Aesthetic Medical International Holdings Group Limited (Nasdaq:

AIH) (the “

Company” or “

AIH”), a

leading provider of aesthetic medical services in China, is pleased

to announce further to its Previous Disclosure, the Company has

closed its previously announced (i) Share Transfer of an aggregate

of 21,321,962 ordinary shares of the Company from Seefar, Jubilee,

and Pengai Hospital Management Corporation to Wanda pursuant to a

share purchase agreement between the Company, the Founders, certain

existing shareholders of the Company controlled by the Founders and

Wanda dated July 20, 2022; (ii) issue of a total number of

12,088,808 ordinary shares (the “

Conversion

Shares”) of the Company to ADV at a conversion price of US

dollars equivalent of RMB4.203 per ordinary share on August 16,

2023 (the “

Closing Date”) pursuant to the Note

issued to ADV on September 17, 2020 and the cooperation agreement

between ADV and its affiliate, the Company, the Founders, Wanda and

Jiechuang dated July 20, 2022 (the “

Issue of Conversion

Shares”); and (iii) issue of warrants (“

Issue of

Warrants”) to Seefar and Wanda pursuant to the

shareholder’s agreement dated July 20, 2022 (Seefar and Wanda

together, the “

Warrantholders”).

Each Warrant shall entitle the Warrantholders to

subscribe for one (1) warrant share (the “Warrant

Share”) at the Exercise Price (as defined in the Warrant)

subject to adjustments. The subscription rights attaching to the

Warrants to subscribe for the Warrant Shares will be exercisable at

any time during the Effective Period (as defined in each of the

Warrants).

Upon the closing of the Share Transfer, Issue of

Conversion Shares, and Issue of Warrants, (collectively, the

“Transactions”), the shareholding percentage of

AIH held directly through ordinary shares and indirectly through

American depositary receipts by Seefar, Wanda and ADV would be

approximately 4.8%, 14.9% and 19.4% of the ordinary shares issued

and outstanding of the Company as enlarged by the issue of the

Conversion Shares, respectively, as of the date of this form 6-K.

This calculation has not taken into consideration of Warrants

delivered to Seefar, Wanda, and ADV, the number of which may cause

further change on the number of total ordinary shares

outstanding.

Copies of the English Translation of Share

Purchase Agreement, Shareholders’ Agreement, Cooperation Agreement,

and Warrant for the Purchase of Shares of the Company to Seefar,

Wanda and ADV are attached as exhibits from 99.2 to 99.8 of the

form 6-K of the Company filed with SEC on July 20, 2022.

Resignations and Appointment of Directors

The board of directors of the Company (the

“Board”) announced that with effect from the

Closing Date the following directors have resigned as a director of

the Company (the “Director”), as follows:

(1) Dr. Zhou

Pengwu has resigned as Chairman of the Board, the chairman of the

nominating and corporate governance committee of the Board and

Chief Executive Officer of the Company due to personal reasons, but

will be reappointed as the non-executive co-chairman of the

Board;(2) Ms. Ding Wenting has resigned as the

vice-chairwoman of the Board due to personal reasons;(3) Ms.

Hu Qing has resigned as a Director due to personal

reasons;(4) Dr. Zhou Yitao has resigned as a Director due to

personal reasons;(5) Mr. Wei Zhinan Nelson has resigned as a

Director due to personal reasons;(6) Mr. Yan Hongfei has

resigned as a Director due to personal reasons;(7) Ms. Cathy Peng

has resigned as an independent Director, the chairwoman of the

compensation committee of the Board, and a member of both the audit

committee and the nominating and corporate governance committee of

the Board due to personal reasons;(8) Mr. Xue Hongwei has resigned

as an independent Director, the chairman of the audit committee of

the Board, and a member of both the compensation committee and the

nominating and corporate governance committee of the Board due to

personal reasons; and(9) Mr. Tsang Eric Chi Wai has resigned as an

independent Director, and a member of both the audit committee and

the compensation committee of the Board due to personal

reasons.

Each of the resigned Directors has confirmed

that he or she has no disagreement with the Board and there is no

other matter relating to his or her resignation as a Director that

needs to be brought to the attention of holders of securities of

the Company or The Nasdaq Inc.

