FALSE000180770700018077072023-07-112023-07-110001807707us-gaap:CommonStockMember2023-07-112023-07-110001807707us-gaap:WarrantMember2023-07-112023-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 11, 2023

AppHarvest, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39288 | 84-5042965 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

500 Appalachian Way Morehead, KY | 40351 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (606) 653-6100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

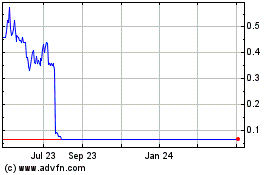

| Common Stock, $0.0001 par value per share | | APPH | | The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | APPHW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-

Balance Sheet Arrangement

On July 11, 2023, AppHarvest Morehead Farm, LLC (the “Borrower Subsidiary”) received a Notice of Acceleration; Demand for Payment; and Reservation of Rights (the “Notice of Acceleration”) from Rabo AgriFinance LLC, a Delaware limited liability company, as lender (“Rabo”), under that certain Master Credit Agreement, dated as of June 15, 2021 (as amended, restated, supplemented or otherwise modified from time to time in accordance with its terms, the “Credit Agreement”) between Rabo and Borrower Subsidiary.

The Notice of Acceleration asserts certain defaults relating to non-payment of certain principal and interest amounts due and payable under the Credit Agreement on July 3, 2023. Pursuant to the Notice of Acceleration, Rabo demanded immediate repayment of $47.213,671.03 consisting of principal and accrued interest, as well as repayment of any additional fees, costs, charges and other obligations as may be payable or become payable under the Credit Agreement.

From and after the alleged events of default, all such amounts due and owing to Rabo will bear interest at the rate applicable to the unpaid principal balance under the Credit Agreement plus 5.000% per annum. In addition, the collateral securing the payment and performance of the obligations under the Credit Agreement consists of a perfected first priority lien on, and security interest in, (i) certain assets of the Borrower Subsidiary, including, without limitation, that certain real property of the Borrower Subsidiary located in Rowan County, Kentucky, together with associated personal property, fixtures, and leases and rent thereon (the “Morehead Property”) and (ii) any license agreement providing for the grant of any right in or to certain intellectual property held by the Borrower Subsidiary.

Following the alleged event of default, Rabo has the right to pursue, among other things, (i) judicial foreclosure of the Morehead Property, (ii) the court-ordered appointment of a receiver to take possession of the Morehead Property, and/or (iii) a suit against the Borrower Subsidiary to recover the debt, including any deficiency resulting in the event that the net revenue from a court-ordered sale of the Morehead Property is less than the amount then-owing to Rabo under the Credit Agreement.

The Company (as defined below) is working with Rabo to come to a resolution, and will pursue a defense to any enforcement action taken by Rabo, but the Company cannot guarantee a resolution on a timely basis, on favorable terms, or at all. If the Company is unable to resolve the alleged defaults under the Credit Agreement, it would have a material adverse effect on the Company’s liquidity, financial condition and results of operations, and could cause the Company to become bankrupt or insolvent.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers

Appointment of Chief Executive Office and Chief Strategy Officer

On July 12, 2023, the Board appointed Jonathan Webb to serve as the Company’s Chief Strategy Officer in lieu of his position as Chief Executive Officer and Anthony Martin to serve as the Company’s Chief Executive Officer in lieu of his position as Chief Operating Officer, effective immediately.

Mr. Webb is the founder of the Company and has served as the Company’s President and Chief Executive Officer and as a member of AppHarvest’s Board since the Company’s incorporation in January 2018. Mr. Webb ceased serving as AppHarvest’s President in January 2021. From 2014 to February 2017, Mr. Webb served as contract support with Archetype USA for the U.S. Army Office of Energy Initiatives through the U.S. Department of Defense.

Mr. Martin has served as a director of the Company since October 2022 and Chief Operating Officer since January 2023. Mr. Martin has served as a member of the board of directors of the Fruit & Vegetable Dispute Resolution Corporation, a non-profit, member-based dispute resolution organization in the fresh produce industry, since May 2018. Previously, from December 2007 to October 2019, Mr. Martin served as Chief Financial Officer of Windset Farms, a controlled environment agriculture producer.

Since the beginning of the Company’s last fiscal year through the present, there have been no transactions with the Company, and there are currently no proposed transactions with the Company, in which the amount involved exceeds $120,000 and in which Mr. Webb had or will have a direct or indirect material interest within the meaning of Item 404(a) of Regulation S-K. There is no family relationship between Mr. Webb and any director or executive officer of the Company and no arrangement or understanding exists between Mr. Webb and any other person pursuant to which Mr. Webb was selected as an officer of the Company.

As previously disclosed, Mr. Martin provides consulting services to the Company pursuant to certain consulting agreements between the Company and Mr. Martin. For the consulting services, Mr. Martin received compensation totaling $234,481 in the year ended December 31, 2022. For the year ended December 31, 2023, the Company has paid Mr. Martin $390,970 for consulting services performed to date, and estimates that it will pay Mr. Martin an additional $390,970 for consulting services rendered for the remainder of the year ended December 31, 2023. There is no family relationship between Mr. Martin and any director or executive officer of the Company and no arrangement or understanding exists between Mr. Martin and any other person pursuant to which Mr. Martin was selected as an officer of the Company.

Appointment of Chief Legal Officer and Chief Restructuring Officer

On July 11, 2023, the Board of Directors (the “Board”) of AppHarvest, Inc. (together with its affiliates, as applicable, the “Company”) appointed Gary Broadbent to serve as the Company’s Chief Legal Officer and Chief Restructuring Officer effective immediately in addition to his position as Corporate Secretary.

Mr. Broadbent previously served as Deputy General Counsel of the Company in 2021 and 2022, as General Counsel of the Company in 2022 and 2023, and as Executive Vice President, General Counsel, and Corporate Secretary of the Company in 2022 and 2023. In 2022, he separately served as Senior Vice President, Deputy General Counsel, and Assistant Corporate Secretary to Rubicon Technologies, Inc. Prior to the foregoing roles, from 2019 to 2020 he served as Executive Vice President, General Counsel, and Secretary, and from 2020 to 2021 he served as Chief Wind-Down Officer, General Counsel, and Secretary, at GenCanna Global, Inc. Prior to that role, from 2018 to 2019 he served as General Counsel, Vice President of Human Resources, and Secretary of Mission Coal Company.

Mr. Broadbent also previously provided consulting services to the Company pursuant to a certain consulting agreement between the Company and Mr. Broadbent, effective December 1, 2022. For the consulting services, Mr. Broadbent received compensation totaling $40,000 in the year ended December 31, 2022. For the year ended December 31, 2023, the Company has paid Mr. Broadbent $200,000 for consulting services performed to date, and no additional payments are anticipated pursuant to the consulting agreement. There is no family relationship between Mr. Broadbent and any director or executive officer of the Company and no arrangement or understanding exists between Mr. Broadbent and any other person pursuant to which Mr. Broadbent was selected as an officer of the Company.

Executive Compensation Plan

On July 11, 2023, the Board approved the AppHarvest, Inc. Key Executive Compensation Plan (the “Executive Compensation Plan”) to enact a compensation program for certain senior level executives. The Board approved the Executive Compensation Plan in recognition of the significant benefits to the Company in compensating such executives to continue assisting the Company in its operations as it evaluates strategic alternatives.

