FALSE000180770700018077072023-08-012023-08-010001807707us-gaap:CommonStockMember2023-08-012023-08-010001807707us-gaap:WarrantMember2023-08-012023-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2023

AppHarvest, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39288 | 84-5042965 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

500 Appalachian Way Morehead, KY | 40351 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (606) 653-6100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

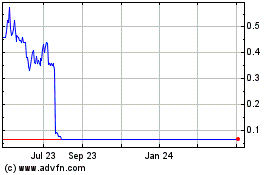

| Common Stock, $0.0001 par value per share | | APPHQ | | None |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | APPHWQ | | None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Restructuring Support Agreement

On August 1, 2023, AppHarvest Richmond Farm, LLC and AppHarvest Morehead Farm, LLC (collectively, the “Sellers”) entered into a binding “stalking horse” asset purchase agreement (the “Stalking Horse APA”) with CEFF II AppHarvest Holdings, LLC (“Equilibrium”), an affiliate of Equilibrium Sustainable Foods, LLC (“ESF”), providing for the sale and purchase of certain assets related to the Richmond Business and Morehead Business (each as defined in the Stalking Horse APA, and collectively, the “Assets”). Under the Stalking Horse APA, Equilibrium agreed, subject to the terms and conditions of the Stalking Horse APA, to acquire the Assets from the Sellers for $113,179,726, which would be satisfied in the form of a credit bid with respect to Equilibrium’s portion of the Company’s secured indebtedness. The Stalking Horse APA includes customary representations and warranties and various customary covenants under the circumstances that are subject to certain limitations, including, without limitation, a reasonable break-up fee and expense reimbursement provisions and the right to designate executory contracts and unexpired leases to assume or reject. The Stalking Horse APA is subject to the approval of the Bankruptcy Court (as defined below).

The foregoing description of the Stalking Horse APA does not purport to be complete and is qualified in its entirety by reference to the Stalking Horse APA, a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Item 8.01 Other Events

As previously reported, on July 23, 2023, AppHarvest, Inc. (the “Company”) and its debtor affiliates (together with the Company, the “Debtors”) filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”), thereby commencing chapter 11 cases for the Debtors (the “Chapter 11 Cases”), which are being jointly administered under Case No. 23-90745.

During the pendency of the Chapter 11 Cases, in lieu of filing annual reports on Form 10-K and quarterly reports on Form 10-Q under Section 13(a) of the Securities Exchange Act of 1934, as amended, the Company expects to file with the Securities and Exchange Commission, under cover of current reports on Form 8-K, copies of the monthly financial reports required to be filed with the Bankruptcy Court pursuant to rule 2015 of the Federal Rules of Bankruptcy Procedure, as well as any other material information concerning developments in its bankruptcy proceedings.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s securities during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders thereof in the Company’s Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to expectations concerning matters that are not historical facts. Words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,”, “could” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “can,” “goal,” “target” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, without limitation, the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; and risks associated with the Company’s business prospects, financial results and business operations. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the SEC, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AppHarvest, Inc. |

| |

| Dated: August 4, 2023 | |

| By: | /s/ Loren Eggleton |

| | Loren Eggleton |

| | Chief Financial Officer |

| | (Principal Financial Officer and Principal Accounting Officer) |

Exhibit 10.1

Execution Version

ASSET PURCHASE AGREEMENT

by and among

CEFF II APPHARVEST HOLDINGS, LLC APPHARVEST RICHMOND FARM, LLC

and

APPHARVEST MOREHEAD FARM, LLC

Dated as of August 1, 2023

TABLE OF CONTENTS

Page

TABLE OF CONTENTS

(continued)

TABLE OF CONTENTS

(continued)

EXHIBITS AND SCHEDULES

EXHIBITS

Exhibit A Defined Terms

Exhibit B Form of Assignment and Assumption Agreement SCHEDULES

Schedule 1.1(a) Seller Knowledge Individuals Schedule 1.1(b) Transferred Leases

Schedule 1.1(c) Transferred Owned Property Schedule 1.1(d) Fixtures and Equipment Schedule 1.6 Executory Contract Schedule` Schedule 5.5(a) Scheduled Employee Schedule Schedule 5.10 Conduct of Sellers

Seller Disclosure Schedule

ASSET PURCHASE AGREEMENT

This ASSET PURCHASE AGREEMENT (including the Exhibits and Schedules hereto, each as amended or restated from time to time in writing, this “Agreement”), dated as of August 1, 2023, is made by and among CEFF II AppHarvest Holdings, LLC, a Delaware limited liability company (“Buyer”), AppHarvest Richmond Farm, LLC, a Delaware limited liability company (“AHRF”) and AppHarvest Morehead Farm, LLC, a Delaware limited liability company (“AHMF”) (each of AHRF and AHMF a “Seller”, and collectively, “Sellers”). Buyer and Sellers are collectively referred to as the “Parties” and each individually as a “Party”. Exhibit A contains definitions of certain capitalized terms used in this Agreement.

RECITALS

WHEREAS, AHRF owns and operates a business as a cultivator, grower, harvester, producer, packager, seller and/or marketer of protected agriculture grown fresh produce, including tomatoes, at its facility located in Richmond, Kentucky (the “Richmond Business”);

WHEREAS, AHMF owns and operates a business as a cultivator, grower, harvester, producer, packager, seller and/or marketer of protected agriculture grown fresh produce, including tomatoes, at its facility located in Morehead, Kentucky (the “Morehead Business”; and collectively with the Richmond Business Sellers operate the “Business”);

WHEREAS, Sellers and certain of their Affiliates will commence voluntary cases under Chapter 11 of the Bankruptcy Code (collectively, the “Bankruptcy Case”) by filing petitions for relief in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”);

WHEREAS, Sellers will seek entry by the Bankruptcy Court of the Bid Procedures Order approving the Bid Procedures;

WHEREAS, Buyer and Sellers are contemplating, among other things, that following the execution of this Agreement, Buyer will act as a “stalking horse bidder” pursuant to the Bid Procedures for the Transferred Assets. Accordingly, in the absence of Sellers’ acceptance of a superior bid made in accordance with the Bid Procedures, Buyer will purchase Sellers’ right, title and interest in and to the Transferred Assets and assume the Assumed Liabilities on the terms and subject to the conditions set forth in this Agreement, in accordance with the Bid Procedures and subject to entry of the Sale Order by the Bankruptcy Court (the “Acquisition”); and

WHEREAS, the Parties desire to consummate the Acquisition as promptly as practicable following the satisfaction of the conditions precedent set out herein, including the entry of the Sale Order by the Bankruptcy Court.