The Board further announced that with effect

from the Closing Date, the following nominees have been appointed

as Directors, as follows:

(1) Mr.

Zhang Chen has been appointed as the executive co-chairman of the

Board, and the chairman of the nominating and corporate governance

committee of the Board;(2) Dr. Zhou Pengwu has been

appointed as the non-executive co-chairman of the Board;(3)

Ms. Wu Binhua has been appointed as a Director and a member

of the compensation committee of the Board;(4) Ms.

Laurena Wu has been appointed as a Director;(5) Ms. Wu

Binqi has been appointed as a Director;(6) Mr. Zhang

Changsuo has been appointed as a Director;(7) Mr. Zhou

Xichun has been appointed as a Director;(8) Mr. Liu Bo

has been appointed as a Director;(9) Mr. Jim Wai Hang

has been appointed as an independent Director and a member of the

audit committee of the Board;(10) Mr. Lin Yingzhou has been

appointed as an independent Director, the chairman of the

compensation committee of the Board, a member of both the audit

committee and the nominating and corporate governance committee of

the Board; and(11) Ms. Li Yanyun has been appointed as an

independent Director and the chairman of the audit committee of the

Board, a member of both the compensation committee and nominating

and corporate governance committee of the Board.

Below are the biographies of each of the newly

appointed Directors:

Mr. Zhang Chen is a renowned entrepreneur, who

had held various leadership positions in different companies,

including as the general manager of Shenzhen Lafang Investment

Management Co., Ltd. Currently, Mr. Zhang is the executive director

of Shenzhen Lafang Investment Management Co., Ltd., executive

director and general manager of Hainan Runming Biotechnology Co.,

Ltd., director of Hawyu (HK) Limited. Furthermore, Mr. Zhang joined

the Chinese listed company, Lafang China Co., Ltd., in 2009 as a

director, vice general manager, and secretary to the board of

directors, where he played a crucial role in the company's success.

Mr. Zhang is the spouse of Ms. Wu Binhua, the brother-in-law of Ms.

Laurena Wu and Ms. Wu Binqi, who are also directors of the Board,

and the son-in-law of Mr. Wu Guiqian, the Company's actual

controller.

Ms. Wu Binhua currently serves as the general

manager of Shenzhen Lafang Investment Management Co., Ltd. and

Shenzhen Yijing Investment Co., Ltd., and a supervisor of Benkang

Biopharmaceutical (Shenzhen) Co., Ltd., and Lafang China (Fujian)

Co., Ltd. Ms. Wu Binhua is the spouse of Mr. Zhang Chen, the newly

appointed executive co-chairman of the Board, and the daughter of

Mr. Wu Guiqian and the sister of Ms. Laurena Wu and Ms. Wu

Binqi.

Ms. Laurena Wu currently

serves as the actual controller and director of Wider Huge Group

Limited and Australia Wanda International Company Limited. Ms.

Laurena Wu is the daughter of Mr. Wu Guiqian and the sister of Ms.

Wu Binhua and Ms. Wu Binqi.

Ms. Wu Binqi currently serves as executive

director and manager of Fasong Investment Management (Shanghai)

Co., Ltd., Dewei (Shanghai) Cosmetics Co., Dewei Luteng (Guangzhou)

Enterprise Management Co., Ltd. and Deji (Guangzhou) Life Science

Technology Co., Ltd., and a supervisor of Guangdong Yitai

Investment Co., Ltd. Ms. Wu Binqi is an exceptional entrepreneur

and a member of Relay China Youth Elite Association. She has spent

years studying fashion abroad and now has turned her attention to

the Chinese cosmetics industry. With her deep knowledge of

international fashion trends and design, she is poised to make a

significant impact on this growing industry. Ms. Wu Binqi is the

daughter of Mr. Wu Guiqian and the sister of Ms. Wu Binhua and Ms.

Laurena Wu.

