Aprea Therapeutics Reports Third Quarter 2022 Financial Results and Provides Update on Business Operations

10 November 2022 - 8:15AM

Aprea Therapeutics, Inc. (Nasdaq: APRE), a biopharmaceutical

company focused on developing and commercializing novel synthetic

lethality-based cancer therapeutics targeting DNA damage response

(DDR) pathways today reported financial results for the three and

nine months ended September 30, 2022 and provided a business

update.

“We are excited about the advancement of ATRN-119, the first

macrocyclic ATR inhibitor, into clinical development,” said Oren

Gilad, Ph.D., President and Chief Executive Officer of Aprea. “We

look forward to collecting clinical data from our Phase 1

trial.”

Third Quarter Financial Results

- Cash and

cash equivalents: As of September 30, 2022, the

Company had $33.1 million of cash and cash equivalents

compared to $53.1 million of cash and cash equivalents as

of December 31, 2021. The Company believes its cash and

cash equivalents as of September 30, 2022 will be sufficient

to meet its current projected operating requirements through the

end of 2023.

- Research and

Development (R&D) expenses: R&D

expenses were $1.1 million for the quarter

ended September 30, 2022, compared to $6.0

million for the comparable period in 2021. R&D expenses

for the quarter ended September 30, 2022 primarily represented

close out costs for (i) the Company’s pivotal Phase 3 clinical

trial of eprenetapopt with azacitidine for the frontline treatment

of TP53 mutant MDS, (ii) the Company’s Phase 2 post-transplant

MDS/AML clinical trial, (iii) the Company’s Phase 1 AML trial, and

(iv) the Company’s Phase 1/2 solid tumor trial and the Company’s

Phase 1 dose-escalation trial of APR-548 as well as decreased

non-cash stock-based compensation expense resulting from the

acceleration of vesting of all outstanding stock options and

restricted stock units in connection with the acquisition of Atrin

in May 2022.

- General and

Administrative (G&A) expenses: G&A

expenses were $3.1 million for the quarter

ended September 30, 2022, compared to $3.4

million for the comparable period in 2021. The decrease

in G&A expenses was primarily due to decreased non-cash

stock-based compensation expense resulting from the acceleration of

vesting of all outstanding stock options and restricted stock units

in connection with the acquisition of Atrin in May 2022, offset in

part by increased professional fees.

- Net

loss: Net loss was $4.0 million, or $0.12

per share for the quarter ended September 30, 2022, compared

to a net loss of $9.5 million, or $0.45 per share for the

quarter ended September 30, 2021. The Company had 52,237,885

shares of common stock outstanding as of September 30, 2022. The

increased common stock outstanding resulted primarily from the

conversion of 2,821,033 shares of Series A preferred stock into

28,210,330 shares of common stock during the third quarter of

2022.

Business Operations Update:

DDR Programs

ATRN-119 – ATRN-119 is an orally-bioavailable, highly potent and

selective macrocyclic small molecule inhibitor of ATR, a protein

with key roles in response to DNA damage. The Company is conducting

a Phase 1 clinical trial to evaluate ATRN-119 monotherapy in cancer

patients with defined genetic mutations. This trial was activated

and opened for enrollment in the third quarter of 2022 and the

Company expects to open 1-2 additional sites in the fourth quarter

of 2022.

ATRN-W1051 – ATRN-W1051 is an orally-bioavailable, highly potent

and selective small molecule inhibitor of WEE1, a key regulator of

multiple phases of the cell cycle. ATRN-W1051 is currently in

preclinical development and the Company anticipates commencing

IND-enabling studies in the fourth quarter of 2022.

p53 Reactivator Programs

Eprenetapopt - APR-246, or eprenetapopt, is a small molecule p53

reactivator that has been tested in clinical trials for solid

tumors and for hematologic malignancies. We currently have no

ongoing clinical trials of eprenetapopt.

