Bridger Aerospace Group Holdings, Inc. (“Bridger” or “Bridger

Aerospace”), (NASDAQ: BAER, BAERW), one of the nation’s largest

aerial firefighting companies, today reported results for the

second quarter ended June 30, 2023.

Highlights:

- First international deployment of Super Scoopers and Air Attack

aircraft into Canada

- 5-Year exclusive use and call when needed contracts awarded by

the U.S. Department of the Interior for up to $68 million for

advanced fire intelligence services to include specialized infrared

fire mapping software analytics and data services in support of

firefighting operations

- Acquisition of Bighorn Airways announced with an expected

closing late in the third quarter

- Revenue and Adjusted EBITDA guidance affirmed due to rapid

acceleration of the North American wildfire season

“Each fire season has its own complexion; this

year is no different. While the considerable winter snowpack and

wet spring conditions pushed out the start of the U.S. wildfire

season by approximately six weeks, the resulting vegetation growth

and current extreme hot and dry conditions through the Western U.S.

has contributed to an acceleration of wildfire activity beginning

late in the second quarter,” commented Tim Sheehy, Bridger

Aerospace’s Chief Executive Officer. “Our entire fleet is currently

deployed in the U.S. supporting active fire incidents from

Washington State to Texas and many places in between. Previous

years with later starts oftentimes push the core wildfire season

into the fourth quarter, thus our 2023 guidance remains achievable.

We also look forward to the addition of Bighorn Airways later this

year which will expand our aerial firefighting services to new

mission critical areas as we strive to support the needs of our

state and federal customers.”

Business Outlook As reiterated on

May 12, 2023, Bridger’s growing fleet and portfolio of services, is

projected to generate revenue of $84 million to $96 million and

Adjusted EBITDA of $37 million to $45 million for 2023.

Bridger is excited to add Bighorn to our fleet and

anticipates incremental revenue opportunities on these new assets

as well as cost synergies in 2024. Bridger will continue to see

additional opportunities to further expand our fleet both in the

U.S and abroad. With the potential for a long and aggressive fire

season, combined with cost savings initiatives put in place to

maximize earnings, 2023 should be a record year for the

company.

Second Quarter 2023 Results

Revenue for the second quarter of 2023 was $11.6 million compared

to $12.8 million in the second quarter of 2022, down approximately

9%. The decrease was the result of a later start to the 2023 U.S.

wildfire season. The Company actively worked to partially offset

the impact of wet spring weather in the U.S. by expanding its

aerial firefighting operations into Canada where wildfire activity

began early. This enabled the Company to increase utilization of

our fleet in the second quarter of 2023 and highlights the benefits

of the geographic flexibility of our business model and reinforces

our strategy for continued exploration of international expansion

to cover more territory and wildfire seasons.

Cost of revenues was $10.5 million in the second

quarter of 2023 and was comprised of flight operations expenses of

$6.3 million and maintenance expenses of $4.2 million. This

compares to $9.4 million in the second quarter of 2022, which

included $5.8 million of flight operations expenses and $3.6

million of maintenance expenses. The increase primarily relates to

higher depreciation, maintenance and other expenses related to the

two additional Super Scooper aircraft that were placed into service

in September 2022 and February 2023, respectively.

Selling, general and administrative expenses

(“SG&A”) were $15.2 million in the second quarter of 2023

compared to $5.7 million in the second quarter of 2022. The

increase was primarily driven by non-cash stock-based compensation

of $7.9 million for restricted stock units (“RSUs”) granted to

employees and $1.1 million in loss on disposal and non-cash asset

impairment charges on aging surveillance aircraft.

Interest expense for the second quarter of 2023

increased to $5.5 million from $2.3 million in the second quarter

of 2022 due to additional interest expense related to the Gallatin

municipal bond issuances of $160 million that closed in the third

quarter of 2022. Bridger also reported Other Income of $0.6 million

for the period ended June 30, 2023, comprised of interest income

for the embedded derivative of its preferred equity of $0.2 million

and realized gains from available-for-sale securities of $0.3

million.

