Dynamic Materials Corporation (DMC) (NASDAQ: BOOM), the world's

leading provider of explosion-welded clad metal plates, today

reported financial results for its second quarter and six-month

period ended June 30, 2010.

Sales for the quarter were $38.3 million, up slightly from $37.8

million reported in last year's second quarter, and a 26% increase

when compared with sales of $30.4 million in the 2010 first

quarter. Management, which had previously forecast a top-line

increase of 10% to 15% versus the first quarter, said sales results

across all segments were better than expected. Second quarter gross

margin was 24% versus 24% in the comparable quarter a year ago and

23% in this year's first quarter.

Second quarter income from operations was $2.1 million versus

$3.0 million in last year's second quarter and $245,000 in the 2010

first quarter. Net income was $3.0 million, or $0.23 per diluted

share, compared with net income of $1.5 million, or $0.12 per

diluted share, in the year-ago second quarter and a net loss of

$411,000, or $0.03 per diluted share, in the first quarter. In

addition to stronger-than-anticipated sales, net income benefited

from a $2.1 million, one-time gain associated with the previously

announced acquisition of the remaining interest in two Russian

joint ventures. Net income also benefited from the tax treatment of

the gain, which reduced DMC's effective tax rate for the first half

of fiscal 2010 to 11.8%.

Adjusted EBITDA was $5.5 million versus $6.4 million in the

second quarter a year ago and $3.5 million in this year's first

quarter. Adjusted EBITDA is a non-GAAP (generally accepted

accounting principle) financial measure used by management to

measure operating performance. See additional information about

adjusted EBITDA at the end of this news release.

Explosive Metalworking

Second quarter sales at DMC's Explosive Metalworking segment

were $26.7 million compared with $31.6 million in the same quarter

a year ago. Operating income was $2.0 million versus $4.6 million

in the comparable year-ago quarter. Adjusted EBITDA was $3.3

million versus $6.0 million in the second quarter of 2009. Order

backlog at the Explosive Metalworking segment was $39.9 million

versus $51.4 million at the end of this year's first quarter.

Oilfield Products

Second quarter sales at DMC's Oilfield Products segment were

$8.7 million compared with $4.0 million in the second quarter last

year. The segment reported operating income of $203,000 versus an

operating loss of $906,000 in the second quarter a year ago. Second

quarter adjusted EBITDA was $1.2 million compared with a negative

$49,000 in the comparable prior-year quarter.

AMK Welding

DMC's AMK Welding segment reported second quarter sales of $2.9

million, which equaled an all-time quarterly high and represented a

32% increase versus sales of $2.2 million in the same quarter last

year. Operating income increased 170% to $826,000 from $306,000 in

the comparable quarter last year. The segment recorded adjusted

EBITDA of $941,000, up 124% from $421,000 in the comparable

year-ago quarter.

Management Commentary

"Each of our business segments exceeded our second quarter sales

expectations," said Yvon Cariou, president and CEO. "We are

particularly pleased with the activity at our Oilfield Products and

AMK Welding segments, which are benefiting from a rebound in

customer spending and an improvement in the broader economy. While

our explosion welding business tends to react to economic trends

later in the cycle, the segment is experiencing a marked increase

in quoting activity. In fact our U.S. sales office reported that

quoting volume during June reached a four-year high."

Cariou said the conversion of quotes to bookings remains

challenging within the explosion welding business, and this is

reflected in the reduction of the segment's order backlog. "Despite

this dip in booked business, we remain confident that it is a

matter of time before order volume improves. The long-term

uncertainty about the direction of the economy has resulted in very

low levels of both new investments and basic maintenance spending

within our end markets, and we believe this is likely resulting in

a significant build up of unaddressed demand."

Cariou said management is particularly encouraged by the

progress within DMC's Oilfield Products business. "Even after

excluding the impact of several recent strategic acquisitions,

Oilfield Product sales increased 13% versus the second quarter last

year," he said. "We are optimistic this growth will continue for

the foreseeable future, as we are effectively capturing new market

share and expect to receive some sizeable orders that would likely

extend into 2011."

Rick Santa, senior vice president and chief financial officer,

said that in light of the current explosion welding backlog and

uncertainty about order timing, full-year 2010 sales are now

expected to be down approximately 5% from fiscal 2009 sales

results, which compares to a prior sales forecast of flat to down

5% versus last year. However, the Company's has maintained its

prior full-year gross margin forecast of between 22% and 24%. Sales

in the third quarter are expected to be 5% to 10% greater than

sales reported in the second quarter.

