptions to be reasonable based on all currently available information but caution the reader that

these assumptions regarding future events, many of which are beyond their control, may ultimately prove to be incorrect since they are

subject to risks and uncertainties that affect Aeterna and Ceapro and their businesses.

Readers

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. For a more detailed

discussion of such risks and other factors that may affect Aeterna’s and Ceapro’s ability to achieve the expectations set

forth in the forward-looking statements contained in this news release, see Aeterna’s Annual Report on Form 20-F and MD&A filed

under Aeterna’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov and Ceapro’s MD&A filed

under Ceapro’s profile on SEDAR+ at www.sedarplus.ca, as well as Aeterna’s and Ceapro’s other filings with the

Canadian securities regulators and the Securities and Exchange Commission. Other than as required by law, Aeterna and Ceapro do not intend,

and do not assume any obligation to, update these forward-looking statements.

Information

Concerning the Registration Statement

Aeterna

filed a Registration Statement on Form F-1 (including a prospectus) (File No. 333-277115) (the “Registration Statement”)

with the U.S. Securities and Exchange Commission (the “SEC”) to register the issuance of Transaction Warrants and

Common Shares issuable upon exercise thereof in connection with the Transaction discussed in this communication under the U.S. Securities

Act of 1933, as amended (the “U.S. Securities Act”). Before you invest in any Common Shares, you should read the prospectus

in the Registration Statement and the other documents incorporated by reference therein for more complete information about Aeterna,

Ceapro, the Transaction and the offering of Transaction Warrants and the Common Shares issuable upon exercise thereof.

You

may get copies of the Registration Statement for free by visiting EDGAR on the SEC website at www.sec.gov or at SEDAR+ at www.sedarplus.ca.

Alternatively, you may obtain copies of them by contacting Aeterna’s proxy solicitor at the details provided below.

Other

than as noted above, none of the securities to be issued pursuant to or in connection with the Transaction have been or will be registered

under the U.S. Securities Act, or any U.S. state securities laws, and such securities are anticipated to be issued in reliance on the

exemption from the registration requirements of the U.S. Securities Act provided by Section 3(a)(10) thereof and similar exemptions under

applicable state securities laws.

No

Offer or Solicitation

This

news release and the information contained herein are not, and do not, constitute an offer to sell any securities or a solicitation of

an offer to buy any securities in the United States or any other state or jurisdiction, nor shall any securities of Aeterna be offered

or sold in any jurisdiction in which such an offer, solicitation or sale would be unlawful. Neither the SEC nor any state securities

commission has approved or disapproved of the transactions described herein or determined if this communication is truthful or complete.

Any representation to the contrary is a criminal offense.

You

should not construe the contents of this communication as legal, tax, accounting or investment advice or a recommendation. You should

consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein.

For

additional information regarding the Consolidation, the Transaction Warrants and the Transaction generally, please refer to the Company’s

Registration Statement and the Notice of Special Meeting of Shareholders and Management Information Circular dated February 9, 2024,

which are available on SEDAR+ at www.sedarplus.com or EDGAR at www.sec.gov.

For

Further Information

Aeterna

Investor Contact:

Aeterna, Investor Relations

AZinfo@aezsinc.com

+1 843-900-3223

Aeterna

Media Contact:

Joel Shaffer

FGS Longview

joel.shaffer@fgslongview.com

416-670-6468

Exhibit

99.2

STATEMENT

OF EXECUTIVE COMPENSATION FOR THE YEAR ENDED DECEMBER 31, 2023

Share

Consolidation

Effective

July 21, 2022, Aeterna Zentaris Inc. (the “Corporation” or “Aeterna Zentaris”) consolidated all

of its outstanding common shares (the “Common Shares”) on a basis of one post-consolidation Common Share for every

25 pre-consolidation Common Shares (the “2022 Consolidation”). Further, on May 3, 2024, the Corporation consolidated

all of its outstanding Common Shares on a basis of one post-consolidation Common Share for every four pre-consolidation Common Shares

(the “2024 Consolidation”). Accordingly, all Common Shares, deferred share units (“DSUs”), warrants

and stock options were adjusted to reflect the 2022 Consolidation and the 2024 Consolidation. All figures used in this document reflect

the 2022 Consolidation and the 2024 Consolidation unless otherwise stated.

Unless

otherwise indicated, all compensation information included in this document is presented in U.S. dollars and, to the extent a director

or officer has been paid in a currency other than U.S. dollars, the amounts have been converted from such person’s home country

currency to U.S. dollars based on the following annual average exchange rates: for the financial year ended December 31, 2023: €1.000

= U.S.$1.082 and CAN$1.000 = U.S.$0.741; for the financial year ended December 31, 2022: €1.000 = U.S.$1.053 and CAN$1.000 = U.S.$0.759;

and for the financial year ended December 31, 2021: €1.000 = U.S.$1.182 and CAN$1.000 = U.S.$0.797.

Remuneration

of Directors

The

compensation paid to members of the Corporation’s Board of Directors (the “Board”) who are not our employees

(our “Outside Directors”) is designed to (i) attract and retain the most qualified people to serve on the Board and

its committees, (ii) align the interests of the Outside Directors with those of our shareholders, and (iii) provide appropriate compensation

for the risks and responsibilities related to being an effective Outside Director. This compensation is recommended to the Board by the

Nominating, Governance and Compensation Committee (the “NGCC”). The NGCC is currently composed of three Outside Directors,

each of whom is independent, namely Ms. Carolyn Egbert (Chair), Mr. Peter G. Edwards and Mr. Gilles Gagnon.

