As filed with the U.S Securities and Exchange

Commission on May 20, 2022

Registration No. 333-262107

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 4 TO

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

AGM Group Holdings Inc.

(Exact name of registrant as specified in its charter)

| N/A |

| (Translation of Registrant’s Name into English) |

| British Virgin Islands |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

c/o Creative Consultants (Hong Kong) Limited

Room 1502-3 15/F., Connaught Commercial Building,

185 Wanchai Road

Wanchai, Hong Kong

+86-010-65020507 – telephone

(Address and telephone number of Registrant’s

principal executive offices)

COGENCY GLOBAL INC.

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Name, address, and telephone number of agent for

service)

Copies to:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

+1-212-588-0022 – telephone

+1-212-826-9307 – facsimile

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement.

If only securities being registered on this Form

are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

The information in this

preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not

soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 20, 2022

AGM Group Holdings Inc.

Up to 1,652,175 Class A Ordinary Shares Underlying

Warrants

This prospectus relates to the offer and resale

of up to 1,652,175 Class A ordinary shares of AGM Group Holdings Inc., a British Virgin Islands company, which include up to 1,449,276

Class A ordinary shares (the “Investor Warrant Shares”) issuable upon the exercise of certain ordinary share purchase warrants

(the “Investor Warrants”) issued in a private placement to certain institutional investors (the “Investors”)

and up to 202,899 Class A ordinary shares (the “Placement Warrant Shares” and together with the Investor Warrant Shares,

the “Warrant Shares”) issuable upon the exercise of that certain ordinary share purchase warrants (the “Placement Agent

Warrants” and together with the Investor Warrants, the “Warrants”)) issued to the placement agent in such private placement

(the “Placement Agent”). The Investors and the Placement Agent are identified as selling shareholders in this registration

statement (the “Selling Shareholders”). The Investor Warrants were issued to the Investors in connection with a certain securities

purchase agreement between the Company and the Investors, dated as of December 10, 2021 (the “Securities Purchase Agreement”).

The Investor Warrants are exercisable immediately from the date of issuance and have a term of three and one-half years from the date

of issuance. The Investor Warrants have an exercise price of $8.30 per share, subject to adjustments thereunder. The Placement Agent

Warrants were issued to the Placement Agent and/or its assignees in connection with that certain placement agency agreement between the

Company and the Placement Agent dated December 10, 2021 (the “Placement Agency Agreement”). The Placement Agent Warrants

have a term of three and a half years from the date of issuance. The Placement Agent Warrants have an exercise price of $8.30 per share,

subject to adjustments thereunder. See section titled “December 2021 Offering” beginning on page 14.

This prospectus also covers any additional ordinary

shares that may become issuable upon any anti-dilution adjustment pursuant to the terms of the Investor Warrants and the Placement Agent

Warrants issued to the Selling Shareholders by reason of stock splits, stock dividends, and other events described therein.

The Warrant Shares will be resold from time

to time by the Selling Shareholders listed in the section titled “Selling Shareholders” beginning on page 16.

The Selling Shareholders, or their

respective transferees, pledgees, donees or other successors-in-interest, may sell the Warrant Shares through public or private

transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The

Selling Shareholders may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what

amount the Selling Shareholders may sell their Warrant Shares hereunder following the effective date of this registration statement.

We provide more information about how a Selling Shareholder may sell its Warrant Shares in the section titled “Plan of

Distribution” on page 20.

We are registering the Warrant Shares on behalf

of the Selling Shareholders, to be offered and sold by them from time to time. While we will not receive any proceeds from the sale of

our Class A ordinary shares by the Selling Shareholders in the offering described in this prospectus, we will receive proceeds upon the

cash exercise of each of the Warrants. Upon exercise of the Investor Warrants for all 1,449,276 Investor Warrant Shares by payment of

cash, we will receive aggregate gross proceeds of $12,028,990.80, if the exercise price is $8.30 per share and upon exercise of the Placement

Agent Warrants for all 202,899 Placement Agent Warrant Shares, we will receive aggregate gross proceeds of $1,684,061.70, at the exercise

price of $8.30 per share. However, we cannot predict when and in what amounts or if the Warrants will be exercised, and it is possible

that the Warrants may expire and never be exercised, in which case we would not receive any cash proceeds. We have agreed to bear all

of the expenses incurred in connection with the registration of the Warrant Shares. The Selling Shareholders will pay or assume discounts,

commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of the Warrant

Shares.

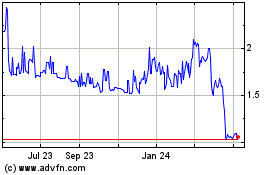

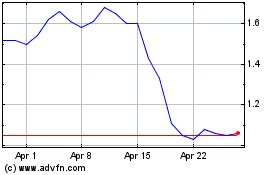

Our Class A ordinary shares are traded on

the Nasdaq Capital Market under the symbol “AGMH”. On May 17, 2022, the last reported sales price of our shares on the Nasdaq

Capital Market was $1.98 per share and we had 24,254,842 shares of Class A ordinary share outstanding as of the date of this prospectus.

Our stock price is volatile. During the 12 months prior to the date of this prospectus, our ordinary share has traded at a low of $1.52

and a high of $12.50. There has been no change recently in our financial condition or results of operations that is consistent

with the recent change in our stock price.

Investors are cautioned that you are not

buying shares of a Hong Kong- or China-based operating company but instead are buying shares of a BVI holding company with operations

conducted by its subsidiaries.

AGM Group Holdings Inc., or AGM, is a holding

company incorporated in the British Virgin Islands, or the BVI. As a holding company with no material operations, AGM conducts a substantial

majority of its operations through its subsidiaries established in the People’s Republic of China, or the PRC or China. However,

neither the holding company nor any of the Company’s Chinese subsidiaries conduct any operations through contractual arrangements

with a variable interest entity based in China. Investors in our ordinary shares should be aware that they may never directly hold equity

interests in the PRC operating entities, but rather purchasing equity solely in AGM Group Holdings Inc., our BVI holding company. Furthermore,

shareholders may face difficulties enforcing their legal rights under United States securities laws against our directors and officers

who are located outside of the United States. See “Risk Factors – Risks Related to Doing Business in China – Uncertainties

with respect to the PRC legal system could adversely affect us” on page 17 of the 2021 Annual Report.