NOW, THEREFORE, in consideration of the foregoing, and of the representations, warranties, covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

ARTICLE I

PURCHASE AND SALE OF THE BUSINESS

1.1.Purchase and Sale of Assets. On the terms and subject to the conditions set forth herein, subject to Section 1.7, at the Closing, Sellers shall Transfer to Buyer, and Buyer shall purchase and acquire from Sellers the entirety of Sellers’ right, title and interest in and to all of the following assets, properties and rights, whether real, personal or mixed, tangible or intangible (including goodwill), wherever located, in the physical possession of Sellers or another Person, in each case free and clear of all Liens, claims, encumbrances, and interests (other than Permitted Encumbrances), Excluded Assets and Excluded Liabilities (the “Transferred Assets”):

(a)Inventory;

(b)Transferred Leased Property;

(c)Transferred Owned Property;

(d)Fixtures and Equipment, including, for greater certainty, all of those assets listed on Schedule 1.1(d);

(e)Transferred Intellectual Property and all the goodwill of the Business and/or associated with or related to such Transferred Intellectual Property;

(f)each Assumed Contract with respect to which an Order has been entered by the Bankruptcy Court (which may be the Sale Order) authorizing the assumption and assignment of such Contract;

(g)subject to the right of Sellers to retain copies, the Books and Records;

(h)to the extent their transfer is permitted by Law, all Permits that are held by Sellers, or any Permits that are held by an Affiliate of Seller Related to the Business, and applications therefor or related thereto;

(i)all credits, prepaid expenses, deposits with propagators for crops related to the Business, deferred charges, advance payments, refunds, security deposits, prepaid items and duties to the extent related to a Transferred Asset, but excluding any refunds of Taxes to the extent included in Section 1.2(e) and any prepayments or deposits of any Asset Taxes prior to the date hereof for which Sellers shall receive credit to the extent provided in Section 5.4(b); and

(j)any claim, right, award, recovery, indemnity, warranty, right to insurance proceeds, refund, reimbursement, audit right, duty, obligation, liability or other intangible right in favor of or owed to any Seller (other than rights arising under or relating to this Agreement, the other Transaction Documents or Sellers’ or any of their Affiliates’ directors’ and officers’ insurance policies (all rights described in this parenthetical, the “D&O Insurance Claims”)), to the extent (i) related to any other Transferred Asset or (ii) related to any insurance proceeds as set forth in Section 5.9(a) other than the Excluded Insurance Proceeds.

(k)any Actions arising under and in connection with the Assumed Contracts.

1.2.Excluded Assets. Notwithstanding anything to the contrary set forth in this Agreement or in any of the other Transaction Documents, the Parties expressly acknowledge and agree that nothing in this Agreement shall be construed to obligate any Seller to Transfer to Buyer any assets, properties or rights of any Seller that are not listed in Section 1.1, including the following (the “Excluded Assets”), which shall be excluded from the Transferred Assets:

(a)all cash and cash equivalents, checks, money orders, funds in time and demand deposits or similar accounts, marketable securities, short-term investments, and other cash equivalents and liquid investments;

(b)all cash deposits in cash collateral, indemnity or other accounts solely to the extent comprising professional fee retainers, professional fee escrows, and indemnity accounts, held by or on behalf of Sellers’, or the bankrupt estates’, professionals;

(c)any claim, right, award, recovery, indemnity, warranty, refund, reimbursement, audit right, duty, obligation, liability or other intangible right in favor of or owed to any Seller (i) to the extent arising under or related to the D&O Insurance Claims, (ii) to the extent related to a Transferred Asset (other than Assumed Contracts) and arising or attributable to the period of time prior to the Closing Date, (iii) to the extent related to any of the Excluded Liabilities, or (iv) related to any insurance proceeds from Sellers’ or any of their Affiliates’ third party insurance policies to the extent such proceeds arise on account of acts or omissions that occurred prior to the Closing Date (together with the D&O Insurance Claims, the “Excluded Insurance Proceeds”);

(d)all rights to the warranties, express or implied, and licenses granted by any third party related to the Excluded Assets;

(e)all trade credits or refunds of costs or expenses borne by any Seller, in each case, attributable to the Transferred Assets and attributable to any period of time prior to the Closing Date;

(f)any shares or other interests in any Person or any securities of any Person;

(g)all invoices, shipping documents, purchase orders and other preprinted business forms that have any Trademark thereon other than those included in the Transferred Intellectual Property;

(h)all Intellectual Property owned by any Seller or any of their Affiliates, other than the Transferred Intellectual Property;

(i)all (i) organizational documents, qualifications to conduct business as a foreign corporation, arrangements with registered agents relating to foreign qualifications, taxpayer and other identification numbers, seals, minute books, stock transfer books, stock certificates, and other documents relating to any Seller’s organization, maintenance, existence, and operation; and (ii) books and records, correspondence or communications to the extent related to

(A) Taxes paid or payable by Sellers, (B) any claims, obligations or liabilities not included in Assumed Liabilities, or (C) this Agreement, any other Transaction Documents or the negotiation

or consummation of the Transactions (and including any attorney-client privilege associated with any of the items described in the preceding clauses (A), (B) or (C));

(j)all personnel records (including all human resources and other records) of any Seller or any of their Affiliates other than the personnel records of the Continuing Employees;

(k)(i) all Tax assets and attributes of any Seller, (ii) all rights to Tax Refunds of any Seller and Claims related thereto, (iii) all rights to any refund of or credits for any Taxes paid by or on behalf of any Seller or with respect to a Pre-Closing Tax Period, other than refunds of Asset Taxes allocable to Buyer pursuant to Section 5.4(b) or refunds related to any period prior to Closing, and (iv) all rights to Tax Refunds and Claims related thereto with respect to any Excluded Asset or Excluded Liability;

(l)all bank accounts and escrow accounts;

(m)all cash in Sellers’ adequate assurance account relating to utilities under Section 366 of the Bankruptcy Code;

(n)any and all proceeds relating to any and all bonds, letters of credit, guarantees or other security provided by any Seller related to the Excluded Contracts;

(o)all prepaid expenses related to the Excluded Contracts;

(p)capital stock of each Seller;

(q)all consideration received by any Seller or their Affiliates pursuant to, and all rights of any Seller and their Affiliates under, this Agreement or any Transaction Document, subject to the terms hereof and thereof;

(r)all Seller Contracts that are not Assumed Contracts (the “Excluded

(s)all Intracompany Receivables;

(t)all Tax Returns;

(u)all Actions owned by or available to any Seller (other than Actions arising

under or in connection with Assumed Contracts), whether in Law or equity and under any forum (including, purely by way of example and without limitation, United States federal courts, any provincial court or state court, any foreign court and any extrajudicial dispute resolution mechanism);

(v)subject to Section 1.7, all assets not transferrable pursuant to applicable Law or terms of this Agreement;

(w)any prepayments and good faith and other bid deposits submitted by any third party under the terms of the Bid and Contract Procedures Order;

(x)all Accounts Receivable; and

(y)all other assets, properties, or rights that are not specifically listed in Section

1.1 as a Transferred Asset.

Each Seller shall retain all of its respective right, title and interest in and to the Excluded Assets and Buyer shall not acquire and shall have no rights or Liabilities with respect to the right, title and interest of each Seller in and to the Excluded Assets.

1.1.Assumption of Liabilities. On the terms and subject to the conditions set forth herein, at the Closing, Buyer will assume, without duplication, and will otherwise in a timely manner pay, perform and discharge and be responsible for, in accordance with their respective terms, all of the following Liabilities (collectively, the “Assumed Liabilities”):

(a)all Liabilities with respect to the ownership, possession, use and operation of the Transferred Assets accruing on or after the Closing (except with respect to Assumed Contracts, which are governed by Section 1.3(c));

(b)all Liabilities for, or related to any obligation for, any Tax that Buyer bears under Section 5.4(b);

(c)all Liabilities under the Assumed Contracts, including all Cure Costs, whether arising before, at or after Closing;

(d)all Liabilities under any Permitted Encumbrance to the extent related to any Transferred Asset; and

(e)all Liabilities assumed by Buyer pursuant to Section 5.5.

