UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of May 2024

Commission File Number: 001-38097

ARGENX SE

(Translation of registrant’s name into English)

Laarderhoogtweg 25

1101 EB Amsterdam, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXPLANATORY NOTE

On May 9, 2024, argenx SE (the

“Company”) issued a press release a copy of which is attached hereto as

Exhibit 99.1 and is incorporated by reference herein.

The information contained in this Current

Report on Form 6-K, including Exhibit 99.1, shall be deemed to be incorporated by reference into the Company’s

Registration Statements on Forms F-3 (File

No. 333-258251) and S-8 (File Nos. 333-225375, 333-258253,

and 333-274721),

and to be part thereof from the date on which this Current Report on Form 6-K is filed, to the extent not superseded by

documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ARGENX SE |

| |

|

|

| Date: May 9, 2024 |

By: |

/s/ Hemamalini (Malini) Moorthy |

| |

|

Name: Hemamalini (Malini) Moorthy

Title: General Counsel |

Exhibit 99.1

argenx Reports First Quarter 2024 Financial Results and

Provides Business Update

$398 million in first quarter global net product sales

FDA review ongoing for CIDP sBLA with PDUFA target action

date of June 21, 2024

On track to submit filing for pre-filled syringe (PFS)

in second quarter 2024

Management to host conference call today at 2:30 PM CET

(8:30 AM ET)

May 9, 2024, 7:00 AM CET

Amsterdam, the

Netherlands – argenx SE (Euronext & Nasdaq: ARGX), a global immunology company committed to improving the lives

of people suffering from severe autoimmune diseases, today announced its first quarter 2024 results and provided a business update.

“The team at argenx has made significant

progress executing across the ambitious plan we set out at the beginning of the year,” said Tim Van Hauwermeiren, Chief Executive

Officer of argenx. “We are driven by our commitment to provide patients with the broadest gMG product offering that consistently

delivers on safety and efficacy. VYVGART SC played a key role in our growth over the quarter, expanding the breadth of our prescriber

base and reaching new patients. The relationships we have built and key market learnings in gMG position us for success as we scale the

organization and prepare for CIDP. After generating the data required for filing, we are also excited to advance the development of our

pre-filled syringe, which should further enhance the patient experience.”

“The clinical opportunity ahead is expansive

– we are preparing for registrational trials across multiple programs including empasiprubart in MMN and efgartigimod in Sjogren's

disease, in addition to those already underway in TED and seronegative gMG. We look forward to deepening our understanding of FcRn with

additional Phase 2 data points expected this year, while rapidly working to deliver on our promise of innovation by bringing the next

wave of molecules to the clinic.”

FIRST QUARTER 2024 AND RECENT BUSINESS UPDATE

Reaching More Patients with VYVGART

VYVGART (efgartigimod alfa-fcab) is a first-in-class

antibody fragment targeting the neonatal Fc receptor (FcRn), and is now the first FcRn antagonist approved in two indications. VYVGART

is approved in more than 30 countries globally for the treatment of generalized myasthenia gravis (gMG) and is approved in Japan for the

treatment of primary immune thrombocytopenia (ITP). VYVGART subcutaneous (SC) (efgartigimod alfa and hyaluronidase-qvfc) is approved in

the U.S. (as VYVGART® Hytrulo), Japan (as VYVDURA®) and Europe, making VYVGART the only gMG treatment available as both an IV

and simple SC injection.

| · | Generated global net product sales (inclusive of both VYVGART and VYVGART SC) of $398 million in the first

quarter of 2024 |

| · | VYVGART approved in Japan for treatment of ITP on March 26, 2024, marking first global approval for

ITP |

| · | Additional VYVGART and VYVGART SC regulatory decisions on approval expected for gMG in 2024, including