The

Board has adopted a formal mandate for the NGCC. The mandate of the NGCC provides that it is responsible for, among other matters, assisting

the Board in developing our approach to corporate governance issues, proposing new Board nominees, overseeing the assessment of the effectiveness

of the Board and its committees, their respective chairs and individual directors, making recommendations to the Board with respect to

directors’ compensation and generally serving in a leadership role for our corporate governance practices.

Compensation

of Outside Directors

Our

Outside Directors are paid an annual cash retainer, the amount of which depends on the position held on the Board. Our Outside Directors

will not be paid fees for attending Board meetings, unless some circumstance dictates that an unusual and burdensome number of meetings

must be held. If such circumstance occurs, the Board may institute meeting payments. The annual retainers are paid in quarterly instalments

on or about the last day of each calendar quarter. All payments are calculated in U.S. dollars. The amount of each payment is converted

to the Outside Director’s home currency based on the exchange rate prevailing on the date of payment. Each Outside Director is

paid the equivalent value of the payment in his or her home currency, net of any withholdings or deductions required by applicable law.

In

2023, the Board retained Bowers Consulting LLC (“Bowers”), an independent consulting firm, to assist the Board and

the NGCC with establishing and reviewing goals and performance objectives for the executive officers. For services provided in 2023,

the Corporation paid Bowers $6,600.

See

the table below under the heading “Total Compensation of Outside Directors” for details on the actual amounts paid

to each Outside Director during the 2023 financial year.

The

annual cash retainers for the Outside Directors are as follows:

| Type of Compensation | |

Annual Retainer for the year 2023 ($) | |

| Chair of the Board Retainer | |

| 80,000 | |

| Board Member Retainer | |

| 50,000 | |

| Audit Committee Chair Retainer | |

| 30,000 | |

| Audit Committee Member Retainer | |

| 7,500 | |

| NGCC Chair Retainer | |

| 15,000 | |

| NGCC Member Retainer | |

| 5,000 | |

| Strategic Committee | |

| 78,000 | |

In

addition to the annual cash retainers above for each of the standing committees of the Board, effective as of October 1, 2022, the members

of the Strategic Committee received a monthly fee of $6,500. The Strategic Committee was formed in December 2021 as an ad hoc committee

to consider and evaluate potential strategic transactions that could be undertaken by the Corporation. The Board elected to defer any

decision on whether and what to pay as a fee or retainer to members of the Strategic Committee so that the Board could evaluate the amount

of effort required of those members. In 2022, Bowers was engaged to consider and advise on the appropriate compensation for members of

the Strategic Committee. The Board considered the recommendations of Bowers on an amount of compensation designed to reflect the significant

time and effort required as the Board accelerated its strategic activities. After considering the recommendations of Bowers, the Board

approved a monthly cash retainer of $6,500 for members of the Strategic Committee, payable commencing as of October 1, 2022. Prior to

November 2, 2022, the Strategic Committee was comprised of Carolyn Egbert (Chair), Peter Edwards and Gilles Gagnon. On November 2, 2022,

Dennis Turpin replaced Gilles Gagnon as a member of the Strategic Committee.

All

Directors are reimbursed for travel and other out-of-pocket expenses incurred in attending Board or committee meetings. Retainers are

prorated when an Outside Director joins the Board during a financial year.

Outstanding Option-Based Awards and Share-Based Awards

The

following table shows all awards outstanding to each Outside Director as at December 31, 2023:

| Name | |

Issuance Date (mm/dd-yyyy) | | |

Number of Securities Underlying Unexercised Options(1) (#) | | |

Option Exercise Price(1) ($) | | |

Option Expiration Date(1) (mm-dd-yyyy) | | |

Value of Unexercised In-the-money Options(1)(2) ($) | | |

Issuance Date (mm-dd-yyyy) | | |

Number of Shares or Units of Shares that have Not Vested(3) (#) | | |

Market or Payout Value of Share-based Awards that have Not Vested(3)(4) ($) | | |

Market or payout value of vested share-based awards not paid out or distributed(3)(4) ($) | |

| Edwards, Peter G. | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/15/2020 | | |

| 300 | | |

| — | | |

| 2,232 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/05/2021 | | |

| 700 | | |

| — | | |

| 5,208 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 08/03/2022 | | |

| 5,000 | | |

| — | | |

| 37,200 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 06/14/2023 | | |

| 6,250 | | |

| — | | |

| 46,500 | |

| Egbert, Carolyn | |

| 08/15/2017 | | |

| 600 | | |

| 200.00 | | |

| 08/15/2024 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/08/2018 | | |

| 230 | | |

| — | | |

| 1,711 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/22/2019 | | |

| 300 | | |

| — | | |

| 2,232 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/15/2020 | | |

| 300 | | |

| — | | |

| 2,232 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/15/2021 | | |

| 700 | | |

| — | | |

| 5,208 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 08/03/2022 | | |

| 5,000 | | |

| — | | |

| 37,200 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 06/14/2023 | | |

| 6,250 | | |

| — | | |

| 46,500 | |

| Gagnon, Gilles | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/15/2020 | | |

