Arqit Quantum Inc. (Nasdaq: ARQQ, ARQQW) (Arqit), Traxpay GmbH

(Traxpay) and Lux Kapitalmarkt Management AG (LuxAG), have entered

into a trade and supply chain financing partnership for Lux AG to

invest in digital negotiable instruments (DNIs), enabling

businesses to use DNIs to get easy access to new pools of working

capital.

Leveraging Arqit’s TradeSecure™ application that

generates highly secure DNIs, Traxpay’s superior supply chain

finance (SCF) technology, and LuxAG’s liquidity management

solutions, this partnership will deliver much needed liquidity to

the SCF market.

LuxAG is a Luxembourg based one-stop-shop

service provider for capital market-oriented transactions, with a

focus on the structuring and implementation of capital

market-oriented transactions. LuxAG facilitates transactions

between institutional investor and corporates in search for

efficient working capital financing.

Arqit's first-of-its-kind technology delivers

unique, referenceable and transferable digital finance instruments

which have broad commercial application and enable businesses to

get closer to pools of available liquidity and improve their cash

flows. Arqit is a world leader in complying with the new standards,

by completed legal review, and in making them provably secure.

Traxpay’s Dynamic Financing Platform© integrates

with corporate clients’ ERP systems and enables the use of digital

negotiable instruments, in the form of Promissory Notes, for Post

Maturity Financing, paying suppliers on time while settling their

obligation to LuxAG on extended terms. Clients can elect to combine

Post Maturity Financing with Dynamic Supplier Financing, paying

suppliers early in return for a discount, again with liquidity on

demand provided by LuxAG.

David Williams, Founder of Arqit

said:

“We are delighted to collaborate with LuxAG and

our long-term partner Traxpay to help deliver much needed liquidity

to support regional and global supply chains, DNIs enable

forward-looking businesses to access and deliver supply chain

finance liquidity in real time, with absolute assurance for

document integrity, acceptance and transfer – all without

undermining their existing terms of trade.”

Markus Wohlgeschaffen, Traxpay MD

Markets & Sales said:

“Without forward-thinking fund managers like

LuxAG we couldn’t bring together this offering that will allow us

to deliver much needed trade liquidity solutions through non-bank

financers into numerous markets across industry verticals including

retail, manufacturing and engineering.”

Mihail Belostennyj, LuxAG Managing

Director said:

“We always aim for the most efficient solutions

for our corporate clients while creating sophisticated structures

to meet the high demands of institutional investor. Backed by

Arqit’s robust security and Traxpay’s superior technology, we have

the confidence to lend using digital negotiable instruments. This

partnership will enable us to enlarge our offering of efficient

financing solutions”.

About Arqit

Arqit Quantum Inc. (Nasdaq: ARQQ, ARQQW) (Arqit)

supplies a unique encryption software service which makes the

communications links of any networked device, cloud machine or data

at rest secure against both current and future forms of attack on

encryption – even from a quantum computer. Compatible with NSA CSfC

Components and meeting the demands of NSA CSfC Symmetric Key

Management Requirements Annexe 1.2. and RFC 8784, Arqit’s Symmetric

Key Agreement Platform uses a lightweight software agent that

allows end point devices to create encryption keys locally in

partnership with any number of other devices. The keys are

computationally secure and facilitate Zero Trust Network Access. It

can create limitless volumes of keys with any group size and

refresh rate and can regulate the secure entrance and exit of a

device in a group. The agent is lightweight and will thus run on

the smallest of end point devices. The product sits within a

growing portfolio of granted patents. It also works in a standards

compliant manner which does not oblige customers to make a

disruptive rip and replace of their technology. Arqit is winner of

two GSMA Global Mobile Awards, The Best Mobile Security Solution

and The CTO Choice Award for Outstanding Mobile Technology, at

Mobile World Congress 2024, recognised for groundbreaking

innovation at the 2023 Institution of Engineering and Technology

Awards and winner of the National Cyber Awards’ Innovation in Cyber

Award and the Cyber Security Awards’ Cyber Security Software

Company of the Year Award. Arqit is ISO 27001 Standard

certified. www.arqit.uk

About Arqit TradeSecure™

Arqit TradeSecure™ enables the creation,

safekeeping and secure transfer of Digital Negotiable Instruments

(DNIs). DNIs are secure digital forms of well established, globally

recognised paper trade finance instruments: e.g. Promissory Notes

& Bills of Exchange. As a result of recent legislation DNIs now

have the same legal standing as paper instruments and will be an

integral part of 21st century corporate working capital solutions

including supply chain and invoice finance.