VYVGART in Switzerland, Australia, Saudi Arabia and South Korea, and VYVGART SC in China through Zai Lab |

| · | Multiple VYVGART SC regulatory submissions under review or planned for chronic inflammatory demyelinating

polyneuropathy (CIDP), including: |

| o | FDA review of Supplemental Biologics License Application (sBLA) ongoing with

Prescription Drug User Fee Act (PDUFA) target action date of June 21, 2024 |

| o | Regulatory submissions completed in China and Japan |

| o | Regulatory submissions expected in Europe and Canada by end of 2024 |

| · | Registrational study of VYVGART in seronegative gMG patients ongoing with aim to expand label into broader

MG populations |

| · | FDA submission for VYVGART SC prefilled syringe for gMG and CIDP expected in second quarter of 2024, following

positive data outcomes from bioequivalence and human factor studies |

Advancing Current Pipeline

argenx continues to demonstrate breadth and depth

within its immunology pipeline and is advancing multiple pipeline-in-a-product candidates. argenx is solidifying its leadership in FcRn

biology and expects that efgartigimod will be approved or under evaluation in at least 15 indications by 2025. argenx is also advancing

its earlier stage pipeline programs, including empasiprubart (C2 inhibitor) with Phase 2 studies ongoing in multifocal motor neuropathy

(MMN), delayed graft function (DGF) and dermatomyositis (DM). In addition, argenx is evaluating ARGX-119, a muscle-specific kinase (MuSK)

agonist in both congenital myasthenic syndrome (CMS) and amyotrophic lateral sclerosis (ALS).

| · | Decision announced to advance development of efgartigimod in primary Sjogren’s disease (SjD) to

Phase 3 following analysis of topline data from Phase 2 RHO study |

| · | Topline data from Phase 2 ALPHA study of efgartigimod in post-COVID-19 postural orthostatic tachycardia

syndrome (PC-POTS) expected in second quarter of 2024 |

| · | Topline data from seamless Phase 2/3 ALKIVIA study evaluating efgartigimod across three myositis subsets

(immune-mediated necrotizing myopathy (IMNM)), anti-synthetase syndrome (ASyS), and DM expected in second half of 2024 |

| · | Update on BALLAD study development plan evaluating efgartigimod in bullous pemphigoid (BP) expected by

end of 2024 |

| · | Registrational studies ongoing of efgartigimod in thyroid eye disease (TED) |

| · | Decision made to discontinue planned development of efgartigimod in ANCA-associated vasculitis (AAV) following

risk assessment of all ongoing studies based on learnings from ADDRESS (pemphigus) and ADVANCE SC (ITP) studies |

| · | Proof-of-concept studies ongoing with efgartigimod in membranous nephropathy (MN) and lupus nephritis

(LN) with studies expected to start this year in antibody mediated rejection (AMR) and newly nominated indication, systemic sclerosis

(SSc) |

| · | Full Phase 2 topline data (cohorts 1 and 2) from ARDA study of empasiprubart in MMN expected in 2024;

cohort 2 ongoing to determine dose response ahead of Phase 3 study start |

| · | Phase 1b/2a trials of ARGX-119 to assess early signal detection in patients with CMS and ALS expected

to start in 2024 |

Leveraging Repeatable Innovation Playbook to Drive Long-Term Pipeline

Growth

argenx continues to invest in its discovery engine,

the Immunology Innovation Program (IIP), to drive long-term sustainable pipeline growth. Through the IIP, four new pipeline candidates

have been nominated, including: ARGX-213 targeting FcRn and further solidifying argenx’s leadership in this new class of medicine;

ARGX-121 and ARGX-220, which are first-in-class targets broadening argenx’s focus across the immune system; and ARGX-109, targeting

IL-6, which plays an important role in inflammation. Investigational new drug (IND) applications for each program are expected to be filed

by end of 2025.

