Ark Restaurants Corp. (NASDAQ:ARKR) today reported financial

results for the fourth quarter and fiscal year ended September 28,

2024.

The Company’s fiscal year ends on the Saturday nearest September

30. The fiscal years ended September 28, 2024 and September 30,

2023 both included 52 weeks and the quarters ended September 28,

2024 and September 30, 2023 both included 13 weeks.

Financial Results

Total revenues for the 13 weeks ended September 28, 2024 were

$43,406,000 versus $44,400,000 for the 13 weeks ended September 30,

2023.

Total revenues for the year ended September 28, 2024 were

$183,545,000 versus $184,793,000 for the year ended September 30,

2023. As required by our lease, Gallagher's Steakhouse at the New

York-New York Hotel and Casino in Las Vegas, NV was substantially

closed for renovation in the prior period from February 5, 2023

through April 27, 2023 (the "Closure Period"). Revenues for the

comparable current period were $3,056,000 as compared to $1,068,000

for the Closure Period.

Company-wide same store sales decreased 3.6% for the 13 weeks

ended September 28, 2024 as compared to the same period of last

year. For the year ended September 28, 2024, company-wide same

store sales decreased 1.1% as compared to last year.

Net loss attributable to Ark Restaurants Corp. for the 13 weeks

ended September 28, 2024, was $(4,457,000) or $(1.24) per basic and

diluted share compared to a net loss of $(10,364,000) or $(2.88)

per basic and diluted share, for the 13 weeks ended September 30,

2023. The Company's Earnings before Interest, Taxes, Depreciation

and Amortization ("EBITDA"), as adjusted, for the 13 weeks ended

September 28, 2024 was $503,000 versus $585,000 for the 13 weeks

ended September 30, 2023 and excludes: (i) a loss on the closure of

El Rio Grande in the amount of $876,000 for the 13 weeks ended

September 28, 2024, (ii) non-cash goodwill impairment charges of

$4,000,000 and $10,000,000, respectively, for the 13 weeks ended

September 28, 2024 and September 30, 2023, and (iii) other items as

set out in the table below. EBITDA is a Non-GAAP Financial Measure.

Please see "Non-GAAP Financial Information" at the end of this news

release.

Net loss attributable to Ark Restaurants Corp. for the year

ended September 28, 2024, was $(3,896,000) or $(1.08) per basic and

diluted share compared to a net loss of $(5,928,000) or $(1.65) per

basic and diluted share, for the year ended September 30, 2023. The

Company's EBITDA, as adjusted, for the year ended September 28,

2024 was $6,128,000 versus $9,266,000 for the year ended September

30, 2023 and excludes: (i) a loss on the closure of El Rio Grande

of $876,000 in fiscal 2024, (ii) impairment losses on right-of-use

("ROU") and long-lived assets of $2,500,000 in fiscal 2024, (iii)

non-cash goodwill impairment charges of $4,000,000 and $10,000,000,

respectively, for the fiscal years ended 2024 and 2023, and (iv)

other items as set out in the table below. EBITDA is a Non-GAAP

Financial Measure. Please see "Non-GAAP Financial Information" at

the end of this news release.

As of September 28, 2024, the Company had cash and cash

equivalents of $10,273,000 and total outstanding debt of

$5,235,000.

Other Matters

Loss on the Closure of El Rio Grande

The Company advised the landlord of El Rio Grande we would be

terminating the lease and closing the property permanently on or

around January 1, 2025. In connection with this notification, the

Company recorded a loss of $876,000 during the year ended September

28, 2024 consisting of: (i) rent and other costs incurred in

accordance with the termination provisions of the lease in the

amount of $398,000, (ii) accrued severance and other costs in the

amount of $94,000, (iii) an impairment charge related to long-lived

assets in the amount of $269,000 and (iv) the write-off of our

security deposit in the amount of $238,000, all partially offset by

a gain related to the write-off of ROU assets and related lease

liabilities in the net amount of $123,000.

Impairment Losses on Right-of-Use and

Long-lived Assets

During the year ended September 28, 2024, impairment indicators

were identified at our Sequoia property located in Washington, D.C.

due to lower-than-expected operating results. Accordingly, the

Company tested the recoverability of Sequoia's ROU and long-lived

assets and concluded they were not recoverable. Based on a

discounted cash flow analysis, the Company recognized impairment

charges of $1,561,000 and $939,000 related to Sequoia's ROU assets

and long-lived assets, respectively. Given the inherent uncertainty

in projecting results of restaurants, the Company will continue to

monitor the recoverability of the carrying value of the assets of

Sequoia and several other restaurants on an ongoing basis. If

expected performance is not realized, further impairment charges

may be recognized in future periods, and such charges could be

material.