Bridger reported a net loss of $19.0 million in

the second quarter of 2023 compared to a net loss of $4.6 million

in the second quarter of 2022. The increase in net loss, despite

costs being in-line with expectations, was primarily driven by the

increases in SG&A described above, as well as the impact of

reduced second quarter revenue due to the delayed start of the

wildfire season. Adjusted EBITDA was $1.0 million in the second

quarter of 2023, compared to $2.0 million in the second quarter of

2022. Adjusted EBITDA excludes interest expense, depreciation and

amortization, stock-based compensation, gains, and losses on

disposals of assets, legal fees and offering costs related to

financing and other transactions and business development and

integration expenses.

Definitions and reconciliations of net loss to

EBITDA and Adjusted EBITDA, are attached as Exhibit A to this

release.

At June 30, 2023, cash and short term investments

stood at $25.7 million which was affected by the late start to the

fire season, however, the balance sheet remains strong and incoming

receivables from the fire season is expected to increase the cash

balance in the coming months.

Year to Date Results Revenue for

the first six months of 2023 was $12.0 million compared to $12.8

million in the first six months of 2022.

Cost of revenues was $17.8 million in the first

six months of 2023 and was comprised of flight operations expenses

of $10.0 million and maintenance expenses of $7.7 million. This

compares to $15.9 million in the first six months of 2022, which

included $9.5 million of flight operations expenses and $6.4

million of maintenance expenses.

SG&A expenses were $48.4 million in the first

six months of 2023 compared to $10.6 million for the first six

months of 2022. The increase was primarily driven by non-cash

stock-based compensation expense of $31.9 million for RSUs.

Interest expense for the first six months of 2023

increased to $11.2 million from $6.0 million in the first six

months of 2022. Bridger also reported Other Income of $1.7 million

for the first six months of 2023 compared to $0.3 million for the

first six months of 2022.

Bridger reported a net loss of $63.7 million in

the first six months of 2023 compared to a net loss of $19.4

million in the first six months of 2022. Adjusted EBITDA was

negative ($9.7) million in the first six months of 2023, compared

to negative ($6.9) million in the six months of 2022.

Conference Call Bridger Aerospace

will hold an investor conference call on Thursday, August 10, 2023

at 5:00 p.m. Eastern Time (3:00 p.m. Mountain Time) to discuss

these results, its current financial position and business outlook.

Interested parties can access the conference call by dialing

877-407-0789 or 201-689-8562. The conference call will also be

broadcast live on the Investor Relations section of our website at

https://ir.bridgeraerospace.com. An audio replay will be available

through August 17, 2023 by calling 844-512-2921 or 412-317-6671 and

using the passcode 13740056. The replay will also be accessible at

https://ir.bridgeraerospace.com.

About Bridger Aerospace Based in

Belgrade, Montana, Bridger Aerospace Group Holdings, Inc. is one of

the nation’s largest aerial firefighting companies. Bridger

Aerospace is committed to utilizing its team, aircraft and

technology to save lives, property and habitats threatened by

wildfires. Bridger Aerospace provides aerial firefighting and

wildfire management services to federal and state government

agencies, including the United States Forest Service, across the

nation. More information about Bridger Aerospace is available

at https://www.bridgeraerospace.com.

Investor Contacts Alison Ziegler

Darrow Associates 201-220-2678 aziegler@darrowir.com

Forward Looking Statements

Certain statements included in this press release

are not historical facts but are forward-looking statements,

including for purposes of the safe harbor provisions under the

United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally are accompanied by words such

as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “project,”

“forecast,” “predict,” “poised,” “positioned,” “potential,” “seem,”