1.2.Excluded Liabilities. Notwithstanding anything to the contrary set forth in this Agreement or in any of the other Transaction Documents, the Parties expressly acknowledge and agree that, except as set forth in Section 1.3, Buyer will not assume, be obligated to pay, perform or otherwise discharge or in any other manner be liable or responsible for, any Liabilities of any Seller, including those arising from or in connection with the Transferred Assets or the Business, or for any Action against any Seller or relating to the Transferred Assets or the Business, whether existing on the Closing or arising thereafter as a result of any act, omission, event, thing or circumstances taking place or not taking place prior to the Closing, including the following (all such Liabilities that Buyer is not assuming being referred to collectively, as the “Excluded Liabilities”):

(a)all Income Taxes of Sellers;

(b)all Liabilities relating to or arising out of the Excluded Assets;

(c)all Liabilities in respect of any pending or threatened Action arising out of, relating to or otherwise in respect of the Business or the Transferred Assets (other than any Action arising out of the Assumed Contracts, which are governed by Section 1.3(c)) to the extent such Action relates to the Business or the Transferred Assets for any period prior to the Closing;

(d)all product Liability or similar claims for injury to a Person or property which arises out of or is based upon any express or implied representation, warranty, agreement or guaranty made by any Seller or based on any tort claim, or by reason of the improper performance or malfunctioning of a product, improper design or manufacture, failure to adequately package, label or warn of hazards or other related product defects of any products at any time manufactured or sold or any service performed by Seller prior to the Closing Date, except to the extent arising under an Assumed Contract (which are governed by Section 1.3(c));

(e)all recall, design defect, improper installation, manufacturing defect or similar or related claims of any products manufactured or sold or any service performed by any Seller prior to the Closing Date, except to the extent arising under an Assumed Contract (which are governed by Section 1.3(c));

(f)all Liabilities arising under or in connection with any present or former employee benefit plan providing benefits to any present or former employee of any Seller or any Seller Affiliate, other than as set forth in Section 1.3(e), provided, that all such Liabilities with respect to the Continuing Employees shall only be Excluded Liabilities to the extent arising or related to any period prior to the Closing;

(g)except as provided in Section 5.5, all Liabilities with respect to any present or former employees, officers, directors, independent contractors or consultants of Seller, including for wages or other work-related benefits, bonuses, fees, accrued vacation, workers’ compensation, employee deferred compensation including stock option plans, equity grants, other grants and agreements, severance, retention, termination or other payments;

(h)all Accounts Payable;

(i)all Liabilities of the Business relating to or arising from unfulfilled commitments, quotations, purchase orders, customer orders or work orders that do not constitute part of the Transferred Assets or Assumed Liabilities, except to the extent arising under an Assumed Contract (which are governed by Section 1.3(c));

(j)all Liabilities to indemnify, reimburse, or advance amounts to any present or former officer, director, employee, agent or independent contractors of any Seller (including with respect to any breach of fiduciary obligations by the same) to the extent such Liabilities relate to conduct that was undertaken prior to Closing;

(k)all Liabilities under the Excluded Contracts, Intracompany Payables and/or resulting from the termination of obligations provided for in Section 1.9(b);

(l)all Liabilities associated with debt, loans, notes, bonds, guarantees, indemnifications or credit facilities of any Seller and/or the Business or the Transferred Assets; and

(m)all Liabilities arising out of, in respect of, or in connection with the failure by any Seller to comply with any Law, except to the extent arising under an Assumed Contract (which are governed by Section 1.3(c)).

1.3.Assumption and Assignment of Contracts.

(a)Sellers shall assign to Buyer, and Buyer shall assume, the Assumed Contracts at the Closing pursuant to the Sale Order, subject to the other provisions of this Section

1.5. Buyer shall pay all Cure Costs in respect of the Assumed Contracts, which shall not be the obligation, liability or responsibility of Sellers.

(b)The Sale Order shall provide for the assumption by the applicable Seller party thereto, and the assignment to the extent legally capable of being assigned by such Seller to Buyer, of each Assumed Contract.

(c)Notwithstanding the foregoing, a Seller Contract shall not be an Assumed Contract hereunder and shall not be assigned to, or assumed by, Buyer to the extent that such Seller Contract is (i) deemed rejected under Section 365 of the Bankruptcy Code or (ii) the subject of an objection to assignment or assumption or requires a Necessary Consent of any Governmental Entity or other third party (other than, and in addition to, that of the U.S. Bankruptcy Court) in order to permit the assumption and assignment by the applicable Seller to Buyer of such Seller Contract pursuant to Section 365 of the Bankruptcy Code, and such objection has not been resolved or such Necessary Consent has not been obtained prior to the 90th day following the Closing (as such 90-day period may be extended by mutual agreement of Buyer and Sellers) or (iii) is terminated by any party thereto other than Sellers, or terminates or expires by its terms, on or prior to such time as it is to be assumed by Buyer as an Assumed Contract hereunder and is not continued or otherwise extended upon assumption. For the avoidance of doubt, in no event shall the failure to assign to Buyer any Seller Contract due to the termination of such Seller Contract in accordance with subsection (ii) above, (x) reduce the Purchase Price payable to Sellers (if applicable) or

(y) constitute a failure to satisfy the conditions to the obligation of Buyer under Section 6.2.

1.4.Executory Contract Schedule.

(a)Schedule 1.6 (the “Executory Contract Schedule”) sets forth a list of all executory contracts and unexpired leases relating to the Business or the Transferred Assets to which one or more of Sellers are party (the “Available Contracts”), which Executory Contract Schedule may not be complete as of the date hereof (but, nonetheless, as of the date hereof shall include all Material Contracts) and which may be updated from time to time after the date hereof by Sellers to add any executory contracts or unexpired leases not included on such schedule as of the date hereof. Notwithstanding the foregoing, the Executory Contract Schedule shall be completed and delivered to Buyer on or before the date that is fourteen (14) Business Days prior to the bid deadline set forth in the Bid Procedures Order. Prior to the Closing Date, Buyer, in its sole discretion by written notice to Sellers, shall designate in writing which Available Contracts from the Executory Contract Schedule (as updated from time to time in accordance with this Section 1.6(a)) relating to the Business or the Transferred Assets that Buyer wishes to “assume” (the “Assumed Contracts”) and subject to the right of Buyer, and no later than three (3) days prior to the Closing Date, Buyer may, in its sole discretion, determine not to “assume” any Available Contracts previously designated as an Assumed Contract; provided that Buyer shall be liable for and reimburse Seller for any administrative expense claims under sections 503, 507, and 365 of the Bankruptcy Code that (a) are incurred as a result of, arise out of, or in connection with the Available Contracts removed from the Executory Contract Schedule following the date of entry of

the Sale Order and (b) solely arise out of or relate to the period (whether or not invoiced during such period) subsequent to the date of entry of the Sale Order to the date of rejection of such Available Contracts. All Contracts of Sellers that are listed on the Executory Contract Schedule as of the Closing Date and which Buyer does not designate in writing for assumption shall not be considered Assumed Contracts or Transferred Assets and shall automatically be deemed “Excluded Contracts” (and for the avoidance of doubt, Buyer shall not be responsible for any related Cure Costs related to any Excluded Contracts). Upon Buyer’s reasonable request, Sellers shall provide additional detailed information as to the Liabilities under the Contracts sufficient for Buyer to make an informed assessment regarding whether to accept an assignment and assumption of such Available Contract hereunder. Sellers shall cause notices to be delivered reasonably promptly to any counterparties to Contracts that are designated as Excluded Contracts from time to time pursuant to this Section 1.6(a).

(b)Sellers shall compile and file one or more customary “cure notices” listing all then scheduled Available Contracts and asserting the Cure Costs associated with each such Available Contract (each, a “Cure Notice”). The Cure Notices shall provide that any failure by a non-Seller counter-party to timely object to the Cure Costs set forth in the applicable Cure Notice shall make the Cure Costs set forth in the Cure Notice binding.

