false

0001191070

BIONOMICS LIMITED/FI

00-0000000

0001191070

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2024

BIONOMICS LIMITED

(Exact name of registrant as specified in its charter)

| Australia |

|

001-41157 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

200 Greenhill Road

Eastwood, SA

Australia |

|

5063 |

| (Address of principal executive

offices) |

|

(Zip Code) |

+61 8 8150 7400

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which registered |

| American Depositary Shares |

|

BNOX |

|

The Nasdaq Global Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 8.01 Other Events

As discussed in a Current Report on Form 8-K that was filed with the

Securities and Exchange Commission on October 2, 2024, Bionomics Limited, an Australian corporation (“Bionomics”), and Neuphoria

Therapeutics Inc., a Delaware corporation (“Neuphoria”), have entered into a Scheme Implementation Agreement to re-domicile

from Australia to the U.S. State of Delaware pursuant to a Scheme of Arrangement under Australian law. Upon completion of the Scheme of

Arrangement, Bionomics would become a wholly-owned subsidiary of Neuphoria and Neuphoria’s common stock would be listed on Nasdaq.

Subsequent to entering into the Scheme Implementation Agreement, Bionomics

and Neuphoria amended it to change the exchange ratio to be as follows:

| ● | holders

of ordinary shares in Bionomics will receive one share of common stock in Neuphoria for every

2,160 ordinary shares of Bionomics held as of record date; and |

| ● | holders

of American Depositary Shares (“ADSs”) of Bionomics will receive one share of

common stock in Neuphoria for every 12 ADSs held in Bionomics as of the record date. |

These changes are set out in an Amending Agreement, which is attached

as Exhibit 99.1 to this Form 8-K.

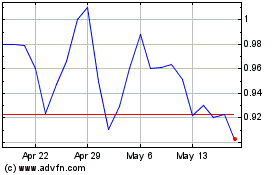

As disclosed in a Form

8-K filed on July 16, 2024, Bionomics received a letter from the Listing Qualifications Department of the Nasdaq Stock Market (“Nasdaq”)

indicating that, based upon the closing bid price of the company’s ADSs for the 30 consecutive business days between May 28, 2024

and July 10, 2024, Bionomics did not meet the minimum bid price of $1.00 per share required for continued listing on The Nasdaq Global

Market pursuant to Nasdaq Listing Rule 5450(a)(1). The letter also indicated that Bionomics will be provided with a compliance period

of 180 calendar days, or until January 7, 2025, in which to regain compliance.

Upon completion of the Scheme of Arrangement, Neuphoria will become

the successor issuer to Bionomics and, with the exchange ratio disclosed above, the company expects to regain compliance with Nasdaq’s

minimum bid price requirement.

On November 8, 2024, the Supreme Court of New South Wales approved:

| |

● |

the convening by Bionomics of a meeting of Bionomics shareholders to consider and vote on the Scheme of Arrangement at 8:30 am on December 12, 2024 Sydney time (“Scheme Meeting”); and |

| |

● |

the dispatch of an explanatory statement providing information about the Scheme of Arrangement, together with notice of meeting for the Scheme Meeting (together, the “Scheme Booklet”), to Bionomics shareholders. |

Further information is included in the Scheme Booklet attached as Exhibit

99.2 and a related press release is attached as Exhibit 99.3, which are both incorporated by reference into this Item 8.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BIONOMICS LIMITED |

| |

|

|

| Date: November 8, 2024 |

By: |

/s/ Spyridon Papapetropoulos |

| |

|

Spyridon Papapetropoulos |

| |

|

President and Chief Executive Officer |

2

Exhibit 99.1

Scheme Implementation Agreement – Amending Agreement

Date: 24 October 2024

Parties

|

Bionomics |

Name |

Bionomics Limited

(a company incorporated in South Australia) |

| |

ACN |

075 582 740 |

| |

Address |

200 Greenhill Road, Eastwood SA 5063 |

| |

Email |

[redacted] |

| |

Attention |

Spyridon “Spyros” Papapetropoulos, M.D. |

| Neuphoria |

Name |

Neuphoria Therapeutics Inc.

(a company incorporated in Delaware) |

| |

Address |

100 Summit Dr, Burlington, MA 01803 USA |

| |

Email |

[redacted] |

| |

Attention |

Spyridon “Spyros” Papapetropoulos, M.D. |

Background

| (A) | The Parties are parties to a Scheme Implementation Agreement dated 1 October 2024 (the Agreement) in respect of a proposed

Scheme of Arrangement between Bionomics and its members. |

| (B) | The Parties wish to amend the Agreement on the terms of this document. |

Operative provisions

| 1. | Definitions and interpretation |

Capitalised terms in this document

have the same meanings as in the Agreement unless the context requires otherwise.

The Agreement is amended as follows.

| (a) | clause 4.2 is deleted in its entirety and replaced with the following: |

“4.2 Scheme Consideration

| (a) | In consideration of the Scheme Shareholders transferring their Scheme Shares to Neuphoria at Completion of the Scheme, Neuphoria covenants

in Bionomics’ favour (in its own right and separately as trustee or nominee for each Scheme Shareholder) that Neuphoria will, on

the Implementation Date and immediately prior to the transfer of the Scheme Shares to Neuphoria, issue to each Scheme Shareholder (other

than the Australian custodian for the ADS Depositary, each Ineligible Foreign Shareholder and each Non-Electing Small Parcel Holder (as

defined in the Scheme at Annexure A)) one Neuphoria Share for every 2,160 Bionomics Shares held by the Scheme Shareholder on the Scheme

Record Date. |

| (b) | in the case of a Scheme Shareholder who holds Scheme Shares on behalf of the ADS Depositary (who itself holds Bionomics Shares for

the benefit of the ADS Holders), being the Australian custodian for the ADS Depositary, Neuphoria will, on the Implementation Date and

immediately prior to the transfer of the Scheme Shares to Neuphoria: |

| (i) | issue one Neuphoria Share to the ADS Depositary for every 2,160 Scheme Shares held by the ADS Depositary; and |

| (ii) | procure the ADS Depositary to then, subject to compliance by the ADS Holder within the terms of the arrangements pursuant to which

the ADS Depositary acts as depositary for ADS Holders, deliver (by way of exchange) such Neuphoria Shares to the ADS Holders on the basis

of one Neuphoria Share for every twelve Bionomics ADSs held by the ADS Holder on the Record Date. |

| (c) | Where a Scheme Shareholder would otherwise be entitled to a fraction of a Neuphoria Share as part of its Scheme Consideration, the

Neuphoria Share entitlement will be rounded to the nearest whole number except if a fractional entitlement would be one-half of a Neuphoria

Share, then the entitlement will be rounded up to one Neuphoria Share.” |

| (b) | Annexure A – Scheme of Arrangement is deleted in its entirety and replaced with the document contained at Annexure A of this

document. |

The amendments to the Agreement which

are set out in this document take effect on and from the date of this document as specified above.

Other than as varied by this document,

the terms and conditions of the Agreement remain in full force and effect.

This document may be signed in counterparts and all counterparts

taken together constitute one document.

| 2.3 | Governing law and jurisdiction |

| (a) | This document is governed by the laws of New South Wales, Australia. |

| (b) | Each party irrevocably and unconditionally: |

| (i) | submits to the exclusive jurisdiction of the courts of New South Wales; and |

| (ii) | waives, without limitation, any claim or objection based on absence of jurisdiction or inconvenient forum. |

Executed as an agreement

| Executed by |

) |

|

| Bionomics Limited |

) |

|

| in accordance with section 127 of the Corporations Act 2001 (Cth): |

) |

|

| |

|

|

| /Spyridon Papapetropoulos/ _________ |

|

/Alan Fisher/ _________ |

| Signature of Director |

|

Signature of Director/Secretary |

| |

|

|

| |

|

|

| Spyridon Papapetropoulos _________ |

|

Alan Fisher _________ |

| Name of Director/Secretary (print) |

|

Name of Director/Secretary (print) |

| Executed by |

) |

|

| Neuphoria Therapeutics Inc. |

) |

|

| In accordance with its constituent documents and laws of its place of incorporation: |

) |

|

| |

|

|

| /Spyridon Papapetropoulos/_________ |

|

|

| |

|

|

Spyridon Papapetropoulos, M.D.

