Bionano Reports First Quarter 2024 Results and Highlights Recent Business Progress

09 May 2024 - 6:01AM

Bionano Genomics, Inc. (Nasdaq: BNGO) today reported financial

results for the first quarter ended March 31, 2024.

Recent Highlights

- Announced a strategic

partnership with Hangzhou Diagens Biotechnology Co.,

Ltd. (Diagens), an

assisted reproductive technology company based in China; the joint

endeavor aims to commercialize the first ever cytogenetic workflow

that integrates OGM plus artificial intelligence (AI) chromosome

karyotype analysis for clinical use in reproductive health.

- Announced a registered direct

offering priced at-the-market under Nasdaq rules, with gross

proceeds to the Company of approximately $10

million, before deducting the placement agent’s fees and

other offering expenses payable by the Company; funds will be used

for general corporate purposes.

- Advancements to the Company’s

suite of comprehensive software analysis tools for cancer are

planned for May 2024; enhancements include a novel

aneusomy caller feature, Phred-like quality scores for detected

variants, enhanced visualization with VIA circos plots, and

customizable reporting options.

- Additional

updates and improvements to the Company’s end-to-end workflow are

underway, with a pre-commercial version of the Ionic®

Purification System for isolation of DNA for OGM analysis to

be evaluated at 3 customer sites and the full commercial launch

anticipated for the third quarter of 2024; improvements to data

analysis processing time on the Stratys™ Compute, a

high-performance workstation developed in collaboration with

NVIDIA, are anticipated for the third quarter of 2024.

- Published an implementation

study which compared OGM to traditional cytogenetic methods for the

detection of structural variants (SVs) in bone marrow aspirate

samples; results showed that OGM detected variants that

were missed by traditional methods, and that targeted Cas9-directed

nanopore sequencing was able to validate the variants detected with

OGM and define the breakpoints at the base pair level efficiently

and at high resolution.

- Reiterated full year 2024

revenue guidance of $37.0 to $41.0

million; revenue for the second quarter of 2024 is

expected to be $7.8 to $8.2 million.

Q1 2024 Highlights

- Continued efforts to reduce

cash burn and operating expense with the March 2024 announcement of

expanded cost savings initiatives; since the initial cost

savings initiative announced in May 2023, the Company plans to have

reduced headcount by approximately 200 people by the end of the

second quarter of 2024 and to have reduced annualized non-GAAP

operating expenses by about $65.0 to $75.0 million by the first

quarter of 2025.

- Installed base of OGM systems

totaled 347 at the end of the first quarter of 2024, which

represents a 34% increase over the 259 installed systems reported

at the end of the first quarter of 2023.

- 8,249 nanochannel array

flowcells sold during the first quarter of 2024, which

represents an increase of 58% over the 5,226 flowcells sold during

the first quarter of 2023.

- Key publications support OGM’s

utility:

- In a study on hereditary breast and

ovarian cancer syndrome, researchers used OGM to detect SVs in

tumors that may be linked to mutated genes and altered signaling

pathways, which may correlate to tumor progression, prognosis and

chemotherapy resistance. OGM also detected chromothripsis events

and novel gene fusions in cancer tissues with high accuracy,

including novel gene fusions that were not detected by other

methods.

- A peer-reviewed publication

in Cancers found that that the use of OGM for SV

detection combined with drug sensitivity data for the same samples

can identify potentially pathogenic SVs that may be drivers of drug

sensitivity or resistance.

“We are pleased with our Q1 2024 results, which

include significant growth in year-over-year revenue, expansion in

the OGM system installed base, and advances to our end-to-end

workflow,” commented Erik Holmlin, PhD, president and chief

executive officer of Bionano. “Our focus remains on strengthening

the company's long-term growth profile. As a part of our ongoing

evolution, we are continuing to execute on cost savings and

strategic productivity initiatives intended to allow us to be more

focused and agile, drive efficiency across the company, and

prioritize investing in opportunities where we see the greatest

potential to increase global adoption and utilization of OGM."

Q1 2024 Financial Results

- Total revenue for the first

quarter of 2024 was $8.8 million, an increase of 18%

compared to the first quarter of 2023.

- GAAP gross margin for the first

quarter of 2024 was 32%, compared to 28% from the first

quarter of 2023. First quarter 2024 non-GAAP gross margin was 34%,

compared to 30% from the first quarter of 2023. First quarter 2024

non-GAAP gross margin excludes $128,000 in stock-based compensation

and $11,000 of restructuring expense.