“seek,” “future,” “outlook,” “target,” and similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters, but the absence of these words

does not mean that a statement is not forward-looking. These

forward-looking statements include, but are not limited to, (1)

anticipated expansion of Bridger’s operations and increased

deployment of Bridger’s aircraft fleet; (2) Bridger’s business

plans and growth plans, including anticipated revenue, Adjusted

EBITDA and Adjusted EBITDA margin for 2023; (3) increases in the

aerial firefighting market; and (4) anticipated investments in

additional aircraft, capital resource, and research and development

and the effect of these investments. These statements are based on

various assumptions, whether or not identified in this press

release, and on the current expectations of Bridger’s management

and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as and must not be relied on by

any investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions. Many actual events and circumstances are

beyond the control of Bridger. These forward-looking statements are

subject to a number of risks and uncertainties, including: changes

in domestic and foreign business, market, financial, political and

legal conditions; Bridger’s ability to successfully and timely

develop, sell and expand its technology and products, and otherwise

implement its growth strategy; risks relating to Bridger’s

operations and business, including information technology and

cybersecurity risks, loss of requisite licenses, flight safety

risks, loss of key customers and deterioration in relationships

between Bridger and its employees; risks related to increased

competition; risks relating to potential disruption of current

plans, operations and infrastructure of Bridger; risks that Bridger

is unable to secure or protect its intellectual property; risks

that Bridger experiences difficulties managing its growth and

expanding operations; the ability to compete with existing or new

companies that could cause downward pressure on prices, fewer

customer orders, reduced margins, the inability to take advantage

of new business opportunities, and the loss of market share; the

impact of the coronavirus pandemic; the ability to successfully

select, execute or integrate future acquisitions into the business,

which could result in material adverse effects to operations and

financial conditions; and those factors discussed in the sections

entitled “Risk Factors” and “Cautionary Statement Regarding

Forward-Looking Statements” included in Bridger’s Annual Report on

Form 10-K filed with the U.S. Securities and Exchange Commission on

March 20, 2023. If any of these risks materialize or our

assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. The

risks and uncertainties above are not exhaustive, and there may be

additional risks that Bridger presently does not know or that

Bridger currently believes are immaterial that could also cause

actual results to differ from those contained in the

forward-looking statements. In addition, forward looking statements

reflect Bridger’s expectations, plans or forecasts of future events

and views as of the date of this press release. Bridger anticipates

that subsequent events and developments will cause Bridger’s

assessments to change. However, while Bridger may elect to update

these forward-looking statements at some point in the future,

Bridger specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing Bridger’s assessments as of any date subsequent to the

date of this press release. Accordingly, undue reliance should not

be placed upon the forward-looking statements contained in this

press release.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

BRIDGER

AEROSPACE GROUP HOLDINGS, LLC |

|

| |

|

|

(PREDECESSOR

TO BRIDGER AEROSPACE GROUP HOLDINGS, INC.) |

|

| |

|

|

CONSOLIDATED

STATEMENTS OF OPERATIONS |

|

| |

|

|

(All amounts in U.S.