Appointment of Brian L. Kotzin, MD as Non-executive Director to

Board of Directors

Dr. Brian Kotzin has been appointed as non-executive

director to the Board of Directors and Chair of the Research & Development Committee for a term of four years. He is currently

a consultant for companies developing therapeutics for autoimmune and inflammatory diseases. His prior roles include Chief Medical Officer

for Nektar Therapeutics and Vice President of Global Clinical Development, Head of the Inflammation Therapeutic Area and Vice President

and Head of Medical Sciences at Amgen.

FIRST QUARTER 2024 FINANCIAL RESULTS

argenx SE

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF PROFIT

OR LOSS

| | |

Three months ended | |

| | |

March 31, | |

| (in thousands of $ except for shares and EPS) | |

2024 | | |

2023 | | |

Variance | |

| Product net sales | |

$ | 398,283 | | |

$ | 218,022 | | |

$ | 180,261 | |

| Collaboration revenue | |

| 2,718 | | |

| 1,118 | | |

| 1,600 | |

| Other operating income | |

| 11,512 | | |

| 10,740 | | |

| 772 | |

| Total operating income | |

| 412,513 | | |

| 229,880 | | |

| 182,633 | |

| | |

| | | |

| | | |

| | |

| Cost of sales | |

| (43,178 | ) | |

| (18,335 | ) | |

| (24,843 | ) |

| Research and development expenses | |

| (224,969 | ) | |

| (165,855 | ) | |

| (59,114 | ) |

| Selling, general and administrative expenses | |

| (235,995 | ) | |

| (149,172 | ) | |

| (86,823 | ) |

| Loss from investment in joint venture | |

| (1,792 | ) | |

| (261 | ) | |

| (1,531 | ) |

| Total operating expenses | |

| (505,934 | ) | |

| (333,623 | ) | |

| (172,311 | ) |

| | |

| | | |

| | | |

| | |

| Operating loss | |

$ | (93,421 | ) | |

$ | (103,743 | ) | |

$ | 10,322 | |

| | |

| | | |

| | | |

| | |

| Financial income | |

| 38,895 | | |

| 16,588 | | |

| 22,307 | |

| Financial expense | |

| (512 | ) | |

| (188 | ) | |

| (324 | ) |

| Exchange gains/(losses) | |

| (19,312 | ) | |

| 11,165 | | |

| (30,477 | ) |

| | |

| | | |

| | | |

| | |

| Loss for the period before taxes | |

$ | (74,350 | ) | |

$ | (76,178 | ) | |

$ | 1,828 | |

| Income tax benefit/(expense) | |

$ | 12,753 | | |

$ | 47,307 | | |

$ | (34,554 | ) |

| Loss for the period | |

$ | (61,597 | ) | |

$ | (28,871 | ) | |

$ | (32,726 | ) |

| Loss for the period attributable to: | |

| | | |

| | | |

| | |

| Owners of the parent | |

$ | (61,597 | ) | |

$ | (28,871 | ) | |

$ | (32,726 | ) |

| Weighted average number of shares outstanding | |

| 59,309,996 | | |

| 55,555,186 | | |

| 3,754,810 | |

| Basic and diluted (loss) per share (in $) | |

| (1.04 | ) | |

| (0.52 | ) | |

| (0.52 | ) |

| Net increase/(decrease) in cash, cash equivalents and current

financial assets compared to year-end 2023 and 2022 | |

| (75,378 | ) | |

| (185,035 | ) | |

| 109,657 | |

| Cash and cash equivalents and current financial assets at the end of the period | |

| 3,104,466 | | |

| 2,007,513 | | |

| | |

DETAILS OF THE FINANCIAL RESULTS

Total operating income for

the three months ended March 31, 2024, was $413 million compared to $230 million for the same period in 2023, and consists of:

| · | Product net sales of VYVGART and VYVGART SC for the three months ended March 31, 2024, were

$398 million compared to $218 million for the same period in 2023. |

| · | Collaboration revenue for the three months ended March 31, 2024, was $3 million compared to