Santa said that if the gain on the Russian joint venture

acquisitions were excluded, DMC's effective tax rate on the

remaining ordinary pretax income for the first six months of 2010

was 34%. "We expect to return to a normalized effective tax rate of

33% to 35% beginning the third quarter, and anticipate a blended

effective tax rate for 2010 in a range of 25% to 28%."

Six-month Results

Sales for the six-month period were $68.6 million versus $87.6

million in the comparable period of 2009. Gross margin was 24%

versus 28% in the same period a year ago. Operating income was $2.3

million versus $11.3 million in the prior year's six-month period.

Net income was $2.6 million, or $0.20 per diluted share, compared

with net income of $6.4 million, or $0.50 per diluted share, at the

six-month mark last year. Adjusted EBITDA was $9.0 million compared

with $18.0 million in the same period a year ago.

The Explosive Metalworking segment reported six-month sales of

$48.0 million versus $75.1 million in the first half of 2009. The

segment reported operating income of $3.2 million compared with

$14.0 million in the same period a year ago. Adjusted EBITDA was

$5.9 million versus $16.9 million in the comparable year-ago

period.

Six-month sales at DMC's Oilfield Products segment were $15.7

million versus $8.0 million in last year's six-month period. The

segment reduced its operating loss to $201,000 from an operating

loss of $1.6 million in the same period a year ago. Six-month

adjusted EBITDA was $1.8 million versus $104,000 in the

prior-year's six-month period.

AMK Welding recorded six-month sales of $5.0 million compared

with $4.5 million in the comparable year-ago period. Operating

income was $1.1 million versus $681,000 in the prior-year period.

Adjusted EBITDA at the six-month mark was $1.3 million compared

with $909,000 in the same period a year ago.

Conference call information

Management will hold a conference call to discuss these results

today at 5:00 p.m. Eastern (3:00 p.m. Mountain). Investors are

invited to listen to the call live via the Internet at

www.dynamicmaterials.com, or by dialing into the teleconference at

866-394-8610 (706-758-0876 for international callers) and entering

the passcode 88274852. Participants should access the website at

least 15 minutes early to register and download any necessary audio

software. A replay of the webcast will be available for 30 days and

a telephonic replay will be available through August 2, 2010, by

calling 800-642-1687 (706-645-9291 for international callers) and

entering the passcode 88274852.

Use of Non-GAAP Financial Measures

Non-GAAP results are presented only as a supplement to the

financial statements based on U.S. generally accepted accounting

principles (GAAP). The non-GAAP financial information is provided

to enhance the reader's understanding of DMC's financial

performance, but no non-GAAP measure should be considered in

isolation or as a substitute for financial measures calculated in

accordance with GAAP. Reconciliations of the most directly

comparable GAAP measures to non-GAAP measures are provided within

the schedules attached to this release.

EBITDA is defined as net income plus or minus net interest plus

taxes, depreciation and amortization. Adjusted EBITDA excludes from

EBITDA stock-based compensation and, when appropriate, other items

that management does not utilize in assessing DMC's operating

performance (as further described in the attached financial

schedules). None of these non-GAAP financial measures are

recognized terms under GAAP and do not purport to be an alternative

to net income as an indicator of operating performance or any other

GAAP measure.

Management uses these non-GAAP measures in its operational and

financial decision-making, believing that it is useful to eliminate

certain items in order to focus on what it deems to be a more

reliable indicator of ongoing operating performance and the

company's ability to generate cash flow from operations. As a

result, internal management reports used during monthly operating

reviews feature the adjusted EBITDA. Management also believes that

investors may find non-GAAP financial measures useful for the same

reasons, although investors are cautioned that non-GAAP financial

measures are not a substitute for GAAP disclosures. EBITDA and

adjusted EBITDA are also used by research analysts, investment

bankers and lenders to assess operating performance. For example, a

measure similar to EBITDA is required by the lenders under DMC's

credit facility.

Because not all companies use identical calculations, DMC's

presentation of non-GAAP financial measures may not be comparable

to other similarly titled measures of other companies. However,

these measures can still be useful in evaluating the company's

performance against its peer companies because management believes

the measures provide users with valuable insight into key

components of GAAP financial disclosures. For example, a company

with greater GAAP net income may not be as appealing to investors

if its net income is more heavily comprised of gains on asset

sales. Likewise, eliminating the effects of interest income and

expense moderates the impact of a company's capital structure on

its performance.