dollars) |

|

| |

|

|

(unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

For the three months ended June 30, |

|

For the six months ended June 30, |

|

| |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

| |

|

|

Revenues |

|

|

$ |

11,615,280 |

|

|

$ |

12,753,671 |

|

|

$ |

11,980,653 |

|

|

$ |

12,822,963 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Cost of

revenues: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

Flight operations |

|

|

|

6,299,122 |

|

|

|

5,849,562 |

|

|

|

10,032,383 |

|

|

|

9,514,914 |

|

|

| |

|

|

Maintenance |

|

|

|

4,210,976 |

|

|

|

3,571,986 |

|

|

|

7,726,427 |

|

|

|

6,433,973 |

|

|

| |

|

|

Total cost

of revenues |

|

|

|

10,510,098 |

|

|

|

9,421,548 |

|

|

|

17,758,810 |

|

|

|

15,948,887 |

|

|

| |

|

|

Gross profit (loss) |

|

|

|

1,105,182 |

|

|

|

3,332,123 |

|

|

|

(5,778,157 |

) |

|

|

(3,125,924 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Selling,

general and administrative expense |

|

|

|

15,187,808 |

|

|

|

5,735,627 |

|

|

|

48,416,299 |

|

|

|

10,576,886 |

|

|

| |

|

|

Operating loss |

|

|

|

(14,082,626 |

) |

|

|

(2,403,504 |

) |

|

|

(54,194,456 |

) |

|

|

(13,702,810 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Interest

expense |

|

|

|

(5,540,867 |

) |

|

|

(2,293,682 |

) |

|

|

(11,205,412 |

) |

|

|

(6,008,228 |

) |

|

| |

|

|

Other

income |

|

|

|

601,891 |

|

|

|

134,311 |

|

|

|

1,693,328 |

|

|

|

275,154 |

|

|

| |

|

|

Net loss |

|

|

$ |

(19,021,602 |

) |

|

$ |

(4,562,875 |

) |

|

$ |

(63,706,540 |

) |

|

$ |

(19,435,884 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Series A

Preferred Stock - adjustment for deemed dividend upon Closing |

|

|

|

- |

|

|

|

- |

|

|

|

(48,300,000 |

) |

|

|

- |

|

|

| |

|

|

Series A

Preferred Stock - adjustment to eliminate 50% multiplier |

|

|

|

- |

|

|

|

- |

|

|

|

156,362,598 |

|

|

|

- |

|

|

| |

|

|

Series A

Preferred Stock - adjustment to maximum redemption value |

|

|

|

(5,805,582 |

) |

|

|

- |

|

|

|

(10,080,022 |

) |

|

|

- |

|

|

| |

|

|

Legacy

Bridger Series C Preferred Shares - adjustment to maximum

redemptions value |

|

|

|

- |

|

|

|

(191,240,782 |

) |

|

|

- |

|

|

|

(191,240,782 |

) |

|

| |

|

|

Legacy

Bridger Series A Preferred Shares - adjustment for redemption,

extinguishment, accrued interes and change in fair value |

|

|

|

- |

|

|

|

(81,323,569 |

) |

|

|

- |

|

|

|

(85,663,336 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Net (loss)

income per share attributable to Class A Common Stockholders -

basic and diluted |

|

|

|

(24,827,184 |

) |

|

|

(277,127,226 |

) |

|

|

34,276,036 |

|

|

|

(296,340,002 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Net (loss)

income per share of Common Stock - basic |

|

|

$ |

(0.55 |

) |

|

$ |

(7.15 |

) |

|

$ |

0.77 |

|

|

$ |

(7.64 |

) |

|

| |

|

|

Net (loss)

income per share of Common Stock - diluted |

|

|

$ |

(0.55 |

) |

|

$ |

(7.15 |

) |

|

$ |

0.44 |

|

|

$ |

(7.64 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Weighted-average Common stock outstanding - basic |

|

|

|

45,388,392 |

|

|

|

38,770,646 |

|

|

|

44,443,930 |

|

|

|

38,770,646 |

|

|

| |

|

|

Weighted-average Common stock outstanding - diluted |

|

|

|

45,388,392 |

|

|

|

38,770,646 |

|

|

|

77,199,129 |

|

|

|

38,770,646 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

BRIDGER

AEROSPACE GROUP HOLDINGS, LLC |

|

| |

|

|

(PREDECESSOR

TO BRIDGER AEROSPACE GROUP HOLDINGS, INC.) |

|

| |

|

|

CONSOLIDATED

BALANCE SHEETS |

|

| |

|

|

(All amounts in U.S.