(c)Sellers shall use reasonable best efforts to establish and verify all Cure Amounts for the Contracts set forth on the Executory Contract Schedule prior to entry of the Sale Order, including, through the filing of Cure Notices. Subject to the other provisions of this Section 1.6, Buyer agrees to pay all Cure Costs required to assume the Assumed Contracts pursuant to this Section 1.6 at the Closing; provided that, prior to the Closing Date, Buyer shall have the option to (x) pay the Cure Costs required to assume all such Contracts or (y) designate any such Available Contracts to be an Excluded Contract; provided that Buyer shall be liable for and reimburse Seller for any administrative expense claims under sections 503, 507, and 365 of the Bankruptcy Code that (a) are incurred as a result of, arise out of, or in connection with the designation of such Available Contracts as an Excluded Contract and (b) solely arise out of or relate to the period (whether or not invoiced during such period) subsequent to the date of entry of the Sale Order to the date of rejection of such Available Contracts. At Closing, Buyer shall promptly pay all Cure Costs in connection with the assumption and assignment of the Assumed Contracts (as set forth in this Agreement, as agreed to by Buyer and the contract counterparty, or as determined by the Bankruptcy Court). Sellers shall cooperate with Buyer to facilitate the payment of the Cure Costs to the Executory Contract counterparties. Sellers shall take all actions reasonably required to assume and assign the Assumed Contracts to Buyer (other than payment of Cure Amounts, if so required), including taking all actions reasonably required to obtain an Order containing a finding that the proposed assumption and assignment of the Assumed Contracts to Buyer satisfies all applicable requirements of Section 365 of the Bankruptcy Code.

(d)Upon objection by the non-debtor Available Contract counterparty to the Cure Amount asserted by Sellers with regard to any Assumed Contract (such contract, a “Disputed Contract”), Sellers, with the consent of Buyer, shall either (a) settle the objection of such party or

(b) shall litigate such objection under procedures as the Bankruptcy Court shall approve and proscribe; provided that from and after the date of entry of the Confirmation Order, Buyer shall be liable for and reimburse Seller for all amounts, costs, or expenses incurred as a result of, arising out of, or in connection with litigation initiated by Sellers pursuant to this clause (b). In no event

shall any Seller settle a Cure Costs objection with regard to any Assumed Contract without the express written consent of Buyer. In the event that a dispute regarding the Cure Costs with respect to an Assumed Contract has not been resolved as of the Closing Date, the Parties shall nonetheless remain obligated to consummate the Acquisition. Upon an Order determining any Cure Costs regarding any Disputed Contract after the Closing, to the maximum extent permissible under sections 365(d)(2) and 365(d)(4) of the Bankruptcy Code, Buyer shall have the option to (x) pay the Cure Costs with respect to such Disputed Contract and assume the Disputed Contract as an “Assumed Contract” or (y) designate the Disputed Contract as an “Excluded Asset”, in which case, for the avoidance of doubt, Buyer shall not assume the Disputed Contract and shall not be responsible for the associated Cure Cost; provided that Buyer shall be liable for and reimburse Seller for any administrative expense claims under sections 503, 507, and 365 of the Bankruptcy Code that (a) are incurred as a result of, arise out of, or in connection with designation of such Disputed Contract as an “Excluded Asset” and (b) solely arise out of or relate to the period (whether or not invoiced during such period) subsequent to the date of entry of the Sale Order to the date of rejection of such Disputed Contracts.

(e)Buyer shall use commercially reasonable efforts to provide the Bankruptcy Court any evidence reasonably necessary to prove adequate assurance of future performance necessary to effect the assumption and assignment of the Assumed Contracts.

(f)Subject to Section 1.7, to the maximum extent permitted under applicable Law and the Bankruptcy Code, Sellers shall transfer and assign all Assumed Contracts to Buyer, and Buyer shall assume all Assumed Contracts from the Seller Parties, as of the Closing Date pursuant to the Sale Order and Section 365 of the Bankruptcy Code.

(g)At any time after the Closing, Sellers and Buyer may (but shall have no obligation to) mutually agree to seek authorization from the Bankruptcy Court, pursuant to section 365 of the Bankruptcy Code, to assume and assign an Available Contract that was not identified as an Assumed Contract as of Closing; provided that Buyer will be solely responsible to pay the Cure Amount required to assume such Available Contract.

1.5.Non-Assignment of Assets. Notwithstanding any other provision of this Agreement to the contrary, this Agreement will not constitute an agreement to assign or Transfer and will not effect the assignment or Transfer of any Transferred Asset (including any Assumed Contract) if (i) (A) prohibited by applicable Law, (B) an attempted assignment or transfer thereof would be reasonably likely to subject Buyer, its Affiliates or any of its or their respective Representatives to criminal Liability or (C) an attempted assignment or transfer thereof, without the approval, authorization, consent or waiver of, or granting or issuance of any license or permit by, any third party thereto (each such action, a “Necessary Consent”), would constitute a breach, default or violation thereof or of any Law or Order or in any way adversely affect the rights of Buyer thereunder or (ii) the Bankruptcy Court has not entered an Order approving such assignment or Transfer. In such event, or in the event that the assignment or Transfer of any Transferred Asset (including any Assumed Contract) is subject to a Necessary Consent being obtained, Sellers and Buyer will use their commercially reasonable efforts to obtain the Necessary Consents with respect to any such Transferred Asset (including any Assumed Contract) or any claim or right or any benefit arising thereunder for the assignment or transfer thereof to Buyer as Buyer may reasonably request; provided, however, that Sellers shall not be obligated for the payment of any consideration

therefor or required to initiate any litigation or legal proceedings to obtain any such approval, authorization, consent or waiver. If any Necessary Consent is not obtained, or if an attempted assignment or transfer would give rise to any of the circumstances described in clauses (i) or (ii) of the first sentence of this Section 1.7, be ineffective or adversely affect the rights of Buyer to such Transferred Asset following the Closing, (x) Sellers and Buyer will, and will cause their respective Affiliates to, (1) use commercially reasonable efforts (including cooperating with one another to obtain such Necessary Consents, to the extent feasible) as may be necessary so that Buyer would obtain the benefits and assume the obligations thereunder in accordance with this Agreement, (2) complete any such assignments or Transfers as soon as reasonably practicable and

(3) upon receipt of any applicable Necessary Consents, Transfer or assign the applicable Transferred Asset to Buyer, and (y) Sellers will, and will cause their respective Affiliates to, reasonably cooperate with Buyer in good faith without further consideration in any arrangement reasonably acceptable to Buyer and Sellers intended to provide Buyer with the benefit of any such Transferred Assets at Buyer’s sole cost and expense, in each case, for a period of 90 days following the Closing Date.

1.6.Wrong Pocket. Subject to Section 1.5 and Section 1.6, if at any time after the Closing (i) Buyer or its designee holds any Excluded Assets or Excluded Liabilities or (ii) any Seller holds any Transferred Assets or Assumed Liabilities, Buyer or the applicable Seller, as applicable, will reasonably promptly Transfer (or cause to be Transferred) such assets or assume (or cause to be assumed) such Liabilities to or from (as the case may be) the other Party, without further consideration from the other Party. Prior to any such Transfer, the Party receiving or possessing any such asset will hold it in trust for such other Party.

1.7.Intracompany Arrangements.

(a)Each of Buyer and Sellers agrees that any Intracompany Payables between any Seller, on the one hand, and any other Seller or Affiliate thereof, on the other hand, shall be fully settled or otherwise deemed cancelled effective as of immediately prior to the Closing.