Our equity structure is a direct holding structure. Within our direct

holding structure, the cross-border transfer of funds within our corporate entities is legal and compliant with the laws and regulations

of the PRC. After the foreign investors’ funds enter AGM, the funds can be directly transferred to the PRC operating companies through

its subsidiaries. Specifically, AGM is permitted under the BVI laws to provide funding to our subsidiaries in the PRC, Hong Kong and Singapore

through loans or capital contributions without restrictions on the amount of the funds, subject to satisfaction of applicable government

registration, approval and filing requirements. Each of our subsidiaries in the Hong Kong and Singapore is also permitted under the laws

of Hong Kong and Singapore to provide funding to AGM through dividend distribution without restrictions on the amount of the funds. Current

PRC regulations permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated profits, if any, determined

in accordance with Chinese accounting standards and regulations. As of the date of this prospectus, there have not been any transfers,

dividends or distributions made between the holding company, its subsidiaries, and to investors. Furthermore, as of the date of this prospectus,

no cash generated from one subsidiary is used to fund another subsidiary’s operations and we do not anticipate any difficulties

or limitations on our ability to transfer cash between subsidiaries. We have also not installed any cash management policies that dictate

the amount of such funds and how such funds are transferred. For the foreseeable future, we intend to use the earnings for our business

operations and as a result, we do not intend to distribute earnings or pay any cash dividends. See “Transfers of Cash to and from

Our Subsidiaries” on page vi of the 2021 Annual Report.

Investing in our securities being offered pursuant

to this prospectus involves a high degree of risk. You should carefully read and consider the “Risk Factors’’

beginning on page 13 before you make your investment decision.

Because our operations are primarily located

in the PRC and Hong Kong through our subsidiaries, we are subject to certain legal and operational risks associated with our operations

in China, including changes in the legal, political and economic policies of the Chinese government, the relations between China

and the United States, or Chinese or United States regulations may materially and adversely affect our business, financial condition

and results of operations. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and

therefore, these risks may result in a material change in our operations and the value of our ordinary shares, or could significantly

limit or completely hinder our ability to offer or continue to offer our securities to investors and cause the value of such securities

to significantly decline or be worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate

business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing

supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the

scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We do not believe that our subsidiaries

are directly subject to these regulatory actions or statements, as we have not implemented any monopolistic behavior and our business

does not involve the collection of user data or implicate cybersecurity. As of the date of this prospectus, no relevant laws or regulations

in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission, or the CSRC, or any other PRC governmental

authorities for our offering, nor has our BVI holding company or any of our subsidiaries received any inquiry, notice, warning or sanctions

regarding our offering from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions

by the PRC government are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain

how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed

implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations

will have on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. The

Standing Committee of the National People’s Congress, or the SCNPC, or other PRC regulatory authorities may in the future promulgate

laws, regulations or implementing rules that requires our company or any of our subsidiaries to obtain regulatory approval from Chinese

authorities before offering in the U.S. In other words, although the Company is currently not required to obtain permission from any

of the PRC federal or local government to obtain such permission and has not received any denial to list on the U.S. exchange, our operations

could be adversely affected, directly or indirectly; our ability to offer, or continue to offer, securities to investors would be potentially

hindered and the value of our securities might significantly decline or be worthless, by existing or future laws and regulations relating

to its business or industry or by intervene or interruption by PRC governmental authorities, if we or our subsidiaries (i) do not receive

or maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, (iii) applicable

laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future, or (iv) any intervention

or interruption by PRC governmental with little advance notice.

Pursuant to the Holding Foreign Companies

Accountable Act, or the HFCAA, if the Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect an issuer’s

auditors for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB issued

a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public

accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more

authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken

by one or more authorities in Hong Kong. Furthermore, the PCAOB’s report identified the specific registered public accounting

firms which are subject to these determinations. On June 22, 2021, United States Senate has passed the Accelerating Holding Foreign

Companies Accountable Act, or the Accelerating HFCAA, which, if enacted, would decrease the number of “non-inspection years”

from three years to two years, and thus, would reduce the time before our securities may be prohibited from trading or delisted if the

PCAOB determines that it cannot inspect or investigate completely our auditor. As of the date of the prospectus, TPS Thayer, LLC (“TPS

Thayer”) and JLKZ CPA LLP (“JLKZ”), our auditors, are not subject to the determinations as to inability

to inspect or investigate completely as announced by the PCAOB on December 16, 2021. The Company’s auditor is based in the U.S.

and is registered with PCAOB and subject to PCAOB inspection, however, recently developments with respect to audits of China-based companies,

create uncertainty about the ability of JLKZ to fully cooperate with the PCAOB’s request for audit workpapers without the approval

of the Chinese authorities. In the event it is later determined that the PCAOB is unable to inspect or investigate completely

the Company’s auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could

cause trading in the Company’s securities to be prohibited under the HFCAA, and ultimately result in a determination by a securities

exchange to delist the Company’s securities. See “Risk Factors – Risks Related to Doing Business in China –

The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable

Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of

their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our

offering” beginning on page 22 of the 2021 Annual Report.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2022

TABLE OF CONTENTS

ABOUT THIS OFFERING

This prospectus describes the general manner in

which the Selling Shareholders may offer from time to time up to 1,652,175 Warrant Shares, including up to 1,449,276 Investor Warrant

Shares issuable upon the exercise of the Investor Warrants and up to 202,899 Placement Agent Warrant Shares issuable upon the exercise

of the Placement Agent Warrants. You should rely only on the information contained in this prospectus and the related exhibits, any prospectus

supplement or amendment thereto and the documents incorporated by reference, or to which we have referred you, before making your investment

decision. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement or amendments thereto

do not constitute an offer to sell, or a solicitation of an offer to purchase, the Class A ordinary shares offered by this prospectus,

any prospectus supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make

such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus,

any prospectus supplement or amendments thereto, as well as information we have previously filed with the U.S. Securities and Exchange

Commission (the “SEC”), is accurate as of any date other than the date on the front cover of the applicable document.

If necessary, the specific manner in which the

ordinary shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or

change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this

prospectus and any prospectus supplement, you should rely on the information in such prospectus supplement, provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated

by reference in this prospectus or any prospectus supplement—the statement in the document having the later date modifies or supersedes

the earlier statement.