Goodwill Impairment

The Company's agreements with the Bryant Park Corporation (the

“Landlord”), (a private non-profit entity that manages Bryant Park

under agreements with the New York City Department of Parks &

Recreation) for the Bryant Park Grill & Cafe and The Porch at

Bryant Park expire on April 30, 2025. During July 2023 (for the

Bryant Park Grill & Cafe) and September 2023 (for The Porch at

Bryant Park), the Company received requests for proposals (the

"RFPs") from the Landlord to which we responded on October 26,

2023. The agreements offered under the RFPs for both locations are

for new 10-year agreements, with one five-year renewal option. Any

operator awarded the agreements must be approved by both the New

York City Department of Parks & Recreation and the New York

Public Library. To date, the landlord has not announced the

selection of a successful bidder; however, the landlord has made

public statements of its intention to select an operator other than

the Company. In response to these public statements and other

information obtained by the Company, management has engaged outside

advisors who have been assisting with our efforts to obtain the

extensions by ensuring the RFP awards process is both fair and

transparent. We intend to pursue all available options to protect

our interests.

As a result of the above and other factors, the Company

determined that there were indicators of potential impairment of

its goodwill and accordingly, the Company performed qualitative and

quantitative assessments for its goodwill as of September 28, 2024

and September 30, 2023. Based on the impairment analysis, the

carrying amount of our equity exceeded its estimated fair value,

which indicated an impairment of the carrying value of our goodwill

at September 28, 2024 and September 30, 2023. Accordingly, during

the fourth quarters of fiscal 2024 and 2023, the Company recorded

goodwill impairment charges of $4,000,000 and $10,000,000,

respectively. Such impairments have been attributed to factors such

as, but not limited to, a decrease in the market price of the

Company's common stock and lower than expected profitability.

Food Court at the Hard Rock Hotel and Casino

in Tampa, Florida

On November 26, 2024, the Company agreed to terminate its lease

for the food court at The Hard Rock Hotel and Casino in Tampa, FL.

The termination agreement is subject to the approval of the United

States Department of the Interior, Bureau of Indian Affairs. In

exchange for vacating the premises sometime in late December 2024,

Ark Hollywood/Tampa Investment LLC, a subsidiary of the Company,

(in which we own a 65% interest) will receive a termination payment

in the amount of $5,500,000 and all obligations under the lease

will cease. The Company expects to record a gain related to the

termination payment and it is expected that Ark Hollywood/Tampa

Investment LLC will distribute approximately 35% of the net

proceeds, after expenses, to the other equity holders of Ark

Hollywood/Tampa Investment LLC.

Conference Call and Webcast Information

Ark Restaurants will host a conference call on December 17, 2024

at 11:00 a.m. Eastern Time to review these results and discuss

other topics.

The call can be accessed by dialing toll-free 1-877-407-4018

(Toll/International: 1-201-689-8471).

A live listen-only webcast of the call will be available by

copying and pasting the following URL into your browser:

https://callme.viavid.com/viavid/?callme=true&passcode=13716421&h=true&info=company&r=true&B=6.

A replay will be available approximately three hours following the

call by dialing toll-free 1-844-512-2921 (Toll/International:

1-412-317-6671) using Access ID 13750617. The replay will be

available until Tuesday, December 24, 2024, 11:45 p.m. Eastern

Time.

About Ark Restaurants Corp.

Ark Restaurants owns and operates 17 restaurants and bars, 16

fast food concepts and catering operations primarily in New York

City, Florida, Washington, DC, Las Vegas, Nevada and the gulf coast

of Alabama. Four restaurants are located in New York City, one is

located in Washington, DC, five are located in Las Vegas, Nevada,

one is located in Atlantic City, New Jersey, four are located on

the east coast of Florida and two are located on the Gulf Coast of

Alabama. The Las Vegas operations include four restaurants within

the New York-New York Hotel & Casino Resort and operation of

the hotel's room service, banquet facilities, employee dining room

and six food court concepts and one restaurant within the Planet

Hollywood Resort and Casino. In Atlantic City, New Jersey, the

Company operates a restaurant in the Tropicana Hotel and Casino.

The Florida operations include the Rustic Inn in Dania Beach,

Shuckers in Jensen Beach, JB’s on the Beach in Deerfield Beach,

Blue Moon Fish Company in Lauderdale-by-the-Sea and the operation

of four fast food facilities in Tampa and six fast food facilities

in Hollywood, each at a Hard Rock Hotel and Casino operated by the

Seminole Indian Tribe at these locations. In Alabama, the Company

operates two Original Oyster Houses, one in Gulf Shores and one in

Spanish Fort.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, this news release contains

forward-looking statements, within the meaning of Section 27A of

the Securities Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended. These statements

involve unknown risks, and uncertainties that may cause the

Company's actual results or outcomes to be materially different

from those anticipated and discussed herein. Important factors that

might cause such differences are discussed in the Company's filings

with the Securities and Exchange Commission. The Company disclaims

any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Actual results could differ materially from those

anticipated in these forward-looking statements, if new information

becomes available in the future.