| 300 | | |

| — | | |

| 2,232 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/19/2021 | | |

| 700 | | |

| — | | |

| 5,208 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 08/03/2022 | | |

| 5,000 | | |

| — | | |

| 37,200 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 06/14/2023 | | |

| 6,250 | | |

| — | | |

| 46,500 | |

| Turpin, Dennis | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 05/19/2021 | | |

| 700 | | |

| — | | |

| 5,208 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 08/03/2022 | | |

| 5,000 | | |

| — | | |

| 37,200 | |

| | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 06/14/2023 | | |

| 6,250 | | |

| — | | |

| 46,500 | |

| (1) | Refers

to an option-based award. |

| (2) | “Value

of unexercised in-the-money options” at financial year-end is calculated based on the

difference between the closing prices of the Common Shares on the Nasdaq Capital Market (“NASDAQ”)

on the last trading day of the fiscal year (December 31, 2023) of $1.86 (figure does not

reflect the 2024 Consolidation) and the exercise price of the options, multiplied by the

number of unexercised options. |

| (3) | Refers

to a share-based award. |

| (4) | The

Corporation used the closing price of its Common Shares on the NASDAQ as at the last trading

day of the fiscal year (December 31, 2023) of $1.86 (figure does not reflect the 2024 Consolidation). |

Total

Compensation of Outside Directors

The

table below summarizes the total compensation paid to our Outside Directors during the financial year ended December 31, 2023. Our Outside

Directors are generally paid in their home currency. Mr. Gagnon and Mr. Turpin were paid in Canadian dollars. Ms. Egbert and Mr. Edwards

were paid in U.S. dollars.

| Name |

|

Fees

earned(1)

($) |

|

|

Share-based

Awards(2)

($) |

|

|

Option-based

Awards

($) |

|

|

Non-Equity

Incentive Plan Compensation

($) |

|

|

Pension

Value

($) |

|

|

All

Other Compensation

($) |

|

|

Total

($)

|

|

| Edwards,

Peter G. |

|

|

140,500 |

|

|

|

71,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

211,500 |

|

| Egbert,

Carolyn |

|

|

173,000 |

|

|

|

71,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

244,000 |

|

| Gagnon,

Gilles |

|

|

62,500 |

|

|

|

71,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

133,500 |

|

| Turpin,

Dennis |

|

|

158,000 |

|

|

|

71,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

229,000 |

|

(1)

In respect of our financial year ended December 31, 2023, we paid an aggregate amount of $534,000 in fees to all of our Outside Directors

for services rendered in their capacity as directors, excluding reimbursement of out-of-pocket expenses and the value of share-based

and option-based awards granted in 2023.

(2)

Amounts shown represent the value of the DSUs on the grant date ($2.84; figure does not reflect the 2024 Consolidation). The value of

one DSU on the grant date is the closing price of one Common Share on the NASDAQ on the last trading day preceding the date of grant.

Compensation

of Executive Officers

The

following is disclosure of information related to the compensation that we paid to our named executive officers (“Named Executive

Officers”) during 2023. For 2023, our Named Executive Officers were as follows:

| ● | Dr.

Klaus Paulini, who is serving as President and Chief Executive Officer of the Corporation,

as well as Managing Director, Aeterna Zentaris GmbH (“AEZS Germany”); |

| ● | Mr.

Giuliano La Fratta, who, since January 24, 2022 has served as the Senior Vice President,

Finance and Chief Financial Officer of the Corporation; |

| ● | Dr.

Matthias Gerlach, who serves as Senior Vice President, Manufacturing & Managing Director,

AEZS Germany; |

| ● | Dr.

Eckhard Guenther, who formerly served as Vice President, Business Development & Alliance

Management and Managing Director, AEZS Germany; and |

| ● | Dr.

Michael Teifel who serves as Senior Vice President, Non-Clinical Development and Chief Scientific

Officer. |

Determining

Compensation

NGCC

The

compensation of executive officers of the Corporation and its subsidiaries is recommended to the Board by the NGCC. The NGCC is responsible

for, among other matters: (i) assisting the Board in developing our approach to corporate governance issues; (ii) proposing new Board

nominees; (iii) overseeing the assessment of the effectiveness of the Board and its committees, their respective chairs and individual

directors; and (iv) making recommendations to the Board with respect to Board member nominees and directors’ compensation, as well

as serving in a leadership role for our corporate governance practices. It is also responsible for taking all reasonable actions to ensure

that appropriate human resources policies, procedures and systems, e.g., recruitment and retention policies, competency and performance

metrics and measurements, training and development programs, and market-based, competitive compensation and benefits structures, are

in place so that we can attract, motivate and retain the quality of personnel required to achieve our business objectives. The NGCC also

assists the Board in discharging its responsibilities relating to the recruitment, retention, development, assessment, compensation and

succession planning for our executive and senior management members.

Thus,

the NGCC recommends the appointment of senior officers, including the terms and conditions of their appointment and termination, and

reviews the evaluation of the performance of our senior officers, including recommending their compensation and overseeing risk identification

and management in relation to executive compensation policies and practices. The Board, which includes the members of the NGCC, reviews

the Chief Executive Officer’s corporate strategy, goals and performance objectives and evaluates and measures his or her performance

and compensation against the achievement of such goals and objectives.