dollars) |

|

| |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

As of June

30, |

|

As of

December 31, |

|

| |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

| |

|

|

ASSETS |

|

|

|

|

|

|

| |

|

|

Current

assets |

|

|

|

|

|

|

| |

|

|

Cash and cash equivalents |

|

|

$ |

844,582 |

|

|

$ |

30,162,475 |

|

|

| |

|

|

Restricted cash |

|

|

|

12,239,819 |

|

|

|

12,297,151 |

|

|

| |

|

|

Investments in marketable securities |

|

|

|

12,572,950 |

|

|

|

54,980,156 |

|

|

| |

|

|

Accounts receivable |

|

|

|

11,815,732 |

|

|

|

28,902 |

|

|

| |

|

|

Aircraft support parts |

|

|

|

434,894 |

|

|

|

1,761,270 |

|

|

| |

|

|

Prepaid expenses and other current assets |

|

|

|

2,892,240 |

|

|

|

1,835,032 |

|

|

| |

|

|

Deferred offering costs |

|

|

|

388,120 |

|

|

|

5,800,144 |

|

|

| |

|

|

Total

current assets |

|

|

|

41,188,337 |

|

|

|

106,865,130 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Property,

plant, and equipment, net |

|

|

|

202,050,389 |

|

|

|

192,091,413 |

|

|

| |

|

|

Intangible

assets, net |

|

|

|

155,369 |

|

|

|

208,196 |

|

|

| |

|

|

Goodwill |

|

|

|

2,457,937 |

|

|

|

2,457,937 |

|

|

| |

|

|

Other

noncurrent assets |

|

|

|

7,583,603 |

|

|

|

4,356,225 |

|

|

| |

|

|

Total assets |

|

|

$ |

253,435,635 |

|

|

$ |

305,978,901 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

LIABILITIES, MEZZANINE EQUITY AND MEMBERS’

EQUITY |

|

|

|

|

|

| |

|

|

Current

liabilities |

|

|

|

|

|

|

| |

|

|

Accounts

payable |

|

|

$ |

6,235,941 |

|

|

$ |

3,170,354 |

|

|

| |

|

|

Accrued

expenses and other current liabilities |

|

|

|

7,823,154 |

|

|

|

18,669,572 |

|

|

| |

|

|

Operating

right-of-use liability |

|

|

|

355,119 |

|

|

|

21,484 |

|

|

| |

|

|

Current

portion of long-term debt, net of debt issuance costs |

|

|

|

2,459,654 |

|

|

|

2,445,594 |

|

|

| |

|

|

Total current liabilities |

|

|

|

16,873,868 |

|

|

|

24,307,004 |

|

|

| |

|

|

Long-term accrued expenses and other noncurrent liabilities |

|

6,864,516 |

|

|

|

45,659 |

|

|

| |

|

|

Operating

right-of-use noncurrent liability |

|

|

|

1,449,911 |

|

|

|

754,673 |

|

|

| |

|

|

Long-term

debt, net of debt issuance costs |

|

|

|

205,060,810 |

|

|

|

205,471,958 |

|

|

| |

|

|

Total liabilities |

|

|

$ |

230,249,105 |

|

|

$ |

230,579,294 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

MEZZANINE EQUITY |

|

|

|

|

|

|

| |

|

|

Series A

Preferred Stock |

|

|

|

342,738,969 |

|

|

|

- |

|

|

| |

|

|

Legacy

Bridger Series C Preferred Shares |

|

|

|

- |

|

|

|

489,021,545 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

STOCKHOLDERS' Deficit |

|

|

|

|

|

|

| |

|

|

Common

Stock |

|

|

|

4,906 |

|

|

|

3,908 |

|

|

| |

|

|

Additional

paid-in-capital |

|

|

|

78,977,391 |

|

|

|

- |

|

|

| |

|

|

Accumulated

deficit |

|

|

|

(400,054,307 |

) |

|

|

(415,304,343 |

) |

|

| |

|

|

Accumulated

other comprehensive income |

|

|

|

1,519,571 |

|

|

|

1,678,497 |

|

|

| |

|

|

Total

stockholders’ deficit |

|

|

|

(319,552,439 |

) |

|

|

(413,621,938 |

) |

|

| |

|

|

Total liabilities, mezzanine equity and stockholders’ deficit |

|

$ |

253,435,635 |

|

|

$ |

305,978,901 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

BRIDGER

AEROSPACE GROUP HOLDINGS, LLC |

|

| |

|

|

(PREDECESSOR

TO BRIDGER AEROSPACE GROUP HOLDINGS, INC.) |

|

| |

|

|

CONSOLIDATED

STATEMENTS OF CASH FLOWS |

|

| |

|

|

(All amounts in U.S.