Neither the delivery of this prospectus nor any

distribution of Class A ordinary shares pursuant to this prospectus shall, under any circumstances, create any implication that there

has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of

this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any applicable prospectus supplement

or amendment and the information incorporated by reference in this prospectus contain various forward-looking statements within the meaning

of Section 27A of the Securities Act and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange

Act”), which represent our expectations or beliefs concerning future events. Forward-looking statements include statements that

are predictive in nature, which depend upon or refer to future events or conditions, and/or which include words such as “believes,”

“plans,” “intends,” “anticipates,” “estimates,” “expects,” “may,”

“will” or similar expressions. In addition, any statements concerning future financial performance, ongoing strategies or

prospects, and possible future actions, which may be provided by our management, are also forward-looking statements. Forward-looking

statements are based on current expectations and projections about future events and are subject to risks, uncertainties, and assumptions

about our company, economic and market factors, and the industry in which we do business, among other things. These statements are not

guarantees of future performance, and we undertake no obligation to publicly update any forward-looking statements, whether as a result

of new information, future events, or otherwise, except as required by law. Actual events and results may differ materially from those

expressed or forecasted in forward-looking statements due to a number of factors. Factors that could cause our actual performance, future

results and actions to differ materially from any forward-looking statements include, but are not limited to, those discussed under the

heading “Risk Factors” in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act. The forward-looking statements in this prospectus, the applicable prospectus supplement or any amendments thereto and the information

incorporated by reference in this prospectus represent our views as of the date such statements are made. These forward-looking statements

should not be relied upon as representing our views as of any date subsequent to the date such statements are made.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained

in this prospectus concerning our industry and the market in which we operate, including our market position, market opportunity and market

size, is based on information from various sources, on assumptions that we have made based on such data and other similar sources and

on our knowledge of the markets for our products. These data sources involve a number of assumptions and limitations, and you are cautioned

not to give undue weight to such estimates.

We have not independently verified any third-party

information. While we believe the market position, market opportunity and market size information included in this prospectus is generally

reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of our future performance and

the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. These and other

factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

OUR COMPANY

This summary highlights information contained

in the documents incorporated herein by reference. Before making an investment decision, you should read the entire prospectus, and our

other filings with the SEC, including those filings incorporated herein by reference, carefully, including the sections entitled “Risk

Factors” and “Special Note Regarding Forward-Looking Statements.”

Overview

We are a technology company. Our products and

services include: 1) a futures trading solution catering to clients using MetaTrader 5; 2) FXSC, a retail-orientated online trading education

website; 3) a foreign exchange (“Forex”) trading system that provides services to financial institutions outside of China;

and 4) technology hardware research and development, manufacture, and sales. Our mission is to become one of the key participants and

contributors in the global technology hardware supply chain and fintech blockchain ecosystem.

Futures trading system

In September 2019, we, through AGM Defi Lab, completed

our development of a futures trading software which integrates future trading API with MetaTrader 5, a well-known and advanced trading

software. However, during the third quarter of 2020, most futures brokers started to accept a new third-party software API connection

method in order to comply with newly enacted futures regulations and policies in China about the trading terminal API pass-through regulation,

which requires “pass through monitoring”. Brokers will need to know exactly who to use API from what third-party software

since, traditionally, brokers did not need to collect such information. All other software products on the market are required to comply

with the new rule. Accordingly, we were obligated to upgrade and transform the system to enable this new API connection method. We completed

the upgrading and transformation of the system at the end of first quarter of 2021. We plan to conduct new trials and improve the

solutions based on feedbacks.

FXSC, a retail-orientated online trading education

website

In July 2020, we launched FXSC through AGM Defi

Lab, a subscription-based online trading education and social trading network platform for Forex traders. FXSC provides trading education

to users through interactive trading simulation and trading contests, which enable users to choose and participate in available contests

and compete for prizes in a real-time streamed, interactive demo trading environment. FXSC also provides demo trading, also referred to

as virtual trading, paper trading, or trading simulation, which is designed to give users, especially the ones with limited knowledge

and skills, a risk-free trading environment to get familiar with the markets and trading tools. We plan to charge subscription fees directly

to end-users for using the social and educational features of the platform. In addition, through partnership with brokers that integrate

its accounts management system with FXSC, we plan to charge brokers a per client monthly service fee for their clients using FXSC. The

launch of FXSC is expected to build our brand. We plan to use some of the proceeds from this offering to invest in mass marketing of FXSC.

Forex trading system

Prior to September 2018,

through AGM Defi Lab, we provided Forex trading services, including computer program technical support and solution services and trading

platform application services, through a combination of in-house developed systems and applications, and the licensed trading platform

MetaTrader. In addition, we were engaged in Forex trading brokerage business and generated revenue from gains and losses from trades

and Forex brokerage fees and commissions. At the time, our clients were retail clients and brokerage firms located in China.

We voluntarily discontinued the Forex trading system due to a policy position by the PRC government that would no longer support the Forex

trading related business and would restrain certain accounts holding the deposits payable. In December 2021, we commenced the sale of

our trading system software to our brokerage clients and partners.

Technology hardware

research and development, manufacture, and sales

In third quarter of 2021,

we formed the company’s new growth strategy and the decision to enter into the ASIC chip research and development to be conducted

through AGM HK. In August 2021, we announced the launch of our first ASIC crypto Miner - KOI MINER C16 (“C16”). C16 is equipped

with the C3012 chip made by Semiconductor Manufacturing International Corp.’s N+1 process. C16 has a hash rate up to 113 TH/s

and a power efficiency ratio of 30 J/T, supporting the mining of Bitcoin, Bitcoin Cash (BCH) and other cryptocurrencies.

The competition of cryptocurrencies

mining equipment has grown intense in recent years. Our main competitors are Bitmain, a multinational semiconductor company, Canaan, a

supercomputing solutions provider, and MicroBT, a technology company based on block chain and artificial intelligence, all

of which are located in China and have both ASIC research and development capacities and deep supply chain connections in China.