The

NGCC recognizes that the industry, regulatory and competitive environment in which we operate requires a balanced level of risk-taking

to promote and achieve the performance expectations of executives of a specialty biopharmaceutical company. The NGCC is of the view that

our executive compensation program should not encourage senior executives to take inappropriate or unreasonable risk. In this regard,

the NGCC recommends the implementation of compensation methods that appropriately connect a portion of senior executive compensation

with our short-term and longer-term performance, as well as that of each individual executive officer and that take into account the

advantages and risks associated with such compensation methods. The NGCC is also responsible for establishing compensation policies that

are intended to reward the creation of shareholder value while reflecting a balance between our short-term and longer-term performance

and that of each executive officer.

The

NGCC is currently composed of Ms. Carolyn Egbert (Chair), Mr. Peter G. Edwards and Mr. Gilles Gagnon, each of whom is independent. The

Board believes that the members of the NGCC collectively have the knowledge, experience and background required to fulfill its mandate:

Carolyn

Egbert has served as a director on our Board since August 2012 and as Chair of our Board since May 2016. After enjoying the private

practice of law as a defense litigator in Michigan and Washington, D.C., she joined Solvay America, Inc. (“Solvay”)

(a chemical and pharmaceutical company) in Houston, Texas. Over the course of a twenty-year career with Solvay, she held the positions

of Vice President, Human Resources, President of Solvay Management Services, Global Head of Human Resources and Senior Executive Vice

President of Global Ethics and Compliance. During her tenure with Solvay, she served as a director on the Board of Directors of seven

subsidiary companies and as Chair of one subsidiary board. After retiring in 2010, she established Creative Solutions for Executives,

a consulting business providing expertise in corporate governance, ethics and compliance, organizational development, executive compensation,

and strategic human resources. She holds a Bachelor of Sciences degree in Biological Sciences from George Washington University, Washington

D.C. and a Juris Doctor degree from Seattle University, Seattle, Washington. Carolyn was also a Ph.D. candidate in Pharmacology at both

Georgetown University Medical School at Washington, D.C. and Northwestern University Medical School at Chicago, Illinois. She remains

an active member of both the Michigan State Bar and the District of Columbia Bar, Washington, D.C.

Peter

G. Edwards joined the Board on May 15, 2020 and is a member of the Audit Committee and of the NGCC. Mr. Edwards most recently served

as General Counsel of Aziyo Biologics from September 2021 to October 2022. Before that, he served as Executive Vice President and General

Counsel of Celanese Corporation from January 2017 to January 2019. Previously, Mr. Edwards was the Executive Vice President and General

Counsel of Baxalta Incorporated, a biopharmaceutical spin-off from Baxter, from June 2015 until its merger with Shire plc in July 2016.

Before that, he was Senior Vice President and General Counsel of the global specialty pharmaceuticals company, Mallinckrodt plc, from

July 2013 to June 2015 and served as its Vice President and General Counsel from May 2010 to its spin-off from Covidien plc in June of

2013. Additionally, Mr. Edwards formerly served as Executive Vice President and General Counsel for Solvay Pharmaceuticals in Brussels,

Belgium from June 2007 until April 2010 and as its Senior Vice President and General Counsel in the US from October 2005 to June 2007.

Prior to that, he held in-house positions of increasing responsibility within Mettler-Toledo, Inc. and Eli Lilly and Company. Mr. Edwards

began his career in 1990 as an associate in the Kansas City, Missouri office of Shook, Hardy & Bacon L.L.P. Mr. Edwards received

his J.D., cum laude, from Brigham Young University.

Gilles

Gagnon joined the Board on January 1, 2020 and is a member of the Audit Committee and of the NGCC. Mr. Gagnon is currently the President

and Chief Executive Officer of Ceapro Inc., a biotechnology company. Prior to that, he was President and CEO of Aeterna Zentaris Inc.

During the past 35 years, Mr. Gagnon has worked at several management levels within the field of health, especially in the hospital environment

and pharmaceutical industry. Mr. Gagnon has participated in several international committees and strategic advisory boards. He served

nine years on the board of directors of Canada’s Research Based Pharmaceutical Companies (Rx&D—now Innovative Medicine

Canada) where he represented members from the biopharmaceutical sector and pioneered the Rx&D’s Canadian Bio partnering initiative.

He currently serves as the President and Chief Executive Officer of Ceapro Inc. He is a member of the CEO Council of Innovative Medicine

Canada. He is a certified corporate Director having completed the Directors Education Program at the Rotman School of Management at the

University of Toronto, and he has served on several boards of both private and publicly listed companies in the biopharmaceutical sector.

Compensation

Discussion & Analysis

Compensation

Philosophy and Objectives

Our

Board, through the NGCC, establishes our executive compensation program that is market-based and at a competitive percentile grouping

for both total cash and total direct compensation. The NGCC has established a compensation program that is designed to attract, motivate

and retain high-performing senior executives, encourage and reward superior performance and align the executives’ interests with

those of our shareholders by:

| ● | providing

the opportunity for an executive to earn compensation that is competitive with the compensation

received by executives serving in the same or measurably similar positions within comparable

companies; |

| ● | providing

the opportunity for executives to participate in equity-based incentive compensation plans; |

| ● | aligning

executive compensation with our corporate objectives; and |

| ● | attracting

and retaining highly qualified individuals in key positions. |

Compensation

Elements

Our

executive compensation is targeted at the 50th percentile for small cap biopharmaceutical companies within both the local and national

markets and is comprised of both fixed and variable components. The variable components include equity and non-equity incentive plans.

Each compensation component is intended to serve a different function, but all elements are intended to work in concert to maximize both

corporate and individual performance by establishing specific, competitive operational and corporate goals and by providing financial

incentives to employees based on their level of attainment of these goals.