Non-GAAP Financial Information

This news release includes non-generally accepted accounting

principles ("GAAP") performance measures. Although EBITDA is not a

measure of performance or liquidity calculated in accordance with

GAAP, the Company believes the use of this non-GAAP financial

measure enhances an overall understanding of the Company's past

financial performance as well as providing useful information to

the investor because of its historical use by the Company as both a

performance measure and measure of liquidity, and the use of EBITDA

by virtually all companies in the restaurant sector as a measure of

both performance and liquidity. However, investors should not

consider this measure in isolation or as a substitute for net

income (loss), operating income (loss), cash flows from operating

activities or any other measure for determining the Company's

operating performance or liquidity that is calculated in accordance

with GAAP as it may not necessarily be comparable to similarly

titled measure employed by other companies.

ARK RESTAURANTS CORP.

Consolidated Statements of

Operations

(In Thousands, Except per share

amounts)

13 Weeks Ended

September 28,

2024

13 Weeks Ended

September 30,

2023

52 Weeks Ended

September 28,

2024

52 Weeks Ended

September 30,

2023

TOTAL REVENUES

$

43,406

$

44,400

$

183,545

$

184,793

COSTS AND EXPENSES:

Food and beverage cost of sales

12,007

12,152

49,519

49,624

Payroll expenses

15,875

17,295

65,844

66,322

Occupancy expenses

6,254

5,884

24,622

23,472

Other operating costs and expenses

5,892

5,940

24,125

23,498

General and administrative expenses

3,112

2,752

12,263

12,407

Depreciation and amortization

909

1,080

4,090

4,310

Loss on closure of El Rio Grande

876

—

876

—

Impairment losses on right-of-use and

long-lived assets

—

—

2,500

—

Goodwill impairment

4,000

10,000

4,000

10,000

Total costs and expenses

48,925

55,103

187,839

189,633

OPERATING LOSS

(5,519

)

(10,703

)

(4,294

)

(4,840

)

OTHER (INCOME) EXPENSE:

Interest expense, net

129

161

577

906

Other income

—

(26

)

(26

)

(52

)

Gain on forgiveness of PPP Loans

—

—

(285

)

(272

)

Total other (income) expense, net

129

135

266

582

LOSS BEFORE BENEFIT FOR INCOME TAXES

(5,648

)

(10,838

)

(4,560

)

(5,422

)

Benefit for income taxes

(613

)

(370

)

(815

)

(64

)

CONSOLIDATED NET LOSS

(5,035

)

(10,468

)

(3,745

)

(5,358

)

Net (income) loss attributable to

non-controlling interests

578

104

(151

)

(570

)

NET LOSS ATTRIBUTABLE TO ARK RESTAURANTS

CORP.

$

(4,457

)

$

(10,364

)

$

(3,896

)

$

(5,928

)

NET LOSS PER ARK RESTAURANTS CORP. COMMON

SHARE:

Basic

$

(1.24

)

$

(2.88

)

$

(1.08

)

$

(1.65

)

Diluted

$

(1.24

)

$

(2.88

)

$

(1.08

)

$

(1.65

)

WEIGHTED AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING:

Basic

3,604

3,602

3,604

3,601

Diluted

3,604

3,602

3,604

3,601

EBITDA Reconciliation:

Loss before benefit for income taxes

$

(5,648

)

$

(10,838

)

$

(4,560

)

$

(5,422

)

Depreciation and amortization

909

1,080

4,090

4,310

Interest expense, net

129

161

577

906

EBITDA (a)

$

(4,610

)

$

(9,597

)

$

107

$

(206

)

EBITDA, adjusted:

EBITDA (as defined) (a)

$

(4,610

)

$

(9,597

)

$

107

$

(206

)

Non-cash stock option activity

(341

)

78

(919

)

314

Loss on closure of El Rio Grande

876

—

876

—

Impairment losses on right-of-use and

long-lived assets

—

—

2,500

—

Goodwill impairment

4,000

10,000

4,000

10,000

Gain on forgiveness of PPP Loans

—

—

(285

)

(272

)

Net (income) loss attributable to

non-controlling interests

578

104

(151

)

(570

)

EBITDA, as adjusted

$

503

$

585

$

6,128

$

9,266

(a)

EBITDA is defined as earnings before

interest, taxes, depreciation and amortization. A reconciliation of

EBITDA to the most comparable GAAP financial measure, pre-tax

income, is included above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216308516/en/

Anthony J. Sirica (212) 206-8800

ajsirica@arkrestaurants.com

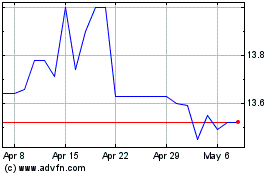

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

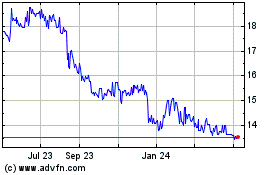

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Dec 2023 to Dec 2024