All of the items included in the reconciliation from net income

to EBITDA and adjusted EBITDA are either (i) non-cash items (e.g.,

depreciation, amortization of purchased intangibles, gain on step

acquisitions and stock-based compensation) or (ii) items that

management does not consider to be useful in assessing DMC's

operating performance (e.g., income taxes and gain on sale of

assets). In the case of the non-cash items, management believes

that investors can better assess the company's operating

performance if the measures are presented without such items

because, unlike cash expenses, these adjustments do not affect

DMC's ability to generate free cash flow or invest in its business.

For example, by adjusting for depreciation and amortization in

computing EBITDA, users can compare operating performance without

regard to different accounting determinations such as useful life.

In the case of the other items, management believes that investors

can better assess operating performance if the measures are

presented without these items because their financial impact does

not reflect ongoing operating performance.

About Dynamic Materials Corporation

Based in Boulder, Colorado, Dynamic Materials Corporation is a

leading international metalworking company. Its products, which are

typically used in industrial capital projects, include

explosion-welded clad metal plates and other metal fabrications for

use in a variety of industries, including oil and gas,

petrochemicals, alternative energy, hydrometallurgy, aluminum

production, shipbuilding, power generation, industrial

refrigeration and similar industries. The Company operates three

business segments: Explosive Metalworking, which uses proprietary

explosive processes to fuse different metals and alloys; Oilfield

Products, which manufactures, markets and sells specialized

explosive components and systems used to perforate oil and gas

wells; and AMK Welding, which utilizes various technologies to weld

components for use in power-generation turbines, as well as

commercial and military jet engines. For more information, visit

the Company's websites at http://www.dynamicmaterials.com and

http://www.dynaenergetics.de.

Safe Harbor Language

Except for the historical information contained herein, this

news release contains forward-looking statements, including our

guidance for second quarter and full-year 2010 sales, margins and

tax rates, quoting and booking expectations, our anticipation of

future customer demand, our long-range strategy of growing market

share, and improving investment activity within certain industrial

processing sectors, all of which involve risks and uncertainties.

These risks and uncertainties include, but are not limited to, the

following: our ability to obtain new contracts at attractive

prices; the size and timing of customer orders and shipments; our

ability to realize sales from our backlog; fluctuations in customer

demand; fluctuations in foreign currencies, changes to customer

orders; the cyclicality of our business; competitive factors; the

timely completion of contracts; the timing and size of

expenditures, the timing and price of metal and other raw material;

the adequacy of local labor supplies at our facilities; current or

future limits on manufacturing capacity at our various operations;

the availability and cost of funds; and general economic

conditions, both domestic and foreign, impacting our business and

the business of the end-market users we serve; as well as the other

risks detailed from time to time in the Company's SEC reports,

including the report on Form 10-K for the year ended December 31,

2009.

DYNAMIC MATERIALS CORPORATION & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2010 AND 2009

(Dollars in Thousands, Except Share Data)

(unaudited)

Three months ended Six months ended

June 30, June 30,

---------------------- ----------------------

2010 2009 2010 2009

---------- ---------- ---------- ----------

NET SALES $ 38,258 $ 37,819 $ 68,615 $ 87,578

COST OF PRODUCTS SOLD 29,000 28,665 52,373 63,096

---------- ---------- ---------- ----------

Gross profit 9,258 9,154 16,242 24,482

---------- ---------- ---------- ----------

COSTS AND EXPENSES:

General and administrative

expenses 3,358 3,043 6,503 6,569

Selling expenses 2,550 1,840 4,871 4,164

Amortization of purchased

intangible assets 1,264 1,232 2,537 2,416

---------- ---------- ---------- ----------

Total costs and expenses 7,172 6,115 13,911 13,149

---------- ---------- ---------- ----------

INCOME FROM OPERATIONS 2,086 3,039 2,331 11,333

OTHER INCOME (EXPENSE):

Gain on step acquisition

of joint ventures 2,117 - 2,117 -

Other income (expense), net (115) 191 14 74

Interest expense (662) (867) (1,806) (1,769)

Interest income 29 38 65 104

Equity in earnings of

joint ventures 86 127 255 79

---------- ---------- ---------- ----------

INCOME BEFORE INCOME TAXES 3,541 2,528 2,976 9,821

INCOME TAX PROVISION 505 1,013 351 3,389

---------- ---------- ---------- ----------

NET INCOME $ 3,036 $ 1,515 $ 2,625 $ 6,432

========== ========== ========== ==========

INCOME PER SHARE:

Basic $ 0.23 $ 0.12 $ 0.20 $ 0.50

========== ========== ========== ==========

Diluted $ 0.23 $ 0.12 $ 0.20 $ 0.50

========== ========== ========== ==========

WEIGHTED AVERAGE NUMBER OF

SHARES OUTSTANDING:

Basic 12,774,316 12,595,551 12,742,589 12,570,640

========== ========== ========== ==========

Diluted 12,786,976 12,611,430 12,755,565 12,601,160

========== ========== ========== ==========

DIVIDENDS DECLARED PER

COMMON SHARE $ 0.04 $ 0.04 $ 0.08 $ 0.04

========== ========== ========== ==========

DYNAMIC MATERIALS CORPORATION & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands)

June 30, December 31,

2010 2009

ASSETS (unaudited)

------------ ------------

Cash and cash equivalents $ 9,794 $ 22,411

Accounts receivable, net 23,108 25,807

Inventories 37,850 32,501

Other current assets 4,694 7,255

------------ ------------

Total current assets 75,446 87,974

Property, plant and equipment, net 39,266 42,052

Goodwill, net 36,517 43,164

Purchased intangible assets, net 47,768 49,079

Other long-term assets 7,134 2,907

------------ ------------

Total assets $ 206,131 $ 225,176

============ ============

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts payable $ 13,281 $ 9,183

Customer advances 7,817 6,528

Dividend payable 528 515

Accrued income taxes 211 1,485

Other current liabilities 7,096 9,162

Lines of credit 3,560 1,777

Current portion of long-term debt 7,483 13,485

------------ ------------

Total current liabilities 39,976 42,135

Long-term debt 23,701 34,120

Deferred tax liabilities 17,700 15,217

Other long-term liabilities 1,320 1,593

Stockholders' equity 123,434 132,111

------------ ------------

Total liabilities and stockholders' equity $ 206,131 $ 225,176

============ ============

DYNAMIC MATERIALS CORPORATION & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2010 AND 2009

(Dollars in Thousands)

(unaudited)

2010 2009

-------- --------

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 2,625 $ 6,432

Adjustments to reconcile net income to net cash

provided by operating activities -

Depreciation (including capital lease amortization) 2,404 2,441

Amortization of purchased intangible assets 2,537 2,416

Amortization of capitalized debt issuance costs 383 141

Stock-based compensation 1,702 1,760

Deferred income tax benefit (961) (954)

Equity in earnings of joint ventures (255) (79)

Gain on step acquisition of joint ventures (2,117) -

Change in working capital, net 3,377 214

-------- --------

Net cash provided by operating activities 9,695 12,371

-------- --------

CASH FLOWS FROM INVESTING ACTIVITIES:

Acquisition of Austin Explosives (3,544) -

Step acquisition of joint ventures, net of cash

acquired (2,065) -

Acquisition of property, plant and equipment (1,445) (2,231)

Change in other non-current assets (125) 23

-------- --------

Net cash used in investing activities (7,179) (2,208)

-------- --------

CASH FLOWS FROM FINANCING ACTIVITIES:

Payment on syndicated credit agreement (15,374) (3,885)

Borrowings on lines of credit, net 1,998 143

Payments on long-term debt (399) (438)

Payments on capital lease obligations (146) (102)

Payment of dividends (1,033) -

Payment of deferred debt issuance costs - (19)

Net proceeds from issuance of common stock 70 373

Excess tax benefit related to stock options 2 93

-------- --------

Net cash used in financing activities (14,882) (3,835)

-------- --------

EFFECTS OF EXCHANGE RATES ON CASH (251) 106

-------- --------

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (12,617) 6,434

CASH AND CASH EQUIVALENTS, beginning of the period 22,411 14,360

-------- --------

CASH AND CASH EQUIVALENTS, end of the period $ 9,794 $ 20,794

======== ========

DYNAMIC MATERIALS CORPORATION & SUBSIDIARIES

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASUREMENTS TO MOST

DIRECTLY COMPARABLE GAAP FINANCIAL MEASUREMENTS

(Dollars in thousands)

Three months ended Six months ended

June 30, June 30,

------------------ ------------------

2010 2009 2010 2009

-------- -------- -------- --------

(unaudited) (unaudited)

Explosive Metalworking Group $ 26,690 $ 31,604 $ 47,996 $ 75,076

Oilfield Products 8,654 4,014 15,660 8,048

AMK Welding 2,914 2,201 4,959 4,454

-------- -------- -------- --------

Net sales $ 38,258 $ 37,819 $ 68,615 $ 87,578

======== ======== ======== ========

Explosive Metalworking Group $ 1,967 $ 4,601 $ 3,184 $ 14,012

Oilfield Products 203 (906) (201) (1,600)

