Dynamic Materials Reports Record Fourth Quarter and Full-Year

Financial Results Highlights: * Fourth quarter revenue increases

126% to $20.0 million BOULDER, Colo., Feb. 22

/PRNewswire-FirstCall/ -- Dynamic Materials Corporation (DMC)

(NASDAQ:BOOM), a leading international provider of explosion-bonded

clad metal plates and other metal fabrications, today announced

record sales and earnings results for the fourth quarter and fiscal

year ended December 31, 2004. Fourth quarter sales increased 126%

to $20.0 million from $8.8 million in the fourth quarter of 2003.

Net income for the fourth quarter was $2.3 million, or $0.41 per

diluted share, versus a net loss of $0.6 million, or $0.11 per

diluted share, in the comparable period of 2003. Fourth quarter net

income was positively impacted by a $0.5 million reduction in

income tax expense relating principally to the recognition of

certain research and development and foreign tax credits. The net

loss in the 2003 fourth quarter included a loss from discontinued

operations of $0.5 million, or $0.09 per diluted share. Full-year

Results Sales in 2004 advanced 51% to $54.2 million from $35.8

million in 2003. Income from continuing operations increased 243%

to $4.4 million, or $0.81 per diluted share, from $1.3 million, or

$0.25 per diluted share, in 2003. Net income was $2.8 million, or

$0.53 per diluted share, versus a net loss of $0.7 million, or

$0.12 per diluted share, in 2003. Net income in 2004 was impacted

by a loss from discontinued operations of $1.6 million, or $0.28

per diluted share, related to the Company's September 17, 2004,

divestiture of its Spin Forge Division. The Company's 2003

bottom-line performance was impacted by the combined 2003 operating

losses of Spin Forge and the former Precision Machined Products

("PMP") division, which was sold on October 7, 2003, and a $0.7

million loss on the sale of PMP, which was recorded in the third

quarter of 2003. Explosive Metalworking Group Sales at the

Company's Explosive Metalworking Group increased 131% to a

quarterly record $19.0 million versus sales of $8.2 million in the

fourth quarter of 2003. Approximately $4.3 million of the Group's

fourth quarter sales were attributable to a $5.5 million nickel

hydrometallurgy project in Australia. The Company expects to

recognize the final $0.6 million associated with the project during

the first quarter of 2005. Group operating income increased to $2.9

million from $0.5 million in the fourth quarter of 2003. For the

full fiscal year, Explosive Metalworking Group sales increased 56%

to $51.4 million from $33.0 million in 2003. Group operating income

increased 131% to $6.6 million versus $2.9 million in 2003. The

increase reflects management's efforts to leverage revenue growth

and is indicative of a more favorable absorption of both fixed

manufacturing overhead expenses and operating expenses. In addition

to achieving record fourth quarter shipments, the Explosive

Metalworking Group ended the period with a record order backlog of

$27.5 million. This compares with a backlog of $25.6 million at

September 30, 2004, and $11.7 million at the end of 2003. AMK

Welding The Company's AMK Welding division reported fourth quarter

sales of $1.0 million, a 60% increase versus the $0.6 million

reported in the fourth quarter of 2003. AMK's fourth quarter

operating income increased to $0.2 million from $13,218 in the

prior-year fourth quarter. Full-year sales at AMK were $2.8 million

versus $2.7 million in 2003, and operating income was $0.3 million

versus $0.5 million in 2003. The decline in operating income was

primarily attributable to a reduction in development work on

ground-based turbines, and an increase in operating expenses.

Management said that while it anticipates relatively slow first

quarter sales at AMK, prospects for the balance of the year and

beyond appear good. One of the division's key customers will

initiate full-scale production of the previously mentioned

ground-based turbines, and demand for commercial aircraft engines

-- an important market for AMK -- continues to improve. Management

Commentary Yvon Cariou, president and CEO, stated, "Our strong 2004

financial results are indicative of robust project activity within

several of our target markets, including petrochemical, refining,

hydrometallurgy, aluminum smelting and shipbuilding. Domestic

demand within the refinery industry has been especially strong, due

in part to customer compliance with new clean fuels regulations. We

do expect that the domestic demand in this sector will begin to

moderate during the coming year as we get closer to 2006 compliance

deadline dates." Cariou added, "Our recent performance also

reflects the strong reputation we have established with our

domestic and international customer base in our core explosion

welding business. We are very focused on delivering high-quality,

reliable products on time and on budget. As a result of this

commitment, we have become the dominant clad supplier to many of

the industries we serve. "Our fourth quarter performance was

unusually strong, thanks in part to our work on the Ravensthorpe

nickel project in Australia. However, despite reporting record

fourth quarter shipments, our order backlog at the end of the year

was at an all-time high. Given this momentum, we obviously are

encouraged by our prospects for continued growth." Cariou said that

during fiscal 2005, management intends to commit approximately $2.4

million to capital improvements and expansion programs at its Mt.