dollars) |

|

| |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

For the six months ended June 30, |

|

| |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

| |

|

|

Cash Flows

from Operating Activities: |

|

|

|

|

|

|

| |

|

|

Net

loss |

|

|

$ |

(63,706,540 |

) |

|

$ |

(19,435,884 |

) |

|

| |

|

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities |

|

|

|

|

|

| |

|

|

Loss on sale of fixed assets |

|

|

|

392,472 |

|

|

|

781,492 |

|

|

| |

|

|

Depreciation and amortization |

|

|

|

4,986,192 |

|

|

|

4,094,854 |

|

|

| |

|

|

Impairment of long-lived assets |

|

|

|

626,848 |

|

|

|

- |

|

|

| |

|

|

Stock based compensation expense |

|

|

|

32,045,584 |

|

|

|

4,780 |

|

|

| |

|

|

Change in fair value of the Warrants |

|

|

|

(533,000 |

) |

|

|

- |

|

|

| |

|

|

Change in fair value of freestanding

derivative |

|

|

|

50,559 |

|

|

|

- |

|

|

| |

|

|

Amortization of debt issuance costs |

|

|

|

483,526 |

|

|

|

89,732 |

|

|

| |

|

|

Interest accrued on Legacy Bridger Series B

Preferred Shares |

|

|

|

- |

|

|

|

3,586,587 |

|

|

| |

|

|

Change in fair value of Legacy Bridger Series C

Preferred shares |

|

|

|

- |

|

|

|

945,455 |

|

|

| |

|

|

Change in fair vlaue of Series A Preferred

Stock |

|

|

|

(224,080 |

) |

|

|

- |

|

|

| |

|

|

Realized gain on investments in marketable

securities |

|

|

|

(407,761 |

) |

|

|

- |

|

|

| |

|

|

Changes in operating assets and liabilities: |

|

|

|

- |

|

|

|

- |

|

|

| |

|

|

Accounts receivable |

|

|

|

(11,786,830 |

) |

|

|

(4,611,847 |

) |

|

| |

|

|

Aircraft support parts |

|

|

|

1,326,376 |

|

|

|

170,475 |

|

|

| |

|

|

Prepaid expense and other current assets |

|

|

|

(3,339,409 |

) |

|

|

522,745 |

|

|

| |

|

|

Accounts payable, accrued expense and other

liabilities |

|

|

|

(13,358,549 |

) |

|

|

3,822,406 |

|

|

| |

|

|

Net cash

used in operating activities |

|

|

|

(53,444,612 |

) |

|

|

(10,029,205 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Cash Flows

from Investing Activities: |

|

|

|

|

|

|

| |

|

|

Investments in construction in progress –

buildings |

|

|

|

(2,444,633 |

) |

|

|

(3,983,754 |

) |

|

| |

|

|

Proceeds from sales and maturities of marketable

securities |

|

|

|

42,723,969 |

|

|

|

- |

|

|

| |

|

|

Sale of property, plant and equipment |

|

|

|

814,000 |

|

|

|

286,400 |

|

|

| |

|

|

Purchases of property, plant and equipment |

|

|

|

(12,528,089 |

) |

|

|

(5,300,950 |

) |

|

| |

|

|

Net cash

provided by (used in) investing activities |

|

|

|

28,565,247 |

|

|

|

(8,998,304 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Cash Flows

from Financing Activities: |

|

|

|

|

|

|

| |

|

|

Payment to Legacy Bridger Series A Preferred

shares members |

|

|

|

- |

|

|

|

(100,000,000 |

) |

|

| |

|

|

Payment to Legacy Bridger Series B Preferred

shares members |

|

|

|

- |

|

|

|

(69,999,223 |

) |

|

| |

|

|

Borrowing from Legacy Bridger Series C Preferred

shares members, net of issuance costs |

|

- |

|

|

|

293,684,675 |

|

|

| |

|

|

Payment of finance lease liability |

|

|

|

(15,615 |

) |

|

|

- |

|

|

| |

|

|

Proceeds from the Closing |

|

|

|

3,193,536 |

|

|

|

- |

|

|

| |

|

|

Costs incurred related to the Closing |

|

|

|

(6,793,574 |

) |

|

|

- |

|

|

| |

|

|

Borrowings from various First Interstate Bank

vehicle loans |

|

|

|

- |

|

|

|