Pursuant to certain Award Agreements under the Executive Compensation Plan, the Company and certain members of the Company’s executive management team (the “Executives” and each an “Executive”), specifically, Mr. Anthony Martin, Mr. Loren Eggleton, Mr. Jonathan Webb, and Mr. Gary Broadbent, shall be bound to the terms and conditions of the Executive Compensation Plan upon execution of each Executive’s applicable Award Agreement.

The Executive Compensation Plan provides for a lump sum, one-time cash payment, less applicable tax withholdings, on the next administratively practicable payroll date following the date the Executive returns a countersigned Award Agreement to the Company (the “Award Payment Date”) in the following amounts: (i) $540,000 for Mr. Martin; (ii) $540,000 for Mr. Eggleton; (iii) $540,000 for Mr. Webb; and (iv) $850,000 for Mr. Broadbent (the “Executive Awards”). Such amounts are in lieu of any payments under any cash incentive or bonus plan maintained by the Company for the 2023 performance year and shall offset and reduce any transaction bonuses payable under the terms of any other compensation bonus or employment agreements between the Company and a Participant by $300,000.

The Executive Awards are subject to a “clawback” requirement, which provides that each Executive must repay the net after-tax amount of his Executive Award upon the occurrence of certain events as set forth in the Executive Compensation Plan.

The Executive Compensation Plan supersedes all oral or written plans, programs, agreements and policies of the Company and its affiliates with respect to the subject matter of the Executive Compensation Plan.

The foregoing does not constitute a complete summary of the terms of the Executive Compensation Plan. A copy of the Executive Compensation Plan is attached hereto as Exhibit 10.1.

Non-Executive Compensation Plan

On July 11, 2023, the Board approved the AppHarvest, Inc. Non-Executive Compensation Plan (the “Non-Executive Compensation Plan”) to enact a compensation program for certain non-executive employees. The Board approved the Non-Executive Compensation Plan in recognition of the significant benefits to the Company in compensating such employees to continue assisting the Company in its operations as it evaluates strategic alternatives.

Pursuant to certain Award Agreements under the Non-Executive Compensation Plan, the Company and each person selected by the Board to participate in the Non-Executive Compensation Plan (each, a “Participant”) shall be bound to the terms and conditions of the Non-Executive Compensation Plan upon execution of each Participant’s applicable Award Agreement.

The Non-Executive Compensation Plan offers each Participant an Award (as defined in the Non-Executive Compensation Plan) in the total amount determined by the Board and set forth in the Participant’s Award Agreement. Subject to the conditions set forth in the Non-Executive Compensation Plan, each Participant will earn a right to receive (i) fifty percent (50%) of the total Award on

the six (6) month anniversary of the Effective Date (as defined in the Non-Executive Compensation Plan), and (ii) the remaining fifty percent (50%) of the total Award on the twelve (12) month anniversary of the Effective Date (each, a “Vesting Date”), in each case subject to the Participant’s continuous employment or engagement (if serving as a non-employee consultant) with the Company on such Vesting Dates. If earned, each such amount (an “Installment”) will be paid in a lump sum in cash on the first administratively practicable payroll period following the applicable Vesting Date. Notwithstanding the foregoing, in the event a Participant’s employment or engagement with the Company is terminated due to death, “Disability” (as defined in the Non-Executive Compensation Plan), or by the Company without “Cause” (as defined in the Non-Executive Compensation Plan) prior to the payment of the total Award, the Participant will be entitled to receive (following execution of a release agreement as described below) only the Installment that otherwise would have been earned if the Participant had remained employed on the next Vesting Date occurring immediately following the Participant’s termination of employment (but not the Installment otherwise payable on the subsequent Vesting Date, if applicable, which such shall be forfeited). Upon such event, the earned Installment shall be paid in a lump sum in cash within forty-five (45) days following the Participant’s termination of employment, subject to the execution and return (and the expiration of any applicable revocation period) of a release agreement in the form provided by the Company prior to end of such forty-five (45) day period (the “Release Expiration Period”). In the event that the Release Expiration Period spans two calendar years, the payment of such Installment shall occur in the second calendar year. For avoidance of doubt, any Participant who terminates his or her employment or engagement, or whose employment or engagement is terminated by the Company for “Cause” (as defined in the Non-Executive Compensation Plan), in each case prior to the occurrence of any Vesting Date, will not be eligible to receive and will forfeit the Installment relating to any such Vesting Date, other than as set forth above.

The Non-Executive Compensation Plan supersedes all oral or written plans, programs, agreements and policies of the Company and its affiliates with respect to the subject matter of the Non-Executive Compensation Plan.

The foregoing does not constitute a complete summary of the terms of the Non-Executive Compensation Plan. A copy of the Non-Executive Compensation Plan is attached hereto as Exhibit 10.2.

Non-Employee Director Compensation Policy

On July 11, 2023, in connection with a review of non-employee director compensation by the Board, the Board adopted an amended and restated Non-Employee Director Compensation Policy to, among other things, (i) pay current cash compensation quarterly in advance of service, (ii) increase annual cash compensation for service on the Board in an amount of $60,000, and (iii) provide for additional meeting fees in the amount of $2,000 for each Board meeting that a Non-Employee Director attends in excess of ten (10) meetings in a fiscal year, subject to a maximum cap of $50,000 for such fees in a fiscal year.

The foregoing does not constitute a complete summary of the terms of the Non-Employee Director Compensation Policy, as amended. A copy of the Non-Executive Compensation Plan, as amended and restated, is attached hereto as Exhibit 10.3.

Item 7.01 Regulation FD Disclosure

On July 13, 2023, the Company issued a press release (the “Press Release”) announcing, among other things, the appointment of Mr. Webb as the Company’s Chief Strategy Officer and Mr. Martin as the Company’s Chief Executive Officer. A copy of the Press Release is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Item 7.01 of the Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 8.01 Other Events

On July 12, 2023, the Board appointed Kevin Willis, an existing member of the Board since February 2022, as the Chairman of the Board. Mr. Willis has served as Senior Vice President and Chief Financial Officer of Ashland Global Holdings Inc., a public company, since September 2016. Mr. Willis held the same positions at Ashland Inc. and has served in such capacities since May 2013.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| 10.1 | | | |

| 10.2 | | | |

| 10.3 | | |

| 99.1 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AppHarvest, Inc. |

| |

| Dated: July 17, 2023 | |

| By: | /s/ Loren Eggleton |

| | Loren Eggleton |

| | Chief Financial Officer |

| | (Principal Financial Officer and Principal Accounting Officer) |

AppHarvest, Inc. Key Executive Compensation Plan

1.Effective Date, Term, and Purpose. This Key Executive Compensation Plan (the “Plan”) of AppHarvest, Inc. (the “Company”) is effective as of the date (the “Effective Date”) of the Plan’s approval by the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of the Company. The Plan provides each Participant (as defined below) with a one-time cash payment (each, an “Award”) pursuant to the terms and conditions set forth herein.

2.Participants Covered. Each person listed on Exhibit A (subtitled “Participants and Awards”) shall become a participant in the Plan as of the Effective Date (each, a “Participant”), provided that such person executes and returns to the Company a countersigned Award Agreement in a form to be provided by the Company substantially in the form of Exhibit B (the “Award Agreement”).