(b)Each of Buyer and Sellers agrees that, any contract, commitment or arrangement between any Seller, on the one hand, and any other Seller or Affiliate thereof, on the other hand, shall be terminated and be of no further force or effect and all obligations thereunder shall be fully satisfied and extinguished, notwithstanding any terms thereof to the contrary, effective as of immediately prior to the Acquisition.

(c)No additional consideration shall be payable by, and no additional amounts shall be owed by, Buyer or any of its Affiliates to Sellers or any of their Affiliates in connection with the transactions effected pursuant to this Section 1.9.

1.8.Further Conveyances and Assurances. From time to time following the Closing, Sellers and Buyer will, and will cause their respective Affiliates to, execute, acknowledge and deliver all such further conveyances, notices, assumptions, assignments, releases and other instruments, and will take such further actions, as may be reasonably necessary or appropriate to assure to Buyer and its successors or assigns, all of the properties, rights, titles, interests, estates, remedies, powers and privileges intended to be conveyed to Buyer under this Agreement.

ARTICLE II CONSIDERATION; CLOSING

2.1.Consideration. At the Closing, Buyer will pay to Sellers, by credit bid of Buyer’s pre-petition debt, an amount equal to $113,179,726 (the “Purchase Price”).

2.2.Closing. The closing of the purchase and sale of the Acquisition (the “Closing”) shall take place remotely, via electronic exchange of documents, as soon as possible, but in no event later than three (3) Business Days following the date on which the last of the conditions set forth in Article VI (other than those conditions that by their nature are to be satisfied at the Closing but subject to the fulfillment or waiver of those conditions) has been satisfied or waived, or at such other date, time and place as the Parties may mutually agree. The actual date on which the Closing occurs, effective 10:00 a.m. prevailing Eastern time on such date, is called the “Closing Date.”

2.3.Deliveries by Buyer. At the Closing, Buyer shall deliver, or cause to be delivered, to Sellers, the following:

(a)evidence of a credit equal to the Purchase Price against the Debt secured by Buyer pursuant to Section 363(k) of the Bankruptcy Code;

(b)the certificates to be delivered pursuant to Section 6.3(c);

(c)a duly executed counterpart to each of the Transaction Documents other than this Agreement; and

(d)such other instruments of assumption and other instruments or documents, including bills of sale and/or assignment and assumption agreements, in form and substance reasonably acceptable to Sellers, as may be necessary to effect Buyer’s assumption of the Assumed Liabilities and the assignment of any Transferred Assets in accordance with the requirements of applicable Law and this Agreement, in each case duly executed by Buyer.

2.4.Deliveries by Sellers. At the Closing, Sellers shall deliver, or cause to be delivered, to Buyer, the following:

(a)the certificate to be delivered pursuant to Section 6.2(c);

(b)a duly executed counterpart to each of the Transaction Documents other than this Agreement;

(c)an IRS Form W-9 with respect to each Seller that is a United States person within the meaning of Section 7701 of the Code, duly completed and executed;

(d)the Books and Records; provided that the delivery obligations of Sellers hereunder shall be deemed satisfied if such Books and Records remain at the Transferred Owned Property or Transferred Leased Property;

(e)a copy of the Sale Order as entered by the Bankruptcy Court, vesting the Transferred Assets in Buyer free and clear of any Liens (other than Permitted Encumbrances);

(f)an instrument of conveyance (including a quit claim deed, real property transfers or similar documents as customary in the applicable jurisdiction and as may be necessary in accordance with the requirements of applicable Law) conveying to Buyer fee simple title to the Transferred Owned Property, subject to Permitted Encumbrances, including any additional documents, forms, or affidavits needed to record such instrument in the real property records; and

(g)such other instruments of assumption and other instruments or documents, including bills of sale and/or assignment and assumption agreements, in form and substance reasonably acceptable to Buyer, as may be necessary to effect Buyer’s assumption of the Assumed Liabilities and the assignment of any Transferred Assets to Buyer in accordance with the requirements of applicable Law and this Agreement, in each case duly executed by the applicable Seller.

2.5.Withholding. Buyer shall be entitled to deduct or withhold from consideration otherwise payable pursuant to this Agreement such amounts as it is required to deduct or withhold with respect to the making of such payment pursuant to this Agreement such amounts as are required to be deducted and withheld with respect to the making of such payment under applicable Law, provided, however that Buyer shall use commercially reasonable efforts to provide Sellers with at least ten Business Days’ notice of the applicability of any such deduction or withholding prior to making such deduction or withholding, and shall afford Sellers a reasonable opportunity to provide any applicable certificates, forms or documentation that would reduce or eliminate the requirement to deduct or withhold Tax under applicable Law. To the extent that amounts are so deducted and withheld, such deducted and withheld amounts shall be timely paid by Buyer to the applicable Tax Governmental Entity and shall be treated for all purposes of this Agreement as having been paid to Sellers. The Parties shall reasonably cooperate to determine whether any such deduction or withholding applies to the payment, and, if so, shall further cooperate to minimize applicable withholding Taxes and to obtain any available refund or credit of withheld amounts.

ARTICLE III REPRESENTATIONS AND WARRANTIES OF SELLERS

Except (a) as set forth in the corresponding numbered section or subsection of a Schedule of the Seller Disclosure Schedule or (b) to the extent relating to the Excluded Assets or the Excluded Liabilities, Sellers represent and warrant to Buyer:

3.1.Organization; Good Standing. Each Seller is duly formed validly existing and in good standing under the Laws of its jurisdiction of formation. Each Seller, subject to the necessary authority from the Bankruptcy Court, has all requisite corporate or similar power and authority to own, lease and operate its properties and assets and to carry on its business as presently conducted and is qualified to do business in each jurisdiction where the ownership, leasing or operation of its assets or properties or conduct of the Business requires such qualification, except where the failure to be so qualified or in good standing, or to have such power or authority, would not, in the aggregate, have a Material Adverse Effect.

3.2.Authority; Approval. Subject to the entry of the Sale Order and any other Order required by the Bankruptcy Court in connection with the transactions contemplated hereby:

(a)each Seller has all right, power and authority to enter into and perform its obligations under the Transaction Documents to which it is or will become a party;

(b)the execution, delivery and performance of each Seller’s obligations under the Transaction Documents to which it is or will become a party, and the performance of each Seller of its obligations under the Transaction Documents, have been duly and validity authorized by all requisite limited liability company action on the part of such Seller;

(c)No additional corporate, shareholder or similar authorization or consent is required in connection with the execution, delivery and performance by Sellers or their Affiliates of this Agreement or any of the other Transaction Documents to which they are or will become party; and

(d)this Agreement has been duly executed and delivered by each Seller and, assuming due authorization, execution and delivery by Buyer, subject to the required Bankruptcy Court approval, will constitute a valid and binding agreement of each Seller, enforceable against each Seller in accordance with its terms, subject to bankruptcy, insolvency, fraudulent conveyance, preferential transfer, reorganization, moratorium and similar Laws relating to or affecting creditors’ rights generally and subject, as to enforceability, to the effect of general principles of equity (the “Equitable Exception”).

3.3.Governmental Filings; No Violations.

(a) Other than the filings, notices, reports, consents, registrations, approvals, permits and authorizations set forth on Section 3.3(a) of the Seller Disclosure Schedule, and subject to the issuance of the Sale Order and any other Order required by the Bankruptcy Court in connection with the transactions contemplated hereby, no filing, notice, report, consent, registration, approval, permit or authorization is required to be given, filed or obtained by any Seller to or from any Governmental Entity in connection with the execution, delivery and performance by any Seller of this Agreement or the transactions contemplated hereby.

