Dynamic Materials Reports Third Quarter 2003 Financial Results

BOULDER, Colo., Nov. 13 /PRNewswire-FirstCall/ -- Dynamic Materials

Corporation, , "DMC", today reported third quarter income from

continuing operations of $226,239, or $.04 per diluted share,

versus income from continuing operations of $547,959, or $.11 per

diluted share, for the third quarter of 2002. DMC's third quarter

2003 sales were $11,129,210, an 8% increase from third quarter 2002

sales of $10,267,254. For the nine months ended September 30, 2003,

DMC reported income from continuing operations of $1,077,948, or

$.21 per diluted share, versus income from continuing operations of

$2,031,524, or $.40 per diluted share, for the first nine months of

2002. DMC reported sales of $31,034,281 and $30,987,927 for the

respective nine-month periods of 2003 and 2002. For the three

months ended September 30, 2003, DMC reported a net loss of

$679,393, or $.13 per diluted share, as compared to net income of

$383,974, or $.08 per diluted share, for the third quarter of 2002.

For the nine months ended September 30, 2003 and 2002, DMC reported

net losses of $130,281, or $.03 per diluted share, and $851,995, or

$.17 per diluted share, respectively. The net loss for the three

and nine month periods of 2003 reflects a loss from discontinued

operations of $905,632, or $.17 per diluted share, and $1,208,229,

or $.24 per diluted share, respectively, including operating losses

of $195,323 and $497,920 for the respective periods and an asset

impairment loss of $710,309 associated with the discontinued

operations of its Precision Machined Products division ("PMP"),

which was sold on October 7, 2003. The net loss for the first nine

months of 2002 included a transitional goodwill impairment charge

of $2,318,108, or $.46 per diluted share, associated with the

cumulative effect of a change in accounting principle as well as a

loss from discontinued operations of $565,411, or $.11 per diluted

share, relating to the reclassification of PMP's 2002 operating

loss to discontinued operations. Explosive Metalworking Group

Performance DMC's Explosive Metalworking Group reported third

quarter 2003 sales of $9,068,486, an 11% increase from sales of

$8,144,835 for the third quarter of 2002. For the three months

ended September 30, 2003 and 2002, the Group reported income from

operations of $820,852 and $1,183,179, respectively. Group sales

for the nine months ended September 30, 2003 were $24,820,283, a

decrease of 2% from sales of $25,245,221 for the first nine months

of 2002. The Group reported income from operations of $2,397,995

and $4,124,018 for the nine months ended September 30, 2003 and

2002, respectively. On a year-to- date basis, Explosive

Metalworking Group sales have been impacted by a weak first quarter

that resulted from a low December 31, 2002 backlog and operating

income has been impacted by a combination of unfavorable changes in

product mix, principally at the Group's European locations, and

lower sales volume in the U.S. Aerospace Group Performance The

Aerospace Group contributed $2,060,724 to sales in the third

quarter of 2003 as compared to reported sales of $2,122,419 in the

third quarter of 2002. For the nine months ended September 30,

2003, the Aerospace Group reported sales of $6,213,998, an increase

of 8% from the $5,742,706 in sales the Group posted for the

comparable period of 2002. The Aerospace Group reported an

operating loss of $26,537 for the nine months ended September 30,

2003 compared to an operating loss of $222,564 for the first nine

months of 2002. For the three months ended September 30, 2003 and

2002, the Group reported operating losses of $122,782 and $60,785,

respectively. The Group's decreased year-to-date 2003 operating

loss is attributable to a decreased operating loss at the Spin

Forge division. AMK Welding reported operating income for both the

third quarter and year-to-date periods but at levels well below the

record operating income that was reported for the comparable 2002

reporting periods. In commenting upon the Company's third quarter

2003 results, Yvon Cariou, DMC's President and CEO, stated, "As

expected, Explosive Metalworking Group sales and operating income

for the third quarter were comparable to those reported in the

second quarter of 2003. While we expect to see a decline in fourth

quarter sales and operating income from the amounts reported for

each of the last two quarters, we are increasingly optimistic about

the 2004 outlook for our Explosive Metalworking Group based on the

recent flow of new orders and the high volume of customer

inquiries." Cariou continued, "Results for our Aerospace Group no

longer include the operating results of PMP which was sold on

October 7, 2003 and whose operating losses for 2003 and 2002 have

been reported as discontinued operations. However, we are concerned

that the Aerospace Group, even without PMP, has reported losses in

2002 and 2003 that are expected to continue in the fourth quarter.