C16’s parameters

have surpassed our competitors’ models, including: Antminer S19 pro of Bitmain, which has a power consumption of 3250W and hash

rate of 104TH/S, and AvalonMiner1246 of Canaan, which has an A1246 hash rate of 90TH/S, power consumption of 3420W

and power efficiency of 38J/T, and Whatminer M30S ++ of MicroBT, which has a hash rate of 112TH/S, power consumption

of 3472 W and power efficiency of 31 J/T. Since the launch of C16, we have received orders from buyers in the United States, Canada

and Europe.

We plan to use some of

the proceeds from this offering to develop the technology hardware business.

Holding

Company Structure

AGM Group Holdings, Inc. is a holding company

established in the British Virgin Islands with no operations of its own. We conduct operations primarily through our operating subsidiaries

in the British Virgin Islands, Singapore, Hong Kong and the PRC. The Class A ordinary shares offered in this prospectus are those of

AGM Group Holdings, Inc., the holding company. Shareholders of AGM Group Holdings, Inc. are not directly investing in and may never hold

equity interest in the operating subsidiaries. Our current corporate structure is as follows:

The COVID-19 Pandemic update

We are monitoring the global outbreak and

spread of the novel strain of coronavirus (COVID-19) and taking steps in an effort to identify and mitigate the adverse impacts on, and

risks to, our business (including but not limited to our employees, customers, other business partners, our manufacturing capabilities

and capacity and our distribution channels) posed by its spread and the governmental and community reactions thereto. We continue to

assess and update our business continuity plans in the context of this pandemic, including taking steps in an effort to help keep our

workforces healthy and safe. The spread of COVID-19 has caused us to modify our business practices (including employee travel, employee

work locations in certain cases, and cancellation of physical participation in certain meetings, events and conferences), and we expect

to take further actions as may be required or recommended by government authorities or as we determine are in the best interests of our

employees, customers and other business partners. We are also working with our suppliers to understand the existing and future negative

impacts to our supply chain and take actions in an effort to mitigate such impacts. Due to the speed with which the COVID-19 situation

is developing, the global breadth of its spread and the range of governmental and community reactions thereto, there is uncertainty around

its duration and ultimate impact; therefore, any negative impact on our overall financial and operating results (including without limitation

our liquidity) cannot be reasonably estimated at this time, but the pandemic could lead to extended disruption of economic activity and

the impact on our financial and operating results could be material. See “Risk Factors—The COVID-19 pandemic has adversely

impacted, and poses risks to, our business, the nature and extent of which are highly uncertain and unpredictable” contained in

the 2021 Annual Report incorporated by reference in this prospectus.

Recent Development

Strategic Partnership with HighSharp (Shenzhen

Gaorui) Electronic Technology Co., Ltd

As part of our plan to expand into the hardware production business,

in September 2021, we entered into a strategic partnership agreement with HighSharp (Shenzhen Gaorui) Electronic Technology Co., Ltd (“HighSharp”),

a fabless integrated circuit designer that provides advanced semiconductor solutions for supercomputing hardware, pursuant to which, for

a six-month period until March 25, 2022, HighSharp will provide the latest ASIC chip technology and manufacturing services to us and we

will be responsible for client development on a global basis, with a target to generate orders of at least US$100 million during the six-month

term until March 25, 2022. If we and HighSharp achieve the respective targets, we and HighSharp plan to form a joint venture, joined by

HighSharp’s key R&D team members, with the goal to integrate next generation product research and development into fabless integrated

circuit design capabilities that provide advanced semiconductor solutions for supercomputing hardware. AGM Group Holdings, Inc. will own

60% of the equity and HighSharp will own 40% of the equity in the joint venture.

Termination of Equity Transfer Agreement

with Yushu Kingo City Real Estate Development Co., Ltd.

On January 16, 2020, AGM Tianjin entered into

an equity transfer agreement (the “Equity Transfer Agreement”) with all the shareholders of Yushu Kingo City Real Estate Development

Co., Ltd. (“Yushu Kingo”), who collectively owns 100% of the equity interest in Yushu Kingo, pursuant to which agreement,

in exchange for 100% of the equity interest in Yushu Kingo, AGM Tianjin agreed to pay $20,000,000 in cash and cause AGM Holdings

to issue 2,000,000 Class A ordinary shares, valued at $15 per share, subject to the terms and conditions of the Agreement. AGM Tianjin

made advance payments in the amount of $4,937,663.72 (the “Advance Payment”).

On April 6, 2021, AGM Tianjin, Yushu Kingo and

its shareholders entered into a supplement agreement (“Supplement Agreement”) to the Equity Transfer Agreement. Pursuant to

the Supplement Agreement, if AGM Tianjin decided not to proceed with the acquisition contemplated by the Equity Transfer Agreement and

terminate such agreement on or before October 31, 2021, Yushu Kingo’s shareholders shall return the Advance Payment and pay an additional

10% interest to AGM Tianjin. If Yushu Kingo’s shareholders are unable to make such payment, Yushu Kingo’s shareholders agreed

to transfer the titles of real properties of Yushu Kingo to AGM Tianjin, valued with a 20% discount to market price. The parties further

agreed to conduct a new evaluation of Yushu Kingo’s assets and to enter into supplement agreement based on such evaluation.

Because of the COVID-19 pandemic, the quarantine

and travel restrictions in China, and the massive economic disruption as a result, Yushu Kingo was not able to complete its construction

projects and the audit and due diligence of Yushu Kingo was not completed on time. On October 4, 2021, AGM Tianjin terminated the Equity

Transfer Agreement and Supplement Agreement with the Yushu Kingo and its shareholders. On October 20, 2021, AGM Tianjin entered into an

agreement on transfer of creditor rights with a non-affiliated third party (the “Buyer”). Pursuant to the Transfer Agreement,

AGM Tianjin agrees to sell to the Buyer all of its rights and obligations under the Equity Transfer Agreement and the Supplement Agreement,

namely, the right to receive the Advance Payment plus interest, for a total purchase price of $5,000,000 (the “Purchase Price”),

$2,500,000 of which will be payable on or before December 31, 2021 and the remaining $2,500,000 will be payable on or before June 30,

2022. The Buyer agrees, in the event it fails to pay the Purchase Price on time, to pay as damages for breach of contract an amount equal

to four times China’s loan prime rate (LPR) of the Purchase Price due.