APR-548 - APR-548 is a second generation p53 reactivator that is

being developed in an oral dosage form. We initiated a Phase 1

clinical trial testing APR-548 in relapsed/refractory MDS and AML

and enrollment in the first dosing cohort was completed. There are

currently no patients receiving APR-548 in this trial and

enrollment into the trial has been closed.

About Aprea Therapeutics, Inc.

Aprea Therapeutics, Inc. is a biopharmaceutical company

headquartered in Boston, Massachusetts with research facilities in

Doylestown, Pennsylvania, focused on developing and commercializing

novel cancer therapeutics that target DNA damage response pathways.

The Company’s lead program is ATRN-119, an orally-bioavailable,

highly potent and selective macrocyclic small molecule inhibitor of

ATR, that is being tested in a Phase 1 clinical trial in solid

tumor indications. ATRN-W1051, the Company’s novel WEE1 inhibitor,

is in preclinical development. For more information, please visit

the company website at www.aprea.com.

The Company may use, and intends to use, its investor relations

website at https://ir.aprea.com/ as a means of disclosing material

nonpublic information and for complying with its disclosure

obligations under Regulation FD.

Forward Looking Statement

Certain information contained in this press release includes

“forward-looking statements”, within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, related to our study

analyses, clinical trials, regulatory submissions, and projected

cash position. We may, in some cases use terms such as “future,”

“predicts,” “believes,” “potential,” “continue,” “anticipates,”

“estimates,” “expects,” “plans,” “intends,” “targeting,”

“confidence,” “may,” “could,” “might,” “likely,” “will,” “should”

or other words that convey uncertainty of the future events or

outcomes to identify these forward-looking statements. Our

forward-looking statements are based on current beliefs and

expectations of our management team that involve risks, potential

changes in circumstances, assumptions, and uncertainties. Any or

all of the forward-looking statements may turn out to be wrong or

be affected by inaccurate assumptions we might make or by known or

unknown risks and uncertainties. These forward-looking statements

are subject to risks and uncertainties including risks related to

the success and timing of our clinical trials or other studies,

risks associated with the coronavirus pandemic and the other risks

set forth in our filings with the U.S. Securities and Exchange

Commission. For all these reasons, actual results and developments

could be materially different from those expressed in or implied by

our forward-looking statements. You are cautioned not to place

undue reliance on these forward-looking statements, which are made

only as of the date of this press release. We undertake no

obligation to publicly update such forward-looking statements to

reflect subsequent events or circumstances.

Source: Aprea Therapeutics, Inc.

Corporate Contacts:

Scott M. CoianteSr. Vice President and Chief Financial

Officer617-463-9385

Gregory A. KorbelSr. Vice President and Chief Operating

Officer617-463-9385

Aprea Therapeutics,

Inc.Condensed Consolidated Balance

Sheets(Unaudited)