These concerns are being addressed by management and appropriate

actions will be taken during the remainder of 2003 and early part

of 2004." Except for the historical information contained herein,

this news release contains forward-looking statements that involve

risks and uncertainties including, but not limited to, the

following: the ability to obtain new contracts at attractive

prices; the size and timing of customer orders; fluctuations in

customer demand; competitive factors; the timely completion of

contracts; the timing and size of expenditures; the timely receipt

of government approvals and permits; the adequacy of local labor

supplies at the Company's facilities; the availability and cost of

funds; and general economic conditions, both domestically and

abroad; as well as the other risks detailed from time to time in

the Company's SEC reports, including the report on Form 10-K for

the year ended December 31, 2002. Based in Boulder, Colorado,

Dynamic Materials Corporation is a leading metalworking company,

and its products include explosion bonded clad metal plates and

other metal fabrications for the petrochemical, chemical

processing, satellite/launch vehicle, commercial aircraft, defense

and a variety of other industries. For more information on Dynamic

Materials Corporation visit the Company's web site at

http://www.dynamicmaterials.com/ DYNAMIC MATERIALS CORPORATION

& SUBSIDIARY CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2003 AND 2002 (unaudited)

Three months ended Nine months ended September 30, September 30,

2003 2002 2003 2002 NET SALES $11,129,210 $10,267,254 $31,034,281

$30,987,927 COST OF PRODUCTS SOLD 8,885,435 7,686,775 23,809,147

22,657,293 Gross profit 2,243,775 2,580,479 7,225,134 8,330,634

COSTS AND EXPENSES: General and administrative expenses 861,511

826,215 2,667,921 2,581,411 Selling expenses 684,194 631,870

2,185,755 1,847,769 Total costs and expenses 1,545,705 1,458,085

4,853,676 4,429,180 INCOME FROM OPERATIONS 698,070 1,122,394

2,371,458 3,901,454 OTHER INCOME (EXPENSE): Other income (expense),

net (16,268) 765 (16,230) (38,803) Interest expense (121,880)

(169,078) (396,893) (526,969) Interest income 1,260 636 2,888 1,155

INCOME BEFORE INCOME TAXES 561,182 954,717 1,961,223 3,336,837

INCOME TAX PROVISION 334,943 406,758 883,275 1,305,313 INCOME FROM

CONTINUING OPERATIONS BEFORE CUMULATIVE EFFECT OF A CHANGE IN

ACCOUNTING PRINCIPLE 226,239 547,959 1,077,948 2,031,524

DISCONTINUED OPERATIONS: Loss from operations of discontinued

operations, net of tax benefit (195,323) (163,985) (497,920)

(565,411) Loss on impairment of assets associated with discontinued

operations, net of tax benefit (710,309) -- (710,309) -- Loss from

discontinued operations (905,632) (163,985) (1,208,229) (565,411)

CUMULATIVE EFFECT OF A CHANGE IN ACCOUNTING PRINCIPLE, NET OF TAX

BENEFIT OF $1,482,000 -- -- -- (2,318,108) NET INCOME (LOSS)

$(679,393) $383,974 $(130,281) $(851,995) NET INCOME (LOSS) PER

SHARE - BASIC AND DILUTED: Continuing operations $0.04 $0.11 $0.21

$0.40 Discontinued operations (0.17) (0.03) (0.24) (0.11)

Cumulative effect of a change in accounting principle -- -- --

(0.46) Net Income (Loss) $(0.13) $0.08 $(0.03) $(0.17) WEIGHTED

AVERAGE NUMBER OF SHARES OUTSTANDING - Basic 5,072,943 5,048,888

5,065,283 5,038,596 Diluted 5,139,144 5,073,508 5,093,010 5,092,379

DATASOURCE: Dynamic Materials Corporation CONTACT: Richard A.

Santa, Vice President and Chief Financial Officer of Dynamic

Materials Corporation, +1-303-604-3938 Web site:

http://www.dynamicmaterials.com/

Copyright

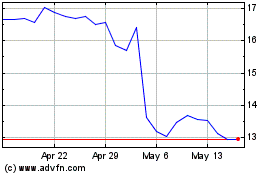

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

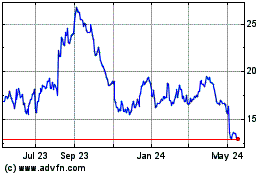

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024