Other than the filings, notices, reports, consents, registrations, approvals, permits and authorizations set forth on Section 3.3(a) of the Seller Disclosure Schedule, and subject to the issuance of the Sale Order and any other Order required by the Bankruptcy Court in connection with the transactions contemplated hereby, no filing, notice, report, consent, registration, approval, permit or authorization is required to be given, filed or obtained by any Seller to or from any Governmental Entity in connection with the execution, delivery and performance by any Seller of this Agreement or the transactions contemplated hereby.

(b)Other than the filings, notices, reports, consents, registrations, approvals, permits and authorization set forth on Section 3.3(b) of the Seller Disclosure Schedule, and subject to the issuance of the Sale Order and any other Order required by the Bankruptcy Court in connection with the transactions contemplated hereby, the execution, delivery and performance by Sellers of this Agreement does not, and the consummation of the transactions contemplated hereby will not, conflict with, or result in any violation of or default (with or without notice, lapse of time or both) under, or give rise to a right of termination or acceleration of any obligation under, or result in the creation of any Lien upon any of the Transferred Assets (i) under any provision of the articles, by-laws or comparable governing documents of any Seller, (ii) any Law or Order to which any Seller, the Business and the Transferred Assets are subject, or (iii) any Material Contract.

3.4.No Undisclosed Material Liabilities. As of the date of this Agreement, there are no material Liabilities of the Business of any kind whatsoever other than the material Liabilities disclosed (i) in Sellers’ unaudited condensed consolidated balance sheet as of March 31, 2023, (ii) in the Seller Disclosure Schedule, or (iii) as set forth in Section 3.4 of the Seller Disclosure Schedule.

3.5.Litigation. Except as set forth in Section 3.5 of the Seller Disclosure Schedule and except for the general pendency of the Bankruptcy Case and Actions arising in connection therewith or in the Ordinary Course seeking damages for amounts less than $1,000,000 as of the date hereof, there are no Actions pending or, to the Knowledge of Sellers, threatened against any Seller that are attributable to any of the Transferred Assets or the ownership or operation thereof or the Business.

3.6.Transferred Owned Property. There are no pending, or, to the Knowledge of Sellers, threatened, appropriation, condemnation, eminent domain or like proceedings relating to any Transferred Owned Property.

3.7.Material Contracts.

(a)Other than this Agreement, the other Transaction Documents and the DIP Financing, Section 3.7(a) of the Seller Disclosure Schedule sets forth a true and correct list of the following Seller Contracts relating to the Transferred Assets (together, the “Material Contracts”):

(i)any joint venture agreements, partnership agreements, purchase and sale agreements or similar agreements that are material to the Business;

(ii)any Seller Contract which is reasonably expected by Sellers as of the date hereof to either (i) involve any future aggregate receipts of revenues by any Sellers or Sellers in excess of $100,000 in the aggregate per annum or (ii) involve any future aggregate payments or obligations by any Seller or Sellers in excess of $100,000 per annum in the aggregate;

(iii)any non-competition agreement or any agreement that purports to restrict, limit or prohibit the manner in which, or the locations in which, any Seller conducts the Business;

(iv)any Contract obligating Sellers or any of their Affiliates to provide or obtain any product or service exclusively to or from any Person, irrespective of any geographic, market or other restriction;

(v)any Contract granting to any Person a right of first refusal, first offer or similar preferential right to purchase or acquire any Transferred Asset;

(vi)any Contract that contains any “most favored nation” or minimum purchase or sale obligations;

(vii)any Contract containing a requirement to provide (including a requirement to provide if so requested by the counterparty) a performance bond, letter of credit or any other similar instrument;

(viii)any Seller Contract pursuant to which any Seller grants or receives any license with respect to Intellectual Property that is material to the Business, taken as a whole, that (i) is exclusive or (ii) requires aggregate payments to or from any of Sellers in excess of $200,000 per annum, in each case of clauses (i) and (ii),

other than (x) agreements granted on standardized terms for commercially available software or information technology services, or (y) outbound licenses granted in the Ordinary Course;

(ix)any Seller Contract with a Governmental Entity;

(x)any Transferred Lease; and

(xi)any Seller Contract pursuant to which any Seller currently leases personal property to or from any Person providing for lease payments in excess of

$50,000 per annum.

(b)Except as disclosed on Section 3.7(b) of the Seller Disclosure Schedule, no Seller is in breach or default under any Material Contract and no Seller has received a written notice of a breach or default of the terms of any Material Contract. The Material Contracts are in full force and effect in accordance with their terms, except as may be limited by the Equitable Exception, and to the Knowledge of Sellers, no event has occurred which constitutes, or which with notice or lapse of time or both would be reasonably be likely to constitute, a breach or default by any Seller (or to Sellers’ Knowledge, any other party thereto) of its obligations under any of the Material Contracts (for the avoidance of doubt, not including with respect to the Bankruptcy Case).

3.8.Compliance with Laws; Permits.

(a)The Business is being conducted in all material respects pursuant to the Laws applicable to the Business or the Transferred Assets, except as resulting from the filing and pendency of the Bankruptcy Case. Seller has received any written notice of (i) any material investigation or review by any Governmental Entity with respect to the Business or the Transferred Assets or (ii) any material noncompliance with any applicable Laws that has not been cured as of the date hereof. Each Seller has obtained and is in material compliance with all Permits and Orders issued or granted by a Governmental Entity necessary to conduct its Business as presently conducted.

(b)Each of Sellers is in compliance with the Foreign Corrupt Practices Act of 1977 (the “FCPA”), and any other U.S. or foreign Law concerning anti-corruption or anti-bribery applicable to the Business, and no Seller is, to Sellers’ Knowledge, being investigated by any Governmental Entity with respect to, or been given notice in writing by a Governmental Entity of, any violation by any of Sellers of the FCPA or any other U.S. or foreign Law concerning anti- corruption or anti-bribery applicable to the Business.

3.9.Brokers and Finders. Except as disclosed on Section 3.9 of the Seller Disclosure Schedule, there are no fees or expenses payable by any Seller to any investment banker, broker, finder or other intermediary that has been retained by or is authorized to act on behalf of Sellers in connection with the transactions contemplated hereby.

3.10.Employees. No Seller is a party to any collective bargaining agreement or other agreement with a labor union or like organization covering any of the Scheduled Employees. As

of the date hereof, there is no pending or, to the Knowledge of Sellers, threatened strike, lockout, slowdown or work stoppage involving the Scheduled Employees.

3.11.Employee Benefit Plans. No Seller maintains or contributes to any Seller Plan, including any plan that is subject to Section 412 of the Code or Section 302 or Title IV of ERISA or any “multiemployer plans” within the meaning of Section 3(37) of ERISA.

3.12.Title to Transferred Assets. Sellers, as applicable, have good and valid title to, or in the case of leased assets, have or will have on the Closing Date good and valid leasehold interests in, all Transferred Assets, free and clear of all Liens (other than Permitted Encumbrances) and, at the Closing, Buyer will be vested with good and valid title to, or in the case of leased assets, good and valid leasehold interest in, the Transferred Assets, free and clear of all Liens (other than Permitted Encumbrances) and Excluded Liabilities, to the fullest extent permissible under Law, including pursuant to Section 363(f) of the Bankruptcy Code.

3.13.Intellectual Property.

(a)Sellers own, as applicable, all Transferred Intellectual Property, free and clear of all Liens other than Permitted Encumbrances. To the Knowledge of Sellers, all Transferred Intellectual Property is valid, subsisting and enforceable, and is not subject to any outstanding Order, judgment, decree or agreement adversely affecting Sellers’ use thereof or rights thereto.