3.Award Payments and Conditions. The Plan offers each Participant an Award in the total amount determined under Section 3(a) below, with payment to occur as set forth in Section 3(b) below, subject to the conditions and clawback terms set forth herein.

a.Amount of Award. The total Award for each Participant shall be the amount set forth next to the Participant’s name on Exhibit A.

b.Timing of Payment. Subject to the conditions set forth in this Plan, each Participant’s Award shall be payable in a lump sum in cash, on the next administratively practicable payroll date following the Participant’s return of a countersigned Award Agreement (the “Award Payment Date”); provided, however, that the Participant must return a countersigned Award Agreement within thirty (30) days following receipt of such agreement in order to be eligible to receive the Award.

c.Clawback. If, prior to the earlier of (i) the first anniversary of the Award Payment Date or (ii) the date on which the Company emerges from a reorganization proceeding filed under chapter 11 of the United States Bankruptcy Code (i.e., the effective date of the chapter 11 reorganization plan) (collectively, the “Clawback Period”), a Participant’s employment or engagement (if serving as a non-employee consultant) with the Company is terminated (A) by the Company for Cause, or (B) by the Participant other than for Good Reason, death, or Disability, the Participant shall be required, as reflected in the Award Agreement, to repay to the Company any payment made to Participant pursuant to the Plan, subject to Section 6(b) below within forty-five (45) calendar days of the effective date of the employment termination triggering the Company’s right to repayment under this Section 3(c) and the Award Agreement. In the event a Participant is terminated by the Company without Cause or by the Participant for Good Reason, death, or Disability during the Clawback Period, any clawback that would otherwise apply to the Award pursuant to the provisions above shall be waived, provided that the Participant (or the Participant’s representative, as applicable) executes and returns a release agreement in a form provided by the Company (and any applicable revocation period expires), to the extent required by the Company in its sole discretion (in which case such release will be provided to the Participant no later than fourteen (14) days of his termination), within forty-five (45) days following the Participant’s termination of employment. Additionally, the Award will be subject to all other Company policies relating to the clawback of executive compensation that are otherwise applicable.

For purposes of this Plan:

“Cause,” shall have the meaning ascribed to such term in a Participant’s employment or consulting agreement with the Company (as amended, if applicable). In absence of such an agreement or definition, “Cause” shall mean that the Company has determined in its sole discretion that the Participant has engaged in any of the following: (i) a material breach of any covenant or condition under this Agreement or any other agreement between the Company and the Participant; (ii) any act constituting dishonesty, fraud, immoral or disreputable conduct; (iii) any conduct which constitutes a felony under applicable law; (iv) material violation of any Company policy or any act of misconduct; (v) repeated refusal to follow or implement a clear and reasonable directive of the Company after the expiration of ten (10) days without cure after written notice of such failure; (vi) gross negligence in the performance of the Participant’s duties or responsibilities; or (vii) breach of fiduciary duty.

"Company” shall mean AppHarvest, Inc., as set forth in Section 1 of the Plan, but shall also be deemed to include any affiliate of AppHarvest, Inc. as the context requires. In circumstances in which a Participant is employed or engaged by AppHarvest, Inc. and any of its affiliates, a termination of employment (or engagement) shall only be deemed to occur if the Participant’s employment (or engagement) terminates with AppHarvest, Inc. and each such affiliate. In the circumstances in which a Participant is employed (or engaged) only by a single affiliate of AppHarvest, Inc., a termination of employment (or engagement) shall be deemed to occur if the Participant’s employment (or engagement) terminates with such affiliate.

“Disability” shall have the meaning ascribed to such term in a Participant’s employment or consulting agreement with the Company (as amended, if applicable). In absence of such an agreement or definition, “Disability” shall mean that the Participant is unable due to a physical or mental condition to perform the essential functions of the Participant’s position with or without reasonable accommodation for six (6) months in the aggregate during any twelve (12) month period or based on the written certification by two licensed physicians of the likely continuation of such condition for such period. This definition shall be interpreted and applied consistent with the Americans with Disabilities Act, the Family and Medical Leave Act, and other applicable law.

“Good Reason” shall have the meaning ascribed to such term in a Participant’s employment or consulting agreement with the Company (as amended, if applicable). In absence of such an agreement or definition, “Good Reason” shall mean the occurrence of any of the following conditions without a Participant’s consent, after the Participant’s provision of written notice to the Company pursuant to Section 6(e) of the existence of such condition (which notice must be provided within thirty (30) days of the initial existence of the condition and must specify the particular condition in reasonable detail), provided that the Company has not first provided notice to the Participant of its intent to terminate the Participant’s employment or engagement: (i) a material reduction in the Participant’s duties, responsibilities or authorities, provided, however, that neither the conversion of the Company to a subsidiary, division or unit of an acquiring entity, or the Participant’s reporting relationships following a Change in Control (as defined in the Company’s 2020 Equity Incentive Plan), nor a change in title, will be deemed a “material reduction” in and of itself or material adverse alteration in, the Participant’s position, title, duties, or responsibilities; (ii) a

material (greater than 10%) reduction by the Company of the Participant’s Base Salary (except in the case of either an across the board reduction in salaries of all similarly situated employees or a temporary reduction due to financial exigency); or (iii) the relocation of the Participant’s principal place of employment by fifty (50) or more miles from the Participant’s then-current principal place of employment or engagement. Notwithstanding the foregoing, Good Reason shall only exist if the Company is provided a thirty (30) day period to cure the event or condition giving rise to Good Reason, and it fails to do so within that cure period (and, additionally, the Participant must resign for such Good Reason condition by giving written notice to the Company pursuant to Section 6(e) within thirty (30) days after the period for curing the violation or condition has ended). To the extent the Participant’s principal place of employment or engagement is not the Company’s corporate offices due to a shelter-in-place order, quarantine order, or similar work-from-home requirement that applies to the Participant, the Participant’s principal place of employment or engagement, from which a change in location under the foregoing clause (iii) will be measured, will be considered the Company’s office location where the Participant’s employment or engagement with the Company primarily was based immediately prior to the commencement of such shelter-in-place order, quarantine order, or similar work-from-home requirement.

4.Tax Consequences and Section 409A. In connection with participation in the Plan and the receipt of any Awards, the Participant shall be solely responsible for all federal, state, and local tax liabilities including, without limitation, income taxes, any additional taxes imposed under Section 409A of the Internal Revenue Code of 1986 (as amended from time to time, the “Code”), any excise taxes, and the employee portion of employment taxes. The Company makes no warranty concerning the tax treatment of any payment of Awards; each Participant should consult his or her tax advisor regarding the appropriate tax treatment of Awards. Each Award payment due under this Plan is intended to be exempt from Section 409A of the Code as a “short-term deferral,” within the meaning of Treasury Regulation 1.409A-1(a)(4), and shall be considered to be a separate payment for purposes of Section 409A. The Committee shall interpret and administer the Plan accordingly, and shall have complete discretion to make any determination and to take any determination that avoids any violation of Section 409A. However, the Company makes no representations concerning Section 409A or any related or other federal, state or local tax law.

5.Section 280G. In the event that the payment of an Award under the Plan (including in combination with any other payments or benefits provided to a Participant) (a) constitutes “parachute payments” within the meaning of Section 280G of the Code (“Section 280G”), and (b) would be subject to the excise tax imposed by Section 4999 of the Code (“Section 4999”), then the payment of the Award shall be either, as agreed to between the parties, (x) delivered in full, or (y) delivered as to such lesser extent which would result in no portion of the Award (or other payments or benefits provided to a Participant in combination with the Award) being subject to excise tax under Section 4999, whichever of the foregoing amounts, taking into account the applicable federal, state and local income taxes and the excise tax imposed by Section 4999, results in the receipt by the Participant on an after-tax basis, of the greatest amount of such payments, notwithstanding that all or some portion of the payments may be taxable under Section 4999. Notwithstanding the foregoing, a Participant shall be fully responsible for, and the Company shall have no liability with respect to, the payment of any excise taxes under Section 4999 resulting from the Award.