Chief Executive Officer |

|

|

Annexure A – Scheme of Arrangement

Scheme of Arrangement

Bionomics Limited

ACN 075 582 740

and

Scheme Participants

SCHEME OF ARRANGEMENT

Under section 411 of the Corporations Act

BETWEEN:

| (1) | Bionomics Limited ACN 075 582 740 formed in Australia whose registered office is at 200 Greenhill

Road, Eastwood South Australia 5063 (Bionomics); and |

| (2) | Each person registered as a holder of fully paid ordinary shares in Bionomics as at the Record Date, other

than Excluded Shareholders (Scheme Participants). |

THE PARTIES AGREE AS FOLLOWS:

| 1. | Definitions and interpretation |

Unless the contrary intention appears,

these meanings apply:

ADS means an American Depositary

Share.

ADS Depositary means Citibank,

N.A.

ADS Holder means a holder of

Bionomics ADSs.

ASIC means the Australian Securities

& Investments Commission.

Bionomics ADS means each American

Depositary Share, representing 180 Bionomics Shares and which trade on Nasdaq under the ticker code “BNOX”.

Bionomics Share means each fully

paid ordinary share in Bionomics.

Bionomics Shareholder means

each person entered in the Register as a holder of Bionomics Shares.

Business Day means a day (other

than a Saturday, Sunday or public holiday) on which banks are open for general banking business in Adelaide, South Australia or Delaware,

United States.

Completion means completion

of the implementation of the Scheme on the Implementation Date.

Corporations Act means the Corporations

Act 2001 (Cth).

Court means Supreme Court of

New South Wales or such other court of competent jurisdiction as the parties may agree in writing.

Deed Poll means the deed poll

dated 23 October 2024 executed by Neuphoria substantially in the form of Annexure D of the Scheme Booklet or as otherwise agreed by Neuphoria

and Bionomics under which Neuphoria covenants in favour of each Scheme Participant to perform its obligations under this Scheme.

Effective means the coming into

effect, under section 411(10) of the Corporations Act, of the order of the Court made under section 411(4)(b) of the Corporations Act

in relation to the Scheme, but in any event at no time before an office copy of the order of the Court is lodged with ASIC.

Effective Date means the date

on which the Scheme becomes Effective.

Encumbrance means any security

for the payment of money or performance of obligations, including a mortgage, charge, lien, pledge, trust, power or title retention or

flawed deposit arrangement and any “security interest” as defined in sections 12(1) or 12(2) of the PPSA or any agreement

to create any of them or allow them to exist.

End Date means the Sunset Date,

including any extension to that date, as defined in the Scheme Implementation Agreement.

Excluded Shareholder means Neuphoria

and any of its subsidiaries.

Implementation Date means the

fifth Business Day following the Record Date or such other date as the parties agree in writing.

Ineligible Overseas Shareholder

means a Bionomics Shareholder:

| (a) | who is (or is acting on behalf of) a resident of a jurisdiction other than a Permitted Jurisdiction; or |

| (b) | whose address shown in the Register is a place outside a Permitted Jurisdiction, |

unless Neuphoria

and Bionomics jointly determine that it is lawful and not unduly onerous and not unduly impracticable to issue that Bionomics Shareholder

with Neuphoria Shares when the Scheme becomes Effective and it is lawful for that Bionomics Shareholder to participate in the Scheme by

the law of such other place as a Bionomics Shareholder may be resident or located.

Nasdaq means the Nasdaq Global

Market.

Neuphoria means Neuphoria Therapeutics Inc., a Delaware

corporation.

Neuphoria Share means a share

of common stock in Neuphoria.

New Neuphoria Shares means Neuphoria

Shares to be issued under the Scheme as Scheme Consideration.

Non-Electing Small Parcel Holder

means a Small Parcel Holder who has not made a valid election to not participate in the Sale Facility, or having made such an election

has validly withdrawn their election.

Permitted Jurisdiction means

Australia, Canada, European Union (excluding Austria), Hong Kong, Jersey, Kazakhstan, Mexico, New Zealand, Norway, Singapore, South Africa,

Switzerland, South Korea, the United Kingdom, the United States and any other jurisdictions mutually agreed by Bionomics and Neuphoria.

PPSA means the Personal Property

Securities Act 2009 (Cth).

Record Date means 7.00 pm on

the second Business Day following the Effective Date, or any other date (after the Effective Date) agreed by the parties to be the record

date to determine entitlements to receive Scheme Consideration under the Scheme.

Register means the register

of members of Bionomics.

Registered Address means, in

relation to a Bionomics Shareholder, the address shown in the Register.

Sale Facility means the facility

to be conducted in accordance with clause 6.4.

Scheme means this scheme of

arrangement between Bionomics and Scheme Participants under which all of the Scheme Shares will be transferred to Neuphoria under Part

5.1 of the Corporations Act as described in clause 6 of this Scheme, in consideration for the Scheme Consideration, subject to any amendments

or conditions made or required by the Court pursuant to section 411(6) of the Corporations Act to the extent they are approved in writing

by Bionomics and Neuphoria in accordance with clause 10 of this Scheme.

Scheme Booklet means the information

prepared in accordance with the Scheme Implementation Agreement and agreed by the parties (acting reasonably) to be approved by the Court

and despatched to Scheme Participants in relation to the Scheme.

Scheme Consideration in relation

to a Scheme Participant means the number of New Neuphoria Shares to be issued to the Scheme Participant as described in clause 6.2.

Scheme Implementation Agreement

means the scheme implementation agreement dated 1 October 2024 between Bionomics and Neuphoria under which, amongst other things, Bionomics

has agreed to propose this Scheme to Bionomics Shareholders, and each of Neuphoria and Bionomics has agreed to take certain steps to give

effect to this Scheme.

Scheme Meeting means the meeting

of Bionomics Shareholders to be convened as ordered by the Court under section 411(1) of the Corporations Act, to consider the Scheme.

Scheme Participant means each

Bionomics Shareholder as at the Record Date (taking into account registration of all registrable transfers and transmission applications

received at Bionomics’ share registry by the Record Date) other than an Excluded Shareholder.

Scheme Record Date means 7.00

pm on the second Business Day after the Effective Date, or such other date (after the Effective Date) as Bionomics and Neuphoria may agree

in writing.

Scheme Share means a Bionomics

Share held by a Scheme Participant as at the Record Date and, for the avoidance of doubt, includes any Bionomics Shares issued on or before

the Record Date.

Second Court Date means the

first day on which the Court hears the application for an order under section 411(4)(b) of the Corporations Act approving the Scheme or,

if the application is adjourned or subject to appeal for any reason, the first day on which the adjourned or appealed application is heard.

Share Scheme Transfer means,

for each Scheme Participant, a duly completed and executed proper instrument of transfer of the Scheme Shares held by that Scheme Participant

for the purposes of section 1071B of the Corporations Act, which may be a master transfer of all Scheme Shares.