- First quarter 2024 GAAP

operating expense was $33.9 million, and $24.7

million on a non-GAAP basis. Non-GAAP operating expense in

the first quarter of 2024 excludes restructuring costs, stock-based

compensation, and other adjustments as detailed in the

reconciliation table accompanying this press release. In the first

quarter of 2023, GAAP operating expense was $39.9 million and $33.6

million on a non-GAAP basis. First quarter 2023 GAAP to non-GAAP

reconciliation can be found in the same table in this release.

- Cash, cash

equivalents, and available-for-sale securities were $53.2 million

as of March 31, 2024 compared to cash, cash equivalents

and available-for-sale securities of $102.3 million as of December

31, 2023. As of March 31, 2024, $24.8 million was subject to

certain restrictions compared to $35.5 million as of December 31,

2023. The $24.8 million subject to certain restrictions is reduced

as we pay down the outstanding principal amount on our debt.

- Raised

$15.1 million in net proceeds in the first quarter of 2024

through our ATM facility.

- The change in total cash

balance from December 31, 2023 to March 31, 2024 consists of $19

million cash burn from operating activities

excluding interest and debt retirement fees, $9

million in interest and debt retirement fees, $37 million in repaid

principal offset by $15 million in net ATM proceeds; in the first

quarter of 2023, cash burn from operating activities excluding

interest and debt retirement fees was $32 million.

Gülsen Kama, chief financial officer at Bionano

added, “Q1 2024 was an important quarter for the Company. Our

operating expense and cash burn improved year-over-year as a result

of the cost savings initiatives we announced in May and October

2023, and we expect to see continued improvement to both as a

result of the reduction in force we announced in March 2024. We

continue to work to reduce our expenditures as we pursue ways to

extend our cash runway.”

Conference Call & Webcast Details

|

Date: |

Wednesday, May 8th, 2024 |

|

Time: |

4:30 p.m. ET |

|

Participant Dial-In: |

Toll Free: 1-833-630-1956International: 1-412-317-1837 |

|

Webcast Link: |

https://edge.media-server.com/mmc/p/5z343pph/ |

Participants may access a live webcast of the call on the

Investors page of the Bionano website. A replay of the conference

call and webcast will be archived on Bionano’s investor relations

website at https://ir.bionano.com/ for at least 30 days.

About Bionano

Bionano is a provider of genome analysis solutions that can

enable researchers and clinicians to reveal answers to challenging

questions in biology and medicine. The Company’s mission is to

transform the way the world sees the genome through OGM solutions,

diagnostic services and software. The Company offers OGM solutions

for applications across basic, translational and clinical research,

and nucleic acid extraction and purification solutions using

proprietary isotachophoresis (ITP) technology. Through

its Lineagen, Inc. d/b/a Bionano

Laboratories business, the Company also provides OGM-based

testing for certain laboratory developed tests. The Company also

offers an industry-leading, platform-agnostic software solution,

which integrates next-generation sequencing and microarray data

designed to provide analysis, visualization, interpretation and

reporting of copy number variants, single-nucleotide variants and

absence of heterozygosity across the genome in one consolidated

view. For more information, visit www.bionano.com

and www.bionanolaboratories.com.

Unless specifically noted otherwise, Bionano’s OGM products

are for research use only and not for use in diagnostic

procedures.

Non-GAAP Financial Measures

To supplement Bionano’s financial results

reported in accordance with U.S. generally accepted accounting

principles (GAAP), the Company has provided non-GAAP gross margin

and non-GAAP operating expense in this press release, which are

non-GAAP financial measures. Non-GAAP operating expense excludes

from GAAP reported operating expense the following components as

detailed in the reconciliation table accompanying this press

release: costs directly attributable to the company restructuring,

stock-based compensation, amortization of intangibles, change in

fair value of contingent consideration and certain deal-related

costs. Non-GAAP gross margin excludes from GAAP reported gross

margin stock-based compensation and certain restructuring expense

as detailed in the reconciliation table accompanying this press

release.