TradeSecure improves business performance for

everybody in the supply chain by:

-

Freeing up working capital for Buyers to pass on to their

Suppliers

-

Allowing businesses to improve cash flow

-

Driving down costs across the entire supply chain

-

Generating a direct bottom line contribution for Buyers

-

Providing end to end data transparency and a full transaction audit

trail

-

Making it easier for a range of Investors to provide much needed

working capital finance

-

Increasing security and reducing operational risk.

Arqit’s quantum-safe encryption technology

provides a robust security solution, which harnesses our

military-grade data encryption expertise. Secured by symmetric

digital keys and notarised on a quantum-secure ledger, DNIs can be

created, transferred and stored in a fully auditable and secure

manner throughout their lifecycle. tradesecure.arqit.uk

About Traxpay

Traxpay is a tradetech company providing working capital

optimisation using a comprehensive suite of supply chain finance

instruments. The Traxpay Dynamic Financing Platform© offers

combined solutions for payables, receivables and payment risk

management. They practice upcycled financing using negotiable

financing instruments in their digital form, taking care of

payment, financing and hedging in one.

Established financial institutions such as Deutsche Bank, DZ

Bank, Nord/LB, LBBW and KfW IPEX-Bank trust Traxpay’s financing

solution and maintain strategic partnerships with the company.

About LuxAG

LuxAG is a management company and operates a Luxembourg

securitisation vehicle. LuxAG has over 15 years of experience in

structuring and managing capital markets transactions for

institutional investors. LuxAG service offering suite includes

off-balance sheet securitisation solutions, product and

portfolio-management, risk management, payment processing, credit

analysis, credit enhancement solutions, and NAV calculations. LuxAG

operates a securitisation vehicle in Luxembourg.

Media relations

enquiries:Arqit: pr@arqit.uk

Investor relations

enquiries:Arqit:

investorrelations@arqit.ukGateway:

arqit@gateway-grp.com

Caution About Forward-Looking Statements

This communication includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, may be forward-looking statements. These

forward-looking statements are based on Arqit’s expectations and

beliefs concerning future events and involve risks and

uncertainties that may cause actual results to differ materially

from current expectations. These factors are difficult to predict

accurately and may be beyond Arqit’s control. Forward-looking

statements in this communication or elsewhere speak only as of the

date made. New uncertainties and risks arise from time to time, and

it is impossible for Arqit to predict these events or how they may

affect it. Except as required by law, Arqit does not have any duty

to, and does not intend to, update or revise the forward-looking

statements in this communication or elsewhere after the date this

communication is issued. In light of these risks and uncertainties,

investors should keep in mind that results, events or developments

discussed in any forward-looking statement made in this

communication may not occur. Uncertainties and risk factors that

could affect Arqit’s future performance and cause results to differ

from the forward-looking statements in this release include, but

are not limited to: (i) the outcome of any legal proceedings that

may be instituted against the Arqit, (ii) the ability to maintain

the listing of Arqit’s securities on a national securities

exchange, (iii) changes in the competitive and regulated industries

in which Arqit operates, variations in operating performance across

competitors and changes in laws and regulations affecting Arqit’s

business, (iv) the ability to implement business plans, forecasts,

and other expectations, and identify and realise additional

opportunities, (v) the potential inability of Arqit to successfully

deliver its operational technology, (vi) the risk of interruption

or failure of Arqit’s information technology and communications

system, (vii) the enforceability of Arqit’s intellectual property,

and (viii) other risks and uncertainties set forth in the sections

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in Arqit’s annual report on Form 20-F

(the “Form 20-F”), filed with the U.S. Securities and Exchange

Commission (the “SEC”) on 21 November 2023 and in subsequent

filings with the SEC. While the list of factors discussed above and

in the Form 20-F and other SEC filings are considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realisation of forward-looking statements.

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

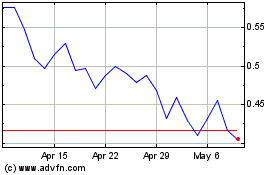

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Jan 2024 to Jan 2025