false

0001881741

0001881741

2024-09-13

2024-09-13

0001881741

AOGO:UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember

2024-09-13

2024-09-13

0001881741

AOGO:ClassCommonStock0.0001ParValuePerShareMember

2024-09-13

2024-09-13

0001881741

AOGO:RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-09-13

2024-09-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 13, 2024

AROGO CAPITAL ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41179 |

|

87-1118179 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

848 Brickell Avenue, Penthouse 5, Miami, FL

33131

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (786) 442-1482

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

AOGOU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, $0.0001 par value per share |

|

AOGO |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

AOGOW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

As previously disclosed in

those Current Reports on Form 8-K filed with the Securities and Exchange Commission (the “Commission”) on March 12, 2024,

August 6, 2024, and August 19, 2024 (as amended by the Current Report on Form 8-K filed with the Commission on August 21, 2024), on January

10, 2024, July 31, 2024, and August 12, 2024, respectively, Arogo Capital Acquisition Corp. (the “Company”), received notification

letters (the “Notices”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq Qualifications

Department”) advising the Company that the Company was not in compliance with the Nasdaq Stock Market LLC (“Nasdaq”)

continued listing requirements under: (a) Nasdaq Listing Rule 5450(b)(2)(A), requiring the Company to maintain a Market Value of Listed

Securities of at least $50 million; (b) Nasdaq Listing Rule 5450(b)(2)(B), the 1,100,000 minimum publicly held shares requirement; and

(c) Nasdaq Listing Rule 5450(a)(2), requiring the Company to have at least 400 total holders (together, the “Nasdaq Listing Requirements”).

On

August 6, 2024, the Company paid the required $20,000 fee and timely submitted its request for a hearing before the Panel to request additional

time to regain compliance with Nasdaq’s listing requirements and to complete a business combination. On September 12, 2024, during

the scheduled hearing, the Company described its ongoing efforts to regain compliance with the Nasdaq Listing Requirements, and notified

the Panel that the Company intended to apply for listing of its securities on OTCQB operated on the OTC Market systems.

On September 13, 2024, the

Company received a letter (the “Nasdaq Delisting Notice”) from Nasdaq stating that the Panel has rejected the Company’s

request to continue its listing on Nasdaq and determined to delist the Company’s securities. Nasdaq will suspend the trading of

the Company’s listed securities (the “Securities”) at the open of trading on September 17, 2024. The Company has 15

days after the date of the Nasdaq Delisting Notice to request that the Panel review the decision, or the Nasdaq Listing and Hearing Review

Council may, on its own motion, determine to review the Panel’s decision within 45 calendar days after the Nasdaq Delisting Notice.

In connection with the Nasdaq Delisting Notice, Nasdaq will complete the delisting by filing a Notification of Removal from Listing and/or

Registration under Section 12(b) of the Securities and Exchange Act of 1934 on Form 25 with the Commission after the applicable Nasdaq

review and appeal periods have lapsed.

The Company has begun the

process to apply and intends to have its Securities quoted on the OTCQB Market on the OTC Markets Group platform; however, there can be

no assurances that its Securities will be approved, or will continue, to be traded on such market.

Pending approval to have its

listed securities quoted on the OTCQB Market, the Company has been informed by the OTC Corporate Actions group and expects that its Class

A Common Stock, $0.0001 par value per share (“Common Stock”), Units consisting of one share of Class A Common Stock and one

Redeemable Warrant (the “Units”), and redeemable warrants, each warrant exercisable for one share of Class A Common Stock

at an exercise price of $11.50 per share (the “Warrants”), will begin trading on the OTC Pink Market at the open of trading

on September 17, 2024, under its the Securities’ current trading symbols “AOGO,” “AGOU” and “AOGOW”

respectively. The Company intends to continue to make all required SEC filings, including those on Forms 10-K, 10-Q and 8-K, and will

remain subject to all SEC rules and regulations applicable to reporting companies under the Securities Exchange Act of 1934. The Company

plans to continue to maintain compliance with all Nasdaq corporate governance requirements notwithstanding the trading suspension and

move to the OTC Markets Group platform, and to provide annual financial statements audited by a Public Company Accounting Oversight Board

auditor and unaudited interim financial reports, prepared in accordance with GAAP.