Mr. Zhang Changsuo has been a leading figure in

the kindergarten through twelfth grade (the

“K-12”) education industry in China for over 14

years. With a focus on K-12 and extracurricular training, he has

made significant contributions to the development of the education

landscape in Southwest China. Mr. Zhang Changsuo began his career

in education as a partner of Xi’an Xin Fangxiang Education

Technology Co., Ltd., where he soon became a prominent expert in

the K-12 education industry with his focused approach and

innovative ideas. In 2011, Mr. Zhang Changsuo founded Mingda

Education Group (the “Mingda”) and served as the

founder and chairman until 2021. Under his leadership, Mingda

became one of the most successful education groups in China. Mingda

has deeply cultivated the K-12 market in Southwest China, providing

students with high-quality education and extracurricular training

programs. After nearly 10 years of development, Mingda has set up a

total of 39 teaching centers with more than 30,000 students

currently enrolled and over 1,000 professional teachers in service

in Hainan Province, Fujian Province, Guizhou Province, and Guangxi

Province in China. Among them, Mingda is ranked No.1 in K-12

education industry in terms of market share in Hainan Province and

Guangxi Province. Mr. Zhang Changsuo received his bachelor’s degree

in Computer Science and Technology from Chang’an University in

2003.

Mr. Zhou Xichun has served as an assistant to

chairman since 2019 and has played a key role in the Company’s

initial public offering. Mr. Zhou Xichun was responsible for

creating the business plan for expanding non-surgical aesthetic

medical clinics, which included funding resources, operation

framework, information technology management, financial projections

and so on. His expertise and leadership have been integral to the

Company’s pioneer role in the Chinese non-surgical aesthetic

medical market. Mr. Zhou Xichun graduated from the University of

California, Irvine in 2021 with a bachelor’s degree in Economics.

Mr. Zhou Xichun is the son of Dr. Zhou Pengwu, the founder of the

Company.

Mr. Liu Bo has over 25 years of experience in

the financial services sector and leads ADV’s coverage of China.

Prior to joining ADV, Mr. Liu Bo served in various senior positions

in Private Equity and Corporate investment roles, including CVC

Capital Partners Asia, CITIC Capital and Wanda Investment (not

affiliated with Australia Wanda International Company Limited). Mr.

Liu Bo holds an MBA from the University of Michigan and a

Bachelor's in Finance and Economics.

Mr. Jim Wai Hang has over 10

years of experience in the financial services industry across

principal investment and investment banking, currently covering the

Greater China Region for ADV Partners Limited, or ADV Partners.

Prior to joining ADV Partners, Mr. Jim Wai Hang worked at Deutsche

Bank's investment banking division from July 2014 to October 2015,

and at Macquarie Capital from February 2013 to June 2014. Mr. Jim

Wai Hang received his bachelor’s degree in Business Administration

in Global Business and Finance from the Hong Kong University of

Science and Technology in June 2012.

Mr. Lin Yingzhou has been engaged in

intellectual property practice for 16 years. He has been the deputy

secretary general of Shantou Patent Protection Association for

three consecutive terms since 2005, and is now an expert of

Guangdong Provincial Intellectual Property Expert Pool, an expert

member and arbitrator of Shantou Arbitration Commission, and an

expert of Shantou Intermediate People's Court Think Tank. He has

been providing consulting services to Shantou enterprises on the

application of the patent system and the strategy of patent rights

defense.

Ms. Li Yanyun is a seasoned financial expert

with over 20 years of experience in finance and accounting,

operation and professional services. She has worked in various

industries such as accounting, shipping, manufacturing and

agriculture, gaining extensive knowledge and expertise in these

fields. Ms. Li Yanyun currently serves as the financial controller

of Fubang Resources (Singapore) Pte Ltd. She is a member of the

Association of Chartered Certified Accountants and a Chartered

Accountant of Singapore. She received her master’s degree in

Finance from the Royal Melbourne Institute of Technology in

2012.

Release of Share Pledge

Release of Share Pledge of Peng Oi Investment

(Hong Kong) Holdings Limited in favor of Beacon Technology

Investment Holdings Limited

On the Closing Date, Peng Oi Investment (Hong

Kong) Holdings Limited (“POI”) as the pledgor and

Beacon Technology Investment Holdings Limited

(“BTI”) as the pledgee entered into a deed of

release (the “Deed of Release”), pursuant to which

the equity interest pledge agreement dated September 17, 2020 (the

“Equity Pledge Agreement”) shall be terminated and

BTI shall relinquish all of its right thereunder, including without

limitation all of its right of pledge in 51% of the equity interest

in Peng Yi Da Business Consulting Co., Ltd.