Bionano believes that non-GAAP gross margin and

non-GAAP operating expense are useful to investors and analysts as

a supplement to its financial information prepared in accordance

with GAAP for analyzing operating performance and identifying

operating trends in its business. Bionano uses non-GAAP gross

margin and non-GAAP operating expense internally to facilitate

period-to-period comparisons and analysis of its operating

performance in order to understand, manage and evaluate its

business and to make operating decisions. Accordingly, Bionano

believes these measures allow for greater transparency with respect

to key financial metrics it uses in assessing its own operating

performance and making operating decisions.

These non-GAAP financial measures are not meant

to be considered in isolation or as a substitute for comparable

GAAP measures; should be read in conjunction with the Company’s

consolidated financial statements prepared in accordance with GAAP;

have no standardized meaning prescribed by GAAP; and are not

prepared under any comprehensive set of accounting rules or

principles. In addition, from time to time in the future, there may

be other items that the Company may exclude for purposes of its

non-GAAP financial measures; and the Company may in the future

cease to exclude items that it has historically excluded for

purposes of its non-GAAP financial measures. Likewise, the Company

may determine to modify the nature of its adjustments to arrive at

its non-GAAP financial measures. Because of the non-standardized

definitions of non-GAAP financial measures, the non-GAAP financial

measures as used by Bionano in this press release and the

accompanying reconciliation table have limits in its usefulness to

investors and may be calculated differently from, and therefore may

not be directly comparable to, similarly titled measures used by

other companies.

For a reconciliation of non-GAAP gross margin

and non-GAAP operating expense to gross margin and operating

expense reported in accordance with GAAP, please refer to the

financial tables accompanying this release.

Forward-Looking Statements of Bionano

Genomics

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Words such as “believe,” “estimate,” “expect,”

“may,” “plan,” “will” and similar expressions (as well as other

words or expressions referencing future events, conditions or

circumstances) convey uncertainty of future events or outcomes and

are intended to identify these forward-looking statements.

Forward-looking statements include statements regarding our

intentions, beliefs, projections, outlook, analyses or current

expectations concerning, among other things: our expectations

regarding product uptake, revenue growth, market development and

increased OGM adoption, including through publications highlighting

the utility and applications of OGM; our growth prospects and

future financial and operating results; the growth of our installed

OGM system base; the sales of our flowcell consumables and the

other expectations related thereto; our commercial expectations,

including the potential to increase global adoption and utilization

of OGM; the anticipated benefits and success of our collaboration

efforts, including the opportunities offered by our anticipated

collaborations with NVIDIA; continued research, presentations and

publications involving OGM and its utility compared to traditional

cytogenetics and our technologies; our ability to drive adoption of

OGM and our technology solutions; our cost savings and strategic

productivity initiative including the expected reduction in

headcount and annualized operating expenses; and efforts to extend

our cash runway. Each of these forward-looking statements involves

risks and uncertainties. Actual results or developments may differ

materially from those projected or implied in these forward-looking

statements. Factors that may cause such a difference include the

risks and uncertainties associated with: the timing and amount of

revenue we are able to recognize in a given fiscal period; the

impact of adverse geopolitical and macroeconomic events, such as

recent and potential future bank failures and the ongoing conflicts

between Ukraine and Russia and Israel and Hamas, on our business

and the global economy; general market conditions, including

inflation and supply chain disruptions; changes in the competitive

landscape and the introduction of competitive technologies or

improvements to existing technologies; changes in our strategic and

commercial plans; our ability to obtain sufficient financing to

fund our strategic plans and commercialization efforts and our

ability to continue as a “going concern”; the ability of medical

and research institutions to obtain funding to support adoption or

continued use of our technologies; study results that differ or

contradict the results mentioned in this press release; and the

risks and uncertainties associated with our business and financial

condition in general, including the risks and uncertainties

described in our filings with the Securities and Exchange

Commission, including, without limitation, our Annual Report on

Form 10-K for the year ended December 31, 2023 and in other filings

subsequently made by us with the Securities and Exchange

Commission. All forward-looking statements contained in this press

release speak only as of the date on which they were made and are

based on management’s assumptions and estimates as of such date. We

do not undertake any obligation to publicly update any

forward-looking statements, whether as a result of the receipt of

new information, the occurrence of future events or otherwise.

