false

0001746109

0001746109

2024-06-18

2024-06-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

June 18, 2024 |

Bank First Corporation

(Exact name of registrant

as specified in its charter)

| Wisconsin |

001-38676 |

39-1435359 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 402 North 8th Street, Manitowoc, WI |

54220 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code |

(920) 652-3100 |

N/A

(Former name or former address,

if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Ticker symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

BFC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for company with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective June 17, 2024, Bank First Corporation

director David R. Sachse retired from the Board of Directors (the “Board”). New director Erin A. Davis was elected to the

Board.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

Bank First Corporation (the “Company”)

held its 2024 Annual Meeting of Shareholders on June 17, 2024 (the “Annual Meeting”). Following is a summary of the proposals

that were submitted to the shareholders for approval and a tabulation of the votes with respect to each proposal.

Proposal 1

The proposal was to elect as directors the five

(5) nominees named in the proxy statement to serve until the 2027 Annual Meeting of Shareholders.

| Nominee | |

Votes For | | |

Vote Against | | |

Abstentions | | |

Broker Non-Votes | |

| Mary-Kay H. Bourbulas | |

4,785,056 | | |

511,273 | | |

0 | | |

1,776,456 | |

| Erin A. Davis | |

5,273,256 | | |

23,073 | | |

0 | | |

1,776,456 | |

| Robert D. Gregorski | |

4,942,071 | | |

354,258 | | |

0 | | |

1,776,456 | |

| Phillip R. Maples | |

5,067,121 | | |

229,209 | | |

0 | | |

1,776,456 | |

| Peter J. Van Sistine | |

5,246,718 | | |

49,611 | | |

0 | | |

1,776,456 | |

Proposal 2

The proposal was to ratify the appointment of

Forvis Mazars, LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024.

| Votes For |

|

|

Votes

Against |

|

|

Abstentions |

|

|

Broker Non-Votes |

|

| 7,008,433 |

|

|

9,777 |

|

|

54,575 |

|

|

0 |

|

Proposal 3

The proposal was an advisory vote on the compensation of the Company’s

named executive officers.

| Votes For | | |

Votes

Against | | |

Abstentions | | |

Broker Non-Votes | |

| 4,943,706 | | |

204,850 | | |

147,773 | | |

1,776,456 | |

Proposal 4

The proposal was an advisory vote on the frequency

of the advisory vote on the Company’s executive compensation.

| Three Years | | |

Two Years | | |

One Year | | |

Abstain | | |

Broker Non-Votes | |

| | 2,381,143 | | |

| 171,866 | | |

| 2,633,221 | | |

| 110,100 | | |

| 1,776,456 | |

| Item 7.01 | Regulation FD Disclosure. |

The Company made a presentation to its shareholders

at the Annual Meeting. A copy of the presentation is attached as Exhibit 99.2 to this Report on Form 8-K and is incorporated herein by

reference.

Pursuant to General Instruction B.2 of Form 8-K,

the information in this Item 7.01 and Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed

to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise

subject to the liabilities under that Section. Furthermore, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to

be incorporated by reference into the filings of the Registrant under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

BANK FIRST CORPORATION |

| |

|

| |

|

| Date: June

18, 2024 |

By: |

/s/ Kevin M. LeMahieu |

| |

|

Kevin M. LeMahieu |

| |

|

Chief Financial Officer |

Exhibit 99.1

| NEWS release |

|

P.O. Box 10, Manitowoc,

WI 54221-0010

For further information, contact:

Rachel Oakes, Marketing Communications Manager

Phone: (608) 372-2265 | roakes@bankfirst.com

FOR IMMEDIATE RELEASE

Bank First Corporation Announces Board Changes

and Celebrates Retirement of Two Directors

MANITOWOC, WI, June 18, 2024 – Bank First

Corporation (NASDAQ: BFC), the holding company for Bank First, N.A., announced changes to its Board of Directors, including the

retirement of two esteemed Directors, Michael G. Ansay and David R. Sachse, and the appointment of Mary-Kay H. Bourbulas as Lead Independent

Director and Erin A. Davis as Director.

| Michael G. Ansay became a Director of the Corporation and Bank in February 2010, and his retirement

from the Board took effect on January 15, 2024. Significant milestones marked his leadership journey within the organization. In 2012,

he was appointed Vice-Chairman and quickly advanced to the role of Chairman in January 2013. During his nearly decade-long tenure as

Chairman of the Board from January 2013 to June 2022, Mr. Ansay provided exceptional strategic direction, steering the Bank through

pivotal periods of growth and change. To help facilitate a smooth transition, the role of Chairman was transitioned to Mike Molepske,