(“PYD”) (the “Equity Pledge”).

Under the Deed of Release, the Equity Pledge shall be released

immediately upon the execution of the Deed of Release.

Release of Share Pledge of Dragon Jade Holdings

Limited in favor of Peak Asia Investment Holdings V Limited

("ADV”)

On the Closing Date, Dragon Jade Holdings

Limited (“DJH”) as the chargor and ADV as the

secured party entered into a deed of release (the “Deed of

Release”), pursuant to which the deed of share charge

dated September 17, 2020 (the “Deed Charge”) shall

be terminated and ADV shall relinquish all of its right thereunder,

including without limitation all of its right of pledge in 51% of

the equity interest in POI (the “Equity Pledge”).

Under the Deed of Release, the Equity Pledge shall be released

immediately upon the execution of the Deed of Release.

Release of Share Pledge of AIH in favor of

ADV

On the Closing Date, AIH as the chargor and ADV

as the secured party entered into a deed of release (the

“Deed of Release”), pursuant to which the deed of

share charge dated September 17, 2020 (the “Deed

Charge”) shall be terminated and ADV shall relinquish all

of its right thereunder, including without limitation all of its

right of pledge in 51% of the equity interest in DJH (the

“Equity Pledge”). Under the Deed of Release, the

Equity Pledge shall be released immediately upon the execution of

the Deed of Release.

As of the date of this form 6-K, POI, DJH and

PYD are wholly-owned subsidiaries of AIH. Copies of the foregoing

deeds of release are attached hereto as Exhibit 99.2, 99.3 and 99.4

and are incorporated by reference herein.

Contractual Arrangements with respect to Equity

Interests

Reference is made to the annual report for the

fiscal year ended December 31, 2022 of the Company filed with the

SEC on April 21, 2023 (the “Annual Report”) in

relation to, among others, the Target Equity Interests in the

Relevant Subsidiaries from page 90 to 94. All capitalized terms not

otherwise defined herein shall have the meanings ascribed to them

in the Annual Report.

Due to the restriction of the Foreign Investment

Catalog 2015, the Company decreased its shareholding to no more

than 70.0% in the Relevant Subsidiaries by transferring excessive

equity interests to Dr. Zhou Pengwu and certain of our employees in

2018. On April 26, 2023, the Company entered into a series of

contractual arrangements (the “Contractual

Arrangements”) with Mr. Zhou Qiuming, Shenzhen Pengai

Investment and Beijing Aomei, Yantai Pengai, Shanghai Pengai,

Shenzhen Pengai Xiuqi and Guangzhou Pengai Xiuqi (collectively,

“Relevant Subsidiaries A”), with respect to the

certain equity interests in the Relevant Subsidiaries A. These

Contractual Arrangements enable the Company to (i) exercise control

over the equity interests in the Relevant Subsidiaries A; (ii)

receive economic benefits from the equity interests in the Relevant

Subsidiaries A; and (iii) have an exclusive option to purchase all

or part of the equity interests when and to the extent permitted by

PRC laws. Mr. Zhou Qiuming is a third-party independent of the

Company and its affiliates.

The following table sets out the equity

interests in each of the Relevant Subsidiaries A held or to be held

by the following nominee(s), for which the Company is entitled to

receive relevant economic benefits pursuant to the Contractual

Arrangements.

| Name of the Relevant

Subsidiaries A |

Name of the

Nominee |

Percentage of the Equity Interests in the Relevant

Subsidiaries A held by the Nominee |

| Beijing Aomei |

Mr. Zhou Qiuming |

25% |

| Yantai Pengai |

Mr. Zhou Qiuming |

24% |

| Shanghai Pengai |

Mr. Zhou Qiuming |

15% |

| Shenzhen Pengai Xiuqi |

Mr. Zhou Qiuming |

27% |

| Guangzhou Pengai Xiuqi |

Mr. Zhou Qiuming |

3% |

The following is a summary of the currently

effective Contractual Arrangements with respect to the equity

interests in the Relevant Subsidiaries A.