(b)To the Knowledge of Sellers’ (i) Sellers’ conduct of the Business as currently conducted does not infringe, misappropriate or otherwise violate the Intellectual Property of any other Person, (ii) no Seller has received any written notice alleging any such infringement, misappropriation of violation by any Seller of Intellectual Property owned by any other Person, and (iii) none of the Transferred Intellectual Property is being infringed upon, misappropriated or otherwise violated by any other Person.

(c)There is no Action pending before any Governmental Entity (other than the Bankruptcy Case) concerning the ownership, validity, registrability, enforceability, infringement, misappropriation or violation of any material Transferred Intellectual Property. None of the Transferred Intellectual Property is subject to any outstanding injunction, directive, Order, decree, award, settlement or judgment restricting the use or validity thereof.

(d)To the Knowledge of Sellers, there have been no security breaches of or unauthorized access to the technology and computer systems and infrastructure, owned by Sellers and used in connection with the Business, in each case, except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

3.14.Environmental Matters. Except for matters that relate to an Excluded Liability or as disclosed on Section 3.14 of the Seller Disclosure Schedule:

(a)the Business and the Transferred Assets are in compliance in all material respects with all applicable Environmental Laws;

(b)there are no written notices, writs, injunctions, decrees, Orders or judgments outstanding, or any actions, suits, proceedings or investigations pending or threatened, relating to

compliance with or material Liability under any Environmental Law affecting the Business, the Transferred Owned Property or the Transferred Leased Property; and

(c)there has been no waste generated or released by Seller or any of its Affiliates or any legally responsible predecessor corporation of Seller, that has given or could reasonably be expected to give rise to any Liability under any Environmental Law for which the Business would incur material Liability.

3.15.Taxes. Other than as set forth in Section 3.15 of the Seller Disclosure Schedule:

(a)(i) Sellers have filed all material Tax Returns with respect to the Transferred Assets required under applicable Law to be filed by Sellers with the appropriate Governmental Entities in all jurisdictions in which such Tax Returns are required to be filed prior to the Closing Date (taking into account any extension of time to file); and (ii) all material Taxes shown as due from Sellers on such Tax Returns with respect to such assets have been paid or arrangements for the payment thereof have been made, except to the extent nonpayment of which is permitted or required by the Bankruptcy Code.

(b)(i) Each Seller has filed all material Tax Returns required under applicable Law to be filed by such Seller with the appropriate Governmental Entities in all jurisdictions in which such Tax Returns are required to be filed prior to the Closing Date (taking into account any extension of time to file); and (ii) all material amounts of Taxes shown as due on such Tax Returns have been paid or arrangements for the payment thereof have been made, except to the extent nonpayment of which is permitted or required by the Bankruptcy Code, and only to the extent that failure to file such Tax Return or to pay such Taxes would give rise to a Lien (other than a Permitted Encumbrance) on the Transferred Assets.

(c)No audit or other proceeding with respect to any material amounts of Taxes or material Tax Returns with respect to the Transferred Assets is currently in progress, or, to the Knowledge of Sellers, has been proposed or threatened.

(d)No Seller has received written notice of any outstanding, proposed or assessed Tax deficiency that has not been paid or accrued for and in accordance with applicable Law, nor has any Seller executed any waiver of any statute of limitations in respect of Taxes nor agreed to any extension of time with respect to a Tax assessment, collection or deficiency, which notice, waiver, or extension of time could give rise to a Lien (other than a Permitted Encumbrance) on the Transferred Assets.

(e)There are no liens for Taxes other than Permitted Encumbrances upon any of the Transferred Assets.

(f)There are not any outstanding ruling requests, and no rulings have been received, by any Seller relating to Taxes which ruling requests or rulings relate to Taxes which could be a Lien (other than a Permitted Encumbrance) on the Transferred Assets.

(g)Each Seller has complied with all applicable Laws relating to the payment and withholding of Taxes (including withholding and reporting requirements under Code Sections 1441 through 1464, 3401 through 3406, 6041 and 6049 and similar provisions under any other

applicable Law) in all material respects and have, within the time and in the manner prescribed by Law, withheld from employee wages, if any, and paid over to the proper Governmental Entity all material required amounts.

(h)Each Seller has collected all material amounts of sales and use Taxes required to be collected, and has remitted, or will remit on a timely basis, such amounts to the appropriate Governmental Entity, or has been furnished properly completed exemption certificates (and has maintained all such records and supporting documents in the manner required by all applicable sales and use Tax statutes and regulations).

(i)No Seller has (i) deferred payment of payroll Taxes or (ii) taken, claimed or applied for an employee retention tax credit, in each case, pursuant to the CARES Act.

(j)No Seller has executed any power of attorney with respect to any Tax or Tax Return, other than powers of attorney that are no longer in force.

3.16.Insurance. Section 3.16 of the Seller Disclosure Schedule sets forth a true and complete list of all insurance policies (the “Existing Insurance Policies”) maintained by Sellers applicable to the Transferred Assets, together with the insurer, the amount of the coverage, the type of insurance, the policy number and any pending claims thereunder. Except as set forth on Section 3.16 of the Seller Disclosure Schedule, Sellers are up-to-date in the payment of all premiums and other amounts payable under the Existing Insurance Policies to maintain the Existing Insurance Policies in full force and effect, and Sellers shall continue to make all such payments until the Closing. As of the date hereof, all such policies are in full force and effect and are sufficient for compliance by Sellers with all applicable Laws.

3.17.Real Property. On the Closing Date, Sellers shall convey to Buyer pursuant to Section 363 of the Bankruptcy Code good and marketable fee simple title and the deed to the Transferred Owned Property, free and clear of all Liens other than Permitted Encumbrances. Except as set forth on Section 3.17 of the Seller Disclosure Schedule, Sellers have not leased or otherwise granted to any Person the right to use or occupy the Transferred Owned Property or any portion thereof, and there are no Persons in possession or Person having the right to occupy or use any of the Transferred Owned Property. Sellers have no leases of any real property other than as set forth on Section 3.17 of the Seller Disclosure Schedule. Except as set forth on Section 3.17 of the Seller Disclosure Schedule, Sellers have not granted any options to purchase or lease or rights of first refusal to purchase or lease any of the Transferred Owned Property. The civic addresses of the parcels comprising the Transferred Owned Property are set out in Schedule 1.1(c).

3.18.Status of Transferred Assets. Except as set forth on Section 3.18 of the Seller Disclosure Schedule, the Fixtures and Equipment and other tangible personal property are in good operating condition and repair and have been reasonably maintained consistent with standards generally followed in the industry (giving due account to the age and length of use of same, ordinary wear and tear excepted), are adequate and suitable for their present and intended uses and, in the case of plants, buildings and other structures (including the roofs thereof), are structurally sound. To the Knowledge of Sellers, since the commencement of the Bankruptcy Case, no Fixtures and Equipment or other tangible personal property has been removed or transferred from the Business or otherwise sold, leased, assigned or transferred, other than replacements or repairs of

Fixtures and Equipment in the Ordinary Course. The Transferred Assets constitute all of the assets of every nature and kind whatsoever necessary for Buyer to conduct and operate the Business immediately after the Closing in the manner previously conducted by Sellers.

3.19.Full Disclosure. There has been no event, transaction or information regarding the Business or the Transferred Assets that has come to Sellers’ Knowledge that has not been disclosed to Buyer in writing that could reasonably be expected to have a Material Adverse Effect.

3.20.No Other Representations or Warranties.