CONTACTS

Company Contact:Erik Holmlin, CEOBionano

Genomics, Inc.+1 (858) 888-7610eholmlin@bionano.com

Investor Relations:David HolmesGilmartin

Group+1 (858) 888-7625IR@bionano.com

|

BIONANO GENOMICS, INC |

|

Condensed Consolidated Balance Sheet

(Unaudited) |

| |

(Unaudited) |

|

|

| |

March 31, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

15,759,000 |

|

|

$ |

17,948,000 |

|

|

Investments |

|

12,561,000 |

|

|

|

48,823,000 |

|

|

Accounts receivable, net |

|

8,313,000 |

|

|

|

9,319,000 |

|

|

Inventory |

|

19,587,000 |

|

|

|

22,892,000 |

|

|

Prepaid expenses and other current assets |

|

4,945,000 |

|

|

|

6,019,000 |

|

|

Restricted investments |

|

24,446,000 |

|

|

|

35,117,000 |

|

| Total current assets |

|

85,611,000 |

|

|

|

140,118,000 |

|

|

Restricted cash |

|

400,000 |

|

|

|

400,000 |

|

|

Property and equipment, net |

|

25,279,000 |

|

|

|

23,345,000 |

|

|

Operating lease right-of-use asset |

|

4,870,000 |

|

|

|

5,633,000 |

|

|

Financing lease right-of-use asset |

|

3,453,000 |

|

|

|

3,503,000 |

|

|

Intangible assets, net |

|

31,734,000 |

|

|

|

33,974,000 |

|

|

Other long-term assets |

|

6,648,000 |

|

|

|

7,431,000 |

|

| Total assets |

$ |

157,995,000 |

|

|

$ |

214,404,000 |

|

| |

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

9,844,000 |

|

|

$ |

10,384,000 |

|

|

Accrued expenses |

|

11,028,000 |

|

|

|

8,089,000 |

|

|

Contract liabilities |

|

1,035,000 |

|

|

|

783,000 |

|

|

Operating lease liability |

|

2,190,000 |

|

|

|

2,163,000 |

|

|

Finance lease liability |

|

269,000 |

|

|

|

272,000 |

|

|

Purchase option liability (at fair value) |

|

5,060,000 |

|

|

|

8,534,000 |

|

|

Convertible notes payable (at fair value) |

|

29,080,000 |

|

|

|

69,803,000 |

|

| Total current liabilities |

|

58,506,000 |

|

|

|

100,028,000 |

|

|

Operating lease liability, net of current portion |

|

2,755,000 |

|

|

|

3,590,000 |

|

|

Finance lease liability, net of current portion |

|

3,575,000 |

|

|

|

3,585,000 |

|

|

Contingent consideration |

|

10,250,000 |

|

|

|

10,890,000 |

|

|

Long-term contract liabilities |

|

138,000 |

|

|

|

154,000 |

|

| Total liabilities |

|

75,224,000 |

|

|

|

118,247,000 |

|

| Stockholders’ equity: |

|

|

|

|

Common stock |

|

6,000 |

|

|

|

5,000 |

|

|

Preferred Stock |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

695,411,000 |

|

|

|

677,337,000 |

|

|

Accumulated deficit |

|

(612,630,000 |

) |

|

|

(581,208,000 |

) |

|

Accumulated other comprehensive income (loss) |

|

(16,000 |

) |

|

|

23,000 |

|

| Total stockholders’