Our

current executive compensation program is comprised of the following four basic components: (i) base salary; (ii) an annual bonus linked

to both individual and corporate performance; (iii) equity incentives, including stock options, previously granted under our second amended

and restated stock option plan adopted by the Board on March 29, 2016, and ratified by the shareholders of Aeterna Zentaris on May 10,

2016 (the “Stock Option Plan”), and presently granted under the Corporation’s long-term incentive plan adopted

by the Board on March 27, 2018 and ratified by the shareholders of Aeterna Zentaris on May 8, 2018, (the “Long-Term Incentive

Plan”), established for the benefit of our directors, certain executive officers and other Participants (as defined below under

the heading “Summary of the Stock Option Plan”) as may be designated from time to time by either the Board or the

NGCC; and (iv) other elements of compensation, consisting of benefits, perquisites and retirement benefits.

Base

Salary. Base salaries are intended to provide a steady income to our executive officers regardless of share price. In determining

individual base salaries, the NGCC takes into consideration individual circumstances that may include the scope of an executive’s

position, the executive’s relevant competencies or experience and retention risk. The NGCC also takes into consideration the fulfillment

of our corporate objectives, as well as the individual performance of the executive.

Short-Term,

Non-Equity Incentive Compensation. Our short-term, non-equity incentive compensation plan sets a target cash bonus for each executive

officer, expressed as a percentage of the executive officer’s base salary. The amount of cash bonus paid to an executive officer

depends on the extent to which he or she contributed to the achievement of the annual performance objectives established by the Board

for the year. The annual performance objectives are specific operational, clinical, regulatory, financial, commercial and corporate goals

that are intended to advance our product pipeline, to promote the success of our commercial efforts and to enhance our financial position.

The annual performance objectives are set at the end of each financial year as part of the annual review of corporate strategies. The

performance objectives are not established for individual executive officers but rather by functional area(s), many of which are carried

out by or fall within the responsibility of our President and Chief Executive Officer, Chief Financial Officer (or principal financial

officer) and our other executive officers, including our Named Executive Officers. The award of a cash bonus requires the approval of

both the NGCC and the Board and is based upon an assessment of each individual’s performance, as well as our overall performance

at a corporate level. The determination of individual performance does not involve quantitative measures using a mathematical calculation

in which each individual performance objective is given a numerical weight. Instead, the NGCC’s determination of individual performance

is a subjective determination as to whether a particular executive officer substantially achieved the stated objectives or over-performed

or under-performed with respect to corporate objectives that were deemed to be important to our success.

Long-Term

Equity Compensation Plan of Executive Officers. The long-term component of the compensation of our executive officers is based exclusively

on the Long-Term Incentive Plan, which permits the issuance of a number of equity-based awards based on the contribution of the officers

and their responsibilities. The Board adopted a policy regarding stock option grants in December 2014, which provides that each Named

Executive Officer is eligible to receive options to acquire our Common Shares having a value, based on the Black-Scholes option pricing

model, equal to a specified multiple of his or her salary. The specified multiple for the President and Chief Executive Officer is 1.5.

The specified multiple for each other Named Executive Officer is 0.75. To encourage retention and focus management on developing and

successfully implementing our continuing growth strategy, stock options vest over a period of three years, with the first third vesting

on the first anniversary of the date of grant. Since the adoption of the Long-Term Incentive Plan in 2018, we have broadened the types

of equity-based awards which we may issue beyond stock options (to include, among other types, restricted stock units (“RSUs”),

DSUs and others).

Other

Forms of Compensation. Our executive employee benefits program also includes life, medical, dental and disability insurance to the

same extent and in the same manner as all other employees as either enrollment in the payroll system benefits program or by additional

percentage compensation to self-enroll in private insurance policies. These benefits and perquisites are designed to be competitive overall

with equivalent positions in comparable North American organizations in the life sciences industry. We also contribute to our North American

employees’ retirement plans up to an annual maximum amount of $19,500 for employees in the United States and Canada. The contribution

amounts for our United States and Canadian employees are subject to limitations imposed by the United States Internal Revenue Service

and the Canada Revenue Agency respectively, on contributions to our most highly compensated employees. Employees based in Frankfurt,

Germany also benefit from certain employer contributions into the employees’ pension funds. Our executive officers, including the

Named Executive Officers, are eligible to participate in such employer-contribution plans to the same extent and in the same manner as

all other employees.

Positioning

The

NGCC is authorized to engage its own independent consultant to advise it with respect to executive compensation matters. While the NGCC

may rely on external information and advice, all of the decisions with respect to executive compensation are made by the Board upon the

recommendation of the NGCC and may reflect factors and considerations other than, or that may differ from, the information and recommendations

provided by any external compensation consultants that may be retained from time to time.

Risk Assessment of Executive Compensation Program

The

Board, through the NGCC, oversees the implementation of compensation methods that tie a portion of executive compensation to our short-term

and long-term performance and that of each executive officer and that take into account the advantages and risks associated with such

compensation methods. In addition, the Board oversees the creation of compensation policies that are intended to reward the creation

of shareholder value while reflecting a balance between our short-term and long-term performance and that of each executive officer.

The NGCC has considered in general terms the concept of risk as it relates to our executive compensation program.