AMK Welding 826 306 1,050 681

Unallocated expenses (910) (962) (1,702) (1,760)

-------- -------- -------- --------

Income from operations $ 2,086 $ 3,039 $ 2,331 $ 11,333

======== ======== ======== ========

For the three months ended June 30, 2010

--------------------------------------------------

Explosive

Metalworking Oilfield AMK Unallocated

Group Products Welding Expenses Total

----------- -------- ------- ---------- --------

(unaudited)

Income from operations $ 1,967 $ 203 $ 826 $ (910) $ 2,086

Adjustments:

Stock-based compensation - - - 910 910

Depreciation 814 321 115 - 1,250

Amortization of

purchased intangibles 551 713 - - 1,264

----------- -------- ------- ---------- --------

Adjusted EBITDA $ 3,332 $ 1,237 $ 941 $ - $ 5,510

=========== ======== ======= ========== ========

For the three months ended June 30, 2009

--------------------------------------------------

Explosive

Metalworking Oilfield AMK Unallocated

Group Products Welding Expenses Total

----------- -------- ------- ---------- --------

(unaudited)

Income (loss) from

operations $ 4,601 $ (906) $ 306 $ (962) $ 3,039

Adjustments:

Stock-based compensation - - - 962 962

Depreciation 847 212 115 - 1,174

Amortization of

purchased intangibles 588 645 - - 1,233

----------- -------- ------- ---------- --------

Adjusted EBITDA $ 6,036 $ (49) $ 421 $ - $ 6,408

=========== ======== ======= ========== ========

DYNAMIC MATERIALS CORPORATION & SUBSIDIARIES

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASUREMENTS TO MOST

DIRECTLY COMPARABLE GAAP FINANCIAL MEASUREMENTS

(Dollars in thousands)

For the six months ended June 30, 2010

--------------------------------------------------

Explosive

Metalworking Oilfield AMK Unallocated

Group Products Welding Expenses Total

----------- -------- ------- ---------- --------

(unaudited)

Income (loss) from

operations $ 3,184 $ (201) $ 1,050 $ (1,702) $ 2,331

Adjustments:

Stock-based compensation - - - 1,702 1,702

Depreciation 1,583 591 230 - 2,404

Amortization of

purchased intangibles 1,149 1,388 - - 2,537

----------- -------- ------- ---------- --------

Adjusted EBITDA $ 5,916 $ 1,778 $ 1,280 $ - $ 8,974

=========== ======== ======= ========== ========

For the six months ended June 30, 2009

--------------------------------------------------

Explosive

Metalworking Oilfield AMK Unallocated

Group Products Welding Expenses Total

----------- -------- ------- ---------- --------

(unaudited)

Income (loss) from

operations $ 14,012 $ (1,600) $ 681 $ (1,760) $ 11,333

Adjustments:

Stock-based compensation - - - 1,760 1,760

Depreciation 1,773 440 228 - 2,441

Amortization of

purchased intangibles 1,152 1,264 - - 2,416

----------- -------- ------- ---------- --------

Adjusted EBITDA $ 16,937 $ 104 $ 909 $ - $ 17,950

=========== ======== ======= ========== ========

Three months ended Six months ended

June 30, June 30,

------------------ ------------------

2010 2009 2010 2009

-------- -------- -------- --------

(unaudited) (unaudited)

Net income $ 3,036 $ 1,515 $ 2,625 $ 6,432

Interest expense 662 867 1,806 1,769

Interest income (29) (38) (65) (104)

Provision for income taxes 505 1,013 351 3,389

Depreciation 1,250 1,174 2,404 2,441

Amortization of purchased

intangible assets 1,264 1,233 2,537 2,416

-------- -------- -------- --------

EBITDA 6,688 5,764 9,658 16,343

Stock-based compensation 910 962 1,702 1,760

Other income (2,002) (191) (2,131) (74)

Equity in earnings of joint

ventures (86) (127) (255) (79)

-------- -------- -------- --------

Adjusted EBITDA $ 5,510 $ 6,408 $ 8,974 $ 17,950

======== ======== ======== ========

CONTACT: Pfeiffer High Investor Relations, Inc. Geoff High

303-393-7044

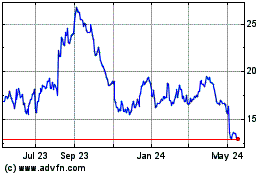

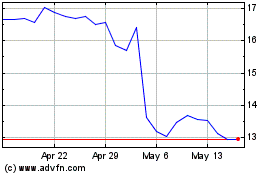

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024