Change of Board of Directors

On April 30, 2021, Tingfu Xie tendered his resignation

as director, the chairman of the Nominating Committee, and a member of the Audit Committee and the Compensation Committee of the Company,

effective April 30, 2021. On the same day, at the recommendation of the Nominating Committee and the Compensation Committee, the

Board of Directors approved and confirmed the appointment of Jing Shi as the succeeding director, the chairwoman of the Nominating Committee

and a member of the Audit Committee and the Compensation Committee of the Company, effective April 30, 2021.

On May 7, 2021, the Company appointed Dr. Bo Zhu as the Chief Strategy

Officer.

On July 12, 2021, the Board of Directors and the Compensation Committee

of approved and confirmed the appointment of Junchen Li as the Co-Chief Executive Officer, effective July 12, 2021. On September 15, 2021,

the Board also approved the appointment of Chenjun Li as the director and the Chairman of the Board to replace Bin Cao, whose employment

agreement with the Company expired on May 19, 2021.

Registered Direct Offering and Concurrent Private

Placement

On December 14, 2021, pursuant to a securities purchase agreement (the

“Purchase Agreement”) with certain institutional investors (the “Purchasers”) dated December 10, 2021, the Company

closed (a) a registered direct offering for the sale of 2,898,552 of its Class A ordinary shares, par value US$0.001 per share, and (b)

a concurrent private placement, for the sale of unregistered warrants to purchase up to 1,449,276 Class A ordinary shares (the “Investor

Warrants”), for gross proceeds of approximately US$20 million. The purchase price for each Share and the corresponding half Warrant

is US$6.90. The Investor Warrants will be exercisable immediately from the date of issuance and have an exercise price of US$8.30 per

share. The Investor Warrants will expire 3.5 years from the date of issuance. Each Investor Warrant contains anti-dilution provisions

to reflect share dividends and splits or other similar transactions, as described in the Investor Warrants.

Pursuant to the Purchase Agreement, the Class

A ordinary shares were issued to the Purchasers in a registered direct offering and registered under the Securities Act of 1933, as amended

(the “Securities Act”), pursuant to a prospectus supplement to the Company’s currently effective registration statement

on Form F-3 (File No. 333-236897), which was initially filed with the SEC on March 5, 2020 and declared effective by the SEC on May 28,

2020. The Company filed the prospectus supplement for the Registered Direct Offering on December 13, 2021.

The Company issued the Investor Warrants to the

Purchasers in a concurrent private placement pursuant to an exemption from the registration requirements of the Securities Act contained

in Section 4(a)(2) thereof and/or Regulation D thereunder (the “Private Placement,” and together with the Registered Direct

Offering, the “Offering”).

FT Global Capital, Inc. (the “Placement

Agent”) acted as the exclusive placement agent in connection with the Offering under the terms of the Placement Agency Agreement,

dated December 10, 2021 between it and the Company (the “Placement Agency Agreement”) and, at closing of the Offering, received

a cash fee equal to 7.5% of the aggregate gross proceeds raised in the Offering as well as reimbursement of certain costs and expenses

of up to US$80,000. Additionally, the Company issued to the Placement Agent or its designees warrants (the “Placement Agent Warrants,”

and together with the Investor Warrants, the “Warrants”) for the purchase of 202,899 Class A ordinary shares with an exercise

price of US$8.30 per share, and with a term expiring 3.5 years from the date of issuance. The Placement Agent Warrants shall have the

same registration rights as the Warrants issued to the Purchasers in the Offering. The Placement Agent is also entitled to additional

tail compensation for any financings consummated by the Company within the 12-month period following the termination of the Placement

Agency Agreement, to the extent such financing is provided to the Company by investors that the Placement Agent had “wall-crossed”

on behalf of the Company in connection with the Offering.

The Company has agreed to file and maintain with

the SEC a registration statement (the “Registration Statement”) to register the Warrants and the Class A ordinary shares underlying

the Warrants (the “Warrant Shares”) within 30 calendar days from the closing of the Offering and to use its best efforts to

cause such registration statement to become effective within 60 calendar days following the closing of the Offering (or, in the event

of a review by the SEC, within 120 calendar days).

The Company agreed in the Purchase Agreement that

it would not issue any ordinary shares or ordinary share equivalents for sixty (60) days following the closing of the Offering subject

to certain exceptions. The Company agreed in the Placement Agency Agreement that it would not issue any ordinary shares or ordinary share

equivalents for one hundred twenty (120) days following the closing of the Offering without the consent of the Placement Agent, subject

to certain exceptions.

The Company agreed in the Purchase Agreement that

it will not issue any ordinary shares or ordinary share equivalents involve in a Variable Rate Transaction (as defined in the Purchase

Agreement) until the earlier of (x) the date the initial Registration Statement is declared effective by the SEC and (y) the date as of

which all of the holders of Investor Warrants may sell all of the Investor Warrant Shares without restriction pursuant to Rule 144 (including,

without limitation, volume restrictions) and without the need for current public information required by Rule 144(c)(1) (or Rule 144(i)(2),

if applicable). The Company further agreed that until the first anniversary of the earlier of (x) or (y) above, it would not issue or

enter into any agreement to issue any ordinary shares or ordinary share equivalents unless the Purchasers are offered a participation

right, subject to certain terms and conditions as set forth in the Purchase Agreement, to subscribe, on a pro rata basis, for up to 50%

of the securities offered in such offering.

Concurrently with the execution of the Purchase

Agreement, the officers and directors of the Company and shareholders of the Company holding 5% or more of the Company’s Class A

ordinary shares entered into lock-up agreements (the “Lock-Up Agreements”) pursuant to which they have agreed, among other

things, not to sell or dispose of any ordinary shares which are or will be beneficially owned by them for one hundred twenty (120) days

following the closing of the Offering, as well as similar lock-up agreements pursuant to the Placement Agency Agreement restricting sales

of ordinary shares for ninety (90) days after the closing of the Offering.

Change of Independent

Registered Public Accounting Firm

On April 5, 2022, the

Company notified its independent registered public accounting firm, JLKZ CPA LLP its decision to dismiss JLKZ CPA LLP as the Company’s

auditor. The Audit Committee and the Board of Directors of the Company ratified the appointment of TPS Thayer LLC as its new independent

registered public accounting firm to audit the Company’s financial statements.