6.Miscellaneous.

a.Administration. the Company, acting by its Board or the Committee, shall administer the Plan, shall in such capacity be responsible for the general administration and management of the Plan, and shall have all powers and duties necessary to fulfill its responsibilities, including the discretion to determine all questions relating to the eligibility of any person to collect Awards, and the calculation and payment of all such Awards. The Committee shall accordingly have the discretion to interpret or construe ambiguous, unclear, or implied (but omitted) terms in any fashion the Committee deems to be appropriate in its sole and absolute discretion, to revise any form associated with this Plan in any manner that the Committee determines to be appropriate, and to make any findings of fact needed in the administration of the Plan. The validity of any such interpretation, construction, decision, or finding of fact shall not be given de novo review if challenged in court, by arbitration, or in any other forum, and shall instead be upheld unless clearly arbitrary or capricious. The Committee’s prior exercise of discretionary authority shall not obligate it to exercise its authority in a like fashion thereafter. Unless arbitrary and capricious, all actions taken and all determinations made by the Committee shall be final and binding on all persons claiming any interest in or under the Plan.

b.Manner of Payment and Tax Withholding. Any amounts payable under this Plan shall be paid to Participants in the same manner as they receive regular payroll (or by mail to the last known address of any Participant whose employment or engagement has terminated). The Company will deduct from any Award payment all required withholdings for state, federal, and local employment, income, payroll, or other taxes. Any repayment by a Participant due to clawback, pursuant to Section 3(c) above, shall be the net (after-tax) amount of the clawed-back payment to Participant.

c.Release. As a condition of payment of the Award, or clawback waiver in the case of any Participant whose employment is terminated due to death, disability, by the Company without Cause or by the executive for Good Reason prior to the end of the clawback period, the Company may require that the Participant execute a release in a form provided by the Company.

d.No Guarantee of Employment or Other Benefits. Except for Participants subject to a written employment agreement which states otherwise, employment with the Company is on an “at will” basis. This means that the employment relationship may be terminated at any time by either the Participant or the Company for any reason not expressly prohibited by law. Any representation to the contrary is invalid and unenforceable and should not be relied upon, unless set forth in a written contract of employment, signed on behalf of the Company by an authorized officer. Participation in this Plan and the receipt of benefits under this Plan shall not automatically be deemed employment for purposes of any other employee benefit plan including, without limitation, participation in (i) any other benefit plan such as medical, dental, disability or other welfare benefit plan, (ii) any retirement or 401(k) plan, or (iii) any other type of benefit.

e.Governing Law. This Plan shall be governed by and construed and enforced in accordance with the laws of the State of Kentucky, without reference to conflict of law principles which would require application of the law of another jurisdiction (except to the minimum extent that the law of the State of Kentucky specifically and mandatorily requires otherwise).

f.Notices. All notices, requests, demands and other communications required or permitted to be given under this Plan shall be in writing and shall be deemed given (i) when personally delivered to the recipient (provided a written acknowledgement of receipt is obtained), (ii) one (1) business day after being sent by a nationally recognized overnight courier (provided that a written acknowledgement of receipt is obtained by the overnight courier) or (iii) four (4) business days after mailing by certified or registered mail, postage prepaid, return receipt requested, to the party concerned at the address indicated below (or such other address as the recipient shall specify by ten days’ advance written notice given in accordance with this Section 6(e)):

To the Company:

Attn: General Counsel

AppHarvest, Inc.

500 Appalachian Way

Morehead, Kentucky 40351

To the Participant:

The last address shown in the Company’s employment records.

g.Successors and Assigns. No rights or benefits under this Plan may be assigned by any Participant without the Company’s prior written consent.

h.Anti-alienation Clause. No payment under the Plan may be anticipated, assigned (either at law or in equity), alienated, or subject to attachment, garnishment, levy, execution or other legal or equitable process whether pursuant to a “qualified domestic relations order” as defined in Section 414(p) of the Code or otherwise.

i.Amendment and Termination. The Company, through the Board or the Committee, may amend this Plan at any time and from time to time, and may terminate this Plan at any time; provided that any amendment or termination that adversely and materially affects a Participant will be subject to the Participant’s written consent thereto.

j.Unfunded Obligation. All Awards payable pursuant to the Plan are unfunded and unsecured and are payable out of the general funds of the Company.

k.Indemnification of Administrator. The Company agrees to indemnify and to defend to the fullest extent permitted by law any employee of the Company serving on the Board or on the Committee against all liabilities, damages, costs and expenses (including attorneys’ fees and amounts paid in settlement of any claims approved by the Company) occasioned by any act or omission to act in connection with the Plan if such act or omission is taken in good faith, is consistent with the direction and authority of their respective position as well as the duties imputed under this Plan, and is neither criminal nor willful misconduct.

IN WITNESS WHEREOF, the Plan has been adopted as of the Effective Date.

AppHarvest, Inc.

| | | | | | | | | | | | | | |

| By: | | /s/ Kevin Willis |

| Name: | | Kevin Willis |

| Title: | | Director, Member of Compensation Committee |

EXHIBIT A

Participants and Awards

| | | | | | | | |

| Executive | Title | Award* |

| Jonathan Webb | Founder & Chief Executive Officer | $540,000 |

| Anthony Martin | Chief Operating Officer | $540,000 |

| Loren Eggleton | Chief Financial Officer | $540,000 |

| Gary Broadbent | Chief Restructuring Officer, General Counsel, & Secretary | $850,000 |

*Amounts set forth above are in lieu of any payments under any cash incentive or bonus plan maintained by the Company for the 2023 performance year and shall offset and reduce any “Transaction Bonuses” payable to a Participant by $300,000 under the terms of any other Retention Bonus or Employment Agreements between the Company and a Participant entered into as of the Effective Date.

EXHIBIT B

FORM OF AWARD AGREEMENT

[DATE]

[NAME]

[ADDRESS]

[CITY STATE ZIP]

Re: Award Agreement Pursuant to Key Executive Compensation Plan

Dear [NAME]:

We are pleased to inform you that the AppHarvest, Inc. (the “Company”) has selected you for an Award under the Key Executive Compensation Plan (the “Plan”) recently approved by the Compensation Committee of the Board of Directors of the Company. We recognize these are uncertain times, and your contributions are essential to our future success. We are taking steps to ensure that your compensation remains attractive and your focus remains on continuing to do great work for the Company. This Award Agreement (the “Agreement”) sets forth the terms and conditions of your Award and, once countersigned by you, shall be a binding agreement between you and the Company.

Award Amount. Your total Award under the Plan is $[TOTAL AMOUNT] (less applicable withholdings and deductions), and it is payable to you as a lump sum on the next administratively practicable payroll date following your return of a signed copy of this Agreement to the Company (the “Award Payment Date”); provided, however, that you must return a signed copy of this Agreement to the Company within thirty (30) days following your receipt of this Agreement in order to receive the Award. You hereby agree that this Award amount shall be in lieu of any amounts payable to you under any cash incentive or bonus plan maintained by the Company for the 2023 performance year. [In addition, this amount will offset and reduce any amount payable to you as a “Transaction Bonus” by $300,000 under [For Loren: your Retention Bonus Agreement with the Company, dated as of February 20, 2023, as amended] [For Gary: Section 2.3 of your Employment Agreement with the Company, dated as of May 10, 2023, as amended]].

