false

0001429764

0001429764

2024-09-17

2024-09-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 17, 2024

| BLINK

CHARGING CO. |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

001-38392 |

|

03-0608147 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5081 Howerton Way, Suite A

Bowie, Maryland |

|

20715 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

| Registrant’s

telephone number, including area code: (305) 521-0200 |

| N/A |

| (Former

name or former address, if changed since last report.) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock |

|

BLNK |

|

The

Nasdaq Stock Market LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CURRENT

REPORT ON FORM 8-K

Blink

Charging Co.

September

17, 2024

| Item

2.05. | Costs

Associated With Exit or Disposal Activities |

On

September 17, 2024, Blink Charging Co. (the “Company”) announced its cost reduction plan anticipated to reduce its global

personnel count by 14%, resulting in annualized savings of approximately $9.0 million (the “Plan”). The Plan will begin immediately

and be completed in the first quarter of 2025. The Plan aims to improve operational efficiencies by streamlining functions across the

Company. The estimates of the charges and expenditures that the Company expects to incur in connection with the Plan, and the timing

thereof, are subject to a number of assumptions, including local law requirements in various jurisdictions, and actual amounts may differ

materially from estimates. In addition, the Company may incur other charges or cash expenditures not currently contemplated due to unanticipated

events that may occur, including in connection with the implementation of the Plan.

The

Company issued a press release regarding the Plan, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Forward-Looking

Statements

This

Item 2.05 contains forward-looking statements as defined within Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. These forward-looking statements, and terms such as “anticipate,” “expect,”

“intend,” “may,” “will,” “should” or other comparable terms, involve risks and uncertainties

because they relate to events and depend on circumstances that will occur in the future. These statements include statements regarding

the intent, belief, or current expectations of the Company and members of its management, as well as the assumptions on which such statements

are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and

involve risks and uncertainties, including the possibility that its planned cost reduction actions will not result in the operational

efficiencies as anticipated by management and the risk factors described in the Company’s periodic reports filed with the SEC and

that actual results may differ materially from those contemplated by such forward-looking statements. Except as required by federal securities

law, the Company undertakes no obligation to update or revise forward-looking statements to reflect changed conditions.

| Item

9.01. | Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BLINK

CHARGING CO. |

| |

|

|

| Dated:

September 24, 2024 |

By: |

/s/

Michael P. Rama |

| |

Name: |

Michael

P. Rama |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Blink

Charging to Position Company for the Future by Implementing Planned Operational Cost Reductions

EV

Charging Infrastructure Leader to Implement Operational Cost Reduction Plan.

Bowie,

MD (September 17, 2024) – Blink Charging Co. (NASDAQ: BLNK) (“Blink” or the “Company”), a leading manufacturer,

owner, operator, and provider of electric vehicle (EV) charging equipment and services, today announced that it will implement its planned

operational cost reduction actions designed to position the Company for short and long-term success within current economic conditions.

The

cost reduction plan anticipates reducing the global personnel count by 14%, resulting in annualized savings of approximately $9 million.

It will begin immediately and be completed in the first quarter of 2025. The plan aims to improve operational efficiencies by streamlining

functions across the company.

Blink

is focused on strengthening its financial position by improving economic stability, profitability, and competitive positioning. Blink

plans to develop a more efficient and resilient organization that supports long-term growth and strategic advantage. These measures aim

to strengthen the Company’s financial performance and growth potential, benefiting shareholders through increased value and returns.

“The

timing of these cost-cutting measures, as indicated in our last earnings announcement, is a proactive step to adapt to current market

conditions while preserving our long-term strategy,” said President & CEO Brendan Jones. “We remain fully committed

to our mission to develop and deploy energy management services and pursue operational excellence and superior customer experience. These

operational changes will make Blink Charging a more efficient and effective organization that is better aligned with our strategic priorities.”

“We

believe the current economic and market challenges facing the EV industry are temporary,” added Blink Chief Operating Officer

and CEO Elect Michael Battaglia. “We are very optimistic about the future. The operational changes we are announcing today will

help us reduce costs and improve our financial performance right away. At the same time, these changes will also help us make faster

progress in establishing Blink as a top provider of electric transportation solutions and innovative technologies.”

###

About

Blink Charging

Blink

Charging Co. (Nasdaq: BLNK) is a global leader in electric vehicle (EV) charging equipment and services, enabling drivers, hosts, and

fleets to easily transition to electric transportation through innovative charging solutions. Blink’s principal line of products

and services include Blink’s EV charging networks (“Blink Networks”), EV charging equipment, and EV charging services.

Blink Networks use proprietary, cloud-based software that operates, maintains, and tracks the EV charging stations connected to the network

and the associated charging data. Blink has established key strategic partnerships for rolling out adoption across numerous location

types, including parking facilities, multifamily residences and condos, workplace locations, health care/medical facilities, schools

and universities, airports, auto dealers, hotels, mixed-use municipal locations, parks and recreation areas, religious institutions,

restaurants, retailers, stadiums, supermarkets, and transportation hubs.

For

more information, please visit https://blinkcharging.com/.

Forward-Looking

Statements

This

press release contains forward-looking statements as defined within Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, and terms such as “anticipate,”

“expect,” “intend,” “may,” “will,” “should” or other comparable terms, involve

risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. These statements include

statements regarding the intent, belief, or current expectations of Blink and members of its management, as well as the assumptions on

which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, including the possibility that its planned cost reduction actions will not result in

the operational efficiencies as anticipated by management and the risk factors described in Blink’s periodic reports filed with

the SEC and that actual results may differ materially from those contemplated by such forward-looking statements. Except as required

by federal securities law, Blink Charging undertakes no obligation to update or revise forward-looking statements to reflect changed

conditions.

Blink

Media Contact

Nipunika

Coe

PR@BlinkCharging.com

305-521-0200

ext. 266

Blink

Investor Relations Contact

Vitalie

Stelea

IR@BlinkCharging.com

305-521-0200

ext. 446

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

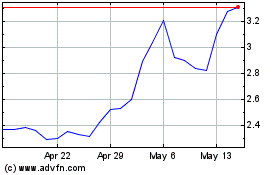

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

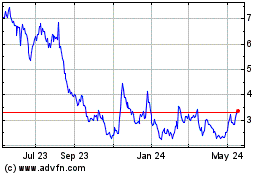

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Dec 2023 to Dec 2024