Survey results indicate home furnishings brands

need to optimize the customer journey across various touchpoints

and gain insight into what products consumers buy online to

maximize sales and drive growth

BigCommerce (Nasdaq: BIGC), a leading open SaaS, composable

ecommerce platform for fast-growing and established B2C and B2B

brands and retailers, today announced the findings in its latest

consumer report, The Omnichannel Customer Journey: The New Buyer

Experience for Home Furnishings Shoppers. The survey, which

gathered insights from over 3,000 U.S. consumers, highlights the

diverse shopping behaviors that are motivating consumers to

purchase home goods, making it crucial for home furnishings brands

to better understand how and where their customers prefer to

shop.

“Today’s home furnishings shoppers are more informed and

selective than ever, blending in-store and online experiences to

make confident purchase decisions,” said Melissa Dixon, director of

brand and content marketing at BigCommerce. “These findings

highlight the importance of a robust omnichannel strategy, complete

with flexible payment options and highly personalized customer

engagement—key drivers not only for boosting sales but also for

fostering deep, long-term brand loyalty.”

The survey results reflect that a robust omnichannel strategy

that blends both online and in-store shopping is the golden key for

home furnishing brands to meet customer expectations, and remain

competitive and resilient in a quickly evolving market. Meanwhile,

promotions, emerging technology, sustainability and in-store

experiences show potential for fostering long-term brand

loyalty.

Where, What and How Consumers Prefer to Buy

While the pandemic fueled a surge in online shopping, its

aftermath has recovered interest in traditional in-store

experiences, with houseware retailers seeing steady foot traffic

throughout 2023. In fact, 48% of consumers prefer to purchase home

furnishings in-store, while 28% favor online shopping and 24% have

no preference.

Despite the majority favoring in-store purchases, more

respondents prefer to find inspiration for how they furnish their

home digitally, with home improvement shows (48%) and home decor

websites and blogs (47%) more popular than in-store browsing (40%).

However, when it comes to today’s digital touchpoints, social media

(48%) reigns supreme in product discovery, likely because of the

abundance of content available on platforms like Instagram and

TikTok that have the power to inspire viewers.

The report also revealed that 66% of shoppers purchased bedroom

essentials online, followed closely by home décor (56%) and storage

solutions (49%). Online marketplaces and big-box store websites are

also the favored choice for purchasing (54%), with most consumers

opting to buy mid-priced items ($100 – $499) from these channels.

It’s notable that shoppers prefer these channels over a brand’s

direct website (39%). Big-box store promotions or features like

Amazon’s free two-day shipping could drive this preference.

Flexible return policies, such as free pickup services, provide

the reassurance shoppers need to make a purchase. Over 60% of

respondents said they were more likely to purchase from an online

home furnishings brand that offers free return shipping, while no

restocking fees (37%), extended return windows (36%) and return

pickup services (34%) showed to be key factors most likely to

influence an online furnishings purchase.

Buy Online, Pick Up in Store (BOPIS) is No Longer a Perk –

But An Expectation

In the past year, 69% of shoppers have used BOPIS, while 36%

have used BOPIS 2-5 times. A whopping 80% of shoppers reported they

purchased additional items when picking up orders, while a

surprising 31% have never used BOPIS before, giving home

furnishings brands new opportunities to drive more sales and

increase repurchase rates.

Big-ticket items respondents were more likely to purchase using

BNPL are indoor furniture (42%), bedroom essentials (32%), outdoor

furniture (28%) and home decor (26%).

Consumers Using Emerging Technologies Are More Confident in

Their Purchases

While a majority of respondents (42%) have not used emerging

technologies, 27% have used virtual showrooms, 24% tried augmented

reality (AR) 3D displays, and 18% have taken advantage of in-store

virtual reality (VR) installations to interact with, and view,

products. It’s worth noting 47% of consumers reported more

confidence in their purchasing decisions when utilizing these

emerging technologies, indicating that consumers are poised to

start relying on these new tools to inform their purchases as they

become more integral in the shopping experience.

Offering online AR preview placements can help shoppers better

visualize products in their own homes. Similarly, VR tools can

allow shoppers to explore a brand’s offerings through in-store

installations or connecting their headsets to an online virtual

showroom. Brand’s like UPLIFT Desk gives shoppers the ability to

view 3D configurations of their desks in their own homes to help

them feel more comfortable with their purchase.