Base

salaries are fixed in amount to provide a steady income to the executive officers regardless of share price and thus do not encourage

or reward risk-taking to the detriment of other important business, operational, commercial or clinical metrics or milestones. The variable

compensation elements (annual bonuses and equity-based awards) are designed to reward each of short-term, mid-term and long-term performance.

For short-term performance, a discretionary annual bonus may be awarded based on the timing and level of attainment of specific operational

and corporate goals that the NGCC believes to be challenging yet does not encourage unnecessary or excessive risk-taking. While our bonus

payments are generally based on annual performance, a maximum bonus payment is pre-fixed for each senior executive officer and represents

only a portion of each individual’s overall total compensation opportunities. In exceptional circumstances, a particular executive

officer may be awarded a bonus that exceeds his or her maximum pre-fixed or target bonus amount. Finally, a significant portion of executive

compensation is provided in the form of equity-based awards, which is intended to further align the interests of executives with those

of shareholders. The NGCC believes that these awards do not encourage unnecessary or excessive risk-taking since the ultimate value of

the awards is tied to our share price, and in the case of grants under the long-term incentive compensation plan, are generally subject

to mid-term and long-term vesting schedules to help ensure that executives generally have significant value tied to long-term share price

performance.

The

NGCC believes that the variable compensation elements (annual bonuses and equity-based awards) represent a percentage of overall compensation

that is sufficient to motivate our executive officers to produce superior short-term, mid-term and long-term corporate results, while

the fixed compensation element (base salary) is also sufficient to discourage executive officers from taking unnecessary or excessive

risks. The NGCC and the Board also generally have the discretion to adjust annual bonuses and equity-based awards based on individual

performance and any other factors they may determine to be appropriate in the circumstances. Such factors may include, where necessary

or appropriate, the level of risk-taking a particular executive officer may have engaged in during the preceding year.

Based

on the foregoing, the NGCC has not identified any specific risks associated with our executive compensation program that are reasonably

likely to have a material adverse effect on us. The NGCC believes that our executive compensation program does not encourage or reward

any unnecessary or excessive risk-taking behavior.

Our

directors, executive officers and employees are prohibited from purchasing, selling or otherwise trading in derivative securities relating

to our Common Shares. Derivative securities are securities whose value varies in relation to the price of our securities. Examples of

derivative securities include warrants to purchase our Common Shares, and put or call options written on our Common Shares, as well as

individually arranged derivative transactions, such as financial instruments, including, for greater certainty, prepaid variable forward

contracts, equity swaps, collars, or units of exchange funds, which are designed to hedge or offset a decrease in market value of our

equity securities granted as executive compensation or directors’ remuneration. Options to acquire our Common Shares and other

equity-based awards issued pursuant to the Stock Option Plan or Long-Term Incentive Plan are not derivative securities for this purpose.

2023 Compensation

Base

Salary. The primary element of our compensation program is base salary. Our view is that a competitive base salary is a necessary

element for retaining qualified executive officers. In determining individual base salaries, the NGCC takes into consideration individual

circumstances that may include the scope of an executive’s position, the executive’s relevant competencies or experience

and retention risk. The NGCC also takes into consideration the fulfillment of our corporate objectives, as well as the individual performance

of the executive.

Short-Term,

Non-Equity Incentive Compensation. The Board, based on the NGCC’s recommendation, adopted the following performance objectives

for 2023:

| Objective |

|

Result |

| Drive

financial performance with a high degree of disclosure quality and receiving clean audited reports and reducing our close to 5-6

days instead of 10-14 days. |

|

Objective

met: We received a clean audit opinion for the 2022 year end, reduced our monthly close

to 6 days and greatly improved the quality of our internal and external financial reporting.

This was accomplished by implementing additional processes, leveraging existing technology,

utilizing new applications, and greater collaboration across the finance team.

|

| Streamlining

back-office process related to month end close; further improving interaction with operations to ensure accuracy by rolling out an

R&D accrual process tool in Q1 and implementing a new reporting tool in Q1. |

|

Objective

met: We have streamlined monthly calls with operations to review progress of projects and ensure accurate R&D accruals. We

also completed our initial implementation of the new Insight reporting tool in Q1. Through Q2 the team continues to refine the reporting

tool and expects it to be fully operational at the end of Q2. |

| Identify

at least $1M in additional savings or gains vs. budget by end of Q2. |

|

Objective

met: As of April 30th, we are $2.6M in favorable cash savings versus budget, and projections indicate that we will exceed this

goal by June. |

Transition

from Novo: Ensure in Q2 the $9.4M are received together with all other deliverables (Product;

API, equipment, documentation) at minimal cost.

|

|

Objective

met: All expected payments ($9.4M) received from Novo; API received at no cost; NDA and documents transferred. |

Continue

to prioritize operational strategies within our pipeline to ensure high quality of work and

success of hitting milestones:

1. Completion

of the DETECT trial (l.p.l.v.) by end of 2023.

2. Securing

neuromyelitis optica spectrum disorder (“NMOSD”) efficacy data from patient blood in Q1.

3. Defining

NMOSD development candidate in Q4. |

|

1. Objective

not met: Completed in Q1, 2024.

2. Objective

met: AIM efficacy data received (T cell effects in blood).