Small Parcel Holder means a

Scheme Participant who holds fewer than 200,000 Bionomics Shares as at the Scheme Record Date.

| 1.2 | General interpretation |

Headings and labels used for definitions

are for convenience only and do not affect interpretation. Unless the contrary intention appears, in this document:

| (a) | the singular includes the plural and vice versa; |

| (b) | a reference to a document includes any agreement or other legally enforceable arrangement created by it

(whether the document is in the form of an agreement, deed or otherwise); |

| (c) | a reference to a document also includes any variation, replacement or novation of it; |

| (d) | the meaning of general words is not limited by specific examples introduced by “including”,

“for example”, “such as” or similar expressions; |

| (e) | a reference to “person” includes an individual, a body corporate, a partnership, a joint venture,

an unincorporated association and an authority or any other entity or organisation; |

| (f) | a reference to a particular person includes the person’s executors, administrators, successors,

substitutes (including persons taking by novation) and assigns; |

| (g) | a reference to a time of day is a reference to Sydney, Australia, time; |

| (h) | a reference to dollars, $ or A$ is a reference to the currency of Australia; |

| (i) | a reference to any legislation includes regulations under it and any consolidations, amendments, re-enactments

or replacements of any of them; |

| (j) | a reference to a group of persons is a reference to any 2 or more of them jointly and to each of them

individually; |

| (k) | a reference to any thing (including an amount) is a reference to the whole and each part of it; |

| (l) | a period of time starting from a given day or the day of an act or event, is to be calculated exclusive

of that day; |

| (m) | if a party must do something under this document on or by a given day and it is done after 5.00 pm on

that day, it is taken to be done on the next day; and |

| (n) | if the day on which a party must do something under this document is not a Business Day, the party must

do it on the next Business Day. |

Bionomics is:

| (a) | An unlisted public company limited by shares; and |

| (b) | incorporated in Australia and registered in South Australia. |

Neuphoria is:

| (a) | An unlisted non-public corporation; and |

| (b) | incorporated in Delaware, United States. |

| 2.3 | If Scheme becomes Effective |

If this Scheme becomes Effective:

| (a) | in consideration of the transfer of each Scheme Share to Neuphoria, Bionomics will procure Neuphoria to

provide the Scheme Consideration to each Scheme Participant in accordance with the terms of this Scheme; |

| (b) | all Scheme Shares will be transferred to Neuphoria on the Implementation Date; and |

| (c) | Bionomics will enter the name of Neuphoria in the Register in respect of all Scheme Shares transferred

to Neuphoria in accordance with the terms of this Scheme. |

| 2.4 | Scheme Implementation Agreement |

Bionomics and Neuphoria have agreed

by executing the Scheme Implementation Agreement to implement the terms of this Scheme.

| (a) | Neuphoria has executed the Deed Poll for the purpose of covenanting in favour of the Scheme Participants

to perform (or procure the performance of) its obligations as contemplated by this Scheme, including to provide the Scheme Consideration. |

| (b) | Bionomics undertakes in favour of each Scheme Participant to enforce the Deed Poll against Neuphoria on

behalf of and as agent and attorney for the Scheme Participants. |

| 3.1 | Conditions precedent to Scheme |

This Scheme is conditional on, and

will have no force or effect until, the satisfaction of each of the following conditions precedent:

| (a) | as at 8.00 am on the Second Court Date, the Deed Poll not having been terminated; |

| (b) | as at 8.00 am on the Second Court Date, all of the conditions precedent in clause 3.1 of the Scheme Implementation

Agreement having been satisfied or waived in accordance with the terms of the Scheme Implementation Agreement, other than the conditions

in clauses 3.1(c) (Court approval of Scheme) and 3.1(d) (Order lodged with ASIC); |

| (c) | the Court having approved this Scheme, with or without any modification or condition, pursuant to section

411(4)(b) of the Corporations Act, and if applicable, Bionomics and Neuphoria having accepted in writing any modification or condition

made or required by the Court under section 411(6) of the Corporations Act; |

| (d) | lodgement with ASIC of an office copy of the order of the Court approving the Scheme pursuant to section

411(10) of the Corporations Act; and |

| (e) | the coming into effect, pursuant to section 411(10) of the Corporations Act, of the orders of the Court

made under section 411(4)(b) of the Corporations Act (and, if applicable, section 411(6) of the Corporations Act) in relation to this

Scheme. |

| 3.2 | Conditions precedent and operation of clause 5 |

The satisfaction of each condition

of clause 3.1 of this Scheme is a condition precedent to the operation of clause 5 of this Scheme.

| 3.3 | Certificate in relation to conditions precedent |

| (a) | Bionomics and Neuphoria must provide to the Court on the Second Court Date a certificate confirming (in

respect of matters within their knowledge) whether or not all of the conditions precedent set out in clause 3.1 of this Scheme (other

than the conditions precedent in clauses 3.1(c), 3.1(d) and 3.1(e) of this Scheme) have been satisfied or waived as at 8.00 am on the

Second Court Date. |

| (b) | The certificate referred to in this clause 3.3 will constitute conclusive evidence of whether the conditions

precedent referred to in clause 3.1 of this Scheme (other than the conditions precedent in clauses 3.1(c), 3.1(d) and 3.1(e) of this Scheme)

have been satisfied or waived as at 8.00 am on the Second Court Date. |

Subject to clause 4.2, this Scheme

will come into effect pursuant to section 411(10) of the Corporations Act on and from the Effective Date.

This Scheme will lapse and be of no

further force or effect if the Effective Date does not occur on or before the End Date.

| 5. | Implementation of Scheme |

| 5.1 | Lodgement of Court orders with ASIC |

If the conditions precedent set out

in clause 3.1 of this Scheme (other than the conditions precedent in clauses 3.1(d) and 3.1(e) of this Scheme) are satisfied, Bionomics

must lodge with ASIC in accordance with section 411(10) of the Corporations Act an office copy of the Court order approving this Scheme

as soon as possible, and in any event by no later than 4.00 pm on the first Business Day after the day on which the Court approves this

Scheme or such later time as Neuphoria and Bionomics agree in writing.

| 5.2 | Transfer and registration of Bionomics Shares |

On the Implementation Date, but subject

to the provision of the Scheme Consideration for the Scheme Shares in accordance with clause 6 of this Scheme and Neuphoria having provided

Bionomics with written confirmation of the provision of the Scheme Consideration:

| (a) | the Scheme Shares, together with all rights and entitlements attaching to the Scheme Shares as at the

Implementation Date, will be transferred to Neuphoria without the need for any further act by any Scheme Participant (other than acts

performed by Bionomics as attorney and agent for Scheme Participants under clause 8 of this Scheme) by: |

| (i) | Bionomics delivering to Neuphoria a duly completed and executed Share Scheme Transfer executed on behalf

of the Scheme Participants; and |

| (ii) | Neuphoria duly executing the Share Scheme Transfer and delivering it to Bionomics for registration; and |

| (b) | as soon as practicable after receipt of the duly executed Share Scheme Transfer, Bionomics must enter

the name of Neuphoria in the Register in respect of all Scheme Shares transferred to Neuphoria in accordance with the terms of this Scheme. |

| 5.3 | Entitlement to Scheme Consideration |

On the Implementation Date, in consideration

for the transfer to Neuphoria of the Scheme Shares, each Scheme Participant will be entitled to receive the Scheme Consideration in respect

of each of their Scheme Shares in accordance with clause 6 of this Scheme.

| 5.4 | Title and rights in Bionomics Shares |

Subject to the provision of the Scheme

Consideration for the Scheme Shares as contemplated by clause 6 of this Scheme, on and from the Implementation Date, Neuphoria will be

beneficially entitled to the Scheme Shares transferred to it under the Scheme, pending registration by Bionomics of Neuphoria in the Register

as the holder of the Scheme Shares.

| 5.5 | Scheme Participants’ agreements |

Under this Scheme, each Scheme Participant

agrees to the transfer of their Scheme Shares, together with all rights and entitlements attaching to those Scheme Shares, in accordance

with the terms of this Scheme.

| 5.6 | Warranty by Scheme Participants |

Each Scheme Participant warrants to

Neuphoria and is deemed to have authorised Bionomics to warrant to Neuphoria as agent and attorney for the Scheme Participant by virtue

of this clause 5.6, that:

| (a) | all their Scheme Shares (including any rights and entitlements attaching to those shares) transferred

to Neuphoria under the Scheme will, as at the date of the transfer, be fully paid and free from all Encumbrances; and |

| (b) | they have full power and capacity to sell and to transfer their Scheme Shares (including any rights and

entitlements attaching to those shares) to Neuphoria under the Scheme. |

| 5.7 | Transfer free of Encumbrances |

To the extent permitted by law, all

Bionomics Shares (including any rights and entitlements attaching to those shares) which are transferred to Neuphoria under this Scheme

will, at the date of the transfer of them to Neuphoria, vest in Neuphoria free from all Encumbrances and interests of third parties of

any kind, whether legal or otherwise, and free from any restrictions on transfer of any kind not referred to in this Scheme.