“When you buy online, you don’t know what the product is going

to look like in your space. As we move into a world with augmented

reality, we’re able to build the tools and products that help a

customer visualize and understand it,” explained Daniel Burrow,

vice president of growth at UPLIFT Desk, a BigCommerce

customer.

Promotions Channels and Types Heavily Influence Where

Consumers Shop

A compelling promotion can often persuade consumers to switch

from their preferred buying method. In fact, 82% of respondents who

prefer in-store purchases will likely buy online when an

online-only promotion is offered. Similarly, 76% of those who favor

online shopping will likely purchase at a physical store if

presented with an in-store-only promotion.

It’s worth noting that fewer online shoppers would switch to

in-store shopping, even with a promotion. This is likely because

many of these shoppers prefer the convenience of being able to

purchase at any time of the day (43%). With 61% of in-store

shoppers and 58% of online shoppers reporting promotions would

attract them to try a different buying method, it would be worth

home furnishing brands to consider prioritizing promotions such as

percentage discounts, BOGO and free gifts with purchase to attract

and retain customers.

Meanwhile, email marketing remains the most effective

promotional channel, with 55% of consumers preferring to receive

promotions via email.

Sustainability Matters, But Not at Any Cost

As more consumers prioritize going green, there is a growing

preference for sustainable products. For instance, while 39% of

respondents look to buy energy-efficient items and 34% look to buy

products with minimal or recycled packaging, the majority of

consumers are not willing to pay more than 10% extra for products

that align with their sustainability preferences. Most are

unwilling to pay any additional cost.

To attract eco-minded shoppers, home furnishings brands should

explore cost-effective ways to incorporate sustainable practices

into their products. Highlighting energy efficiency and

environmentally friendly packaging on product pages and shipping

materials can help differentiate them from competitors. A great

example is Molly Mutt who showcases their commitment to

sustainability through a dedicated page on their ecommerce site,

raising customer awareness of their green initiatives.

For home furnishings businesses to thrive in this challenging

landscape, it’s crucial to understand how their audiences prefer to

shop and what they value in a brand. With this insight, brands can

make strategic adjustments to their business models that

differentiate them from competitors.

BigCommerce works with leading home, garden and furniture

retailers including Chair King Backyard Store, Designerie, Jennifer

Taylor Home, Wovenbyrd and Burrow, who are leveraging these

strategies to elevate their customer shopping experiences and

accelerate growth.

Click here to download the full report and learn how your home

and garden brand can captivate customers with a beautiful

storefront that can help sell more, scale and convert. To see how

leading home, garden and furniture brands are succeeding on the

BigCommerce platform, visit here.

Methodology

BigCommerce conducted a consumer survey in August 2024. There

were 3,007 participants total across the Northeast (792), Southwest

(382), West (316), Southeast (883), and Midwest (634) of the United

States. The survey required all respondents to be 18 or older and

to have purchased at least one home furnishings product online in

the last 12 months.

All data referenced in this report is sourced from BigCommerce’s

consumer survey unless stated otherwise. Unless indicated

differently, the report highlights aggregated data.

About BigCommerce

BigCommerce (Nasdaq: BIGC) is a leading open SaaS and composable

ecommerce platform that empowers brands and retailers of all sizes

to build, innovate and grow their businesses online. BigCommerce

provides its customers sophisticated enterprise-grade

functionality, customization and performance with simplicity and

ease-of-use. Tens of thousands of B2C and B2B companies across 150

countries and numerous industries rely on BigCommerce, including

Burrow, Coldwater Creek, Francesca’s, Harvey Nichols, King Arthur

Baking Co., MKM Building Supplies, United Aqua Group and Uplift

Desk. For more information, please visit www.bigcommerce.com or

follow us on X and LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023080092/en/

Dana Marruffo dana.marruffo@bigcommerce.com

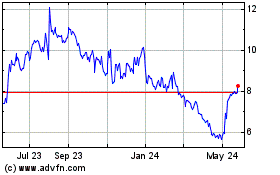

BigCommerce (NASDAQ:BIGC)

Historical Stock Chart

From Dec 2024 to Jan 2025

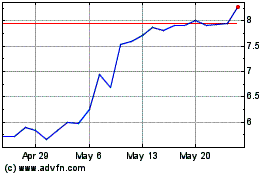

BigCommerce (NASDAQ:BIGC)

Historical Stock Chart

From Jan 2024 to Jan 2025