3. Objective

on track: to define development candidates for AIMs. |

| Ensure

Go/No-Go decision of amyotrophic lateral sclerosis (“ALS”) project by end of Q1 |

|

Objective

met: Positive ALS data warrants continuation, a go decision. |

| Enable

evaluation of success probability of ALS vs. delayed clearance parathyroid hormone (“DC-PTH”) project before ASM

meeting. |

|

Objective

met: ALS and DC-PTH seem feasible and we are looking to identify partners for both projects. |

| Ensure

timely product supplies with adequate quality oversight to prevent any re-calls throughout 2023. |

|

Objective

met. |

Meet

or beat the YTD performance of the XBI index on Dec. 1st, 2023.

|

|

Objective

not met: Due to delays in achieving certain business and operational milestones.

|

| Objective |

|

Result |

Revise

IR strategy and planning from the restrained approach during H1 2023:

1. Constant

review of retail investors chat rooms.

2. More

public appearances in person and virtually.

3. Tailored

outreach to our known (main) investors.

4. Increased

outreach to potential institutional investors. |

|

1. Objective

ongoing – Review of investor feedback from chat rooms is included as a recurrent item for internal investor relations meetings.

2. Objective

ongoing – The Corporation made appearances at two events: the JTC Virtual Investor Summer Spotlight Series (July 13) and the

H.C. Wainwright 25th Annual Global Investment Conference (Sept. 11-13).

3. Objective

ongoing – Regular outreach program to our known investor base was implemented and is ongoing.

4. Objective

ongoing – The Corporation’s M&A process during the year resulted in tailoring back outreach to selected activities. |

| MACRILEN

partnering in US – Identify a new US and Canadian partner for Macrilen® by the end of 2023. |

|

Objective

ongoing. |

The

NGCC considered the goals set out above in determining the cash bonus amounts awarded to the management team for 2023. The NGCC recognized

that delays were experienced due to external factors, primarily that the war in Ukraine impacted the conduct of the DETECT study at clinical

trial sites initiated in Ukraine and Russia and delayed the planned progress of the Corporation’s pre-clinical program. As a result,

some of the goals for 2023 were not fully achieved. After considering the extent to which the goals for 2023 were achieved and, where

not achieved, the degree to which that was within the control of management, the NGCC recommended that cash bonuses awarded to the management

team be paid but at a significantly reduced amount from both the target amounts and the amounts awarded in 2022. The amounts and comparisons

with those paid in prior years are reflected in the Summary Compensation Table set out below under the heading “Summary Compensation

Table”.

Long-Term Equity Compensation

For

the financial year ended December 31, 2023, the Board did not approve any issuance of stock option awards to any of the Named Executive

Officers.

Summary of the Stock Option Plan

We

established the Stock Option Plan in order to attract and retain directors, officers, employees and suppliers of ongoing services, who

will be motivated to work towards ensuring our success. The Board has full and complete authority to interpret the Stock Option Plan,

to establish applicable rules and regulations and to make all other determinations it deems necessary or useful for the administration

of the Stock Option Plan, provided that such interpretations, rules, regulations and determinations are consistent with the rules of

all stock exchanges and quotation systems on which our securities are then traded and with all relevant securities legislation.

There

were 600 options outstanding under the Stock Option Plan representing approximately 0.0% of all issued and outstanding Common Shares

as of December 31, 2023. The proposed number of Common Shares issuable pursuant to the Long-Term Incentive Plan is fixed at 11.4% of

the issued and outstanding Common Shares at any given time less the number of Common Shares issuable pursuant to stock options granted

at such time under the Stock Option Plan. See below for a complete description of the Long-Term Incentive Plan. As of December 31, 2023,

there were 59,414 Common Shares unallocated and available for future grants of options under the Stock Option Plan; however, the Corporation

does not intend on issuing any new stock options under the Stock Option Plan, and instead will issue any future stock options under the

Long-Term Incentive Plan.

The

burn rate for the Stock Option Plan for the most recently completed fiscal year is set out below:

| Stock Option Plan |

| Year End | |

Options Granted | | |

Weighted Average Shares Outstanding | | |

Burn Rate(1) | |

| December 31, 2023 | |

| 0 | | |

| 1,213,942 | | |

| 0 | % |

| December 31, 2022 | |

| 0 | | |

| 1,213,942 | | |

| 0 | % |

| December 31, 2021 | |

| 0 | | |

| 1,149,245 | | |

| 0 | % |

| (1) | Annual

burn rate is expressed as a percentage and is calculated by dividing the number of securities

granted under the Stock Option Plan by the weighted average number of securities outstanding

for the applicable fiscal year. |

Under

the Stock Option Plan, (i) the number of securities issuable to insiders, at any time, or issued within any one-year period, under all

of our security-based compensation arrangements, cannot exceed 10% of our issued and outstanding securities and (ii) no single person

eligible to receive grants under the Stock Option Plan (each a “Participant”) may hold options to purchase, from time

to time, more than 5% of our issued and outstanding Common Shares. In addition: (i) the aggregate fair value of options granted under

all of our security-based compensation arrangements to any one of our Outside Directors entitled to receive a benefit under the Stock

Option Plan, within any one-year period, cannot exceed $100,000 valued on a Black-Scholes basis and as determined by the NGCC; and (ii)

the aggregate number of securities issuable to all of our Outside Directors entitled to receive a benefit under the Stock Option Plan,

within any one-year period, under all of our security-based compensation arrangements, cannot exceed 1% of its issued and outstanding

securities.