equity |

|

82,771,000 |

|

|

|

96,157,000 |

|

| Total liabilities and

stockholders’ equity |

$ |

157,995,000 |

|

|

$ |

214,404,000 |

|

| |

|

|

|

|

Bionano Genomics, Inc. |

|

Condensed Consolidated Statement of Operations

(Unaudited) |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

Product revenue |

$ |

6,828,000 |

|

|

$ |

5,447,000 |

|

|

Service and other revenue |

|

1,941,000 |

|

|

|

1,968,000 |

|

|

Total revenue |

|

8,769,000 |

|

|

|

7,415,000 |

|

| Cost of revenue: |

|

|

|

|

Cost of product revenue |

|

4,904,000 |

|

|

|

3,858,000 |

|

|

Cost of service and other revenue |

|

1,041,000 |

|

|

|

1,487,000 |

|

|

Total cost of revenue |

|

5,945,000 |

|

|

|

5,345,000 |

|

| Operating expenses: |

|

|

|

|

Research and development |

|

9,779,000 |

|

|

|

13,937,000 |

|

|

Selling, general and administrative |

|

19,536,000 |

|

|

|

25,976,000 |

|

|

Restructuring costs |

|

4,632,000 |

|

|

|

— |

|

|

Total operating expenses |

|

33,947,000 |

|

|

|

39,913,000 |

|

| Loss from operations |

|

(31,123,000 |

) |

|

|

(37,843,000 |

) |

| Other income (expenses): |

|

|

|

|

Interest income |

|

1,044,000 |

|

|

|

704,000 |

|

|

Interest expense |

|

(122,000 |

) |

|

|

(76,000 |

) |

|

Other income (expense) |

|

(1,239,000 |

) |

|

|

117,000 |

|

|

Total other income (expense) |

|

(317,000 |

) |

|

|

745,000 |

|

| Loss before income taxes |

|

(31,440,000 |

) |

|

|

(37,098,000 |

) |

| Provision for income

taxes |

|

18,000 |

|

|

|

(26,000 |

) |

| Net loss |

$ |

(31,422,000 |

) |

|

$ |

(37,124,000 |

) |

| |

|

|

|

|

|

|

|

|

Bionano Genomics, Inc. |

|

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited) |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP gross margin: |

|

|

|

| GAAP revenue |

$ |

8,769,000 |

|

|

$ |

7,415,000 |

|

| GAAP cost of revenue |

|

5,945,000 |

|

|

|

5,345,000 |

|

|

GAAP gross profit |

|

2,824,000 |

|

|

|

2,070,000 |

|

|

GAAP gross margin % |

|

32 |

% |

|

|

28 |

% |

| |

|

|

|

| Adjusted non-GAAP gross

margin: |

|

|

|

| GAAP revenue |

$ |

8,769,000 |

|

|

$ |

7,415,000 |

|

| GAAP cost of revenue |

|

5,945,000 |

|

|

|

5,345,000 |

|

|

Stock-based compensation expense |

|

(128,000 |

) |

|

|

(146,000 |

) |

|

COGS restructuring |

|

(11,000 |

) |

|

|

— |

|

|

Adjusted non-GAAP cost of revenue |

|

5,806,000 |

|

|

|

5,199,000 |

|

|

Adjusted non-GAAP gross profit |

|

2,963,000 |

|

|

|

2,216,000 |

|

|

Adjusted non-GAAP gross margin % |

|

34 |

% |

|

|

30 |

% |

| |

|

|

|

| GAAP operating expense |

|

|

|

|

GAAP selling, general and administrative expense |

$ |

19,536,000 |

|

|

$ |

25,976,000 |

|

|

Stock-based compensation expense |

|

(1,716,000 |

) |

|

|

(2,379,000 |

) |

|

Intangible asset amortization |

|

(1,792,000 |

) |

|

|

(1,792,000 |

) |

|

Change in fair value of contingent consideration |

|

640,000 |

|

|

|

(789,000 |

) |

|

Loss on intangible asset impairment |

|

(448,000 |

) |

|

|

— |

|

|

Transaction related expenses |

|

(91,000 |

) |

|

|

— |

|

|

Adjusted non-GAAP selling, general and administrative expense |

|

16,129,000 |

|

|

|

21,016,000 |

|

|

GAAP research and development expense |

$ |

9,779,000 |

|

|

$ |

13,937,000 |

|

|

Stock-based compensation expense |

|

(1,171,000 |

) |

|

|

(1,357,000 |

) |

|

Adjusted non-GAAP research and development expense |

|

8,608,000 |

|

|

|

12,580,000 |

|

|

GAAP restructuring costs |

$ |

4,632,000 |

|

|

$ |

— |

|

|

Restructuring costs |

|

(4,632,000 |

) |

|

|

— |

|

|

Adjusted non-GAAP restructuring costs |

|

— |

|

|

|

— |

|

| Total adjusted non-GAAP

operating expense |

$ |

24,737,000 |

|

|

$ |

33,596,000 |

|

| |

|

|

|

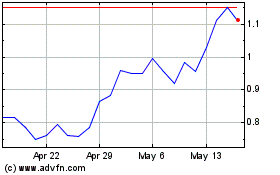

Bionano Genomics (NASDAQ:BNGO)

Historical Stock Chart

From Apr 2024 to May 2024

Bionano Genomics (NASDAQ:BNGO)

Historical Stock Chart

From May 2023 to May 2024