false

--12-31

0001690080

0001690080

2024-02-26

2024-02-26

0001690080

ATNF:CommonStockParValue0.0001PerShareMember

2024-02-26

2024-02-26

0001690080

ATNF:WarrantsToPurchaseSharesOfCommonStockMember

2024-02-26

2024-02-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): February 26, 2024

180 LIFE SCIENCES CORP.

(Exact Name of

Registrant as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto,

CA |

|

94306 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (650) 507-0669

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on

which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ Stock Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders

The information set forth in Item

5.03 is hereby incorporated into this Item 3.03 by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

Reverse Stock

Split

As

discussed in greater detail in Item 5.07 of the Current Report on Form 8-K filed by 180 Life Sciences Corp. (the “Company,”

“we,” “our,” or “us”) with the Securities and Exchange Commission on February

16, 2024, on February 16, 2024, at a Special Meeting of the Stockholders (the “Special Meeting”), of the Company,

the stockholders of the Company approved an amendment to the Company’s Second Amended and Restated Certificate of Incorporation,

as amended, to effect a reverse stock split of our issued and outstanding shares of our common stock, par value $0.0001 per share, by

a ratio of between one-for-four to one-for-forty, inclusive, with the exact ratio to be set at a whole number to be determined by our

Board of Directors or a duly authorized committee thereof in its discretion, at any time after approval of the amendment and prior to

February 16, 2025 (the “Stockholder Authority”).

On

February 16, 2024, and following the Special Meeting, the Company’s Board of Directors (the “Board”), with the

Stockholder Authority, approved an amendment to our Second Amended and Restated Certificate of Incorporation to effect a reverse stock

split of our common stock at a ratio of 1-for-19 (the “Reverse Stock Split”). The Reverse Stock Split is more fully

described in the Company’s definitive proxy statement, which was filed with the Securities and Exchange Commission (the “Commission”)

on December 26, 2023.

On

February 26, 2024, we filed a Certificate of Amendment to our Second Amended and Restated Certificate of Incorporation, as amended (the

“Certificate of Amendment”) with the Secretary of State of the State of Delaware to effect the Reverse Stock Split.

A copy of the Certificate of Amendment is attached hereto as Exhibit 3.1 and is incorporated by reference herein.

Pursuant

to the Certificate of Amendment, the Reverse Stock Split will be effective on February 28, 2024 at 12:01 a.m. Eastern Time (the “Effective

Time”). The shares of the Company’s common stock are expected to begin trading on the NASDAQ Capital Market (“NASDAQ”)

on a post-split basis on February 28, 2024, with new CUSIP number: 68236V302. No change was made to the trading symbol for the Company’s

shares of common stock or public warrants, “ATNF” and “ATNFW”, respectively, in connection with the Reverse Stock

Split.

At the Effective Time, every nineteen (19) shares of issued and outstanding common stock will be converted into one (1) share of issued

and outstanding common stock, and the total outstanding shares of common stock will be reduced from approximately 11.3 million to approximately

0.6 million, without giving effect to any rounding up of fractional shares. The Company’s transfer agent, Continental Stock Transfer

& Trust Company (“Continental”), will serve as exchange agent for the Reverse Stock Split and will provide instructions

to stockholders of record regarding the Reverse Stock Split, to the extent applicable.

Because the Certificate of

Amendment did not reduce the number of authorized shares of our common stock, the effect of the Reverse Stock Split was to increase the

number of shares of our common stock available for issuance relative to the number of shares issued and outstanding. The Reverse Stock

Split did not alter the par value of our common stock or modify any voting rights or other terms of our common stock.

No fractional shares will

be issued in connection with the Reverse Stock Split. Stockholders of record who otherwise would be entitled to receive fractional shares,

will be entitled to have their fractional shares rounded up to the nearest whole share. No stockholders will receive cash in lieu of

fractional shares.

Each certificate that immediately

prior to the Effective Time represented shares of our common stock (“Old Certificates”) shall thereafter represent

that number of shares of our common stock into which the shares of our common stock represented by the Old Certificate shall have been

combined, subject to the adjustment for fractional shares as described above. Unless otherwise requested by the stockholder, Continental

will be issuing all of the post-split shares in paperless, “book-entry” form, and unless otherwise requested by the

stockholder, Continental will hold the shares in an account set up for the stockholder. All book-entry or other electronic positions

representing issued and outstanding shares of our common stock will be automatically adjusted. Those stockholders holding our common

stock in “street name” will receive instructions from their brokers.