Clawback. As a further condition of your receipt of any Award, you agree that if, prior to the earlier of (i) the first anniversary of the Award Payment Date or (ii) the date on which the Company emerges from a reorganization proceeding filed under chapter 11 of the United States Bankruptcy Code (the “Clawback Period”), your employment or engagement (if serving as a non-employee consultant) with the Company is terminated (A) by the Company for Cause, or (B) by you for reasons other than for Good Reason, death, or Disability, you shall be required to repay the net (after-tax) amount of such clawed-back payment within forty-five (45) days of the effective date of your employment termination. The Company will specify the precise amount to be repaid when providing you with notice of your repayment obligation. You further agree that in the event that you owe the Company any amounts of any kind under the Plan, including under Section 3(c) of the Plan, as of the termination of your employment or engagement, as applicable, you hereby authorize the Company, to the maximum extent permitted by law and without further notice to or authorization by you, to withhold from any final pay, expense reimbursement, or other amounts that may become payable by the Company to you, all such amounts as are sufficient to satisfy your repayment obligations in whole or in part.

In the event your employment is terminated by the Company without Cause or by you for Good Reason, death, or Disability during the Clawback Period, any clawback that would otherwise apply to the Award pursuant to the provisions above shall be waived, provided that you (or your representative, as applicable) execute and return a release agreement in a form provided by the

Company (and any applicable revocation period expires), to the extent required by the Company in its sole discretion (in which case such release will be provided to you no later than fourteen (14) days of your termination), within forty-five (45) days following your termination of employment. Additionally, the Award will be subject to all other Company policies relating to the clawback of executive compensation that are otherwise applicable.

Plan Terms Controlling. This Agreement incorporates all the terms of the Plan document, a copy of which is attached. In the event of any conflict between this Agreement and the Plan document, the Plan document shall control. Any capitalized terms used but not otherwise defined herein shall have the meaning ascribed to such terms in the Plan document. By your signature below, you acknowledge and agree that you have had an ample opportunity to read, understand and seek counsel of your choice with respect to the terms of this Agreement and the Plan document and that you voluntarily agree to be bound by this Agreement and the terms of the Plan document.

No Other Modifications. Except as expressly set forth herein, the other terms and conditions of your employment or engagement are unaffected by this Agreement.

We hope that this Award opportunity demonstrates the Company’s commitment to your continued success at the Company and the value we place on your service. If you wish to accept the Award opportunity on the terms set forth above, including the fuller terms and conditions set forth in the Plan document, please countersign this Agreement where indicated below, whereupon it shall become binding on you and the Company, and return the countersigned Agreement to the Company within thirty (30) days of your receipt of this Agreement.

Please do not hesitate to contact me if there is anything else we can do to help you and the Company succeed together.

Very truly yours,

[NAME]

[TITLE]

AGREED TO AND ACCEPTED BY:

Signature: _____________________________________________

Print Name: ___________________________________________

Dated: ____________________________

Attachment

AppHarvest, Inc. Key Executive Compensation Plan

AppHarvest, Inc. Non-Executive Compensation Plan

1.Effective Date, Term, and Purpose. This Non-Executive Compensation Plan (the “Plan”) of AppHarvest, Inc. (the “Company”) is effective as of the date (the “Effective Date”) of the Plan’s approval by the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of the Company. Under the Plan, each Participant (as defined below) is eligible to receive cash payments (each, an “Award”) pursuant to the terms and conditions set forth herein.

2.Participants Covered. Each person selected by the Committee to participate in the Plan shall become a participant in the Plan as of the Effective Date (each, a “Participant”), provided that such person executes and returns to the Company in the time period determined by the Company (which shall not be later than thirty (30) days following the Effective Date) a countersigned Award Agreement in a form to be provided by the Company substantially in the form of Exhibit A (the “Award Agreement”).

3.Award Payments and Conditions. The Plan offers each Participant an Award in the total amount determined under Section 3(a) below, with payment to occur as set forth in Section 3(b) below, subject to the conditions set forth herein.

a.Amount of Award. The total Award for each Participant shall be determined by the Committee and set forth in the Participant’s Award Agreement.

b.Vesting Conditions; Time of Payment. Subject to the conditions set forth in this Plan, each Participant will earn a right to receive (i) fifty percent (50%) of his or her total Award on the six (6) month anniversary of the Effective Date, and (ii) the remaining fifty percent (50%) of the total Award on the twelve (12) month anniversary of the Effective Date (each, a “Vesting Date”), in each case subject to the Participant’s continuous employment or engagement (if serving as a non-employee consultant) with the Company and remaining in good standing with the Company during the period beginning on the Effective Date and ending on each such Vesting Date. If earned, each such amount (an “Installment”) will be paid in a lump sum in cash on the first administratively practicable payroll period following the applicable Vesting Date.

Notwithstanding the foregoing, in the event a Participant’s employment or engagement with the Company is terminated due to death, Disability, or by the Company without Cause prior to the payment of any Installment, the Participant will be entitled to receive (following execution of a release agreement as described below) only the Installment that otherwise would have been earned if the Participant had remained employed or engaged on the next Vesting Date occurring immediately following the Participant’s termination of employment or engagement (but not the Installment payable on the subsequent Vesting Date, if applicable, which such shall be forfeited). Upon such event, the earned Installment shall be paid in a lump sum in cash within forty-five (45) days following the Participant’s termination of employment, subject to the Company’s timely receipt of a release agreement in a form acceptable to the Company (and expiration of the applicable revocation period) prior to the end of such forty-five (45) day period (the “Release Expiration Period”), which is properly signed and dated by the Participant. In the event that the Release Expiration Period spans two calendar years, the payment of such Installment shall occur in the second calendar year.

For the avoidance of doubt, any Participant who terminates his or her employment or engagement, or whose employment or engagement is terminated by the Company for Cause, in each case prior to the occurrence of any Vesting Date, will not be eligible to receive and will forfeit the Installment relating to any such Vesting Date, other than as set forth in the immediately preceding paragraph.

For purposes of this Plan:

“Cause,” shall have the meaning ascribed to such term in a Participant’s employment or consulting agreement with the Company (as amended, if applicable). In absence of such an agreement or definition, “Cause” shall mean, in the Company’s sole discretion, (i) the Participant’s willful and continued failure to perform the Participant’s duties (other than any such failure resulting from death or Disability); (ii) the Participant’s willful failure to comply with any valid and legal directive of the Company; (iii) the Participant’s willful engagement in dishonesty, illegal conduct or gross misconduct, which is, in each case, materially injurious to the business or reputation of Company or any of the Company’s affiliates; (iv) the Participant’s conviction of or plea of guilty or nolo contendere to a crime that constitutes a felony or a crime that constitutes a misdemeanor involving fraud, embezzlement, theft, financial dishonesty or moral turpitude; (v) gross misconduct by the Participant that has or is reasonably likely to bring the Company or any of its affiliates into substantial public disgrace or disrepute; (vi) the Participant’s gross negligence, recklessness or willful material misconduct with respect to the Company or any of its affiliates, including the Participant’s material violation of any Company policy or state or federal law relating to workplace environment (including, without limitation, laws relating to sexual harassment, other prohibited harassment or discrimination); or (vii) the Participant’s material breach of any other section of this Agreement or any written agreement between the Employee and the Company.