Chief Executive Officer of Bank First, in June 2022, in advance of Mr. Ansay’s planned retirement. Over his 14 years of service,

Mr. Ansay’s visionary leadership and unwavering commitment to excellence have been instrumental in shaping the organization's

success. |

|

Bank First remains steadfast in its commitment

to the strategic partnership with Ansay & Associates, a second-generation independent insurance agency renowned for delivering integrated

insurance, risk management, and benefits solutions tailored to businesses, families, and individuals. This valued relationship allows

Bank First to extend a wide array of world-class insurance products to its customers, enhancing their overall financial security and

peace of mind.

| David R. Sachse became a Director of the Corporation and the Bank in June 2010. Bringing a wealth

of experience in financial planning and analysis, internal audit, compliance, and acquisition structuring, Mr. Sachse has played a

crucial role in Bank First’s growth and success over the past 14 years. In addition, Mr. Sachse served as Lead Independent Director,

a role he initiated to ensure the best interests of both the directors and the Bank’s senior management team were always at the

forefront. Through his insightful approach to business development, Sachse assisted the Bank in identifying and capitalizing on new

opportunities, driving substantial growth. Sachse’s leadership and keen business acumen have been instrumental in navigating

complex financial landscapes, ensuring the Bank's competitive edge and long-term success. His retirement from the Board of Directors

of Bank First and Bank First Corporation was effective June 17, 2024. |

|

Mr. Ansay and Mr. Sachse have served on the Board

with remarkable distinction, delivering invaluable guidance and steadfast support crucial to the Bank's success. During their tenure,

Bank First significantly expanded its footprint across Wisconsin through strategic acquisitions and the establishment of de novo offices

in new markets. It also experienced extraordinary asset growth, increasing from $832 million in 2010 to $4.2 billion today. The retirement

of Mr. Ansay and Mr. Sachse was celebrated at the Bank's annual meeting on Monday, June 17, 2024.

“We are honored to recognize Mike Ansay

and David Sachse, who have retired after many years of dedicated service. I feel grateful to have known and worked with them both personally

and professionally,” stated Mike Molepske, Chief Executive Officer and Chairman of the Board. “Their visionary contributions

have solidified Bank First’s position as one of the top-performing banks in the country. We are deeply grateful for their years

of service and wish them all the best in their future endeavors.”

| Mary-Kay H. Bourbulas was appointed the new Lead Independent Director and transitioned into

the role before Mr. Sachse’s retirement. Ms. Bourbulas brings a wealth of experience and leadership to this critical role, ensuring

the continued independence and effectiveness of the Board. She became a Director of the Company and the Bank in July 2019. Her experience

in evaluating and managing secured assets and troubled loans, coupled with her tenure in the investment services industry, brings valuable

expertise to Bank First’s Board. As Lead Independent Director, Ms. Bourbulas will serve as a liaison between the Chairman of

the Board and the independent directors. Ms. Bourbulas is also the Chair of the Governance and Nominating Committee. |

|

| Erin A. Davis became a Director of the Bank on April 16, 2024, and was elected to the Board

of Directors of Bank First Corporation effective June 17, 2024. As the CEO of Quality Roasting, Inc., a Wisconsin-based soybean processing

company, Davis brings valuable experience in business management. Her diverse background and critical thinking skills enrich the Board’s

capabilities, fostering an environment of innovative thinking and strategic planning. Davis’s perspective will be instrumental

in driving the Bank's vision forward and ensuring it remains adaptable and resilient in an ever-evolving industry. |

|

“The blend of seasoned leadership and new

insights positions Bank First and our Board for a dynamic and successful future," Molepske commented. "Mary-Kay has consistently

shown outstanding leadership, strategic vision, and a deep commitment to our values. The Board has full confidence in her ability to

lead us through future opportunities and endeavors. We also warmly welcome Erin to the Board. She brings experience and fresh perspectives

that will be invaluable as we continue to innovate and grow.”

# # #

Bank First Corporation (NASDAQ: BFC) provides

financial services through its subsidiary, Bank First, N.A., which was incorporated in 1894. Bank First offers loan, deposit, and treasury

management products at each of its 26 banking locations in Wisconsin. The Bank has grown through both acquisitions and de novo branch

expansion. The Bank employs approximately 379 full-time equivalent staff and has assets of approximately $4.2 billion. Insurance services

are available through its bond with Ansay & Associates, LLC. Trust, investment advisory, and other financial services are offered

in collaboration with several regional partners. Further information about Bank First Corporation is available by clicking on the Shareholder

Services tab at www.bankfirst.com.