In addition, the number of

shares of common stock issuable upon exercise of our stock options and other equity awards (including shares reserved for issuance under

the Company’s equity compensation plans) were proportionately adjusted by the applicable administrator, using the 1-for-19 ratio,

and rounded down to the nearest whole share, to be effective at the Effective Time, pursuant to the terms of the Company’s equity

plans. The conversion rates of our preferred stock (of which none are outstanding) will also be adjusted in a ratio of 1-for-19. The

number of shares issuable upon exercise of our outstanding warrants to purchase shares of common stock outstanding at the Effective Time

will also be equitably adjusted pursuant to the terms of such securities in connection with the 1-for-19 Reverse Stock Split. In addition,

the exercise price for each outstanding stock option and warrant will be increased in inverse proportion to the 1-for-19 split ratio

such that upon an exercise, the aggregate exercise price payable by the optionee or warrant holder to the Company for the shares subject

to the option or warrant will remain approximately the same as the aggregate exercise price prior to the Reverse Stock Split, subject

to the terms of such securities.

Further, pursuant to the

terms of the Company’s Class K Special Voting Shares (the “Voting Stock”), following the Effective Time, the

Voting Stock is now convertible into a number of shares of common stock equal to, and votes a number of voting shares equal to, 14 shares.

Each stockholder’s

percentage ownership interest in the Company and proportional voting power remains virtually unchanged as a result of the Reverse Stock

Split, except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and privileges

of the holders of shares of common stock will be substantially unaffected by the Reverse Stock Split.

The above description of

the Certificate of Amendment and the Reverse Stock Split is a summary of the material terms thereof and is qualified in its entirety

by reference to the Certificate of Amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated

herein by reference.

Reason for the Reverse Stock Split

The Company is effecting

the Reverse Stock Split to satisfy the $1.00 minimum bid price requirement, as set forth in Nasdaq Listing Rule 5550(a)(2), for continued

listing on The NASDAQ Capital Market. As previously disclosed in a Current Report on Form 8-K filed with the Securities and Exchange

Commission on September 8, 2023, on September 7, 2023, the Company received a deficiency letter from the Listing Qualifications Department

(the “Staff”) of the Nasdaq Stock Market (“Nasdaq”) notifying the Company that, for the preceding

30 consecutive business days, the closing bid price for the common stock was trading below the minimum $1.00 per share requirement for

continued inclusion on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”).

In accordance with Nasdaq Rules, the Company has been provided an initial period of 180 calendar days, or until March 5, 2024 (the “Compliance

Date”), to regain compliance with the Bid Price Requirement. If at any time before the Compliance Date the closing bid price

for the Company’s common stock is at least $1.00 for a minimum of 10 consecutive business days, the Staff will provide the Company

written confirmation of compliance with the Bid Price Requirement. By effecting the Reverse Stock Split, the Company expects that the

closing bid price for the common stock will increase above the $1.00 per share requirement.

Item 8.01. Other Events

The

information provided in Item 5.03 is hereby incorporated by reference.

The

Company has a registration statement on Form S-3 (File No. 333-265416) and three registration statements on Form S-8 (File No. 333-259918,

File No. 333-266716 and File No. 333-274276) on file with the Commission. Commission regulations permit the Company to incorporate by

reference future filings made with the Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, prior to the termination of the offerings covered by registration statements filed on Form S-3 or Form S-8. The information

incorporated by reference is considered to be part of the prospectus included within each of those registration statements. Information

in this Item 8.01 of this Current Report on Form 8-K is therefore intended to be automatically incorporated by reference

into each of the active registration statements listed above, thereby amending them. Pursuant to Rule 416(b) under the Securities Act,

the amount of undistributed shares of common stock deemed to be covered by the effective registration statements of the Company described

above are proportionately reduced as of the Effective Time to give effect to the Reverse Stock Split.

Item 9.01 Financial Statements, Pro

Forma Financial Information and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: February 28, 2024

| |

180 LIFE SCIENCES CORP. |

| |

|

| |

By: |

/s/ James N. Woody, M.D., Ph.D. |

| |

|

Name: |

James N. Woody, M.D., Ph.D. |

| |

|

Title: |

Chief Executive Officer |

4

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF

SECOND AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

180 LIFE SCIENCES CORP.

180 Life Sciences Corp.,

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, DOES HEREBY CERTIFY:

FIRST: The name

of the corporation is 180 Life Sciences Corp.