Loan Agreement

Loan agreements between Shenzhen Pengai

Investment and Mr. Zhou Qiuming

Shenzhen Pengai Investment, as the lender,

entered into certain loan agreements with Mr. Zhou Qiuming, as the

borrower. Pursuant to each of these loan agreements, Shenzhen

Pengai Investment agrees to extend a loan to Mr. Zhou Qiuming in an

equivalent amount to the purchase price to be paid by Mr. Zhou

Qiuming for acquiring the equity interests in the Relevant

Subsidiaries A. Pursuant to each of these loan agreements, Mr. Zhou

Qiuming shall repay the loan by transferring its current and future

economic interest of the equity interests in the Relevant

Subsidiaries A to Shenzhen Pengai Investment.

Economic Interest Transfer Agreement

Economic Interest Transfer Agreement between Mr.

Zhou Qiuming, Shenzhen Pengai Investment and the Relevant

Subsidiaries A

Mr. Zhou Qiuming, Shenzhen Pengai Investment and

each of the Relevant Subsidiaries A entered into certain economic

interest transfer agreements. Pursuant to each of these economic

interest transfer agreements, the economic interest in relation to

the equity interests currently held and subsequently acquired by

Mr. Zhou Qiuming, including but not limited to (i) incomes arising

from the disposal of the equity interests (including derivative

equity interest of the equity interests) under any circumstance;

(ii) dividends and bonus obtained on the basis of the equity

interests (including derivative equity interest of the equity

interests) under any circumstance; (iii) residual assets and other

economic profits allocated after the liquidation of the Relevant

Subsidiaries A, and (iv) any other cash income, property and

economic benefit arising from the equity interests (including

derivative equity interest of the equity interests), shall be

transferred to Shenzhen Pengai Investment. Upon the execution of

each economic interest transfer agreement, the repayment obligation

of Mr. Zhou Qiuming under each loan agreement is deemed fully

discharged.

Exclusive Option Agreement

Exclusive Option Agreement between Shenzhen

Pengai Investment, Mr. Zhou Qiuming and the Relevant Subsidiaries

A

Mr. Zhou Qiuming, Shenzhen Pengai Investment and

each of the Relevant Subsidiaries A entered into certain exclusive

option agreements. Pursuant to these exclusive option agreements,

Mr. Zhou Qiuming irrevocably granted Shenzhen Pengai Investment an

exclusive right to purchase, or have its designated person(s) to

purchase, at its discretion, all or part of his equity interests in

the Relevant Subsidiaries A, and the purchase price shall be the

lowest price permitted by applicable PRC law. Each of Mr. Zhou

Qiuming and the Relevant Subsidiaries A undertakes that, among

others, without the prior written consent of Shenzhen Pengai

Investment, he or it shall or shall cause the Relevant Subsidiaries

A not to declare any dividends or distribute any residual profits,

change or amend its articles of association, increase or decrease

its registered capital, or change its structure of registered

capital in other manners. In the event that Mr. Zhou Qiuming

increases its capital injection into the Relevant Subsidiaries A,

Mr. Zhou Qiuming undertakes and confirms that any additional equity

so acquired shall be subject to the purchase option. Unless

terminated by Shenzhen Pengai Investment at its sole discretion,

the exclusive option agreement will remain effective until all

equity interests in the Relevant Subsidiaries A held by Mr. Zhou

Qiuming are transferred or assigned to Shenzhen Pengai Investment

or its designated person(s).