Exhibit 99.2

| ANNUAL SHAREHOLDER MEETING

June 17, 2024 |

| Forward Looking Statements: This presentation may contain certain “forward

looking statements” that represent Bank First Corporation’s expectations or

beliefs concerning future events. Such forward looking statements are about

matters that are inherently subject to risks and uncertainties. Because of the

risks and uncertainties inherent in forward looking statements, readers are

cautioned not to place undue reliance on them, whether included in this

presentation or made elsewhere from time to time by Bank First Corporation

or on its behalf. Bank First Corporation disclaims any obligation to update

such forward looking statements. In addition, statements regarding historical

stock price performance are not indicative of or guarantees of future price

performance.

2

FORWARD-LOOKING STATEMENTS |

| 3

MIKE MOLEPSKE

Chairman and Chief Executive Officer |

| Board of Directors

4

WELCOME |

| Senior Management

5

WELCOME |

| Special Guests

6

WELCOME

MARK KANALY

Partner at Alston & Bird, LLP

SARAH SAUNDERS

Partner at Forvis Mazars |

| • Determination of Quorum

• Approval of Minutes

• Business to be Conducted

7

MEETING BUSINESS |

| To elect five (5) directors of the Company, each for three-year terms

and in each case until their successors are elected and qualified.

8

PROPOSAL 1

BOB

GREGORSKI

ERIN

DAVIS

PHIL

MAPLES

MARY-KAY

BOURBULAS

PETE

VAN SISTINE |

| 9

To ratify the appointment of FORVIS MAZARS, LLP as

the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2024.

PROPOSAL 2

To hold an advisory vote on the

compensation of the Company’s named

executive officers.

PROPOSAL 3 |

| 10

To hold an advisory vote on the frequency of

the advisory vote on executive compensation.

PROPOSAL 4

To transact such other business as may

properly come before the Annual Meeting or

any adjournments or postponements thereof.

PROPOSAL 5 |

| $11.25

$81.64

6/1/2010 6/1/2024

11

MIKE ANSAY

RETIRING DIRECTOR

• Joined Bank First Corporation in 2010

• Appointed Vice-Chairman in 2012

• Served as Chairman 2013-2022

• Chairman and CEO Ansay & Associates

• Managing member of Ansay Development

Corporation & Ansay International

BFC STOCK PRICE

626%

INCREASE |

| DAVE SACHSE

$11.25

$81.64

6/1/2010 6/1/2024

12

RETIRING DIRECTOR

• Joined Bank First Corporation in 2010

• Appointed Lead Independent

Director in 2022

• President and Owner of Landmark

Consultants, Inc.

BFC STOCK PRICE

626%

INCREASE |

| 13

NEW LEAD INDEPENDENT DIRECTOR

MARY-KAY BOURBULAS

• Joined Bank First Corporation in 2019

• Chair of the Governance and Nominating

Committee

• Served on the Board of Directors of

Partnership Community Bancshares, Inc.

from 2013-2019

• Co-owner, founder and manager of

Handen Distillery |

| 14

NEW DIRECTOR

ERIN DAVIS

• CEO of Quality Roasting, Inc.

• Founder of QR Transport, LLC

• Experience in engineering, sales and

management in dairy food processing

• 2024 Insight on Business “40 Under 40”

honoree |

| 15

TIM MCFARLANE

President |

| STATE OF THE BANK

BANK FIRST IN THE NEWS

BankDirector 2023 RankingBanking:

• Ranked #5 among banks with $1 billion - $5

billion in assets and #6 among the 300 largest

publicly-traded banks in the U.S.

S&P Global Market Intelligence

• Ranked #3 of 200 banks with $3 billion - $10

billion in assets.

Forbes' 15th Annual America's Best Banks

• Ranked 4th best-performing bank in the U.S.

Insight Magazine’s Fastest Growing Companies in the New North Region

• Recognized as #20 of the top 25 fastest growing companies in the New North region for 2023.

Raymond James Community Bankers Cup

• Awarded the Raymond James Community Bankers Cup for the fourth consecutive year. |

| 17

Scaling for Growth

• Reorganized frontline, retail banking, and business

banking functions

• Introduced new operations leadership

• Focus on talent development

Service Delivery

• Emphasizing the G.U.E.S.T. experience throughout the

organization

• Enabling personalized, solution-driven experiences

• Implementing a first-contact resolution model

Meaningful investments in technology

• Building an enhanced account opening platform

• Upgrading to an advanced online banking platform

STATE OF THE BANK

ELEVATING THE CUSTOMER EXPERIENCE

Kim Schmitz, VP – Branch Operations,

coaches Jason Pratt, a Teller in our

Manitowoc location.