SECOND: The original

name of the Corporation was KBL Merger Corp. IV. The date on which the Corporation’s original Certificate of Incorporation

was filed with the Secretary of State of the State of Delaware is September 7, 2016. The Amended and Restated Certificate of Incorporation

of the Corporation was filed with the Secretary of State of the State of Delaware on June 2, 2017. The Second Amended and Restated

Certificate of Incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on November 6, 2020.

THIRD: The Board

of Directors of the Corporation (the “Board”), acting in accordance with the provisions of Sections

141 and 242 of the General Corporation Law of the State of Delaware (the “DGCL”),

adopted resolutions approving and deeming advisable an amendment to the Corporation’s Second Amended and Restated Certificate of

Incorporation, as amended (the “Restated Certificate”), as follows:

RESOLVED: That

Article IV of the Second Amended and Restated Certificate of Incorporation of the Corporation be and it hereby is amended to add

the following paragraph as follows:

“4.6. Reverse

Stock Split of Outstanding Common Stock. Upon this Certificate of Amendment becoming effective pursuant to the General Corporation

Law of the State of Delaware (the “Effective Time”), every Nineteen (19) shares of Common Stock, either

issued and outstanding or held by the corporation as treasury stock, in each case immediately prior to the Effective Time (the “Old

Common Stock”), shall be automatically reclassified as and converted into one (1) share of Common Stock (the “New

Common Stock”). No fractional shares of the New Common Stock shall be issued in connection with the reverse stock split.

To the extent any holders of shares of the Old Common Stock are entitled to fractional shares of the New Common Stock as a result of the

Reverse Stock Split, the Corporation will issue an additional share of New Common Stock to all holders of fractional shares of the Old

Common Stock. Any stock certificate that, immediately prior to the Effective Time, represented shares of the Old Common Stock, shall from

and after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent that number of whole

shares of New Common Stock into which such shares of Old Common Stock shall have been reclassified pursuant to this Certificate of Amendment.

The Reverse Stock Split shall have no effect on the number of authorized shares of capital stock, previously designated series of preferred

stock (except to the extent such reverse stock split results in an adjustment to the conversion ratios thereof), or the par value thereof

as set forth above in the preceding paragraphs.”

RESOLVED: That

except as expressly amended hereby no other aspect of such Article IV shall be modified hereby.

FOURTH: The foregoing

amendment was submitted to the stockholders of the Corporation for their approval at a special meeting of stockholders which was duly

called and held, upon notice in accordance with Section 222 of the DGCL, at which meeting the necessary number of

shares as required by statute were voted in favor of the amendment. Accordingly, said amendment was duly adopted in accordance with the

provisions of Section 242 of the DGCL.

FIFTH: This Certificate

of Amendment shall become effective on February 28, 2024 at 12:01 A.M. Eastern Time.

IN WITNESS WHEREOF, 180 Life

Sciences Corp. has caused this certificate to be signed by Ozan Pamir, its Chief Financial Officer, on February 22, 2024.

| 180 LIFE SCIENCES CORP. |

|

| |

|

| /s/ Ozan Pamir |

|

| Ozan Pamir |

|

| Chief Financial Officer |

|

v3.24.0.1

Cover

|

Feb. 26, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 26, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-38105

|

| Entity Registrant Name |

180 LIFE SCIENCES CORP.

|

| Entity Central Index Key |

0001690080

|

| Entity Tax Identification Number |

90-1890354

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3000 El Camino Real

|

| Entity Address, Address Line Two |

Bldg. 4

|

| Entity Address, Address Line Three |

Suite 200

|

| Entity Address, City or Town |

Palo Alto

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94306

|

| City Area Code |

650

|

| Local Phone Number |

507-0669

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ATNF

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase shares of Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of Common Stock

|

| Trading Symbol |

ATNFW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

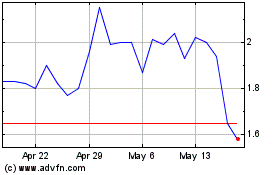

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Dec 2024 to Jan 2025

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Jan 2024 to Jan 2025