(a)Except for the representations and warranties contained in this Article III, no Seller nor any other Person on Sellers’ behalf makes any other express or implied representation or warranty with respect to Sellers, the Business, the Transferred Assets, the Assumed Liabilities or the transactions contemplated hereby, and each Seller expressly disclaims any other representations or warranties, whether made by Sellers, any Affiliate of Sellers or any of Sellers’ or their Affiliates’ respective Representatives.

(b)Each Seller acknowledges and agrees that, except for the representations and warranties expressly set forth in Article IV, neither Buyer nor any other Person has made any express or implied representation or warranty with respect to the transactions contemplated hereby or with respect to the accuracy or completeness of any other information provided, or made available, to Sellers in connection with the transactions contemplated hereby and none of Sellers have relied on any representation or warranty other than those expressly set forth in Article IV.

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer hereby represents and warrants to Sellers:

4.1.Organization; Good Standing. Buyer is a limited liability company duly organized, validly existing and in good standing under the Laws of the State of Delaware. Buyer has all requisite corporate or similar power and authority to own, lease and operate its properties and assets and to carry on its business as presently conducted and is qualified to do business and, to the extent such concept applies, is in good standing as a foreign legal entity in each jurisdiction where the ownership, leasing or operation of its assets or properties or conduct of its business requires such qualification, in each case, except where the failure to be so qualified or in good standing or to have such power or authority, would not, individually or in the aggregate, reasonably be likely to prevent, materially delay or materially impair the consummation of the transactions contemplated by this Agreement.

4.2.Authority; Approval.

(a)Buyer has all right, power and authority to enter into and perform its obligations under the Transaction Documents to which it is or will become a party.

(b)The execution, delivery and performance of Buyer’s obligations under the Transaction Documents to which it is or will become a party, and the performance of Buyer of its

obligations under the Transaction Documents, have been dully and validly authorized by all requisite limited liability company action on the part of Buyer.

(c)No additional corporate or shareholder authorization or consent is required in connection with the execution, delivery and performance by Buyer of this Agreement or any of the other Transaction Documents to which it is or will become party.

(d)This Agreement has been duly executed and delivered by Buyer and, when executed and delivered by Sellers, will constitute a valid and binding agreement of Buyer enforceable against Buyer in accordance with its terms, subject to the Equitable Exception.

4.3.Governmental Filings; No Violations.

(a)Subject to the issuance of the Sale Order and any other Order required by the Bankruptcy Court in connection with the transactions contemplated hereby, no filing, notice, report, consent, registration, approval, permit or authorization is required to be given, filed or obtained by Buyer to or from any Governmental Entity in connection with the execution, delivery and performance by Buyer of this Agreement or the transactions contemplated hereby.

(b)The execution, delivery and performance by Buyer of this Agreement does not, and the consummation of the transactions contemplated hereby will not, conflict with, or result in any violation of or default (with or without notice, lapse of time or both) under, or give rise to a right of termination, loss of rights, adverse modification of provisions, cancellation or acceleration of any obligation under (i) any provision of the articles, by-laws or comparable governing documents of Buyer, (ii) subject to the Sale Order, any Law or Order to which Buyer is subject or (iii) subject to the Sale Order, any Contracts to which Buyer is a party, except, in the case of clauses (i) and (ii) above, for any such breach, violation, termination, default, creation or acceleration that would not, individually or in the aggregate, reasonably be expected to prevent, materially delay or materially impair the consummation of the transactions contemplated by this Agreement.

4.4.Litigation. There are no Actions pending, or, to the Knowledge of Buyer, threatened against Buyer, and Buyer is not subject to any Order, in each case, that would, individually or in the aggregate, reasonably be expected to prevent, materially delay or materially impair the consummation of the transactions contemplated by this Agreement.

4.5.Available Funds. Buyer has sufficient funds available to it in cash to pay or cause to be paid the Purchase Price, all Cure Costs and the other fees and expenses required to be paid by Buyer in connection with the transactions contemplated hereby, and to effect the transactions contemplated hereby. Upon the consummation of the transactions contemplated hereby, (a) Buyer will not be insolvent as defined in Section 101 of the Bankruptcy Code, (b) Buyer will not be left with unreasonably small capital, and (c) Buyer will not have incurred debts beyond its ability to pay such debts as they mature. There are no bankruptcy, reorganization or arrangement proceedings pending against, being contemplated by, or to the Knowledge of Buyer, threatened against Buyer.

4.6.Brokers and Finders. Except for fees and expenses payable by Buyer, there are no fees or expenses payable to any investment banker, broker, finder or other intermediary that has

been retained by or is authorized to act on behalf of Buyer in connection with the transactions contemplated hereby.

4.7.Adequate Assurances Regarding Executory Contracts. Buyer is and will be capable of satisfying the conditions contained in Section 365 of the Bankruptcy Code with respect to the Transferred Assets, Transferred Owned Property, Transferred Leased Property, and Transferred Intellectual Property.

4.8.No Other Representations or Warranties.

(a)Except for the representations and warranties contained in this Article IV, neither Buyer nor any other Person makes any other express or implied representation or warranty with respect to the transactions contemplated hereby, and Buyer disclaims any other representations or warranties, whether made by Buyer, any Affiliate of Buyer or any of Buyer’s or its Affiliate s’ respective Representatives.

(b)Buyer acknowledges and agrees that, except for the representations and warranties expressly set forth in Article III, no Seller nor any other Person has made any express or implied representation or warranty with respect to the transactions contemplated hereby, the Business, either Seller, the Transferred Assets, the Excluded Assets, the Assumed Liabilities, the Excluded Liabilities, the accuracy or completeness of any other information provided, or made available, to Buyer in connection with the transactions contemplated hereby and Buyer has not relied on any representation or warranty other than those expressly set forth in Article III.

(c)Buyer acknowledges and agrees that the enforceability of this Agreement against Sellers is subject to entry of the Sale Order.

ARTICLE V COVENANTS

5.1.Access.

(a)From the date hereof through the Closing Date, subject to Section 5.1(b), Buyer will be entitled, through its Representatives, to have reasonable access to the Scheduled Employees, the Transferred Assets, the Business and the Assumed Liabilities. Any such access will be conducted upon reasonable advance notice and under reasonable circumstances and will be subject to restrictions under applicable Law. Subject to Section 5.2, Sellers will direct and use their commercially reasonable efforts to cause their Representatives to cooperate with Buyer and Buyer’s Representatives in connection with such access, and Buyer and its Representatives will cooperate with Sellers and their Representatives; provided that: (i) any such access shall be conducted at Buyer’s expense, in accordance with applicable Law (including applicable privacy and competition laws), under the supervision of Sellers’ personnel and in such a manner as to maintain confidentiality and not to interfere with the normal operations of the Business of Sellers and their Affiliates and (ii) the foregoing shall not require Sellers to disclose information or materials (A) protected by attorney-client, attorney work product or other legally recognized privileges or immunity from disclosure or the disclosure of which would result in the disclosure of any trade secrets of third parties or violate any applicable Laws related to the exchange of

information or any obligation of any Seller with respect to confidentiality; or (B) relating to other bids or potential bids for any of the Transferred Assets.

(b)All information received pursuant to this Section 5.1 shall be governed by the terms of Section 5.6.

5.2.Competing Transactions. Each Party acknowledges that this Agreement and the sale of the Transferred Assets and assumption and assignment of the Assumed Contracts are subject to approval by the Bankruptcy Court and the consideration and acceptance by Sellers of higher or better competing bids in respect of all or any part of the Transferred Assets or the Assumed Contracts, as determined in accordance with the provisions of the Bid Procedures Order.

5.3.Cooperation; Status Updates; Regulatory Filings.