Braddock, Nobelclad and AMK Welding operations. The investments

will nearly double 2004 capital spending, and will allow the

Company to more effectively pursue new growth opportunities. Note

on Spin Forge Divestiture As previously reported, DMC divested its

Spin Forge Division on September 17, 2004, under a transaction that

included the subleasing of the Spin Forge real estate. It has been

determined that the accounting treatment of the Spin Forge real

estate lease should have been changed to capital lease accounting

in 2003 due to an increase in the value of the underlying property.

Consequently, the Company will restate its December 31, 2003,

balance sheet to add a capital lease asset of $2.9 million and an

offsetting capital lease obligation of the same amount under the

assets and liabilities of discontinued operations. There will be no

impact on the Company's historical income statements. The Company

continues to hold an option to purchase the Spin Forge real estate

for $2.9 million that can be exercised between November 1, 2006 and

January 31, 2007. Additional detail related to this balance sheet

restatement will be available in the Company's Form 10-K, which

will be filed with the Securities and Exchange Commission in March.

About Dynamic Materials Corporation Based in Boulder, Colorado,

Dynamic Materials Corporation is a leading international

metalworking company. Its products include explosion-bonded clad

metal plates and other metal fabrications for use in petrochemical,

chemical processing, power generation, commercial aircraft, defense

and a variety of other industries. The Company operates two

business segments: the Explosive Metalworking Group, which uses

proprietary explosive processes to perform metal cladding, and AMK

Welding, which utilizes various technologies to weld components for

use in jet engines and ground-based turbines. For more information,

visit the Company's website at http://www.dynamicmaterials.com/.

Except for the historical information contained herein, this news

release contains forward-looking statements that involve risks and

uncertainties including, but not limited to, the following: the

ability to obtain new contracts at attractive prices; the size and

timing of customer orders; fluctuations in customer demand;

competitive factors; the timely completion of contracts; the timing

and size of expenditures; the timely receipt of government

approvals and permits; the adequacy of local labor supplies at the

Company's facilities; the availability and cost of funds; and

general economic conditions, both domestically and abroad; as well

as the other risks detailed from time to time in the Company's SEC

reports, including the report on Form 10-K for the year ended

December 31, 2003. DYNAMIC MATERIALS CORPORATION & SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in Thousands, Except

Per Share Data) (unaudited) Three months ended Twelve months ended

December 31, December 31, 2004 2003 2004 2003 NET SALES 20,026

8,849 54,165 35,779 COST OF PRODUCTS SOLD 14,773 6,785 40,559

26,802 Gross profit 5,253 2,064 13,606 8,977 COSTS AND EXPENSES:

General and administrative expenses 1,233 764 3,335 2,645 Selling

expenses 912 830 3,383 3,016 Total costs and expenses 2,145 1,594

6,718 5,661 INCOME FROM OPERATIONS OF CONTINUING OPERATIONS 3,108

470 6,888 3,316 OTHER INCOME (EXPENSE): Other income (expense), net

5 (3) 7 (19) Interest expense (203) (121) (554) (518) Interest

income 5 7 23 9 INCOME BEFORE INCOME TAXES AND DISCONTINUED

OPERATIONS 2,915 353 6,364 2,788 INCOME TAX PROVISION 619 436 1,961

1,504 INCOME (LOSS) FROM CONTINUING OPERATIONS 2,296 (83) 4,403

1,284 DISCONTINUED OPERATIONS: Loss from operations of discontinued

operations, net of tax benefit -- (496) (783) (1,283) Loss on sale

of discontinued operations, net of tax benefit -- -- (787) (710)

Loss from discontinued operations -- (496) (1,570) (1,993) NET

INCOME (LOSS) 2,296 (579) 2,833 (709) INCOME (LOSS) PER SHARE -

BASIC: Continuing operations $0.44 $(0.02) $0.86 $0.25 Discontinued

operations -- (0.09) (0.31) (0.39) Net Income (Loss) $0.44 $(0.11)

$0.55 $(0.14) INCOME (LOSS) PER SHARE - DILUTED: Continuing

operations $0.41 $(0.02) $0.81 $0.25 Discontinued operations --

(0.09) (0.28) (0.37) Net Income (Loss) $0.41 $(0.11) $0.53 $(0.12)

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - Basic 5,207,765

5,073,378 5,134,540 5,067,324 Diluted 5,689,495 5,073,378 5,484,045

5,310,806 DATASOURCE: Dynamic Materials Corporation CONTACT:

Richard A. Santa, Vice President & Chief Financial Officer of

Dynamic Materials Corporation, +1-303-604-3938; or Investors and

Financial Media, Geoff High of Pfeiffer High Investor Relations,

Inc., +1-303-393-7044, for Dynamic Materials Corporation

Copyright

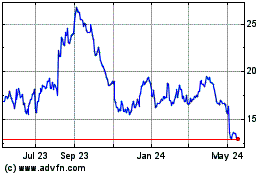

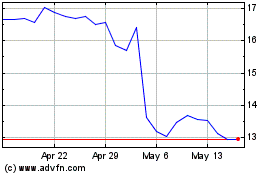

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024