Additional Information

and Where to Find It

In connection with the

previously announced proposed business combination transaction, the Company intends to file a registration statement on Form F-4, which

will include a proxy statement/prospectus, with the Securities and Exchange Commission (“SEC”). The Company’s stockholders

and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto

and the definitive proxy statement and documents incorporated by reference therein filed in connection with the proposed business combination

transaction, as these materials will contain important information about the Company, Ayurcann Holding Corp. and the proposed business

combination transaction. Promptly after the Form F-4 is declared effective by the SEC, the Company will mail the definitive proxy statement/prospectus

and a proxy card to each stockholder entitled to vote at the meeting relating to the approval of the business combination and other proposals

set forth in the proxy statement/prospectus. Before making any voting or investment decision, investors and security holders of the Company

and other interested parties are urged to read the proxy statement/prospectus, any amendments thereto and any other documents filed with

the SEC carefully and in their entirety, when they become available, because they will contain important information about the proposed

business combination and the parties to the business combination. The preliminary proxy statement/prospectus and the definitive proxy

statement/prospectus, when available, and other reports and filings made with the SEC by the Company are available free of charge through

the website maintained by the SEC at http://www.sec.gov, or by directing a request to Arogo Capital Acquisition Corp., 848 Brickell Avenue,

Penthouse 5, Miami, FL 33131.

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report on

Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include those that express a belief, expectation

or intention, as well as those that are not statements of historical fact. Forward-looking statements include information regarding our

future plans and goals, as well as our expectations with respect to, without limitation: our ability to consummate the proposed business

combination; availability and terms of capital; our ability to have our securities quoted on the OTCQB Market, and our ability to continue

to trade on such market.

Forward-looking statements

may be accompanied by words such as “outlook,” “aim,” “anticipate,” “assume,” “believe,”

“budget,” “contemplate,” “continue,” “could,” “due,” “estimate,”

“expect,” “future,” “goal,” “intend,” “may,” “objective,” “plan,”

“predict,” “potential,” “positioned,” “pursue,” “seek,” “should,”

“target,” “will,” “would” and other similar expressions that are predictions of or indicate future

events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements

contain these words. Forward-looking statements are not assurances of future performance and involve risks, uncertainties and assumptions

which may cause actual results to differ materially from any results expressed or implied by any forward-looking statement, including,

but not limited to, the Company’s ability to regain compliance with the Nasdaq listing requirements; and the other important factors

outlined under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December

31, 2023, as such factors may be updated from time to time in the Company’s other filings with the SEC, which are available on the

SEC’s website at www.sec.gov. Although the Company believes that the expectations and assumptions reflected in its forward-looking

statements are reasonable, it cannot guarantee future results. These forward-looking statements speak only as of the date they were made

and, except as otherwise required by law, the Company undertakes no obligation to update, amend or ratify any forward-looking statements

because of new information, future events or other factors.

Participants

in the Solicitation

The Company and Ayurcann

Holdings Corp. and their respective directors and certain of their respective executive officers and other members of management and employees

may be considered participants in the solicitation of proxies from the stockholders of the Company with respect to the proposed business

combination. Information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 filed with the SEC on May 10, 2024. Additional information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy

statement and/or prospectus and other relevant materials to be filed with the SEC regarding the proposed business combination, when they

become available. Stockholders, potential investors and other interested persons should read the proxy statement/prospectus carefully,

when it becomes available, before making any voting or investment decisions. When available, these documents can be obtained free of charge

from the sources indicated above.

No Offer or Solicitation

This Current Report on

Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the

proposed business combination. This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AROGO CAPITAL ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Suradech Taweesaengsakulthai |

| |

|

Name: |

Suradech Taweesaengsakulthai |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

| Dated: September 17, 2024 |

|

|

3

v3.24.3

Cover

|

Sep. 13, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 13, 2024

|

| Entity File Number |

001-41179

|

| Entity Registrant Name |

AROGO CAPITAL ACQUISITION CORP.

|

| Entity Central Index Key |

0001881741

|

| Entity Tax Identification Number |

87-1118179

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

848 Brickell Avenue

|

| Entity Address, Address Line Two |

Penthouse 5

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33131

|

| City Area Code |

786

|

| Local Phone Number |

442-1482

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant

|

| Trading Symbol |

AOGOU

|

| Security Exchange Name |

NASDAQ

|

| Class A Common Stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

AOGO

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

AOGOW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AOGO_UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AOGO_ClassCommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AOGO_RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

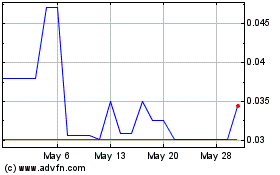

Arogo Capital Acquisition (NASDAQ:AOGOW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arogo Capital Acquisition (NASDAQ:AOGOW)

Historical Stock Chart

From Jan 2024 to Jan 2025