"Company” shall mean AppHarvest, Inc., as set forth in Section 1 of the Plan, but shall also be deemed to include any affiliate of AppHarvest, Inc. as the context requires. In circumstances in which a Participant is employed or engaged by AppHarvest, Inc. and any of its affiliates, a termination of employment (or engagement) shall only be deemed to occur if the Participant’s employment (or engagement) terminates with AppHarvest, Inc. and each such affiliate. In the circumstances in which a Participant is employed (or engaged) only by a single affiliate of AppHarvest, Inc., a termination of employment (or engagement) shall be deemed to occur if the Participant’s employment (or engagement) terminates with such affiliate.

“Disability” shall have the meaning ascribed to such term in a Participant’s employment or consulting agreement with the Company (as amended, if applicable). In absence of such an agreement or definition, “Disability” shall mean that the Participant is unable, due to physical or mental incapacity, to perform the essential functions of Employee’s job for one hundred twenty (120) consecutive days.

4.Tax Consequences and Section 409A. In connection with participation in the Plan and the receipt of any Awards, the Participant shall be solely responsible for all federal, state, and local tax liabilities including, without limitation, income taxes, any additional taxes imposed under Section 409A of the Internal Revenue Code of 1986 (as amended from time to time, the “Code”), any excise taxes, and the employee portion of employment taxes. The Company makes no warranty concerning the tax treatment of any payment of Awards; each

Participant should consult his or her tax advisor regarding the appropriate tax treatment of Awards. Each Award payment due under this Plan is intended to be exempt from Section 409A of the Code as a “short-term deferral,” within the meaning of Treasury Regulation 1.409A-1(a)(4), and shall be considered to be a separate payment for purposes of Section 409A. The Committee shall interpret and administer the Plan accordingly, and shall have complete discretion to make any determination and to take any determination that avoids any violation of Section 409A. However, the Company makes no representations concerning Section 409A or any related or other federal, state or local tax law.

5.Section 280G. In the event that the payment of an Award under the Plan (including in combination with any other payments or benefits provided to a Participant) (a) constitutes “parachute payments” within the meaning of Section 280G of the Code (“Section 280G”), and (b) would be subject to the excise tax imposed by Section 4999 of the Code (“Section 4999”), then the payment of the Award shall be reduced to the extent necessary to result in no portion of the Award (or other payments or benefits provided to a Participant in combination with the Award) being subject to excise tax under Section 4999. Notwithstanding the foregoing, a Participant shall be fully responsible for, and the Company shall have no liability with respect to, the payment of any excise taxes under Section 4999 resulting from the Award.

6.Miscellaneous.

a.Administration. the Company, acting by its Board or the Committee, shall administer the Plan, shall in such capacity be responsible for the general administration and management of the Plan, and shall have all powers and duties necessary to fulfill its responsibilities, including the discretion to determine all questions relating to the eligibility of any person to collect Awards, and the calculation and payment of all such Awards. The Committee shall accordingly have the discretion to interpret or construe ambiguous, unclear, or implied (but omitted) terms in any fashion the Committee deems to be appropriate in its sole and absolute discretion, to revise any form associated with this Plan in any manner that the Committee determines to be appropriate, and to make any findings of fact needed in the administration of the Plan. The validity of any such interpretation, construction, decision, or finding of fact shall not be given de novo review if challenged in court, by arbitration, or in any other forum, and shall instead be upheld unless clearly arbitrary or capricious. The Committee’s prior exercise of discretionary authority shall not obligate it to exercise its authority in a like fashion thereafter. Unless arbitrary and capricious, all actions taken and all determinations made by the Committee shall be final and binding on all persons claiming any interest in or under the Plan.

b.Manner of Payment and Tax Withholding. Any amounts payable under this Plan shall be paid to Participants in the same manner as they receive regular payroll (or by mail to the last known address of any Participant whose employment or engagement has terminated). The Company will deduct from any Award payment all required withholdings for state, federal, and local employment, income, payroll, or other taxes.

c.No Guarantee of Employment or Other Benefits. Except for Participants subject to a written employment agreement which states otherwise, employment with the Company is on an “at will” basis. This means that the employment relationship may be terminated at any time by either the Participant or the Company for any reason not expressly prohibited by law. Any representation to the contrary is invalid and unenforceable and should not be relied upon, unless set forth in a written contract of employment, signed on behalf of the Company by an

authorized officer. Participation in this Plan and the receipt of benefits under this Plan shall not automatically be deemed employment for purposes of any other employee benefit plan including, without limitation, participation in (i) any other benefit plan such as medical, dental, disability or other welfare benefit plan, (ii) any retirement or 401(k) plan, or (iii) any other type of benefit.

d.Governing Law. This Plan shall be governed by and construed and enforced in accordance with the laws of the State of Kentucky, without reference to conflict of law principles which would require application of the law of another jurisdiction (except to the minimum extent that the law of the State of Kentucky specifically and mandatorily requires otherwise).

e.Notices. All notices, requests, demands and other communications required or permitted to be given under this Plan shall be in writing and shall be deemed given (i) when personally delivered to the recipient (provided a written acknowledgement of receipt is obtained), (ii) one (1) business day after being sent by a nationally recognized overnight courier (provided that a written acknowledgement of receipt is obtained by the overnight courier) or (iii) four (4) business days after mailing by certified or registered mail, postage prepaid, return receipt requested, to the party concerned at the address indicated below (or such other address as the recipient shall specify by ten days’ advance written notice given in accordance with this Section 6(e)):

To the Company:

Attn: General Counsel

AppHarvest, Inc.

500 Appalachian Way

Morehead, Kentucky 40351

To the Participant:

The last address shown in the Company’s employment records.

f.Successors and Assigns. No rights or benefits under this Plan may be assigned by any Participant without the Company’s prior written consent. This Plan shall be binding on the successors of the Company.

g.Anti-alienation Clause. No payment under the Plan may be anticipated, assigned (either at law or in equity), alienated, or subject to attachment, garnishment, levy, execution or other legal or equitable process whether pursuant to a “qualified domestic relations order” as defined in Section 414(p) of the Code or otherwise.

h.Amendment and Termination. The Company, through the Board or the Committee, may amend this Plan at any time and from time to time, and may terminate this Plan at any time; provided that any amendment or termination that adversely and materially affects a Participant will be subject to the Participant’s written consent thereto.

i.Unfunded Obligation. All Awards payable pursuant to the Plan are unfunded and unsecured and are payable out of the general funds of the Company. Notwithstanding anything in the Plan to the contrary, the timing of payment, and the amount of the Award, including any Installment Payment, are subject to adjustment as may be required by or in connection with any court or judicial

proceeding, including in connection with a bankruptcy, insolvency or restructuring of the Company, if applicable.

j.Indemnification of Administrator. The Company agrees to indemnify and to defend to the fullest extent permitted by law any employee of the Company serving on the Board or on the Committee against all liabilities, damages, costs and expenses (including attorneys’ fees and amounts paid in settlement of any claims approved by the Company) occasioned by any act or omission to act in connection with the Plan if such act or omission is taken in good faith, is consistent with the direction and authority of their respective position as well as the duties imputed under this Plan, and is neither criminal nor willful misconduct.

k.No Amounts Payable to Insiders. None of the Participants are “insiders” as that term is defined in 11 U.S.C. Section 101(31) and used in 11 U.S.C. Section 503(c), and none are a controlling person of any entity which comprises the Company. None of the Participants participated in the design of the Plan.

IN WITNESS WHEREOF, the Plan has been adopted as of the Effective Date.