202,217 |

|

|

| |

|

|

Payment of debt issuance costs |

|

|

|

- |

|

|

|

(3,000 |

) |

|

| |

|

|

Repayments on debt |

|

|

|

(880,613 |

) |

|

|

(962,904 |

) |

|

| |

|

|

Net cash

used in financing activities |

|

|

|

(4,496,266 |

) |

|

|

122,921,765 |

|

|

| |

|

|

Effect of exchange rate changes |

|

|

|

406 |

|

|

|

(263 |

) |

|

| |

|

|

Net change

in cash, cash equivalents and restricted cash |

|

|

|

(29,375,225 |

) |

|

|

103,893,993 |

|

|

| |

|

|

Cash, cash

equivalents and restricted cash – beginning of the period |

|

|

|

42,459,626 |

|

|

|

17,261,132 |

|

|

| |

|

|

Cash, cash

equivalents and restricted cash – end of the period |

|

|

$ |

13,084,401 |

|

|

$ |

121,155,125 |

|

|

| |

|

|

Less:

Restricted cash – end of the year |

|

|

|

12,239,819 |

|

|

|

3,922,506 |

|

|

| |

|

|

Cash and

cash equivalents – end of the year |

|

|

$ |

844,582 |

|

|

$ |

117,232,619 |

|

|

| |

|

|

|

|

|

|

|

|

|

EXHIBIT A Non-GAAP

Results and Reconciliations

Although Bridger believes that net income or loss,

as determined in accordance with GAAP, is the most appropriate

earnings measure, we use EBITDA and Adjusted EBITDA as key

profitability measures to assess the performance of our business.

Bridger believes these measures help illustrate underlying trends

in our business and use the measures to establish budgets and

operational goals, and communicate internally and externally, for

managing our business and evaluating its performance. Bridger also

believes these measures help investors compare our operating

performance with its results in prior periods in a way that is

consistent with how management evaluates such performance.

Each of the profitability measures described below

are not recognized under GAAP and do not purport to be an

alternative to net income or loss determined in accordance with

GAAP as a measure of our performance. Such measures have

limitations as analytical tools and you should not consider any of

such measures in isolation or as substitutes for our results as

reported under GAAP. EBITDA and Adjusted EBITDA exclude items that

can have a significant effect on our profit or loss and should,

therefore, be used only in conjunction with our GAAP profit or loss

for the period. Bridger’s management compensates for the

limitations of using non-GAAP financial measures by using them to

supplement GAAP results to provide a more complete understanding of

the factors and trends affecting the business than GAAP results

alone. Because not all companies use identical calculations, these

measures may not be comparable to other similarly titled measures

of other companies.

Bridger does not provide a reconciliation of

forward-looking measures where Bridger believes such a

reconciliation would imply a degree of precision and certainty that

could be confusing to investors and is unable to reasonably predict

certain items contained in the GAAP measures without unreasonable

efforts, such as acquisition costs, integration costs and loss on

the disposal or obsolescence of aging aircraft. This is due to the

inherent difficulty of forecasting the timing or amount of various

items that have not yet occurred and are out of Bridger’s control

or cannot be reasonably predicted. For the same reasons, Bridger is

unable to address the probable significance of the unavailable

information. Forward-looking non-GAAP financial measures provided

without the most directly comparable GAAP financial measures may

vary materially from the corresponding GAAP financial measures.