Options

granted under the Stock Option Plan may be exercised at any time within a maximum period of seven or ten years following the date of

their grant (the “Outside Expiry Date”), depending on the date of grant. The Board or the NGCC, as the case may be,

designates, at its discretion, the specific Participants to whom stock options are granted under the Stock Option Plan and determines

the number of Common Shares covered by each of such option grants, the grant date, the exercise price of each option, the Outside Expiry

Date and any other matter relating thereto, in each case in accordance with the applicable rules and regulations of the regulatory authorities.

The price at which the Common Shares may be purchased may not be lower than the greater of the closing prices of the Common Shares on

the NASDAQ on the last trading day preceding the date of grant of the option. Options granted under the Stock Option Plan shall vest

in equal tranches over a three-year period (one-third each year, starting on the first anniversary of the grant date) or as otherwise

determined by the Board or the NGCC, as the case may be. Participants may not assign their options (nor any interest therein) other than

by will or in accordance with the applicable laws of estates and succession.

Unless

the Board or the NGCC decides otherwise, Participants cease to be entitled to exercise their options under the Stock Option Plan: (i)

immediately, in the event a Participant who is an officer or employee resigns or voluntarily leaves his or her employment or his or her

employment is terminated with cause and, in the case of a Participant who is a non-employee director of us or one of our subsidiaries,

the date on which such Participant ceases to be a member of the relevant Board; (ii) six months following the date on which employment

is terminated as a result of the death of a Participant who is an officer or employee and, in the case of a Participant who is an Outside

Director, six months following the date on which such Participant ceases to be a member of the Board by reason of death; (iii) 90 days

following the date on which a Participant’s employment is terminated for a reason other than those mentioned in (i) or (ii) above

including, without limitation, upon the disability, long-term illness, retirement or early retirement of the Participant; and (iv) where

the Participant is a service supplier, 30 days following the date on which such Participant ceases to act as such, for any cause or reason

(each, an “Early Expiry Date”).

The

Stock Option Plan also provides that, if the expiry date of one or more options (whether an Early Expiry Date or an Outside Expiry Date)

occurs during a Blackout Period (as defined below) or within the seven business days immediately after a blackout period imposed by us,

the expiry date will be automatically extended to the date that is seven business days after the last day of the blackout period. For

the purposes of the foregoing, “Blackout Period” means the period during which trading in our securities is restricted

in accordance with our corporate policies.

If

(i) we accept an offer to amalgamate, merge or consolidate with any other entity (other than one of our wholly-owned subsidiaries) or

to sell or license all or substantially all of our assets to any other entity (other than one of our wholly-owned subsidiaries); (ii)

we sign a support agreement in customary form pursuant to which the Board agrees to support a takeover bid and recommends that our shareholders

tender their Common Shares to such takeover bid; or (iii) holders of more than 50% of our then outstanding Common Shares tender all of

their Common Shares to a takeover bid made to all of the holders of the Common Shares to purchase all of the then issued and outstanding

Common Shares, then, in each case, all of the outstanding options shall, without any further action required to be taken by us, immediately

vest. Each Participant shall thereafter be entitled to exercise all of such options at any time up to and including, but not after the

close of business on that date which is ten days following the Closing Date (as defined below). Upon the expiration of such ten-day period,

all rights of the Participant to such options or to the exercise of same (to the extent not already exercised) shall automatically terminate

and have no further force or effect whatsoever. “Closing Date” is defined to mean (x) the closing date of the amalgamation,

merger, consolidation, sale or license transaction in the case of clause (i) above; (y) the first expiry date of the takeover bid on

which each of the offeror’s conditions are either satisfied or waived in the case of clause (ii) above; or (z) the date on which

it is publicly announced that holders of greater than 50% of our then outstanding Common Shares have tendered their Common Shares to

a takeover bid in the case of clause (iii) above.

The

Stock Option Plan provides that the following amendments may be made to the plan only upon approval of each of the Board and our shareholders

as well as receipt of all required regulatory approvals:

| ● | any

amendment to Section 3.2 of the Stock Option Plan (which sets forth the limit on the number

of options that may be granted to insiders) that would have the effect of permitting, without

having to obtain shareholder approval on a “disinterested vote” at a duly convened

shareholders’ meeting, the grant of any option(s) under the Stock Option Plan otherwise

prohibited by Section 3.2 of the Stock Option Plan; |

| ● | any

amendment to the number of securities issuable under the Stock Option Plan (except for certain

permitted adjustments, such as in the case of stock splits, consolidations or reclassifications); |

| ● | any

amendment that would permit any option granted under the Stock Option Plan to be transferable

or assignable other than by will or in accordance with the applicable laws of estates and

succession; |

| ● | the

addition of a cashless exercise feature, payable in cash or securities, which does not provide

for a full deduction of the number of underlying securities from the Stock Option Plan reserve; |

| ● | the

addition of a deferred or restricted share unit component or any other provision that results

in employees receiving securities while no cash consideration is received by us; |

| ● | with

respect to any Participant, whether or not such Participant is an “insider” and

except in respect of certain permitted adjustments, such as in the case of stock splits,

consolidations or reclassifications; |

| ● | any

reduction in the exercise price of any option after the option has been granted; |

| ● | any

cancellation of an option and the re-grant of that option under different terms; |

| ● | any

extension to the term of an option beyond its Outside Expiry Date to a Participant who is

an “insider” (except for extensions made in the context of a Blackout Period); |

| ● | any

amendment to the method of determining the exercise price of an option granted pursuant to

the Stock Option Plan; |

| ● | the