Summary of Risk Factors

Investing in our ordinary shares involves

significant risks. You should carefully consider all of the information in this prospectus before making an investment in our Ordinary

Shares. Below please find a summary of the principal risks we face, organized under relevant headings. These risks are discussed more

fully under “Item 3. Key Information—D. Risk Factors” in the 2021 Annual Report and in the section titled “Risk

Factors” beginning on page 13 of this prospectus.

Risks

Related to Our Business and Industry (for a more detailed discussion, see “Item 3. Key Information—D. Risk

Factors—Risks Related to Our Business and Industry” in the 2021 Annual Report)

| |

● |

Our business could be materially harmed by the

ongoing coronavirus (COVID-19) pandemic (see “Risk Factors – Risks Related to Our Business and Industry – The

COVID-19 pandemic has adversely impacted, and poses risks to, our business, the nature and extent of which are highly uncertain and

unpredictable” on page 7 of the 2021 Annual Report); |

| ● | We

might require additional capital to support business growth (see “Risk Factors –

Risks Related to Our Business and Industry – We might require additional capital to

support business growth, and this capital might not be available on acceptable terms, if

at all” on page 7 of the 2021 Annual Report); |

| |

● |

Unauthorized disclosure of sensitive or confidential

customer information or our failure or the perception by our customers that we failed to comply with privacy laws or properly address

privacy concerns could harm our business and standing with our customers (see “Risk Factors – Risks Related to Our

Business and Industry – Unauthorized disclosure of sensitive or confidential customer information or our failure or the perception

by our customers that we failed to comply with privacy laws or properly address privacy concerns could harm our business and standing

with our customers” on page 9 of the 2021 Annual Report); |

| |

● |

Our bitcoin mining machine business faces a number

of uncertainties in technology, regulations and operations (see “Risk Factors – Risks Related to Our Business and

Industry – Significant contributors to the bitcoin network could propose amendments to its protocols and software which, if

accepted and authorized, could negatively impact our business and operations” on page 2 of the 2021 Annual Report). |

Risks Related to Doing Business

in China (for a more detailed discussion, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing

Business in China” in the 2021 Annual Report)

| |

● |

China’s legal system is evolving and has

inherent uncertainties that could limit the legal protection available to you (see “Risk Factors – Risks Related to

Doing Business in China – Uncertainties with respect to the PRC legal system could adversely affect us” on page 17

of the 2021 Annual Report); |

| |

● |

We may be exposed to liabilities under the Foreign

Corrupt Practices Act and Chinese anti-corruption law (see “Risk Factors – Risks Related to Doing Business in China

– We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law” on page

20 of the 2021 Annual Report); |

| |

● |

The regulation of Internet website operators in

China is subject to interpretation, and our operation of online trading platform and education programs could be harmed if we are

deemed to have violated applicable laws and regulations (see “Risk Factors – Risks Related to Doing Business in China

– The regulation of Internet website operators in China is subject to interpretation, and our operation of online trading platform

and education programs could be harmed if we are deemed to have violated applicable laws and regulations” on page 21 of

the 2021 Annual Report); |

| |

● |

The Chinese government exerts substantial influence

over the manner in which we must conduct our business activities and may intervene or influence our operations at any time with little

advance notice, which could result in a material change in our operations and the value of our Class A Ordinary Shares (see “Risk

Factors –The Chinese government exerts substantial influence over the manner in which we must conduct our business activities

and may intervene or influence our operations at any time with little advance notice, which could result in a material change in

our operations and the value of our Class A Ordinary Shares” on page 14 of the 2021 Annual Report); |

| |

● |

Any actions by Chinese government, including any

decision to intervene or influence our operations or to exert control over any offering of securities conducted overseas and/or foreign

investment in China-based issuers, may cause us to make material changes to our operations, may limit or completely hinder our ability

to offer or continue to offer securities to investors, and may cause the value of such securities to significantly decline or be

worthless (see “Risk Factors – The Chinese government exerts substantial influence over the manner in which

we must conduct our business activities and may intervene or influence our operations at any time with little advance notice, which

could result in a material change in our operations and the value of our Class A Ordinary Shares” on page 14 of the 2021

Annual Report); |

| |

● |

The M&A Rules and certain other PRC regulations

establish complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult

for us to pursue growth through acquisitions in China (see “Risk Factors – The M&A Rules and certain other PRC

regulations establish complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more

difficult for us to pursue growth through acquisitions in China” on page 16 of the 2021 Annual Report); |

| |

|

|

| |

● |

You may have difficulty enforcing judgments obtained against us (see “Risk

Factors – You may have difficulty enforcing judgments obtained against us” on page 16 of the 2021 Annual Report); |

| |

● |

We may rely on dividends and other distributions

on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability

of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business (see

“Risk Factors – We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any

cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could

have a material and adverse effect on our ability to conduct our business” on page 13 of the 2021 Annual Report); |

| |

● |

The recent joint statement by the SEC and the Public

Company Accounting Oversight Board (United States), or the “PCAOB,” proposed rule changes submitted by Nasdaq and

the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market

companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB.

These developments could add uncertainties to our offering (see “Risk Factors – Risks Related to Doing Business in

China – The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign

Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing

the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could

add uncertainties to our offering” on page 24 of the 2021 Annual Report); |

| |

● |

The approval of the China Securities Regulatory

Commission may be required in connection with this offering, and, if required, we cannot predict whether we will be able to obtain

such approval (see “Risk Factors – Risks Related to Doing Business in China – The approval of the China Securities

Regulatory Commission may be required in connection with this offering, and, if required, we cannot predict whether we will be able

to obtain such approval” on page 16 of the 2021 Annual Report); |

Risks Related to Our Capital Structure

and Class A Ordinary Shares China (for a more detailed discussion, see “Item 3. Key

Information—D. Risk Factors—Risks Related to Our Capital Structure and Class A Ordinary Shares” in the 2021 Annual

Report and “Risk Factors – Risks Related to Our Ordinary Shares” beginning on page 13 of this prospectus)

| |

● |

The dual-class structure of our ordinary shares has the effect of

concentrating voting control with certain shareholders, including our executive officers, employees and directors and their affiliates,

which will limit your ability to influence the outcome of important transactions, including a change in control (see “Risk