AppHarvest, Inc.

| | | | | | | | | | | | | | |

| By: | | /s/ Gary Broadbent |

| Name: | | Gary Broadbent |

| Title: | | Chief Restructuring Officer, Chief Legal Officer, and Corporate Secretary |

EXHIBIT A

FORM OF AWARD AGREEMENT

[DATE]

[NAME]

[ADDRESS]

[CITY STATE ZIP]

Re: Award Agreement Pursuant to Non-Executive Compensation Plan

Dear [NAME]:

We are pleased to inform you that the AppHarvest, Inc. (the “Company”) has selected you for an Award under the Non-Executive Compensation Plan (the “Plan”) recently approved by the Compensation Committee of the Board of Directors of the Company. We recognize these are uncertain times, and your contributions are essential to our future success. We are taking steps to ensure that your compensation remains attractive and your focus remains on continuing to do great work for the Company. This Award Agreement (the “Agreement”) sets forth the terms and conditions of your Award and, once countersigned by you, shall be a binding agreement between you and the Company.

Award Amount. Your total Award under the Plan is $[TOTAL AMOUNT] (less applicable withholdings and deductions). Subject your continuous employment or engagement (if serving as a non-employee consultant) and your remaining in good standing with the Company on the following dates (each, a “Vesting Date”), you will earn a right to receive:

(i)Fifty percent (50%) of the total Award on the six (6) month anniversary of the Effective Date of the Plan, and

(ii)Fifty percent (50%) of the total Award on the twelve (12) month anniversary of the Effective Date of the Plan.

If earned, each such amount (an “Installment”) will be paid in a lump sum in cash on the first administratively practicable payroll period following the applicable Vesting Date. Notwithstanding the foregoing, in the event your employment (or engagement) with the Company is terminated due to death, Disability, or by the Company without Cause prior to the payment of the total Award, you will be entitled to receive the Installment that you otherwise would have earned if you had remained employed (or engaged) on the next Vesting Date occurring immediately following your termination of employment or engagement (but, for the avoidance of doubt, not the second Installment, which will be forfeited if your employment or engagement terminates during the initial six-month period following the Effective Date), subject to your execution of a release agreement in the form requested by the Company. Upon such event, the earned Installment shall be paid in a lump sum in cash within forty-five (45) days following your termination of employment (or engagement), provided that you execute a release agreement in the form requested by the Company (and any revocation period applicable to such release expires) prior to the end of such forty-five (45) day period (the “Release Expiration Period”). If the Release Expiration Period spans two calendar years, , you will be paid such Installment in the second calendar year.

If you voluntarily terminate your employment (or engagement) or your employment (or engagement) is terminated by the Company for Cause, in each case prior to the occurrence of any Vesting Date, will not be eligible to receive and will forfeit the Installment relating to any such Vesting Date. Additionally, you hereby agree that payment of your Award shall be in lieu of any amounts payable to you under any cash incentive or bonus plan maintained by the Company for the 2023 performance year.

Plan Terms Controlling. This Agreement incorporates all the terms of the Plan document, a copy of which is attached, and your right to receive any payment hereunder is contingent upon your compliance with the terms of the Plan. In the event of any conflict between this Agreement and the Plan document, the Plan document shall control. Any capitalized terms used but not otherwise defined herein shall have the meaning ascribed to such terms in the Plan document. By your signature below, you acknowledge and agree that you have had an ample opportunity to read, understand and seek counsel of your choice with respect to the terms of this Agreement and the Plan document and that you voluntarily agree to be bound by this Agreement and the terms of the Plan document.

No Other Modifications. Except as expressly set forth herein, the other terms and conditions of your employment are unaffected by this Agreement.

We hope that this Award opportunity demonstrates the Company’s commitment to your continued success at the Company and the value we place on your service. If you wish to accept the Award opportunity on the terms set forth above, including the fuller terms and conditions set forth in the Plan document, please countersign this Agreement where indicated below, whereupon it shall become binding on you and the Company, and return the countersigned Agreement to the Company within thirty (30) days of your receipt of this Agreement.

Please do not hesitate to contact me if there is anything else we can do to help you and the Company succeed together.

Very truly yours,

[NAME]

[TITLE]

AGREED TO AND ACCEPTED BY:

Signature: _____________________________________________

Print Name: ___________________________________________

Dated: ____________________________

Attachment

AppHarvest, Inc. Non-Executive Compensation Plan

AppHarvest, Inc.

Non-Employee Director Compensation Policy

Amended and Restated Effective: July 11, 2023

Each member of the Board of Directors (the “Board”) of AppHarvest, Inc. (the “Company”) who is not an employee of the Company (each, a “Non-Employee Director”) will receive the compensation described in this Non-Employee Director Compensation Policy (this “Director Compensation Policy”) for his or her Board service, subject to the terms and conditions set forth herein. In light of the increasing efforts required by Non-Employee Directors with respect to recent events, this Director Compensation Policy is being amended and restated effective as of the date set forth above (the “Effective Date”).

This Director Compensation Policy may be amended or modified, or any provision of it waived, at any time in the sole discretion of the Board or the Compensation Committee of the Board (the “Compensation Committee”).

Annual Cash Compensation

Beginning on the Effective Date, all annual cash compensation amounts payable to Non-Employee Directors will be paid in equal quarterly installments in advance of each fiscal quarter in which the service occurs, prorated for any partial months of service. On and after the Effective Date, the annual cash retainers (the “Annual Cash Retainers”) for Non-Employee Directors’ service on the Board shall be as follows (as applicable):

(a) All Eligible Directors: $135,000

(b) Non-Executive Chair: $50,000 (in addition to regular Annual Board Service Retainer)

Additional Frequent Meeting Fees

In the event a Non-Employee Director attends more than ten (10) Board meetings in a fiscal year, he or she shall receive an additional payment of $2,000 per Board meeting he or she attends in excess of the tenth (10th) Board meeting in the fiscal year (the “Frequent Meeting Payment”). Such Frequent Meeting Payments shall be subject to a maximum aggregate limit of $50,000 per fiscal year. Any Frequent Meeting Payments that a Non-Employee Director earns shall be paid in a lump sum in cash within thirty (30) days of the date of the applicable Board meeting.

Equity Compensation

Commencing on the Effective Date, each eligible Non-Employee Director will be eligible to receive the equity compensation set forth below. Equity awards will be granted under the Company’s 2021 Equity Incentive Plan (the “Plan”).

(a) Automatic Equity Grants. Without any further action of the Board or Compensation Committee, at the close of business on the date of each Annual Meeting of the Company’s Stockholders following the Effective Date (the “Annual Meeting”), each person who is then a Non-Employee Director, will automatically receive a restricted stock unit (“RSU”) award having a value of $100,000 (the “Annual RSU”). Each Annual RSU will vest on the date of the following year’s Annual Meeting (or the date immediately preceding the date of the following year’s Annual Meeting if the Non-Employee Director’s service as a director ends at

such meeting as a result of the director’s failure to be re-elected or the director not standing for re-election).

(b) Vesting; Change of Control. The vesting of each Annual RSU is subject to the Non-Employee Director’s Continuous Service (as defined in the Plan) on the applicable vesting date of each such award. Notwithstanding the foregoing, for each Non-Employee Director who remains in Continuous Service with the Company until immediately prior to the closing of a Change in Control (as defined in the Plan), such Non-Employee Director’s then-outstanding Annual RSU will become fully vested immediately prior to the closing of such Change in Control. The grants will be eligible for deferred settlement in accordance with such deferral program as may be established by the Company and approved by the Board.