G

U

E

S

T |

| 18

STATE OF THE BANK

INVESTING IN OUR FACILITIES

REEDSVILLE REMODEL

Completed in October 2023 |

| 19

STATE OF THE BANK

INVESTING IN OUR FACILITIES

SHAWANO REMODEL

Completed in December 2023

Jim Meyer, Market President,

represents Bank First at the official

ribbon cutting ceremony. |

| 20

STATE OF THE BANK

INVESTING IN OUR FACILITIES

NEW HOWARD OFFICE

Completed in January 2024 |

| 21

STATE OF THE BANK

INVESTING IN OUR FACILITIES

NEW FOND DU LAC OFFICE

Coming Late 2024! |

| 22

STATE OF THE BANK

INVESTING IN OUR FACILITIES

NEW STURGEON BAY OFFICE

Coming Early 2025 |

| 23

STATE OF THE BANK

INVESTING IN OUR FACILITIES

NEW DENMARK OFFICE

Coming Early 2025 |

| 24

KEVIN LEMAHIEU

Chief Financial Officer |

| Annual Earnings per Share (previous 10 years)

25

FINANCIAL REPORT

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21 Dec-22 Dec-23

Compounded annual growth rate:

10 year = 15.1%

6 year = 20.0% |

| Quarterly Earnings per Share (previous 5 years)

26

FINANCIAL REPORT

$0.80

$1.30

$1.80

$2.30

$2.80

$3.30

$3.80

Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23 |

| 27

FINANCIAL REPORT

Gain on Sales of Loans to the

Secondary Market per Quarter

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

$3,000,000

$3,500,000

$4,000,000

$4,500,000

Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23

Income from Paycheck Protection

Program Loans per Quarter

$0

$500,000

$1,000,000

$1,500,000

$2,000,000

$2,500,000

$3,000,000

$3,500,000

$4,000,000

$4,500,000

Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23 |

| 28

FINANCIAL REPORT

Quarterly Earnings Per Share (previous 5 years)

($1.00)

($0.50)

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24

Adjusted EPS Impact of Purchase Accounting Impact of Acquisition Costs

Gain on sale of UFS Other one-time events Total EPS |

| Quarterly Adjusted Earnings per Share (previous 5 years)

29

FINANCIAL REPORT

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

$1.80

Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23 |

| Net Interest Margin, Earning Asset Yield,

and Cost of Funds per Quarter

30

FINANCIAL REPORT

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

5.50%

6.00%

Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23

Net interest margin Yield on earning assets Cost of funds |

| 31

FINANCIAL REPORT

Strong Core Deposit Base (dollars in millions)

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2018 2019 2020 2021 2022 2023 Mar-24

Noninterest Bearing Time Deposits Other Interest Bearing

46%

55%

59%

55%

52% 54%

29%

26%

21%

15%

10%

25%

29%

54%

20%

26%

13%

31%

10%

32%

14%

31%

17%

31%

17% |

| 32

FINANCIAL REPORT

$1,124 $1,238 $1,316

$1,753 $1,793

$2,210

$2,718

$2,938

$3,660

$4,222 $4,100

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 3/31/2024

Asset Growth (in millions) |

| 33

FINANCIAL REPORT

Dividends Per Share

*Annualized based on the first two quarters of 2023.

$0.10

$0.30

$0.50

$0.70

$0.90

$1.10

$1.30

$1.50

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024*

One-time $0.29

special dividend |

| 34

STOCK PERFORMANCE (Total Return)

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

Value of $100 invested on June 1, 2014 (10 year)

BFC Russell 2000 S&P Regional Banking ETF

$462.72

$182.47

$155.33

10 yr. compounded annual growth rate:

BFC = 16.6%

Russell 2000 = 6.2%

S&P Regional Banking ETF = 4.5% |

| 35

QUESTIONS / COMMENTS |

| Who to contact:

36

SHAREHOLDER SERVICES TEAM

Please reach out to

Bank First Shareholder Services at

shareholderservices@bankfirst.com

or 920-652-3360.

Our dedicated team will be able to assist with any

questions or concerns you may have.

Business cards are available at the entrance. |

| Thank You! |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

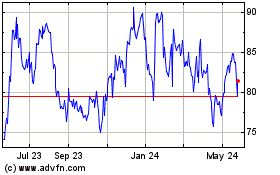

Bank First (NASDAQ:BFC)

Historical Stock Chart

From Nov 2024 to Dec 2024

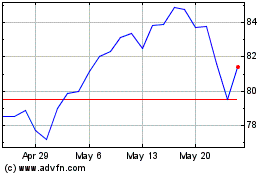

Bank First (NASDAQ:BFC)

Historical Stock Chart

From Dec 2023 to Dec 2024