$1 million for the same period in 2023. Collaboration revenue for the three months ended March 31, 2024, includes $2 million in royalty

revenue from VYVGART sales in China. |

| · | Other operating income for the three months ended March 31, 2024, was $12 million compared

to $11 million for the same period in 2023. The other operating income for the three months ended March 31, 2024 and 2023, primarily

relates to research and development tax incentives. |

Total operating expenses for

the three months ended March 31, 2024, were $506 million compared to $334 million for the same period in 2023, and mainly consists

of:

| · | Cost of sales for the three months ended March 31, 2024, was $43 million compared to $18 million

for the same period in 2023. The cost of sales was recognized with respect to the sale of VYVGART and VYVGART SC. |

| · | Research and development expenses for the three months ended March 31, 2024, were $225 million

compared to $166 million for the same period in 2023. The research and development expenses mainly relate to external research and development

expenses and personnel expenses incurred in the clinical development of efgartigimod in various indications and the expansion of other

clinical and preclinical pipeline candidates. |

| · | Selling, general and administrative expenses for the three months ended March 31, 2024, were

$236 million compared to $149 million for the same period in 2023. The selling, general and administrative expenses mainly relate to professional

and marketing fees linked to the commercialization of VYVGART and VYVGART SC, and personnel expenses. |

Financial income

for the three months ended March 31, 2024, was $39 million compared to $17 million for the same period in 2023. The increase

in financial income is mainly due to an increase in interest income coming from an increase of cash, cash equivalents and current financial

assets as a result of the July 2023 financing round.

Exchange losses

for the three months ended March 31, 2024, were $19 million compared to $11 million of exchange gains for the same period

in 2023. Exchange gains/losses are mainly attributable to unrealized exchange rate gains or losses on the cash, cash equivalents and current

financial assets denominated in Euro.

Income tax for

the three months ended March 31, 2024, was $13 million of income tax benefit compared to $47 million of income tax benefit for the

same period in 2023. Income tax benefit for the three months ended March 31, 2024, consists of $6 million of current income tax expense

and $19 million of deferred tax benefit, compared to $11 million of current income tax expense and $58 million of deferred tax benefit

for the comparable prior period.

Net loss for

the three months ended March 31, 2024, was $62 million compared to $29 million for the same period in 2023. On a per weighted average

share basis, the net loss was $1.04 and $0.52 for the three months ended March 31, 2024 and 2023, respectively.

Cash, cash equivalents

and current financial assets totalled $3.1 billion as of March 31, 2024, compared to $3.2 billion as of December 31,

2023. The decrease in cash and cash equivalents and current financial assets result from net cash flows used in operating activities.

FINANCIAL GUIDANCE

Based on its current operating plans, argenx expects

its combined Research and development and Selling, general and administrative expenses in 2024 to be less than $2 billion. argenx expects

to utilize up to $500 million of net cash in 2024 on these anticipated operating expenses as well as working capital and capital expenditures.

EXPECTED 2024 FINANCIAL CALENDAR

| · | July 25, 2024: Q2 2024 financial results and business update |

| · | October 31, 2024: Q3 2024 financial results and business update |

CONFERENCE CALL DETAILS

The first quarter 2024 financial results and business update will

be discussed during a conference call and webcast presentation today at 2:30 PM CET/8:30 AM ET. A webcast of the live call may be accessed

on the Investors section of the argenx website at argenx.com/investors. A replay of the webcast will be available on the argenx website.