(c) Calculation of Value of an RSU Award. The value of an RSU award to be granted under this Director Compensation Policy will be determined based on the unweighted average closing price of a share of the Company’s Common Stock over the thirty (30) consecutive trading day period immediately preceding the date that is five (5) trading days prior to the date of grant of such award.

(d) Remaining Terms. The remaining terms and conditions of each RSU award, including transferability, will be as set forth in the Company’s Restricted Stock Unit Award Notice and Agreement, in the form adopted from time to time by the Board or Compensation Committee.

Non-Employee Director Compensation Limit

Notwithstanding anything herein to the contrary, the cash compensation and equity compensation that each Non-Employee Director is eligible to receive under this Director Compensation Policy shall be subject to the limits set forth in the Plan.

Ability to Decline Compensation

A Non-Employee Director may decline all or any portion of his or her compensation under this Director Compensation Policy by giving notice to the Company prior to the date cash is to be paid or equity awards are to be granted, as the case may be.

Expenses

The Company will reimburse each Non-Employee Director for any ordinary and reasonable out-of-pocket expenses actually incurred by such director in connection with in-person attendance at and participation in Board and committee meetings; provided, that such director timely submits to the Company appropriate documentation substantiating such expenses in accordance with the Company’s travel and expense policy as in effect from time to time.

* * * * *

Media Contact: Darla Turner, Darla.Turner@appharvest.com

AppHarvest names CEA industry vet Tony Martin CEO

to help accelerate production and revenue ramp up of high-tech indoor farm network

Martin will continue rapid execution of Project New Leaf focused on operational efficiency

for higher yields, improved quality and cost savings

Kevin Willis named AppHarvest board chair

AppHarvest has been shipping more sustainable produce to top grocers, restaurants and food service outlets since 2021

MOREHEAD, Ky., July 13, 2023 -- AppHarvest, Inc. (NASDAQ: APPH, APPHW), a sustainable food company, public benefit corporation and Certified B Corp building some of the world’s largest high-tech indoor farms to grow affordable, nutritious fruits and vegetables at scale while providing good jobs in Appalachia, today named controlled environment agriculture veteran Tony Martin its chief executive officer effective immediately to accelerate its strategic plan, Project New Leaf, which has shown strong progress toward operational efficiencies resulting in higher sales, cost savings and product quality as the company works to increase production across its four-farm network.

Martin has served as an AppHarvest board member since October 2022 and as chief operating officer since January of this year. He joined AppHarvest following a nearly 12-year career with Windset Farms, one of the largest controlled environment agriculture (CEA) producers and marketers of indoor-grown crops in North America with more than 250 acres in the U.S. and Canada. At Windset, he supported both significant infrastructure and revenue growth. Martin has served as a consultant in the CEA sector and is a board member of the Fruit & Vegetable Dispute Resolution Corporation, a non-profit that sets standards for the trade of fresh fruits and vegetables in Canada. He also serves on the board of Natureripe Farms, the second largest strawberry producer in North America, and is a partner in GA Partners, which consults on agricultural operations and assisting businesses in transition.

Martin’s Project New Leaf strategic plan focuses on improving labor efficiency, better leveraging industry relationships and expertise, implementing disciplined cost control, improving the feedback loop across the organization and aligning the workforce to the five-year plan. “I’m seeing a maturity building in the organization to better manage issues and to mitigate any material impact from challenges. We’re working more collaboratively, which is delivering cost savings and driving product quality. The mission and purpose behind AppHarvest have brought a tremendous amount of talent to the team, and I expect to see more operational efficiencies leading to increased performance throughout the year.”

Kevin Willis, who has served on the AppHarvest board since February of 2022, will assume the position of board chair. Willis currently serves as senior vice president and chief financial officer of Ashland (NYSE: ASH), a global specialty materials company.

AppHarvest Founder Jonathan Webb transitions from his previous roles as chairman and CEO to become chief strategy officer. He remains on the board as a director. “I founded AppHarvest based on a mission to improve domestic food security by farming more sustainably with climate-resilient practices while providing economic opportunity in Central Appalachia,” said Webb. “Thanks to the AppHarvest team and the tenacity of the people of Kentucky, we undertook the largest simultaneous buildout of CEA infrastructure in U.S. history and worked to put the region on the map as a hub for AgTech drawing more CEA investment to the state. While I will continue to support the company, I am confident that Tony’s leadership, extensive background in CEA and track record for optimizing revenue growth will provide the guidance the company needs at this inflection point.”

“In the brief time Tony has served as COO, he already has shaped a culture of measurement, accountability, collaboration, responsiveness and learning, and the board welcomes his leadership in the role of CEO,” said AppHarvest Board Chair Kevin Willis. “Jonathan’s vision to set a new standard in sustainable farming has brought attention to the need for climate-resilient agriculture that helps ensure domestic food security with a more sustainable footprint that’s better for people and planet. The board and I thank Jonathan for his service as CEO and chair and appreciate his continued efforts to support the company.”

About AppHarvest

AppHarvest is a sustainable food company in Appalachia developing and operating some of the world’s largest high-tech indoor farms with high levels of automation to build a reliable, climate-resilient food system. AppHarvest’s farms are designed to grow produce using sunshine, rainwater and up to 90% less water than open-field growing, all while producing yields up to 30 times that of traditional agriculture and preventing pollution from agricultural runoff. AppHarvest currently operates its 60-acre flagship farm in Morehead, Ky., producing tomatoes, a 15-acre indoor farm for salad greens in Berea, Ky., a 30-acre farm for strawberries and cucumbers in Somerset, Ky., and a 60-acre farm in Richmond, Ky., for tomatoes. The four-farm network consists of 165 acres. For more information, visit https://www.appharvest.com.

Forward-Looking Statements

Certain statements included in this press release that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “expect,” “believe,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “could,” “would,” “plan,” “potential,” “seem,” “future,” “outlook,” “can,” “may, ”“target,” “strategy,” “working to” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All statements, other than statements of present or historical fact included in this press release, regarding AppHarvest’s intention to build high-tech CEA farms, the anticipated benefits of and production at such facilities, including implementation of a phased approach at each facility, timing and availability of tomatoes at top national grocery stores and restaurants, anticipated benefits of the third season harvest, the benefits of using a data-driven approach to optimize production across the farm network, the anticipated benefits and timing of the Company’s strategic program referred to as Project New Leaf, the potential for a sale-leaseback of an additional farm, AppHarvest’s future financial performance, as well as AppHarvest’s growth and evolving business plans and strategy, ability to capitalize on commercial opportunities, future operations, estimated financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of AppHarvest’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of AppHarvest. These forward-looking statements are subject to a number of risks and uncertainties, including those discussed in the company’s Quarterly Report on Form 10-Q filed with the SEC by AppHarvest on May 10, 2023, under the heading “Risk Factors,” and other documents AppHarvest has filed, or that AppHarvest will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. In addition, forward-looking statements reflect AppHarvest’s expectations, plans, or forecasts of future events and views as of the date of this press release. AppHarvest anticipates that subsequent events and developments will cause its assessments to change. However, while AppHarvest may elect to update these forward-looking statements at some point in the future, AppHarvest specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing AppHarvest’s assessments of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

v3.23.2

Cover

|

Jul. 11, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 11, 2023

|

| Entity Registrant Name |

AppHarvest, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39288

|