| 5.8 | Nomination of acquirer subsidiary |

If Neuphoria nominates a Neuphoria

Nominee (as defined in clause 4.3 of the Scheme Implementation Agreement) to acquire Bionomics Shares under the Scheme references to the

transfer of Scheme Shares to Neuphoria and the entering of Neuphoria into the Register, will be read as references to Neuphoria Nominee.

| 6.1 | Issue of consideration under the Scheme |

On the Implementation Date, Bionomics must procure that,

in consideration for the transfer to Neuphoria of the Bionomics Shares, Neuphoria issues to the Scheme Participants (or to the nominee

in the case of Ineligible Overseas Shareholders or Non-Electing Small Parcel Holders, in accordance with clause 6.4) the Scheme Consideration

in accordance with this clause 6.

| (a) | In consideration of the Bionomics Shareholders transferring their Bionomics Shares to Neuphoria at Completion,

Neuphoria will, on the Implementation Date and immediately upon transfer of the Bionomics Shares to Neuphoria, issue to each Bionomics

Shareholder (other than the Australian custodian for the ADS Depositary and each Ineligible Overseas Shareholder and each Non-Electing

Small Parcel Holder) one Neuphoria Share for every 2,160 Bionomics Shares held by the Bionomics Shareholder on the Scheme Record Date. |

| (b) | In the case of the Bionomics Shareholder who holds Bionomics Shares on behalf of the ADS Depositary (who

itself holds Bionomics Shares for the benefit of the ADS Holders), being the Australian custodian for the ADS Depositary, Neuphoria will,

on the Implementation Date and immediately prior to the transfer of the Bionomics Shares to Neuphoria: |

| (i) | issue one Neuphoria Share to the ADS Depositary for every 2,160 Scheme Shares held by the ADS Depositary;

and |

| (ii) | procure the ADS Depositary to then, subject to compliance by the ADS Holder within the terms of the arrangements

pursuant to which the ADS Depositary acts as depositary for ADS Holders, deliver (by way of exchange) such Neuphoria Shares to the ADS

Holders on the basis of one Neuphoria Share for every 12 Bionomics ADSs held by the ADS Holder on the Record Date. |

| (c) | Where a Bionomics Shareholder would otherwise be entitled to a fraction of a Neuphoria Share as part of

its Scheme Consideration, the Neuphoria Share entitlement will be rounded to the nearest whole number except if a fractional entitlement

would be one-half of a Neuphoria Share, then the entitlement will be rounded up to one Neuphoria Share. |

| 6.3 | Scheme Participants’ agreements |

Under this Scheme, each Scheme Participant

(and the nominee on behalf of the Ineligible Overseas Shareholders and Non-Electing Small Parcel Holders) irrevocably:

| (a) | agrees to become a shareholder of Neuphoria, to have their name entered in the Neuphoria register, accepts

the Neuphoria Shares issued to them and agrees to be bound by the Neuphoria’s charter documents; |

| (b) | agrees and acknowledges that the issue of Neuphoria Shares in accordance with clause 6.2 or the payment

under clause 6.4 (as applicable) constitutes satisfaction of all that person’s entitlements under this Scheme; |

| (c) | acknowledges that the Scheme binds Bionomics and all of the Scheme Participants from time to time (including

those who do not attend the Scheme Meeting and those who do not vote, or vote against this Scheme, at the Scheme Meeting); and |

| (d) | consents to Bionomics and Neuphoria doing all things and executing all deeds, instruments, transfers or

other documents as may be necessary or desirable to give full effect to this Scheme and the transactions contemplated by it. |

Where a Scheme Participant is an Ineligible

Overseas Shareholder or a Non-Electing Small Parcel Holder, such Scheme Participant authorises Neuphoria to:

| (a) | issue to a nominee appointed by Neuphoria any New Neuphoria Shares to which an Ineligible Overseas Shareholder

or a Non-Electing Small Parcel Holder would otherwise be entitled to (Relevant Neuphoria Shares); |

| (b) | procure, as soon as reasonably practicable after the Implementation Date, and in no event no more than

30 days after the Implementation Date, that the nominee: |

| (i) | sells or procures the sale of all of the Relevant Neuphoria Shares issued to the nominee pursuant to clause

6.4(a), in the ordinary course of trading on Nasdaq at such price as the nominee determines in good faith; and |

| (ii) | remits to Neuphoria the proceeds of sale (Bionomics will pay all brokerage and related costs, levies or

fees associated with the sale of Neuphoria Shares through the Sale Facility); and |

| (c) | promptly after the last sale of the Relevant Neuphoria Shares in accordance with clause 6.4(b)(i),

pay to each Ineligible Overseas Shareholder and Non-Electing Small Parcel Holder an amount equal to the proportion of the proceeds of

sale received by Neuphoria under clause 6.4(b)(ii) to which that Ineligible Overseas Shareholder and Non-Electing Small Parcel Holder

is entitled, in full satisfaction of their entitlement to the Relevant Neuphoria Shares. |

Neither Bionomics nor Neuphoria make

any assurance or representation as to the amount of proceeds of sale to be received by Ineligible Overseas Shareholders and Non-Electing

Small Parcel Holders under the Sale Facility. Both Bionomics and Neuphoria expressly disclaim any fiduciary duty to the Ineligible Overseas

Shareholders and Non-Electing Small Parcel Holders which may arise in connection with the Sale Facility.

| 6.5 | Shares to rank equally |

Neuphoria covenants in favour of Bionomics

(in its own right and on behalf of the Scheme Participants) that:

| (a) | the New Neuphoria Shares will rank equally in all respects with all existing Neuphoria Shares; |

| (b) | it will do everything reasonably necessary to ensure that trading in the New Neuphoria Shares commences

by the first Business Day after the Implementation Date; and |

| (c) | on issue, each New Neuphoria Share will be fully paid and free from any Encumbrance. |

In the case of Bionomics Shares held

in joint names:

| (a) | any Neuphoria Shares to be issued under this Scheme must be issued and registered in the names of the

joint holders and entry in the Neuphoria register of members must take place in the same order as the holders’ names appear in the

Register; and |

| (b) | any document required to be sent under this Scheme, will be forwarded to either, at the sole discretion

of Bionomics, the holder whose name appears first in the Register as at the Record Date or to the joint holders. |

| 7. | Dealings in Scheme Shares |

| 7.1 | Determination of Scheme Participants |

To establish the identity of the Scheme

Participants, dealings in Scheme Shares will only be recognised by Bionomics if registrable transmission applications or transfers in

registrable form in respect of those dealings are received on or before the Record Date at the place where the Register is kept.

Bionomics must register any registrable

transmission applications or transfers of the Scheme Shares received in accordance with clause 7.1 of this Scheme on or before the Record

Date.

| 7.3 | No disposals after Effective Date |

| (a) | If this Scheme becomes Effective, a holder of Scheme Shares (and any person claiming through that holder)

must not dispose of or purport or agree to dispose of any Scheme Shares or any interest in them after the Effective Date in any way except

as set out in this Scheme and any such disposal will be void and of no legal effect whatsoever. |

| (b) | Bionomics will not accept for registration or recognise for any purpose any transmission, application

or transfer in respect of Scheme Shares received after the Record Date (except a transfer to Neuphoria pursuant to this Scheme and any

subsequent transfer by Neuphoria or its successors in title). |

| 7.4 | Maintenance of Bionomics Register |

For the purpose of determining entitlements

to the Scheme Consideration, Bionomics will maintain the Register in accordance with the provisions of this clause 7.4 until the Scheme

Consideration has been issued to the Scheme Participants and Neuphoria has been entered in the Register as the holder of all the Scheme

Shares. The Register in this form will solely determine entitlements to the Scheme Consideration.

| 7.5 | Effect of certificates and holding statements |

Subject to provision of the Scheme

Consideration and registration of the transfer to Neuphoria contemplated in clauses 5.2 and 7.4 of this Scheme, any statements of holding

in respect of Scheme Shares will cease to have effect after the Record Date as documents of title in respect of those shares (other than

statements of holding in favour of Neuphoria and its successors in title). After the Record Date, each entry current on the Register as

at the Record Date (other than entries in respect of Neuphoria or its successors in title) will cease to have effect except as evidence

of entitlement to the Scheme Consideration.

| 7.6 | Details of Scheme Participants |

Within three Business Days after the

Record Date, Bionomics will ensure that details of the names, Registered Addresses and holdings of Scheme Shares for each Scheme Participant,

as shown in the Register at the Record Date are available to Neuphoria in such form as Neuphoria reasonably requires.