Factors – Risks Related to Our Capital Structure and Class A Ordinary Shares – The dual-class structure of our ordinary

shares has the effect of concentrating voting control with certain shareholders, including our executive officers, employees and

directors and their affiliates, which will limit your ability to influence the outcome of important transactions, including a change

in control” on page 25 of the 2021 Annual Report); |

| |

● |

The laws of the British Virgin Islands provide

little protection for minority shareholders, so minority shareholders will have little or no recourse if they are dissatisfied with

the conduct of our affairs (see “Risk Factors – Risks Related to Our Capital Structure and Class A Ordinary Shares

– The laws of the British Virgin Islands provide little protection for minority shareholders, so minority shareholders will

have little or no recourse if they are dissatisfied with the conduct of our affairs” on page 25 of the 2021 Annual Report); |

| |

● |

The market price of our ordinary shares may be volatile or may decline

regardless of our operating performance (see “Risk Factors – Risks Related to Our Capital Structure and Class A Ordinary

Shares – The trading price of our Class A Ordinary Shares has been, and is likely to continue to be, volatile; you might not

be able to sell your shares at or above the price that you paid for them and we may not be able to stop the decline of our stock

price” on page 26 of the 2021 Annual Report); |

| |

● |

The exercise of the Warrants may further dilute

the ordinary shares and adversely impact the price of our ordinary shares (see “Risk Factors – Risks Related to Our

Ordinary Shares – The exercise of the Warrants may further dilute the ordinary shares and adversely impact the price of our

ordinary shares” on page 13 of this prospectus). |

Legal and Operational Risks of Operating in the PRC

Because our operations are primarily located

in the PRC and Hong Kong through our subsidiaries, we are subject to certain legal and operational risks associated with our operations

in China, including changes in the legal, political and economic policies of the Chinese government, the relations between China and

the United States, or Chinese or United States regulations may materially and adversely affect our business, financial condition and

results of operations. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore,

these risks may result in a material change in our operations and the value of our ordinary shares, or could significantly limit or completely

hinder our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly

decline or be worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement. We do not believe that our subsidiaries are directly subject to

these regulatory actions or statements, as we have not implemented any monopolistic behavior and our business does not involve the collection

of user data or implicate cybersecurity. As of the date of this prospectus, no relevant laws or regulations in the PRC explicitly require

us to seek approval from the China Securities Regulatory Commission, or the CSRC, or any other PRC governmental authorities for our offering,

nor has our BVI holding company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding our offering

from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions by the PRC government

are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain how soon legislative

or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and

interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have

on our daily business operation, the ability to accept foreign investments and list on an U.S. or other foreign exchange. The Standing

Committee of the National People’s Congress, or the SCNPC, or other PRC regulatory authorities may in the future promulgate laws,

regulations or implementing rules that requires our company or any of our subsidiaries to obtain regulatory approval from Chinese authorities

before offering in the U.S.

For a more detailed discussion, see “Item

3. Key Information—D. Risk Factors—Risks Related to Doing Business in China”

in the 2021 Annual Report.

Transfers of Cash to and from Our Subsidiaries

AGM Group Holdings Inc. is a holding company with

no operations of its own. We conduct our operations in China and Hong Kong primarily through our subsidiaries in China, Hong Kong SAR

and Singapore. We may rely on dividends to be paid by our subsidiaries in Singapore, China and Hong Kong SAR to fund our cash and financing

requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we

may incur and to pay our operating expenses. If our subsidiaries incur debt on their own behalf in the future, the instruments governing

the debt may restrict its ability to pay dividends or make other distributions to us.

Our equity structure is a direct holding structure.

Within our direct holding structure, the cross-border transfer of funds within our corporate entities is legal and compliant with the

laws and regulations of the PRC. After the foreign investors’ funds enter AGM, the funds can be directly transferred to the PRC

operating companies through its subsidiaries. Specifically, AGM Group Holdings Inc. is permitted under the BVI laws to provide funding

to our subsidiaries in Singapore, China and Hong Kong SAR through loans or capital contributions without restrictions on the amount of

the funds, subject to satisfaction of applicable government registration, approval and filing requirements. AGM Defi Tech Limited and

AGM Technology Limited are also permitted under the laws of Hong Kong to provide funding to AGM Group Holdings Inc. through dividend

distribution without restrictions on the amount of the funds. As of the date of this prospectus, there have not been any transfers,

dividends or distributions made between the holding company, its subsidiaries, and to investors.

We currently intend to retain all available funds

and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in

the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors

after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and

other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

Subject to the BVI Business Companies Act and

our bylaws, our board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think

fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of our assets will exceed our liabilities

and we will be able to pay our debts as they become due.

Under the current practice of the Inland Revenue Department of Hong Kong,

no tax is payable in Hong Kong in respect of dividends paid by us. The laws and regulations of the PRC do not currently have any

material impact on transfer of cash from AGM Group Holdings Inc. to AGM Defi Tech Limited and AGM Technology Limited, or from AGM Defi

Tech Limited and AGM Technology Limited to AGM Group Holdings Inc. There are no restrictions or limitation under the laws of Hong Kong

imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong or across borders and

to U.S investors.

Current PRC regulations permit our PRC subsidiaries

to pay dividends to AGM Defi Tech Limited and AGM Technology Limited only out of their accumulated profits, if any, determined in accordance

with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside at least 10%

of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each

of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although

the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be

used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective

companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

To address persistent capital outflows and

the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and the State Administration

of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the subsequent months, including stricter vetting

procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments.

The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other distributions

may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into foreign currencies

and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures

necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries

in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make

other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations, we may be unable to pay dividends

on our Class A ordinary shares.

Cash dividends, if any, on our Class A ordinary

shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our

overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to

10.0%.

In order for us to pay dividends to our shareholders,

we will rely on payments made from our PRC subsidiaries, i.e., Beijing Keen Sense Technology Service Co., Ltd. to AGM Defi Tech Limited,

AGM Tianjing Construction Development Co., Ltd. and Nanjing Lucun Semiconductor Co., Ltd. to AGM Technology Limited, and from AGM Defi

Tech Limited and AGM Technology Limited to AGM Group Holdings Inc. Certain payments from our PRC subsidiaries in Hong Kong are subject

to PRC taxes, including business taxes and VAT. As of the date of this prospectus, our PRC subsidiaries have not made any transfers or

distributions. As of the date of this prospectus, no cash or asset transfers have occurred among the Company and its subsidiaries. We

do not expect to pay any cash dividends in the foreseeable future. Furthermore, as of the date of this prospectus, no cash generated

from one subsidiary is used to fund another subsidiary’s operations and we do not anticipate any difficulties or limitations on

our ability to transfer cash between subsidiaries. We have also not installed any cash management policies that dictate the amount of

such funds and how such funds are transferred.