Equity Interest Pledge Agreement

Equity Interest Pledge Agreement between

Shenzhen Pengai Investment, Mr. Zhou Qiuming and the Relevant

Subsidiaries A

Mr. Zhou Qiuming as pledgor, Shenzhen Pengai

Investment as pledgee, and each of the Relevant Subsidiaries A

entered into certain equity interest pledge agreements. Pursuant to

these equity interest pledge agreements, Mr. Zhou Qiuming has

pledged all of the equity interests in Relevant Subsidiaries A and

agreed to pledge all future equity interests in the Relevant

Subsidiaries A acquired by him to Shenzhen Pengai Investment to

guarantee the performance by Mr. Zhou Qiuming and the Relevant

Subsidiaries A of their respective obligations under the loan

agreement, the economic interest transfer agreement, the exclusive

option agreement and the power of attorney. If the Relevant

Subsidiaries A or Mr. Zhou Qiuming breach any obligations under

these agreements, Shenzhen Pengai Investment, as pledgee, will be

entitled to dispose of the pledged equity and have priority to be

compensated by the proceeds from the disposal of the pledged

equity. Mr. Zhou Qiuming shall not permit the existence of any

security interest or other encumbrance on the pledged equity

interests or any portion thereof, without the prior written consent

of Shenzhen Pengai Investment and the Relevant Subsidiaries A shall

not assent to or assist in such actions. These equity interest

pledge agreements will remain effective until Mr. Zhou Qiuming

discharges all the obligations under the loan agreement, the

economic interest transfer agreement, the exclusive option

agreement and the power of attorney and the full payment of all

direct, indirect and derivative losses and losses of anticipated

profits, suffered by the pledgee, incurred as a result of any

breach by Mr. Zhou Qiuming or the Relevant Subsidiaries A under

these agreements or invalidity, revocation and termination of any

of these agreements.

Power of Attorney

Power of Attorney Executed by Mr. Zhou Qiuming

Pursuant to relevant power of attorney executed

by Mr. Zhou Qiuming, he has irrevocably authorized Shenzhen Pengai

Investment or its designated person(s) to exercise all of such

shareholder’s voting and other rights associated with the equity

interests in each of the Relevant Subsidiaries A, including but not

limited to, the right to attend shareholder meetings, the right to

vote, the right to sell, transfer, pledge or depose of the equity

interests and the right to appoint legal representatives, directors

and other management. The proxy agreement remains effective as long

as Mr. Zhou Qiuming remains a shareholder of the Relevant

Subsidiaries A, unless Pengai Investment has given contrary written

instructions.

Spousal consent letter

Spousal consent letter of Ms. Ma Xiuhua

Pursuant to relevant spousal consent letters

executed by Ms. Ma Xiuhua, she unconditionally and irrevocably

agreed that the equity interest in each of the Relevant

Subsidiaries A held or to be held by Mr. Zhou Qiuming and

registered or to be registered in his name will be disposed of

pursuant to the loan agreement, the economic interest transfer

agreement, the exclusive option agreement and the power of

attorney. Ms. Ma Xiuhua agreed not to assert any rights over the

equity interest in the Relevant Subsidiaries A held or to be held

by Mr. Zhou Qiuming. In addition, in the event that Ms. Ma Xiuhua

obtains any equity interest in each of the Relevant Subsidiaries A

for any reason, she agreed to be bound by the Contractual

Arrangements.

About Aesthetic Medical International Holdings Group

Limited

AIH, known as “Peng’ai” in China, is a leading

provider of aesthetic medical services in China. AIH operates

through treatment centers that are spread across major cities in

mainland China, with a major focus in the Guangdong-Hong Kong-Macau

Greater Bay area and the Yangtze River Delta area. Leveraging over

20 years of clinical experience, AIH provides one-stop aesthetic

service offerings, including surgical aesthetic treatments,

non-surgical aesthetic treatments, general medical services and

other aesthetic services. For more information regarding the

Company, please visit: https://ir.aihgroup.net/.

Cautionary Statements

This press release contains

“forward-looking statements.” These statements are made under the

“safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be

identified by terminology such as “will”, “expects”, “anticipates”,

“aims”, “future”, “intends”, “plans”, “believes”, “estimates”,

“likely to” or other similar statements. Statements that are not

historical facts, including, without limitation, statements about

the Company’s beliefs, plans and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and

uncertainties. These risks and uncertainties and others that relate

to the Company’s business and financial conditions are detailed

from time to time in the Company’s SEC filings, and could cause the

actual results to differ materially from those contained in any

forward-looking statement. These forward-looking statements are

made only as of the date indicated, and the Company undertakes no

obligation to update or revise the information contained in any

forward-looking statements, except as required under applicable

law.

Investor Relations Contacts

For investor and media inquiries, please

contact:Aesthetic Medical International Holdings Group

LimitedEmail: ir@pengai.com.cn

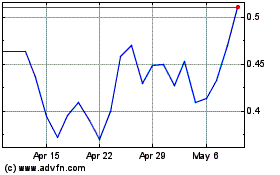

Aesthetic Medical (NASDAQ:AIH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aesthetic Medical (NASDAQ:AIH)

Historical Stock Chart

From Nov 2023 to Nov 2024