Each Scheme Participant, without the

need for any further act by any Scheme Participant, irrevocably appoints Bionomics and each of its directors and secretaries (jointly

and each of them individually) as its attorney and agent for the purpose of:

| (a) | executing any document necessary or expedient to give effect to this Scheme including the Share Scheme

Transfer; and |

| (b) | enforcing the Deed Poll against Neuphoria, and Bionomics accepts such appointment. |

If a notice, transfer, transmission

application, direction or other communication referred to in this Scheme is sent by post to Bionomics, it will not be taken to be received

in the ordinary course of post or on a date and time other than the date and time (if any) on which it is actually received at Bionomics’

registered office or at the office of the registrar of Bionomics Shares.

The accidental omission to give notice

of the Scheme Meeting or the non-receipt of such a notice by any Bionomics Shareholder will not, unless so ordered by the Court, invalidate

the Scheme Meeting or the proceedings of the Scheme Meeting.

| 10.1 | Variations, alterations and conditions |

Bionomics may, with the consent of

Neuphoria (which cannot be unreasonably withheld), by its counsel or solicitor consent on behalf of all persons concerned to any variations,

alterations or conditions to this Scheme which the Court thinks fit to impose.

| 10.2 | Further action by Bionomics |

Bionomics will execute all documents

and do all things (on its own behalf and on behalf of each Scheme Participant) necessary or expedient to implement, and perform its obligations

under, this Scheme.

| 10.3 | Authority and acknowledgement |

Each of the Scheme Participants:

| (a) | irrevocably consents to Bionomics and Neuphoria doing all things necessary or expedient for or incidental

to the implementation of this Scheme; and |

| (b) | acknowledges that this Scheme binds Bionomics and all Scheme Participants (including those who do not

attend the Scheme Meeting or do not vote at that meeting or vote against the Scheme at that meeting) and, to the extent of any inconsistency

and to the extent permitted by law, overrides the constitution of Bionomics. |

| 10.4 | No liability when acting in good faith |

Without prejudice to the parties’ rights

under the Scheme Implementation Agreement, neither Bionomics nor Neuphoria, nor any of their respective officers, will be liable for anything

done or omitted to be done in the performance of this Scheme in good faith.

Neuphoria will pay all stamp duty (including

any fines, penalties and interest) payable in connection with this Scheme.

| 11.1 | Governing law and jurisdiction |

| (a) | This document and any dispute arising out of or in connection with the subject matter of this document

is governed by the laws of South Australia, Australia. |

| (b) | Each party submits to the non-exclusive jurisdiction of the courts of that state, and courts of appeal

from them, in respect of any proceedings arising out of or in connection with the subject matter of this document. |

Without preventing any other method

of service, any document in an action in connection with this document may be served on a party by being delivered or left at that party’s

address set out below:

Bionomics

| |

Address: |

200 Greenhill Road, Eastwood SA 5063 |

| |

Email: |

[redacted] |

| |

Attention: |

Spyridon “Spyros” Papapetropoulos, M.D - CEO |

| |

Copy to: |

Guy Sanderson, Hamilton Locke |

| |

Address: |

Level 42, Australia Square, 264 George Street, Sydney NSW 2000 |

| |

Email: |

[redacted] |

Neuphoria

| |

Address: |

100 Summit Dr, Burlington, MA 01803 USA |

| |

Email: |

[redacted] |

| |

Attention: |

Spyridon “Spyros” Papapetropoulos, M.D - CEO |

| |

Copy to: |

Andrew Reilly, Rimon |

| |

Address: |

Level 2, 50 Bridge Street, Sydney NSW 2000 |

| |

Email: |

[redacted] |

Exhibit 99.2

Bionomics Limited

Scheme Booklet

for a scheme of arrangement in relation to the proposed acquisition

by Neuphoria Therapeutics Inc. of the ordinary shares in Bionomics Limited (ACN 075 582 740).

The Bionomics Directors unanimously recommend that you vote in

favour of the Scheme, subject to the Independent Expert continuing to conclude that the Scheme is in the best interests of Bionomics Shareholders.

This is an important document and requires your urgent attention.

If you are in any doubt as to how to deal with this Scheme Booklet, please consult your legal, financial, taxation or other professional adviser. If you have any general questions relating to the Scheme, please call the Bionomics Shareholder Information Line on 1300 850 505 (within Australia) or +61 3 9415 4000 (outside Australia) on Monday to Friday between 8.30am and 5.00pm (Sydney time).

Please disregard this Scheme Booklet if you have recently sold all your Bionomics Shares (including as represented by American Depositary Shares) or no longer hold any Bionomics Shares.

| Australian legal adviser to Bionomics |

|

US legal adviser to Bionomics |

| |

|

|

|

|

|

Important Notices

Nature of this booklet

This Scheme Booklet is important. Bionomics Shareholders should

carefully read this Scheme Booklet in its entirety before making a decision on how to vote on the Scheme.

The purpose of this Scheme Booklet is to explain the terms of

the Scheme, the manner in which the Scheme will be considered and implemented (if all of the conditions to the Scheme are satisfied or

(if permitted) waived) and to provide such information as is prescribed or otherwise material for Bionomics Shareholders when deciding

how to vote on the Scheme. This document includes the explanatory statement required by section 412(1) of the Corporations Act in relation

to the Scheme.

This Scheme Booklet is not a disclosure document required by Chapter

6D or Part 7.9 of the Corporations Act. Section 708(17) of the Corporations Act provides that an offer of securities does not require

disclosure to investors if it is made under a compromise or arrangement under Part 5.1 of the Corporations Act and approved at a meeting

held as a result of an order under section 411(1) or (1A) of the Corporations Act.

If you have sold all your Bionomics Shares (including as represented

by American Depositary Shares), please disregard this Scheme Booklet.

RESPONSIBILITY FOR INFORMATION

Bionomics has been solely responsible for preparing the Bionomics

Information. The information concerning Bionomics and the intentions, views and opinions of Bionomics and the Bionomics Directors contained

in this Scheme Booklet has been prepared by Bionomics and is the responsibility of Bionomics. None of Neuphoria, its Related Bodies Corporate,

or their respective directors, officers, employees or advisers have verified any of the Bionomics Information, and none of them assume

any responsibility for the accuracy or completeness of any of the Bionomics Information.

Neuphoria has been solely responsible for preparing the Neuphoria

Information. The information concerning Neuphoria and the intentions, views and opinions of Neuphoria contained in this Scheme Booklet,

has been prepared by Neuphoria and is the responsibility of Neuphoria. None of Bionomics, its Related Bodies Corporate, or their respective

directors, officers, employees or advisers have verified any of the Neuphoria Information, and none of them assume any responsibility

for the accuracy or completeness of any of the Neuphoria Information.

The Independent Expert, Findex Corporate Finance (Aust) Ltd, has

prepared the Independent Expert’s Report and takes responsibility for that report. None of Bionomics, Neuphoria or their respective

Related Bodies Corporate, or any of their respective directors, officers, employees or advisers takes any responsibility for the Independent

Expert’s Report. The Independent Expert’s Report is set out in Annexure A.

REGULATORY INFORMATION AND ROLE

OF ASIC

This document includes the explanatory statement for the Scheme

between Bionomics and the Scheme Participants for the purposes of section 412(1) of the Corporations Act. A copy of the Scheme is included

in this Scheme Booklet as Annexure B.

A draft of this Scheme Booklet has been provided to ASIC in accordance

with section 411(2) of the Corporations Act. It was then registered by ASIC under section 412(6) of the Corporations Act before being

sent to Bionomics Shareholders.