EBITDA and Adjusted EBITDA

EBITDA is a non-GAAP profitability measure that

represents net income or loss for the period before the impact of

the interest expense, income tax expense (benefit) and depreciation

and amortization of property, plant and equipment and intangible

assets. EBITDA eliminates potential differences in performance

caused by variations in capital structures (affecting financing

expenses), the cost and age of tangible assets (affecting relative

depreciation expense) and the extent to which intangible assets are

identifiable (affecting relative amortization expense).

Adjusted EBITDA is a non-GAAP profitability

measure that represents EBITDA before certain items that are

considered to hinder comparison of the performance of our

businesses on a period-over-period basis or with other businesses.

During the periods presented, we exclude from Adjusted EBITDA gains

and losses on disposals of assets, legal fees and offering costs

related to financing and other transactions, which include costs

that are required to be expensed in accordance with GAAP. In

addition, we exclude from Adjusted EBITDA non-cash stock-based

compensation and business development expenses. Our management

believes that the inclusion of supplementary adjustments to EBITDA

applied in presenting Adjusted EBITDA are appropriate to provide

additional information to investors about certain material non-cash

items and about unusual items that we do not expect to continue at

the same level in the future.

The following table reconciles net loss, the most

directly comparable GAAP measure, to EBITDA and Adjusted EBITDA for

the three and six months ended June 30, 2023 and 2022.

| |

|

For the three months ended June 30, |

|

For the six months ended June 30, |

| (All amounts

in U.S. dollars) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(19,021,602 |

) |

|

$ |

(4,562,875 |

) |

|

$ |

(63,706,540 |

) |

|

$ |

(19,435,884 |

) |

| Depreciation

and amortization |

|

|

3,235,147 |

|

|

|

2,827,932 |

|

|

|

4,986,192 |

|

|

|

4,094,854 |

|

| Interest

expense |

|

|

5,540,867 |

|

|

|

2,293,682 |

|

|

|

11,205,412 |

|

|

|

6,008,228 |

|

| EBITDA |

|

|

(10,245,588 |

) |

|

|

558,739 |

|

|

|

(47,514,936 |

) |

|

|

(9,332,802 |

) |

| Loss on

disposals (i) |

|

|

1,053,866 |

|

|

|

- |

|

|

|

1,052,407 |

|

|

|

781,492 |

|

| Offering

costs (ii) |

|

|

1,184,487 |

|

|

|

1,213,198 |

|

|

|

3,267,607 |

|

|

|

1,213,198 |

|

| Stock-based

comp (iii) |

|

|

8,612,514 |

|

|

|

2,222 |

|

|

|

32,610,530 |

|

|

|

4,780 |

|

| Business

development (iv) |

|

|

354,455 |

|

|

|

236,603 |

|

|

|

873,277 |

|

|

|

391,976 |

|

| Adjusted

EBITDA |

|

$ |

959,734 |

|

|

$ |

2,010,762 |

|

|

$ |

(9,711,115 |

) |

|

$ |

(6,941,356 |

) |

| |

|

|

|

|

|

|

|

|

i) Represents loss on the disposal and impairment on aging

surveillance aircraft.

ii) Represents one-time professional service fees related to the

preparation for potential offerings that have been expensed during

the period.

iii) Represents stock-based compensation expense recognized for

RSUs granted to certain executives and senior management and the

fair value adjustment for warrants issued in connection with the

Business Combination.

iv) Represents expenses related to potential acquisition targets

and additional business lines.

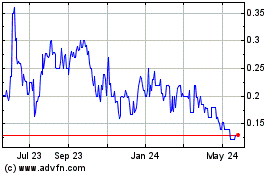

Bridger Aerospace (NASDAQ:BAERW)

Historical Stock Chart

From Oct 2024 to Nov 2024

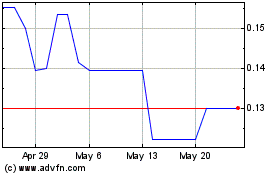

Bridger Aerospace (NASDAQ:BAERW)

Historical Stock Chart

From Nov 2023 to Nov 2024