Implications of Holding Foreign Company Accountable

Act

On March 24, 2021, the SEC adopted interim final

rules relating to the implementation of certain disclosure and documentation requirements of the HFCAA. An identified issuer will be required

to comply with these rules if the SEC identifies it as having a “non-inspection” year under a process to be subsequently established

by the SEC. In June 2021, the Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if signed into law, would

reduce the time period for the delisting of foreign companies under the HFCAA to two consecutive years instead of three years. If our

auditor cannot be inspected by the Public Company Accounting Oversight Board, or the PCAOB, for two consecutive years, the trading of

our securities on any U.S. national securities exchanges, as well as any over-the-counter trading in the U.S., will be prohibited. On

September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which provides a framework for the PCAOB to use when determining,

as contemplated under the HFCAA, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located

in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 2, 2021, the SEC issued

amendments to finalize rules implementing the submission and disclosure requirements in the HFCA Act. The rules apply to registrants that

the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located

in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in

foreign jurisdictions. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate

completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by PRC

authorities in those jurisdictions.

Each of JLKZ CPA LLP, the independent registered

public accounting firm that issues the audit report for the fiscal years ended December 31, 2020 and 2019 included elsewhere or incorporated

by reference in this prospectus, and TPS Thayer LLC, the independent registered public account firm that issued the audit report for

the fiscal year ended December 31, 2021 included elsewhere or incorporated by reference in this prospectus, as an auditor of companies

that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant

to which the PCAOB conducts regular inspections to assess such auditor’s compliance with the applicable professional standards.

JLKZ CPA LLP is headquartered in Flushing, New York, and is subject to inspection by the PCAOB on a regular basis. TPS Thayer LLC is

headquartered in Sugar Land, Texas, and is subject to inspection by the PCAOB on a regular basis. Therefore, we believe JLKZ CPA LLP

and TPS Thayer LLC are not subject to the determinations as to the inability to inspect or investigate registered firms completely announced

by the PCAOB on December 16, 2021. However, as more stringent criteria have been imposed by the SEC and the PCAOB, recently, which would

add uncertainties to future offerings, and we cannot assure you whether Nasdaq or regulatory authorities would apply additional and more

stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures,

adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial

statements. See “The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding

Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon

assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments

could add uncertainties to our offering” on page 22 of the 2021 Annual Report.

PRC Regulatory Permissions

We and our operating subsidiaries currently

have received all material permissions and approvals required for our operations in compliance with the relevant PRC laws and regulations

in the PRC, including the business licenses of our operating subsidiaries and other permissions related to our business.

The business license is a permit issued by

Market Supervision and Administration that allows the company to conduct specific business within the government’s geographical

jurisdiction. Each of our PRC subsidiaries has received its business license. As of the date of this prospectus, except for the business

licenses and the permissions mentioned here, AGM Group Holdings Inc. and our PRC subsidiaries are not required to obtain any other permissions

or approvals from any Chinese authorities to operate the business. However, applicable laws and regulations may be tightened, and new

laws or regulations may be introduced to impose additional government approval, license, and permit requirements. If we or our subsidiaries

fail to obtain and maintain such approvals, licenses, or permits required for our business, inadvertently conclude that such approval

is not required, or respond to changes in the regulatory environment, we or our subsidiaries could be subject to liabilities, penalties,

and operational disruption, which may materially and adversely affect our business, operating results, financial condition and the value

of our ordinary shares, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or

cause such securities to significantly decline in value or become worthless.

On August 8, 2006, six PRC regulatory

agencies jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules,

which came into effect on September 8, 2006 and were amended on June 22, 2009. The M&A Rules requires that an offshore

special purpose vehicle formed for overseas listing purposes and controlled directly or indirectly by PRC Citizens shall obtain the approval

of the China Securities Regulatory Commission prior to overseas listing and trading of such special purpose vehicle’s securities

on an overseas stock exchange. Based on our understanding of the Chinese laws and regulations in effect at the time of this prospectus,

we will not be required to submit an application to the CSRC for its approval of this offering and the listing and trading of ordinary

shares on the Nasdaq under the M&A Rules. However, there remains some uncertainty as to how the M&A Rules will be interpreted

or implemented, and the requirement standard may change when new laws, rules and regulations or detailed implementations and interpretations

in any form relating to the M&A Rules are installed. We cannot assure you that relevant Chinese government agencies, including the

CSRC, would reach the same conclusion.

Recently, the General Office of the Central

Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Strictly Cracking

Down on Illegal Securities Activities, which were made available to the public on July 6, 2021. The Opinions on Strictly Cracking Down

on Illegal Securities Activities emphasized the need to strengthen the administration over illegal securities activities, and the need

to strengthen the supervision over overseas listings by Chinese companies. Pursuant to the Opinions, Chinese regulators are required

to accelerate rulemaking related to the overseas issuance and listing of securities, and update the existing laws and regulations related

to data security, cross-border data flow, and management of confidential information. Numerous regulations, guidelines and other measures

are expected to be adopted under the umbrella of or in addition to the Cybersecurity Law and Data Security Law. As of the date of this

prospectus, no official guidance or related implementation rules have been issued. As a result, the Opinions on Strictly Cracking Down

on Illegal Securities Activities remain unclear on how they will be interpreted, amended and implemented by the relevant PRC governmental

authorities.

On December 24, 2021, the CSRC, together with

other relevant government authorities in China issued the Provisions of the State Council on the Administration of Overseas Securities

Offering and Listing by Domestic Companies (Draft for Comments), and the Measures for the Filing of Overseas Securities Offering and

Listing by Domestic Companies (Draft for Comments) (“Draft Overseas Listing Regulations”). The Draft Overseas Listing Regulations

requires that a PRC domestic enterprise seeking to issue and list its shares overseas (“Overseas Issuance and Listing”) shall

complete the filing procedures of and submit the relevant information to CSRC. The Overseas Issuance and Listing includes direct and