ASIC has been requested to provide a statement, in accordance

with section 411(17)(b) of the Corporations Act, that it has no objection to the Scheme. ASIC’s policy in relation to statements

under section 411(17)(b) of the Corporations Act is that it will not provide such a statement until the Second Court Date. This is because

ASIC will not be in a position to advise the Court until it has had an opportunity to observe the entire process of the Scheme.

If ASIC provides that statement, it will be produced to the Court

at the Second Court Hearing. Neither ASIC nor any of its officers takes any responsibility for the contents of this Scheme Booklet.

FORWARD LOOKING STATEMENTS

This Scheme Booklet contains both historical and forward- looking

statements. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements.

All forward looking statements in this Scheme Booklet reflect

views only as at the date of this Scheme Booklet, and generally may be identified by the use of forward-looking words such as “believe”,

“aim”, “expect”, “anticipate”, “intending”, “foreseeing”, “likely”,

“should”, “planned”, “may”, “estimate”, “potential”, or other similar words.

Similarly, statements that describe Bionomics, Neuphoria or the Combined Group’s objectives, plans, goals or expectations are or

may be forward looking statements. The statements contained in this Scheme Booklet about the impact that the Scheme may have on the results

of Bionomics and/or Neuphoria’s operations and the advantages and disadvantages anticipated to result from the Scheme are also forward-looking

statements.

Bionomics Shareholders should be aware that there are risks (both

known and unknown), uncertainties, assumptions and other important factors that could cause the actual conduct, results, performance or

achievements of Bionomics, Neuphoria or the Combined Group to be materially different from the future conduct, results, performance or

achievements expressed or implied by such statements or that could cause the future conduct, results, performance or achievements to be

materially different from historical conduct, results, performance or achievements. These risks, uncertainties, assumptions and other

important factors include, among other things, the risks set out in section 10 of this Scheme Booklet.

None of Bionomics, Neuphoria, or any of their respective Related

Bodies Corporate, directors, officers, employees or advisers, or any person named in this Scheme Booklet with their consent, or otherwise

involved in the preparation of this Scheme Booklet, give any representation, assurance or guarantee that the occurrence of the events

expressed or implied in any forward-looking statements in this Scheme Booklet will actually occur.

Bionomics Shareholders are cautioned about relying on any such

forward looking statements. The forward-looking statements in this Scheme Booklet reflect views held only as at the date of this Scheme

Booklet. Subject to any continuing obligations under applicable law or the Listing Rules, Bionomics, Neuphoria and their respective directors

and officers disclaim any obligation to update any forward-looking statements after the date of this Scheme Booklet, to reflect any change

in expectations in relation to those statements or change in events, conditions or circumstances on which a statement is based.

NOT INVESTMENT ADVICE

The information contained in this Scheme Booklet does not take

into account the investment objectives, financial situation or particular needs of any individual Bionomics Shareholder or any other person.

Before making any investment decision in relation to the Scheme, you should consider, with or without the assistance of an independent

securities or other adviser, whether that decision is appropriate in light of your particular investment needs, objectives and financial

circumstances. No cooling-off period applies to the acquisition of Neuphoria Shares under the Scheme.

Past performance

You should note that past performance metrics and figures (including

any data about past share price of Bionomics and Neuphoria) in this Scheme Booklet are given for illustrative purposes only and cannot

be relied upon as an indicator of (and provide no guidance as to) future performance, including future share price of the Combined Group.

Any such historical information is not represented as being, and is not, indicative of the view of Bionomics and Neuphoria on their future

financial condition and/or performance, nor the future financial condition or performance of the Combined Group.

FOREIGN JURISDICTIONS

The release, publication or distribution of this Scheme Booklet

in jurisdictions other than Australia may be restricted by law or regulation in such other jurisdictions and persons outside Australia

who come into possession of this Scheme Booklet should observe any such restrictions. Any failure to comply with such restrictions may

constitute a violation of applicable laws or regulations.

This Scheme Booklet has been prepared in accordance with Australian

law. No action has been taken to register or qualify this Scheme Booklet or any aspect of the Scheme in any jurisdiction outside Australia.

If you are an Ineligible Overseas Shareholder, you will not be

entitled to receive Neuphoria Shares. Neuphoria Shares that would otherwise be issued to you under the Scheme will be issued the Sale

Agent to be sold on Nasdaq, with the sale proceeds, to be paid to you. Bionomics will pay all brokerage and related costs, levies or fees

associated with the sale of Neuphoria Shares through the Sale Facility.

Based on the information available, Bionomics

shareholders whose addresses are shown in the register on the Record Date as being in the following jurisdictions will be entitled to

receive the Scheme Booklet and have Neuphoria Shares issued to them under the Scheme subject to any qualifications set out below in respect

of that jurisdiction:

| (iii) | European Union (excluding Austria and France), where the Bionomics shareholder is a “qualified investor”

(as defined in Article 2(e) of the EU Prospectus Regulation) or (ii) the number of other Bionomics shareholders is less than 150; |

| (iv) | France, where the Bionomics shareholder is a “qualified investor” (as defined in Article 2(e)

of the Prospectus Regulation) and, solely with respect to the issuance of Neuphoria Shares upon completion of the Scheme, the number of

other Bionomics shareholders is less than 150; |

| (vi) | Jersey, where the number of Bionomics shareholders is fewer than 50; |

| (viii) | Mexico, where the number of Bionomics shareholders is less than 100; |

| (x) | Norway, where (a) Bionomics shareholders are “professional clients” or (b) the number of non-professional

clients is less than 150; |

| (xiii) | South Korea, where (a) Bionomics shareholders are “accredited investors” (as defined in the

Financial Investment Services and Capitals Markets Act of Korea) or (b) the number of other Bionomics shareholders is less than 50; |

| (xvii) | any other person or jurisdiction in respect of which Bionomics reasonably believes that it is not prohibited

and not unduly onerous or impractical to issue Neuphoria Shares to a Bionomics shareholder with a registered address in such jurisdiction. |

Nominees and custodians who hold Bionomics shares

on behalf of a beneficial owner resident outside Australia, Canada, Hong Kong, Kazakhstan, New Zealand, Singapore, South Africa, Switzerland,

United Kingdom and the United States may not forward this Scheme Booklet (or any accompanying document) to anyone outside these countries

without the consent of Bionomics, except nominees and custodians may forward the Scheme Booklet to any beneficial shareholder in the European

Union (excluding Austria) who is a “qualified investor” (as defined in Article 2(e) of the Regulation (EU) 2017/1129 of the

European Parliament and the Council of the European Union). A Shareholder whose address shown in the Bionomics Share Register is in a

jurisdiction outside the Eligible Jurisdictions will be deemed to be an Ineligible Overseas Shareholder for the purposes of the Scheme.

Shareholders who are deemed to be Ineligible Overseas Shareholders should refer to Section 6.5 for more information.

This Scheme Booklet does not constitute an offer

to sell, or a solicitation of an offer to purchase, any securities in any jurisdiction in which, or to any person to whom, it would not

be lawful to make such an offer or solicitation.

See Section 12.11 for further information on legal

restrictions outside Australia on the distribution of the Scheme Booklet and participation in the Scheme.

Notice to Shareholders in the United States

The Neuphoria Shares have not been registered

under the US Securities Act or the securities laws of any state or other jurisdiction of the United States. Instead, Neuphoria intends

to rely on an exemption from the registration requirements of the US Securities Act provided by Section 3(a)(10) of the US Securities

Act in connection with the consummation of the Scheme and the issuance of Neuphoria Shares. Section 3(a)(10) of the US Securities Act

exempts securities issued in exchange for other securities from the general requirement of registration where the terms and conditions

of the issuance and exchange have been approved by a court of competent jurisdiction, after a hearing upon the fairness of the terms and

conditions of the issuance at which all persons to whom the securities will be issued have the right to appear. Approval of the Scheme

by the Court will be relied upon by Bionomics and Neuphoria for the purposes of qualifying for the Section 3(a)(10) exemption.

This Scheme Booklet has not been filed with, or

reviewed by, the US Securities and Exchange Commission or any US state securities authority and none of them has passed upon the merits

of the Scheme or the accuracy, adequacy or completeness of this Scheme Booklet. Any representation to the contrary is a criminal offence.