|

|

September 30, 2022 |

|

December 31, 2021 |

|

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash

equivalents |

$ |

33,112,601 |

|

|

$ |

53,076,052 |

|

|

Prepaid expenses and other current

assets |

|

361,178 |

|

|

|

3,508,358 |

|

|

Total current

assets |

|

33,473,779 |

|

|

|

56,584,410 |

|

|

Property and equipment,

net |

|

12,237 |

|

|

|

23,870 |

|

|

Right of use lease and other noncurrent

assets |

|

135,888 |

|

|

|

215,183 |

|

|

Total

assets |

$ |

33,621,904 |

|

|

$ |

56,823,463 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

Current liabilities: |

|

|

|

Accounts

payable |

$ |

1,136,064 |

|

|

$ |

1,773,032 |

|

|

Accrued

expenses |

|

2,751,524 |

|

|

|

5,352,996 |

|

|

Lease

liability—current |

|

110,551 |

|

|

|

190,471 |

|

|

Total current

liabilities |

|

3,998,139 |

|

|

|

7,316,499 |

|

|

Lease

liability—noncurrent |

|

-- |

|

|

|

-- |

|

|

Total

liabilities |

|

3,998,139 |

|

|

|

7,316,499 |

|

|

Commitments and contingencies |

|

|

|

Preferred stock, par value $0.001; 128,597 and 0 shares issued and

outstanding at September 30, 2022 and December 31, 2021,

respectively |

|

2,998,537 |

|

|

|

-- |

|

|

Stockholders’ equity: |

|

|

|

Common stock, par value $0.001; 52,237,885 and 21,859,413 shares

issued and outstanding at September 30, 2022 and December 31, 2021,

respectively. |

|

52,237 |

|

|

|

21,859 |

|

|

Additional paid-in

capital |

|

328,167,899 |

|

|

|

240,978,439 |

|

|

Accumulated other comprehensive

loss |

|

(10,240,645 |

) |

|

|

(10,358,956 |

) |

|

Accumulated

deficit |

|

(291,354,263 |

) |

|

|

(181,134,378 |

) |

|

Total stockholders’

equity |

|

26,625,228 |

|

|

|

49,506,964 |

|

|

Total liabilities and stockholders’

equity |

$ |

33,621,904 |

|

|

$ |

56,823,463 |

|

|

|

|

|

|

|

|

|

|

Aprea Therapeutics,

Inc.Condensed Consolidated Statements of

Operations and Comprehensive

Loss(Unaudited)

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

1,117,576 |

|

|

$ |

6,015,616 |

|

|

$ |

15,870,867 |

|

|

$ |

19,433,721 |

|

|

General and administrative |

|

|

3,082,618 |

|

|

|

3,414,795 |

|

|

|

18,849,549 |

|

|

|

10,183,953 |

|

|

Acquired in-process research and development |

|

|

-- |

|

|

|

-- |

|

|

|

76,020,184 |

|

|

|

-- |

|

| Total operating expenses |

|

|

4,200,194 |

|

|

|

9,430,411 |

|

|

|

110,740,600 |

|

|

|

29,617,674 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense) |

|

|

151,123 |

|

|

|

(33 |

) |

|

|

205,585 |

|

|

|

(1,678 |

) |

|

Foreign currency (loss) gain |

|

|

24,353 |

|

|

|

(21,907 |

) |

|

|

315,130 |

|

|

|

247,233 |

|

| Total other income (expense) |

|

|

175,476 |

|

|

|

(21,940 |

) |

|

|

520,715 |

|

|

|

245,555 |

|

| Net loss |

|

$ |

(4,024,718 |

) |

|

$ |

(9,452,351 |

) |

|

$ |

(110,219,885 |

) |

|

$ |

(29,372,119 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

|

26,161 |

|

|

|

(207,608 |

) |

|

|

118,311 |

|

|

|

(417,438 |

) |

| Total comprehensive loss |

|

|

(3,998,557 |

) |

|

|

(9,659,959 |

) |

|

|

(110,101,574 |

) |

|

|

(29,789,557 |

) |

| Net loss per share attributable

to common stockholders, basic and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.45 |

) |

|

$ |

(4.17 |

) |

|

$ |

(1.39 |

) |

| Weighted-average common shares

outstanding, basic and diluted |

|

|

34,655,750 |

|

|

|

21,231,584 |

|

|

|

26,453,091 |

|

|

|

21,201,910 |

|

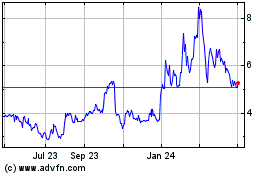

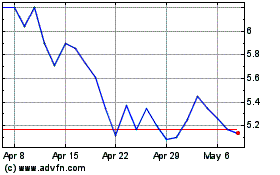

Aprea Therapeutics (NASDAQ:APRE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Aprea Therapeutics (NASDAQ:APRE)

Historical Stock Chart

From Jul 2023 to Jul 2024