Dial-in numbers:

Please dial in 15 minutes prior to the live call.

| Belgium |

32 800 50 201 |

| France |

33 800 943355 |

| Netherlands |

31 20 795 1090 |

| United Kingdom |

44 800 358 0970 |

| United States |

1 800 715 9871 |

| Japan |

81 3 4578 9081 |

| Switzerland |

41 43 210 11 32 |

About argenx

argenx is a global

immunology company committed to improving the lives of people suffering from severe autoimmune diseases. Partnering with leading academic

researchers through its Immunology Innovation Program (IIP), argenx aims to translate immunology breakthroughs into a world-class portfolio

of novel antibody-based medicines. argenx developed and is commercializing the first approved neonatal Fc receptor (FcRn) blocker, globally

in the U.S., Japan, Israel, the EU, the UK, China and Canada. The Company is evaluating efgartigimod in multiple serious autoimmune

diseases and advancing several earlier stage experimental medicines within its therapeutic franchises. For more information, visit

www.argenx.com and follow us on LinkedIn, X/Twitter, Instagram, Facebook, and YouTube.

For further information, please contact:

Media:

Ben Petok

bpetok@argenx.com

Investors:

Alexandra Roy (US)

aroy@argenx.com

Lynn Elton (EU)

lelton@argenx.com

Forward-looking Statements

The contents of this announcement include

statements that are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms “aim,” “anticipates,”

“believes,” “continue,” “expects,” “will,” “plan,”

“prepare,” or “should” and include statements argenx makes regarding its commitment to provide patients with

the broadest generalized myasthenia gravis (gMG) product offerings; the ability to scale the organization and prepare for CIDP; the

preparation for registrational trials across multiple programs including empasiprubart in MMN and efgartigimod in Sjogren's disease;

the pending regulatory decisions for gMG in Switzerland, Australia, Saudi Arabia and South Korea, and VYVGART SC in China through

Zai Lab; regulatory submissions in Europe and Canada; its plans to expand label for VYVGART in seronegative gMG patients into

broader MG populations; the planned FDA submission for VYVGART SC prefilled syringe for gMG and CIDP in second quarter of 2024; its

aim to solidify its Fc receptor (FcRn) leadership and expectation that efgartigimod will be approved or under evaluation in at least

15 autoimmune diseases by 2025; its advancement of earlier stage pipeline programs; its evaluation of ARGX-119; its expected updates

on BALLAD study development plan by end of 2024; data readouts and regulatory milestones and plans, including the timing of planned

clinical trials and expected data readouts; its investigational new drug applications for four new pipeline candidates through the

Immunology Innovation Program expected to be filed by the end of 2025; and its 2024 research and development and selling, general

and administrative expenses and operating expenses. By their nature, forward-looking statements involve risks and uncertainties and

readers are cautioned that any such forward-looking statements are not guarantees of future performance. argenx’s actual

results may differ materially from those predicted by the forward-looking statements as a result of various important factors,

including the results of argenx's clinical trials; expectations regarding the inherent uncertainties associated with the development

of novel drug therapies; preclinical and clinical trial and product development activities and regulatory approval requirements in

products and product candidates; the acceptance of argenx's products and product candidates by patients as safe, effective and

cost-effective; the impact of governmental laws and regulations on our business; disruptions caused on our reliance of third parties

suppliers, service provides and manufacturing; inflation and deflation and the corresponding fluctuations in interest rates; the

results of the PDUFA review; and regional instability and conflicts. A further list and description of these risks, uncertainties

and other risks can be found in argenx’s U.S. Securities and Exchange Commission (SEC) filings and reports, including in

argenx’s most recent annual report on Form 20-F filed with the SEC as well as subsequent filings and reports filed by

argenx with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking

statements. These forward-looking statements speak only as of the date of publication of this document. argenx undertakes no

obligation to publicly update or revise the information in this press release, including any forward-looking statements, except as

may be required by law.

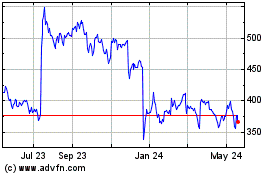

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Oct 2024 to Nov 2024

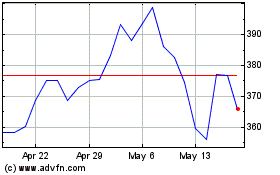

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Nov 2023 to Nov 2024