Bionomics Shareholders in the United States should

note that the Scheme will be conducted in accordance with the laws of Australia. As a result, it may be difficult for you to enforce your

rights, including any claim you may have arising under US federal securities laws, as Bionomics is incorporated in Australia and some

of its officers and directors are resident in Australia. As such, you may not be able to take legal action against Bionomics or its officers

and directors in Australia for violations of US securities laws and it may be difficult to compel Bionomics and its officers and directors

to subject themselves to a US court’s judgement.

IMPORTANT NOTICE ASSOCIATED WITH

COURT ORDER

The fact that, under subsection 411(1) of the Corporations Act,

the Court has ordered that the Scheme Meeting be convened does not mean that the Court:

| ● | has formed any view as to the merits of the proposed Scheme or as to how

Bionomics Shareholders should vote (on this matter, Bionomics Shareholders must reach their own decision); or |

| ● | has prepared, or is responsible for the content of, the Scheme Booklet. |

The order of the Court that the Scheme Meeting be convened is

not, and should not be treated as, an endorsement by the Court of, or any other expression of opinion by the Court on, the Scheme.

NOTICE OF Scheme Meeting

The

Notice of Scheme Meeting is set out in Annexure D.

NOTICE OF SECOND COURT HEARING

At the Second Court Hearing, the Court will consider whether to

approve the Scheme following the vote at the Scheme Meeting.

Any Bionomics Shareholder may appear at the Second Court Hearing,

which is expected to be held on Monday 16 December 2024 at the Supreme Court of New South Wales.

Any Bionomics Shareholder who wishes to oppose approval of the

Scheme at the Second Court Hearing may do so by filing with the Court and serving on Bionomics a notice of appearance in the prescribed

form together with any affidavit that the Bionomics Shareholder proposes to rely on.

The notice of appearance and affidavit must be served on Bionomics

at its address for service at least three days before the Second Court Hearing. The postal address for service is 200 Greenhill Road,

Eastwood SA 5063, Australia.

implied value

Scheme Participants (other than Ineligible Overseas Shareholders

and Electing Small Parcel Holders) will receive their Scheme Consideration as Neuphoria Shares. Any reference to the implied value

of the Scheme Consideration should not be taken as an indication that the implied value is fixed. The implied value of the Scheme Consideration

will vary with the market price of Neuphoria Shares.

If you are an Ineligible Overseas Shareholder or an Electing

Small Parcel Holder, this also applies to the Neuphoria Shares which will be issued to the Sale Agent and sold on Nasdaq by the Sale Agent.

The amount of cash remitted to you from the net sale proceeds will depend on the market price of Neuphoria Shares at the time of sale

by the Sale Agent.

TAX IMPLICATIONS OF THE Scheme

If the Scheme becomes Effective and is implemented, there will

be tax consequences for Scheme Participants which may include tax being payable on any gain on disposal of Bionomics Shares unless potentially

capital gains tax roll-over relief applies.

For further detail about the general US and Australian tax consequences

of the Scheme, refer to section 11 of this Scheme Booklet. The tax treatment may vary depending on the nature and characteristics of each

Bionomics Shareholder and their specific circumstances. Accordingly, Bionomics Shareholders should seek professional tax advice in relation

to their particular circumstances.

PRIVACY

Bionomics and Neuphoria may need to collect personal information

in connection with the Scheme.

The personal information may include the names, contact details

and details of holdings of Bionomics Shareholders, together with contact details of individuals appointed as proxies, attorneys or corporate

representatives for the Scheme Meeting. The collection of some of this information is required or authorised by the Corporations Act.

The primary purpose of the collection of personal information

is to assist Bionomics and Neuphoria to conduct the Scheme Meeting and implement the Scheme.

The information may be disclosed to Bionomics, Neuphoria, and

their respective Related Bodies Corporate and advisers, print and mail service providers, share registries, securities brokers and any

other service provider to the extent necessary to promote and effect the Scheme.

Bionomics Shareholders who are individuals, and other individuals

in respect of whom personal information is collected, have certain rights to access the personal information collected about them. Bionomics

Shareholders may contact the Share Registry if they wish to exercise these rights.

If the information outlined above is not collected, Bionomics

and Neuphoria may be hindered in, or prevented from, conducting the Scheme Meeting or implementing the Scheme. Bionomics Shareholders

who appoint an individual as their proxy, attorney or corporate representative to vote at the Scheme Meeting should inform that individual

of the matters outlined above.

RIGHT to inspect share register

Bionomics Shareholders have the right to inspect the Share Register

which contains the name and address of each Bionomics Shareholder and certain other prescribed details relating to Bionomics Shareholders,

without charge.

Bionomics Shareholders also have the right to request a copy of

the Share Register upon payment of a fee (if any) up to a prescribed amount.

Bionomics Shareholders have these rights by virtue of section

173 of the Corporations Act.

EXTERNAL WEBSITES

Unless expressly stated otherwise, the content of Bionomics’

website and Neuphoria’s website does not form part of this Scheme Booklet and Bionomics Shareholders should not rely on any such content.

Defined terms

Capitalised terms used in this Scheme Booklet (other than in the

Annexures which accompany this Scheme Booklet) are defined in the Glossary in section 13 of this Scheme Booklet or otherwise in the sections

in which they are used.

Section 13 of this Scheme Booklet also sets out rules of interpretation

which apply to this Scheme Booklet.

Financial amounts

All financial amounts in this Scheme Booklet are expressed in

Australian currency, unless otherwise stated.

Charts and diagrams

Any diagrams, charts, graphs and tables appearing in this Scheme

Booklet are illustrative only and may not be drawn to scale. Unless otherwise stated, all data contained in diagrams, charts, graphs and

tables is based on information available at the date of this document.

Rounding

A number of figures, amounts, percentages, prices, estimates, calculations

of value and fractions in this Scheme Booklet are subject to the effect of rounding. Accordingly, the actual calculation of figures, amounts,

percentages, prices, estimates, calculations of value and fractions may differ from the figures, amounts, percentages, prices, estimates,

calculations of value and fractions set out in this Scheme Booklet. Any discrepancies between totals in tables or financial information,

or in calculations, graphs or charts are due to rounding.

Time

A reference to time in this Scheme Booklet is to Sydney, Australia

time, unless otherwise indicated.

DATE OF THIS SCHEME BOOKLET

This Scheme Booklet is dated 8 November 2024.

Contents Page

| Important Notices |

2 |

| |

|

| Key dates and times |

10 |

| |

|

| What you should do |

11 |

| |

|

| Key reasons to vote for and against the Scheme |

12 |

| |

|

| Letter from the Chair of the Bionomics Board |

13 |

| 1. |

Overview of the Scheme |

16 |

| |

|

|

| 2. |

Frequently asked questions |

22 |

| |

|

|

| 3. |

How to vote |

31 |

| |

|

|

| 4. |

Considerations relevant to your vote |

33 |

| |

|

|

| 5. |

Implementation of the Scheme |

39 |

| |

|

|

| 6. |

Scheme Consideration |

47 |

| |

|

|

| 7. |

Information about Bionomics |

50 |

| |

|

|

| 8. |

Information about Neuphoria |

62 |

| |

|

|

| 9. |

Overview of the Combined Group |

73 |

| |

|

|

| 10. |

Risk factors |

76 |

| |

|

|

| 11. |

Taxation |

78 |

| |

|

|

| 12. |

Additional information |

90 |

| |

|

|

| 13. |

Glossary |

103 |

| Corporate Directory |

111 |

| |

|

| Schedule 1 |

112 |

| |

|

| Annexure A – Independent Expert’s Report |

135 |

| |

|

| Annexure B – Scheme |

136 |

| |

|

| Annexure C – Deed Poll |

148 |

| |

|

| Annexure D – Notice of Scheme Meeting |

154 |

Key dates and times

| Event |

Date |

| Deadline for receipt by the Share Registry of Proxy Forms, powers of attorney or appointments of corporate representatives for the Scheme Meeting (Proxy Cut-Off Date) |

8.30am (Sydney time) Tuesday 10 December 2024 |

| Time and date for determining eligibility to vote at the Scheme Meeting (Voting Entitlement Time) |

5.00pm (Sydney time) Tuesday 10 December 2024 |

| Scheme Meeting |

8.30am (Sydney time) Thursday 12 December 2024 |

| Last day to reposition Shares between the Australian principal and United States branch share registers |

Friday, 13 December 2024 |

| Election

date: Last date by which the Share Registry must receive an election from Small Parcel Holders who wish to opt in to participating

in the Sale Facility, or withdraw a previous election made |

5.00pm on Friday, 13 December 2024 |

| Second Court Hearing for approval of the Scheme |

3.00pm Monday 16 December 2024 |

| Close of ADS books (i.e. cessation of issuance and cancellation) |

Friday 13 December 2024 |

| Effective Date of the Scheme |

Monday 16 December 2024 |

| Record Date: Time and date for determining entitlements to the Scheme Consideration |

5.00pm (Sydney time) Tuesday 17 December 2024 |

| Scheme Implementation |

Tuesday 24 December 2024 |

| Commencement of trading of Neuphoria Shares on Nasdaq |

Expected to commence promptly following the Implementation Date |

All times and dates in the above timetable are

references to the time and date in Sydney, Australia. All dates following the date of the Scheme Meeting are indicative only and, amongst

other things, are subject to all necessary approvals from the Court and ASIC and any other relevant government agency, and any other conditions

to the Scheme having been satisfied or, if applicable, waived. Any changes to the above timetable will be announced on Bionomics’

website at https://www.bionomics.com.au/.

What you should do

STEP 1: READ THIS SCHEME BOOKLET

This is an important document and requires your immediate attention.

It contains information that is material to Bionomics Shareholders in making a decision on whether or not to vote in favour of the Scheme.

You should read this Scheme Booklet in its entirety,

including the Independent Expert’s Report, before making a decision on how to vote in relation to the Scheme.

If you are in any doubt as to what you should

do with this Scheme Booklet, please consult your legal, financial, tax or other professional adviser. If you have any general questions

relating to the Scheme, please call the Bionomics Shareholder Information Line on 1300 850 505 (within Australia) or +61 3 9415 4000 (outside

Australia) on Monday to Friday between 8.30am and 5.00pm (Sydney time).

STEP 2: VOTE AT THE SCHEME MEETING

If you are registered as a Bionomics Shareholder by the Share

Registry at the Voting Entitlement Time, which is 5.00pm (Sydney time) on Tuesday 10 December 2024, you will be entitled to vote at the

Scheme Meeting.

If you are entitled to vote at the Scheme Meeting, it is important

that you vote. This is because the Scheme must be passed by a majority in number (more than 50%) of Bionomics Shareholders who are present

and voting at the Scheme Meeting, by person or by proxy, and at least 75% of the votes cast at the Scheme Meeting.

The Scheme

Meeting will be held at 8:30 am Sydney time on Thursday 12 December 2024 / 4:30

pm New York time on Wednesday 11 December 2024 via Bionomics’ online meeting platform at https://meetnow.global/MCKR7AV.

Further details about the Scheme Meeting are set out in the Notice

of Scheme Meeting contained in Annexure D of this Scheme Booklet.

You should note that implementation of the Scheme is subject to

a number of other Scheme Conditions which must be satisfied or waived (where capable of waiver) before the Scheme can be implemented.

So, the Scheme may not proceed even if the Scheme is approved by Bionomics Shareholders at the Scheme Meeting. The Scheme Conditions are

summarised in detail in section 5.3 of this Scheme Booklet.

Please refer to section 3 of this Scheme Booklet for a summary of voting

procedures for the Scheme Meeting.

STEP 3: IF YOU ARE A SMALL PARCEL HOLDER, CONSIDER WHETHER TO

OPT IN TO PARTICIPATE IN THE SALE FACILITY

If you are registered as the holder of fewer than 200,000 Bionomics

Shareholder on the Record Date (and you are not an Ineligible Overseas Shareholder), you will be a Small Parcel Holder. As a Small

Parcel Holder you have the option to opt in to participate in the Sale Facility, which will mean that the Neuphoria Shares to which you

would otherwise be entitled to receive as a Scheme Participant will be issued to the Sale Agent and sold on your behalf. Your share of

the sale proceeds of all the Neuphoria Shares in the Sale Facility will then be paid to you, and Bionomics will pay the brokerage and

other costs of the Sale Facility.

If you want to opt in to participate then you will need to complete

and return the Election Form. Participation is optional, and if you do not return the Election Form then you will not participate in the

Sale Facility and you will receive Neuphoria Shares as the Scheme Consideration on the same basis as all other Bionomics Shareholders

(assuming the Scheme becomes Effective).

The decision whether to opt in to the Sale Facility is separate to

your decision as to how to vote on the Scheme. Relevant considerations for your Sale Facility election decision are set out in section

1.3.

Key reasons to vote for and against the Scheme

Reasons

to vote in favour of the Scheme

| ü |

Directors’ unanimous recommendation1 |

| ü |

The Independent Expert has concluded that the Scheme is in the best interests of Bionomics Shareholders |

| ü |

Increased alignment with prominent US pharmaceutical companies |

| ü |

US corporate structure that should increase the company’s attractiveness to potential strategic partners or acquirers |

| ü |

Improved marketability to US institutional investors |

| ü |

Increased attractiveness to a broader US investor pool who previously could not invest in non-US companies |

| ü |

Simplified corporate structure that will decrease administrative costs, including compliance and auditing costs |

| ü |

Eliminate administrative fees payable under Bionomics’ American Depositary Receipt program |

| ü |

Facilitate engagement with the US Food and Drug Administration and enhance regulatory pathway |

| Reasons why you might decide to vote in favour of the Scheme are set out in more detail in section 4 of this Scheme Booklet |

Potential

reasons to vote against the Scheme

| r |

You may disagree with the Directors and the Independent Expert |

| r |

Change in legal jurisdiction and differences in shareholders’ rights between Australia and Delaware |

| r |

The tax consequences of the Scheme may not suit your current financial situation |

| r |

The future value of Neuphoria Shares may shift with investor sentiment and as such is uncertain |

| r |

There could be a more litigious environment under Delaware corporate law |

| r |

The costs of implementing the Scheme |

Reasons

why you might decide not to vote in favour of the Scheme are set out in more detail in section 4 of this Scheme Booklet.

|

| 1 | Each Bionomics Director, other than Mr Peter Davies, holds Bionomics

Options pursuant to the employee equity plan involving Bionomics Options issued to directors and employees of Bionomics. Bionomics Directors

who hold Bionomics Options will be asked to enter into an Options Exchange Agreement with Bionomics and Neuphoria and will receive Neuphoria

Options under the agreement, as would be the case with (and on identical terms as) any other holder of Bionomics Options. The terms of

the Bionomics Options do not contain any vesting conditions that will be affected or triggered by the Scheme. Mr Peter Davies, who does

not hold Bionomics Options, considers that, despite these arrangements, it is appropriate for the Bionomics Directors who hold Bionomics

Options to make a recommendation on the Scheme Resolution given their role in the operation and management of Bionomics, and that Bionomics

Shareholders would wish to know their views in relation to the Scheme Resolution. Those Bionomics Directors also consider that it is

appropriate for them to make recommendations on the Scheme Resolution. |

Letter from the Chair of the

Bionomics Board

Dear Bionomics Shareholder,

On behalf of the Board of Bionomics, I am pleased to provide you

with this Scheme Booklet that contains information that you will need to consider in relation to the proposed scheme of arrangement relating

to Bionomics.

On 1 October 2024, Bionomics and Neuphoria signed a binding Scheme

Implementation Agreement to re-domicile Bionomics from Australia to the United States via a proposed scheme of arrangement between Bionomics

and its shareholders that will be governed by Australian law. Implementation of the Scheme is subject to approval of Bionomics’

shareholders and other regulatory and court approvals.

Overview of the Scheme

Bionomics is an Australian corporation and its ordinary shares, in